Gannett Co., Inc. ("Gannett", "we", "us", "our", or the

"Company") (NYSE: GCI) today reported its financial results for the

fourth quarter ended December 31, 2024.

"In 2024, we made continued strong progress executing on our

strategy to advance our digital transformation, resulting in total

digital revenues exceeding 45% of total revenues in the fourth

quarter, and amounting to over $1.1 billion for the year. Equally

important, we expanded our audience, improved engagement, and grew

digital revenues through diversified channels. Total 2024 digital

revenues increased by over 5% compared to 2023," said Michael Reed,

Gannett Chairman and Chief Executive Officer.

"The successful execution of our strategy has driven continued

improvement across our key financial metrics. In 2024, we delivered

full-year growth in both Adjusted EBITDA and free cash flow, while

driving improvement to our bottom line. We also remained focused on

enhancing our capital structure in 2024, which was evidenced by

repaying $73.5 million of debt in addition to repayments made in

connection with the completion of our comprehensive refinancing

that extended our debt maturities and significantly reduced

potential future dilution from our convertible notes."

"With our continued strong performance, we are pleased to have

delivered on the expectations we set for 2024 at the beginning of

the year for total revenue, Adjusted EBITDA, free cash flow, and

net income. This success reinforces our confidence in achieving our

2025 expectations that we shared this morning. Further, when

considering the impact of the refinancing we completed in Q4, our

expectations for 2025 and 2026 remain in line with the guidance

provided at the start of 2024. While transformations are never a

straight line, the reaffirmation of our key financial goals

demonstrates the continued progress we are making on our

transformation."

"As we look ahead to 2025, we expect to build on that progress

and drive improvement across our key financial metrics. We believe

we are well-positioned to realize total revenue growth during 2025,

growth in both total digital revenues and Adjusted EBITDA,

significant free cash flow generation, and meaningful debt

reduction. We are excited about our operational and financial plans

for 2025, as well as the opportunity to create meaningful value for

both our shareholders as well as the communities that we

serve."

Fourth Quarter 2024 Digital Highlights

(Year-Over-Year):

- Total digital revenues of $280.4 million increased 1.2%, or

3.4% on a same store basis(1)

- Digital-only subscription revenues of $49.0 million grew

17.0%

- 200 million(2) average monthly unique visitors, an increase of

7.0%

- Digital advertising revenues of $92.7 million grew 1.7%

Additional Fourth Quarter 2024

Highlights (Year-Over-Year):

- Total revenues of $621.3 million decreased 7.2%

- Total revenues were impacted by the decision to sell or shut

down certain non-strategic assets

- Same store revenues(1) decreased 5.5%, reflecting an

improvement of 250 basis points

- Net income attributable to Gannett of $64.3 million, a margin

of 10.4%

- Adjusted Net income attributable to Gannett(1) of $38.3 million

improved by $56.5 million

- Adjusted EBITDA(1) totaled $78.2 million, an increase of

5.5%

- Adjusted EBITDA(1) margin of 12.6% improved by 150 basis

points

- Cash provided by operating activities of $9.0 million

- Free cash flow(1) of $3.8 million

________________________

(1)

Adjusted EBITDA, Adjusted EBITDA margin,

Adjusted net income (loss) attributable to Gannett, Free cash flow,

and Same store revenues are non-GAAP measures. See "Use of Non-GAAP

Information" below for information about these non-GAAP

measures.

(2)

200 million average monthly unique

visitors in the fourth quarter of 2024 with approximately 149

million average monthly unique visitors coming from our U.S. media

network, which includes USA TODAY (based on December 2024 Comscore

Media Metrix®) and approximately 51 million average monthly unique

visitors resulting from our U.K. digital properties (based on Adobe

Analytics).

Capital Structure

Highlights:

- As of December 31, 2024, the Company had cash and cash

equivalents of $106.3 million

- Total principal debt outstanding at December 31, 2024 was

$1,111.8 million, including $850.0 million in first lien debt

- First lien net leverage(3) was 2.7x

- In February 2025, the Company entered into an asset purchase

agreement with Hearst Corporation to divest the Austin

American-Statesman, which is expected to close in the first quarter

of 2025

Business Outlook(4)

The Company presents its full year outlook for 2025. The

Company's estimates factor in the pending sale of the Austin

American-Statesman but do not factor in the impact of any future

acquisitions or dispositions.

