Form 8-K - Current report

28 May 2024 - 10:38PM

Edgar (US Regulatory)

false

0001898496

0001898496

2024-05-28

2024-05-28

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

May 28, 2024

GETTY IMAGES HOLDINGS, INC.

(Exact Name of Registrant as Specified in Charter)

| Delaware |

001-41453 |

87-3764229 |

(State

or Other Jurisdiction of

Incorporation) |

(Commission

File Number) |

(IRS

Employer

Identification No.) |

605 5th Ave S. Suite 400

Seattle, WA |

98104 |

| (Address

of Principal Executive Offices) |

(Zip

Code) |

Registrant’s telephone number, including

area code: (206) 925-5000

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2.

below):

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e 4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | |

Trading Symbol(s) | |

Name of each exchange

on which registered |

| Class A Common Stock | |

GETY | |

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company x

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act.

Item 7.01. Regulation FD Disclosures

On May 28, 2024, Getty Images Holdings, Inc.

(the “Company”) posted an investor presentation dated May 28, 2024 to its website at investors.gettyimages.com. The

presentation included a video providing an overview of the Company’s Generative AI by Getty Images tool powered by NVIDIA, including

anticipated additional capabilities. A copy of the presentation is included as Exhibit 99.1 to this Current Report on Form 8-K and

is incorporated herein by reference.

* * *

The information contained in Item 7.01 of this

Current Report on Form 8-K, including Exhibit 99.1 referenced in Item 7.01 above, is being furnished and shall not be deemed “filed”

for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject

to the liabilities of that section. Such information shall not be incorporated by reference into any registration statement or other document

pursuant to the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference

in any such filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: May 28, 2024

| |

|

| |

GETTY IMAGES HOLDINGS, INC. |

| |

|

| |

By: |

/s/ Kjelti Kellough |

| |

Name: |

Kjelti Kellough |

| |

Title: |

Senior Vice President, General Counsel, and Corporate Secretary |

Exhibit 99.1

| CONFIDENTIAL 1

With the Power of Elevated Visual Content

May 28, 2024

Move the World

469262742, wundervisuals |

| 2

1

3

4

Our Differentiated Value Proposition

Our AI Opportunity

Financial Highlights

2

2

The Power of Our Authentic Content

Getty Images is a Preeminent Global Content Creator and Marketplace

1454065258, Marco Bottigelli |

| 1 The Power of Our Authentic Content

1634256861, Willie B. Thomas 3 |

| We Believe in the Power of Visual Content

4 |

| 5

Visuals that Make People Think, Feel, Take Action, or Bear Witness to History |

| An Image That Instantly Tells a Story

1856938959, Pyrosky 6 |

| 7

A Shot That Expands Global Perspective and Transcends Language

463933990, AFP |

| 8

An Image that Transports You Back to a Moment

515612650, Bettmann |

| 9

Or The Big Moment Captured Through a Unique Lens

1450119456, Shaun Botterill – FIFA |

| Created with Generative AI by Getty Images 10

An AI-Generated Visual Sprung From the Depths of the Imagination |

| There’s a Story in Every Picture,

a Narrative in Every Frame

11 |

| 12 Source: 1 2023 study by eMarketer. 2 2019 study by Performics and Northwestern’s Medill School of Journalism. 3 2024 meta-analysis by We Are Social and Meltwater utilizing data from Kepios.

4 2023 polling by Gallup.

12

…Our Authentic, Differentiated, High Quality Content Stands Out More than Ever

> 200 x

Growth in People Actively Using

Social Media Globally Since 2000

(~62% of World Population)3

>7 Hours

Spent Daily Consuming

Digital Media on Average by

American Adults in 20231

>50 %

Of Consumers Prefer Visual

Content Over Text When Making

Purchase Decisions2

With the Omnipresence of Visual Storytelling…

~290 %

Increase in the Percentage of

Americans Who Place No Trust

in Mass Media Since 20004 |

| 2 Our Differentiated Value Proposition

2146684880, Gregory Shamus |

| 14

1 A Leading Industry Player with Powerful, Optimized Platform

2 Unique and Scaled Creative & Editorial Content Offering

3 Diversified and Loyal Customer Base

4 Subscription-Driven, High-Margin, Durable Financial Profile

5 Experienced Management Team Committed to De-Leveraging

6 Well-Positioned to Capitalize on AI Opportunity with Best-in-Class Product Partnerships

14

7 Poised to Benefit from Near-Term Macro Tailwinds

Investing in a Market Leader With an Enduring Competitive Edge

1203392571, donwogdo |

| 15

Solutions For a Full Spectrum of Content

Needs and Budgets that Mitigate Risk

Competitive Royalties

with Higher Tiers for Exclusive Content

Significant Audience

Reach & Scale

Creators of Visual Content Customers of Visual Content

Why Do Creators and Customers Consistently Choose Getty Images?

Depth, Breadth, and Quality of

Differentiated and Authentic Content

Access to Getty Images’ Exceptional Expertise in Visual Content for Crafting Compelling Stories |

| 16

Asset Type

Plans & Pricing

Go-to-Market

Asset Rights

Free & Low-Cost

Creative Stills

Capped /

No Indemnification

Primarily E-Commerce &

Online Service

Free (Ads), Subscriptions,

Paid API Integrations

Budget-Conscious

Stills, Video,

and Generative AI

Capped Indemnification With

Option for More Protection

Primarily E-Commerce &

Online Service

A La Carte, Subscriptions

Premium Creative & Editorial

(Stills, Music, Video, and

Generative AI)

