Form NPORT-P - Monthly Portfolio Investments Report on Form N-PORT (Public)

27 September 2024 - 9:26PM

Edgar (US Regulatory)

Eaton Vance

Tax-Advantaged Global Dividend

Income Fund

July 31, 2024

Portfolio of Investments (Unaudited)

| Security

| Shares

| Value

|

| Aerospace & Defense — 0.9%

|

| Safran SA

|

| 65,588

| $ 14,409,201

|

|

|

|

| $ 14,409,201

|

| Air Freight & Logistics — 1.2%

|

| GXO Logistics, Inc.(1)(2)

|

| 328,423

| $ 18,385,119

|

|

|

|

| $ 18,385,119

|

| Automobiles — 0.5%

|

| Tesla, Inc.(1)

|

| 35,316

| $ 8,195,784

|

|

|

|

| $ 8,195,784

|

| Banks — 7.0%

|

| Banco Santander SA

|

| 2,089,458

| $ 10,079,853

|

| Barclays PLC

|

| 6,212,440

| 18,577,095

|

| HDFC Bank Ltd.

|

| 862,113

| 16,682,377

|

| HSBC Holdings PLC

|

| 1,752,867

| 15,940,754

|

| KBC Group NV

|

| 116,281

| 8,993,861

|

| Societe Generale SA

|

| 560,310

| 14,532,739

|

| Toronto-Dominion Bank

|

| 257,513

| 15,206,631

|

| Truist Financial Corp.

|

| 252,855

| 11,300,090

|

|

|

|

| $ 111,313,400

|

| Beverages — 1.1%

|

| Diageo PLC

|

| 301,515

| $ 9,381,629

|

| Pernod Ricard SA

|

| 57,179

| 7,650,958

|

|

|

|

| $ 17,032,587

|

| Biotechnology — 1.3%

|

| CSL Ltd.

|

| 99,224

| $ 20,138,808

|

|

|

|

| $ 20,138,808

|

| Broadline Retail — 4.1%

|

| Amazon.com, Inc.(1)(2)

|

| 346,922

| $ 64,867,475

|

|

|

|

| $ 64,867,475

|

| Capital Markets — 0.7%

|

| Intercontinental Exchange, Inc.(2)

|

| 72,369

| $ 10,968,246

|

|

|

|

| $ 10,968,246

|

| Security

| Shares

| Value

|

| Consumer Finance — 0.9%

|

| Discover Financial Services

|

| 104,509

| $ 15,048,251

|

|

|

|

| $ 15,048,251

|

| Consumer Staples Distribution & Retail — 0.9%

|

| Dollar Tree, Inc.(1)(2)

|

| 136,463

| $ 14,238,549

|

|

|

|

| $ 14,238,549

|

| Diversified Telecommunication Services — 0.6%

|

| Zegona Communications PLC(1)

|

| 2,019,306

| $ 9,037,050

|

|

|

|

| $ 9,037,050

|

| Electric Utilities — 2.2%

|

| Iberdrola SA

|

| 1,453,034

| $ 19,191,954

|

| NextEra Energy, Inc.(2)

|

| 203,732

| 15,563,088

|

|

|

|

| $ 34,755,042

|

| Electrical Equipment — 2.2%

|

| AMETEK, Inc.

|

| 119,645

| $ 20,756,015

|

| Schneider Electric SE

|

| 62,224

| 14,998,172

|

|

|

|

| $ 35,754,187

|

| Electronic Equipment, Instruments & Components — 4.0%

|

| CDW Corp.

|

| 114,600

| $ 24,995,406

|

| Halma PLC

|

| 654,923

| 22,417,077

|

| Keyence Corp.

|

| 38,680

| 16,913,221

|

|

|

|

| $ 64,325,704

|

| Entertainment — 1.7%

|

| Walt Disney Co.

|

| 284,456

| $ 26,650,683

|

|

|

|

| $ 26,650,683

|

| Financial Services — 2.0%

|

| Fidelity National Information Services, Inc.(2)

|

| 128,670

| $ 9,885,716

|

| Visa, Inc., Class A

|

| 82,216

| 21,842,325

|

|

|

|

| $ 31,728,041

|

| Food Products — 2.1%

|

| Nestle SA

|

| 331,785

| $ 33,607,363

|

|

|

|

| $ 33,607,363

|

| Ground Transportation — 0.8%

|

| Union Pacific Corp.