- Full Year 2025 Business Outlook(4)

- Total digital revenues are expected to grow approximately

7%-10% on a same store basis(1)

- Total digital revenues are expected to make up 50% of total

revenues during 2025

- Total revenues are expected to be down in the low single digits

on a same store basis(1)

- Same store(1) revenue trends are expected to grow on an overall

basis during 2025

- Net income attributable to Gannett is expected to improve

compared to the prior year

- Adjusted EBITDA(1) is expected to grow versus the prior

year

- Cash provided by operating activities is expected to grow in

excess of 30% versus the prior year

- Free cash flow(1) is expected to grow in excess(5) of 40%

versus the prior year

Financial Highlights

In thousands

Fourth Quarter 2024

Full Year 2024

Revenues

$

621,275

$

2,509,315

Net income (loss) attributable to

Gannett

64,319

(26,354

)

Adjusted EBITDA(6) (non-GAAP basis)

78,158

273,189

Adjusted net income attributable to

Gannett(6) (non-GAAP basis)

38,320

24,970

Cash provided by operating activities

8,989

100,310

Free cash flow(6) (non-GAAP basis)

3,832

58,445

________________________

(3)

As of December 31, 2024, the First Lien

Net Leverage ratio was calculated by subtracting cash on the

balance sheet from the sum of our five-year first lien term loan

facility (the "2029 Term Loan Facility") and dividing that by Q4

2024 LTM Adjusted EBITDA. The 6% Senior Secured Convertible Notes

due 2027 and 6% Senior Secured Convertible Notes due 2031 are

secured by liens junior to those securing our 2029 Term Loan

Facility.

(4)

Projections are based on Company estimates

as of February 20, 2025 and are provided solely for illustrative

purposes. Actual results may vary. The Company undertakes no

obligation to update this information. Additionally, the Company's

estimates do not factor in the impact of any future acquisitions or

dispositions. The Company's future financial results could differ

materially from the Company’s current estimates.

(5)

Capital expenditures are expected to

increase as a result of investments in technology and products.

(6)

Refer to "Use of Non-GAAP Information"

below for the Company's definition of Adjusted EBITDA, Adjusted net

income (loss) attributable to Gannett, and Free cash flow, as well

as the reconciliation of such measures to the most comparable GAAP

measure.

Earnings Conference Call

Management will host a conference call on Thursday, February 20,

2025 at 8:30 A.M. Eastern Time to review the financial and

operating results for the period. A copy of the earnings release

will be posted to the Investor Relations section of Gannett’s

website, investors.gannett.com. The conference call may be accessed

by dialing 1-888-506-0062 (from within the U.S.) or 1-973-528-0011

(from outside of the U.S.) ten minutes prior to the scheduled start

of the call; please reference "Gannett Fourth Quarter Earnings

Call" or access code "669986". We use our website as a channel of

distribution for important Company information and we use the

investors.gannett.com website as a means of disclosing material

non-public information and for complying with our disclosure

obligations under Regulation FD. A simultaneous webcast of the

conference call will be available to the public on a listen-only

basis at investors.gannett.com. Please allow extra time prior to

the call to visit the website and download any necessary software

required to listen to the internet broadcast. A telephonic replay

of the conference call will also be available approximately two

hours following the call’s completion through 11:59 P.M. Eastern

Time on Thursday, March 6, 2025 by dialing 1-877-481-4010 (from

within the U.S.) or 1-919-882-2331 (from outside of the U.S.);

please reference access code "50823". A transcript of our earnings

call held today also will be posted to the investors.gannett.com

website.

About Gannett

Gannett Co., Inc. (NYSE: GCI) is a diversified media company

with expansive reach at the national and local level dedicated to

empowering and enriching communities. We seek to inspire, inform,

and connect audiences as a sustainable, growth focused media and

digital marketing solutions company. Through our trusted brands,

including the USA TODAY NETWORK, comprised of the national

publication, USA TODAY, and local media organizations, including

our network of local properties, in the United States, and

Newsquest, a wholly-owned subsidiary operating in the United

Kingdom, we provide essential journalism, local content, and

digital experiences to audiences and businesses. We deliver

high-quality, trusted content with a commitment to balanced,

unbiased journalism, where and when consumers want to engage. Our

digital marketing solutions brand, LocaliQ, supports small and

medium-sized businesses with innovative digital marketing products

and solutions.

Cautionary Statement Regarding

Forward-Looking Statements

Certain items in this press release may constitute

forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995, including, but not

limited to, our full year 2025 business outlook, statements

regarding our business outlook, digital revenue performance and

growth, growth in our Digital Marketing Solutions segment, growth

of and demand for our digital-only subscriptions and audience,

digital marketing and advertising services, digital revenues,

monetization of our audience, print advertising trends and

revenues, expected results of our targeting and pricing models,

expectations regarding our cash from operating activities, free

cash flows, revenues, net income (loss) attributable to Gannett,

Adjusted EBITDA, same store revenues and cash flows, expectations

regarding our long-term growth, sustainable growth, and inflection

in our revenue, our ability to create long-term stockholder value,

our expectations, in terms of both amount and timing, with respect

to debt repayment, our expectations with respect to the effects of

our refinancing transaction, expectations regarding our divestiture

of the Austin American-Statesman and the closing of such

transaction, our expected capital expenditures, expectations

regarding real estate and non-strategic asset sales, our strategy,

our partnerships, our ability to achieve our operating priorities,

our long-term opportunities, economic impacts, our ability to

navigate volatility, achieve our financial goals, optimize our

capital structure and achieve optimal financial performance, our

cost structure, future revenue and expense trends, and our ability

to influence trends. Words such as "expect(s)", "believe(s)",

"aim(s)", "will", "can", "outlook", "guidance", "estimate(s)",

"project(s)", "suggest", "trend", "focus", and similar expressions

are intended to identify such forward-looking statements. These

statements are based on management’s current expectations and

beliefs and are subject to a number of risks and uncertainties.

