Energy Transfer LP (NYSE:ET) (“Energy Transfer” or the

“Partnership”) today reported financial results for the quarter and

year ended December 31, 2024.

Energy Transfer reported net income attributable to partners for

the three months ended December 31, 2024 of $1.08 billion. For the

three months ended December 31, 2024, net income per common unit

(basic) was $0.29.

Adjusted EBITDA for the three months ended December 31, 2024 was

$3.88 billion compared to $3.60 billion for the same period last

year, an increase of 8%.

Distributable Cash Flow attributable to partners, as adjusted,

for the three months ended December 31, 2024 was $1.98 billion.

Growth capital expenditures in the fourth quarter of 2024 were

$1.22 billion while maintenance capital expenditures were $309

million.

2025 Outlook

- Energy Transfer expects its 2025 Adjusted EBITDA to range

between $16.1 billion and $16.5 billion.

- For 2025, the Partnership expects its growth capital

expenditures to be approximately $5.0 billion. Maintenance capital

expenditures for 2025 are expected to be approximately $1.1

billion.

Operational Highlights

- Energy Transfer’s volumes continued to grow during the fourth

quarter of 2024.

- Crude oil transportation volumes were up 15%.

- NGL transportation volumes were up 5%.

- NGL exports were up more than 2%.

- Midstream gathered volumes increased 2%.

- Interstate natural gas transportation volumes were up 2%.

- In December 2024, Energy Transfer completed the initial phase

of the Sabina 2 pipeline conversion from Mont Belvieu to Nederland,

which increased the capacity for multiple products from 25,000

barrels per day to 40,000 barrels per day.

- In November 2024, Energy Transfer completed the optimization of

the Grey Wolf processing plant in the Permian Basin, which

increased the capacity of the plant from 200 MMcf/d to 250

MMcf/d.

- Energy Transfer also recently commissioned the first of eight,

10-megawatt natural gas-fired electric generation facilities to

support the Partnership’s operations in Texas.

Strategic Highlights

- Yesterday, Energy Transfer announced that it has entered into a

long-term agreement with Cloudburst Data Centers, Inc.

(“CloudBurst”) to provide natural gas to CloudBurst’s flagship

AI-focused data center development. Per the agreement, Energy

Transfer would utilize its Oasis Pipeline to provide natural gas to

CloudBurst’s Next-Gen Data Center campus in central Texas, subject

to CloudBurst reaching a final investment decision with its

customer.

- In December 2024, Energy Transfer announced that it has reached

a positive final investment decision for the construction of the

Hugh Brinson Pipeline, an intrastate natural gas pipeline

connecting Permian Basin production to premier markets and trading

hubs in Texas.

- In December 2024, Energy Transfer announced a 20-year LNG Sale

and Purchase Agreement (“SPA”) to supply 2.0 million tonnes of LNG

per annum to Chevron U.S.A. Inc. related to its Lake Charles LNG

project.

- In February 2025, the Partnership approved construction of an

additional processing plant in the Midland Basin. The Mustang Draw

plant will have a capacity of approximately 275 MMcf/d and is

expected to be in service in the first half of 2026.

Financial Highlights

- In January 2025, Energy Transfer announced a quarterly cash

distribution of $0.3250 per common unit ($1.30 annualized) for the

quarter ended December 31, 2024, which is an increase of 3.2%

compared to the fourth quarter of 2023.

- As of December 31, 2024, the Partnership’s revolving credit

facility had an aggregate $2.21 billion of available borrowing

capacity.

- For the three months ended December 31, 2024, the Partnership

invested approximately $1.22 billion on growth capital

expenditures.

Energy Transfer benefits from a portfolio of assets with

exceptional product and geographic diversity. The Partnership’s

multiple segments generate high-quality, balanced earnings with no

single segment contributing more than one-third of the

Partnership’s consolidated Adjusted EBITDA for the three months or

full year ended December 31, 2024. The vast majority of the

Partnership’s segment margins are fee-based and therefore have

limited commodity price sensitivity.

Conference call information:

The Partnership has scheduled a conference call for 3:30 p.m.

Central Time/4:30 p.m. Eastern Time on Tuesday, February 11, 2025

to discuss its fourth quarter 2024 results and provide an update on

the Partnership, including its outlook for 2025. The conference

call will be broadcast live via an internet webcast, which can be

accessed through www.energytransfer.com and will also be available

for replay on the Partnership’s website for a limited time.

Energy Transfer LP (NYSE: ET) owns and operates one of

the largest and most diversified portfolios of energy assets in the

United States, with more than 130,000 miles of pipeline and

associated energy infrastructure. Energy Transfer’s strategic

network spans 44 states with assets in all of the major U.S.

production basins. Energy Transfer is a publicly traded limited

partnership with core operations that include complementary natural

gas midstream, intrastate and interstate transportation and storage

assets; crude oil, natural gas liquids (“NGL”) and refined product

transportation and terminalling assets; and NGL fractionation.

