Revenue of $607.9M

Net income attributable to shareholders was

$139.7m, or $1.42 per diluted share

Canada Goose Holdings Inc. (NYSE, TSX: GOOS) announced today

financial results for the third quarter of fiscal 2025, which ended

December 29, 2024. All amounts are in Canadian dollars unless

otherwise indicated.

“Our third quarter results highlight the power of strong

execution during a key consumer shopping period, particularly in

December where we saw significant acceleration in the business,"

said Dani Reiss, Chairman and CEO of Canada Goose. “Brand momentum

was robust in the quarter, amplified by the integrated global

launch of our new Snow Goose collection which drove record-setting

media coverage and a three-year high in brand search. Our retail

execution delivered solid results despite ongoing macro challenges

and, looking ahead, our focus remains on balancing operational

excellence with strategic investments and strengthening the

foundations that will continue driving both brand heat and

commercial momentum across all our channels.”

Third Quarter Fiscal 2025 Business Highlights:

Notable highlights from our third quarter included the

following:

- Launched Haider Ackermann’s inaugural capsule, reintroducing

our Snow Goose label through a fulsome 360° campaign. The campaign

included impactful in-store activations, influencer collaborations,

social media campaigns, and brand events in locations including

Iceland, Seoul, and Toronto.

- As part of our brand evolution, elevated the wholesale shopping

experience at Selfridges, London with a bold visual expression,

launching a Polar Bears International pop-up and taking over the

window displays with our Fall Winter 24 collection.

- Opened two concession-based shop-in-shops bringing the total

permanent store count to 74 at the end of the third quarter of

fiscal 2025, strengthening our position in key markets.

Subsequent to Third Quarter Fiscal 2025

- Launched our Eyewear collection through our licensee

partnership with Marchon Eyewear, representing a significant

milestone in our ongoing product expansion journey.

- Appointed Judit Bankus as our new Head of Merchandising.

Third Quarter Financial Highlights1: All Year-Over-Year

Comparisons Unless Otherwise Noted:

- Total revenue decreased $2.0m to $607.9m, down 2.2% on a

constant currency basis2.

- DTC revenue increased 0.7% to $517.8m, or down 1.4% on a

constant currency basis2 with DTC comparable sales3 declining 6.2%,

partially offset by sales from non-comparable stores.

- Wholesale revenue decreased 7.5% to $75.7m or 8.1% on a

constant currency basis2 due to a planned lower order book as we

continue to elevate our presence within this sales channel by

right-sizing our inventory position and building strong

relationships with brand-aligned partners.

- Other revenue increased $0.3m to $14.4m.

- Gross profit increased 0.5% to $452.0m. Gross margin for

the quarter was 74.4% compared to 73.7% in the third quarter of

fiscal 2024 primarily due to pricing and lower inventory

provisioning, partially offset by product mix.

- Selling, general and administrative (SG&A) expenses

were $247.7m, compared to $250.9m in the prior year period. The

reduction in SG&A was primarily due to corporate expense

efficiencies, including our fiscal 2024 workforce reductions, as

well non-recurrence of costs relating to the Transformation Program

and foreign exchange fluctuations. This was partially offset by a

planned increase in marketing spend associated with the Snow Goose

campaign and increase in store expenses such as labor related to

the expansion of our global retail network.

- Operating Income was $204.3m, compared to $198.8m in the

prior year period.

- Adjusted EBIT4 was $205.2m, compared to $207.2m in the

prior year period.

- Net income attributable to shareholders was $139.7m, or

$1.42 per diluted share, compared with a net income attributable to

shareholders of $130.6m, or $1.29 per diluted share in the prior

year period.

- Adjusted net income attributable to shareholders4 was

$148.3m, or $1.51 per diluted share, compared with an adjusted net

income attributed to shareholders of $138.6m, or $1.37 per diluted

share in the prior year period.

Balance Sheet Highlights

Inventory of $407.4m for the third quarter ended December 29,

2024, was down 15% year-over-year, due to a temporary reduction in

production levels.

