Getty Images Holdings, Inc. (NYSE: GETY) and Shutterstock (NYSE:

SSTK) today announced that they entered into a definitive merger

agreement to combine in a merger of equals transaction, creating a

premier visual content company. The combined company, which would

have an enterprise value of approximately $3.7 billioni, will be

named Getty Images Holdings, Inc and will continue to trade on the

New York Stock Exchange under the ticker symbol “GETY”.

As a combined company, Getty Images and Shutterstock will offer

a content library with greater depth and breadth for the benefit of

customers, expanded opportunities for its contributor community and

a reinforced commitment to the adoption of inclusive and

representative content. Furthermore, the stronger financial profile

of the combined company is expected to create increased capacity

for product investment and innovation for customers in a

fast-evolving and highly competitive environment.

“Today’s announcement is exciting and transformational for our

companies, unlocking multiple opportunities to strengthen our

financial foundation and invest in the future—including enhancing

our content offerings, expanding event coverage, and delivering new

technologies to better serve our customers,” said Craig Peters,

CEO, Getty Images. “With the rapid rise in demand for compelling

visual content across industries, there has never been a better

time for our two businesses to come together. By combining our

complementary strengths, we can better address customer

opportunities while delivering exceptional value to our partners,

contributors, and stockholders.”

“We are excited by the opportunities we see to expand our

creative content library and enhance our product offering to meet

diverse customer needs,” said Paul Hennessy, CEO, Shutterstock. “We

expect the merger to produce value for the customers and

stockholders of both companies by capitalizing on attractive growth

opportunities to drive combined revenues, accelerating product

innovation, realizing significant cost synergies and improving cash

flow. We look forward to working closely with the Getty Images

management team to complete the transaction and drive the next

chapter of growth.”

Strategic and Financial Benefits

- Cutting-edge innovation: Facilitates

greater investment in innovative content creation, expanded event

coverage, and customer-facing technologies and capabilities such as

search, 3D imagery and generative AI.

- Complementary portfolios: Creates a

broader set of visual content products across still imagery, video,

music, 3D and other asset types.

- Expanded opportunities for content

creators: Provides contributors substantially greater opportunities

to reach customers around the world.

- Strengthened balance sheet and

greater cash flow generation: By deleveraging the combined balance

sheet through the transaction and driving more robust cash flow,

the combined company will be well positioned to accelerate debt

repayment, reduce borrowing costs, and capitalize on new

opportunities to create value for customers and stockholders.

- Significant synergies: Drives

expected run rate synergies across SG&A and CAPEX between $150

million and $200 million achieved within the first three years

post-close, with approximately two-thirds expected to be delivered

within the first twelve to twenty-four months.

- Compelling Financial Profile: On a

pro forma 2024 basis the combined company would have an attractive

financial profile:

- Revenue of between $1,979 million

and $1,993 million, including 46% of subscription revenue

- Pre-synergy EBITDA of between $569

million and $574 million

- Pre-synergy Adjusted EBITDA less

capital expenditures of between $461 million and $466 million

- Pre-synergy net leverage of 3.0x pro

forma 2024 pre-synergy EBITDA

Leadership and Governance

At close, Getty Images’s CEO, Craig Peters, will serve as CEO of

the combined company. The combined company will have an

eleven-member Board of Directors, comprised of Getty Images CEO

Craig Peters, six directors designated by Getty Images and four

directors designated by Shutterstock, including Paul Hennessy,

Shutterstock CEO. The Chairman of the Board of Directors of the

combined company will be Mark Getty, currently Chairman of Getty

Images.

Transaction Details

Under the terms of the agreement, which was unanimously approved

by the Boards of Directors of both companies, Shutterstock

stockholders at close can elect to receive one of the

following:

- $28.84870 per share in cash for each

share of Shutterstock common stock they own;

- 13.67237 shares of Getty Images

common stock for each share of Shutterstock common stock they own;

or

- a mixed consideration of 9.17 shares

of Getty Images common stock plus $9.50 in cash for each share of

Shutterstock common stock they own.

Shutterstock shareholder elections at close are subject to

proration to ensure that the aggregate consideration payable by

Getty Images consist of $9.50 in cash per Shutterstock share as of

immediately before close and 9.17 shares of Getty Images stock per

Shutterstock share as immediately before close.