Energy Transfer also owns Lake Charles LNG Company, as well as the

general partner interests, the incentive distribution rights and

approximately 21% of the outstanding common units of Sunoco LP

(NYSE: SUN), and the general partner interests and approximately

39% of the outstanding common units of USA Compression Partners, LP

(NYSE: USAC). For more information, visit the Energy Transfer LP

website at www.energytransfer.com.

Sunoco LP (NYSE: SUN) is a leading energy infrastructure

and fuel distribution master limited partnership operating in over

40 U.S. states, Puerto Rico, Europe, and Mexico. SUN's midstream

operations include an extensive network of approximately 14,000

miles of pipeline and over 100 terminals. This critical

infrastructure complements SUN's fuel distribution operations,

which serve approximately 7,400 Sunoco and partner branded

locations and additional independent dealers and commercial

customers. SUN's general partner is owned by Energy Transfer LP

(NYSE: ET). For more information, visit the Sunoco LP website at

www.sunocolp.com.

USA Compression Partners, LP (NYSE: USAC) is one of the

nation’s largest independent providers of natural gas compression

services in terms of total compression fleet horsepower. USAC

partners with a broad customer base composed of producers,

processors, gatherers, and transporters of natural gas and crude

oil. USAC focuses on providing midstream natural gas compression

services to infrastructure applications primarily in high-volume

gathering systems, processing facilities, and transportation

applications. For more information, visit the USAC website at

www.usacompression.com.

Forward-Looking Statements

This news release may include certain statements concerning

expectations for the future that are forward-looking statements as

defined by federal law. Such forward-looking statements are subject

to a variety of known and unknown risks, uncertainties, and other

factors that are difficult to predict and many of which are beyond

management’s control. An extensive list of factors that can affect

future results, including Adjusted EBITDA, and impact current

projections, including capital expenditures, are discussed in the

Partnership’s Annual Report on Form 10-K and other documents filed

from time to time with the Securities and Exchange Commission. The

Partnership undertakes no obligation to update or revise any

forward-looking statement to reflect new information or events.

The information contained in this press release is available on

our website at www.energytransfer.com.

ENERGY

TRANSFER LP AND SUBSIDIARIES CONDENSED

CONSOLIDATED BALANCE SHEETS (In millions)

(unaudited)

December 31,

2024

December 31,

2023

ASSETS

Current assets

$

14,202

$

12,433

Property, plant and equipment, net

95,212

85,351

Investments in unconsolidated

affiliates

3,266

3,097

Lease right-of-use assets, net

809

826

Other non-current assets, net

2,017

1,733

Intangible assets, net

5,971

6,239

Goodwill

3,903

4,019

Total assets

$

125,380

$

113,698

LIABILITIES AND EQUITY

Current liabilities

$

12,656

$

11,277

Long-term debt, less current

maturities

59,752

51,380

Non-current derivative liabilities

—

4

Non-current operating lease

liabilities

730

778

Deferred income taxes

4,190

3,931

Other non-current liabilities

1,618

1,611

Commitments and contingencies

Redeemable noncontrolling interests

417

778

Equity:

Limited Partners:

Preferred Unitholders

3,852

6,459

Common Unitholders

31,195

30,197

General Partner

(2

)

(2

)

Accumulated other comprehensive income

73

28

Total partners’ capital

35,118

36,682

Noncontrolling interests

10,899

7,257

Total equity

46,017

43,939

Total liabilities and equity

$

125,380

$

113,698

ENERGY

TRANSFER LP AND SUBSIDIARIES CONDENSED

CONSOLIDATED STATEMENTS OF OPERATIONS (In millions,

except per unit data) (unaudited)

Three Months Ended

December 31,

Year Ended

December 31,

2024

2023

2024

2023

REVENUES

$

19,541

$

20,532

$

82,671

$

78,586

COSTS AND EXPENSES:

Cost of products sold

14,157

15,780

61,975

60,541

Operating expenses

1,441

1,144

5,164

4,368

Depreciation, depletion and

amortization

1,374

1,158

5,165

4,385

Selling, general and administrative

288

285

1,177

985

Impairment losses and other

2

—

52

12

Total costs and expenses

17,262

18,367

73,533

70,291

OPERATING INCOME

2,279

2,165

9,138

8,295

OTHER INCOME (EXPENSE):

Interest expense, net of interest

capitalized

(807

)

(686

)

(3,125

)

(2,578

)

Equity in earnings of unconsolidated

affiliates

94

97

379

383

Gains on extinguishments of debt

(1

)

2

(12

)

2

Gains (losses) on interest rate

derivatives

—

(11

)

6

36

Non-operating litigation related loss

—

(2

)

—

(627

)

Gain (loss) on sale of Sunoco LP West

Texas assets

(12

)