The Company ended the third quarter of fiscal 2025 with net

debt4 of $546.4m, compared with $587.4m at the end of the third

quarter of fiscal 2024 due to higher cash balances primarily driven

by working capital release this fiscal year. The Company renewed

its normal course issuer bid (the “NCIB”) in the third quarter of

fiscal 2025, allowing the company to purchase for cancellation up

to 4,556,841 subordinate voting shares over the 12-month period

commencing on November 22, 2024 and ending on November 21, 2025,

representing 10% of the “public float” determined in accordance

with the requirements of the Toronto Stock Exchange as at November

8, 2024.

Fiscal 2025 Outlook5

The outlook that follows constitutes “financial outlook” and

“forward-looking information” within the meaning of applicable

securities laws, and is based on a number of assumptions and

subject to a number of risks. The purpose of this outlook is to

provide a description of management's expectations regarding the

Company's annual financial performance and may not be appropriate

for other purposes. Actual results could vary materially as a

result of numerous factors, including certain risk factors, many of

which are beyond the company’s control. Please see "Forward-looking

Statements" below for more information.

Canada Goose is updating the fiscal 2025 guidance issued with

second quarter fiscal 2025 results published on November 7, 2024 to

the following:

All results versus prior fiscal year

unless otherwise noted

Prior Outlook (as of November 7,

2024)

Current Outlook (as of February

6, 2025)

Total Revenue Growth (%)

Low-single digit increase to low-single

digit decrease

Low-single digit increase to low-single

digit decrease

Non-IFRS Adjusted EBIT Margin

+60 basis points to -60 basis points

Flat to -100 basis points

Non-IFRS Adjusted Net Income per Diluted

Share growth (%)

Mid-single digit increase

Low-single digit increase to flat

Our updated outlook takes into account our DTC year-to-date

performance, which fell short of our expectations due to trends in

global luxury consumer spending, and an increase in marketing

investments in fiscal 2025, along with the following

assumptions:

All results versus prior fiscal year

unless otherwise noted

Prior Assumption (as of November

7, 2024)

Current Assumption (as of

February 6, 2025)

Note

1H FY2025 vs 2H FY2025 revenue split

Approximate 25%/75% distribution split

between 1H and 2H of fiscal 2025

Approximate 25%/75% distribution split

between 1H and 2H of fiscal 2025

No Change

DTC Comparable Sales Growth (%)

Low-single digit increase to low-single

digit decrease

Flat to Mid-single digit decrease

Revised

Retail store expansion

Opening two new stores and three new

concession-based shop-in-shops

Opening two new stores and three new

concession-based shop-in-shops

No Change

Pricing Increase (%)

Average mid-single digit increase

Average mid-single digit increase

No Change

Wholesale Revenue Growth (%)

20% decrease

20% decrease

No Change

Consolidated Gross Margin

Similar to Fiscal 2024

Similar to Fiscal 2024

No Change

Weighted Average Diluted Shares

Outstanding

Approximately 98 million shares

Approximately 98 million shares

No Change

Conference Call Information

The Company will host the conference call at 8:30 a.m. EDT on

February 6, 2025. The conference call can be accessed by using the

following link: https://events.q4inc.com/attendee/451792319. After

registering, an email will be sent including dial-in details and a

unique conference call pin required to join the live call. A live

webcast of the conference call will also be available on the

investor relations page of the Company's website at

http://investor.canadagoose.com.

About Canada Goose

Canada Goose is a performance luxury outerwear, apparel,

footwear and accessories brand that inspires all people to thrive

in the world outside. We are globally recognized for our commitment

to Canadian manufacturing and our high standards of quality,

craftsmanship and functionality. We believe in the power of

performance, the importance of experience, and that our purpose is

to keep the planet cold and the people on it warm. For more

information, visit www.canadagoose.com.

Cautionary Note Regarding Forward-Looking Statements

This press release contains forward-looking statements,

including statements relating to our updated fiscal 2025 financial

outlook, the related assumptions included herein, the execution of

our proposed strategy, and our operating performance and prospects.

