Form SC TO-T/A - Tender offer statement by Third Party: [Amend]

13 March 2025 - 12:03AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE TO

TENDER OFFER STATEMENT UNDER SECTION 14(D)(1) OR 13(E)(1)

OF THE SECURITIES EXCHANGE ACT OF 1934

(Amendment No. 7)

ASPEN TECHNOLOGY, INC.

(Name of Subject Company (Issuer))

EMERSUB CXV, INC.

a wholly owned subsidiary of

EMERSON ELECTRIC CO.

(Names of Filing Persons (Offeror))

EMR HOLDINGS, INC.

EMR WORLDWIDE INC.

(Names of Filing Persons (Other Persons))

Common Stock, Par Value $0.0001 Per Share

(Title of Class of Securities)

29109X106

(Cusip Number of Class of Securities)

Michael Tang

Senior Vice President, Secretary & Chief Legal Officer

Emerson Electric Co.

8027 Forsyth Boulevard

St. Louis, MO 63105

314-553-2000

(Name, Address and Telephone Number of Person Authorized to

Receive Notices and Communications on Behalf of Filing Persons)

Copies to:

Phillip R. Mills

Cheryl Chan

Davis Polk & Wardwell LLP

450 Lexington Avenue

New York, NY 10017

212-450-4000

|

☐

|

Check the box if the filing relates solely to preliminary communications made before the commencement of a tender offer.

|

Check the appropriate boxes below to designate any transactions to which the statement relates:

|

☒

|

third-party tender offer subject to Rule 14d-1.

|

|

☐

|

issuer tender offer subject to Rule 13e-4.

|

|

☒

|

going-private transaction subject to Rule 13e-3.

|

|

☐

|

amendment to Schedule 13D under Rule 13d-2.

|

Check the following box if the filing is a final amendment reporting the results of the tender offer. ☐

This Amendment No. 7 (this “Amendment”) amends and supplements the Tender Offer Statement on Schedule TO, filed by Emersub CXV, Inc., a Delaware corporation and a wholly owned subsidiary of Parent (“Purchaser”), Emerson Electric Co., a Missouri

corporation (“Parent”), EMR Holdings, Inc., a Delaware corporation and EMR Worldwide Inc., a Delaware corporation (“EMR Worldwide”), on February 10, 2025 (together with any amendments and supplements thereto, the “Schedule TO”). The Schedule TO

relates to the offer by Purchaser to purchase all outstanding shares of common stock, par value $0.0001 per share (“Shares”), of Aspen Technology, Inc., a Delaware corporation (“AspenTech”), at a price per Share of $265.00, net to the seller in

cash, without interest (the “Offer Price”), and subject to any withholding of taxes, upon the terms and subject to the conditions described in the Offer to Purchase dated February 10, 2025 (together with any amendments or supplements thereto, the

“Offer to Purchase”) and in the accompanying Letter of Transmittal (together with any amendments or supplements thereto and with the Offer to Purchase, the “Offer”), copies of which are incorporated by reference to Exhibits (a)(1)(i) and (a)(1)(ii)

of the Schedule TO respectively.

Except as otherwise set forth in this Amendment, the information set forth in the Offer to Purchase, including all schedules thereto, is hereby expressly incorporated by reference in response to all of the items of the Schedule TO, including,

without limitation, all of the information required by Schedule 13E-3 that is not included in or covered by the items in the Schedule TO, and is supplemented by the information specifically provided herein. Capitalized terms used but not defined

herein have the applicable meanings ascribed to them in the Schedule TO or the Offer to Purchase.

Item 1 through 9, Item 11 and Item 13.