Based on the common shares outstanding as of the signing date,

the aggregate consideration payable by Getty Images would consist

of $331 million in cash and 319.4 million shares of Getty Images

stock. These figures do not include the impact of unvested

Shutterstock equityholders as of the signing date and do not assume

any vesting of currently-unvested Shutterstock equity holdings

between signing and close.

Shutterstock equityholders with unvested RSU and PSU grants at

close will only be eligible to receive the mixed consideration

noted above upon vesting with respect to such grants. Shutterstock

option holders will have their options and strike prices adjusted

by a ratio equal to the sum of (i) 9.17 and (ii) $9.50 divided by

the 10-day average closing stock price of Getty Images common stock

for the period ending two (2) business days prior to the closing as

quoted on NYSE. Equity treatment will take into account any

employment contracts in place at the close of the transaction.

Aggregate cash and share amounts are estimates and are subject to

change between signing and close.

At close, Getty Images stockholders will own approximately 54.7%

and Shutterstock stockholders will own approximately 45.3% of the

combined company on a fully diluted basis. Shutterstock will, at

the discretion of its Board of Directors, continue to declare and

pay quarterly cash dividends, in accordance with its dividend

policy, pending the close of the transaction.

Timing and Closing

The transaction is subject to the satisfaction of customary

closing conditions, including receipt of required regulatory

approvals, the approval of Getty Images and Shutterstock

stockholders and the extension or refinancing of Getty Images’

existing debt obligations.

Advisors

Berenson & Company, LLC is acting as lead financial advisor

and J.P. Morgan Securities LLC is acting as a financial advisor to

Getty Images and Skadden, Arps, Slate, Meagher & Flom LLP is

serving as legal advisor. Allen & Company LLC is acting as

exclusive financial advisor to Shutterstock and White & Case

LLP is serving as legal advisor.

Conference Call

Getty Images and Shutterstock will hold a conference call to

discuss the transaction today, January 7, 2025, at 8:30 a.m.

Eastern Time. The live webcast will be accessible through the

Investor Relations section of the each company’s website at

https://investors.gettyimages.com/ and

https://investor.shutterstock.com.

To access the call through a conference line, dial

1-800-445-7795 (in the U.S.) or 1-785-424-1699 (international

callers). The conference ID for the call is GETTY. A replay of the

conference call will be posted shortly after the call and will be

available for fourteen days following the call. To access the

replay, dial 1-844-512-2921 (in the U.S.) or 1-412-317-6671

(international callers). The access code for the replay is

11156500.

Investor Contact Getty Images:Steven

KannerInvestorrelations@gettyimages.com

Media Contact Getty Images:Anne

FlanaganAnne.flanagan@gettyimages.com

Investor Contact Shutterstock:Chris

Suhcsuh@shutterstock.com

Media Contact Shutterstock:Lori

Rodneylrodney@shutterstock.com

About Getty Images

Getty Images (NYSE: GETY) is a preeminent global visual content

creator and marketplace that offers a full range of content

solutions to meet the needs of any customer around the globe, no

matter their size. Through its Getty Images, iStock and Unsplash

brands, websites and APIs, Getty Images serves customers in almost

every country in the world and is the first-place people turn to

discover, purchase and share powerful visual content from the

world’s best photographers and videographers. Getty Images works

with over 576,000 content creators and more than 340 content

partners to deliver this powerful and comprehensive content. Each

year Getty Images covers more than 160,000 news, sport and

entertainment events providing depth and breadth of coverage that

is unmatched. Getty Images maintains one of the largest and best

privately-owned photographic archives in the world with millions of

images dating back to the beginning of photography.

Through its best-in-class creative library and Custom Content

solutions, Getty Images helps customers elevate their creativity

and entire end-to-end creative process to find the right visual for

any need. With the adoption and distribution of generative AI

technologies and tools trained on permissioned content that include

indemnification and perpetual, worldwide usage rights, Getty Images

and iStock customers can use text to image generation to ideate and

create commercially safe compelling visuals, further expanding

Getty Images capabilities to deliver exactly what customers are

looking for.

For company news and announcements, visit our

Newsroom.

About Shutterstock, Inc.

Shutterstock, Inc. (NYSE: SSTK) is a premier partner for

transformative brands, digital media and marketing companies,

empowering the world to create with confidence. Fueled by millions

of creators around the world and a fearless approach to product

innovation, Shutterstock is the leading global platform for

licensing from the most extensive and diverse collection of

high-quality 3D models, videos, music, photographs, vectors and

illustrations. From the world's largest content marketplace, to

breaking news and A-list entertainment editorial access, to

all-in-one content editing platform and studio production

service—all using the latest in innovative technology—Shutterstock

offers the most comprehensive selection of resources to bring

storytelling to life.