These forward-looking statements generally can be identified by the

use of words such as “believe,” “could,” “continue,” “expect,”

“estimate,” “may,” “potential,” “would,” “will,” and other words of

similar meaning. Each forward-looking statement contained in this

press release is subject to substantial risks and uncertainties

that could cause actual results to differ materially from those

expressed or implied by such statement. Applicable risks and

uncertainties include, among others, the impact on our operations

of the current global economic conditions and international trade

environment and their evolution and are discussed under “Cautionary

Note regarding Forward-Looking Statements” and “Factors Affecting

our Performance” in our Management's Discussion and Analysis

("MD&A") as well as under “Risk Factors” in our Annual Report

on Form 20-F for the year ended March 31, 2024. You are also

encouraged to read our filings with the SEC, available at

www.sec.gov, and our filings with Canadian securities regulatory

authorities available on SEDAR+ at www.sedarplus.ca for a

discussion of these and other risks and uncertainties. Investors,

potential investors, and others should give careful consideration

to these risks and uncertainties. We caution investors not to rely

on the forward-looking statements contained in this press release

when making an investment decision in our securities.

Although we base the forward-looking statements contained in

this press release on assumptions that we believe are reasonable,

we caution readers that actual results and developments (including

our results of operations, financial condition and liquidity, and

the development of the industry in which we operate) may differ

materially from those made in or suggested by the forward-looking

statements contained in this press release. Additional impacts may

arise that we are not aware of currently. The potential of such

additional impacts intensifies the business and operating risks

which we face, and these should be considered when reading the

forward-looking statements contained in this press release. In

addition, even if results and developments are consistent with the

forward-looking statements contained in this press release, those

results and developments may not be indicative of results or

developments in subsequent periods. As a result, any or all of our

forward-looking statements in this press release may prove to be

inaccurate. No forward-looking statement is a guarantee of future

results. Moreover, we operate in a highly competitive and rapidly

changing environment in which new risks often emerge. It is not

possible for our management to predict all risks, nor can we assess

the impact of all factors on our business or the extent to which

any factor, or combination of factors, may cause actual results to

differ materially from those contained in any forward-looking

statements we may make. Consequently, all of the forward-looking

information contained herein is qualified by the foregoing

cautionary statements. You should read this press release and the

documents that we reference herein completely and with the

understanding that our actual future results may be materially

different from what we expect. The forward-looking statements

contained herein are made as of the date of this press release (or

as of the date specifically indicated therein), and we do not

assume any obligation to update any forward-looking statements

except as required by applicable laws. For greater certainty,

references herein to “forward-looking statements” include

“forward-looking information” within the meaning of Canadian

securities laws.

Condensed Consolidated Interim Statements of Income (in

millions of Canadian dollars, except per share amounts)

Third quarter ended

Three quarters ended

December 29,

2024

December 31,

2023

December 29,

2024

December 31,

2023

$

$

$

$

Revenue

607.9

609.9

963.8

975.8

Cost of sales

155.9

160.2

295.1

291.4

Gross profit

452.0

449.7

668.7

684.4

Selling, general & administrative

expenses

247.7

250.9

559.7

583.0

Operating income

204.3

198.8

109.0

101.4

Net interest, finance and other costs

14.3

14.8

26.0

42.9

Income before income taxes

190.0

184.0

83.0

58.5

Income tax expense

46.4

52.6

7.1

8.0

Net income

143.6

131.4

75.9

50.5

Attributable to:

Shareholders of the Company

139.7

130.6

67.7

53.4

Non-controlling interest

3.9

0.8

8.2

(2.9

)

Net income

143.6

131.4

75.9

50.5

Earnings per share attributable to

shareholders of the Company

Basic

$

1.44

$

1.30

$

0.70

$

0.52

Diluted

$

1.42

$

1.29

$

0.69

$

0.52

Condensed Consolidated Interim Statements of Comprehensive

Income (in millions of Canadian dollars, except per share

amounts)

Third quarter ended

Three quarters ended

December 29,

2024

December 31,

2023

December 29,

2024

December 31,

2023

$

$

$

$

Net income

143.6

131.4

75.9

50.5

Other comprehensive income

Items that will not be reclassified to

earnings, net of tax:

Actuarial loss on post-employment

obligation

—

(0.1

)

(0.7

)

(0.3

)

Items that may be reclassified to

earnings, net of tax:

Cumulative translation adjustment (loss)

gain

(7.5

)

6.7

10.0

0.2

Net loss on derivatives designated as cash

flow hedges

(1.2

)

(7.5

)

(10.2

)

(1.5

)

Reclassification of net loss (gain) on

cash flow hedges to income

1.4

0.1

1.3

(0.9

)

Other comprehensive (loss) income

(7.3

)

(0.8

)

