Farmland Partners Announces Tax Treatment of 2024 Distributions

01 February 2025 - 8:30AM

Business Wire

Farmland Partners Inc. (NYSE: FPI) (the “Company” or “FPI”)

today announced the tax treatment of our 2024 common stock

distributions, as summarized in the following table.

Farmland Partners Inc. CUSIP: 31154R109 EIN: 46-3769850

Farmland Partners Inc. 2024 Dividend Treatment Common

Stock Dividends Capital Gains DeclarationDate Payment Date

Record Date DistributionPer Share DistributionPer Share Allocable

to2024 TaxableOrdinary(Box 1a) Qualified (Box 1b)(1) Total(Box 2a)

Unrecaptured Section 1250 (Box 2b) Return of Capital(Box 3)(2)

Section 199A(Box 5)(1)

12/12/2023

1/12/2024

12/29/2023

$

0.210000

$

0.005147

$

0.000652

$

-

$

0.004495

$

-

$

-

$

0.000652

10/24/2023

1/17/2024

1/2/2024

$

0.060000

$

0.060000

$

0.007599

$

-

$

0.052401

$

0.007599

2/27/2024

4/15/2024

4/1/2024

$

0.060000

$

0.060000

$

0.007599

$

-

$

0.052401

$

-

$

-

$

0.007599

4/29/2024

7/15/2024

7/1/2024

$

0.060000

$

0.060000

$

0.007599

$

-

$

0.052401

$

-

$

-

$

0.007599

7/23/2024

10/15/2024

10/1/2024

$

0.060000

$

0.060000

$

0.007599

$

-

$

0.052401

$

-

$

-

$

0.007599

12/13/2024

1/8/2025

12/18/2024

$

1.150000

$

1.150000

$

0.145638

$

-

$

1.004362

$

-

$

-

$

0.145638

$

1.600000

$

1.395147

$

0.176684

$

-

$

1.218463

$

-

$

-

$

0.176684

Footnotes: (1) Qualified dividends and Section 199A

dividends are a subset of, and included in, the taxable ordinary

dividend amount. (2) Return of capital represents a return of

stockholder investment.

The special dividend of $0.21 per share declared December 12,

2023, and paid on or around January 12, 2024, is a split-year

distribution with $0.0051474 per share considered a distribution

made in 2024 for federal income tax purposes1.

The special dividend of $1.15 per share declared December 13,

2024 for shareholders of record as of December 18, 2024, and paid

on or around January 8, 2025, is considered to be a distribution

made in 2024 for federal income tax purposes2.

Pursuant to Treas. Reg. § 1.1061-4(b)(7)(i), the capital gains

shown in box 2(a) are determined under Section 1231 and are

excluded from “applicable partnership interest” disclosures.

In 2024, there was no “Box 3 Nondividend Distribution” on form

1099-DIV, and therefore no requirement to file Form 8937.

The Nareit REIT 1099-DIV Spreadsheet is available for download

under the heading “2024 Dividend Information” at this link:

https://ir.farmlandpartners.com/resources/IRS-Forms/default.aspx.

Stockholders are encouraged to consult with their tax advisors

as to the specific tax treatment of the distributions they received

from us.

About Farmland Partners Inc.

Farmland Partners Inc. is an internally managed real estate

company that owns and seeks to acquire high-quality North American

farmland and makes loans to farmers secured by farm real estate. As

of December 31, 2024, the Company owns and/or manages approximately

141,800 acres in 16 states, including Arkansas, California,

Colorado, Illinois, Indiana, Iowa, Kansas, Louisiana, Mississippi,

Missouri, Nebraska, North Carolina, Oklahoma, South Carolina,

Texas, and West Virginia. In addition, the Company owns land and

buildings for four agriculture equipment dealerships in Ohio leased

to Ag Pro under the John Deere brand. The Company elected to be

taxed as a REIT for U.S. federal income tax purposes, commencing

with the taxable year ended December 31, 2014. Additional

information: www.farmlandpartners.com or (720) 452-3100.

1 The REIT declared a dividend in December of 2023, and it was

payable to shareholders of record as of December of 2023. In

accordance with IRC §857(b)(9) the dividend deemed paid in 2023 was

limited to the earnings & profits at that time. The remaining

balance that was not includable in 2023 should be reported as a

2024 dividend. 2 The REIT declared a dividend in December 2024,

payable to shareholders of record as of December 18, 2024. In

accordance with IRC §857(b)(9) the dividend is deemed paid entirely

in 2024 as it consists of undistributed 2024 earnings &

profits.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250131766033/en/

Susan Landi ir@farmlandpartners.com

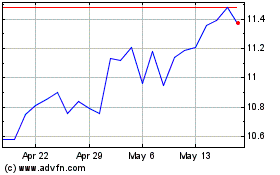

Farmland Partners (NYSE:FPI)

Historical Stock Chart

From Jan 2025 to Feb 2025

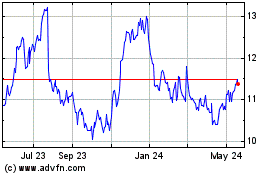

Farmland Partners (NYSE:FPI)

Historical Stock Chart

From Feb 2024 to Feb 2025