GAAP subscription revenue of $132.0 million, above midpoint of

Q3 guidance range

E2open Parent Holdings, Inc. (NYSE: ETWO) (“e2open” or the

“Company”), the connected supply chain SaaS platform with the

largest multi-enterprise network, today announced financial results

for its fiscal third quarter ended November 30, 2024.

“During the third quarter, e2open made further progress in

putting our company back on a growth path,” said Andrew Appel,

e2open chief executive officer. “We significantly improved our

retention performance, and we demonstrated the power of our

end-to-end software solutions by winning cross-sell and new logo

business with clients in a variety of industries. We are honored to

be long-term technology partners to so many of the world’s leading

global companies.

“To further increase strategic client engagement and accelerate

innovation, we have created two new executive roles,” Appel

continued. “Pawan Joshi, a visionary supply chain expert and

longtime e2open senior leader, has been named chief strategy

officer. And Rachit Lohani has joined e2open as chief product and

technology officer, bringing an impressive track record of

developing world-class SaaS software. These appointments will allow

e2open to maximize the growth potential of our deep client

relationships and unique technology platform.”

“In Q3 FY25, e2open delivered subscription revenue above the

mid-point of our guidance along with strong adjusted EBITDA and

cash flow,” said Marje Armstrong, chief financial officer of

e2open. “We are modestly narrowing our full year subscription

revenue guidance mainly due to U.S. dollar strengthening, while

maintaining full year adjusted EBITDA guidance. As we continue our

strategic review, our comprehensive return-to-growth plan remains

on track.”

Fiscal Third Quarter 2025 Financial

Highlights

- Revenue

- GAAP subscription revenue for the third quarter of 2025

was $132.0 million, a decrease of 0.6% from the year-ago comparable

period and 87.0% of total revenue.

- Total GAAP revenue for the third quarter of 2025 was

$151.7 million, a decrease of 3.7% from the year-ago comparable

period.

- GAAP gross profit for the third quarter of 2025 was

$75.7 million, a decrease of 3.6% from the year-ago comparable

period. Non-GAAP gross profit was $104.3 million, down 4.9%.

- GAAP gross margin for the third quarter of 2025 was

49.9% compared to 49.9% for the year-ago comparable period.

Non-GAAP gross margin was 68.8% compared to 69.6% from the

comparable year-ago period.

- GAAP Net loss for the third quarter of 2025 was $381.6

million compared to a net loss of $740.0 million from the year-ago

comparable period. Adjusted EBITDA for the third quarter of

2025 was $53.6 million, a decrease of 3.2% from the year-ago

comparable period. Adjusted EBITDA margin was 35.3% versus 35.1%

from the comparable year-ago period.

- GAAP EPS for the third quarter of 2025 was a loss of

$1.12. Adjusted EPS for the third quarter of 2025 was

$0.05.

Recent Business

Highlights

- Closed new logo and cross-sell business with large, well-known

global companies in diverse market segments including industrial

manufacturing, consumer retail, grocery, consumer packaged goods,

and food and beverage. These clients selected e2open solutions

across the platform to increase productivity and efficiency, reduce

risk, improve compliance, significantly reduce or eliminate manual

processes, and enhance their ability to serve their own

customers.

- Among the wins in the third quarter was a large cross-sell deal

with a leading global retailer, providing another example of

e2open’s strength in Supply Chain Collaboration and Supply Planning

for the consumer retail segment. This customer has used e2open

solutions for inventory collaboration and management for more than

a decade and will now expand and deepen its utilization of e2open’s

comprehensive platform to solve a wider array of business needs.

Implementing e2open planning and supply applications will allow the

client to reduce manual planning efforts by at least half, improve

supplier relationships, reduce expediting of goods for freight

savings, and improve on-time delivery.

- Among the customer go-lives in the quarter was a large

multinational pharmaceutical and healthcare company that will

improve onboarding and decrease shipping time across its supply

network, and a multinational apparel company that has centralized

its global trade management with e2open to increase productivity,

reduce risk, and control spending.