0.4

(2.5

)

Comprehensive income

136.3

130.6

76.3

48.0

Attributable to:

Shareholders of the Company

132.6

129.7

68.1

51.6

Non-controlling interest

3.7

0.9

8.2

(3.6

)

Comprehensive income

136.3

130.6

76.3

48.0

Condensed Consolidated Interim Statements of Financial

Position (in millions of Canadian dollars)

December 29,

2024

December 31,

2023

March 31, 2024

Assets

$

$

$

Current assets

Reclassified

Reclassified

Cash

285.2

154.3

144.9

Trade receivables

174.9

144.5

70.4

Inventories

407.4

478.4

445.2

Income taxes receivable

15.9

8.1

28.0

Other current assets

55.0

61.0

52.3

Total current assets

938.4

846.3

740.8

Deferred income taxes

102.4

90.3

76.3

Property, plant and equipment

164.9

177.2

171.8

Intangible assets

132.2

132.1

135.1

Right-of-use assets

299.4

272.7

279.8

Goodwill

71.3

76.5

70.8

Other long-term assets

15.6

6.8

7.0

Total assets

1,724.2

1,601.9

1,481.6

Liabilities

Current liabilities

Accounts payable and accrued

liabilities

215.6

268.8

177.7

Provisions

69.7

78.3

49.1

Income taxes payable

25.9

14.5

16.8

Short-term borrowings

70.6

38.7

9.4

Current portion of lease liabilities

84.7

76.4

79.9

Total current liabilities

466.5

476.7

332.9

Provisions

16.0

13.9

14.3

Deferred income taxes

13.4

13.6

17.2

Term Loan

410.5

381.0

388.5

Lease liabilities

265.3

244.9

250.6

Other long-term liabilities

43.1

70.9

54.6

Total liabilities

1,214.8

1,201.0

1,058.1

Equity

Equity attributable to shareholders of the

Company

494.7

396.5

417.0

Non-controlling interests

14.7

4.4

6.5

Total equity

509.4

400.9

423.5

Total liabilities and equity

1,724.2

1,601.9

1,481.6

Condensed Consolidated Interim Statements of Cash Flows

(in millions of Canadian dollars)

Third quarter ended

Three quarters ended

December 29,

2024

December 31,

2023

December 29,

2024

December 31,

2023

$

$

$

$

Operating activities

Net income

143.6

131.4

75.9

50.5

Items not affecting cash:

Depreciation and amortization

32.6

32.2

97.5

92.0

Income tax expense

46.4

52.6

7.1

8.0

Interest expense

14.9

11.8

37.5

32.1

Foreign exchange loss (gain)

0.7

(1.4

)

(1.2

)

(1.9

)

Loss on disposal of assets

0.5

0.1

0.9

0.1

Share-based payment

3.6

4.3

9.8

11.5

Remeasurement of put option

0.7

4.9

1.6

15.7

Remeasurement of contingent

consideration

(1.3

)

(1.9

)

(13.1

)

(4.9

)

241.7

234.0

216.0

203.1

Changes in non-cash operating items

118.4

134.0

(20.2

)

(32.2

)

Income taxes paid

(3.9

)

(7.6

)

(11.2

)

(56.6

)

Interest paid

(8.2

)

(12.1

)

(29.9

)

(32.5

)

Net cash from operating

activities

348.0

348.3

154.7

81.8

Investing activities

Purchase of property, plant and

equipment

(9.5

)

(15.1

)

(14.9

)

(46.3

)

Investment in intangible assets

(0.1

)

(0.2

)

(0.1

)

(0.7

)

Initial direct costs of right-of-use

assets

(0.3

)

—

(0.4

)

(0.4

)

Net cash outflow from business

combination

—

(12.3

)

—

(12.3

)

Net cash used in investing

activities

(9.9

)

(27.6

)

(15.4

)

(59.7

)

Financing activities

Mainland China Facilities (repayments)

borrowings

(44.3

)

(38.2

)

30.1

(0.5

)

Japan Facility borrowings (repayments)

3.8

(3.7

)

29.8

11.7

Term Loan repayments

—

(1.0

)

(2.0

)

(3.0

)

Revolving Facility repayments

(60.9

)

(86.3

)

—

—

Transaction costs on financing

activities

—

0.1

—

(0.2

)

