false

0000927066

0000927066

2024-09-09

2024-09-09

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

Form

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the

Securities

Exchange Act of 1934

Date

of Report (date of earliest event reported): September 9, 2024

DAVITA

INC.

(Exact

name of registrant as specified in its charter)

| |

|

|

| DE |

1-14106 |

51-0354549 |

(State

or other jurisdiction

of incorporation) |

(Commission

File Number) |

(IRS

Employer

Identification No.) |

| |

|

|

|

|

|

|

|

|

| 2000

16th Street |

| Denver, CO |

|

80202 |

(Address

of principal executive offices including Zip Code)

(720)

631-2100

(Registrant’s

telephone number, including area code)

Not

applicable

(Former

name or former address, if changed since last report)

Check the appropriate

box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following

provisions:

☐ Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered

pursuant to Section 12(b) of the Act:

| |

|

|

| Title

of each class: |

Trading

symbol(s): |

Name

of each exchange on which registered: |

| Common

Stock, $0.001 par value |

DVA |

New

York Stock Exchange |

| |

|

|

Indicate by check

mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this

chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

☐ Emerging

growth company

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any

new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of

Certain Officers.

Chief

Operating Officer Transition

On

September 9, 2024, DaVita Inc. (the “Company”) announced that David P. Maughan, Senior Vice President of the Company, has

been appointed Chief Operating Officer, DaVita Kidney Care, effective September 15, 2024 (the “Effective Date”). Mr.

Maughan will replace Michael D. Staffieri, who will transition to the role of Chief Operating Officer Emeritus, as of the Effective Date.

Mr.

Maughan, 47, served as a Senior Vice President, Kidney Care, responsible for DaVita’s national home and hospital services businesses,

as well as a range of key business functions including oversight of human resources, IT, marketing and communications, and State government

affairs from November 2019 to September 2024. He joined DaVita in 2006 and served in various field operations roles of increasing responsibility

from September 2006 to November 2019. Prior to joining DaVita, Mr. Maughan worked for Goldman Sachs in Finance from 2001 to 2004 in New

York City and London. Mr. Maughan received his undergraduate degree in English literature from Brigham Young University and received

his MBA from the Harvard Business School.

There

are no family relationships between Mr. Maughan and any director or executive officer of the Company, or with any person selected to

become a director or an executive officer of the Company. The Company has had no transactions since the beginning of its last fiscal

year, and has no transactions proposed, in which Mr. Maughan, or any member of his immediate family, has a direct or indirect material

interest and which would require disclosure under Item 404(a) of Regulation S-K.

Employment

Agreement with Mr. Maughan

In

connection with this transition, the Company and Mr. Maughan entered into an employment agreement, effective as of the Effective Date

(the “Employment Agreement”). The payments and benefits to which Mr. Maughan is entitled under the Employment Agreement include:

(i) an annual base salary of $725,000; (ii) participation in the Company’s annual incentive plan, with a 2024 target incentive

bonus opportunity equal to 100% of his base salary earned during 2024; (iii) participation in the Company’s employee benefit plans

that are generally available to similarly situated Company executives; and (iv) participation in any long-term cash or equity incentive

plans in which other similarly situated Company senior executives generally participate.

Pursuant

to the Employment Agreement, if the Company terminates Mr. Maughan’s employment for reasons other than material cause, disability

(in each case, as defined in the Employment Agreement) or death, then Mr. Maughan will be entitled to the benefits set forth in

the DaVita Inc. Severance Plan for Directors and Above (the “Severance Plan”), pursuant to the terms and conditions

of the plan in effect at the time of termination, and subject to his execution of a release and continued cooperation and compliance

with other agreement provisions. In the event that Mr. Maughan resigns for good cause (as defined in the Employment Agreement), the Employment

Agreement provides that he will be entitled to receive (i) benefits set forth in the Severance Plan, pursuant to the terms and conditions

of the plan in effect at the time of termination; provided that such benefits shall not be less than base salary continuation for a period

of one year (two years in the event of a resignation within 60 days following a good cause event that occurs within two years following

a change in control); and (ii) if his employment is terminated after April in a given year, Mr. Maughan will receive a lump-sum payment

equal to the bonus paid in the year prior to the year in which the termination occurs, pro-rated for the number of months served in the

year of termination, in each case, subject to his execution of a release and continued cooperation and compliance with other agreement

provisions.

The

foregoing description of the terms and conditions of the Employment Agreement does not purport to be complete and is qualified in its

entirety by reference to the Employment Agreement, which is filed as Exhibit 10.1 hereto, and incorporated herein by reference.

