Increasing Activity in the Second Half of

2023 Accelerating Shareholder Returns

GeoPark Limited (“GeoPark” or the “Company”) (NYSE: GPRK), a

leading independent Latin American oil and gas explorer, operator

and consolidator, today announces its operational update for the

three-month period ended June 30, 2023 (“2Q2023”).

All figures are expressed in US Dollars. Growth comparisons

refer to the same period of the prior year, except when otherwise

specified.

Oil and Gas Production

- Consolidated average oil and gas production of 36,581 boepd,

below its production potential of approximately 39,500-40,500

boepd, as previously announced on March 8, April 11 and May 3,

2023, mainly due to temporarily shut-in production in the CPO-5

block (GeoPark non-operated, 30% WI) in Colombia and to a lesser

extent, in the Fell block (GeoPark operated, 100% WI) in Chile

- 9 rigs in operation in June 2023 (5 drilling rigs and 4

workover rigs), with 3 more rigs to be added in 3Q2023 (two

drilling rigs and one workover rig)

Colombia - Llanos Basin

Llanos 34 block (GeoPark operated, 45% WI):

- Average gross production of 55,307 bopd (up 1% vs 1Q2023)

- Three drilling and four workover rigs currently in

operation

- Spudded a second horizontal development well in the Tigana

Field

- The well was drilled to a total depth of 14,030 feet and a

horizontal lateral length of 1,680 feet

- Total depth reached in July 2023, expecting to complete the

well and initiate testing in late July 2023

- Second horizontal well was drilled within budget and ahead of

time. Also, was drilled 16% faster, 10% lower drilling costs, and

with 32% longer lateral length as compared to the first horizontal

well

- The Company is evaluating drilling 3-4 additional horizontal

wells in 2H2023

CPO-5 block:

- Average gross production of 17,807 bopd (up 6% vs 1Q2023),

below its production potential of approximately 25,000-26,000 bopd

gross, due to shut-in production of the Indico 6 and Indico 7

wells

- The operator is currently executing civil works and expects to

resume production of the Indico 6 and Indico 7 wells in August 2023

- These two wells were drilled in late 2022 and together tested

over 11,000 bopd gross (or 3,300 bopd net to GeoPark). The wells

are expected to stabilize production at approximately 8,000 bopd

gross

- The two wells remained shut in for most of 1H20231 after the

regulator (ANH) asked the operator to suspend production pending

completion of required surface facilities

- Resuming drilling activities in 3Q2023 with one drilling rig,

targeting to drill two wells in 2H2023

- Pre-drilling activities underway for the Halcon 1 well,

targeting an exploration prospect in the northern part of the

block, close to the Llanos 34 block, expected to be spudded in

September/October 2023

Llanos 87 block (GeoPark operated, 50% WI):

- Additional drilling activities planned for 2H2023 updip of the

Zorzal 1 well discovery, where there is incremental potential

identified in the Barco formation (subject to joint venture partner

approval)

Llanos 123 block (GeoPark operated, 50% WI):

- One drilling rig currently in operation

- Saltador 1 exploration well was spudded in late May 2023 and

reached total depth in early July 2023

- Preliminary logging information indicated hydrocarbons in the

Barco and Mirador formations

- Testing activities are expected to start in July/August

2023

- Pre-drilling activities underway, targeting to spud the Toritos

1 exploration well in August 2023

Llanos 124 block (GeoPark operated, 50% WI)

- One drilling rig currently in operation

- The Cucarachero 1 exploration well was spudded in July 2023 and

is expected to reach total depth in August 2023

Llanos 86 and Llanos 104 blocks (GeoPark operated, 50% WI)

- Preliminary activities currently underway targeting to acquire

over 650 square kilometers of 3D seismic, expected to start in

early 2024

- Once executed, this project would be one of the three biggest

onshore seismic acquisition projects in Colombia

- 3D seismic acquisition is expected to add additional

exploration prospects to GeoPark’s deep organic exploration

inventory in the Llanos basin. The Llanos 86 and Llanos 104 blocks

are adjacent to the CPO-5 block

Colombia - Putumayo Basin

Platanillo block (GeoPark operated, 100% WI):