These and other risks and uncertainties could cause actual results

to differ materially from those described in the forward-looking

statements, many of which are beyond our control. The Company can

give no assurance its expectations will be attained. Accordingly,

you should not place undue reliance on any forward-looking

statements contained in this press release. For a discussion of

some of the risks and important factors that could cause actual

results to differ from such forward-looking statements, see the

risks and other factors detailed from time to time in the Company's

most recent Annual Report on Form 10-K, our quarterly reports on

Form 10-Q, and our other filings with the Securities and Exchange

Commission. Furthermore, new risks and uncertainties emerge from

time to time, and it is not possible for the Company to predict or

assess the impact of every factor that may cause its actual results

to differ from those contained in any forward-looking statements.

Such forward-looking statements speak only as of the date of this

press release. Except to the extent required by law, the Company

expressly disclaims any obligation to release publicly any updates

or revisions to any forward-looking statements contained herein to

reflect any change in the Company’s expectations with regard

thereto or change in events, conditions or circumstances on which

any statement is based.

GANNETT CO., INC.

CONSOLIDATED BALANCE SHEETS

Table No. 1

In thousands, except share data

December 31, 2024

December 31, 2023

Assets

Current assets:

Cash and cash equivalents

$

106,299

$

100,180

Accounts receivable, net of allowance for

credit losses of $13,596 and $16,338, respectively

239,636

266,096

Inventories

20,910

26,794

Prepaid expenses

40,268

36,210

Other current assets

18,782

14,957

Total current assets

425,895

444,237

Property, plant, and equipment, net of

accumulated depreciation of $337,013 and $336,408, respectively

240,980

239,087

Operating lease assets

143,955

221,733

Goodwill

530,028

533,876

Intangible assets, net

430,374

524,350

Deferred tax assets

60,983

37,125

Pension and other assets

207,932

180,839

Total assets

$

2,040,147

$

2,181,247

Liabilities and equity

Current liabilities:

Accounts payable and accrued

liabilities

$

318,384

$

293,444

Deferred revenue

108,000

120,502

Current portion of long-term debt

74,300

63,752

Operating lease liabilities

39,761

45,763

Other current liabilities

5,157

10,052

Total current liabilities

545,602

533,513

Long-term debt

755,754

564,836

Convertible debt

249,757

416,036

Deferred tax liabilities

4,928

2,028

Pension and other postretirement benefit

obligations

37,820

42,661

Long-term operating lease liabilities

167,731

203,871

Other long-term liabilities

125,921

100,989

Total noncurrent liabilities

1,341,911

1,330,421

Total liabilities

1,887,513

1,863,934

Commitments and contingent

liabilities

Equity

Preferred stock, $0.01 par value per

share, 300,000 shares authorized, none of which were issued and

outstanding at December 31, 2024 and December 31, 2023

—

—

Common stock, $0.01 par value per share,

2,000,000,000 shares authorized; 158,835,742 shares issued and

147,388,555 shares outstanding at December 31, 2024; 158,554,705

shares issued and 148,939,463 shares outstanding at December 31,

2023

1,588

1,586

Treasury stock, at cost, 11,447,187 shares

and 9,615,242 shares at December 31, 2024 and December 31, 2023,

respectively

(20,540

)

(17,393

)

Additional paid-in capital

1,281,801

1,426,325

Accumulated deficit

(1,053,546

)

(1,027,192

)

Accumulated other comprehensive loss

(56,164

)

(65,541

)

Total Gannett stockholders'

equity

153,139

317,785

Noncontrolling interests

(505

)

(472

)

Total equity

152,634

317,313

Total liabilities and equity

$

2,040,147

$

2,181,247

GANNETT CO., INC.

CONSOLIDATED STATEMENTS OF

OPERATIONS

Table No. 2

Three months ended December

31,

Year ended December

31,

In thousands, except per share amounts

2024

2023

2024

2023

(Unaudited)

Digital

$

280,388

$

277,145

$

1,103,651

$

1,050,370

Print and commercial

340,887

392,260

1,405,664

1,613,180

Total revenues

621,275

669,405

2,509,315

2,663,550

Operating costs

375,799

419,644

1,545,584

1,692,031

Selling, general and administrative

expenses

178,663

185,908

726,028

735,339

Depreciation and amortization

39,333

38,496

156,287

162,622

Integration and reorganization costs

11,192

6,009

66,155

24,468

Asset impairments

513

—

46,589

1,370

(Gain) loss on sale or disposal of assets,

net

(466

)

768

1,106

(40,101

)

Other operating expenses

10,136

722

10,404

1,550

Total operating expenses

615,170

651,547

2,552,153

2,577,279

Operating income (loss)

6,105

17,858

(42,838

)

86,271

Interest expense

25,903

26,969

104,697

111,776

Gain on early extinguishment of debt

(55,205

)