|

| 53,816

| $ 13,278,022

|

|

|

|

| $ 13,278,022

|

Eaton Vance

Tax-Advantaged Global Dividend

Income Fund

July 31, 2024

Portfolio of Investments

(Unaudited) — continued

| Security

| Shares

| Value

|

| Health Care Equipment & Supplies — 4.8%

|

| Alcon, Inc.

|

| 148,237

| $ 14,035,751

|

| Boston Scientific Corp.(1)(2)

|

| 272,685

| 20,145,968

|

| Coloplast AS, Class B

|

| 119,645

| 15,553,910

|

| Intuitive Surgical, Inc.(1)(2)

|

| 43,725

| 19,440,572

|

| Straumann Holding AG

|

| 55,497

| 7,156,433

|

|

|

|

| $ 76,332,634

|

| Health Care Providers & Services — 0.9%

|

| UnitedHealth Group, Inc.

|

| 23,544

| $ 13,565,111

|

|

|

|

| $ 13,565,111

|

| Health Care REITs — 1.1%

|

| Healthpeak Properties, Inc.

|

| 784,658

| $ 17,121,238

|

|

|

|

| $ 17,121,238

|

| Hotels, Restaurants & Leisure — 4.6%

|

| Amadeus IT Group SA

|

| 331,786

| $ 21,851,699

|

| Compass Group PLC

|

| 1,343,720

| 41,379,867

|

| InterContinental Hotels Group PLC

|

| 106,191

| 10,698,278

|

|

|

|

| $ 73,929,844

|

| Household Products — 1.0%

|

| Reckitt Benckiser Group PLC

|

| 297,910

| $ 16,025,666

|

|

|

|

| $ 16,025,666

|

| Industrial Conglomerates — 1.7%

|

| Siemens AG

|

| 151,597

| $ 27,756,953

|

|

|

|

| $ 27,756,953

|

| Insurance — 4.4%

|

| AIA Group Ltd.

|

| 2,557,353

| $ 17,105,765

|

| Allstate Corp.(2)

|

| 72,316

| 12,374,714

|

| Assurant, Inc.

|

| 67,251

| 11,760,182

|

| AXA SA

|

| 388,966

| 13,656,519

|

| RenaissanceRe Holdings Ltd.(2)

|

| 62,224

| 14,430,368

|

|

|

|

| $ 69,327,548

|

| Interactive Media & Services — 4.8%

|

| Alphabet, Inc., Class C(2)

|

| 441,100

| $ 76,376,465

|

|

|

|

| $ 76,376,465

|

| Life Sciences Tools & Services — 2.0%

|

| Danaher Corp.

|

| 79,043

| $ 21,901,234

|

| Sartorius AG, PFC Shares

|

| 36,998

| 10,493,442

|

|

|

|

| $ 32,394,676

|

| Security

| Shares

| Value

|

| Machinery — 1.6%

|

| Ingersoll Rand, Inc.

|

| 133,099

| $ 13,363,140

|

| Parker-Hannifin Corp.

|

| 20,181

| 11,324,770

|

|

|

|

| $ 24,687,910

|

| Metals & Mining — 1.2%

|

| Anglo American PLC

|

| 321,697

| $ 9,752,669

|

| Rio Tinto Ltd.

|

| 124,689

| 9,581,364

|

|

|

|

| $ 19,334,033

|

| Multi-Utilities — 0.4%

|

| CMS Energy Corp.

|

| 99,224

| $ 6,429,715

|

|

|

|

| $ 6,429,715

|

| Oil, Gas & Consumable Fuels — 3.3%

|

| ConocoPhillips(2)

|

| 247,458

| $ 27,517,330

|

| EOG Resources, Inc.

|

| 195,324

| 24,767,083

|

|

|

|

| $ 52,284,413

|

| Pharmaceuticals — 9.9%

|

| AstraZeneca PLC

|

| 254,185

| $ 40,382,568

|

| Eli Lilly & Co.

|

| 31,954

| 25,699,644

|

| Novo Nordisk AS, Class B

|

| 185,232

| 24,541,922

|

| Sanofi SA

|

| 363,738

| 37,498,650

|

| Zoetis, Inc.

