Gannett Co., Inc. (“Gannett”, “we”, “us”, “our”, or the

“Company”) (NYSE: GCI) announced today that the Company and its

wholly-owned subsidiary, Gannett Holdings LLC (“Gannett Holdings”)

have commenced an offer to eligible holders to exchange (the

“Exchange Offer”) any and all outstanding 6.000% Senior Secured

Notes due 2026 of Gannett Holdings, as set forth in the table below

(the “Notes”), for, at the election of each holder of Notes, either

(a) (i) first lien term loans (the “Term Loans”) of Gannett

Holdings and (ii) an upfront fee equal to 1.5% of such Term Loans

(together with the Term Loans, the “Loan Option Consideration”); or

(b) cash (the “Cash Option Consideration”).

The following table sets forth the Exchange Consideration, Early

Participation Premium and Total Consideration for Early

Participation with respect to the exchange of the Notes:

Notes to be Exchanged

CUSIP/ISIN

Aggregate Principal Amount of

Notes Outstanding

Exchange

Consideration(1)(2)

Early Participation

Premium(2)

Total Consideration For Early

Participation(1)(2)(3)

36474G AA3 / US36474GAA31U

3647GAA2 /USU3647GAA23

6.000% Senior Secured Notes due

2026

$278,541,000

Loan

Option: $950 in Term Loans and 1.5% upfront fee

Loan

Option: $50 in Term Loans and 1.5% upfront fee

Loan

Option: $1,000 in Term Loans and 1.5% upfront fee

or

or

or

Cash

Option: $950 cash

Cash

Option: $50 cash

Cash

Option: $1,000 cash

_________________________________________

(1)

The Total Consideration for Early

Participation or Exchange Consideration, as applicable, will be

paid for each $1,000 principal amount of Notes accepted for

exchange. In addition, accrued and unpaid interest will be paid in

cash on Notes exchanged in the Exchange Offer up to, but not

including, the applicable settlement date.

(2)

Each Term Loan dollar figure represents

the principal amount of such Term Loan being exchanged for each

$1,000 principal amount of the Notes. Tenders of Notes will be

accepted only in a minimum principal amount equal to $2,000 and

integral multiples of $1,000 in excess thereof.

(3)

The Total Consideration for Early

Participation is equal to the Exchange Consideration plus the Early

Participation Premium.

The Term Loans will be guaranteed on a senior secured basis by

the Company, the direct parent of Gannett Holdings, and certain of

the Company’s present and future subsidiaries.

Concurrently with the Exchange Offer, Gannett and Gannett

Holdings are soliciting consents (the “Consent Solicitation”) to

(i) eliminate substantially all of the restrictive covenants

contained in the Indenture governing the Notes, dated as of October

15, 2021 (the “Indenture”), (ii) eliminate certain of the default

provisions contained in the Indenture and (iii) amend certain

related provisions to conform for such eliminations (collectively,

the “Proposed Amendments”). Holders of Notes may not tender Notes

without delivering the related Consents, and holders of Notes that

tender Notes prior to the Expiration Time (as defined below) will

be deemed automatically to have delivered a consent to the Proposed

Amendments. The Exchange Offer is not conditioned on receipt of the

requisite consents to the Proposed Amendments in the Consent

Solicitation.

The Exchange Offer and Consent Solicitation are being made

pursuant to the terms and subject to the conditions set forth in a

confidential offer to exchange and consent solicitation statement

dated September 26, 2024 (the “Offer to Exchange and Consent

Solicitation Statement”).

We may extend or terminate the Exchange Offer and/or the Consent

Solicitation, in our sole and absolute discretion, and may

otherwise amend or modify the Exchange Offer and/or the Consent

Solicitation in any respect, at any time and for any reason,

including based on the acceptance rate and outcome of the Exchange

Offer or if any of the conditions to the Exchange Offer are not

satisfied.

Holders who validly tender (and do not validly withdraw) their

Notes at or prior to 5:00 p.m., New York City time, on October 10,

2024, unless extended (the “Early Tender Time”), will be eligible

to receive, on the early settlement date, the applicable Total

Consideration for Early Participation as set forth in the table

above, which includes the applicable Early Participation Premium as

set forth in the table above, for all such Notes that are accepted.

The early settlement date will be promptly after the Early Tender

Time and is expected to be the third business day after the Early

Tender Time. Holders who validly tender (and do not validly

withdraw) their Notes after the Early Tender Date but prior to 5:00

p.m., New York City time, on October 25, 2024, unless extended (the

“Expiration Time”), will not be eligible to receive the applicable

Early Participation Premium and, accordingly, will be eligible to

receive, on the final settlement date, only the applicable Exchange

Consideration as set forth in the table above, for all such Notes

that are accepted. The final settlement date will be promptly after

the Expiration Time and is expected to be the third business day

after the Expiration Time. Holders electing the Loan Option

Consideration must also timely complete and deliver certain lender

documentation to the Exchange Agent (as defined below) at or prior

to 12:00 p.m., New York City time one business day after the Early

Tender Time or Expiration Time, as applicable, in order to receive

the Loan Option Consideration.

Notes tendered for exchange in the Exchange Offer may be

withdrawn and the related consents may be revoked at any time at or

prior to the Early Tender Time, but not thereafter.

The Offer to Exchange and Consent Solicitation Statement will be

distributed only to holders of the Notes. The complete terms and

conditions of the Exchange Offer and the Consent Solicitation are

described in the Offer to Exchange and Consent Solicitation

Statement, a copy of which may be obtained by contacting Epiq

Corporate Restructuring, LLC (the “Exchange Agent”), the exchange

agent and information agent in connection with the Exchange Offer

and the Consent Solicitation, at (646) 362-6336 or

Registration@epiqglobal.com, with reference to “Gannett” in the

subject line.