(1,316

)

(55,559

)

(4,529

)

Non-operating pension income

(2,962

)

(2,375

)

(12,438

)

(9,382

)

Equity income in unconsolidated investees,

net

(271

)

(1,038

)

(548

)

(2,379

)

Other non-operating expense (income),

net

2,454

(3,067

)

(1,317

)

(3,050

)

Non-operating expenses

(30,081

)

19,173

34,835

92,436

Income (loss) before income

taxes

36,186

(1,315

)

(77,673

)

(6,165

)

(Benefit) provision for income taxes

(28,132

)

21,581

(51,286

)

21,729

Net income (loss)

64,318

(22,896

)

(26,387

)

(27,894

)

Net loss attributable to noncontrolling

interests

(1

)

(4

)

(33

)

(103

)

Net income (loss) attributable to

Gannett

$

64,319

$

(22,892

)

$

(26,354

)

$

(27,791

)

Income (loss) per share attributable to

Gannett - basic

$

0.45

$

(0.16

)

$

(0.18

)

$

(0.20

)

Income (loss) per share attributable to

Gannett - diluted

$

0.11

$

(0.16

)

$

(0.18

)

$

(0.20

)

GANNETT CO., INC.

CONSOLIDATED STATEMENTS OF CASH

FLOWS

Table No. 3

Year ended December

31,

In thousands

2024

2023

Operating activities

Net loss

$

(26,387

)

$

(27,894

)

Adjustments to reconcile net loss to

operating cash flows:

Depreciation and amortization

156,287

162,622

Share-based compensation expense

12,522

16,567

Non-cash interest expense

18,072

21,199

(Benefit) provision for deferred income

taxes

(44,758

)

11,514

Loss (gain) on sale or disposal of assets,

net

1,106

(40,101

)

Gain on early extinguishment of debt

(55,559

)

(4,529

)

Asset impairments

46,589

1,370

Pension and other postretirement benefit

obligations

(23,916

)

(13,917

)

Equity income in unconsolidated investees,

net

(548

)

(2,379

)

Change in other assets and liabilities,

net:

Accounts receivable, net

25,843

34,135

Inventory

4,617

18,510

Prepaid expenses

(1,820

)

16,680

Accounts payable and accrued

liabilities

(1,934

)

(65,094

)

Deferred revenue

(17,277

)

(29,971

)

Other assets and liabilities

7,473

(4,138

)

Cash provided by operating

activities

100,310

94,574

Investing activities

Purchase of property, plant and

equipment

(49,534

)

(38,116

)

Proceeds from sale of real estate and

other assets

20,976

85,298

Change in other investing activities

608

(203

)

Cash (used for) provided by investing

activities

(27,950

)

46,979

Financing activities

Payments of deferred financing costs

(8,933

)

—

Borrowings of long-term debt

837,671

—

Repayments of long-term debt

(644,732

)

(133,821

)

Repurchase of convertible debt

(248,211

)

—

Proceeds from convertible debt

110

—

Treasury stock

(3,141

)

(2,642

)

Changes in other financing activities

(1,617

)

952

Cash used for financing

activities

(68,853

)

(135,511

)

Effect of currency exchange rate change on

cash

2,062

(234

)

Increase in cash, cash equivalents and

restricted cash

5,569

5,808

Cash, cash equivalents and restricted cash

at beginning of period

110,612

104,804

Cash, cash equivalents and restricted

cash at end of period

$

116,181

$

110,612

GANNETT CO., INC.

SEGMENT INFORMATION

(Unaudited)

Table No. 4

Three months ended December

31,

Year ended December

31,

In thousands

2024

2023

2024

2023

Revenues:

Domestic Gannett Media

$

482,259

$

529,217

$

1,938,398

$

2,095,853

Newsquest

58,275

58,178

239,273

233,980

Digital Marketing Solutions

117,035

120,384

477,807

477,909

Corporate and other

1,363

1,665

5,656

6,268

Intersegment eliminations

(37,657

)

(40,039

)

(151,819

)

(150,460

)

Total

$

621,275

$

669,405

$

2,509,315

$

2,663,550

USE OF NON-GAAP INFORMATION

The Company uses non-GAAP financial performance and liquidity

measures to supplement the financial information presented on a

U.S. generally accepted accounting principles ("U.S. GAAP") basis.

These non-GAAP financial performance and liquidity measures, which

may not be comparable to, and may be defined differently than,

similarly titled measures used or reported by other companies,

should not be considered in isolation from or as a substitute for

the related U.S. GAAP measures and should be read together with

financial information presented on a U.S. GAAP basis.

We define our non-GAAP financial performance and liquidity

measures as follows:

- Adjusted EBITDA is a non-GAAP financial performance measure we

believe offers a useful view of the overall and segment operations

of our business. We define Adjusted EBITDA as Net income (loss)

attributable to Gannett before (1) Income tax expense (benefit),

(2) Interest expense, (3) Gains or losses on the early

extinguishment of debt, (4) Non-operating pension income, (5) Loss

on convertible notes derivative, (6) Depreciation and amortization,

(7) Integration and reorganization costs, (8) Third-party debt

expenses and acquisition costs, (9) Asset impairments, (10)

Goodwill and intangible impairments, (11) Gains or losses on the

sale or disposal of assets, (12) Share-based compensation, (13)

Other non-operating (income) expense, net, and (14) Non-recurring

items. The most directly comparable U.S. GAAP financial performance

measure is Net income (loss) attributable to Gannett.