- Named a Leader by IDC industry analysts in multiple Supply

Chain Planning categories including IDC MarketScape: Worldwide

Supply Chain Planning Overall; IDC MarketScape: Worldwide Supply

Chain Planning for Process Industries; and IDC MarketScape:

Worldwide Supply Chain Planning for Distribution Industries 2024

Vendor Assessments, for advanced planning and execution on one

platform, powered by field-proven AI and the largest

multi-enterprise supply chain commerce network.

- Released e2open’s 24.4 quarterly product update, focused on

enhancing automation and intelligence, leveraging AI, strengthening

compliance features, and refining the user experience across the

entire e2open connected supply chain platform.

- Published 2024 Forecasting and Inventory Benchmark Study,

revealing extensive analysis of supply chain performance over a

multi-year period and identifying opportunities for businesses to

strengthen resilience with AI-driven demand sensing to optimize

inventory, realize more value from planning investments, and better

serve clients during disruptions of any size.

Financial Outlook for Fiscal Year

2025

As of January 10, 2025, e2open is updating full year 2025

guidance previously provided on October 9, 2024, and providing

fourth quarter 2025 guidance as follows:

Fiscal 2025 and Fiscal Fourth Quarter GAAP Subscription

Revenue

- GAAP subscription revenue for fiscal 2025 is expected to be in

the range of $526 million to $529 million, reflecting a negative

1.7% growth rate at the mid-point.

- GAAP subscription revenue for the fiscal fourth quarter of 2025

is expected to be in the range of $131 million to $134 million,

reflecting a negative 1.4% growth rate at the mid-point and

negative 1.1% growth on a constant currency basis.

Fiscal 2025 Total GAAP Revenue

- Total GAAP revenue for fiscal 2025 is expected to be in the

range of $607 million to $611 million, reflecting a negative 4.0%

organic growth rate at the mid-point.

Fiscal 2025 Non-GAAP Gross Profit Margin

- Non-GAAP gross profit margin for fiscal 2025 is expected to be

in the range of 68% to 70%.

Fiscal 2025 Adjusted EBITDA

- Adjusted EBITDA for fiscal 2025 is expected to be approximately

$215 million with an implied adjusted EBITDA margin of

approximately 35%, both consistent with previous guidance.

Quarterly Conference

Call

E2open will host a conference call today at 8:30 a.m. ET to

review fiscal third quarter 2025 financial results, in addition to

discussing the Company’s outlook for the full fiscal year 2025. To

access this call, dial 888-506-0062 (domestic) or 973-528-0011

(international). The conference ID is 588291. A live webcast of the

conference call will be accessible in the “Investor Relations”

section of e2open’s website at www.e2open.com. A replay of this

conference call can also be accessed through January 23, 2025, at

877-481-4010 (domestic) or 919-882-2331 (international). The replay

passcode is 51733. An archived webcast of this conference call will

also be available after the completion of the call in the “Investor

Relations” section of the Company’s website at www.e2open.com.

About e2open

E2open is the connected supply chain software platform that

enables the world’s largest companies to transform the way they

make, move, and sell goods and services. With the broadest

cloud-native global platform purpose-built for modern supply

chains, e2open connects more than 480,000 manufacturing, logistics,

channel, and distribution partners as one multi-enterprise network

tracking over 16 billion transactions annually. Our SaaS platform

anticipates disruptions and opportunities to help companies improve

efficiency, reduce waste, and operate sustainably. Moving as one.™

Learn More: www.e2open.com.

E2open and “Moving as one.” are the registered trademarks of

E2open, LLC. All other trademarks, registered trademarks and

service marks are the property of their respective owners.

Non-GAAP Financial

Measures

This press release includes certain financial measures not

presented in accordance with generally accepted accounting

principles (“GAAP”) including non-GAAP revenue, non-GAAP

subscription revenue, non-GAAP professional services and other

revenue, adjusted EBITDA, adjusted EBITDA margin, non-GAAP gross

profit, non-GAAP net income, non-GAAP gross margin, adjusted free

cash flow and adjusted earnings per share. These non-GAAP financial

measures are not a measure of financial performance in accordance

with GAAP and may exclude items that are significant in

understanding and assessing the Company’s financial results.

Therefore, these measures should not be considered in isolation or

as an alternative to net income, cash flows from operations or

other measures of profitability, liquidity, or performance under

GAAP. You should be aware that the Company’s presentation of these

measures may not be comparable to similarly titled measures used by

other companies.