|

| 160,006

| 28,807,480

|

|

|

|

| $ 156,930,264

|

| Professional Services — 2.7%

|

| Recruit Holdings Co. Ltd.

|

| 397,373

| $ 22,786,676

|

| RELX PLC

|

| 234,003

| 11,044,353

|

| Verisk Analytics, Inc.

|

| 33,635

| 8,803,961

|

|

|

|

| $ 42,634,990

|

| Residential REITs — 0.6%

|

| Invitation Homes, Inc.

|

| 272,356

| $ 9,605,996

|

|

|

|

| $ 9,605,996

|

| Semiconductors & Semiconductor Equipment — 10.6%

|

| ASML Holding NV

|

| 28,590

| $ 26,622,188

|

| Infineon Technologies AG

|

| 813,248

| 28,250,722

|

| Micron Technology, Inc.

|

| 247,457

| 27,175,728

|

| NVIDIA Corp.(2)

|

| 622,968

| 72,899,715

|

| Taiwan Semiconductor Manufacturing Co. Ltd. ADR

|

| 84,087

| 13,941,624

|

|

|

|

| $ 168,889,977

|

Eaton Vance

Tax-Advantaged Global Dividend

Income Fund

July 31, 2024

Portfolio of Investments

(Unaudited) — continued

| Security

| Shares

| Value

|

| Software — 9.2%

|

| Adobe, Inc.(1)(2)

|

| 48,771

| $ 26,904,522

|

| Intuit, Inc.

|

| 36,999

| 23,951,303

|

| Microsoft Corp.(2)

|

| 228,958

| 95,784,579

|

|

|

|

| $ 146,640,404

|

| Specialty Retail — 1.6%

|

| TJX Cos., Inc.

|

| 218,868

| $ 24,736,461

|

|

|

|

| $ 24,736,461

|

| Technology Hardware, Storage & Peripherals — 3.2%

|

| Apple, Inc.

|

| 232,323

| $ 51,594,292

|

|

|

|

| $ 51,594,292

|

| Textiles, Apparel & Luxury Goods — 1.2%

|

| Cie Financiere Richemont SA, Class A

|

| 57,180

| $ 8,721,740

|

| LVMH Moet Hennessy Louis Vuitton SE

|

| 15,135

| 10,675,657

|

|

|

|

| $ 19,397,397

|

| Trading Companies & Distributors — 2.5%

|

| Ashtead Group PLC

|

| 220,550

| $ 15,916,520

|

| IMCD NV

|

| 166,734

| 23,975,253

|

|

|

|

| $ 39,891,773

|

Total Common Stocks

(identified cost $1,424,145,270)

|

|

| $1,709,621,272

|

| Security

| Principal

Amount

(000's omitted)

| Value

|

| Banks — 8.5%

|

| Australia & New Zealand Banking Group Ltd., 6.75% to 6/15/26(3)(4)(5)

| $

| 375

| $ 378,927

|

| Banco Bilbao Vizcaya Argentaria SA:

|

|

|

|

| 6.125% to 11/16/27(4)(5)

|

| 3,800

| 3,584,420

|

| 9.375% to 3/19/29(4)(5)

|

| 2,200

| 2,377,590

|

| Banco Davivienda SA, 6.65% to 4/22/31(3)(4)(5)

|

| 1,000

| 774,076

|

| Banco de Credito e Inversiones SA, 8.75% to 2/8/29(3)(4)(5)

|

| 1,510

| 1,590,340

|

| Banco Mercantil del Norte SA/Grand Cayman:

|

|

|

|

| 7.50% to 6/27/29(3)(4)(5)

|

| 2,470

| 2,434,338

|

| 7.625% to 1/10/28(3)(4)(5)

|

| 1,160

| 1,160,935

|

| 8.375% to 10/14/30(3)(4)(5)

|

| 1,105

| 1,137,470

|

| Banco Santander SA, 9.625% to 5/21/33(4)(5)

|

| 5,400

|

6,176,844

|

| Security

| Principal

Amount

(000's omitted)

| Value

|

| Banks (continued)

|

| Bank of America Corp., Series TT, 6.125% to 4/27/27(4)(5)

| $

| 2,338

| $ 2,348,079

|

| Bank of Montreal, 7.70% to 5/26/29, 5/26/84(5)