- Adjusted EBITDA margin is a non-GAAP financial performance

measure we believe offers a useful view of the overall and segment

operations of our business. We define Adjusted EBITDA margin as

Adjusted EBITDA divided by total Revenues.

- Adjusted net income (loss) attributable to Gannett is a

non-GAAP financial performance measure we believe offers a useful

view of the overall operations of our business and is useful to

analysts and investors in evaluating the results of operations and

operational trends. We define Adjusted net income (loss)

attributable to Gannett as Net income (loss) attributable to

Gannett before (1) Gains or losses on the early extinguishment of

debt, (2) Loss on convertible notes derivative, (3) Integration and

reorganization costs, (4) Third-party debt expenses and acquisition

costs, (5) Asset impairments, (6) Goodwill and intangibles

impairments, (7) Gains or losses on the sale or disposal of assets,

(8) Other items, including (Gain) loss on sale of investments, and

(9) the tax impact of the above items.

- Free cash flow is a non-GAAP liquidity measure that adjusts our

reported U.S. GAAP results for items we believe are critical to the

ongoing success of our business. We define Free cash flow as Cash

provided by (used for) operating activities as reported on the

consolidated statements of cash flows including the impact of (i)

capital expenditures and excluding the impact of (ii) third-party

debt expenses associated with the refinancing of debt. The result

is a figure representing Free cash flow available for use in

operations, additional investments, ongoing debt obligations, and

returns to stockholders. The most directly comparable U.S. GAAP

financial liquidity measure is Cash provided by (used for)

operating activities.

- Same store revenues is a non-GAAP financial performance measure

based on our U.S. GAAP revenues for the current period, excluding

(1) acquired revenues, (2) currency impact, and (3) exited

operations.

Management’s Use of Non-GAAP Measures

Adjusted EBITDA, Adjusted EBITDA margin, Adjusted net income

(loss) attributable to Gannett, Free cash flow and Same store

revenues are not measurements of financial performance or liquidity

under U.S. GAAP and should not be considered in isolation or as an

alternative to net income (loss), margin, income (loss) from

operations, cash flow provided by (used for) operating activities,

revenues, or any other measure of performance or liquidity derived

in accordance with U.S. GAAP. We believe these non-GAAP financial

performance and liquidity measures, as we have defined them, are

helpful in identifying trends in our day-to-day performance because

the items excluded have little or no significance on our day-to-day

operations. These measures provide an assessment of core expenses

and afford management the ability to make decisions which are

expected to facilitate meeting current financial goals as well as

achieve optimal financial performance.

We use Adjusted EBITDA, Adjusted EBITDA margin, Adjusted Net

income (loss) attributable to Gannett, Free cash flow and Same

store revenues as measures of our day-to-day operating performance,

which is evidenced by the publishing and delivery of news and other

media and excludes certain expenses that may not be indicative of

our day-to-day business operating results.

Limitations of Non-GAAP Measures

Each of our non-GAAP measures have limitations as analytical

tools. They should not be viewed in isolation or as a substitute

for U.S. GAAP measures of earnings or cash flows. Material

limitations in making the adjustments to our earnings to calculate

Adjusted EBITDA and Adjusted Net income (loss) attributable to

Gannett using these non-GAAP financial measures as compared to U.S.

GAAP net income (loss) include: the exclusion of the cash portion

of interest / financing expense, income tax (benefit) provision,

and charges related to asset impairments, which are items that may

significantly affect our financial results.

Management believes these items are important in evaluating our

performance, results of operations, and financial position. We use

non-GAAP financial performance and liquidity measures to supplement

our U.S. GAAP results in order to provide a more complete

understanding of the factors and trends affecting our business.

Adjusted EBITDA, Adjusted EBITDA margin, Adjusted Net income

(loss) attributable to Gannett, Free cash flow and Same store

revenues are not alternatives to net income (loss), margin, income

(loss) from operations, cash flow provided by (used for) operating

activities, revenues, or any other measure of performance or

liquidity derived in accordance with U.S. GAAP. As such, they

should not be considered or relied upon as substitutes or

alternatives for any such U.S. GAAP financial measures. We strongly

urge you to review the reconciliations of Net income (loss)

attributable to Gannett to Adjusted EBITDA, Adjusted EBITDA margin,

Net income (loss) attributable to Gannett to Adjusted Net income

(loss) attributable to Gannett, Cash provided by (used for)

operations to Free cash flow and Revenues to Same Store revenues

along with our consolidated financial statements included elsewhere

in this report. We also strongly urge you not to rely on any single

financial performance or liquidity measure to evaluate our

business. In addition, because Adjusted EBITDA, Adjusted EBITDA

margin, Adjusted Net income (loss) attributable to Gannett, Free

cash flow and Same store revenues are not measures of financial

performance under U.S. GAAP and are susceptible to varying

calculations, the Adjusted EBITDA, Adjusted EBITDA margin, Adjusted

Net income (loss) attributable to Gannett, Free cash flow and Same

store revenues measures as presented in this release may differ

from and may not be comparable to similarly titled measures used by

other companies.

