Delivers ARR growth of 18% year-over-year on

a constant currency basis

Subscription Revenue growth of 21% on a

constant currency basis

Achieves GAAP Operating Margin of 11% and

Non-GAAP Operating Margin of 30%

Dynatrace (NYSE: DT) today announced financial results for the

third quarter of fiscal 2025 ended December 31, 2024.

"Our third quarter results exceeded guidance across all key

operating metrics," said Rick McConnell, Chief Executive Officer of

Dynatrace. "The explosion of data, along with its complexity,

combined with the unprecedented requirements for speed and scale,

are making modern digital ecosystems unmanageable. In a world where

generative and now agentic AI workloads are ramping, the

observability market has become mission critical for organizations

to ensure high business resiliency and deliver exceptional customer

experiences. Our leading AI-powered observability platform,

combined with our ongoing innovation, provide us with a powerful

advantage to capture the opportunity ahead."

Third Quarter Fiscal 2025 Financial and Other Recent Business

Highlights:

All growth rates are compared to the third quarter of fiscal

2024, unless otherwise noted.

Financial Highlights:

- ARR of $1,647 million, an increase of 16%, or 18% on a constant

currency basis

- Total Revenue of $436 million, an increase of 19%, or 20% on a

constant currency basis

- Subscription Revenue of $417 million, an increase of 20%, or

21% on a constant currency basis

- GAAP Income from Operations of $47 million and Non-GAAP Income

from Operations of $131 million

- GAAP EPS of $1.191 and Non-GAAP EPS of $0.37, both on a

dilutive basis

Business Highlights:

- Industry recognition: Dynatrace received the following

recognitions by third-party industry analysts:

- Named a Leader in both the Cloud-Native Observability and

Security Quadrants in the 2024 ISG Provider Lens, Multi Public

Cloud Solutions Report, for competitive strength and portfolio

attractiveness.

- Recognized as a Leader in the inaugural 2024 GigaOm Radar

Report for Kubernetes Observability.

- Partner evolution: Dynatrace was named the 2024 AWS EMEA

technology partner of the year for helping customers innovate

faster, reduce costs and be more agile through cloud migration and

modernization programs. In addition, Dynatrace became a member of

the Microsoft Intelligent Security Association (MISA) based on our

powerful integration with Microsoft’s SIEM solution, Microsoft

Sentinel.

- Sustainability progress: We published our second annual

Sustainability Report, which discusses our progress on

environmental, social, and governance topics that are important to

Dynatrace stakeholders. The report is posted on our website at

www.dynatrace.com/company/sustainability/ and highlights third

party limited assurance/verification of our fiscal year 2024

greenhouse gas emissions data, our new Global Inclusion Council,

AI-related governance developments, and more.

Share Repurchase Program

- During the third quarter, Dynatrace spent $40 million to

repurchase 732,000 shares at an average price of $54.64 under its

$500 million share repurchase program. From the inception of the

program in May 2024 through December 31, 2024, Dynatrace has

repurchased 2.7 million shares for $130 million at an average price

of $48.89.

________________________________

1 During the third quarter, Dynatrace

completed an intra-entity asset transfer of the global economic

rights of intellectual property (IP) from a wholly-owned U.S.

subsidiary to a wholly-owned Swiss subsidiary, more closely

aligning IP rights with business operations. The transfer generated

an income tax benefit of $320.9 million, or $1.06 per share on a

dilutive basis.

Third Quarter 2025 Financial

Highlights

(Unaudited – In thousands,

except per share data)

Three Months Ended December

31,

2024

2023

Key Operating Metric:

Annual recurring revenue (ARR)

$

1,647,412

$

1,425,284

Year-over-Year Increase

16

%

Year-over-Year Increase - constant

currency (*)

18

%

Revenue:

Total revenue

$

436,169

$

365,096

Year-over-Year Increase

19

%

Year-over-Year Increase - constant

currency (*)

20

%

Subscription revenue

$

417,207

$

348,294

Year-over-Year Increase

20

%

Year-over-Year Increase - constant

currency (*)

21

%

GAAP Financial Measures:

GAAP income from operations

$

47,464

$

35,720

GAAP operating margin

11

%

10

%

GAAP net income (**)