Uncapped Indemnification &

Rights Customized to

Customer Needs

Premium Account

Management & Dedicated

Support

A La Carte, Subscriptions, &

Custom Assignments

Target Customer

SMBs, Prosumers,

Pro & Semipro Content

Creators

Enterprises SMBs

We Are Uniquely Positioned at the Center of the Creative Economy |

| 17 ~1/ 3 ~2/ 3 Powerful Creative & Editorial Content 34 % 66 % Editorial Creative Royalty-Free Photos, Illustrations, and Videos Underpinned by Exclusive Content Non-Exclusive Content Exclusive Content 110 Dedicated Staff Photographers & Videographers 80K+ Exclusive Contributors 70+ Exclusive Content Partners Serving a Broad & Tenured Customer Base 56 % 28 % 16 % Corporat ions Media Agencies 11 % 8 % 81 % 0-5 Years 6-10 Years 10+ Years That is Increasingly Subscription Driven 53 % 47 % Subscript ion A La Carte 557K+ Total Contributors Source: Company filings and internal financial records as of Dec-2023. Customer Breakdown (% of 2023 Revenue) Getty Images’ High Quality Revenue Model Custom Visual Content Shoots Generative AI Services 90+ Person Creative Insights Team News, Sports, & Entertainment One of the Largest Privately Held Image Archives Customer Tenure (% of 2023 Revenue) Subscription Penetration (% of 2023 Revenue) (% of 2023 Revenue) (% of 2023 Revenue)

|

| 18

High Quality Creative Library

with Breadth and Depth for Any

Use Case

Comprehensive Custom Content

Offering

Custom Market Research and In-House Visual Expertise

Via VisualGPS

~2/3

Of 2023 Revenue

From Creative

7,000+

Consumers Engaged Through the

VisualGPS Platform

Global Insights Team Collaborating

With Leading Partners

Creative: Introducing Our Differentiated and Authentic Offering

Unique and Robust Visual Collection of Royalty-Free Images and Videos, Available in a Variety of Formats and Styles

75K+

In-Network Exclusive Creators to Help

Brands Develop Custom Creative Content

Fueling Powerful Brand Messaging

for Companies Like

To Fully Realize Their Creative Visions

2.8B+

Annual Searches Across Getty

Images’ Library of Assets

Photos Illustrations Videos

Vectors Music

1402003572, Daniel Garrido |

| 19 |

| 1216206166, simonkr 20 |

| 21

The Power of Our Editorial Business ~1/3

Of 2023 Revenue

From Editorial

Unique Scope &

Scale of Coverage

Award-Winning

Specialists

70+ Premium

Content Partners

Comprehensive

Archive

Deep Expertise &

Capabilities

Exclusive

Rights & Access

160K+

Annual Events

Across News, Sports,

and Entertainment

110

Staff Photographers

and Videographers

1,400+

Industry Awards

135M+

Images Across

Geographies, Times,

and Verticals

~300

Members of Our

Dedicated Editorial

Team With Deep

Industry Experience

14+

Years of Experience

on Average

Bettmann Archive

Sygma

Gamma

1294931398, Win McNamee

Paris 2024

Summer Olympics |

| 22 |

| 23

Exclusive Content Underpins Competitive Differentiation and Drives ~2/3 of Revenue

For many customers, Getty Images is the preferred visual content partner because of our exceptional access

to exclusive content that cannot be obtained anywhere else.

In a world of infinite imagery, we help our customers stand out with elevated visual storytelling.

860880772, skynesher |

| 24

Craig Peters

Chief Executive Officer

Over 16 Years of Experience at Getty Images with Broader

Experience in Media, Sports, and Technology

2139231507, Ben Solomon

Michael Teaster

SVP, Chief of Staff

30 Years with

Getty Images

Mikael Cho

Co-Founder & CEO

of Unsplash

Founded Unsplash

in 2017 with Broad

Experience in

Media and

Entrepreneurship

Grant Farhall

Chief Product

Officer

13 Years with

Getty Images

Gene Foca

Chief Marketing

Officer

7 Years with

Getty Images.

Previously with

Fresh Direct,

Amazon and Time

Nate Gandert

Chief Technology

Officer

13 Years with

Getty Images

Kjelti Kellough

General Counsel

15 Years with

Getty Images

Jennifer Leyden

Chief Financial

Officer

8 Years with

Getty Images.

Prior CFO at

Physique 57 &

Previously with

Sony Music &

Columbia Records

Ken Mainardis

SVP, Global Head

of Content

20 Years with

Getty Images

Peter Orlowsky

SVP, Strategic

Development

27 Years with

Getty Images

Rebecca Swift

SVP, Creative

Content

6 Years With Getty

Images, Founder of

Getty Images’

Creative Research

Team

Lizanne Vaughan

Chief People

Officer

20 Years with

Getty Images

Daine Weston

SVP, Ecommerce

12 Years with

Getty Images

24

Experienced Management Team |

| 44 % 53 % 2019A 2023A 7.0 x 4.2 x 2019A 2023A $ 200 $ 244 2019A 2023A $ 245 $ 301 2019A 2023A 25 Since our 2019 financing, we have reoriented our strategy and made significant investments to position us for capital-light growth Progressed Key Initiatives Which Resulted in Tangible Business Enhancements Migration of End-to-End Platform to the Cloud Forged Leading Tech Partnerships to Cement Our AI Offerings Prioritization of Shift to High-Retention Subscriptions Successfully Exited Legacy Declining Products Restructured Sales and Support Functions Revamped Marketing Through SEO and iStock Growth Vector Consistent Deleveraging of Balance Sheet Adjusted EBITDA1 Unlevered Pre-Tax FCF 3 Subscription % of Mix1 Net Leverage1,4 Source: Company filings as of Dec-2023 and internal financial records. Note: Adjusted EBITDA, Unlevered Pre-Tax FCF, and Net Leverage are all non-GAAP measures. Please see "Disclaimer." Additional details regarding reconciliation of each of these metrics to the nearest GAAP measure are available on Pages 44-45. 1 Adjusted EBITDA is defined as Reported EBITDA adjusted for non-recurring items and certain retired products. 2019A Revenue excludes the effect of certain retired products; see Pages 44-45 for reconciliation. 2 Represents EBITDA margin ex. certain retired products. 3 Unlevered Pre-Tax FCF is defined as Adjusted EBITDA minus Capital Expenditures. 4 Net Leverage Ratio is calculated as Net Leverage / adjusted EBITDA; Net Leverage is the face value of debt less cash & cash equivalents. 5 Excludes discontinued products. 30 %2 33 %2 ~1 x de-leverage at IPO Our Strategic Transformation Positioned Us to Deliver Growth 5 |