The Company believes this non-GAAP measure of financial results

provides useful information to management and investors regarding

certain financial and business trends relating to the Company’s

financial condition and results of operations. The Company believes

that the use of these non-GAAP financial measures provides an

additional tool for investors to use in evaluating ongoing

operating results and trends in comparing the Company’s financial

measures with other similar companies, many of which present

similar non-GAAP financial measures to investors. These non-GAAP

financial measures are subject to inherent limitations as they

reflect the exercise of judgments by management about which expense

and income are excluded or included in determining these non-GAAP

financial measures.

NOTE: E2open is unable to quantify certain amounts that would be

required to be included in the most directly comparable GAAP

financial measures for non-GAAP gross profit margin or adjusted

EBITDA without unreasonable effort, and therefore no reconciliation

of certain forward-looking non-GAAP financial measures for non-GAAP

gross profit margin or adjusted EBITDA is included.

Safe Harbor Statement

Certain statements in this press release are "forward-looking

statements" within the meaning of Section 21E of the Securities

Exchange Act of 1934, as amended, and are subject to the safe

harbor created thereby. These statements relate to future events or

the Company's future financial performance and involve known and

unknown risks, uncertainties and other factors that may cause the

actual results, levels of activity, performance or achievements of

the Company or its industry to be materially different from those

expressed or implied by any forward-looking statements. In

particular, statements about the Company's expectations, beliefs,

plans, objectives, assumptions, future events or future performance

contained in this press release are forward-looking statements. In

some cases, forward-looking statements can be identified by

terminology such as "may," "will," "could," "would," "should,"

"expect," "plan," "anticipate," "intend," "believe," "estimate,"

"predict," "potential," "outlook," "guidance" or the negative of

those terms or other comparable terminology.

Please see the Company's documents filed or to be filed with the

Securities and Exchange Commission, including the annual report

filed on Form 10-K, and any amendments thereto for a discussion of

certain important risk factors that relate to forward-looking

statements contained in this press release. The Company has based

these forward-looking statements on its current expectations,

assumptions, estimates and projections. While the Company believes

these expectations, assumptions, estimates, and projections are

reasonable, such forward-looking statements are only predictions

and involve known and unknown risks and uncertainties, many of

which are beyond the Company's control. These and other important

factors may cause actual results, performance or achievements to

differ materially from those expressed or implied by these

forward-looking statements. Any forward-looking statements are made

only as of the date hereof, and unless otherwise required by

applicable securities laws, the Company disclaims any intention or

obligation to update or revise any forward-looking statements,

whether as a result of new information, future events or

otherwise.

E2OPEN PARENT HOLDINGS,

INC.

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS

(Unaudited)

Three Months Ended November

30,

(In thousands, except per share

amounts)

2024

2023

Revenue

Subscriptions

$

132,000

$

132,800

Professional services and other

19,655

24,697

Total revenue

151,655

157,497

Cost of Revenue

Subscriptions

35,640

36,689

Professional services and other

16,546

17,642

Amortization of acquired intangible

assets

23,727

24,590

Total cost of revenue

75,913

78,921

Gross Profit

75,742

78,576

Operating Expenses

Research and development

23,259

24,937

Sales and marketing

21,529

22,583

General and administrative

20,831

24,739

Acquisition-related expenses

187

9

Amortization of acquired intangible

assets

5,611

20,014

Goodwill impairment

369,100

687,700

Intangible asset impairment

10,000

30,000

Total operating expenses

450,517

809,982

Loss from operations

(374,775

)

(731,406

)

Other income (expense)

Interest and other expense, net

(25,423

)

(24,643

)

Gain from change in tax receivable

agreement liability

2,530

2,888

Gain from change in fair value of warrant

liability

4,893

2,617

Gain from change in fair value of

contingent consideration

8,700

5,100

Total other expense

(9,300

)

(14,038

)

Loss before income tax

provision

(384,075

)

(745,444

)

Income tax benefit

2,431

5,413

Net loss

(381,644

)

(740,031

)

Less: Net loss attributable to

noncontrolling interest

(34,734

)

(72,475

)

Net loss attributable to E2open Parent

Holdings, Inc.