Learn more at www.shutterstock.com and follow us on

LinkedIn, Instagram, Twitter, Facebook and YouTube.

Additional Information about the Acquisition and Where

to Find It

In connection with the proposed transaction, Getty Images

intends to file with the Securities and Exchange Commission (the

“SEC”) a registration statement on Form S-4 that will include an

information statement of Getty Images and a proxy statement of

Shutterstock and that also will constitute a prospectus with

respect to shares of Getty Images’ common stock to be issued in the

transaction (the “joint proxy and information

statement/prospectus”). Each of Getty Images and Shutterstock may

also file with or furnish to the SEC other relevant documents

regarding the proposed transaction. This press release is not a

substitute for the joint proxy and information statement/prospectus

or any other document that Getty Images or Shutterstock may file

with or furnish to the SEC. The definitive joint proxy and

information statement/prospectus (if and when available) will be

mailed to stockholders of Getty Images and Shutterstock. BEFORE

MAKING ANY VOTING OR INVESTMENT DECISION, INVESTORS AND SECURITY

HOLDERS ARE URGED TO READ THE JOINT PROXY AND INFORMATION

STATEMENT/PROSPECTUS (WHEN AVAILABLE) AND ALL OTHER RELEVANT

DOCUMENTS THAT ARE OR WILL BE FILED WITH OR FURNISHED TO THE SEC,

AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS,

CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY CONTAIN OR WILL

CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION AND

RELATED MATTERS. Investors and security holders will be able to

obtain free copies of the joint proxy and information

statement/prospectus (if and when available) and other documents

containing important information about Getty Images, Shutterstock

and the proposed transaction, once such documents are filed with or

furnished to the SEC through the website maintained by the SEC at

www.sec.gov. Copies of the documents filed with or furnished to the

SEC by Getty Images will be available free of charge on Getty

Images’ website at investors.gettyimages.com or by contacting Getty

Images’ Investor Relations department by email at

investorrelations@gettyimages.com. Copies of the documents filed

with or furnished to the SEC by Shutterstock will be available free

of charge on Shutterstock’s website at investor. shutterstock.com

or by contacting Shutterstock’s Investor Relations department by

email at IR@Shutterstock.com.

Participants in the Solicitation

This communication is not a solicitation of proxies in

connection with the proposed transaction. Getty Images,

Shutterstock and certain of their respective directors and

executive officers and other members of their respective management

and employees may be deemed to be participants in the solicitation

of proxies in respect of the proposed transaction. Information

about the directors and executive officers of Getty Images,

including a description of their direct or indirect interests, by

security holdings or otherwise, is set forth in Getty Images’ proxy

statement for its 2024 annual meeting of stockholders, which was

filed with the SEC on April 24, 2024. Information about the

directors and executive officers of Shutterstock, including a

description of their direct or indirect interests, by security

holdings or otherwise, is set forth in Shutterstock’s proxy

statement for its 2024 annual meeting of stockholders, which was

filed with the SEC on April 26, 2024. Other information regarding

the participants in the proxy solicitations and a description of

their direct and indirect interests, by security holdings or

otherwise, will be contained in the joint proxy and information

statement/prospectus and other relevant materials to be filed with

or furnished to the SEC regarding the proposed transaction. You may

obtain free copies of these documents using the sources indicated

above.

No Offer or Solicitation

This communication is not intended to and shall not constitute

an offer to buy or sell or the solicitation of an offer to buy or

sell any securities, or a solicitation of any vote or approval, nor

shall there be any sale of securities in any jurisdiction in which

such offer, solicitation or sale would be unlawful prior to

registration or qualification under the securities laws of any such

jurisdiction. No offer of securities shall be made, except by means

of a prospectus meeting the requirements of Section 10 of the

Securities Act of 1933, as amended.