- Average gross production of 2,456 bopd (up 8% vs 1Q2023)

resulting from successful development drilling activities

Put-8 block (GeoPark operated, 50% WI):

- Currently working on environmental licensing for the Bienparado

exploration prospect

- Public hearing held in July 2023, the final decision by the

regulatory body is pending

Ecuador – Oriente Basin

Perico block (GeoPark non-operated, 50% WI)

- Initiated drilling activities in July 2023, targeting to drill

the Yin 2 development well and the Yang 1 exploration well in

3Q2023

Chile – Magallanes Basin

Fell block (GeoPark operated, 100% WI)

- Ongoing commercial negotiations with ENAP, the oil offtaker in

Chile, expecting to resume shut-in production of approximately 400

bopd in 3Q2023

- Implemented a restructuring initiative in Chile in April 2023

to provide further cost reductions, in conjunction with a process

to evaluate farm-out/divestment opportunities

Enhanced ESG Performance

- Installed a photovoltaic solar system in the OBA export

pipeline (running from the Platanillo block) that will allow

GeoPark to reduce its GHG emissions and reduce energy and

maintenance costs

2023 Work Program: Growing Production and Giving Back to

Shareholders

- 2023 annual production guidance of 38,000-40,000 boepd

- Fully-funded 2023 capital expenditures program of $180-200

million

- At $80-90 per bbl Brent, GeoPark expects to generate an

Adjusted EBITDA of $490-560 million and a free cash flow of

$120-140 million2

- Targeting to return approximately 40-50% of free cash flow

after taxes to shareholders

Accelerating Shareholder Returns While Maintaining a Strong

Balance Sheet

- Returned $15 million in cash dividends in 1H2023 ($7.5 million

on March 31 and May 31, respectively, or an annualized dividend of

approximately $30 million, a 5% dividend yield3)

- Acquired 1.7 million shares for $18.6 million in 1H2023 ($7.5

million in 1Q2023 and $11.1 million in 2Q2023), representing

approximately 3% of shares outstanding

- Cash and cash equivalents of $86 million4 as of June 30, 2023

(after paying approximately $88 million in cash taxes in

2Q2023)

Upcoming Catalysts

- Drilling 20-25 gross wells in 2H2023, targeting attractive

conventional, short-cycle development and exploration projects

- Key projects include:

- Llanos 34 block: Testing a second horizontal well and drilling

3-4 new horizontal wells

- Llanos 87 block: Drilling the Zorzal 2 well (subject to joint

venture partner approval)

- CPO-5 block: Drilling two wells, including the Halcon 1

exploration well

- Llanos 123 block: Testing the Saltador 1 exploration well and

drilling the Toritos 1 exploration well

- Llanos 124 block: Drilling the Cucarachero 1 exploration

well

- Perico block: Drilling the Yang 1 exploration well and the Yin

2 development well

Breakdown of Quarterly Production by Country

The following table shows production figures for 2Q2023, as

compared to 2Q2022:

2Q2023

2Q2022

Total (boepd)

Oil (bopd)a

Gas (mcfpd)

Total (boepd)

% Chg.

Colombia

33,045

32,945

598

34,253

-4%

Ecuador

634

634

-

634

-

Chile

1,690

74

9,695

2,358

-28%

Brazil

1,212

19

7,160

1,695

-28%

Total

36,581

33,672

17,453

38,940

-6%

a)

Includes royalties and other economic

rights paid in kind in Colombia for approximately 2,952 bopd in

2Q2023. No royalties were paid in kind in Ecuador, Chile or Brazil.

Production in Ecuador is reported before the Government’s

production share of approximately 186 bopd.