| 31Our AI Opportunity

Created with Generative AI by Getty Images 26 |

| 27

Elevating Creativity

Commercially Scalable

Commercially Safe & Legally Protected

Compensates Creators End to End Solution

Created with Generative AI by Getty Images

Power of AI

Powerful

Pre-Shot Content

Powered by NVIDIA

Partnering with trusted industry leader, NVIDIA, our AI Generator pairs Getty Images' vast content and data with the

latest AI technology to unlock endless possibilities for ideation and efficient commercial content creation

+

AI Taps Into Our Competitive Differentiation and Provides New Paths for Growth

by |

| 28

Other Generative AI Model Services

Unclear Legal Protection and Data Sourcing

Potential Output Degradation

& Contamination With Unreleased Content

Not Trained on Getty Images High Quality Content

Fully Permissioned, Indemnified Content Generation

Expansive Library of Training Data With High Quality,

Exclusive Assets Added Each Quarter

Compensates Creators, on a Recurring Basis

Our Approach Allows Our Customers to Safely Tap Into the Potential of Generative AI

Through a Commercially Safe and Responsibly Built Solution

Quality of Outputs Limited to Quality of Inputs

by

Powered by NVIDIA

Trained on the Highest Quality Creative Visuals

(Preserving Pre-Shot / Editorial Integrity)

We Are Uniquely Positioned to Benefit From AI

Most Other Model Services Are Not Commercially Safe and Put Companies at Risk of Infringing Trademarks and Other Rights

While Also Providing Lower Quality Outputs |

| 29 |

| 30

Generative AI by Getty Images Builds on the Millions of Images in Our Vast Pre-Shot Library, Opening up Incredible Opportunities

for Brands and Marketers to Elevate Their Creativity and Expand Efficiencies Throughout the Creative Process. This Powerful

Combination of Carefully Crafted Imagery and the Latest AI Technology Allows Customers To:

Tap Into the Expertise of Our Creative Directors

and Content Creators

Turn Unique Ideas Into Original Content

Test, Learn and Iterate on Generated Content

Until it’s the Perfect Match for any Visual Need

Quickly Ideate on Trending Themes that

Connect with Consumers

Getty Images’ Unique Pre-Shot Library + Generative AI Technology

Combines to Create a Powerful Tool for Content Creation |

| 31

Our Proprietary Search Infrastructure

Natural Language Queries

Natural Language Processing (NLP) &

Machine Learning to Contextualize Queries

Augment Retrieval With Metadata

Attached to Each Asset

Dynamic Image Placement Algorithms to

Improve Result Relevance

Enhanced Search Available

Cross-Platform Via API

Search in Action

Providing More Relevant Search Results Improves User Outcomes & Retention

a group of friends in a sunny environment Creative Images Search by image

or video

NLP & Metadata Matching

Outdoors

Friendship Group of People

Friendship Sunny People Joy

Friendship Sunny Summer

In Addition to Our Generative AI, We Are Embedding AI

Across Some of Our Other Capabilities |

| 32

Our Core Business Remains Healthy in the Age of AI

LTM Total Purchasing Customers

(Thousands)

46 %

49 %

53 %

2021 2022 2023

LTM Total Active Annual

Subscribers (Thousands)

Subscriptions as a %

of Total Revenue

LTM Paid Download Volume

(Millions)

Source: Company filings as of Dec-2023. 1 Represents currency neutral year-over-year growth rate. 2 Excludes 2020 and 2023 growth figures.

Our core KPIs remain strong, with stable fundamentals and increasing subscription penetration

Purchasing

customer

decline due

to shift to

committed

subscriptions

75

129

236

2021 2022 2023

89

95 95

2021 2022 2023

794 835 799

2021 2022 2023

On a currency neutral basis, revenue growth across Creative and Editorial segments has remained largely flat or positive

$ 597 $ 585 $ 579

2021 2022 2023

Creative Revenue (Millions)

$ 307 $ 326 $ 321

2021 2022 2023

Editorial Revenue (Millions)

2023 performance impacted by adverse impact of

Hollywood strikes. Outside of 2020 (COVID) and 2023

(strikes), the business has consistently grown over the

L10Y, with average annual CN growth of ~7.5%2

9.5 %1 2.7 %1

(0.6)%1 12.4 %1 11.5 %1

(1.2)%1 |

| 51Financial Highlights

1170614184, Ducan Raban/Popperfoto |

| 34

Stable Revenue & Long-Term Growth Strong Cash Generation Customer Acquisition Efficiency Consistent. High Margin Profile

Total Revenue1 Unlevered Pre-Tax Free Cash Flow1

71 % 73 %

2019 2023

Gross Margin

Source: Company filings as of Dec-2023 and internal financial records. Note: Unlevered Pre-Tax FCF is a non-GAAP measure. Please see “Disclaimer.” Additional details

regarding reconciliation of this metric to the nearest GAAP measure are available on Pages 44-45. Please refer to subsequent pages for metric methodology. 1 Figures in

millions. 2 2019 CAC figure reflects changes made to our customer account aggregation in September 2022. Under prior reporting, 2019 CAC would have been $160.