—

586

—

Other, net

30

49

134

86

INCOME BEFORE INCOME TAX EXPENSE

1,583

1,614

7,106

5,597

Income tax expense

136

47

541

303

NET INCOME

1,447

1,567

6,565

5,294

Less: Net income attributable to

noncontrolling interests

355

219

1,692

1,299

Less: Net income attributable to

redeemable noncontrolling interests

15

21

59

60

NET INCOME ATTRIBUTABLE TO PARTNERS

1,077

1,327

4,814

3,935

General Partner’s interest in net

income

1

1

4

3

Preferred Unitholders’ interest in net

income

68

123

362

463

Loss on redemption of preferred units

—

—

54

—

Common Unitholders’ interest in net

income

$

1,008

$

1,203

$

4,394

$

3,469

NET INCOME PER COMMON UNIT:

Basic

$

0.29

$

0.37

$

1.29

$

1.10

Diluted

$

0.29

$

0.37

$

1.28

$

1.09

WEIGHTED AVERAGE NUMBER OF UNITS

OUTSTANDING:

Basic

3,425.6

3,278.6

3,395.1

3,161.7

Diluted

3,449.9

3,295.3

3,420.6

3,177.2

ENERGY

TRANSFER LP AND SUBSIDIARIES SUPPLEMENTAL INFORMATION (Dollars and units in

millions) (unaudited)

Three Months Ended

December 31,

Year Ended

December 31,

2024

2023

2024

2023

Reconciliation of net income to

Adjusted EBITDA and Distributable Cash Flow (a):

Net income

$

1,447

$

1,567

$

6,565

$

5,294

Interest expense, net of interest

capitalized

807

686

3,125

2,578

Impairment losses and other

2

—

52

12

Income tax expense

136

47

541

303

Depreciation, depletion and

amortization

1,374

1,158

5,165

4,385

Non-cash compensation expense

38

31

151

130

(Gains) losses on interest rate

derivatives

—

11

(6

)

(36

)

Unrealized (gains) losses on commodity

risk management activities

6

(185

)

56

(3

)

(Gains) losses on extinguishments of

debt

1

(2

)

12

(2

)

Inventory valuation adjustments (Sunoco

LP)

(13

)

227

86

114

Equity in earnings of unconsolidated

affiliates

(94

)

(97

)

(379

)

(383

)

Adjusted EBITDA related to unconsolidated

affiliates

170

177

692

691

Non-operating litigation related loss

—

2

—

627

Gain on sale of Sunoco LP West Texas

assets

12

—

(586

)

—

Other, net

(2

)

(20

)

9

(12

)

Adjusted EBITDA (consolidated)

3,884

3,602

15,483

13,698

Adjusted EBITDA related to unconsolidated

affiliates (b)

(170

)

(177

)

(692

)

(691

)

Distributable cash flow from

unconsolidated affiliates (b)

113

121

486

485

Interest expense, net of interest

capitalized

(807

)

(686

)

(3,125

)

(2,578

)

Preferred unitholders’ distributions

(71

)

(135

)

(361

)

(511

)

Current income tax expense

(24

)

(31

)

(265

)

(100

)

Transaction-related income taxes (c)

(2

)

—

179

—

Maintenance capital expenditures

(376

)

(259

)

(1,161

)

(860

)

Other, net

16

20

90

41

Distributable Cash Flow (consolidated)

2,563

2,455

10,634

9,484

Distributable Cash Flow attributable to

Sunoco LP

(254

)

(145

)

(946

)

(659

)

Distributions from Sunoco LP

63

43

245

173

Distributable Cash Flow attributable to

USAC (100%)

(96

)

(80

)

(355

)

(281

)

Distributions from USAC

24

24

97

97

Distributable Cash Flow attributable to

noncontrolling interests in other non-wholly owned consolidated

subsidiaries

(326

)

(369

)

(1,335

)

(1,352

)

Distributable Cash Flow attributable to

the partners of Energy Transfer

1,974

1,928

8,340

7,462

Transaction-related adjustments (d)

4

102

23

116

Distributable Cash Flow attributable to

the partners of Energy Transfer, as adjusted

$

1,978

$

2,030

$

8,363

$

7,578

Distributions to partners:

Limited Partners

$

1,115

$

1,061

$

4,384

$

3,984

General Partner

1

1

4

3

Total distributions to be paid to

partners

$

1,116

$

1,062

$

4,388

$

3,987

Common Units outstanding – end of

period

3,431.1

3,367.5

3,431.1

3,367.5

(a)

Adjusted EBITDA and Distributable Cash

Flow are non-GAAP financial measures used by industry analysts,

investors, lenders and rating agencies to assess the financial

performance and the operating results of Energy Transfer’s

fundamental business activities and should not be considered in

isolation or as a substitute for net income, income from

operations, cash flows from operating activities or other GAAP

measures.

There are material limitations to using

measures such as Adjusted EBITDA and Distributable Cash Flow,

including the difficulty associated with using either as the sole

measure to compare the results of one company to another, and the

inability to analyze certain significant items that directly affect

a company’s net income or loss or cash flows. In addition, our

calculations of Adjusted EBITDA and Distributable Cash Flow may not

be consistent with similarly titled measures of other companies and

should be viewed in conjunction with measures that are computed in

accordance with GAAP, such as operating income, net income and cash

flows from operating activities.