|

| 5,835

| 6,020,501

|

| Bank of New York Mellon Corp., Series G, 4.70% to 9/20/25(4)(5)

|

| 350

| 344,901

|

| Bank of Nova Scotia:

|

|

|

|

| 4.90% to 6/4/25(4)(5)

|

| 1,625

| 1,599,652

|

| 8.00% to 1/27/29, 1/27/84(5)

|

| 1,190

| 1,249,349

|

| 8.625% to 10/27/27, 10/27/82(5)

|

| 3,960

| 4,204,732

|

| Barclays PLC:

|

|

|

|

| 6.125% to 12/15/25(4)(5)

|

| 3,796

| 3,752,181

|

| 8.00% to 3/15/29(4)(5)

|

| 3,629

| 3,736,230

|

| BBVA Bancomer SA, 8.45% to 6/29/33, 6/29/38(3)(5)

|

| 1,000

| 1,056,576

|

| BNP Paribas SA:

|

|

|

|

| 4.625% to 2/25/31(3)(4)(5)

|

| 1,210

| 1,016,462

|

| 7.75% to 8/16/29(3)(4)(5)

|

| 1,710

| 1,765,571

|

| Citigroup, Inc., Series W, 4.00% to 12/10/25(4)(5)

|

| 8,826

| 8,471,358

|

| CoBank ACB, 7.25% to 7/1/29(4)(5)

|

| 1,760

| 1,800,973

|

| Discover Bank, 5.974%, 8/9/28

|

| 1,250

| 1,254,298

|

| Farm Credit Bank of Texas, 7.75% to 6/15/29(4)(5)

|

| 2,898

| 2,958,185

|

| HSBC Holdings PLC, 4.60% to 12/17/30(4)(5)

|

| 3,637

| 3,161,947

|

| Huntington Bancshares, Inc., Series F, 5.625% to 7/15/30(4)(5)

|

| 3,676

| 3,539,411

|

| ING Groep NV, 6.50% to 4/16/25(4)(5)

|

| 4,708

| 4,696,043

|

| JPMorgan Chase & Co., Series KK, 3.65% to 6/1/26(4)(5)

|

| 7,203

| 6,857,930

|

| NatWest Group PLC:

|

|

|

|

| 4.60% to 6/28/31(4)(5)

|

| 752

| 618,237

|

| 6.00% to 12/29/25(4)(5)

|

| 1,642

| 1,624,913

|

| 8.00% to 8/10/25(4)(5)

|

| 1,585

| 1,603,557

|

| PNC Financial Services Group, Inc., Series V, 6.20% to 9/15/27(4)(5)

|

| 2,475

| 2,474,763

|

| Regions Financial Corp., Series D, 5.75% to 6/15/25(4)(5)

|

| 2,250

| 2,232,359

|

| Royal Bank of Canada, 7.50% to 5/2/29, 5/2/84(5)

|

| 3,470

| 3,612,402

|

| Societe Generale SA:

|

|

|

|

| 5.375% to 11/18/30(3)(4)(5)

|

| 4,948

| 4,131,173

|

| 9.375% to 11/22/27(3)(4)(5)

|

| 662

| 680,644

|

| 10.00% to 11/14/28(3)(4)(5)

|

| 950

| 1,005,399

|

| State Street Corp., Series J, 6.70% to 9/15/29(4)(5)

|

| 2,320

| 2,322,825

|

| Sumitomo Mitsui Financial Group, Inc., 6.60% to 6/5/34(4)(5)

|

| 3,660

| 3,696,230

|

| Swedbank AB, Series NC5, 5.625% to 9/17/24(4)(5)(6)

|

| 2,400

| 2,399,400

|

| Toronto-Dominion Bank, 8.125% to 10/31/27, 10/31/82(5)

|

| 5,625

| 5,878,682

|

| Truist Financial Corp., Series Q, 5.10% to 3/1/30(4)(5)

|

| 4,161

|

3,907,175

|

Eaton Vance

Tax-Advantaged Global Dividend

Income Fund

July 31, 2024

Portfolio of Investments

(Unaudited) — continued

| Security

| Principal

Amount

(000's omitted)

| Value

|

| Banks (continued)

|

| UBS Group AG:

|

|

|

|

| 4.375% to 2/10/31(3)(4)(5)