Forward Looking Statements

The statements in this press release, and any related oral

statements, include forward-looking statements concerning Getty

Images, Shutterstock, the proposed transaction described herein and

other matters. All statements, other than historical facts, are

forward-looking statements. Forward-looking statements may discuss

goals, intentions and expectations as to future plans, trends,

events, results of operations or financial condition, financings or

otherwise, based on current beliefs and involve numerous risks and

uncertainties that could cause actual results to differ materially

from expectations. Forward-looking statements speak only as of the

date they are made or as of the dates indicated in the statements

and should not be relied upon as predictions of future events, as

there can be no assurance that the events or circumstances

reflected in these statements will be achieved or will occur or the

timing thereof. Forward-looking statements can often, but not

always, be identified by the use of forward-looking terminology

including “believes,” “expects,” “may,” “will,” “should,” “could,”

“might,” “seeks,” “intends,” “plans,” “pro forma,” “estimates,”

“anticipates,” “designed,” or the negative of these words and

phrases, other variations of these words and phrases or comparable

terminology, but not all forward-looking statements include such

identifying words. Forward-looking statements are based upon

current plans, estimates and expectations that are subject to

risks, uncertainties and assumptions. Should one or more of these

risks or uncertainties materialize, or should underlying

assumptions prove incorrect, actual results may vary. The

forward-looking statements in this press release relate to, among

other things, obtaining applicable regulatory and stockholder

approvals on a timely basis or otherwise, satisfying other closing

conditions to the proposed transaction, on a timely basis or

otherwise, the expected tax treatment of the transaction, the

expected timing of the transaction, and the integration of the

businesses and the expected benefits, cost savings, accretion,

synergies and growth to result therefrom. Important factors that

could cause actual results to differ materially from such

forward-looking statements include, among other things: failure to

obtain applicable regulatory or stockholder approvals in a timely

manner or otherwise; interloper risk; failure to satisfy other

closing conditions to the transaction or to complete the

transaction on anticipated terms and timing (or at all); negative

effects of the announcement of the transaction on the ability of

Shutterstock or Getty Images to retain and hire key personnel and

maintain relationships with customers, suppliers and others who

Shutterstock or Getty Images does business, or on Shutterstock or

Getty Images’ operating results and business generally; risks that

the businesses will not be integrated successfully or that the

combined company will not realize expected benefits, cost savings,

accretion, synergies and/or growth, as expected (or at all), or

that such benefits may take longer to realize or may be more costly

to achieve than expected; the risk that disruptions from the

transaction will harm business plans and operations; risks relating

to unanticipated costs of integration; significant transaction

and/or integration costs, or difficulties in connection with the

transaction and/or unknown or inestimable liabilities; restrictions

during the pendency of the transaction that may impact the ability

to pursue certain business opportunities or strategic transactions;

potential litigation associated with the transaction; the potential

impact of the announcement or consummation of the transaction on

Getty Images’, Shutterstock’s or the combined company’s

relationships with suppliers, customers, employers and regulators;

demand for the combined company’s products; potential changes in

the Getty Images stock price that could negatively impact the value

of the consideration offered to the Shutterstock stockholders; the

occurrence of any event that could give rise to the termination of

the proposed transaction; and Getty Images’ ability to complete any

refinancing of its debt or new debt financing on a timely basis, on

favorable terms or at all. A more fulsome discussion of the risks

related to the proposed transaction will be included in the joint

proxy and information statement/prospectus. For a discussion of

factors that could cause actual results to differ materially from

those contemplated by forward-looking statements, see the section

captioned “Risk Factors” in each of Getty Images’ and

Shutterstock’s Annual Report on Form 10-K for the fiscal year ended

December 31, 2023, subsequent Quarterly Reports on Form 10-Q and

other filings with the SEC. Should one or more of these risks or

uncertainties materialize, or should underlying assumptions prove

incorrect, actual results may vary materially from those indicated

or anticipated by such forward looking statements. While the list

of factors presented here is, and the list of factors presented in

the joint proxy and information statement/prospectus will be,

considered representative, no such list should be considered to be

a complete statement of all potential risks and uncertainties.

Unlisted factors may present significant additional obstacles to

the realization of forward looking statements. Neither Getty Images

nor Shutterstock assumes, and each hereby disclaims, any obligation

to update forward-looking statements, except as may be required by

law.

______________________

i Pro-Forma Combined Enterprise Value is based on closing share

prices as of January 6, 2025.

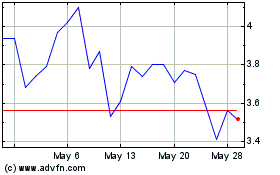

Getty Images (NYSE:GETY)

Historical Stock Chart

From Dec 2024 to Jan 2025

Getty Images (NYSE:GETY)

Historical Stock Chart

From Jan 2024 to Jan 2025