$

361,752

$

42,691

GAAP net income per share - diluted

(**)

$

1.19

$

0.14

GAAP shares outstanding - diluted

303,467

299,246

Net cash provided by operating

activities

$

42,238

$

75,657

Non-GAAP Financial Measures

(*):

Non-GAAP income from operations

$

130,734

$

104,636

Non-GAAP operating margin

30

%

29

%

Non-GAAP net income

$

111,679

$

96,184

Non-GAAP net income per share -

diluted

$

0.37

$

0.32

Non-GAAP shares outstanding - diluted

303,467

299,246

Free cash flow

$

37,569

$

67,357

* For additional information, please see

the "Non-GAAP Financial Measures" and "Definitions - Non-GAAP and

Other Metrics" sections of this press release.

** For additional information, please see

note 1 above.

Financial Outlook

Based on information available as of January 30, 2025, Dynatrace

is issuing guidance for the fourth quarter and increasing its

previous guidance for full year fiscal 2025 in the table below.

This guidance reflects foreign exchange rates as of December 31,

2024. We now expect foreign exchange to be a headwind of

approximately $38 million on ARR and approximately $17 million on

revenue for fiscal 2025 compared to ARR and revenue at constant

currency. Given recent strengthening of the U.S. dollar, this

represents an incremental headwind of approximately $28 million to

ARR and $10 million to revenue. This guidance also excludes the

impact of any share repurchases during the fourth quarter of fiscal

2025.

Growth rates for ARR, Total revenue, and Subscription revenue

are presented in constant currency to provide better visibility

into the underlying growth of the business.

All growth rates below are compared to the fourth quarter and

full year of fiscal 2024.

(In millions, except per share data)

Q4 Fiscal 2025

Guidance

Total revenue

$432 - $437

As reported

13% - 15%

Constant currency

16% - 17%

Subscription revenue

$410 - $415

As reported

14% - 15%

Constant currency

17% - 18%

Non-GAAP income from operations

$104 - $110

Non-GAAP operating margin

24% - 25%

Non-GAAP net income

$88 - $93

Non-GAAP net income per diluted share

$0.29 - $0.31

Diluted weighted average shares

outstanding

304 - 305

(In millions, except per share data)

Current Guidance

Fiscal 2025

Prior Guidance

Fiscal 2025*

Guidance Change

at Midpoint**

ARR

$1,705 - $1,715

$1,720 - $1,735

$(18)

As reported

13% - 14%

14% - 15%

(100) bps

Constant currency

16% - 16.5%

15% - 16%

75 bps

Total revenue

$1,686 - $1,691

$1,665 - $1,675

$19

As reported

18%

16% - 17%

150 bps

Constant currency

19%

17% - 18%

150 bps

Subscription revenue

$1,609 - $1,614

$1,590 - $1,600

$17

As reported

18% - 19%

17% - 18%

100 bps

Constant currency

20%

17% - 18%

250 bps

Non-GAAP income from operations

$480 - $486

$466 - $474

$13

Non-GAAP operating margin

28.5% - 28.75%

28% - 28.25%

50 bps

Non-GAAP net income

$412 - $417

$396 - $404

$15

Non-GAAP net income per diluted share

$1.36 - $1.37

$1.31 - $1.33

$0.05

Diluted weighted average shares

outstanding

303 - 304

303 - 305

(1)

Free cash flow

$415 - $420

$393 - $404

$19

Free cash flow margin

25%

23.5% - 24%

125 bps

*Prior guidance was issued on November 7,

2024.

**Guidance change at midpoint rounded to

the nearest million.

Conference Call and Webcast Information

Dynatrace will host a conference call and live webcast to

discuss its results and business outlook for investors and analysts

at 8:00 a.m. Eastern Time today, January 30, 2025. To access the

conference call from the U.S. and Canada, dial (866) 405-1247, or

internationally, dial (201) 689-8045 with conference ID# 13750856.

The call will also be available live via webcast on the company’s

website, ir.dynatrace.com.

An audio replay of the call will also be available until 11:59

p.m. Eastern Time on April 30, 2025, by dialing (877) 660-6853 from

the U.S. and Canada, or for international callers by dialing (201)

612-7415 and entering conference ID# 13750856. In addition, an

archived webcast will be available at ir.dynatrace.com.