Item

9.01. Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its

behalf by the undersigned hereunto duly authorized.

| |

DAVITA

INC. |

| |

|

|

| Date:

September 13, 2024 |

By: |

/s/

Kathleen A. Waters |

| |

|

Kathleen

A. Waters |

| |

|

Chief

Legal and Public Affairs Officer |

Exhibit 10.1

EMPLOYMENT AGREEMENT

This Employment Agreement

(this “Agreement”) is made effective as of September 15, 2024 (the “Effective Date”), by and between

DaVita Inc., a Delaware corporation (the “Company”) and David Maughan (“Employee”).

WHEREAS, the Company desires

to appoint Employee as Chief Operating Officer, Kidney Care, and Employee desires to serve in such position, upon the terms and subject

to the conditions set forth herein.

NOW, THEREFORE, in consideration

of the mutual covenants and agreements hereinafter set forth and for other good and valuable consideration, the parties hereto, intending

to be legally bound hereby, agree as follows:

Section 1. Employment

and Duties. The Company hereby employs Employee to serve as Chief Operating Officer, Kidney Care. Employee accepts such employment

on the terms and conditions set forth in this Agreement. Employee shall perform the duties of Chief Operating Officer, Kidney Care or

any additional or different duties or jobs as the Company deems appropriate. Employee shall work out of Denver, Colorado, although Employee

shall travel to other locations as necessary, and the work location is subject to change to suit business needs. Employee agrees to devote

substantially all of his time, energy, and ability to the business of the Company on a full-time basis and shall not engage in any other

business activities during the term of this Agreement, including but not limited to providing consulting services to any investment firm,

such as a hedge fund; provided however, Employee may pursue normal charitable activities so long as such activities do not require a substantial

amount of time and do not interfere with his ability to perform his duties. Employee agrees that he shall not serve on the board of directors,

advisory board, or similar oversight body of any not-for-profit or for-profit company, entity or institution without the express written

approval of the Chief Executive Officer of the Company or the Nominating and Governance Committee of the Board of Directors of the Company

(the “Board”). Employee shall at all times observe and abide by the Company’s policies and procedures as in effect from

time to time.

Section 2. Compensation.

In consideration of the services to be performed by Employee hereunder, Employee shall receive the following compensation and benefits.

2.1 Base Salary.

The Company shall pay Employee a base salary of $725,000 per annum, less standard withholdings and authorized deductions. Employee shall

be paid consistent with the Company’s payroll schedule. The base salary will be reviewed from time to time.

2.2. Annual

Incentive Bonus. Employee shall be entitled to participate in the Company’s annual bonus plan for senior executives (the “Incentive

Plan”) in accordance with the terms of such plan, with Employee’s target bonus incentive opportunity for each performance

year under the Incentive Plan to be established by the Compensation Committee of the Board (the “Compensation Committee”).

The 2024 target incentive bonus opportunity for Employee under the Incentive Plan shall be equal to 100% of Employee’s base salary

earned during 2024. The actual incentive bonus payable for any fiscal year shall be based on the degree to which the

applicable performance

goals are achieved, which goals shall be (or, in the case of 2024, have been) established and approved by the Compensation Committee.

2.3 Other

Benefits. Employee and/or his family, as the case may be, shall be eligible for participation in and shall receive all benefits under

the Company’s health and welfare benefit plans (including, without limitation, medical, prescription, dental, disability, and life

insurance) under the same terms and conditions applicable to most executives at similar levels of compensation and responsibility. Employee

shall be entitled to take time off for vacation or illness in accordance with the Company’s policies.

2.4 Long-Term Incentive

Awards. Employee shall be eligible to participate in any long-term cash or equity incentive plans in which other senior executives

of the Company generally participate, as determined by the Compensation Committee of the Board.

2.5 Expense

Reimbursement. The Company shall reimburse Employee, in accordance with the Company’s policies and procedures, for all proper

expenses incurred by Employee in the performance of Employee’s duties hereunder.

2.6 Possible

Recoupment of Certain Compensation. Notwithstanding any other provision in this Agreement to the contrary, Employee shall be subject

to the written policies of the Board as well as laws and regulations applicable to executives of the Company and its affiliates, including

the DaVita Inc. Dodd-Frank Policy on Recoupment of Incentive Compensation, and the Amended and Restated Incentive Compensation Clawback

Policy, each as may be amended from time to time, and any other Company policy, law or regulation relating to recoupment or “clawback”

of compensation that may exist from time to time during Employee’s employment by the Company and its affiliates and thereafter.