Normal course issuer bid purchase of

subordinate voting shares

—

(54.3

)

—

(111.7

)

Principal payments on lease

liabilities

(23.2

)

(21.0

)

(64.1

)

(49.7

)

Issuance of shares

0.6

—

0.6

0.1

Net cash used in financing

activities

(124.0

)

(204.4

)

(5.6

)

(153.3

)

Effects of foreign currency exchange rate

changes on cash

2.3

0.5

6.6

(1.0

)

Increase (decrease) in cash

216.4

116.8

140.3

(132.2

)

Cash, beginning of period

68.8

37.5

144.9

286.5

Cash, end of period

285.2

154.3

285.2

154.3

Non-IFRS Financial Measures and Other Specified Financial

Measures

This press release includes references to certain non-IFRS

financial measures such as adjusted EBIT, adjusted net income

(loss) attributable to shareholders of the Company, net debt, and

constant currency revenue and certain non-IFRS ratios such as,

adjusted EBIT margin and adjusted net income (loss) per basic and

diluted share attributable to the shareholders of the Company.

These financial measures are employed by the Company to measure its

operating and economic performance and to assist in business

decision-making, as well as providing key performance information

to senior management. The Company believes that, in addition to

conventional measures prepared in accordance with IFRS, certain

investors and analysts use this information to evaluate the

Company’s operating and financial performance. These financial

measures are not defined under IFRS nor do they replace or

supersede any standardized measure under IFRS. Other companies in

our industry may calculate these measures differently than we do,

limiting their usefulness as comparative measures. Additional

information, including definitions and reconciliations of non-IFRS

financial measures to the nearest IFRS financial measure can be

found in our MD&A for the third quarter and three quarters

ended December 29, 2024, under “Non-IFRS Financial Measures and

Other Specified Financial Measures”. Such reconciliations can also

be found in this press release under “Reconciliation of Non-IFRS

Measures” below.

This press release also includes references to DTC comparable

sales (decline) growth which is a supplementary financial measure

defined as a rate of (decline) growth of sales on a constant

currency basis from e-Commerce sites and stores which have been

operating for one full year (12 successive fiscal months). The

measure excludes store sales from both periods for the specific

trading days when the stores were closed, whether those closures

occurred in the current period or the comparative period.

Reconciliation of Non-IFRS Measures

The tables below reconcile net income to adjusted EBIT and

adjusted net income attributable to shareholders of the Company for

the periods indicated, constant currency revenue to revenue across

segments and geographies, and net debt for purposes of presenting

its calculation. Adjusted EBIT margin is equal to adjusted EBIT for

the period presented as a percentage of revenue for the same

period.

Third quarter ended

Three quarters ended

CAD $ millions

December 29,

2024

December 31,

2023

December 29,

2024

December 31,

2023

Net income

143.6

131.4

75.9

50.5

Add (deduct) the impact of:

Income tax expense

46.4

52.6

7.1

8.0

Net interest, finance and other costs

14.3

14.8

26.0

42.9

Operating income

204.3

198.8

109.0

101.4

Head office transition costs (a)

—

—

—

0.8

Japan Joint Venture costs (c)

—

2.3

—

2.4

Transformation Program costs (e)

—

5.6

—

26.6

Paola Confectii Earn-Out costs (f)

0.9

0.5

2.7

0.5

Total adjustments

0.9

8.4

2.7

30.3

Adjusted EBIT

205.2

207.2

111.7

131.7

Adjusted EBIT margin

33.8

%

34.0

%

11.6

%

13.5

%

Third quarter ended

Three quarters ended

CAD $ millions

December 29,

2024

December 31,

2023

December 29,

2024

December 31,

2023

Net income

143.6

131.4

75.9

50.5

Add (deduct) the impact of:

Head office transition costs (a) (b)

—

—

—

1.2

Japan Joint Venture costs (c)

—

2.3

—

2.4

Japan Joint Venture remeasurement (gain)

loss on contingent consideration and put option (d)

(0.6

)

3.0

(11.5

)

10.8

Transformation Program costs (e)

—

5.6

—

26.6

Paola Confectii Earn-Out costs (f)

0.9

0.5

2.7

0.5

Unrealized foreign exchange loss on Term

Loan (g)