$

(346,910

)

$

(667,556

)

Weighted-average common shares

outstanding:

Basic

308,904

303,848

Diluted

308,904

303,848

Net loss attributable to E2open Parent

Holdings, Inc. common shareholders per share:

Basic

$

(1.12

)

$

(2.20

)

Diluted

$

(1.12

)

$

(2.20

)

E2OPEN PARENT HOLDINGS,

INC.

CONDENSED CONSOLIDATED BALANCE

SHEETS

(Unaudited)

(In thousands)

November 30, 2024

February 29, 2024

Assets

Cash and cash equivalents

$

151,213

$

134,478

Restricted cash

17,221

14,560

Accounts receivable, net

133,960

161,556

Prepaid expenses and other current

assets

31,159

28,843

Total current assets

333,553

339,437

Goodwill

1,467,584

1,843,477

Intangible assets, net

711,569

841,031

Property and equipment, net

63,045

67,177

Operating lease right-of-use assets

16,627

21,299

Other noncurrent assets

29,766

29,234

Total assets

$

2,622,144

$

3,141,655

Liabilities, Redeemable Share-Based

Awards and Stockholders' Equity

Accounts payable and accrued

liabilities

$

77,129

$

90,594

Channel client deposits payable

17,221

14,560

Deferred revenue

187,526

213,138

Current portion of notes payable

11,288

11,272

Current portion of operating lease

obligations

6,597

7,378

Current portion of financing lease

obligations

2,207

1,448

Income taxes payable

7,360

584

Total current liabilities

309,328

338,974

Long-term deferred revenue

2,581

2,077

Operating lease obligations

12,335

17,372

Financing lease obligations

3,643

3,626

Notes payable

1,032,770

1,037,623

Tax receivable agreement liability

60,627

67,927

Warrant liability

1,660

14,713

Contingent consideration

9,568

18,028

Deferred taxes

41,999

55,586

Other noncurrent liabilities

1,035

602

Total liabilities

1,475,546

1,556,528

Commitments and Contingencies

Redeemable share-based awards

2,481

—

Stockholders' Equity

Class A common stock

31

31

Class V common stock

—

—

Series B-1 common stock

—

—

Series B-2 common stock

—

—

Additional paid-in capital

3,433,910

3,407,694

Accumulated other comprehensive loss

(54,523

)

(46,835

)

Accumulated deficit

(2,289,338

)

(1,873,703

)

Treasury stock, at cost

(2,473

)

(2,473

)

Total E2open Parent Holdings, Inc.

equity

1,087,607

1,484,714

Noncontrolling interest

56,510

100,413

Total stockholders' equity

1,144,117

1,585,127

Total liabilities, redeemable share-based

awards and stockholders' equity

$

2,622,144

$

3,141,655

E2OPEN PARENT HOLDINGS,

INC.

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

(Unaudited)

Nine Months Ended November

30,

(In thousands)

2024

2023

Cash flows from operating

activities

Net loss

$

(457,285

)

$

(1,139,544

)

Adjustments to reconcile net loss to net

cash from operating activities:

Depreciation and amortization

144,896

160,758

Amortization of deferred commissions

6,921

4,452

Provision for credit losses

2,087

2,657

Amortization of debt issuance costs

3,961

3,961

Amortization of operating lease

right-of-use assets

4,932

5,454

Share-based compensation

35,124

18,728

Deferred income taxes

(13,060

)

(79,791

)

Right-of-use assets impairment charge

576

619

Goodwill impairment charge

369,100

1,097,741

Indefinite-lived intangible asset

impairment charge

10,000

34,000

Gain from change in tax receivable

agreement liability

(1,464

)

(8,355

)

Gain from change in fair value of warrant

liability

(13,053

)

(18,786

)

Gain from change in fair value of

contingent consideration

(8,460

)

(15,360

)

Gain on operating lease termination

(126

)

(187

)

Loss (gain) on disposal of property and

equipment

135

(16

)

Changes in operating assets and

liabilities:

Accounts receivable

25,509

44,822

Prepaid expenses and other current

assets

(4,482

)

(3,972

)

Other noncurrent assets

(7,453

)

(7,351

)