2.7 Return

of Compensation or other Property Received in Connection with Director, Officer, Shareholder or Similar Position. All fees, compensation,

other remuneration, dividends, distributions, or other property or financial benefit received by Employee in connection with Employee's

position as a director, officer, member, shareholder, partner or any other similar position of any controlled or uncontrolled direct or

indirect subsidiary or affiliate of the Company, or other contractual obligor to the Company or any of its subsidiaries or affiliates

the obligations of which constitute revenue to the Company or any of its subsidiaries or affiliates and of which Employee beneficially

owns or has the right to acquire, directly or indirectly, 10% or more of the equity interests or has the power to vote 10% or more of

the voting interests, shall belong to the Company and shall be immediately remitted to the Company. Notwithstanding the foregoing, this

provision shall not apply to any amounts payable to, earned by, received by or otherwise due to Employee as employment compensation from

the Company or any of its subsidiaries or affiliates, or any dividends or other distributions received by Employee in Employee’s

capacity as a stockholder of the Company.

2.8 Indemnification.

The Company agrees to indemnify and defend Employee, including the payment of reasonable attorneys’ fees and costs, against and

in respect of any and all claims, actions, or demands, to the extent permitted by the Company’s By-laws and applicable law.

2.9 Changes to Benefit

Plans. The Company reserves the right to modify, suspend, or discontinue any and all of its benefit plans, practices, policies, and

programs at any time, with or without notice, without recourse by Employee so long as such action is taken generally with respect to all

other similarly-situated peer executives and does not single out Employee.

Section 3. Provisions

Relating to Termination of Employment.

3.1 Employment Is At-Will.

Employee’s employment with the Company is “at will” and is terminable by the Company or by Employee at any time and

for any reason or no reason, subject to the notice requirements set forth below.

3.2 Termination for

Material Cause. The Company may terminate Employee’s employment without advance notice for Material Cause (as defined below).

Upon termination for Material Cause, Employee shall (i) be entitled to receive the base salary and benefits as set forth in Section

2.1 and Section 2.3, respectively, through the effective date of such termination and (ii) not be entitled to receive any other

compensation, benefits, or payments of any kind, except as otherwise required by law or by the terms of any benefit or retirement plan

or other arrangement that would, by its terms, apply.

3.3 Other Termination.

The Company may terminate the employment of Employee for any reason or for no reason at any time upon at least thirty (30) days’

advance written notice. If the Company terminates the employment of Employee for reasons other than for death, Material Cause, or Disability

(as defined below), and contingent upon Employee’s execution and non-revocation of the Company’s standard Severance and General

Release Agreement used by the Company at the time of termination (the “Severance and Release Agreement”) within the period

specified in the Severance and Release Agreement (not to exceed 60 days following such termination of employment), Employee shall be entitled

to the benefits set forth in the DaVita Inc. Severance Plan for Directors and Above (the “Severance Plan”), pursuant to the

terms and conditions of that plan as they exist at the time of the termination of Employee’s employment. During the period of time

when Employee receives benefits under the Severance Plan, Employee agrees to (a) make himself available to answer questions and to cooperate

in the transition of his duties, (b) respond to any inquiries from the compliance department, including making himself available for interview,

and (c) cooperate with the Company in the prosecution and/or defense of any claim, including making himself available for any interview,

appearing at depositions, and producing requested documents. The Company shall reimburse Employee for any reasonable out-of-pocket expenses

he may incur in connection with this Section 3.3.

3.4. Voluntary Resignation.

Employee may resign from the Company at any time upon at least ninety (90) days’ advance written notice. If Employee resigns from

the Company for any reason other than Good Cause (as defined below), Employee shall (i) be entitled to receive the base salary and benefits

as set forth in Section 2.1 and Section 2.3, respectively, through the effective date of such termination and (ii) not

be entitled to receive any other compensation, benefits, or payments of any kind, except as otherwise required by law or by the terms

of any benefit or retirement plan or other arrangement that would, by its terms, apply. In the event Employee resigns from the Company

at any time, the Company shall have the right to make such resignation effective as of any date before the expiration of the required

notice period.

3.5 Good Cause Resignation.

If Employee resigns for Good Cause and contingent upon Employee’s execution of the Severance and Release Agreement within the period

specified in the Severance and Release Agreement (not to exceed 60 days following such termination of employment), Employee shall (i)

be entitled to receive the base salary and benefits as set forth in Section 2.1 and Section 2.3, respectively, through the

effective date of such resignation, (ii) be entitled to the benefits set forth in the Severance Plan, pursuant to the terms and conditions

of that plan as they exist at the time of the termination of Employee’s employment except for the requirement that a teammate is

only eligible for severance if the teammate’s employment is terminated involuntarily by the Company, but in no event shall such

benefits include less than a right to receive continuation of his base salary for the twelve-month period following the termination of

his employment, subject to the Company’s payroll practices and procedures, (iii) if Employee’s employment is terminated after