Customer Acquisition Cost2

The Enduring Strength of the Getty Images Platform

$ 200 $ 244

2019 2023

$ 823 $ 917

2019 2023

$ 176

$ 109

2019 2023 |

| 459 503 516 532 597 585 579

276

296 294 266

14 307 326 321

16 13 13

15 15 17

$749

$815 $823 $811

$919 $926 $917

FY17A FY18A FY19A FY20A FY21A FY22A FY23A

Creative Editorial Other

% Growth:

Revenue1

Note: Dollars in millions. Revenue for FY17 – FY20 excludes certain retired products; see Pages 44-45 for the reconciliation.

1 Stronger US Dollar relative to foreign currencies, in particular the Euro and GBP, reduced 2022 revenue growth by 490 bps.

% Subscription:

$532

$583 $588 $587

$671 $671 $666

71% 72% 71% 72% 73% 73% 73%

FY17E FY18A FY19A FY20A FY21A FY22A FY23A

% margin

Revenue Less Cost of Revenue

9%

39%

1%

44%

(2%)

46%

13%

36% 46%

3%

($ in millions)

1%

49%

35

1

(1%)

53%

Revenue1

($ in Millions)

Revenue Less Cost of Revenue

($ in Millions)

Summary Financial Overview

COVID

Impacted

Hollywood Strike

Impacted

COVID

Impacted

Hollywood Strike

Impacted |

| $ 103

$ 158

$ 200

$ 226

$ 260 $ 246 $ 244

FY17A FY18A FY19A FY20A FY21A FY22A FY23A

$167

$211

$245

$271

$309 $305 $301

22%

26%

30%

33% 34% 33% 33%

FY17A FY18A FY19A FY20A FY21A FY22A FY23A

% margin

Note: Adjusted EBITDA and Unlevered Pre-Tax FCF are non-GAAP measures. Please see “Disclaimer.” Additional details regarding reconciliation of each of these metrics to the nearest GAAP measure are available on Pages 44-45. 1 Adjusted EBITDA is defined

as Reported EBITDA adjusted for non-recurring items and certain retired products. Adjusted EBITDA margin is defined as the ratio of Adjusted EBITDA to Revenue, excluding certain retired products.

2 FY21 and FY22 Adjusted EBITDA include ~$4 and $8 million

of public company costs (BOD, D&O, additional headcount and audit and professional fees) respectively. FY22 and FY23 Adjusted EBITDA exclude ~$1.1 million and ~$6.4 million, respectively, of previously reclassified legal fees associated with loss on litigation.

3 Unlevered Pre-Tax Free Cash Flow is defined as Adjusted EBITDA minus Capital Expenditures. 4

Includes one-time time Capital Expenditures items of ~$7 million related to Salesforce Implementation and Platform Unification in 2017, and ~$4 million related to

Cloud Migration in 2018. 5 Based on GAAP Capital Expenditures divided by revenue excluding revenue for certain retired products.

2

7

$64

8.6%

Capital Expenditures4:

Capital Expenditures % of Revenue5:

36

6.4%

$52

5.5%

$46

5.5%

$45

5.4%

$49

6.4%

$59

6.2%

$57

2 2

Adj. EBITDA1

($ in Millions)

Unlevered Pre-Tax Free Cash Flow3

($ in Millions)

Summary Financial Overview |

| 656

688 672

715

794

835

799

FY17A FY18A FY19A FY20A FY21A FY22A FY23A

30 45 53 59

75

129

236

FY17A FY18A FY19A FY20A FY21A FY22A FY23A

98.7% 101.3% 97.5%

87.9%

104.5% 100.1% 92.4%

FY17A FY18A FY19A FY20A FY21A FY22A FY23A

Note: The Company launched Unsplash+ during the three months ended December 31, 2022. This new Unsplash subscription is included within these KPI’s from the launch date forward. 1 Based on billed revenue. 2

Excludes downloads from Editorial Subscriptions, Editorial feeds, and certain API structured deals, including bulk unlimited deals. Excludes downloads starting in Q3’22 tied to a two-year deal signed with Amazon

in July 2022, as the magnitude of the potential download volume over the deal term could result in significant fluctuations in this metric without corresponding impact to revenue in the same period.

( in thousands)

57

68

84 83 89 95 95

FY17A FY18A FY19A FY20A FY21A FY22A FY23A

37

COVID

Impacted

Total Purchasing Customers1

(in Thousands)

Annual Paid Download Volume

(in Millions) LTM Annual Subscriber Revenue Retention

COVID

Impacted

Driven by

growth in

smaller

subs

Total Active Annual Subscribers

(in Thousands)

Consistent Growth Across Key Performance Indicators

2 |

| 1 A measure of the percentage of total paid customer downloaders who are video downloaders. The underlying calculation of this metric was changed vs. previously reported metrics. This change was

made to exclude the impact of downloader activity from our free trial subscriptions which are skewed entirely to stills-only content.

535

322

362

400 426

458

497

FY17A FY18A FY19A FY20A FY21A FY22A FY23A

7

9

12

17

20

24

28

FY17A FY18A FY19A FY20A FY21A FY22A FY23A

14.1%

7.9%

9.2%

10.3% 10.9%

12.1%

13.1%

FY17A FY18A FY19A FY20A FY21A FY22A FY23A

38

Video Attachment Rate1

Image Collection

(in Millions)

Video Collection

(in Millions)

Consistent Growth Across All Key Performance Indicators |

| ~4.2 x

~2.5x – 3.0x

2023 Target

Pay Down Debt to De-lever the

Business

Investment in Marketing

to Drive Growth

Investment in Data

Capabilities and Technology

to Drive Product Innovation

Opportunistically

Evaluate M&A

Balance Capital Structure

and Shareholder Return

Priorities for Cash

Flow Spend

Note: Unlevered Pre-Tax FCF and Adjusted EBITDA are non-GAAP measures. Please see “Disclaimer.” Additional details regarding reconciliation of each of these metrics to the nearest GAAP measure

are available on Pages 44-45. 1 Unlevered Pre-Tax Free Cash Flow is defined as Adjusted EBITDA minus Capital Expenditures.