| $

| 2,750

| $ 2,304,352

|

| 6.875% to 8/7/25(4)(5)(6)

|

| 1,471

| 1,468,242

|

| 9.25% to 11/13/33(3)(4)(5)

|

| 2,950

| 3,345,757

|

| UniCredit SpA, 7.296% to 4/2/29, 4/2/34(3)(5)

|

| 3,765

| 3,911,467

|

| Wells Fargo & Co., Series BB, 3.90% to 3/15/26(4)(5)

|

| 8,820

| 8,465,891

|

|

|

|

| $ 135,132,787

|

| Capital Markets — 0.3%

|

| AerCap Holdings NV, 5.875% to 10/10/24, 10/10/79(5)

| $

| 507

| $ 506,149

|

| Charles Schwab Corp.:

|

|

|

|

| Series G, 5.375% to 6/1/25(4)(5)

|

| 1,775

| 1,758,665

|

| Series I, 4.00% to 6/1/26(4)(5)

|

| 3,551

| 3,320,504

|

|

|

|

| $ 5,585,318

|

| Diversified Financial Services — 0.9%

|

| AerCap Ireland Capital DAC/AerCap Global Aviation Trust, 6.95% to 12/10/29, 3/10/55(5)

| $

| 1,010

| $ 1,021,739

|

| Air Lease Corp., Series B, 4.65% to 6/15/26(4)(5)

|

| 3,579

| 3,463,577

|

| Ally Financial, Inc., 6.70%, 2/14/33

|

| 1,215

| 1,249,613

|

| Alpha Holding SA de CV:

|

|

|

|

| 9.00%, 2/10/25(3)(7)

|

| 3,050

| 16,682

|

| 10.00%, 12/19/22(3)(7)

|

| 443

| 6,639

|

| American AgCredit Corp., Series A, 5.25% to 6/15/26(3)(4)(5)

|

| 5,139

| 5,036,220

|

| Goldman Sachs Group, Inc.:

|

|

|

|

| Series V, 4.125% to 11/10/26(4)(5)

|

| 1,046

| 980,598

|

| Series W, 7.50% to 2/10/29(4)(5)

|

| 2,425

| 2,542,962

|

| Unifin Financiera SAB de CV:

|

|

|

|

| 7.375%, 2/12/26(3)(7)(8)

|

| 1,325

| 0

|

| 7.375%, 2/12/26(3)(7)(8)

|

| 1,325

| 0

|

|

|

|

| $ 14,318,030

|

| Electric Utilities — 0.8%

|

| Dominion Energy, Inc., Series C, 4.35% to 1/15/27(4)(5)

| $

| 1,941

| $ 1,851,660

|

| Edison International, Series B, 5.00% to 12/15/26(4)(5)

|

| 757

| 729,410

|

| Emera, Inc., Series 16-A, 6.75% to 6/15/26, 6/15/76(5)

|

| 3,025

| 3,020,467

|

| Sempra, 4.125% to 1/1/27, 4/1/52(5)

|

| 4,252

| 3,944,590

|

| Southern Co., Series 21-A, 3.75% to 6/15/26, 9/15/51(5)

|

| 2,980

| 2,814,914

|

|

|

|

| $ 12,361,041

|

| Security

| Principal

Amount

(000's omitted)

| Value

|

| Financial Services — 0.1%

|

| Ally Financial, Inc., Series B, 4.70% to 5/15/26(4)(5)

| $

| 1,400

| $ 1,287,908

|

|

|

|

| $ 1,287,908

|

| Food Products — 0.3%

|

| Land O' Lakes, Inc., 8.00%(3)(4)

| $

| 5,982

| $ 5,316,502

|

|

|

|

| $ 5,316,502

|

| Independent Power and Renewable Electricity Producers — 0.2%

|

| Algonquin Power & Utilities Corp., 4.75% to 1/18/27, 1/18/82(5)

| $

| 2,886

| $ 2,641,146

|

|

|

|

| $ 2,641,146

|

| Insurance — 1.2%

|

| Allianz SE, 3.50% to 11/17/25(3)(4)(5)

| $

| 2,800

| $ 2,657,395

|

| Corebridge Financial, Inc., 6.875% to 9/15/27, 12/15/52(5)

|

| 3,575

| 3,640,591

|

| Global Atlantic Fin Co., 7.95% to 7/15/29, 10/15/54(3)(5)