April in a given year, receive a lump-sum payment equal to the bonus under the Incentive Plan paid in the year prior to the termination

of Employee’s employment, pro-rated for the number of months served in the year Employee’s employment is terminated, to be

paid on or around the time the Company normally pays performance bonuses to other senior executives so long as he has complied with the

terms of all agreements relating to nonsolicitation, noncompetition, and confidentiality, and (iv) not be entitled to any other compensation,

benefits, or payments of any kind, except as otherwise required by law or by the terms of any benefit or retirement plan or other arrangement

that would by its terms, apply. If Employee resigns within sixty (60) days following a Good Cause event that occurs within two years after

a Change of Control (as defined below), Employee shall receive the severance benefits set forth above except that the period in clause

(ii) shall be increased from twelve months to two years. Any severance shall be subject to the terms and conditions of the Severance Plan

and the cooperation and compliance with other agreement provisions set forth in Section 3.3, set forth above, and which are fully

incorporated herein by reference.

3.6 Disability.

Upon thirty (30) days’ advance notice (which notice may be given before the completion of the periods described herein), the Company

may terminate Employee’s employment for Disability.

3.7 Definitions.

For the purposes of this Agreement, the following terms shall have the meanings indicated:

(a) “Change

in Control” means:

(i) any transaction

or series of transactions in which any person or group (within the meaning of Rule 13d-5 under the Securities Exchange Act of 1934 (the

“Exchange Act”) and Sections 13(d) and 14(d) under the Exchange Act) becomes the direct or indirect “beneficial owner”

(as defined in Rule 13d-3 under the Exchange Act), by way of a stock issuance, tender offer, merger, consolidation, other business combination

or otherwise, of greater than 50% of the total voting power (on a fully diluted basis as if all convertible securities had been converted

and all warrants and options had been exercised) entitled to vote in the election of directors of the Company (including any transaction

in which the Company becomes a wholly owned or majority-owned subsidiary of another corporation);

(ii) consummation of any merger or consolidation in which the beneficial owners of the shares of the Company’s common stock outstanding

immediately prior to

such merger or consolidation represent 50% or less of the voting power of the corporation resulting from such merger

or consolidation, or, if applicable, the ultimate parent corporation of such corporation;

(iii) during

any 24-month period, individuals who, as of the beginning of such period, constitute the Board (the “Incumbent Board”), cease

for any reason to constitute at least a majority of such Board; provided that any individual who becomes a director of the Company subsequent

to the beginning of such period whose election, or nomination for election by the Company’s stockholders, was approved by the vote

of at least a majority of the directors then comprising the Incumbent Board shall be deemed a member of the Incumbent Board; and provided,

further, that any individual who was initially elected as a director of the Company as a result of an actual or threatened solicitation

by a person other than the Board for the purpose of opposing a solicitation by any other person with respect to the election or removal

of directors, or any other actual or threatened solicitation of proxies or consents by or on behalf of any person other than the Board,

shall not be deemed a member of the Incumbent Board;

(iv) consummation

of any transaction in which all or substantially all of the Company’s assets are sold; or

(v) the

approval by the Company’s stockholders of a plan of complete liquidation or dissolution of the Company.

(b) “Disability”

shall mean the inability, for a period of six (6) months, to adequately perform Employee’s regular duties, with or without reasonable

accommodation, due to a physical or mental illness, condition, or disability.

(c) “Good

Cause” shall mean the occurrence of the following events without Employee’s express written consent: (i) the Company materially

diminishes the scope of Employee’s duties and responsibilities (other than while Employee is physically or mentally incapacitated

or as required by applicable law); (ii) the Company materially reduces Employee’s base salary; or (iii) the Company requires Employee

to relocate more than fifty (50) miles from Denver, Colorado. Notwithstanding the above, the occurrence of any such condition shall not

constitute Good Cause unless the Employee provides written notice to the Company of the existence of such condition not later than 30

days after the initial existence of such condition, and the Company shall have failed to cure such condition within 30 days after receipt

of such written notice and Employee shall terminate employment within 60 days after the expiration of the Company’s cure period.

(d)

“Material Cause” shall mean any of the following: (i) conviction of a felony or plea of no contest to a felony; (ii)

any act of fraud or dishonesty in connection with the performance of his duties; (iii) repeated failure or refusal by Employee to follow

policies or directives reasonably established by the Board or the Chief Executive Officer of the Company or his/her designee that goes

uncorrected for a period of ten (10) consecutive days after written notice has been provided to Employee; (iv) a material breach of this

Agreement; (v) any gross or willful misconduct or gross negligence by Employee in the performance of his duties; (vi) egregious conduct

by Employee that brings the Company or any of its subsidiaries or affiliates into public

disgrace or disrepute; (vii) an act of unlawful

discrimination, including sexual harassment; (viii) a violation of the duty of loyalty or of any fiduciary duty; or (ix) exclusion or

notice of exclusion of Employee from participating in any federal health care program.