Accounts payable and accrued

liabilities

(23,676

)

(16,712

)

Channel client deposits payable

2,661

8,349

Deferred revenue

(25,108

)

(27,244

)

Changes in other liabilities

(5,588

)

(7,568

)

Net cash provided by operating

activities

46,147

56,655

Cash flows from investing

activities

Capital expenditures

(18,465

)

(22,301

)

Net cash used in investing activities

(18,465

)

(22,301

)

Cash flows from financing

activities

Repayments of indebtedness

(8,427

)

(8,366

)

Repayments of financing lease

obligations

(1,370

)

(2,432

)

Proceeds from exercise of stock

options

155

—

Net cash used in financing activities

(9,642

)

(10,798

)

Effect of exchange rate changes on cash

and cash equivalents

1,356

2,040

Net increase in cash, cash equivalents and

restricted cash

19,396

25,596

Cash, cash equivalents and restricted

cash at beginning of period

149,038

104,342

Cash, cash equivalents and restricted

cash at end of period

$

168,434

$

129,938

E2OPEN PARENT HOLDINGS,

INC.

RECONCILIATION OF PRO FORMA

INFORMATION

TABLE I

Fiscal Third Quarter 2025

(in millions)

Q3

Q3

$ Var

% Var

FY2025

FY2024

PRO FORMA REVENUE

RECONCILIATION

Total GAAP Revenue

151.7

157.5

(5.8

)

(3.7

%)

Constant currency FX impact (1)

(0.6

)

-

(0.6

)

n/m

Total non-GAAP revenue (constant

currency basis) (2)

$

151.0

$

157.5

($

6.5

)

(4.1

%)

GAAP Subscription Revenue

132.0

132.8

(0.8

)

(0.6

%)

Constant currency FX impact (1)

(0.6

)

-

(0.6

)

n/m

Non-GAAP subscription revenue (constant

currency basis) (2)

$

131.4

$

132.8

($

1.4

)

(1.0

%)

GAAP Professional Services and other

revenue

19.7

24.7

(5.0

)

(20.4

%)

Constant currency FX impact (1)

(0.1

)

-

(0.1

)

n/m

Non-GAAP professional services and

other revenue (constant currency basis) (2)

$

19.6

$

24.7

($

5.1

)

(20.6

%)

PRO FORMA GROSS PROFIT

RECONCILIATION

GAAP Gross profit

75.7

78.6

(2.8

)

(3.6

%)

Depreciation and amortization

27.0

28.7

(1.7

)

(5.8

%)

Share-based compensation (3)

1.5

1.3

0.2

14.5

%

Non-recurring/non-operating costs (4)

0.0

1.1

(1.1

)

(96.4

%)

Non-GAAP gross profit

$

104.3

$

109.7

($

5.4

)

(4.9

%)

Non-GAAP Gross Margin %

68.8

%

69.6

%

Constant currency FX impact (1)

(0.2

)

-

(0.2

)

n/m

Total non-GAAP gross profit (constant

currency basis) (2)

$

104.1

$

109.7

($

5.6

)

(5.1

%)

Non-GAAP Gross Margin % (constant currency

basis) (2)

68.9

%

69.6

%

PRO FORMA ADJUSTED EBITDA

RECONCILIATION

Net income (loss)

(381.6

)

(740.0

)

358.4

n/m

Interest expense, net

23.4

24.9

(1.5

)

(6.2

%)

Income tax benefit

(2.4

)

(5.4

)

3.0

(55.1

%)

Depreciation and amortization

37.8

53.6

(15.8

)

(29.4

%)

EBITDA

($

322.8

)

($

666.9

)

$

344.1

n/m

Share-based compensation (3)

10.4

6.8

3.6

52.2

%

Non-recurring/non-operating costs (4)

2.8

8.3

(5.4

)

(65.7

%)

Acquisition-related adjustments (5)

0.2

0.0

0.2

n/m

Change in tax receivable agreement

liability (6)

(2.5

)

(2.9

)

0.4

(12.5

%)

Change in fair value of warrant liability

(7)

(4.9

)

(2.6

)

(2.3

)

86.6

%

Change in fair value of contingent

consideration (8)

(8.7

)

(5.1

)

(3.6

)