|

| 1,090

| 1,108,899

|

| Liberty Mutual Group, Inc., 4.125% to 9/15/26, 12/15/51(3)(5)

|

| 6,337

| 5,933,157

|

| QBE Insurance Group Ltd., 5.875% to 5/12/25(3)(4)(5)

|

| 6,060

| 6,019,192

|

|

|

|

| $ 19,359,234

|

| Oil and Gas — 0.4%

|

| BP Capital Markets PLC, 6.45% to 12/1/33(4)(5)

| $

| 3,390

| $ 3,507,091

|

| Petroleos Mexicanos, 6.50%, 3/13/27

|

| 2,750

| 2,646,520

|

|

|

|

| $ 6,153,611

|

| Pipelines — 0.4%

|

| Enbridge, Inc., Series NC5, 8.25% to 10/15/28, 1/15/84(5)

| $

| 5,668

| $ 5,958,508

|

|

|

|

| $ 5,958,508

|

| Telecommunications — 0.2%

|

| Rogers Communications, Inc., 5.25% to 3/15/27, 3/15/82(3)(5)

| $

| 3,750

| $ 3,638,272

|

|

|

|

| $ 3,638,272

|

Total Corporate Bonds

(identified cost $214,839,885)

|

|

| $ 211,752,357

|

Eaton Vance

Tax-Advantaged Global Dividend

Income Fund

July 31, 2024

Portfolio of Investments

(Unaudited) — continued

| Security

| Shares

| Value

|

| Banks — 0.1%

|

| Citizens Financial Group, Inc., 7.375%

|

| 46,616

| $ 1,191,505

|

| Farm Credit Bank of Texas, 9.611%, (3 mo. SOFR + 4.01%)(3)(9)

|

| 4,562

| 463,043

|

|

|

|

| $ 1,654,548

|

| Capital Markets — 0.2%

|

| Affiliated Managers Group, Inc., 4.75%

|

| 143,480

| $ 2,733,294

|

|

|

|

| $ 2,733,294

|

| Electric Utilities — 0.5%

|

| Brookfield BRP Holdings Canada, Inc.:

|

|

|

|

| 4.625%

|

| 130,175

| $ 2,032,032

|

| 7.25%

|

| 79,518

| 1,995,902

|

| SCE Trust III, Series H, 8.591%, (3 mo. SOFR + 3.25%)(9)

|

| 61,853

| 1,558,077

|

| SCE Trust IV, Series J, 5.375% to 9/15/25(5)

|

| 12,679

| 303,789

|

| SCE Trust V, Series K, 5.45% to 3/15/26(5)

|

| 68,884

| 1,669,748

|

|

|

|

| $ 7,559,548

|

| Insurance — 0.4%

|

| American National Group, Inc., Series B, 6.625% to 9/1/25(5)

|

| 110,882

| $ 2,755,418

|

| Athene Holding Ltd., Series C, 6.375% to 6/30/25(5)

|

| 113,887

| 2,826,675

|

|

|

|

| $ 5,582,093

|

| Wireless Telecommunication Services — 0.1%

|

| U.S. Cellular Corp., 5.50%

|

| 102,328

| $ 2,087,491

|

|

|

|

| $ 2,087,491

|

Total Preferred Stocks

(identified cost $21,382,564)

|

|

| $ 19,616,974

|

| Short-Term Investments — 0.7%

|

| Security

| Shares

| Value

|

| Morgan Stanley Institutional Liquidity Funds - Government Portfolio, Institutional

Class, 5.21%(10)

|

| 11,828,463

| $ 11,828,463

|

Total Short-Term Investments

(identified cost $11,828,463)

|

|

| $ 11,828,463

|

Total Investments — 122.8%(11)

(identified cost $1,672,196,182)

|

|

| $1,952,819,066

|

| Other Assets, Less Liabilities — (22.8)%

|

|

| $ (362,820,410)

|

| Net Assets — 100.0%

|

|

| $1,589,998,656

|

| The percentage shown for each investment category in the Portfolio of Investments is based on net assets.

|

| (1)

| Non-income producing security.

|

| (2)

| All or a portion of this security was on loan at July 31, 2024 pursuant to the Liquidity Agreement. The aggregate market value of securities on loan at July 31, 2024 was $344,753,705

and the total market value of the collateral received by State Street Bank and Trust Company was $343,596,482 comprised of cash.