3.8 Notice of Termination.

Any purported termination of Employee’s employment by the Company or by Employee shall be communicated by a written Notice of Termination

to the other party hereto in accordance with Section 6 hereof. A “Notice of Termination” shall mean a written notice

that indicates the specific termination provision in this Agreement.

3.9 Effect of Termination.

Upon termination, this Agreement shall be of no further force and effect and neither party shall have any further right or obligation

hereunder; provided, however, that no termination shall modify or affect the rights and obligations of the parties that have accrued prior

to termination; and provided further, that the rights and obligations of the parties under Section 3, Section 4, Section

5 and Section 6 shall survive termination of this Agreement.

3.10 Resignation

from Other Positions. Upon the termination of Employee’s employment for any reason (unless otherwise agreed in writing by the

Company and Employee), Employee shall be deemed to have resigned, without any further action by Employee, from any and all officer and

director positions that Employee, immediately prior to such termination, (i) held with the Company or any of its affiliates and (ii) held

with any other entities at the direction of, or as a result of the Employee’s affiliation with, the Company or any of its affiliates.

If for any reason this Section 3.10 is deemed to be insufficient to effectuate such resignations, then Employee shall, upon the

Company’s request, execute any documents or instruments that the Company may deem necessary or desirable to effectuate such resignations.

In addition, Employee hereby designates the Secretary or any Assistant Secretary of the Company and its affiliates to execute any such

documents or instruments as Employee’s attorney-in-fact to effectuate such resignations if execution by the Secretary or any Assistant

Secretary of the Company or its affiliates is deemed by the Company or its affiliates to be a more expedient means to effectuate such

resignation or resignations.

Section 4: Noncompetition,

Nonsolicitation and Confidentiality Agreement. Employee acknowledges and agrees that he is and remains subject to the Noncompetition,

Nonsolicitation and Confidentiality Agreement, dated December 9, 2009, between the Company and Employee (the “Restrictive Covenant

Agreement”). Nothing contained in this Agreement, the Restrictive Covenant Agreement or any other agreement between the Company

or any of its affiliates and Employee (i) prohibits or limits Employee’s ability to file a charge or complaint with any federal,

state or local governmental agency or commission, including but not limited to the U.S. Securities and Exchange Commission or (ii) prohibits

or limits Employee’s ability to communicate with any federal, state or local governmental agency or commission (including but not

limited to the U.S. Securities and Exchange Commission), or to otherwise participate in any investigation or proceeding that may be conducted

by such an agency or commission (including but not limited to the U.S. Securities and Exchange Commission), including providing documents

or other information or receiving an award for such information provided or prevents Employee from discussing or disclosing information

about unlawful acts in the workplace, such as harassment or discrimination or any other conduct that Employee has reason to believe is

unlawful. Further, Employee shall not be held criminally or civilly liable under any Federal or State trade secret law for the disclosure

of a trade secret that: (1) is made (a) in confidence to a Federal, State, or local

government official, either directly or indirectly,

or to an attorney, and (b) solely for the purpose of reporting or investigating a suspected violation of law; or (2) is made in a complaint

or other document filed in a lawsuit or other proceeding, if such filing is made under seal. Disclosures to attorneys, made under seal,

or pursuant to court order are also protected in certain circumstances under 18 U.S.C. § 1833. Further, an individual who files a

lawsuit for retaliation by an employer for reporting a suspected violation of law may disclose the employer’s trade secrets to the

attorney and use the trade secret information in the court proceeding if the individual files any document containing the trade secret

under seal and does not disclose the trade secret, except pursuant to court order.

Section 5. Tax Matters.

5.1 Federal

and State Withholding. The Company shall deduct from the amounts payable to Employee pursuant to this Agreement the amount of all

required federal, state and local withholding taxes in accordance with Employee’s Form W-4 on file with the Company, and all applicable

federal employment taxes. Employee is ultimately liable and responsible for all taxes under all applicable federal, state, local or other

laws or regulations (the “Required Tax Payments”) owed in connection with the compensation payable under this Agreement, regardless

of any action the Company or any of its affiliates takes with respect to any tax withholding obligations that arise in connection with

the payment of such compensation. Neither the Company nor any of its affiliates makes any representation or undertaking regarding the

treatment of any tax withholding in connection with the compensation received pursuant to this Agreement. The Company and its affiliates

do not commit and are under no obligation to structure the Employee’s compensation terms to reduce or eliminate Employee’s

tax liability.

5.2 Section

409A of the Code.