70.6

%

Goodwill impairment (9)

369.1

687.7

(318.6

)

(46.3

%)

Right-of-use assets & Intangible

impairment charge (10)

10.0

30.1

(20.1

)

(66.8

%)

Adjusted EBITDA

$

53.6

$

55.4

($

1.8

)

(3.2

%)

Adjusted EBITDA Margin %

35.3

%

35.1

%

Constant currency FX impact (1)

0.2

-

0.2

n/m

Total adjusted EBITDA (constant

currency basis) (2)

$

53.8

$

55.4

($

1.6

)

(2.9

%)

Adjusted EBITDA Margin % (constant

currency basis) (2)

35.6

%

35.1

%

(1) Constant Currency refers to pro-forma

amounts excluding the impact of translating foreign currencies into

U.S. dollars. To calculate foreign currency translation on a

constant currency basis, operating results for the current year

period for entities reporting in currencies other than the U.S.

dollar are translated into U.S. dollars at the exchange rates in

effect during the comparable period of the prior year (rather than

the actual exchange rates in effect during the current year

period).

(2) Constant Currency refers to pro forma

amounts excluding translation and transactional impacts from

foreign currency exchange rates.

(3) Reflects non-cash, long-term

share-based compensation expense.

(4) Primarily includes non-recurring

expenses such as the non-acquisition severance related to cost

reduction initiatives, reorganizations and executive transition

costs; foreign currency transaction gains and losses; systems

integrations; legal entity rationalization and non-recurring

consulting and advisory fees.

(5) Primarily includes advisory,

consulting, accounting and legal expenses incurred in connection

with the strategic review.

(6) Represents the fair value adjustment

at each balance sheet date for the Tax Receivable Agreement along

with the associated interest.

(7) Represents the fair value adjustment

at each balance sheet date of the warrant liability related to our

warrants.

(8) Represents the fair value adjustment

at each balance sheet date of the contingent consideration

liability related to the restricted B-2 common stock and Series 2

RCUs.

(9) Represents the goodwill impairment

taken in the third quarters of fiscal 2024 and 2025.

(10) The company recognized an intangible

impairment charge of $10.0M in Q3 FY25 and $30.0M in Q3 FY24, and a

right-of-use asset impairment charge of $0.1M in G&A in Q3

FY24

E2OPEN PARENT HOLDINGS,

INC.

RECONCILIATION OF NON-GAAP

EXPENSES

TABLE II

Fiscal Third Quarter 2025

(in millions)

GAAP

Non-recurring(1)

Depreciation &

Amortization

Share-Based

Compensation

Non-GAAP (Adjusted)

% of Revenue

Impairment Charges(2)

COST OF GOODS

Subscriptions

35.6

-

-

(3.1)

(0.9)

31.6

23.9%

Professional services and other

16.6

-

-

(0.2)

(0.6)

15.8

80.1%

Amortization of intangibles

23.7

-

-

(23.7)

-

-

Total cost of revenue

$75.9

($0.1)

-

(27.0)

(1.5)

$47.3

31.2%

Gross Profit

$75.7

$0.1

-

$27.0

$1.5

$104.3

68.8%

OPERATING COSTS

Research & development

23.3

(0.2)

-

(4.8)

(1.1)

17.1

11.3%

Sales & marketing

21.5

-

-

(0.2)

(1.7)

19.6

12.9%

General & administrative

20.8

(0.5)

-

(0.2)

(6.1)

14.1

9.3%

Acquisition related expenses

0.2

(0.2)

-

-

-

-

Amortization of intangibles

5.6

-

-

(5.6)

-

-

Intangible impairment charge

10.0

-

(10.0)

-

-

-

Goodwill impairment

369.1

-

(369.1)

-

-

-

Total operating expenses

$450.5

($1.0)

($379.1)

($10.8)

($8.9)

$50.8

33.5%

(1) Primarily includes other non-recurring

expenses such as non-acquisition related severance, systems

integrations, legal entity rationalization, and non-recurring

consulting and advisory fees.

(2) Represents the goodwill impairment and

intangible impairment taken in the third quarter of fiscal

2025.

E2OPEN PARENT HOLDINGS,

INC.