We announce material financial information to our investors

using our Investor Relations website, press releases, SEC filings

and public conference calls and webcasts. We also use these

channels to disclose information about the company, our planned

financial and other announcements, attendance at upcoming investor

and industry conferences, and for complying with our disclosure

obligations under Regulation FD.

Non-GAAP Financial Measures

In addition to disclosing financial measures prepared in

accordance with GAAP, this press release and the accompanying

tables contain certain non-GAAP financial measures as defined by

Regulation G, including non-GAAP income from operations, non-GAAP

operating margin, non-GAAP net income, non-GAAP net income per

diluted share, and free cash flow. We also use or discuss non-GAAP

financial measures in conference calls, slide presentations and

webcasts.

We use these non-GAAP financial measures for financial and

operational decision-making purposes, and as a means to evaluate

period-to-period comparisons and liquidity. We believe that these

non-GAAP financial measures provide useful information about our

operating results, enhance the overall understanding of past

financial performance and allow for greater transparency with

respect to metrics used by our management in its financial and

operational decision-making.

The presentation of the non-GAAP financial measures is not

intended to be considered in isolation or as a substitute for, or

superior to, the financial information prepared and presented in

accordance with GAAP. Our non-GAAP financial measures may not

provide information that is directly comparable to similarly titled

metrics provided by other companies.

Non-GAAP financial measures are defined in this press release

and the tables included in this press release include

reconciliations of historical non-GAAP financial measures to their

most directly comparable GAAP measures.

We also include non-GAAP financial measures in our financial

outlook included in this press release. Reconciliations of

forward-looking non-GAAP income from operations, non-GAAP net

income, non-GAAP net income per diluted share, and free cash flow

guidance to the most directly comparable GAAP measures are not

available without unreasonable efforts due to the high variability,

complexity, and low visibility with respect to the charges excluded

from these non-GAAP measures; in particular, the measures and

effects of share-based compensation expense, employer taxes and tax

deductions specific to equity compensation awards that are directly

impacted by future hiring, turnover and retention needs, as well as

unpredictable fluctuations in our stock price. We expect the

variability of the above charges to have a significant, and

potentially unpredictable, impact on our future GAAP financial

results.

Definitions - Non-GAAP and Other Metrics

Annual Recurring Revenue (ARR) is defined as the daily

revenue of all subscription agreements that are actively generating

revenue as of the last day of the reporting period multiplied by

365. We exclude from our calculation of ARR any revenues derived

from month-to-month agreements and/or product usage overage

billings.

Constant Currency amounts for ARR, Total Revenue and

Subscription Revenue are presented to provide a framework for

assessing how our underlying businesses performed excluding the

effect of foreign exchange rate fluctuations. To present this

information, current and comparative prior period results for

entities reporting in currencies other than United States dollars

are converted into United States dollars using the average exchange

rates from the comparative period rather than the actual exchange

rates in effect during the respective periods. All growth

comparisons relate to the corresponding period in the last fiscal

year.

Non-GAAP Income from Operations is defined as GAAP income

from operations adjusted for the following items: share-based

compensation; employer payroll taxes on employee stock

transactions; amortization of intangibles; transaction,

restructuring and other non-recurring or unusual items that may

arise from time to time. The related margin is non-GAAP income from

operations expressed as a percentage of total revenue.

Non-GAAP Net Income is defined as GAAP net income

adjusted for the following items: income tax expense/benefit;

non-GAAP effective cash taxes; net interest expense and income; net

cash received from and paid for interest; share-based compensation;

employer payroll taxes on employee stock transactions, amortization

of intangibles; gains and losses on currency translation; and

transaction, restructuring and other non-recurring or unusual items

that may arise from time to time. Non-GAAP net income per diluted

share is calculated as non-GAAP net income divided by the diluted

weighted average shares outstanding used to compute GAAP net income

per diluted share.

Free Cash Flow is defined as the net cash provided by or

used in operating activities less capital expenditures, reflected

as purchase of property and equipment and capitalized software

additions in our financial statements. The related margin is free

cash flow expressed as a percentage of total revenue.

About Dynatrace

Dynatrace exists to make the world's software work perfectly.