Items 1 through 9, Item 11 and Item 13 of the Schedule TO, to the extent such Items incorporated by reference the information contained in the Offer to Purchase, are hereby amended and supplemented as follows:

“The Offer expired at 5:00 p.m., Eastern Time, on March 11, 2025. According to Equiniti Trust Company, LLC, the depository for the Offer, 19,479,909 Shares were validly tendered and not validly

withdrawn in the Offer (including 1,859,751 Shares tendered in the Offer that have not yet been “received” by the “depository” (as such terms are defined in Section 251(h)(6) of the General Corporation Law of the State of Delaware (the “DGCL”))),

representing approximately 72% of the outstanding Shares, excluding, for the purposes of calculating the total number of Shares outstanding, Shares owned by Parent and its subsidiaries, Parent’s and its subsidiaries’ directors and officers and

AspenTech’s directors and officers. The number of Shares tendered satisfied the condition to the Offer that there be validly tendered and not validly withdrawn Shares (excluding (1) Shares tendered in the Offer that have not yet been “received” by

the “depository” (as such terms are defined in Section 251(h)(6) of the DGCL) and (2) Shares owned by Parent and its subsidiaries, Parent’s and its subsidiaries’ directors and officers and AspenTech’s directors and officers), that represent at

least one more Share than 50% of the total number of Shares outstanding at the time of the expiration of the Offer, excluding, for the purposes of calculating the total number of Shares outstanding, Shares owned by Parent and its subsidiaries,

Parent’s and its subsidiaries’ directors and officers and AspenTech’s directors and officers. All conditions to the Offer having been satisfied or waived, Parent and Purchaser accepted for payment all Shares validly tendered and not validly

withdrawn.

Following the consummation of the Offer, the remaining conditions to the Merger set forth in the Merger Agreement were satisfied or waived, and on March 12, 2025, Purchaser merged with and into AspenTech pursuant to

Section 251(h) of the DGCL, with AspenTech being the surviving corporation (the “Merger”). Each Share outstanding immediately prior to the effective time of the Merger (other than (1) the Shares held by AspenTech, Parent, Purchaser or any of their

respective wholly owned subsidiaries, (2) Shares irrevocably accepted by Purchaser for purchase pursuant to the Offer and (3) Shares held by stockholders who have properly exercised and perfected their demands for appraisal of such Shares in

accordance with the DGCL and have neither withdrawn nor lost such rights prior to the effective time of the Merger) was canceled and converted into the right to receive an amount in cash equal to the Offer Price, net to the seller in cash, without

interest, and subject to any required withholding of taxes.”

Item 12. Exhibits.

Item 12 of the Schedule TO is hereby amended and supplemented by adding the following exhibit:

|

Index No.

|

|

|

|

|

|

Emerson Press Release, dated March 12, 2025.

|

SIGNATURE

After due inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

Dated: March 12, 2025

| |

|

|

|

EMERSON ELECTRIC CO.

|

| |

|

|

|

|

|

|

| |

|

By:

|

|

|

| |

|

|

|

Name:

|

|

John A. Sperino

|

| |

|

|

|

Title:

|

|

Vice President and Assistant Secretary

|

| |

|

|

|

|

| |

|

|

EMR HOLDINGS, INC.

|

| |

|

|

|

|

| |

|

By:

|

|

|

| |

|

|

|

Name:

|

|

John A. Sperino

|

| |

|

|

|

Title:

|

|

Vice President and Secretary

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

EMR WORLDWIDE INC.

|

| |

|

|

|

|

|

|

| |

|

By:

|

|

|

| |

|

|

|

Name:

|

|

John A. Sperino

|

| |

|

|

|

Title:

|

|

President and Secretary

|

| |

|

|

|

|

|

|

| |

|

|

|

EMERSUB CXV, INC.

|

| |

|

|

|

|

|

|

| |

|

By:

|

|

|

| |

|

|

|

Name:

|

|

John A. Sperino

|

| |

|

|

|

Title:

|

|

Vice President and Secretary

|

Exhibit (a)(5)(x)

Emerson Completes Acquisition of Remaining Outstanding Shares of AspenTech

ST. LOUIS – March 12, 2025 – Emerson (NYSE: EMR) today announced that it has completed its acquisition of all outstanding shares of common stock of Aspen Technology, Inc. (“AspenTech”) not already owned by

Emerson.

“The completion of our acquisition of AspenTech marks a key milestone in the final phase of Emerson’s portfolio transformation,” said Emerson President and Chief Executive Officer Lal Karsanbhai. “I want to thank Antonio for his leadership of

AspenTech and partnership with Emerson over the years. We look forward to welcoming the talented AspenTech team to Emerson and continuing to drive shareholder value as we enhance our offering.”