(a) General. It

is intended that payments and benefits made or provided under this Agreement shall not result in penalty taxes or accelerated taxation

pursuant to Section 409A of the Internal Revenue Code of 1986, as amended (the “Code”). Any payments that qualify for the

“short-term deferral” exception, the separation pay exception or another exception under Section 409A of the Code shall be

paid under the applicable exception. For purposes of the limitations on nonqualified deferred compensation under Section 409A of the Code,

each payment of compensation under this Agreement shall be treated as a separate payment of compensation. All payments to be made upon

a termination of employment under this Agreement may only be made upon a “separation from service” under Section 409A of the

Code to the extent necessary in order to avoid the imposition of penalty taxes on Employee pursuant to Section 409A of the Code. In no

event may Employee, directly or indirectly, designate the calendar year of any payment under this Agreement, and to the extent required

by Section 409A of the Code, any payment that may be paid in more than one taxable year (depending on the time that Employee executes

the Separation Agreement and Release) shall be paid in the later taxable year.

(b) Reimbursements

and In-Kind Benefits. Notwithstanding anything to the contrary in this Agreement, all reimbursements and in-kind benefits provided

under this Agreement that are subject to Section 409A of the Code shall be made in accordance with the requirements of Section 409A of

the Code, including, where applicable, the requirement that (i) any reimbursement is for expenses incurred during Employee’s lifetime

(or during a shorter period of time specified in this

Agreement); (ii) the amount of expenses eligible for reimbursement, or in-kind benefits

provided, during a calendar year may not affect the expenses eligible for reimbursement, or in-kind benefits to be provided, in any other

calendar year; (iii) the reimbursement of an eligible expense will be made no later than the last day of the calendar year following the

year in which the expense is incurred; and (iv) the right to reimbursement or in-kind benefits is not subject to liquidation or exchange

for another benefit.

(c) Delay of Payments.

Notwithstanding any other provision of this Agreement to the contrary, if Employee is considered a “specified employee” for

purposes of Section 409A of the Code (as determined in accordance with the methodology established by the Company and its affiliates as

in effect on the date of termination), any payment that constitutes nonqualified deferred compensation within the meaning of Section 409A

of the Code that is otherwise due to Employee under this Agreement during the six-month period immediately following Employee’s

separation from service (as determined in accordance with Section 409A of the Code) on account of Employee’s separation from service

shall be accumulated and paid to Employee during the seventh calendar month following the calendar month in which his separation from

service (such date, the “Delayed Payment Date”), to the extent necessary to prevent the imposition of tax penalties on Employee

under Section 409A of the Code. If Employee dies during the postponement period, the amounts and entitlements delayed on account of Section

409A of the Code shall be paid to the personal representative of his estate on the first to occur of the Delayed Payment Date or 30 calendar

days after the date of Employee’s death.

5.3 Section

280G of the Code.

(a) General. In

the event it shall be determined that any payment or distribution by the Company or its affiliates to or for the benefit of Employee (whether

paid or payable or distributed or distributable pursuant to the terms of this Agreement or otherwise) (collectively, the “Payments”)

would be subject to the excise tax imposed by Section 4999 of the Code, or any interest or penalties are incurred by Employee with respect

to such excise tax, then the Payments shall be either (i) reduced (but not below zero) so that the present value of the Payments will

be one dollar ($1.00) less than three times Employee’s “base amount” (as defined in Section 280G(b)(3) of the Code)

and so that no portion of the Payments received by Employee shall be subject to the excise tax imposed by Section 4999 of the Code or

(ii) paid in full, whichever produces the better net after-tax position to Employee. The reduction of Payments, if any, shall be made

by reducing first any Payments that are exempt from Section 409A of the Code and then reducing any Payments subject to Section 409A of

the Code on a pro rata basis. If, notwithstanding clause (i), a reduced Payment is made or provided and, through error or otherwise, that

Payment, when aggregated with other payments and benefits from the Company (or its affiliates) used in determining if a “parachute

payment” exists, exceeds one dollar ($1.00) less than three times Employee’s base amount, then Employee shall immediately

repay such excess to the Company.

(b) Determinations.

All determinations required to be made under this Section 5.3(b), including whether and when the reductions contemplated by Section

5.3(a) are required and the assumptions to be utilized in arriving at such determination, shall be made by the Company’s public

accounting firm (the “Accounting Firm”), which shall provide detailed supporting calculations both to the Company and to Employee.

In the event that the Accounting Firm is serving as accountant or auditor for the individual, entity or group effecting the change in

control,

the Company shall appoint another nationally recognized public accounting firm to make the determinations required hereunder

(which accounting firm shall then be referred to as the Accounting Firm hereunder). All fees and expenses of the Accounting Firm shall

be borne solely by the Company. Any determination by the Accounting Firm shall be binding upon the Company and Employee.