Our end-to-end platform combines broad and deep observability and

continuous runtime application security with Davis® hypermodal AI

to provide answers and intelligent automation from data at an

enormous scale. This enables innovators to modernize and automate

cloud operations, deliver software faster and more securely, and

ensure flawless digital experiences. That's why the world's largest

organizations trust the Dynatrace® platform to accelerate digital

transformation.

Cautionary Language Concerning Forward-Looking

Statements

This press release includes certain “forward-looking statements”

within the meaning of the Private Securities Litigation Reform Act

of 1995, including statements related to benefits that we believe

organizations receive from using Dynatrace and our financial and

business outlook, including our financial guidance for the fourth

quarter and full year of fiscal 2025. These forward-looking

statements include, but are not limited to, plans, objectives,

expectations and intentions and other statements contained in this

press release that are not historical facts and statements

identified by words such as “will,” “expects,” “anticipates,”

“intends,” “plans,” “believes,” “seeks,” “estimates” or words of

similar meaning. These forward-looking statements reflect our

current views about our plans, intentions, expectations, strategies

and prospects, which are based on the information currently

available to us and on assumptions we have made. Although we

believe that our plans, intentions, expectations, strategies and

prospects as reflected in or suggested by those forward-looking

statements are reasonable, we can give no assurance that the plans,

intentions, expectations or strategies will be attained or

achieved. Furthermore, actual results may differ materially from

those described in the forward-looking statements and will be

affected by a variety of risks and factors that are beyond our

control including, without limitation, our ability to maintain our

revenue growth rates in future periods; market adoption of our

product offerings; continued demand for, and spending on, our

solutions; our ability to innovate and develop solutions that meet

customer needs, including through Davis AI; the ability of our

platform and solutions to effectively interoperate with customers’

IT infrastructures; our ability to acquire new customers and retain

and expand our relationships with existing customers; our ability

to expand our sales and marketing capabilities; our ability to

compete; our ability to maintain successful relationships with

partners; security breaches, other security incidents and any real

or perceived errors, failures, defects or vulnerabilities in our

solutions; our ability to protect our intellectual property; our

ability to hire and retain necessary qualified employees to grow

our business and expand our operations; our ability to successfully

complete acquisitions and to integrate newly acquired businesses

and offerings; the effect on our business of the macroeconomic

environment, associated global economic conditions and geopolitical

disruption; and other risks set forth under the caption “Risk

Factors” in our Annual Report on Form 10-K, subsequent Quarterly

Reports on Form 10-Q, and our other SEC filings. We assume no

obligation to update any forward-looking statements contained in

this document as a result of new information, future events or

otherwise.

DYNATRACE, INC.

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS

(Unaudited – In thousands,

except per share data)

Three Months Ended

December 31,

Nine Months Ended

December 31,

2024

2023

2024

2023

Revenue:

Subscription

$

417,207

$

348,294

$

1,198,593

$

999,245

Service

18,962

16,802

54,925

50,437

Total revenue

436,169

365,096

1,253,518

1,049,682

Cost of revenue:

Cost of subscription

60,666

46,888

170,034

134,584

Cost of service

18,139

16,744

52,536

47,961

Amortization of acquired technology

3,756

4,237

12,528

12,035

Total cost of revenue

82,561

67,869

235,098

194,580

Gross profit

353,608

297,227

1,018,420

855,102

Operating expenses:

Research and development

98,343

80,102

281,287

220,468

Sales and marketing

154,472

132,723

443,802

385,445

General and administrative

49,354

43,231

143,285

127,074

Amortization of other intangibles

3,975

5,451

13,527

16,838

Total operating expenses

306,144

261,507

881,901

749,825

Income from operations

47,464

35,720

136,519

105,277

Interest income, net

11,726

10,605

37,351

26,260

Other expense, net

(2,072

)

(3,901

)

(6,145

)

(6,724

)

Income before income taxes

57,118

42,424

167,725

124,813

Income tax benefit (expense)

304,634

267

276,655

(8,125

)

Net income

$

361,752

$

42,691

$

444,380

$

116,688

Net income per share:

Basic

$

1.21

$

0.14

$

1.49

$

0.40

Diluted

$

1.19

$

0.14

$

1.47

$

0.39

Weighted average shares outstanding:

Basic

298,646

294,869

298,049

293,295

Diluted

303,467

299,246

302,815

298,335

UNAUDITED SHARE-BASED

COMPENSATION

Three Months Ended

December 31,

Nine Months Ended

December 31,

2024

2023

2024

2023

Cost of revenue

$

9,821

$

6,975

$

27,265

$

19,660

Research and development

26,582

18,678

74,769

50,119

Sales and marketing

20,709

15,947

57,481

48,823

General and administrative

15,027

13,222

41,984

34,696

Total share-based compensation

$

72,139

$

54,822

$

201,499

$

153,298

DYNATRACE, INC.

CONDENSED CONSOLIDATED BALANCE

SHEETS

(In thousands, except share

and per share data)

December 31, 2024

March 31, 2024

(unaudited)

Assets

Current assets:

Cash and cash equivalents

$

907,482

$

778,983

Short-term investments

100,225

57,891

Accounts receivable, net

391,578

602,739

Deferred commissions, current

102,811

98,935

Prepaid expenses and other current

assets

73,130

66,749

Total current assets

1,575,226

1,605,297

Long-term investments

46,260

46,350

Property and equipment, net

49,426

53,325

Operating lease right-of-use assets,

net

66,666

61,390

Goodwill

1,335,386

1,335,494

Intangible assets, net

23,351

50,995

Deferred tax assets, net

514,838

138,836

Deferred commissions, non-current

88,237

93,310

Other assets

35,715

24,782

Total assets

$

3,735,105

$

3,409,779

Liabilities and shareholders'

equity

Current liabilities:

Accounts payable

$

8,552

$

21,410

Accrued expenses, current

213,130

233,675

Deferred revenue, current

812,892

987,953

Operating lease liabilities, current

13,995

15,513

Total current liabilities

1,048,569

1,258,551

Deferred revenue, non-current

54,940

62,308

Accrued expenses, non-current

16,533

18,404

Operating lease liabilities,

non-current

61,216

54,013

Deferred tax liabilities

563

1,013

Total liabilities

1,181,821

1,394,289

Shareholders' equity:

Common shares, $0.001 par value,

600,000,000 shares authorized, 299,343,079 and 296,962,547 shares

issued and outstanding at December 31, 2024 and March 31, 2024,

respectively

299

297

Additional paid-in capital

2,340,470

2,249,349

Retained earnings (accumulated

deficit)

245,623

(198,757

)

Accumulated other comprehensive loss

(33,108

)

(35,399

)

Total shareholders' equity

2,553,284

2,015,490

Total liabilities and shareholders'

equity

$

3,735,105

$

3,409,779

DYNATRACE, INC.

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

(Unaudited – In

thousands)

Nine Months Ended

December 31,

2024

2023

Cash flows from operating

activities:

Net income

$

444,380

$

116,688

Adjustments to reconcile net income to

cash provided by operations:

Depreciation

13,851

11,781

Amortization

27,603

29,067

Share-based compensation

201,499

153,298

Deferred income taxes

(378,795

)

(49,579

)

Other

4,135

7,016

Net change in operating assets and

liabilities:

Accounts receivable

204,251

83,444

Deferred commissions

(3,035

)

874

Prepaid expenses and other assets

(21,573

)

(27,437

)

Accounts payable and accrued expenses

(27,608

)

(24,022

)

Operating leases, net

434

1,253

Deferred revenue

(168,513

)

(55,946

)

Net cash provided by operating

activities

296,629

246,437

Cash flows from investing

activities:

Purchase of property and equipment

(11,540

)

(16,662

)

Capitalized software additions

—

(4,655

)

Acquisition of a business, net of cash

acquired

(100

)

(32,297

)

Purchases of investments

(107,989

)

—

Proceeds from sales and maturities of

investments

68,145

—

Net cash used in investing activities

(51,484

)

(53,614

)

Cash flows from financing

activities:

Payments of deferred consideration related

to capitalized software additions

(1,656

)

—

Proceeds from employee stock purchase

plan

21,159

19,472

Proceeds from exercise of stock

options

14,903

24,205

Repurchases of common stock

(130,100

)

—

Taxes paid related to net share settlement

of equity awards

(16,338

)

—

Net cash (used in) provided by financing

activities

(112,032

)

43,677

Effect of exchange rates on cash and cash

equivalents

(4,614

)

(9,199

)

Net increase in cash and cash

equivalents

128,499

227,301

Cash and cash equivalents, beginning of

period

778,983

555,348

Cash and cash equivalents, end of

period

$

907,482

$

782,649

DYNATRACE, INC.