Definition of Adjusted EBITDA

We define Adjusted EBITDA as total

partnership earnings before interest, taxes, depreciation,

depletion, amortization and other non-cash items, such as non-cash

compensation expense, gains and losses on disposals of assets, the

allowance for equity funds used during construction, unrealized

gains and losses on commodity risk management activities, inventory

valuation adjustments, non-cash impairment charges, losses on

extinguishments of debt and other non-operating income or expense

items. Inventory valuation adjustments that are excluded from the

calculation of Adjusted EBITDA represent only the changes in lower

of cost or market reserves on inventory that is carried at last-in,

first-out (“LIFO”). These amounts are unrealized valuation

adjustments applied to Sunoco LP’s fuel volumes remaining in

inventory at the end of the period.

Adjusted EBITDA reflects amounts for

unconsolidated affiliates based on the same recognition and

measurement methods used to record equity in earnings of

unconsolidated affiliates. Adjusted EBITDA related to

unconsolidated affiliates excludes the same items with respect to

the unconsolidated affiliate as those excluded from the calculation

of Adjusted EBITDA, such as interest, taxes, depreciation,

depletion, amortization and other non-cash items. Although these

amounts are excluded from Adjusted EBITDA related to unconsolidated

affiliates, such exclusion should not be understood to imply that

we have control over the operations and resulting revenues and

expenses of such affiliates. We do not control our unconsolidated

affiliates; therefore, we do not control the earnings or cash flows

of such affiliates. The use of Adjusted EBITDA or Adjusted EBITDA

related to unconsolidated affiliates as an analytical tool should

be limited accordingly.

Adjusted EBITDA is used by management to

determine our operating performance and, along with other financial

and volumetric data, as internal measures for setting annual

operating budgets, assessing financial performance of our numerous

business locations, as a measure for evaluating targeted businesses

for acquisition and as a measurement component of incentive

compensation.

Definition of Distributable Cash

Flow

We define Distributable Cash Flow as net

income, adjusted for certain non-cash items, less distributions to

preferred unitholders and maintenance capital expenditures.

Non-cash items include depreciation, depletion and amortization,

non-cash compensation expense, amortization included in interest

expense, gains and losses on disposals of assets, the allowance for

equity funds used during construction, unrealized gains and losses

on commodity risk management activities, inventory valuation

adjustments, non-cash impairment charges, losses on extinguishments

of debt and deferred income taxes. For unconsolidated affiliates,

Distributable Cash Flow reflects the Partnership’s proportionate

share of the investees’ distributable cash flow.

Distributable Cash Flow is used by

management to evaluate our overall performance. Our partnership

agreement requires us to distribute all available cash, and

Distributable Cash Flow is calculated to evaluate our ability to

fund distributions through cash generated by our

operations.

On a consolidated basis, Distributable

Cash Flow includes 100% of the Distributable Cash Flow of Energy

Transfer’s consolidated subsidiaries. However, to the extent that

noncontrolling interests exist among our subsidiaries, the

Distributable Cash Flow generated by our subsidiaries may not be

available to be distributed to our partners. In order to reflect

the cash flows available for distributions to our partners, we have

reported Distributable Cash Flow attributable to partners, which is

calculated by adjusting Distributable Cash Flow (consolidated), as

follows:

- For subsidiaries with publicly traded equity interests,

Distributable Cash Flow (consolidated) includes 100% of

Distributable Cash Flow attributable to such subsidiary, and

Distributable Cash Flow attributable to our partners includes

distributions to be received by the parent company with respect to

the periods presented.

- For consolidated joint ventures or similar entities, where the

noncontrolling interest is not publicly traded, Distributable Cash

Flow (consolidated) includes 100% of Distributable Cash Flow

attributable to such subsidiaries, but Distributable Cash Flow

attributable to partners reflects only the amount of Distributable

Cash Flow of such subsidiaries that is attributable to our

ownership interest.

For Distributable Cash Flow attributable

to partners, as adjusted, certain transaction-related adjustments

and non-recurring expenses that are included in net income are

excluded.

(b)

These amounts exclude Sunoco LP’s Adjusted

EBITDA and distributable cash flow related to its investment in the

ET-S Permian joint venture, which amounts are eliminated in the

Energy Transfer consolidation.

(c)

For the year ended December 31, 2024, the

amount reflected for transaction-related income taxes reflects

current income tax expense recognized by Sunoco LP in connection

with its April 2024 sale of convenience stores in West Texas, New

Mexico and Oklahoma.

(d)

For the three months and year ended

December 31, 2023, transaction-related adjustments includes $49

million of Distributable Cash Flow attributable to the operations

of Crestwood for October 1, 2023 through the acquisition date,

which represents amounts distributable to Energy Transfer’s common

unitholders (including the holders of the common units issued in

the Crestwood acquisition) with respect to the fourth quarter 2023

distribution.