2 Net Leverage is the face value of total debt less cash & cash

equivalents at December 31, 2023. 3 Adjusted EBITDA for twelve months ending December 31, 2023. 4 2022 and 2023 Unlevered Pre-Tax Free Cash Flow was negatively impacted due to EBITDA

Decline. 5 Net Leverage Target based on assumption that Company continues to generate strong free cash flow and uses excess cash flow to pay down debt.

Expect to be within target leverage range

within ~24 – 36 months5

Expect continued long-term growth, driven by:

• Annual Adjusted EBITDA growth

• Annual cash interest savings on $370mm incremental debt

paydowns since August 2022 of ~$37mm

• Interest savings from further leverage reduction

and potential refinancing of debt structure to offset

the rise in interest rates

39

4 4

Unlevered Pre-Tax Free Cash Flow1

($ in Millions) Target Net Leverage / Adjusted EBITDA2,3

$ 103

$ 159

$ 200

$ 226

$ 260 $ 245 $ 244

FY17A FY18A FY19A FY20A FY21A FY22A FY23A

Capital Structure and Cash Flow Priorities |

| ($mm) Q1 2024 Q1 2023

Revenue $ 222 $ 236

% YoY Reported Growth (5.7)% 2.0 %

⠀Revenue less Cost of Revenue⠀ $ 162 $ 172

Margin % 72.9 % 73.1 %

Adjusted EBITDA $ 7 0 $ 7 6

Adjusted EBITDA as % of Total Revenue 31.6 % 32.4%

Unlevered Pre-Tax Free Cash Flow1

$ 5 6 $ 6 1

40

Q1 2024: Fading Residual Headwinds Position Us For Growth For the Rest of 2024

Q1 2024 Summary Financial Overview

($ in Millions)

Q1 2024 Select KPIs

Q1 2024 Q1 2023

LTM Total Purchasing Customers (thousands) 769 829

LTM Growth (%) (7.2)%

LTM Total Active Annual Subscribers (thousands) 262 147

LTM Growth (%) 78.2 %

LTM Paid Download Volume (millions) 9 5 9 5

LTM Growth (%) 0.0 %

Note: Unlevered Pre-Tax FCF and Adjusted EBITDA are non-GAAP measures. Please see “Disclaimer.” Additional details regarding reconciliation of each of these metrics to the nearest GAAP measure

are available on Pages 44-45. 1 Unlevered Pre-Tax Free Cash Flow calculated as Adjusted EBITDA – Capital Expenditures.

• Q1’2024 results continue to demonstrate the consistency and resiliency of

our business, despite the residual effects of last year’s Hollywood strikes

• Profitability: Margins remain steady with gross margin of ~73% and Adjusted

EBITDA margin of ~32%, demonstrating our continued fiscal discipline

• 2024 Outlook: We remain steadfastly confident in our ability to return to

growth in 2024 as our headwinds dissipate and we flip the calendar to a

robust Editorial season in the second half of the year

• Decline in purchasing customers driven by residual headwinds in the agency

segment and a continued shift from a-la-carte purchases to committed

subscriptions

• Stable Paid Download Volume reflects the enduring demand for our content

from our global customer base

• 6

th consecutive quarter of YoY Active Annual Subscriber growth >50%, with

YoY growth of 78.2% in Q1, with the majority of growth stemming from our e-commerce subscriptions and new customer acquisition |

| 41

Hollywood Writers and Actors

Strike Resolved

Major 2024 Editorial Events

Summer Olympic Games

U.S. Presidential Election

Copa América

UEFA European Championship

Macro Improvements & Tailwinds

AI Revenue Streams

Corporate Segment Expansion

Video Consumption

International Expansion

Long-Term Growth Opportunities

Poised for Return to Growth |

| 42

Thank You

1609807673, d3sign |

| Appendix

Created with Generative AI by Getty Images |

| ($mm) 2017A 2018A 2019A 2020A 2021A 2022A 2023A

LTM as of

Q1 2024A

Reported Revenues $ 838 $ 868 $ 847 $ 814 $ 919 $ 926 $ 917 $ 903

(-) Retired Products (89) (53) (24) (3) 0 0 0 0

Revenue (Excl. Retired Products) $ 749 $ 815 $ 823 $ 811 $ 919 $ 926 $ 917 $ 903

Adjusted Revenue Growth % 9 % 1 % (1)% 1 3 % 1 % (1)%

Reported Net Income / (Loss) $(109) $(57) $(53) $(37) $ 117 $(78) $ 2 0 $ 3 0

Net Income Margin (13)% (7)% (6)% (5)% 1 3 % (8)% 2 % 3 %

(+) D&A $ 212 $ 119 $ 106 $ 9 9 $ 100 $ 9 3 $ 7 8 $ 7 3

(+) Net Interest Expense 142 142 135 125 122 117 127 129

(+/-) Income Tax Expense (Benefit) (36) 1 9 3 0 1 0 1 9 4 4 (46) (39)