6. Miscellaneous.

6.1 Representations.

Employee represents and warrants to the Company that (a) the execution, delivery and performance of this Agreement by Employee does not

and will not conflict with, breach, violate or cause a default under any contract, agreement, instrument, order, judgment or decree to

which Employee is a party or by which Employee is bound, (b) Employee is not a party to or bound by any employment agreement, noncompetition

agreement or confidentiality agreement with any other person or entity that would interfere with the execution, delivery or performance

of this Agreement by Employee and (c) upon the execution and delivery of this Agreement by the Company, this Agreement shall be the valid

and binding obligation of Employee, enforceable in accordance with its terms.

6.2 Entire

Agreement; Amendment. This Agreement constitutes the entire agreement and understanding between the parties with respect to the subject

matter hereof and supersedes and preempts any other prior understandings, agreements or representations by or between the parties, written

or oral, which may have related in any manner to the subject matter hereof; provided, however, this Agreement shall not supersede any

prior acknowledgements or agreements of any Company compensation recoupment or “clawback” policies, or any restrictive covenants

set forth in any other plan, agreement or arrangement (including the Restrictive Covenant Agreement) between the Company or its affiliates

and Employee (the “Existing Compensation Recoupment and Restrictive Covenant Provisions”) and to the extent that the provisions

of this Agreement conflict with such Existing Compensation Recoupment and Restrictive Covenant Provisions, the provisions that are most

protective of the Company’s, and any of its subsidiaries’ or affiliates’, interests, as determined by the Company, shall

govern. This Agreement may not be altered or amended except in writing executed by both parties hereto.

6.3 Assignment; Benefit.

This Agreement is personal and may not be assigned by Employee. This Agreement may be assigned by the Company and shall inure to the benefit

of and be binding upon the successors and assigns of the Company.

6.4 Governing Law.

This Agreement shall be governed by the laws of the State of Colorado without regard to the principles of conflicts of laws.

6.5 Dispute

Resolution.

(a) Mediation.

Except as expressly set forth in the Restrictive Covenant Agreement, in the event of any dispute concerning Employee’s employment

by the Company, whether or not relating to this Agreement, Employee and the Company shall first attempt to resolve such dispute through

mediation as provided in this Section 6.5(a); provided, however, that neither party shall be required to utilize such mediation

procedures to the extent that injunctive relief is being sought by a party in the good faith belief that an immediate remedy is required

to avoid irreparable injury

to such party. Except as otherwise provided in the proviso to the immediately preceding sentence, in the event

that either party desires to resolve a dispute concerning Employee’s employment by the Company, such party shall first give written

notice to the other party identifying the nature of the dispute. The parties shall then promptly (and, in any event, within ten business

days of the giving of notice of a dispute) engage the services of an impartial, experienced employment mediator (the “Mediator”)

under the auspices of JAMS/Endispute (or such other mediation service as the parties may mutually select) in Denver, Colorado, and shall

promptly schedule a mediation session with the Mediator which is not later than 45 days after the date of the selection of the Mediator.

The Mediator shall conduct a one-day mediation session, attended by both parties and their counsel, in an attempt to informally resolve

the dispute. By oral or written agreement of both parties, follow-up or additional mediation sessions may be scheduled, but neither party

shall be required to participate in more than one day of mediation. Neither party shall be required to submit briefs or position papers

to the Mediator, but both parties shall have the right to do so, subject to such rules and procedures as the Mediator may establish in

his or her sole discretion. Except as otherwise agreed by the parties, all written submissions to the Mediator shall remain confidential

as between the submitting party and the Mediator. The mediation process shall be treated as a settlement negotiation and no evidence introduced

or statements made in the mediation process may be used in any way by either party or any other person in connection with any subsequent

litigation or other legal proceedings (except to the extent independently obtained through discovery in such litigation or proceedings)

and the disclosure of any privileged information to the Mediator shall not operate as a waiver of the privilege with respect to such information.

Each party shall bear all of its own costs, attorneys’ fees and expenses related to preparing for and attending any mediation conducted

under this Agreement. The fees and expenses of the Mediator and the mediation service used, if any, shall be borne equally by the Company

and Employee, and will be borne exclusively by the Company when such is required by law.

(b) Arbitration.