RECONCILIATION OF ADJUSTED

EARNINGS PER SHARE

TABLE III

Fiscal Third Quarter 2025

(in millions, except per share

amounts)

Q3 25

GAAP Net income (loss)

(381.6)

Interest expense, net

23.4

Income taxes benefit

(2.4)

Depreciation & amortization

37.8

EBITDA

($322.8)

Share-based compensation

10.4

Non-recurring/non-operating costs

2.8

Acquisition-related adjustments

0.2

Change in tax receivable agreement

liability

(2.5)

Change in fair value of warrant

liability

(4.9)

Change in fair value of contingent

consideration

(8.7)

Goodwill impairment

369.1

Intangible asset impairment charge

10.0

Adjusted EBITDA

$53.6

Depreciation

(8.5)

Interest and other expense, net

(23.4)

Normalized income taxes (1)

(5.2)

Adjusted Net Income

$16.5

Adjusted basic shares outstanding

345.9

Adjusted earnings per share

0.05

(1) Income taxes calculated using 24%

effective rate.

E2OPEN PARENT HOLDINGS,

INC.

ADJUSTED FREE CASH

FLOW

TABLE IV

Fiscal Third Quarter 2025

(in millions)

Q1 25

Q2 25

Q3 25

Q3 YTD

GAAP operating cash flow

35.9

(7.5)

17.7

46.1

Add: Non-recurring cash payments (1)

4.3

2.9

4.0

11.2

Add: Change in channel client deposits

payable (2)

(1.2)

(0.9)

(0.6)

(2.7)

Adjusted operating cash flow

$39.1

($5.5)

$21.1

$54.7

Capital expenditures

(6.1)

(6.2)

(6.2)

(18.5)

Adjusted free cash flow

$33.0

($11.6)

$14.9

$36.2

(1) Primarily includes other non-recurring

expenses such as non-acquisition related severance, systems

integrations, legal entity rationalization, and non-recurring

consulting and advisory fees.

(2) Channel Client Deposits Payable

represents client deposits for the incentive payment program

associated with the Company's channel shaping application. The

Company offers services to administer incentive payments to

partners on behalf of the Company’s clients. The Company’s clients

deposit these funds into a restricted cash account with an offset

included as a liability in incentive program payable in the

Consolidated Balance Sheets.

E2OPEN PARENT HOLDINGS,

INC.

CONSOLIDATED CAPITAL

TABLE V

Fiscal Third Quarter 2025

Description

Shares (000's)

Notes

Shares outstanding as of November 30,

2024

309,173

Shares outstanding

Common Units

30,692

Units issued in the Business Combination

that have not been converted from common units to Class A common

stock (Common units are represented by Class V shares).

Series B-2 Shares (unvested)

3,372

Represents the right to acquire shares of

Class A common stock when the 20-day VWAP reaches $15.00 per

share.

Restricted Common Units Series 2

(unvested)

2,628

Represents the right in E2open Holdings,

LLC that converts into common units when the 20-day VWAP reaches

$15.00. Upon conversion to common units, the holders can elect to

convert the common units to Class A common stock.

Adjusted Basic Shares

345,865

Warrants

29,080

Outstanding warrants with an exercise

price of $11.50.

Options (vested/unreleased and

unvested)

6,151

Options issued to management under the

long-term incentive plan.

Restricted Shares (vested/unreleased and

unvested)

15,937

Restricted shares issued to employees,

management and directors under the long-term incentive plan.

Fully Converted Shares

397,033

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250110285205/en/

Investor Contact Russell

Johnson SVP Treasurer & Investor Relations, e2open

russell.johnson@e2open.com investor.relations@e2open.com

Media Contact 5W PR for

e2open e2open@5wpr.com 408-504-7707

Corporate Contact Kristin

Seigworth VP Communications, e2open kristin.seigworth@e2open.com

pr@e2open.com

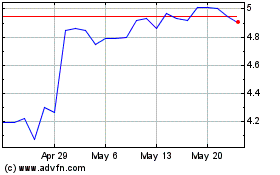

E2open Parent (NYSE:ETWO)

Historical Stock Chart

From Dec 2024 to Jan 2025

E2open Parent (NYSE:ETWO)

Historical Stock Chart

From Jan 2024 to Jan 2025