Non-GAAP Outlook

Our full year 2025 business outlook included in this release

include certain non-GAAP financial performance and liquidity

measures, including Same store revenues, Adjusted EBITDA, and Free

cash flow. The outlook for each of these non-GAAP items does not

factor in the impact of any future acquisitions or dispositions. We

have provided these non-GAAP measures for future guidance for the

same reasons that were outlined above for historical non-GAAP

measures. We have not reconciled non-GAAP forward-looking Same

store revenues, Adjusted EBITDA, and Free cash flow to their most

directly comparable U.S. GAAP measure, as permitted by Item

10(e)(1)(i)(B) of Regulation S-K. Such reconciliations would

require unreasonable efforts to estimate and quantify various

necessary U.S. GAAP components largely because forecasting or

predicting our future operating results is subject to many factors

or future events out of our control, is unavailable, or is not

readily predictable, and could significantly impact, either

individually or in the aggregate, our comparable U.S. GAAP

measures. Accordingly, we are unable to provide a full

reconciliation of the non-GAAP measures used in our outlook without

unreasonable efforts.

GANNETT CO., INC.

NON-GAAP FINANCIAL INFORMATION

ADJUSTED EBITDA

(Unaudited)

Table No. 5

Three months ended December

31, 2024

In thousands

Domestic Gannett Media

Newsquest

Digital Marketing

Solutions

Corporate and other

Consolidated Total

Net income attributable to Gannett

$

30,188

$

12,315

$

1,574

$

20,242

$

64,319

Benefit for income taxes

—

—

—

(28,132

)

(28,132

)

Interest expense

—

—

—

25,903

25,903

Gain on early extinguishment of debt

—

—

—

(55,205

)

(55,205

)

Non-operating pension income

(1,102

)

(1,860

)

—

—

(2,962

)

Depreciation and amortization

23,420

2,293

5,687

7,933

39,333

Integration and reorganization costs

(reversal)

6,681

(1,009

)

119

5,401

11,192

Third-party debt expenses and acquisition

costs

—

—

—

10,259

10,259

Asset impairments

513

—

—

—

513

(Gain) loss on sale or disposal of assets,

net

(487

)

(7

)

—

28

(466

)

Share-based compensation expense

—

—

—

3,279

3,279

Other non-operating (income) expense,

net

(532

)

(541

)

4,003

(476

)

2,454

Non-recurring items

29

—

—

7,642

7,671

Adjusted EBITDA (non-GAAP basis)

$

58,710

$

11,191

$

11,383

$

(3,126

)

$

78,158

Net income attributable to Gannett

margin

6.3

%

21.1

%

1.3

%

NM

10.4

%

Adjusted EBITDA margin (non-GAAP

basis)

12.2

%

19.2

%

9.7

%

NM

12.6

%

NM indicates not meaningful.

Three months ended December

31, 2023

In thousands

Domestic Gannett Media

Newsquest

Digital Marketing

Solutions

Corporate and other

Consolidated Total

Net income (loss) attributable to

Gannett

$

26,915

$

11,107

$

8,043

$

(68,957

)

$

(22,892

)

Provision for income taxes

—

—

—

21,581

21,581

Interest expense

—

—

—

26,969

26,969

Gain on early extinguishment of debt

—

—

—

(1,316

)

(1,316

)

Non-operating pension income

(209

)

(2,166

)

—

—

(2,375

)

Depreciation and amortization

25,721

2,063

5,993

4,719

38,496

Integration and reorganization costs

3,248

677

182

1,902

6,009

Third-party debt expenses and acquisition

costs

—

215

—

507

722

Loss (gain) on sale or disposal of assets,

net

703

(29

)

92

2

768

Share-based compensation expense

—

—

—

3,840

3,840

Other non-operating income, net

(215

)

(634

)

(1,815

)

(403

)

(3,067

)

Non-recurring items

(65

)

96

—

5,340

5,371

Adjusted EBITDA (non-GAAP basis)

$

56,098

$

11,329

$

12,495

$

(5,816

)

$

74,106

Net income (loss) attributable to Gannett

margin

5.1

%

19.1

%

6.7

%

NM

(3.4

)%

Adjusted EBITDA margin (non-GAAP

basis)

10.6

%

19.5

%

10.4

%

NM

11.1

%

NM indicates not meaningful.

GANNETT CO., INC.