GAAP to Non-GAAP

Reconciliations

(Unaudited - In thousands,

except percentages)

Three Months Ended December

31, 2024

GAAP

Share-based

compensation

Employer payroll taxes on

employee stock transactions

Amortization of

intangibles

Transaction, restructuring,

and other

Non-GAAP

Non-GAAP income from

operations:

Cost of revenue

$

82,561

$

(9,821

)

$

(469

)

$

(3,756

)

$

—

$

68,515

Gross profit

353,608

9,821

469

3,756

—

367,654

Gross margin

81

%

84

%

Research and development

98,343

(26,582

)

(1,770

)

—

—

69,991

Sales and marketing

154,472

(20,709

)

(756

)

—

(106

)

132,901

General and administrative

49,354

(15,027

)

(299

)

—

34,028

Amortization of other intangibles

3,975

—

—

(3,975

)

—

—

Income from operations

47,464

72,139

3,294

7,731

106

130,734

Operating margin

11

%

30

%

Three Months Ended December

31, 2023

GAAP

Share-based

compensation

Employer payroll taxes on

employee stock transactions

Amortization of

intangibles

Transaction, restructuring,

and other

Non-GAAP

Non-GAAP income from

operations:

Cost of revenue

$

67,869

$

(6,975

)

$

(284

)

$

(4,237

)

$

—

$

56,373

Gross profit

297,227

6,975

284

4,237

—

308,723

Gross margin

81

%

85

%

Research and development

80,102

(18,678

)

(1,196

)

—

—

60,228

Sales and marketing

132,723

(15,947

)

(1,029

)

—

201

115,948

General and administrative

43,231

(13,222

)

(360

)

—

(1,738

)

27,911

Amortization of other intangibles

5,451

—

—

(5,451

)

—

—

Income from operations

$

35,720

$

54,822

$

2,869

$

9,688

$

1,537

$

104,636

Operating margin

10

%

29

%

DYNATRACE, INC.

GAAP to Non-GAAP

Reconciliations

(Unaudited - In thousands,

except per share data)

Three Months Ended December

31,

2024

2023

Non-GAAP net income:

Net income

$

361,752

$

42,691

Income tax benefit

(304,634

)

(267

)

Non-GAAP effective cash tax

(30,588

)

(18,516

)

Interest income, net

(11,726

)

(10,605

)

Cash received from interest, net

11,533

10,064

Share-based compensation

72,139

54,822

Employer payroll taxes on employee stock

transactions

3,294

2,869

Amortization of intangibles

7,731

9,688

Transaction, restructuring, and other

106

1,537

Loss on currency translation

2,072

3,901

Non-GAAP net income

$

111,679

$

96,184

Share count:

Weighted-average shares outstanding -

basic

298,646

294,869

Weighted-average shares outstanding -

diluted

303,467

299,246

Shares used in non-GAAP per share

calculations:

Weighted-average shares outstanding -

basic

298,646

294,869

Weighted-average shares outstanding -

diluted

303,467

299,246

Non-GAAP net income per share:

Net income per share - basic

$

1.21

$

0.14

Net income per share - diluted

$

1.19

$

0.14

Non-GAAP net income per share - basic

$

0.37

$

0.33

Non-GAAP net income per share -

diluted

$

0.37

$

0.32

Three Months Ended December

31,

2024

2023

Free cash flow:

Net cash provided by operating

activities

$

42,238

$

75,657

Purchase of property and equipment

(4,669

)

(3,645

)

Capitalized software additions

—

(4,655

)

Free cash flow

$

37,569

$

67,357

DYNATRACE, INC.