|

| (3)

| Security exempt from registration under Rule 144A of the Securities Act of 1933, as amended. These securities may be sold in certain transactions in reliance on an exemption from

registration (normally to qualified institutional buyers). At July 31, 2024, the aggregate value of these securities is $56,889,488 or 3.6% of the Fund's net assets.

|

| (4)

| Perpetual security with no stated maturity date but may be subject to calls by the issuer.

|

| (5)

| Security converts to variable rate after the indicated fixed-rate coupon period.

|

| (6)

| Security exempt from registration under Regulation S of the Securities Act of 1933, as amended, which exempts from registration securities offered and sold outside the United States.

Security may not be offered or sold in the United States except pursuant to an exemption from, or in a transaction not subject to, the registration requirements of the Securities Act of 1933, as amended. At July 31,

2024, the aggregate value of these securities is $3,867,642 or 0.2% of the Fund's net assets.

|

| (7)

| Issuer is in default with respect to interest and/or principal payments and is non-income producing.

|

| (8)

| For fair value measurement disclosure purposes, security is categorized as Level 3.

|

| (9)

| Variable rate security. The stated interest rate represents the rate in effect at July 31, 2024.

|

| (10)

| May be deemed to be an affiliated investment company. The rate shown is the annualized seven-day yield as of July 31, 2024.

|

| (11)

| The Fund has granted a security interest in all the Fund’s investments, unless otherwise pledged, in connection with the Liquidity Agreement.

|

Eaton Vance

Tax-Advantaged Global Dividend

Income Fund

July 31, 2024

Portfolio of Investments

(Unaudited) — continued

| Country Concentration of Portfolio

|

| Country

| Percentage of

Total Investments

| Value

|

| United States

| 61.0%

| $1,191,187,228

|

| United Kingdom

| 11.5

| 225,297,922

|

| France

| 3.6

| 69,524,323

|

| Germany

| 3.6

| 69,158,512

|

| Spain

| 3.2

| 63,262,360

|

| Canada

| 2.9

| 57,058,276

|

| Netherlands

| 2.8

| 55,293,484

|

| Japan

| 2.2

| 43,396,127

|

| Denmark

| 2.1

| 40,095,832

|

| Switzerland

| 1.2

| 22,996,524

|

| Hong Kong

| 0.9

| 17,105,765

|

| India

| 0.9

| 16,682,377

|

| Australia

| 0.8

| 15,979,483

|

| Bermuda

| 0.7

| 14,430,368

|

| Taiwan

| 0.7

| 13,941,624

|

| South Africa

| 0.5

| 9,752,669

|

| Belgium

| 0.5

| 8,993,861

|

| Mexico

| 0.4

| 8,459,160

|

| Italy

| 0.2

| 3,911,467

|

| Sweden

| 0.1

| 2,399,400

|

| Chile

| 0.1

| 1,590,340

|

| Ireland

| 0.1

| 1,527,888

|

| Colombia

| 0.0(1)

| 774,076

|

| Total Investments

| 100.0%

| $1,952,819,066

|

| (1)

| Amount is less than 0.05%.

|

| Abbreviations:

|

| ADR

| – American Depositary Receipt

|

| PFC Shares

| – Preference Shares

|

| REITs

| – Real Estate Investment Trusts

|

| SOFR

| – Secured Overnight Financing Rate

|

Eaton Vance

Tax-Advantaged Global Dividend

Income Fund

July 31, 2024

Portfolio of Investments

(Unaudited) — continued

The Fund did not have any open

derivative instruments at July 31, 2024.

Affiliated Investments

At July 31, 2024, the value of the

Fund's investment in funds that may be deemed to be affiliated was $11,828,463, which represents 0.7% of the Fund's net assets. Transactions in such investments by the Fund for the fiscal year to date ended July

31, 2024 were as follows:

| Name

| Value,

beginning

of period

| Purchases

| Sales

proceeds

| Net realized

gain (loss)

| Change in

unrealized

appreciation

(depreciation)

| Value, end

of period

| Dividend

income

| Shares,

end of period

|

| Short-Term Investments

|

| Liquidity Fund, Institutional Class(1)

| $34,329,290

| $403,267,762

| $(425,768,589)

| $ —

| $ —

| $11,828,463

| $481,350

| 11,828,463

|

| (1)

| Represents investment in Morgan Stanley Institutional Liquidity Funds - Government Portfolio.