With the completion of the acquisition, AspenTech is now a wholly owned subsidiary of Emerson.

Antonio Pietri will retire from his role as CEO of AspenTech. Vincent M. Servello has been appointed to lead the AspenTech business unit as President. Mr. Servello joined Emerson in 2014 and has served in a variety of leadership roles with

increasing responsibility, most recently as Vice President, Strategy & Corporate Development for the enterprise since 2021. He brings deep expertise in industrial technology, operational execution and corporate strategy to AspenTech. David Baker,

who served as Chief Financial Officer of AspenTech prior to the completion of the transaction, will continue to serve as business unit CFO.

As an independent business unit, AspenTech’s results will be consolidated into the Control Systems & Software segment, which is led by Sabee Mitra, Business Group President of Control Systems & Software.

Successful Completion of Tender Offer and Merger

Prior to the completion of the transaction, Emerson’s tender offer for all outstanding shares of common stock of AspenTech not already owned by Emerson for $265.00 per share in cash expired on March 11, 2025, at 5:00 p.m. Eastern Time. Based on the

final count by Equiniti Trust Company, LLC, the Depository Agent for the tender offer, an aggregate of 19,479,909 shares were validly tendered and not validly withdrawn (including 1,859,751 shares tendered by way of guaranteed delivery), representing

approximately 72% of the outstanding shares of AspenTech common stock not already owned by Emerson and its subsidiaries, Emerson’s and its subsidiaries’ directors and officers, and AspenTech’s directors and officers.

Following completion of the tender offer, Emerson completed the acquisition of the remaining outstanding shares of common stock of AspenTech on March 12, 2025 through a merger.

AspenTech shareholders who have not already tendered their shares are entitled to receive $265.00 per share in cash for each share of AspenTech common stock owned.

AspenTech’s shares of common stock have ceased trading on the NASDAQ.

Advisors

Goldman Sachs & Co. LLC and Centerview Partners LLC served as financial advisors to Emerson, and Davis Polk & Wardwell LLP served as legal advisor. Joele Frank, Wilkinson Brimmer Katcher served as strategic communications advisor to Emerson.

About Emerson

Emerson (NYSE: EMR) is a global industrial technology leader that provides advanced automation. With an unmatched portfolio of intelligent devices, control systems, and industrial software, Emerson delivers solutions that automate and optimize

business performance. Headquartered in Saint Louis, Missouri, Emerson combines innovative technology with proven operational excellence to power the future of automation. For more information, visit Emerson.com.

Forward-Looking and Cautionary Statements

Statements in this press release that are not strictly historical may be “forward-looking” statements, which involve risks and uncertainties, and Emerson undertakes no obligation to update any such statements to reflect later developments. These

risks and uncertainties include the scope, duration and ultimate impacts of the Russia-Ukraine and other global conflicts, as well as economic and currency conditions, market demand, pricing, protection of intellectual property, cybersecurity, tariffs,

competitive and technological factors, inflation, among others, as set forth in the Company's most recent Annual Report on Form 10-K and subsequent reports filed with the SEC. The outlook contained herein represents the Company's expectation for its

consolidated results, other than as noted herein.

Emerson uses our Investor Relations website, www.Emerson.com/investors, as a means of disclosing information which may be of interest or material to our investors and for complying with disclosure obligations under Regulation FD. Accordingly,

investors should monitor our Investor Relations website, in addition to following our press releases, SEC filings, public conference calls, webcasts and social media. The information contained on, or that may be accessed through, our website is not

incorporated by reference into, and is not a part of, this document.

Contacts

Investors

Colleen Mettler

314-553-2197

Media

Joseph Sala / Greg Klassen / Connor Murphy

Joele Frank, Wilkinson Brimmer Katcher

212-355-4449

Emerson Electric (NYSE:EMR)

Historical Stock Chart

From Feb 2025 to Mar 2025

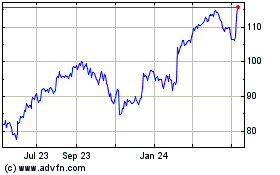

Emerson Electric (NYSE:EMR)

Historical Stock Chart

From Mar 2024 to Mar 2025