NON-GAAP FINANCIAL INFORMATION

ADJUSTED EBITDA

(Unaudited)

Table No. 5 (continued)

Year ended December 31,

2024

In thousands

Domestic Gannett Media

Newsquest

Digital Marketing

Solutions

Corporate and other

Consolidated Total

Net income (loss) attributable to

Gannett

$

61,333

$

55,196

$

13,382

$

(156,265

)

$

(26,354

)

Benefit for income taxes

—

—

—

(51,286

)

(51,286

)

Interest expense

—

—

—

104,697

104,697

Gain on early extinguishment of debt

—

—

—

(55,559

)

(55,559

)

Non-operating pension income

(5,021

)

(7,417

)

—

—

(12,438

)

Depreciation and amortization

96,478

8,485

24,066

27,258

156,287

Integration and reorganization costs

(reversal)

49,625

(513

)

2,061

14,982

66,155

Third-party debt expenses and acquisition

costs

—

(22

)

—

10,954

10,932

Asset impairments

600

—

—

45,989

46,589

Loss (gain) on sale or disposal of assets,

net

1,682

(894

)

93

225

1,106

Share-based compensation expense

—

—

—

12,522

12,522

Other non-operating (loss) income, net

(2,263

)

(1,426

)

3,442

(1,070

)

(1,317

)

Non-recurring items

(13

)

—

634

21,234

21,855

Adjusted EBITDA (non-GAAP basis)

$

202,421

$

53,409

$

43,678

$

(26,319

)

$

273,189

Net income (loss) attributable to Gannett

margin

3.2

%

23.1

%

2.8

%

NM

(1.1

)%

Adjusted EBITDA margin (non-GAAP

basis)

10.4

%

22.3

%

9.1

%

NM

10.9

%

NM indicates not meaningful.

Year ended December 31,

2023

In thousands

Domestic Gannett Media

Newsquest

Digital Marketing

Solutions

Corporate and other

Consolidated Total

Net income (loss) attributable to

Gannett

$

114,254

$

49,257

$

28,841

$

(220,143

)

$

(27,791

)

Provision for income taxes

—

—

—

21,729

21,729

Interest expense

—

—

—

111,776

111,776

Gain on early extinguishment of debt

—

—

—

(4,529

)

(4,529

)

Non-operating pension income

(705

)

(8,677

)

—

—

(9,382

)

Depreciation and amortization

112,201

8,792

23,795

17,834

162,622

Integration and reorganization costs

5,582

1,763

784

16,339

24,468

Third-party debt expenses and acquisition

costs

139

215

—

1,196

1,550

Asset impairments

1,370

—

—

—

1,370

(Gain) loss on sale or disposal of assets,

net

(38,937

)

(42

)

324

(1,446

)

(40,101

)

Share-based compensation expense

—

—

—

16,567

16,567

Other non-operating income (loss), net

773

(1,539

)

(521

)

(1,763

)

(3,050

)

Non-recurring items

(36

)

359

—

12,131

12,454

Adjusted EBITDA (non-GAAP basis)

$

194,641

$

50,128

$

53,223

$

(30,309

)

$

267,683

Net income (loss) attributable to Gannett

margin

5.5

%

21.1

%

6.0

%

NM

(1.0

)%

Adjusted EBITDA margin (non-GAAP

basis)

9.3

%

21.4

%

11.1

%

NM

10.0

%

NM indicates not meaningful.

GANNETT CO., INC.

NON-GAAP FINANCIAL INFORMATION

ADJUSTED NET INCOME (LOSS) ATTRIBUTABLE

TO GANNETT

(Unaudited)

Table No. 6

Three months ended December

31,

Year ended December

31,

In thousands

2024

2023

2024

2023

Net income (loss) attributable to

Gannett

$

64,319

$

(22,892

)

$

(26,354

)

$

(27,791

)

Gain on early extinguishment of debt

(55,205

)

(1,316

)

(55,559

)

(4,529

)

Integration and reorganization costs

11,192

6,009

66,155

24,468

Third-party debt expenses and acquisition

costs

10,259

722

10,932

1,550

Asset impairments

513

—

46,589

1,370

(Gain) loss on sale or disposal of assets,

net

(466

)

768

1,106

(40,101

)

Other items

20

(99

)

(597

)

(196

)

Subtotal

30,632

(16,808

)

42,272

(45,229

)

Tax impact of above items

7,688

(1,412

)

(17,302

)

4,247

Adjusted net income (loss) attributable to

Gannett (non-GAAP basis)

$

38,320

$

(18,220

)

$

24,970

$

(40,982

)

GANNETT CO., INC.

NON-GAAP FINANCIAL INFORMATION

FREE CASH FLOW

(Unaudited)

Table No. 7

Three months ended December

31,

Year ended December

31,

In thousands

2024

2023

2024

2023

Cash provided by operating activities

(GAAP basis)

$

8,989

$

21,157

$

100,310

$

94,574

Capital expenditures

(12,826

)

(8,409

)

(49,534

)

(38,116

)

Third-party debt expenses

7,669

—

7,669

—

Free cash flow (non-GAAP basis)(1)

$

3,832

$

12,748

$

58,445

$

56,458

(1) For the three months ended December 31, 2024 and 2023, free

cash flow was negatively impacted by interest paid of $35.9 million

and $33.2 million, respectively, integration and reorganization

costs of $7.8 million and $6.7 million, respectively, and other

costs of $8.3 million and $5.6 million, respectively. For the year

ended December 31, 2024 and 2023, free cash flow was negatively

impacted by interest paid of $86.3 million and $89.3 million,

respectively, integration and reorganization costs of $31.2 million

and $53.7 million, respectively, and other costs of $30.5 million

and $13.2 million, respectively.