Reported EBITDA $ 208 $ 223 $ 218 $ 196 $ 359 $ 177 $ 178 $ 194

(+) Equity-Based Compensation 1 3 1 0 8 8 6 9 3 8 4 1

(+) Restructuring Costs 1 0 1 7 7 9 0 (1) 0 0

(+) Loss on Debt Ext. & Modification Expenses 0 0 7 (0) 0 3 0 0

(+) Loss on Litigation, Net of Recovery 0 0 0 0 0 1 5 6 5 8

(+) Non-Recurring Operating Expenses 6 5 1 0 0 161 2 4

(+/-) FX Gains / Losses & Other Expenses (6) (6) 1 9 5 9 (56) (45) 2 8 (1)

(-) Retired Products (65) (38) (16) (2) 0 0 0 0

Adjusted EBITDA $ 167 $ 211 $ 245 $ 271 $ 309 $ 305 $ 301 $ 295

Adjusted EBITDA Growth 2 6 % 1 6 % 1 1 % 1 4 % (1)% (1)%

Adjusted EBITDA Margin 2 2 % 2 6 % 3 0 % 3 3 % 3 4 % 3 3 % 3 3 % 3 3 %

Total Debt $ 2,374 $ 2,354 $ 1,835 $ 1,829 $ 1,772 $ 1,434 $ 1,401 $ 1,386

(-) Cash & Cash Equivalents (87) (89) (113) (156) (186) (98) (137) (134)

Total Net Leverage $ 2,287 $ 2,265 $ 1,721 $ 1,672 $ 1,585 $ 1,336 $ 1,264 $ 1,252

Net Leverage / Adjusted EBITDA 13.7 x 10.7 x 7.0 x 6.2 x 5.1 x 4.4 x 4.2 x 4.2 x

Net Leverage / Reported EBITDA 11.0 x 10.2 x 7.9 x 8.5 x 4.4 x 7.6 x 7.1 x 6.5 x

Adjusted EBITDA $ 167 $ 211 $ 245 $ 271 $ 309 $ 305 $ 301 $ 295

(-) Capital Expenditures (64) (52) (46) (45) (49) (60) (57) (56)

Unlevered Pre-Tax Free Cash Flow $ 103 $ 158 $ 200 $ 226 $ 260 $ 245 $ 244 $ 239

Note: Unlevered Pre-Tax FCF and Adjusted EBITDA are non-GAAP measures. Please see “Disclaimer”.

1 Represents the removal of the historical revenue and cost of revenue as a % of revenue for certain retired products (e.g., Rights Managed, Thinkstock, Unauthorized Use).

2 Non-recurring expense related to the impairment of long-lived assets, accretion on leases, change in fair value of contingent consideration and income / loss from equity investments.

3

Includes Gain/Losses on FX Currency, Gain/Losses on FV of Hedge Derivatives and Interest Income from Investments.

44

2

3

1

1

GAAP vs. Non-GAAP Reconciliation |

| ⠀2021⠀ ⠀2021⠀ ⠀2021⠀ ⠀2021⠀ ⠀2022⠀ ⠀2022⠀ ⠀2022⠀ ⠀2022⠀ ⠀2023⠀ ⠀2023⠀ ⠀2023⠀ ⠀2023⠀ ⠀2024⠀

⠀Q1⠀ ⠀Q2⠀ ⠀Q3⠀ ⠀Q4⠀ ⠀Q1⠀ ⠀Q2⠀ ⠀Q3⠀ ⠀Q4⠀ ⠀Q1⠀ ⠀Q2⠀ ⠀Q3⠀ ⠀Q4⠀ ⠀Q1⠀

Total Creative $ 145 $ 148 $ 148 $ 156 $ 148 $ 147 $ 145 $ 145 $ 146 $ 141 $ 145 $ 146 $ 139

% YoY Reported Growth 16 % 17 % 8 % 7 % 3 % (1)% (2)% (7)% (1)% (4)% (0)% 0 % (5)%

Total Editorial $ 7 0 $ 7 2 $ 8 4 $ 8 0 $ 7 9 $ 8 3 $ 8 2 $ 8 2 $ 8 5 $ 8 0 $ 8 0 $ 7 6 $ 7 9

% YoY Reported Growth 1 % 28 % 24 % 10 % 12 % 15 % (3)% 3 % 8 % (3)% (2)% (8)% (6)%

Total Other $ 3 $ 4 $ 4 $ 4 $ 4 $ 4 $ 3 $ 4 $ 5 $ 4 $ 4 $ 4 $ 4

% YoY Reported Growth 22 % 15 % 45 % 7 % 11 % (6)% (19)% 14 % 18 % 11 % 22 % 7 % (12)%

Total Revenue $ 218 $ 224 $ 237 $ 239 $ 231 $ 233 $ 230 $ 231 $ 236 $ 226 $ 229 $ 226 $ 222

% YoY Reported Growth 10 % 21 % 13 % 8 % 6 % 4 % (3)% (3)% 2 % (3)% (1)% (2)% (6)%

Net Income (Loss) $ 30 $ 13 $ 34 $ 42 $ 25 $ 39 $(118) $(23) $ 3 $(4) $(18) $ 39 $ 14

(+) D&A 25 26 25 25 25 24 24 20 20 21 21 16 15

(+) Net Interest Expense 31 31 31 30 30 30 29 28 30 32 32 32 33

(+/-) Income Tax Expense / (Benefit) 14 (3) 9 (0) 13 15 11 5 3 3 5 (58) 11

Reported EBITDA $ 9 9 $ 6 5 $ 9 8 $ 9 6 $ 9 3 $ 108 $(54) $ 3 0 $ 5 7 $ 5 1 $ 4 0 $ 3 0 $ 7 2

(+) Equity-Based Compensation $ 2 $ 2 $ 2 $ 2 $ 2 $ 1 $ 3 $ 3 $ 6 $ 1 2 $ 9 $ 1 0 $ 9