|

Fair Value Measurements

Under generally accepted accounting

principles for fair value measurements, a three-tier hierarchy to prioritize the assumptions, referred to as inputs, is used in valuation techniques to measure fair value. The three-tier hierarchy of inputs is

summarized in the three broad levels listed below.

| •

|

Level 1 – quoted prices in active markets for identical investments

|

| •

|

Level 2 – other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, credit risk, etc.)

|

| •

| Level 3 – significant unobservable inputs (including a fund's own assumptions in determining the fair value of investments)

|

In cases where the inputs used to

measure fair value fall in different levels of the fair value hierarchy, the level disclosed is determined based on the lowest level input that is significant to the fair value measurement in its entirety. The inputs

or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

At July 31, 2024, the hierarchy of

inputs used in valuing the Fund’s investments, which are carried at fair value, were as follows:

| Asset Description

| Level 1

| Level 2

| Level 3*

| Total

|

| Common Stocks:

|

|

|

|

|

| Communication Services

| $ 103,027,148

| $ 9,037,050

| $ —

| $ 112,064,198

|

| Consumer Discretionary

| 97,799,720

| 93,327,241

| —

| 191,126,961

|

| Consumer Staples

| 14,238,549

| 66,665,616

| —

| 80,904,165

|

| Energy

| 52,284,413

| —

| —

| 52,284,413

|

| Financials

| 122,816,523

| 115,568,963

| —

| 238,385,486

|

| Health Care

| 129,560,009

| 169,801,484

| —

| 299,361,493

|

| Industrials

| 85,911,027

| 130,887,128

| —

| 216,798,155

|

| Information Technology

| 337,247,169

| 94,203,208

| —

| 431,450,377

|

| Materials

| —

| 19,334,033

| —

| 19,334,033

|

| Real Estate

| 26,727,234

| —

| —

| 26,727,234

|

| Utilities

| 21,992,803

| 19,191,954

| —

| 41,184,757

|

| Total Common Stocks

| $ 991,604,595

| $718,016,677**

| $ —

| $1,709,621,272

|

| Corporate Bonds

| $ —

| $211,752,357

| $0

| $ 211,752,357

|

| Preferred Stocks:

|

|

|

|

|

| Communication Services

| 2,087,491

| —

| —

| 2,087,491

|

| Financials

| 9,506,892

| 463,043

| —

| 9,969,935

|

| Utilities

| 7,559,548

| —

| —

| 7,559,548

|

| Total Preferred Stocks

| $ 19,153,931

| $ 463,043

| $ —

| $ 19,616,974

|

Eaton Vance

Tax-Advantaged Global Dividend

Income Fund

July 31, 2024

Portfolio of Investments

(Unaudited) — continued

| Asset Description (continued)

| Level 1

| Level 2

| Level 3*

| Total

|

| Short-Term Investments

| $ 11,828,463

| $ —

| $ —

| $ 11,828,463

|

| Total Investments

| $1,022,586,989

| $930,232,077

| $0

| $1,952,819,066

|

| *

| None of the unobservable inputs for Level 3 assets, individually or collectively, had a material impact on the Fund.

|

| **

| Includes foreign equity securities whose values were adjusted to reflect market trading of comparable securities or other correlated instruments that occurred

after the close of trading in their applicable foreign markets.

|

Level 3 investments at the beginning

and/or end of the period in relation to net assets were not significant and accordingly, a reconciliation of Level 3 assets for the fiscal year to date ended July 31, 2024 is not presented.

For information on the Fund's policy

regarding the valuation of investments and other significant accounting policies, please refer to the Fund's most recent financial statements included in its semi-annual or annual report to shareholders.

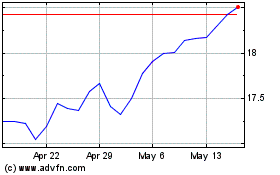

Eaton Vance Tax Advantag... (NYSE:ETG)

Historical Stock Chart

From Dec 2024 to Dec 2024

Eaton Vance Tax Advantag... (NYSE:ETG)

Historical Stock Chart

From Dec 2023 to Dec 2024