Granite Point Mortgage Trust Inc. Announces Second Quarter 2024 Common and Preferred Stock Dividends and Business Update

19 June 2024 - 6:59AM

Business Wire

Granite Point Mortgage Trust Inc. (NYSE: GPMT) (“GPMT,” “Granite

Point” or the “Company”) today announced that the Company’s Board

of Directors declared a quarterly cash dividend of $0.05 per share

of common stock for the second quarter of 2024. This dividend is

payable on July 15, 2024, to holders of record of common stock at

the close of business on July 1, 2024.

The Company’s Board of Directors also declared a quarterly cash

dividend of $0.4375 per share of the 7.00% Series A

Fixed-to-Floating Rate Cumulative Redeemable Preferred Stock for

the second quarter of 2024. This dividend is payable on July 15,

2024, to the holders of record of the Series A Preferred Stock at

the close of business on July 1, 2024.

“In setting the current level of our common dividend, the Board

considered a number of factors, including our strategic focus on

supporting book value during a period of reduced profitability of

the Company due to the ongoing real estate market challenges,” said

Jack Taylor, President and Chief Executive Officer of Granite

Point. “Additionally, it will enhance our flexibility to

opportunistically repurchase our common shares. Consistent with our

prevailing view that our stock represents an attractive value for

investors, during the quarter we repurchased 0.5 million shares of

our common stock at a compelling valuation versus our book value.

We have also continued to make progress resolving our nonperforming

loans, two of which are noted below, and which such resolutions

should improve our run-rate profitability. We believe that our

strategy of protecting both sides of the balance sheet through

emphasizing liquidity and proactive asset management will position

us well for long-term success.”

Second Quarter Business Update

- In June, the Company resolved an $11.6 million senior loan that

had been on nonaccrual status. The resolution involved a

coordinated sale of the collateral property, a multifamily asset

located in Milwaukee, WI. As a result of this transaction, the

Company expects to realize a loss of approximately $(2.5) million,

which had been reserved for through a previously recorded allowance

for credit loss on this loan and will be reflected in the Company’s

financial results for the second quarter of 2024.

- An office property located in Los Angeles, CA, securing the

Company’s $37.6 million senior loan, is currently under contract to

be sold. The loan was previously placed on nonaccrual status. The

potential transaction is expected to close during the third quarter

of 2024.

- During the quarter, the Company repurchased 0.5 million shares

of its common stock at an average price of $3.10 per share for a

total of approximately $1.6 million. Consistent with its flexible

capital return strategy and the goal of supporting long-term

shareholder value, since June of 2021, the Company has repurchased

approximately 5.4 million of its common shares representing

approximately 10% of its common shares outstanding.

- The Company funded approximately $10 million on existing loan

commitments during the quarter and realized about $45 million in

repayments and paydowns, excluding the nonaccrual resolution

referenced above.

About Granite Point Mortgage Trust Inc.

Granite Point Mortgage Trust Inc. is a Maryland corporation

focused on directly originating, investing in and managing senior

floating-rate commercial mortgage loans and other debt and

debt-like commercial real estate investments. Granite Point is

headquartered in New York, NY. Additional information is available

at www.gpmtreit.com.

Forward-Looking Statements

This press release contains, or incorporates by reference, not

only historical information, but also forward-looking statements

within the meaning of the Private Securities Litigation Reform Act

of 1995. Forward-looking statements are not historical in nature

and can be identified by words such as “anticipate,” “estimate,”

“will,” “should,” “expect,” “target,” “believe,” “outlook,”

“potential,” “continue,” “intend,” “seek,” “plan,” “goals,”

“future,” “likely,” “may” and similar expressions or their negative

forms, or by references to strategy, plans or intentions. The

illustrative examples herein are forward-looking statements. Our

expectations, beliefs and estimates are expressed in good faith,

and we believe there is a reasonable basis for them. However, there

can be no assurance that management's expectations, beliefs and

estimates will prove to be correct or be achieved, and actual

results may vary materially from what is expressed in or indicated

by the forward-looking statements.

These forward-looking statements are subject to risks and

uncertainties, including, among other things, those described in

our Annual Report on Form 10-K for the year ended December 31,

2023, under the caption “Risk Factors,” and our subsequent filings

made with the SEC. Forward-looking statements speak only as of the

date they are made, and we undertake no obligation to update or

revise any such forward-looking statements, whether as a result of

new information, future events or otherwise.

Additional Information

Stockholders of Granite Point and other interested persons may

find additional information regarding the Company at the Securities

and Exchange Commission’s Internet site at www.sec.gov or by

directing requests to: Granite Point Mortgage Trust Inc., 3 Bryant

Park, 24th floor, New York, NY 10036, telephone (212) 364-5500.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240618528575/en/

Investors: Chris Petta, Investor Relations, Granite Point

Mortgage Trust Inc., (212) 364-5500, investors@gpmtreit.com

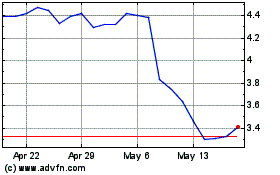

Granite Point Mortgage (NYSE:GPMT)

Historical Stock Chart

From Nov 2024 to Dec 2024

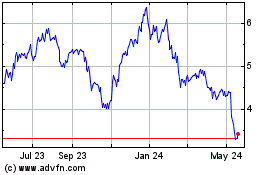

Granite Point Mortgage (NYSE:GPMT)

Historical Stock Chart

From Dec 2023 to Dec 2024