(+) Restructuring Costs 0 0 0 0 0 0 0 0 0 0 0 0 0

(+) Loss on Debt Ext. & Modification Expenses 0 0 0 0 0 0 3 0 0 0 0 0 0

(+) Loss on Litigation, Net of Recovery 0 0 0 0 0 0 0 1 0 6 46 4 2

(+) Non-Recurring Operating Expenses (1) 0 (0) 1 3 1 162 (5) 0 0 (0) 1 3

(+/-) FX Gains / Losses & Other Expenses (25) 3 (18) (16) (19) (36) (36) 46 13 3 (15) 27 (16)

Total Adjusted EBITDA $ 7 6 $ 7 0 $ 8 2 $ 8 2 $ 7 8 $ 7 4 $ 7 8 $ 7 6 $ 7 6 $ 7 3 $ 8 0 $ 7 2 $ 7 0

Adjusted EBITDA as % of Total Revenue 35 % 31 % 34 % 34 % 34 % 32 % 34 % 33 % 32 % 32 % 35 % 32 % 32 %

Subscriptions

Subscription Revenue as % of Total Revenue 44.8% 44.3% 47.1% 46.1% 48.3% 48.2% 49.4% 50.2% 50.7% 51.8% 55.9% 54.5% 55.4%

Historical Quarterly Financials & Reconciliations

45

Note: 1 Beginning in the third quarter 2023 reporting period, the Company reclassified historical legal fees associated with our warrant litigation from “Selling, general and administrative expenses” to

“Loss on litigation” within the Condensed Consolidated Statements of Operations, and revised its Adjusted EBITDA calculation. 2 Fair value adjustments for our swaps and foreign currency exchange

contracts, foreign exchange gains (losses) and other insignificant non-operating related expenses.

1

2 |

| 46

Disclaimer

This presentation has been prepared for informational purposes only and is being provided by Getty Images Holdings, Inc. (the “Company”) and its consolidated subsidiaries, which includes Getty Images, Inc. for

use by a limited number of parties. By accepting delivery of this presentation and/or attending the meeting where this presentation is made, you agree: (1) to keep strictly confidential the contents of this

presentation and such other information and not to disclose such document, the contents thereof or any such information to any third party; (2) not to copy all or any portion of this presentation, or any such other

information; and (3) to return this presentation and all such other documents and information to the Company upon its request.

Any unauthorized use of this presentation is strictly prohibited. By accepting delivery hereof, you and any person reviewing this presentation agree that you will hold its contents and all related documents in the

strictest confidence and that you and they will not utilize such information to the detriment of the Company or for any purpose other than as set forth herein.

The information contained in this document (a) speaks only as of the date hereof and is subject to change without notice, (b) does not purport to contain all the information that may be necessary or desirable to

fully and accurately evaluate an investment in the Company and (c) is not to be considered as a recommendation by the Company that any person make an investment in the Company These materials are not, and

in no circumstances are they to be construed as, a prospectus, an offering memorandum, an advertisement, or a public offering of securities. In addition, these materials do not form part of any offer or invitation to

sell or issue, or any solicitation of any offer to purchase or subscribe for, or any offer to underwrite or otherwise acquire any securities of the Company or any other securities, nor shall they or any part of them nor

the fact of their distribution or communication form the basis of, or be relied on in connection with, any contract, commitment or investment decision in relation thereto, nor does it constitute a recommendation

regarding the securities of the Company. No securities regulatory authority or similar authority has reviewed or in any way passed upon the accuracy or adequacy of such documents or the merits of any securities

issued by the Company and any representation to the contrary is a criminal offense.

No reliance may be placed for any purposes whatsoever on the information contained in these materials or on their completeness. No representation or warranty, express or implied, is given by or on behalf of the

Company, any agent of the Company or any of such persons’ directors, officers or employees or any other person as to the accuracy or completeness of the information contained in these materials and no liability

whatsoever is accepted by the Company, any agent of the Company or any of such persons’ directors, officers or employees nor any other person for any loss how so ever arising, directly or indirectly, from any

use of such information or otherwise arising in connection therewith.

If any recipient of these materials wishes to make an investment in the Company (each such recipient, a “prospective investor”) such prospective investor must rely on their own examination of the Company,

including the merits and risks involved. Prospective investors should not construe anything in this presentation as investment, legal or tax advice. Each prospective investor should consult its own investment,

legal, tax and other advisers regarding the financial, legal, tax and other aspects of any investment in the Company.

This presentation includes market and industry data which was obtained from various publicly available sources and other independent third-party sources. Although the Company believes such sources to be

reliable, the Company has not independently verified any of the data obtained from these sources, analyzed or verified the underlying reports relied upon or referred to by such sources, or ascertained the

underlying assumptions relied upon by such sources. The Company does not make any representation as to the accuracy or completeness of such information. |

| 47

Disclaimer (Cont’d)

Forward-Looking Statements

Certain statements included in this Presentation that are not historical facts are forward-looking statements for purposes of the safe harbor provisions under the United States Private Securities Litigation Reform

Act of 1995. Forward-looking statements may be identified by the use of the words such as “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “expect,” “should,” “would,” “plan,” “project,”

“forecast,” “predict,” “potential,” “seem,” “seek,” “future,” “outlook,” “target” or similar expressions that predict or indicate future events or trends or that are not statements of historical matters. These forward-looking statements include, but are not limited to, statements regarding estimates and forecasts of other financial and performance metrics and projections of market opportunity. These statements are based on

various assumptions, whether or not identified in this report, and on the current expectations of our management and are not predictions of actual performance. These forward-looking statements are provided for

illustrative purposes only and are not intended to serve as, and must not be relied on by any investor as, a guarantee, an assurance, a prediction or a definitive statement of fact or probability. Actual events and

circumstances are difficult or impossible to predict and will differ from assumptions. Many actual events and circumstances are beyond our control.