GAAP to Non-GAAP

Reconciliations

(Unaudited - In thousands,

except percentages)

Nine Months Ended December 31,

2024

GAAP

Share-based

compensation

Employer payroll taxes on

employee stock transactions

Amortization of

intangibles

Transaction, restructuring,

and other

Non-GAAP

Non-GAAP income from

operations:

Cost of revenue

$

235,098

$

(27,265

)

$

(1,786

)

$

(12,528

)

$

—

$

193,519

Gross profit

1,018,420

27,265

1,786

12,528

—

1,059,999

Gross margin

81

%

85

%

Research and development

281,287

(74,769

)

(5,484

)

—

(3

)

201,031

Sales and marketing

443,802

(57,481

)

(2,989

)

—

(106

)

383,226

General and administrative

143,285

(41,984

)

(1,215

)

—

3

100,089

Amortization of other intangibles

13,527

—

—

(13,527

)

—

—

Income from operations

$

136,519

$

201,499

$

11,474

$

26,055

$

106

$

375,653

Operating margin

11

%

30

%

Nine Months Ended December 31,

2023

GAAP

Share-based

compensation

Employer payroll taxes on

employee stock transactions

Amortization of

intangibles

Transaction, restructuring,

and other

Non-GAAP

Non-GAAP income from

operations:

Cost of revenue

$

194,580

$

(19,660

)

$

(1,516

)

$

(12,035

)

$

—

$

161,369

Gross profit

855,102

19,660

1,516

12,035

—

888,313

Gross margin

81

%

85

%

Research and development

220,468

(50,119

)

(4,391

)

—

—

165,958

Sales and marketing

385,445

(48,823

)

(3,341

)

—

399

333,680

General and administrative

127,074

(34,696

)

(1,125

)

—

(5,724

)

85,529

Amortization of other intangibles

16,838

—

—

(16,838

)

—

—

Income from operations

$

105,277

$

153,298

$

10,373

$

28,873

$

5,325

$

303,146

Operating margin

10

%

29

%

DYNATRACE, INC.

GAAP to Non-GAAP

Reconciliations

(Unaudited - In thousands,

except per share data)

Nine Months Ended December

31,

2024

2023

Non-GAAP net income:

Net income

$

444,380

$

116,688

Income tax (benefit) expense

(276,655

)

8,125

Non-GAAP effective cash tax

(88,538

)

(58,986

)

Interest income, net

(37,351

)

(26,260

)

Cash received from interest, net

36,151

24,556

Share-based compensation

201,499

153,298

Employer payroll taxes on employee stock

transactions

11,474

10,373

Amortization of intangibles

26,055

28,873

Transaction, restructuring, and other

106

5,325

Loss on currency translation

6,145

6,724

Non-GAAP net income

$

323,266

$

268,716

Share count:

Weighted-average shares outstanding -

basic

298,049

293,295

Weighted-average shares outstanding -

diluted

302,815

298,335

Shares used in non-GAAP per share

calculations:

Weighted-average shares outstanding -

basic

298,049

293,295

Weighted-average shares outstanding -

diluted

302,815

298,335

Non-GAAP net income per share:

Net income per share - basic

$

1.49

$

0.40

Net income per share - diluted

$

1.47

$

0.39

Non-GAAP net income per share - basic

$

1.08

$

0.92

Non-GAAP net income per share -

diluted

$

1.07

$

0.90

Nine Months Ended December

31,

2024

2023

Free cash flow:

Net cash provided by operating

activities

$

296,629

$

246,437

Purchase of property and equipment

(11,540

)

(16,662

)

Capitalized software additions

—

(4,655

)

Free cash flow

$

285,089

$

225,120

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250130713720/en/

Investors: Noelle Faris VP, Investor Relations

Noelle.Faris@dynatrace.com

Media Relations: Kristy Campbell VP, Brand and

Communications Kristy.Campbell@dynatrace.com

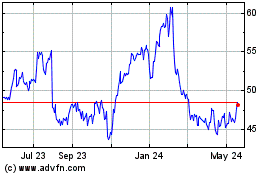

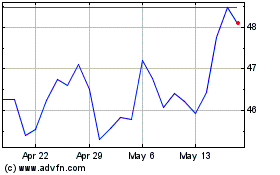

Dynatrace (NYSE:DT)

Historical Stock Chart

From Jan 2025 to Feb 2025

Dynatrace (NYSE:DT)

Historical Stock Chart

From Feb 2024 to Feb 2025