Fortive Recommends Rejection by Shareholders of the Mini-Tender Offer by TRC Capital Investment Corporation

17 December 2024 - 8:15AM

Business Wire

Fortive Corporation (“Fortive”) (NYSE: FTV) has been notified of

an unsolicited “mini-tender offer” by TRC Capital Investment

Corporation (“TRC”) for TRC to purchase for cash up to 1,500,000

shares, or approximately 0.44%, of the outstanding common stock of

Fortive, at a price of $75.00 per share. TRC’s offer price of

$75.00 per share represents a 4.93% discount to the closing price

per share of Fortive’s common stock on December 6, 2024, the last

trading day before the commencement of TRC’s unsolicited

mini-tender offer.

Fortive recommends that shareholders reject TRC’s unsolicited

offer because, among other reasons, the offer price is below the

current market price for shares of Fortive common stock. The offer

also is subject to numerous conditions. Fortive also recommends

that any shareholders who have tendered shares to TRC withdraw

those shares by providing the written notice described in the

offering documentation before the expiration of the offer, which is

currently scheduled for one minute after 11:59 p.m., New York City

Time, on January 9, 2025.

Fortive is not associated with TRC, its mini-tender offer or the

mini-tender offer documentation.

TRC made a similar unsolicited mini-tender offer for shares of

Fortive in 2021. In addition, TRC has made similar unsolicited

mini-tender offers for shares of other public companies.

Mini-tender offers are designed to seek less than 5 percent of a

company's outstanding shares, thereby avoiding many investor

protections, including the disclosure and procedural requirements,

applicable to larger tender offers under United States securities

laws. The U.S. Securities and Exchange Commission (the “SEC”) has

cautioned investors about mini-tender offers, noting that "some

bidders make mini-tender offers at below-market prices, hoping that

they will catch investors off guard if the investors do not compare

the offer price to the current market price." The SEC has also

published investor tips regarding these offers on its website at:

http://www.sec.gov/investor/pubs/minitend.htm.

Fortive encourages brokers and dealers, as well as other market

participants, to review the SEC's letter regarding broker-dealer

mini-tender offer dissemination and disclosures on the SEC's

website at:

http://www.sec.gov/divisions/marketreg/minitenders/sia072401.htm.

Fortive urges investors to obtain current market quotations

for shares of Fortive’s common stock, consult with their brokers or

financial advisors and exercise caution with respect to TRC's

offer.

ABOUT FORTIVE

Fortive is a provider of essential technologies for connected

workflow solutions across a range of attractive end-markets.

Fortive’s strategic segments - Intelligent Operating Solutions,

Precision Technologies, and Advanced Healthcare Solutions - include

well-known brands with leading positions in their markets. The

company’s businesses design, develop, service, manufacture, and

market professional and engineered products, software, and

services, building upon leading brand names, innovative

technologies, and significant market positions. Fortive is

headquartered in Everett, Washington and employs a team of more

than 18,000 research and development, manufacturing, sales,

distribution, service and administrative employees in more than 50

countries around the world. With a culture rooted in continuous

improvement, the core of our company’s operating model is the

Fortive Business System. For more information please visit:

www.fortive.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241216892796/en/

Elena Rosman Vice President, Investor Relations Fortive

Corporation 6920 Seaway Boulevard Everett, WA 98203 Telephone:

(425) 446-5000

Fortive (NYSE:FTV)

Historical Stock Chart

From Nov 2024 to Dec 2024

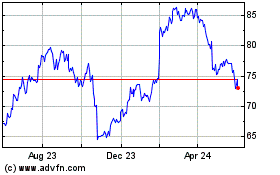

Fortive (NYSE:FTV)

Historical Stock Chart

From Dec 2023 to Dec 2024