These forward-looking statements are subject to a number of risks and uncertainties, including: our inability to continue to license third-party content and offer relevant quality and diversity of content to satisfy

customer needs; our ability to attract new customers and retain and motivate an increase in spending by its existing customers; the user experience of our customers on its websites; the extent to which we are

able to maintain and expand the breadth and quality of our content library through content licensed from third-party suppliers, content acquisitions and imagery captured by our staff of in-house photographers;

the mix of and basis upon which we license our content, including the price-points at, and the license models and purchase options through, which we license our content; the risk that we operate in a highly

competitive market; the risk that we are unable to successfully execute our business strategy or effectively manage costs; our inability to effectively manage our growth; our inability to maintain an effective

system of internal controls and financial reporting; the risk that we may lose the right to use “Getty Images” trademarks; our inability to evaluate our future prospects and challenges due to evolving markets and

customers’ industries; the legal, social and ethical issues relating to the use of new and evolving technologies, such as Artificial Intelligence (“AI”), including statements regarding AI and innovation momentum,

including our ability to expand our AI product offerings as described herein or at all; the risk that our operations in and continued expansion into international markets bring additional business, political,

regulatory, operational, financial and economic risks; our inability to adequately adapt our technology systems to ingest and deliver sufficient new content; the risk of technological interruptions or cybersecurity

breaches, incidents, and vulnerabilities; the risk that any prolonged strike by, or lockout of, one or more of the unions that provide personnel essential to the production of films or television programs, such as the

2023 strike by the writers’ union and the actors' unions, could further impact our entertainment business; the inability to expand our operations into new products, services and technologies and to increase

customer and supplier awareness of new and emerging products and services, including with respect to our AI initiatives; the loss of and inability to attract and retain key personnel that could negatively impact

our business growth; the inability to protect the proprietary information of customers and networks against security breaches and protect and enforce intellectual property rights; our reliance on third parties; the

risks related to our use of independent contractors; the risk that an increase in government regulation of the industries and markets in which we operate could negatively impact our business; the impact of

worldwide and regional political, military or economic conditions, including declines in foreign currencies in relation to the value of the U.S. dollar, hyperinflation, higher interest rates, devaluation, the impact of

recent bank failures on the marketplace and the ability to access credit and significant political or civil disturbances in international markets where we conduct business; the risk that claims, judgements, lawsuits

and other proceedings that have been, or may be, instituted against us or our predecessors could adversely affect our business; the inability to maintain the listing of our Class A common stock on the New York

Stock Exchange; volatility in our stock price and in the liquidity of the trading market for our Class A common stock; the lingering effect of the COVID-19 pandemic; changes in applicable laws or regulations; the

risks associated with evolving corporate governance and public disclosure requirements; the risk of greater than anticipated tax liabilities; the risks associated with the storage and use of personally identifiable

information; earnings-related risks such as those associated with late payments, goodwill or other intangible assets; our ability to obtain additional capital on commercially reasonable terms; the risks associated

with being an “emerging growth company” and “smaller reporting company” within the meaning of the U. S. securities laws; risks associated with our reliance on information technology in critical areas of our

operations; our inability to pay dividends for the foreseeable future; the risks associated with additional issuances of Class A common stock without stockholder approval; costs related to operating as a public

company; and other risks and uncertainties identified in “Item 1A. Risk Factors” of our most recently filed Annual Report on Form 10-K. If any of these risks materialize or our assumptions prove incorrect, actual

results could differ materially from the results implied by these forward-looking statements. |

| 48

Disclaimer (Cont’d)

These and other factors that could cause actual results to differ from those implied by the forward-looking statements in this Presentation are more fully described under the heading “Item 1A. Risk Factors” in our

most recently filed Annual Report on Form 10-K. The risks described under the heading “Item 1A. Risk Factors” are not exhaustive. New risk factors emerge from time to time and it is not possible to predict all

such risk factors, nor can we assess the impact of all such risk factors on our business or the extent to which any factor or combination of factors may cause actual results to differ materially from those contained

in any forward-looking statements. All forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by the foregoing cautionary statements. We undertake

no obligations to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

Non-GAAP Financial Measures

In order to assist investors in understanding the core operating results that our management uses to evaluate the business and for financial planning, we present the following non-GAAP measures: (1) Adjusted

EBITDA, (2) Adjusted EBITDA Margin, (3) Unlevered Pre-Tax Free Cash Flow, and (4) Net Leverage. The presentation of this financial information is not intended to be considered in isolation or as a substitute for,

or superior to, the financial information prepared and presented in accordance with U.S. GAAP.

The Company believes that these measures are relevant and provide useful information widely used by analysts, investors and other interested parties in our industry to provide a baseline for evaluating and

comparing our operating performance, and in the case of free cash flow and levered pre-tax free cash flow, our liquidity results. We also evaluate our revenue on an as reported (U.S. GAAP) and currency neutral

basis. We believe presenting currency neutral information provides valuable supplemental information regarding our comparable results, consistent with how we evaluate our performance internally.

Please see Pages 25 and 36 for definitions of such non-GAAP measures and pages 44 and 45 for reconciliations of these non-GAAP measures to the most comparable GAAP measures. Certain totals, subtotals and

percentages may not reconcile due to rounding. |

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

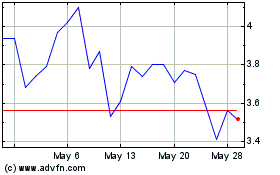

Getty Images (NYSE:GETY)

Historical Stock Chart

From Feb 2025 to Mar 2025

Getty Images (NYSE:GETY)

Historical Stock Chart

From Mar 2024 to Mar 2025