American Express Global Business Travel Announces Refinancing of its Existing Credit Facility

27 July 2024 - 6:30AM

Business Wire

American Express Global Business Travel, which is operated by

Global Business Travel Group, Inc. (NYSE: GBTG) (“Amex GBT” or the

“Company”), a leading software and services company for travel,

expense, and meetings and events, today announced that it entered

into an amended and restated credit agreement, which provides for a

principal amount of $1,400 million senior secured first lien term

loan facility, maturing on July 26, 2031, and a $360 million senior

secured first lien revolving credit facility, maturing on July 26,

2029.

Transaction Highlights:

- Significant interest rate margin reduction of approximately 180

bps, with the new term loan facility priced at secured overnight

financing rate (SOFR) +3.00% (99.75 original issue discount).

- Delivering estimated interest savings of approximately $25

million in 2024 versus 2023, including the refinancing and

previously achieved interest savings from lowered leverage

ratio.

- Strengthens balance sheet by extending near-term term loan

maturities to 2031, providing seven years of runway as cash flow

generation accelerates.

- Upsized revolving credit facility capacity from $50 million to

$360 million (currently undrawn), providing the Company with

increased liquidity and flexibility.

- Total debt level unchanged, and focus remains on continued

deleveraging, with target leverage ratio of 1.5x – 2.5x Net Debt /

Adjusted EBITDA.

The term loans were drawn in full on July 26, 2024, and the

proceeds were used to repay in full the principal amount of all

term loans and other outstanding obligations (including related

fees and expenses) under the Company’s previously existing

principal credit facility. The $360 million of available borrowings

under the new revolving credit facility may be drawn in the future

for working capital needs and other general corporate purposes,

subject to customary conditions similar to those in the Company’s

previously existing principal credit facility.

The term loans bear interest based on SOFR, plus a margin of

3.00% per annum. Borrowings under the revolving credit facility are

subject to interest based on SOFR, plus a margin of 2.75% per

annum.

About American Express Global Business Travel

American Express Global Business Travel is the world’s leading

B2B travel platform, providing software and services to manage

travel, expenses, and meetings & events for companies of all

sizes. We have built the most valuable marketplace in B2B travel to

deliver unrivalled choice, value and experiences. With travel

professionals in more than 140 countries, our customers and

travelers enjoy the powerful backing of American Express Global

Business Travel.

Visit amexglobalbusinesstravel.com for more information about

Amex GBT. Follow @amexgbt on Twitter, LinkedIn and Instagram.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240726242175/en/

Investors: Jennifer Thorington Vice President Investor

Relations investor@amexgbt.com

Media: Martin Ferguson Vice President Global

Communications and Public Affairs martin.ferguson@amexgbt.com

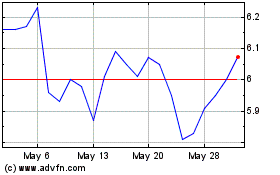

Global Business Travel (NYSE:GBTG)

Historical Stock Chart

From Nov 2024 to Dec 2024

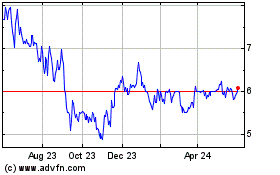

Global Business Travel (NYSE:GBTG)

Historical Stock Chart

From Dec 2023 to Dec 2024