This press release does not constitute an offer to sell or

purchase, or a solicitation of an offer to sell or purchase, or the

solicitation of tenders or consents with respect to, any security.

No offer, solicitation, purchase or sale will be made in any

jurisdiction in which such an offer, solicitation, or sale would be

unlawful. The Exchange Offer and Consent Solicitation are being

made solely pursuant to the Offer to Exchange and Consent

Solicitation Statement and only to such persons and in such

jurisdictions as is permitted under applicable law.

Other Refinancing

Transactions

The Exchange Offer and Consent Solicitation are part of the debt

refinancing transactions that Gannett is undertaking pursuant to

its previously announced commitment letter (the “Commitment

Letter”). The Commitment Letter provides for a new senior secured

credit facility (the “Term Loan Facility”) with funds managed by

affiliates of Apollo (NYSE:APO) (“Apollo Funds”) of up to $900

million. Holders of the Notes electing the Loan Option

Consideration will receive Term Loans under the Term Loan Facility.

The net proceeds of the Term Loan Facility will be used to repay in

full our five-year senior secured term loan facility maturing on

October 15, 2026, pay the Cash Option Consideration on the

settlement dates of the Exchange Offer and repurchase for cash up

to 50% of Gannett’s outstanding 6.000% Senior Secured Convertible

Notes due 2027 (the “2027 Notes”). Net proceeds of the Term Loan

Facility may also be used to later redeem any Notes not tendered in

the Exchange Offer. Concurrently with the Exchange Offer, we intend

to repurchase for cash up to 50% of the aggregate principal amount

of the outstanding 2027 Notes at a rate of $1,110 per $1,000

principal amount of 2027 Notes and to exchange up to 50% of the

aggregate principal amount of the outstanding 2027 Notes for new

6.000% Senior Secured Convertible Notes due 2031.

About Gannett

Gannett Co., Inc. (NYSE: GCI) is a diversified media company

with expansive reach at the national and local level dedicated to

empowering and enriching communities. We seek to inspire, inform,

and connect audiences as a sustainable, growth focused media and

digital marketing solutions company. We endeavor to deliver

essential content, marketing solutions, and experiences for curated

audiences, advertisers, consumers, and stakeholders by leveraging

our diverse teams and suite of products to enrich the local

communities and businesses we serve. Our current portfolio of

trusted media brands includes the USA TODAY NETWORK, comprised of

the national publication, USA TODAY, and local media organizations

in the United States, and Newsquest, a wholly-owned subsidiary

operating in the United Kingdom. Our digital marketing solutions

brand, LocaliQ, uses innovation and software to enable small and

medium-sized businesses to grow, and USA TODAY NETWORK Ventures,

our events division, creates impactful consumer engagements,

promotions, and races.

Our website address is www.gannett.com. We use our website as a

channel of distribution for important company information,

including press releases and other news and presentations, which is

accessible on the Investor Relations and News and Events subpages

of our website.

Cautionary Statement Regarding

Forward-Looking Statements

Certain items in this press release may constitute

forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995, including, among others,

statements regarding our ability to refinance our debt facilities,

maturity of debt, note repurchases, exchanges and redemptions, uses

of proceeds, expectations (including timing) with respect to the

Exchange Offer and Consents Solicitation, availability of future

financing and interest expense. Words such as “expect(s)”,

“intend”, “will”, “believe(s)”, “anticipate(s)” and similar

expressions are intended to identify such forward-looking

statements. These statements are based on management’s current

expectations and beliefs and are subject to a number of risks and

uncertainties. These and other risks and uncertainties could cause

actual results to differ materially from those described in the

forward-looking statements, many of which are beyond our control.

The Company can give no assurance its expectations regarding the

Exchange Offer and Consents Solicitation or any other proposed

financing or liability management transactions, or otherwise, will

be attained. Accordingly, you should not place undue reliance on

any forward-looking statements contained in this press release. For

a discussion of some of the risks and important factors that could

cause actual results to differ from such forward-looking

statements, see the section entitled “Risk Factors” in the Offer to

Exchange and Consent Solicitation Statement and the risks and other

factors detailed in the Company’s 2023 Annual Report on Form 10-K

and from time to time in other filings with the Securities and

Exchange Commission. Furthermore, new risks and uncertainties

emerge from time to time, and it is not possible for the Company to

predict or assess the impact of every factor that may cause its

actual results to differ from those contained in any

forward-looking statements. Such forward-looking statements speak

only as of the date of this press release. Except to the extent

required by law, the Company expressly disclaims any obligation to

release publicly any updates or revisions to any forward-looking

statements contained herein to reflect any change in the Company’s

expectations with regard thereto or change in events, conditions or

circumstances on which any statement is based.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240926916667/en/

For investor inquiries, contact: Matt Esposito Investor

Relations 703-854-3000 investors@gannett.com

For media inquiries, contact: Lark-Marie Anton Corporate

Communications 646-906-4087 lark@gannett.com

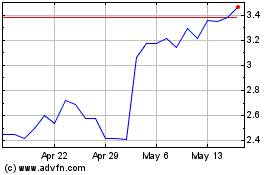

New Gannett (NYSE:GCI)

Historical Stock Chart

From Feb 2025 to Mar 2025

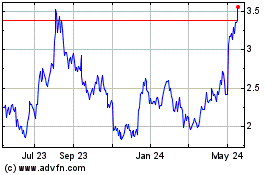

New Gannett (NYSE:GCI)

Historical Stock Chart

From Mar 2024 to Mar 2025