ENERGY

TRANSFER LP AND SUBSIDIARIES SUMMARY

ANALYSIS OF QUARTERLY RESULTS BY SEGMENT (Tabular dollar

amounts in millions) (unaudited)

Three Months Ended

December 31,

2024

2023

Segment Adjusted EBITDA:

Intrastate transportation and storage

$

263

$

242

Interstate transportation and storage

493

541

Midstream

705

674

NGL and refined products transportation

and services

1,108

1,042

Crude oil transportation and services

760

775

Investment in Sunoco LP

439

236

Investment in USAC

155

139

All other

(39

)

(47

)

Adjusted EBITDA (consolidated)

$

3,884

$

3,602

The following analysis of segment

operating results, includes a measure of segment margin. Segment

margin is a non-GAAP financial measure and is presented herein to

assist in the analysis of segment operating results and

particularly to facilitate an understanding of the impacts that

changes in sales revenues have on the segment performance measure

of Segment Adjusted EBITDA. Segment margin is similar to the GAAP

measure of gross margin, except that segment margin excludes

charges for depreciation, depletion and amortization. Among the

GAAP measures reported by the Partnership, the most directly

comparable measure to segment margin is Segment Adjusted EBITDA; a

reconciliation of segment margin to Segment Adjusted EBITDA is

included in the following tables for each segment where segment

margin is presented.

Intrastate Transportation and

Storage

Three Months Ended

December 31,

2024

2023

Natural gas transported (BBtu/d)

13,145

14,229

Withdrawals from storage natural gas

inventory (BBtu)

10,350

6,440

Revenues

$

820

$

892

Cost of products sold

426

497

Segment margin

394

395

Unrealized gains on commodity risk

management activities

(59

)

(78

)

Operating expenses, excluding non-cash

compensation expense

(66

)

(72

)

Selling, general and administrative

expenses, excluding non-cash compensation expense

(13

)

(13

)

Adjusted EBITDA related to unconsolidated

affiliates

6

6

Other

1

4

Segment Adjusted EBITDA

$

263

$

242

Transported volumes of gas on our Texas

and Oklahoma intrastate pipelines decreased primarily due to less

third-party transportation and decreased gas production from the

Haynesville area. Transported volumes reported above exclude

volumes attributable to purchases and sales of gas for our

pipelines’ own accounts and the optimization of any unused

capacity.

Segment Adjusted EBITDA. For the three

months ended December 31, 2024 compared to the same period last

year, Segment Adjusted EBITDA related to our intrastate

transportation and storage segment increased due to the net impact

of the following:

- an increase of $13 million in realized natural gas sales and

other primarily due to higher pipeline optimization from physical

sales; and

- an increase of $11 million in storage margin primarily due to

the timing of physical and financial gains.

Interstate Transportation and

Storage

Three Months Ended

December 31,

2024

2023

Natural gas transported (BBtu/d)

17,026

16,651

Natural gas sold (BBtu/d)

46

31

Revenues

$

600

$

620

Cost of products sold

3

1

Segment margin

597

619

Operating expenses, excluding non-cash

compensation, amortization, accretion and other non-cash

expenses

(191

)

(179

)

Selling, general and administrative

expenses, excluding non-cash compensation, amortization and

accretion expenses

(30

)

(26

)

Adjusted EBITDA related to unconsolidated

affiliates

116

122

Other

1

5

Segment Adjusted EBITDA

$

493

$

541

Transported volumes increased primarily

due to more capacity sold and higher utilization on our Panhandle,

Trunkline and Gulf Run systems due to increased demand.

Segment Adjusted EBITDA. For the three

months ended December 31, 2024 compared to the same period last

year, Segment Adjusted EBITDA related to our interstate

transportation and storage segment decreased due to the net impact

of the following:

- a decrease of $22 million in segment margin primarily due to a

$13 million decrease in parking revenue and a $5 million decrease

in interruptible utilization;

- an increase of $12 million in operating expenses primarily due

to an aggregate $8 million increase in employee related costs,

outside services, materials and office expense, a $3 million

increase in maintenance project costs and a $2 million increase in

ad valorem taxes and revaluation of system gas;

- an increase of $4 million in selling, general and

administrative expenses primarily due to higher professional fees

and higher allocated costs;

- a decrease of $6 million in Adjusted EBITDA related to

unconsolidated affiliates primarily due to a $7 million decrease

from our Citrus joint venture due to higher operating expenses,

partially offset by a $3 million increase from our Southeast Supply

Header joint venture due to higher contracted volumes; and

- a decrease of $4 million in other primarily due to the prior

period recognition of certain amounts related to a shipper

bankruptcy.

Midstream

Three Months Ended

December 31,

2024

2023

Gathered volumes (BBtu/d)

20,690

20,322

NGLs produced (MBbls/d)

1,134

976

Equity NGLs (MBbls/d)

59

49

Revenues

$

3,160

$

2,407

Cost of products sold

1,910

1,379

Segment margin

1,250

1,028

Operating expenses, excluding non-cash

compensation expense

(495

)

(314

)

Selling, general and administrative

expenses, excluding non-cash compensation expense

(55

)

(47

)

Adjusted EBITDA related to unconsolidated

affiliates

5

6

Other

—

1

Segment Adjusted EBITDA

$

705

$

674

Gathered volumes increased primarily due

to recently acquired assets and higher volumes in the Permian

region. NGL production increased primarily due to recently acquired

assets and increased Permian plant utilization.