GANNETT CO., INC.

NON-GAAP FINANCIAL INFORMATION

SAME STORE REVENUES - CONSOLIDATED

& DIGITAL

(Unaudited)

Table No. 8

Three months ended December

31,

Year ended December

31,

In thousands

2024

2023

% Change

2024

2023

% Change

Total revenues

$

621,275

$

669,405

(7.2

)%

$

2,509,315

$

2,663,550

(5.8

)%

Currency impact

(1,839

)

—

(6,111

)

—

Exited operations(1)

(942

)

(14,998

)

(3,094

)

(29,339

)

Same store total revenues

$

618,494

$

654,407

(5.5

)%

$

2,500,110

$

2,634,211

(5.1

)%

(1) Exited operations include (i)

businesses divested and (ii) the elimination of stand-alone print

products discontinued within the media markets.

Three months ended December

31,

Year ended December

31,

In thousands

2024

2023

% Change

2024

2023

% Change

Digital revenues

$

280,388

$

277,145

1.2

%

$

1,103,651

$

1,050,370

5.1

%

Currency impact

(556

)

—

(1,772

)

—

Exited operations(1)

(930

)

(7,480

)

(3,053

)

(11,644

)

Same store digital revenues

$

278,902

$

269,665

3.4

%

$

1,098,826

$

1,038,726

5.8

%

(1) Exited operations include (i)

businesses divested and (ii) the elimination of stand-alone print

products discontinued within the media markets.

KEY PERFORMANCE INDICATORS

A key performance indicator ("KPI") is generally defined as a

quantifiable measurement or metric used to gauge performance,

specifically to help determine strategic, financial, and

operational achievements, especially compared to those of similar

businesses.

We define Digital-only average revenue per user ("ARPU") as

digital-only subscription average monthly revenues divided by the

average digital-only paid subscriptions within the respective

period. We define Core platform ARPU as core platform average

monthly revenues divided by average monthly customer count within

the period. We define core platform revenues as revenue derived

from customers utilizing our proprietary digital marketing services

platform that are sold by either our direct or local market

teams.

Management believes Digital-only ARPU, Core platform ARPU,

digital-only paid subscriptions, core platform revenues and core

platform average customer count are KPIs that offer useful

information in understanding consumer behavior, trends in our

business, and our overall operating results. Management utilizes

these KPIs to track and analyze trends across our segments.

GANNETT CO., INC.

KEY PERFORMANCE INDICATORS

(Unaudited)

Table No. 9

Three months ended December

31,

Year ended December

31,

In thousands, except ARPU

2024

2023

Change

% Change

2024

2023

Change

% Change

Domestic Gannett Media:

Digital-only ARPU

$

8.03

$

7.09

$

0.94

13.3

%

$

7.83

$

6.46

$

1.37

21.2

%

Newsquest:

Digital-only ARPU

$

6.21

$

6.18

$

0.03

0.5

%

$

6.17

$

6.14

$

0.03

0.5

%

Total Gannett:

Digital-only ARPU

$

7.93

$

7.05

$

0.88

12.5

%

$

7.75

$

6.45

$

1.30

20.2

%

DMS:

Core platform revenues

$

116,248

$

119,355

$

(3,107

)

(2.6

)%

$

474,298

$

473,172

$

1,126

0.2

%

Core platform ARPU

$

2,788

$

2,663

$

125

4.7

%

$

2,760

$

2,620

$

140

5.3

%

Core platform average customer count

13.9

14.9

(1.0

)

(6.7

)%

14.3

15.1

(0.8

)

(5.3

)%

Table No. 10

As of December 31,

In thousands

2024

2023

% Change

Digital-only paid

subscriptions:

Domestic Gannett Media

1,953

1,912

2.1

%

Newsquest

110

83

32.5

%

Total Gannett

2,063

1,995

3.4

%

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250220488444/en/

For investor inquiries, contact: Matt Esposito Investor

Relations 703-854-3000 investors@gannett.com

For media inquiries, contact: Lark-Marie Anton Corporate

Communications 646-906-4087 lark@gannett.com

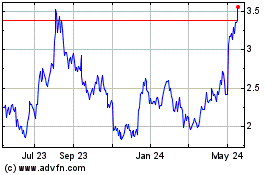

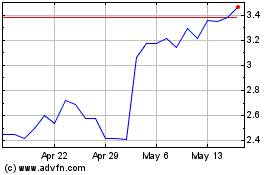

New Gannett (NYSE:GCI)

Historical Stock Chart

From Jan 2025 to Feb 2025

New Gannett (NYSE:GCI)

Historical Stock Chart

From Feb 2024 to Feb 2025