4.9

0.5

5.7

—

5.2

11.9

(3.1

)

41.5

Tax effect of adjustments

(0.8

)

(1.3

)

(1.2

)

(6.2

)

Deferred tax adjustment (h)

—

—

—

(0.5

)

Adjusted net income

148.0

142.0

71.6

85.3

Adjusted net income (loss) attributable to

non-controlling interest (i)

0.3

(3.4

)

5.8

(3.6

)

Adjusted net income attributable to

shareholders of the Company

148.3

138.6

77.4

81.7

Weighted average number of shares

outstanding

Basic

96,798,985

100,253,473

96,714,942

102,144,232

Diluted

98,172,212

101,308,836

98,033,979

103,125,365

Adjusted net income per basic share

attributable to shareholders of the Company

$

1.53

$

1.38

$

0.80

$

0.80

Adjusted net income per diluted share

attributable to shareholders of the Company

$

1.51

$

1.37

$

0.79

$

0.79

(a)

Costs incurred for the corporate head

office transition, including depreciation on right-of-use

assets.

(b)

Corporate head office transition costs

incurred in (a) as well as $nil and $0.4m of interest expense on

lease liabilities for the third and three quarters ended December

31, 2023, respectively.

(c)

Costs incurred in connection with the

establishment of the Japan Joint Venture. This is driven by the

impact of gross margin that would otherwise have been recognized on

the sale of inventory recorded at net realizable value less costs

to sell, as well as other costs of establishing the Japan Joint

Venture.

(d)

Changes to the fair value remeasurement of

the contingent consideration and put option liability, inclusive of

translation gains and losses, related to the Japan Joint Venture.

The Company recorded gains of $0.6m and $11.5m on the fair value

remeasurement of the contingent consideration and put option during

the third and three quarters ended December 29, 2024, respectively

(third and three quarters ended December 31, 2023 - losses of $3.0m

and $10.8m, respectively). These gains and losses are included in

net interest, finance and other costs within the interim statements

of income.

(e)

Transformation Program costs include

consultancy fees of $5.6m and $21.1m, as well as severance costs,

net of shared-based award forfeitures of $nil and $5.5m, associated

with the reduction in workforce for the third and three quarters

ended December 31, 2023, respectively.

(f)

Additional consideration payable to the

controlling shareholders of Paola Confectii SRL (“PCML Vendors”) if

certain performance conditions are met based on financial results

(“Earn-Out”) related to the acquisition of Paola Confectii SRL,

recognized as renumeration expense.

(g)

Unrealized gains and losses on the

translation of the term loan facility from USD to CAD, net of the

effect of derivative transactions entered into to hedge a portion

of the exposure to foreign currency exchange risk. These costs are

included in net interest, finance and other costs within the

interim statements of income.

(h)

Deferred tax adjustment recorded as the

result of Swiss tax reform in Canada Goose International AG.

(i)

Calculated as net income attributable to

non-controlling interest within the interim statements of income of

$0.3m and $5.8m for the put option liability and contingent

consideration revaluation related to the non-controlling interest

within the Japan Joint Venture for the third and three quarters

ended December 29, 2024, respectively. Net income (loss)

attributable to non-controlling interest within the interim

statements of income of $(0.8)m and $2.9m plus $(2.6)m and $(6.5)m

for the gross margin adjustment and the put option liability and

contingent consideration revaluation related to the non-controlling

interest within the Japan Joint Venture for the third and three

quarters ended December 31, 2023, respectively.

Revenue By Segment

Third quarter ended

$ Change

% Change

CAD $ millions

December 29,

2024

December 31,

2023

As reported

Foreign exchange

impact

In constant currency

As reported

In constant currency

DTC

517.8

514.0

3.8

(11.1

)

(7.3

)

0.7

%

(1.4

)%

Wholesale

75.7

81.8

(6.1

)

(0.5

)

(6.6

)

(7.5

)%

(8.1

)%

Other

14.4

14.1

0.3

(0.1

)

0.2

2.1

%

1.4

%

Total revenue

607.9

609.9

(2.0

)

(11.7

)

(13.7

)

(0.3

)%

(2.2

)%

Revenue by Geography

Third quarter ended

$ Change

% Change

CAD $ millions

December 29,

2024

December 31,

2023

As reported

Foreign exchange

impact

In constant currency

As reported

In constant currency

Canada

91.1

94.9

(3.8

)