Segment Adjusted EBITDA. For the three

months ended December 31, 2024 compared to the same period last

year, Segment Adjusted EBITDA related to our midstream segment

increased due to the net impact of the following:

- an increase of $228 million in segment margin primarily due to

recently acquired assets and higher volumes in the Permian region;

partially offset by

- a decrease of $6 million in segment margin due to lower natural

gas prices of $7 million, partially offset by higher NGL prices of

$1 million;

- an increase of $181 million in operating expenses primarily due

to a $138 million increase related to recent acquisitions and

assets placed in service, a $15 million increase in environmental

reserves, a $12 million increase in ad valorem and prior period

sales taxes accruals and a $12 million increase in materials and

projects;

- an increase of $8 million in selling, general and

administrative expenses primarily due to higher corporate

allocations, insurance claims and recently acquired assets;

and

- a decrease of $1 million in Adjusted EBITDA related to

unconsolidated affiliates due to the impact of the Partnership’s

consolidation of Aqua-ETC Water Services, LLC, which previously had

been an equity method investment until October 2024.

NGL and Refined Products Transportation

and Services

Three Months Ended

December 31,

2024

2023

NGL transportation volumes (MBbls/d)

2,262

2,162

Refined products transportation volumes

(MBbls/d)

570

552

NGL and refined products terminal volumes

(MBbls/d)

1,465

1,446

NGL fractionation volumes (MBbls/d)

1,141

1,137

Revenues

$

6,356

$

6,039

Cost of products sold

5,048

4,684

Segment margin

1,308

1,355

Unrealized (gains) losses on commodity

risk management activities

60

(72

)

Operating expenses, excluding non-cash

compensation expense

(254

)

(225

)

Selling, general and administrative

expenses, excluding non-cash compensation expense

(42

)

(51

)

Adjusted EBITDA related to unconsolidated

affiliates

36

34

Other

—

1

Segment Adjusted EBITDA

$

1,108

$

1,042

NGL transportation and terminal volumes

increased primarily due to higher volumes from the Permian region,

on our Mariner East pipeline system and on our Gulf Coast export

pipelines. The increase in transportation volumes and the

commissioning of our eighth fractionator in August 2023 also led to

higher fractionated volumes at our Mont Belvieu NGL

Complex.

Segment Adjusted EBITDA. For the three

months ended December 31, 2024 compared to the same period last

year, Segment Adjusted EBITDA related to our NGL and refined

products transportation and services segment increased due to the

net impact of the following:

- an increase of $45 million in transportation margin primarily

due to higher throughput and contractual rate escalations on our

Gulf Coast and Mariner East pipeline systems. These increases were

partially offset by a $5 million decrease from the timing of

third-party deficiency payments on our Northeast region

pipelines;

- an increase of $38 million in terminal services margin

primarily due to a $34 million increase in fees from loading

volumes for export at our Nederland and Marcus Hook terminals and a

$3 million increase due to higher throughput and storage at our

refined product terminals;

- an increase of $18 million in marketing margin (excluding

unrealized gains and losses on commodity risk management

activities) primarily due to higher gains during 2024 from the

optimization of hedged NGL and refined product inventories;

and

- a decrease of $9 million in selling, general and administrative

expenses primarily due to a one-time charge related to regulatory

expenses in the prior period; partially offset by

- an increase of $29 million in operating expenses primarily due

to an $8 million increase in outside services expenses, a $7

million increase in ad valorem taxes, a $6 million increase in

employee costs, a $5 million increase resulting from the timing of

project related expenses, a $3 million increase in office expenses

and increases totaling $6 million from various other operating

expenses. These increases were partially offset by a $7 million

decrease in gas and power utility costs;

- a decrease of $10 million in fractionators and refinery

services margin resulting from a decrease in rates, primarily from

our midstream segment due to the restructuring of certain affiliate

fractionation agreements; and

- a decrease of $5 million in storage margin primarily due to the

timing of third-party deficiency payments.

Crude Oil Transportation and

Services

Three Months Ended

December 31,

2024

2023

Crude oil transportation volumes

(MBbls/d)

6,831

5,949

Crude oil terminal volumes (MBbls/d)

3,316

3,430

Revenues

$

6,220

$

7,214

Cost of products sold

5,207

6,213

Segment margin

1,013

1,001

Unrealized gains on commodity risk

management activities

(4

)

(13

)

Operating expenses, excluding non-cash

compensation expense

(217

)

(191

)

Selling, general and administrative

expenses, excluding non-cash compensation expense

(38

)

(30

)

Adjusted EBITDA related to unconsolidated

affiliates

6

7

Other

—

1

Segment Adjusted EBITDA

$

760

$

775

Crude oil transportation volumes were

higher due to continued growth on our gathering systems, as well as

contributions from recently acquired assets and from assets

contributed upon the recent formation of the ET-S Permian joint

venture with Sunoco LP, partially offset by lower volumes on our

Bakken Pipeline.