Except as otherwise expressly set forth in the Restrictive Covenant Agreement, in the event that a dispute concerning Employee’s

employment by the Company, whether or not relating to this Agreement, is not resolved pursuant to the mediation process described in Section

6.5(a), such dispute shall be settled by final and binding arbitration in Denver, Colorado, administered by the American Arbitration

Association, with any such dispute arising under this Agreement being so administered in accordance with its Employment Dispute Rules

then in effect, and judgment on the award rendered by the arbitrator may be entered in any court having jurisdiction thereof. Adequate

discovery will be permitted by the arbitrator consistent with applicable law and the objectives of the arbitration. The arbitrator shall

apply Colorado and federal substantive law, including any applicable statutes of limitation. The arbitrator shall have the authority to

award any remedy or relief that a court of competent jurisdiction could order or grant, including the issuance of an injunction, and may

award the prevailing party legal fees and expenses and arbitration fees and expenses that are incurred by the prevailing party if the

substantive law at issue, or other applicable law, permits. Either party may, without inconsistency with this arbitration provision, apply

to any court having jurisdiction over such dispute or controversy and seek interim provisional, injunctive or other equitable relief until

the arbitration award is rendered or the controversy is otherwise resolved. The award of the arbitrator, which shall be in writing summarizing

the basis for the decision, shall be final and binding upon the parties and subject only to limited review as required by law. To the

extent required by law, the Company shall pay the fees and costs of the arbitrator that exceed those normally incurred in the filing of

a lawsuit in court. Except as necessary in court proceedings to enforce this arbitration provision or an award rendered

hereunder, or

to obtain interim relief, neither a party nor an arbitrator may disclose the existence, content or results of any arbitration hereunder

without the prior written consent of the Company and Employee. The Company and Employee acknowledge that this Agreement evidences a transaction

involving interstate commerce. Notwithstanding any choice of law provision included in this Agreement, the United States Federal Arbitration

Act shall govern the interpretation and enforcement of this arbitration provision.

6.6 Notice. Notices

and all other communications provided for in this Agreement shall be in writing and shall be deemed to have been duly given when delivered

or mailed by United States registered mail, return receipt requested, postage prepaid, addressed to the Company at its principal office

and to Employee at Employee’s principal residence as shown in the Company’s personnel records, provided that all notices to

the Company shall be directed to the attention of the Chief Executive Officer of the Company, or to such other address as either party

may have furnished to the other in writing in accordance herewith, except that notice of change of address shall be effective only upon

receipt.

6.7 Construction.

Each party has cooperated in the drafting and preparation of this Agreement. Hence, in any construction to be made of this Agreement,

the same shall not be construed against any party on the basis that the party was the drafter. The captions of this Agreement are not

part of the provisions hereof and shall have no force or effect.

6.8 Execution. This

Agreement may be executed in one or more counterparts, each of which shall be deemed an original, but all of which together shall constitute

one and the same instrument. Photographic or facsimile copies of such signed counterparts may be used in lieu of the originals for any

purpose.

6.9 Legal Counsel.

Employee and the Company recognize that this is a legally binding contract and acknowledge and agree that they have had the opportunity

to consult with legal counsel of their choice.

6.10 Waiver. The

waiver by any party of a breach of any provision of this Agreement by the other shall not operate or be construed as a waiver of any other

or subsequent breach of such or any provision.

6.11 Invalidity of Provision.

In the event that any provision of this Agreement is determined to be illegal, invalid, or void for any reason, the remaining provisions

hereof shall continue in full force and effect.

6.12 Company

Policies. Employee shall be subject to additional policies of the Company and its affiliates as in effect from time-to-time, including,

without limitation, the Company’s Code of Conduct and policies with regard to stock ownership and securities trading by senior executives.

6.13 Approval by DaVita

Inc. as to Form. The parties acknowledge and agree that this Agreement shall take effect and be legally binding upon the parties only

upon full execution hereof by the parties and upon approval by DaVita Inc. as to the form of hereof.

IN WITNESS WHEREOF, the

parties hereto have entered into this Agreement effective as of the date and year first written above.

| |

DAVITA INC. |

| |

|

|

| |

By: |

/s/ Kathleen A. Waters |

| |

Name |

Kathleen A. Waters |

| |

Title: |

Chief Legal and Public Affairs Officer |

| |

|

|

| |

EMPLOYEE |

| |

|

|

| |

|

/s/ David Maughan |

| |

|

David Maughan |

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

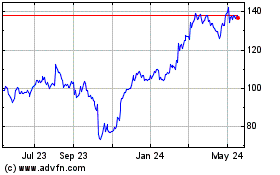

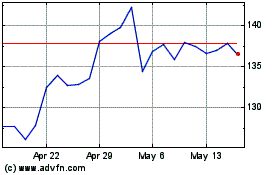

DaVita (NYSE:DVA)

Historical Stock Chart

From Sep 2024 to Oct 2024

DaVita (NYSE:DVA)

Historical Stock Chart

From Oct 2023 to Oct 2024