—

(3.8

)

(4.0

)%

(4.0

)%

United States

161.5

157.5

4.0

(4.5

)

(0.5

)

2.5

%

(0.3

)%

North America

252.6

252.4

0.2

(4.5

)

(4.3

)

0.1

%

(1.7

)%

Greater China1

219.6

230.5

(10.9

)

(6.7

)

(17.6

)

(4.7

)%

(7.6

)%

Asia Pacific (excluding Greater

China1)

50.9

40.2

10.7

0.7

11.4

26.6

%

28.4

%

Asia Pacific

270.5

270.7

(0.2

)

(6.0

)

(6.2

)

(0.1

)%

(2.3

)%

EMEA2

84.8

86.8

(2.0

)

(1.2

)

(3.2

)

(2.3

)%

(3.7

)%

Total revenue

607.9

609.9

(2.0

)

(11.7

)

(13.7

)

(0.3

)%

(2.2

)%

1.

Greater China comprises Mainland China,

Hong Kong, Macau, and Taiwan.

2.

EMEA comprises Europe, the Middle East,

Africa, and Latin America.

Indebtedness

CAD $ millions

December 29,

2024

December 31,

2023

$ Change

March 31, 2024

$ Change

Cash

285.2

154.3

130.9

144.9

140.3

Mainland China Facilities

(30.1

)

(9.3

)

(20.8

)

—

(30.1

)

Japan Facility

(35.2

)

(25.4

)

(9.8

)

(5.4

)

(29.8

)

Revolving Facility

—

—

—

—

—

Term Loan

(416.3

)

(385.7

)

(30.6

)

(393.1

)

(23.2

)

Lease liabilities

(350.0

)

(321.3

)

(28.7

)

(330.5

)

(19.5

)

Net debt

(546.4

)

(587.4

)

41.0

(584.1

)

37.7

____________________________________

1 Comparisons to third quarter ended

December 31, 2023.

2 Constant currency revenue is a non-IFRS

financial measure. See “Non-IFRS Financial Measures and Other

Specified Financial Measures” for more information.

3 DTC comparable sales (decline) growth is

a supplementary financial measure. See “Non-IFRS Financial Measures

and Other Specified Financial Measures” for a description of this

measure.

4 Adjusted EBIT, adjusted net income

attributable to shareholders of the Company, and net debt are

non-IFRS financial measures, and Adjusted EBIT margin, and adjusted

net income per diluted share attributable to the shareholders of

the Company are non-IFRS financial ratios. See “Non-IFRS Financial

Measures and Other Specified Financial Measures” for more

information.

5 The Company is not able to provide,

without unreasonable effort, a reconciliation of the guidance for

non-IFRS adjusted EBIT and non-IFRS adjusted net income per diluted

share to the most directly comparable IFRS measure because the

Company does not currently have sufficient data to accurately

estimate the variables and individual adjustments included in the

most directly comparable IFRS measure that would be necessary for

such reconciliations, including (a) income tax related accruals in

respect of certain one-time items (b) the impact of foreign

currency exchange and (c) non-recurring expenses that cannot

reasonably be estimated in advance. These adjustments are

inherently variable and uncertain and depend on various factors

that are beyond the Company's control and as a result it is also

unable to predict their probable significance. Therefore, because

management cannot estimate on a forward-looking basis without

unreasonable effort the impact these variables and individual

adjustments will have on its reported results in accordance with

IFRS, we are unable to provide a reconciliation of the non-IFRS

measures included in our fiscal 2025 guidance.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250206755048/en/

Investors: ir@canadagoose.com Media: media@canadagoose.com

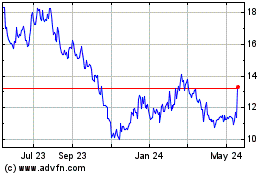

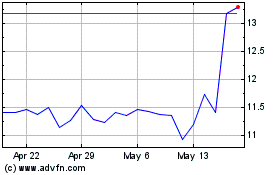

Canada Goose (NYSE:GOOS)

Historical Stock Chart

From Jan 2025 to Feb 2025

Canada Goose (NYSE:GOOS)

Historical Stock Chart

From Feb 2024 to Feb 2025