Adjusted EBITDA. For the three months

ended December 31, 2024 compared to the same period last year,

Segment Adjusted EBITDA related to our crude oil transportation and

services segment decreased due to the net impact of the

following:

- an increase of $21 million in segment margin (excluding

unrealized gains and losses on commodity risk management

activities) primarily due to a $99 million increase from recently

acquired assets and assets contributed upon the recent formation of

the ET-S Permian joint venture, partially offset by a $52 million

decrease in transportation revenues from existing assets and a $25

million decrease from our crude oil acquisition and marketing

activities; partially offset by

- an increase of $26 million in operating expenses primarily due

to a $21 million increase from recently acquired assets and assets

contributed upon the recent formation of the ET-S Permian joint

venture, a $3 million increase in outside services, a $2 million

increase in ad valorem taxes, a $2 million increase in employee

costs and various increases in volume-driven expenses; and

- an increase of $8 million in selling, general and

administrative expenses primarily due to an $11 million increase

from recently acquired assets and assets contributed upon the

recent formation of the ET-S Permian joint venture, as well as

higher employee costs.

Investment in Sunoco LP

Three Months Ended

December 31,

2024

2023

Revenues

$

5,269

$

5,641

Cost of products sold

4,644

5,492

Segment margin

625

149

Unrealized (gains) losses on commodity

risk management activities

4

(10

)

Operating expenses, excluding non-cash

compensation expense

(188

)

(110

)

Selling, general and administrative

expenses, excluding non-cash compensation expense

(50

)

(30

)

Adjusted EBITDA related to unconsolidated

affiliates

48

2

Inventory fair value adjustments

(13

)

227

Other, net

13

8

Segment Adjusted EBITDA

$

439

$

236

The Investment in Sunoco LP segment

reflects the consolidated results of Sunoco LP.

Segment Adjusted EBITDA. For the three

months ended December 31, 2024 compared to the same period last

year, Segment Adjusted EBITDA related to our investment in Sunoco

LP increased due to the net impact of the following:

- an increase of $250 million in segment margin (excluding

unrealized gains and losses on commodity risk management activities

and inventory valuation adjustments) primarily due to the

acquisitions of NuStar and Zenith European terminals; and

- an increase of $46 million in Adjusted EBITDA related to

unconsolidated affiliates due to the formation of the ET-S Permian

joint venture; partially offset by

- an increase of $78 million in operating expenses and $20

million in selling, general and administrative expenses primarily

due to the acquisitions of NuStar and Zenith European

terminals.

Investment in USAC

Three Months Ended

December 31,

2024

2023

Revenues

$

245

$

225

Cost of products sold

36

33

Segment margin

209

192

Operating expenses, excluding non-cash

compensation expense

(41

)

(40

)

Selling, general and administrative

expenses, excluding non-cash compensation expense

(12

)

(14

)

Other, net

(1

)

1

Segment Adjusted EBITDA

$

155

$

139

The Investment in USAC segment reflects

the consolidated results of USAC.

Segment Adjusted EBITDA. For the three

months ended December 31, 2024 compared to the same period last

year, Segment Adjusted EBITDA related to our investment in USAC

increased primarily due to higher revenue-generating horsepower as

a result of increased demand for compression services, higher

market-based rates on newly deployed and redeployed compression

units and higher average rates on existing customer contracts.

All Other

Three Months Ended

December 31,

2024

2023

Revenues

$

607

$

411

Cost of products sold

602

386

Segment margin

5

25

Unrealized (gains) losses on commodity

risk management activities

5

(11

)

Operating expenses, excluding non-cash

compensation expense

8

(22

)

Selling, general and administrative

expenses, excluding non-cash compensation expense

(19

)

(52

)

Adjusted EBITDA related to unconsolidated

affiliates

2

1

Other and eliminations

(40

)

12

Segment Adjusted EBITDA

$

(39

)

$

(47

)

Segment Adjusted EBITDA. For the three

months ended December 31, 2024 compared to the same period last

year, Segment Adjusted EBITDA related to our all other segment

increased due to the net impact of the following:

- an increase of $48 million due to higher M&A expenses in

the prior period; and

- an increase of $15 million in our natural gas marketing

business due to increased sales following the WTG Midstream

acquisition; partially offset by

- a decrease of $45 million primarily due to intersegment

eliminations of Sunoco LP’s 32.5% share of the ET-S Permian joint

venture, which is consolidated in our crude oil transportation and

services segment and also reflected as an unconsolidated affiliate

in our investment in Sunoco LP segment;

- a decrease of $5 million in our dual drive compression business

due to lower gas prices in 2024; and

- a decrease of $3 million from the timing of our compressor

sales in our compressor business.

ENERGY

TRANSFER LP AND SUBSIDIARIES SUPPLEMENTAL INFORMATION ON LIQUIDITY (In

millions) (unaudited)

The table below provides information on

our revolving credit facility. We also have consolidated

subsidiaries with revolving credit facilities which are not

included in this table.

