E2open Releases 2024 Forecasting and Inventory Benchmark Study: Lessons from the Pandemic for Future Resilience

02 October 2024 - 11:15PM

Business Wire

The latest study highlights opportunities for businesses to

strengthen resilience with artificial intelligence (AI)-driven

demand sensing to optimize inventory, realize more value from

planning investments, and better serve clients during disruptions

of any size.

E2open Parent Holdings, Inc. (NYSE: ETWO), the connected supply

chain SaaS platform with the largest multi-enterprise network,

announced today at its annual Connect customer conference the

release of its highly anticipated 2024 Forecasting and Inventory

Benchmark Study. This in-depth special report provides an extensive

analysis of supply chain performance throughout the entirety of the

biggest disruption in modern history, the COVID-19 pandemic —

offering unique insights that cover the years before, during and

after the pandemic’s impact.

This year’s study follows e2open’s 2021 report, which examined

the initial influence of the pandemic on global supply chains. Now,

with data spanning from 2019 to 2023, the 2024 Forecasting and

Inventory Benchmark Study answers key questions that emerged as

supply chains around the world navigated the complexities of

lockdowns, supply shortages and fluctuating demand. By leveraging

real-world data, this report equips businesses that make, move and

sell goods with valuable insights to enhance decision-making and

build resilience against future disruptions.

Key Findings from e2open’s 2024 Forecasting and Inventory

Benchmark Study:

Changes in Consumer Purchasing and Manufacturing Strategies

- At the pandemic’s onset, consumer demand surged, causing a 10%

spike in shipments and driving record-high sales per item. However,

by 2023, sales growth normalized to just 1% above 2018 levels. To

adapt to supply chain constraints, manufacturers streamlined

product offerings and focused on fewer, more efficient items.

However, the continued rapid pace of product turnover, with

one-third churning annually, raises concerns about hidden costs

associated with inventory, packaging, and manufacturing

changeovers.

Planning Error for Top Movers and the Tail

- The pandemic underscored the disproportionate difficulty of

planning for slow-moving items. Planning errors for these "tail"

items increased by 21 percentage points—nearly double the 11-point

rise for top movers. With 85% of items classified as slow movers,

companies experienced significant service issues and profit loss.

On the other hand, the top 10% of items accounted for 75% of sales.

This highlights an opportunity for businesses to reduce their

portfolios and drive greater profitability by focusing on

high-performing products.

Forecast Error and the Role of AI to Sense Demand

- Throughout the pandemic, demand sensing technology consistently

reduced forecast error by one-third compared to traditional

methods, even during the extreme volatility of panic buying. With

AI-driven insights, businesses were able to adapt to rapid shifts

in consumer behavior and maintain better forecast accuracy, proving

the value of real-time data and artificial intelligence in

mitigating large-scale supply chain disruptions.

Impact on Inventory Management

- The pandemic emphasized the importance of balancing inventory

to avoid overstocking and production inefficiencies. Companies

using multi-echelon inventory optimization paired with demand

sensing were able to reduce safety stock by 40-50%, enhancing

efficiency and risk mitigation during disruption.

“The research enables us to identify specific opportunities to

increase resilience, particularly by leveraging AI-driven demand

sensing to improve forecast accuracy, manage product assortment,

and use multi-echelon inventory optimization to better manage stock

levels in volatile times," said Pawan Joshi, EVP of Products and

Strategy at e2open. "This year’s Forecasting and Inventory

Benchmark Study offers valuable primary research for leaders,

economists, and analysts seeking a fact-based assessment on how the

pandemic reshaped supply chains. By comparing their performance to

the report’s benchmarks, leaders can identify best practices to

boost and prepare for future disruptions."

Download the report today at e2open.com to learn how to build

resilience into your supply chain, improving your day-to-day

operations and putting you in a better position to navigate the

next major disruption.

About e2open

E2open is the connected supply chain software platform that

enables the world’s largest companies to transform the way they

make, move, and sell goods and services. With the broadest

cloud-native global platform purpose-built for modern supply

chains, e2open connects more than 480,000 manufacturing, logistics,

channel, and distribution partners as one multi-enterprise network

tracking over 16 billion transactions annually. Our SaaS platform

anticipates disruptions and opportunities to help companies improve

efficiency, reduce waste, and operate sustainably. E2open’s

headquarters is now in Dallas, TX. Moving as one.™ Learn More:

www.e2open.com.

E2open and “Moving as one.” are the registered trademarks of

E2open, LLC. All other trademarks, registered trademarks and

service marks are the property of their respective owners.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241002486322/en/

Media Contact: 5W PR for e2open e2open@5wpr.com 408-504-7707

Investor Relations Contact: Dusty Buell dusty.buell@e2open.com

investor.relations@e2open.com

Corporate Contact: Kristin Seigworth VP Communications, e2open

kristin.seigworth@e2open.com pr@e2open.com

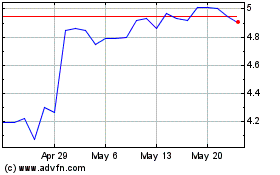

E2open Parent (NYSE:ETWO)

Historical Stock Chart

From Jan 2025 to Feb 2025

E2open Parent (NYSE:ETWO)

Historical Stock Chart

From Feb 2024 to Feb 2025