Facility Size

Funds Available at

December 31, 2024

Maturity Date

Five-Year Revolving Credit Facility

$

5,000

$

2,211

April 11, 2027

(1)

(1)

Following the Partnership’s exercise of

its option to extend the maturity date on December 18, 2024, the

credit facility allows for unsecured borrowings up to $4.84 billion

until April 11, 2029.

ENERGY

TRANSFER LP AND SUBSIDIARIES SUPPLEMENTAL INFORMATION ON UNCONSOLIDATED

AFFILIATES (In millions) (unaudited)

The table below provides information on an

aggregated basis for our unconsolidated affiliates, which are

accounted for as equity method investments in the Partnership’s

financial statements for the periods presented.

Three Months Ended

December 31,

2024

2023

Equity in earnings of unconsolidated

affiliates:

Citrus

$

31

$

36

MEP

16

19

White Cliffs

5

5

Explorer

8

10

SESH

13

9

Other

21

18

Total equity in earnings of unconsolidated

affiliates

$

94

$

97

Adjusted EBITDA related to

unconsolidated affiliates:

Citrus

$

77

$

85

MEP

25

27

White Cliffs

10

10

Explorer

12

15

SESH

14

13

Other

32

27

Total Adjusted EBITDA related to

unconsolidated affiliates

$

170

$

177

Distributions received from

unconsolidated affiliates:

Citrus

$

35

$

12

MEP

23

26

White Cliffs

8

7

Explorer

7

9

SESH

12

8

Other

23

23

Total distributions received from

unconsolidated affiliates

$

108

$

85

ENERGY

TRANSFER LP AND SUBSIDIARIES SUPPLEMENTAL INFORMATION ON NON-WHOLLY OWNED JOINT

VENTURE SUBSIDIARIES (In millions) (unaudited)

The table below provides information on an

aggregated basis for our non-wholly owned joint venture

subsidiaries, which are reflected on a consolidated basis in our

financial statements. The table below excludes Sunoco LP and USAC,

which are non-wholly owned subsidiaries that are publicly traded,

as well as Sunoco LP’s 32.5% interest in the ET-S Permian joint

venture.

Three Months Ended

December 31,

2024

2023

Adjusted EBITDA of non-wholly owned

subsidiaries (100%) (a)

$

634

$

709

Our proportionate share of Adjusted EBITDA

of non-wholly owned subsidiaries (b)

305

334

Distributable Cash Flow of non-wholly

owned subsidiaries (100%) (c)

$

614

$

682

Our proportionate share of Distributable

Cash Flow of non-wholly owned subsidiaries (d)

288

313

Below is our ownership percentage of

certain non-wholly owned subsidiaries:

Non-wholly owned subsidiary:

Energy Transfer

Percentage Ownership (e)

Bakken Pipeline

36.4

%

Bayou Bridge

60.0

%

Maurepas

51.0

%

Ohio River System

75.0

%

Permian Express Partners

87.7

%

Red Bluff Express

70.0

%

Rover

32.6

%

Others

various

(a)

Adjusted EBITDA of non-wholly owned

subsidiaries reflects the total Adjusted EBITDA of our non-wholly

owned subsidiaries on an aggregated basis. This is the amount

included in our consolidated non-GAAP measure of Adjusted

EBITDA.

(b)

Our proportionate share of Adjusted EBITDA

of non-wholly owned subsidiaries reflects the amount of Adjusted

EBITDA of such subsidiaries (on an aggregated basis) that is

attributable to our ownership interest.

(c)

Distributable Cash Flow of non-wholly

owned subsidiaries reflects the total Distributable Cash Flow of

our non-wholly owned subsidiaries on an aggregated basis.

(d)

Our proportionate share of Distributable

Cash Flow of non-wholly owned subsidiaries reflects the amount of

Distributable Cash Flow of such subsidiaries (on an aggregated

basis) that is attributable to our ownership interest. This is the

amount included in our consolidated non-GAAP measure of

Distributable Cash Flow attributable to the partners of Energy

Transfer.

(e)

Our ownership reflects the total economic

interest held by us and our subsidiaries. In some cases, this

percentage comprises ownership interests held in (or by) multiple

entities.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250211500994/en/

Investor Relations: Bill Baerg, Brent Ratliff, Lyndsay

Hannah, 214-981-0795

Media Relations: Vicki Granado, 214-840-5820

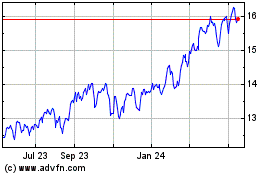

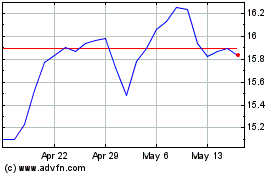

Energy Transfer (NYSE:ET)

Historical Stock Chart

From Jan 2025 to Feb 2025

Energy Transfer (NYSE:ET)

Historical Stock Chart

From Feb 2024 to Feb 2025