Quarterly Production

(boepd)

2Q2023

1Q2023

4Q2022

3Q2022

2Q2022

Colombia

33,045

32,580

33,749

33,338

34,253

Ecuador

634

990

1,259

1,194

634

Chile

1,690

1,988

2,291

2,425

2,358

Brazil

1,212

1,020

1,134

1,439

1,695

Total a

36,581

36,578

38,433

38,396

38,940

Oil

33,672

33,801

35,451

34,875

35,238

Gas

2,909

2,777

2,982

3,521

3,702

a)

In Colombia, production includes royalties

paid in kind, and in Ecuador it is shown before the Government’s

production share.

Oil and Gas Production Update

Consolidated:

Oil and gas production in 2Q2023 was 36,581 boepd, down by 6%

compared to 2Q2022, due to lower production in Colombia, Chile and

Brazil and flat production in Ecuador. Oil represented 92% and 90%

of total reported production in 2Q2023 and 2Q2022,

respectively.

Compared to 1Q2023, consolidated oil and gas production was

flat, resulting from increased production in Colombia and Brazil

that was offset by lower production in Chile and Ecuador.

Colombia:

Average net oil and gas production in Colombia decreased by 4%

to 33,045 boepd in 2Q2023 compared to 34,253 boepd in 2Q2022,

mainly resulting from lower production in the Llanos 34 and CPO-5

blocks, partially offset by higher production in the Platanillo

block.

Oil and gas production in GeoPark’s main blocks in Colombia:

- Llanos 34 block net average production decreased by 3% to

24,888 bopd (or 55,307 bopd gross) in 2Q2023 compared to 2Q2022.

Compared to 1Q2023, net average production increased by 1%

- CPO-5 block net average production decreased by 12% to 5,342

bopd (or 17,807 bopd gross) in 2Q2023 compared to 2Q2022. As

previously announced on March 8, April 11 and May 3, 2023,

production in 1H2023 was below its production potential of

25,000-26,000 bopd gross due to shut-in production of the Indico 6

and Indico 7 wells. Compared to 1Q2023, net average production

increased by 7% (1Q2023 production and operations were affected for

9 days by localized blockades)

- Platanillo block average production increased by 12% to 2,456

bopd in 2Q2023 compared to 2Q2022. Compared to 1Q2023, net average

production increased by 8%, mainly due to successful development

drilling activities in 2023

Recent Activity in the Llanos and Putumayo

Basins

Llanos 34 Block

- Following the successful drilling and testing of the first

horizontal development well, in early June 2023 GeoPark spudded a

second horizontal development well in the Tigana field

- The well was drilled to a total depth of 14,030 feet and a

horizontal lateral length of 1,680 feet

- Total depth was reached in July 2023 and the well is expected

to be completed for initial testing in late July 2023

CPO-5 Block

- The operator is currently executing required civil works and

expects to resume production in the Indico 6 and Indico 7 wells in

August 2023

- Pre-drilling activities are currently underway to drill the

Halcon 1 exploration well in September/October 2023

- The Halcon exploration prospect is located in the northern part

of the block, close to the Llanos 34 block

Llanos 87 Block

- Targeting to drill the Zorzal 2 well, updip of the Zorzal 1

well discovery, where there is incremental potential identified in

the Barco formation (subject to joint venture partner

approval)

Llanos 123 Block

- In 2Q2023 GeoPark drilled its first exploration well in the

block, located to the west of the Llanos 34 block and adjacent to

the Llanos 124 block

- The Saltador 1 exploration well was spudded in late May and

reached total depth in early July 2023

- Preliminary logging information indicated hydrocarbons in the

Barco and Mirador formations

- Testing activities are expected to start in July/August

2023

- The drilling rig will initiate mobilization in the upcoming

weeks to spud the Toritos 1 exploration well, expected in August

2023

Llanos 124 Block

- The Llanos 124 block is located adjacent to the west of the

Llanos 34 block

- In 2Q2023 GeoPark continued executing civil works and other

pre-drilling activities to spud its first exploration well in the

block in early 3Q2023

- The Cucarachero 1 exploration well was spudded in July 2023 and

is expected to reach total depth in August 2023

Llanos 86 and Llanos 104 Blocks

- The Llanos 86 and Llanos 104 blocks are located adjacent to the

east of the CPO-5 block

- Preliminary activities currently underway to acquire over 650

square kilometers of 3D seismic, expected to be executed in early

2024

- This 3D seismic acquisition is expected to add additional

exploration prospects to GeoPark’s organic exploration

inventory

Put-8 Block

- Currently working on environmental licensing for the Bienparado

exploration prospect

- A public hearing was held on July 8, 2023

- Final decision by the regulatory body, ANLA, is pending

Ecuador:

Average net oil production in Ecuador before the Government’s

share reached 634 bopd in 2Q2023, (approximately 448 bopd after the

Government’s share), flat compared to 2Q2022.

The Government’s production share varies with oil prices and is

approximately 30-40% considering an Oriente crude oil price of

$70-100 per bbl.

Drilling activities currently underway in the Perico block

targeting to drill two wells in 3Q2023 (one development well, Yin

2, and one exploration well, Yang 1).

Chile:

Average net production in Chile decreased 28% to 1,690 boepd in

2Q2023 compared to 2,358 boepd in 2Q2022, resulting from the

natural decline of the fields, limited drilling activities and

temporarily shut-in oil production due to ongoing commercial

negotiations with the oil offtaker. The production mix was 96%

natural gas (vs 78% in 2Q2022) and 4% light oil (vs 22% in

2Q2022).

Commercial negotiations with the oil offtaker are currently

ongoing and the Company expects to resume shut-in production of

approximately 400 bopd in 3Q2023.

Brazil:

Average net production in the Manati field in Brazil decreased

28% to 1,212 boepd in 2Q2023 compared to 1,695 boepd in 2Q2022 due

to limited gas demand, the natural decline of the field and

maintenance activities affecting production in the Manati platform

for 10 days during June 2023 and that were normalized by the end of

June 2023.

The production mix was 98% natural gas (vs 99% in 2Q2022) and 2%

oil and condensate (vs 1% in 2Q2022).

OTHER NEWS

Reporting Date for 2Q2023 Results Release, Conference Call

and Webcast

GeoPark will report its 2Q2023 financial results on Wednesday,

August 9, 2023, after the market close.

In conjunction with the 2Q2023 results press release, GeoPark

management will host a conference call on August 10, 2023, at 10:00

am (Eastern Daylight Time) to discuss the 2Q2023 financial

results.

To listen to the call, participants can access the webcast

located in the “Invest with Us” section of the Company’s website at

www.geo-park.com, or by clicking below:

https://events.q4inc.com/attendee/893129503

Interested parties may participate in the conference call by

dialing the numbers provided below:

United States Participants: +1 (404)

975-4839

International Participants: +1 (929)

526-1599

Passcode: 931988

Please allow extra time prior to the call to visit the website

and download any streaming media software that might be required to

listen to the webcast.

An archive of the webcast replay will be made available in the

“Invest with Us” section of the Company’s website at

www.geo-park.com after the conclusion of the live call.

NOTICE

Additional information about GeoPark can be found in the “Invest

with Us” section on the website at www.geo-park.com.

Certain amounts included in this press release have been rounded

for ease of presentation.

CAUTIONARY STATEMENTS RELEVANT TO

FORWARD-LOOKING INFORMATION

This press release contains statements that constitute

forward-looking statements. Many of the forward-looking statements

contained in this press release can be identified by the use of

forward-looking words such as ‘‘anticipate,’’ ‘‘believe,’’

‘‘could,’’ ‘‘expect,’’ ‘‘should,’’ ‘‘plan,’’ ‘‘intend,’’ ‘‘will,’’

‘‘estimate’’ and ‘‘potential,’’ among others.

Forward-looking statements that appear in a number of places in

this press release include, but are not limited to, statements

regarding the intent, belief, or current expectations, regarding

various matters, including expected future financial performance,

capital expenditures, expected adjusted EBITDA and free cash flow

generation, expected production guidance, drilling activities,

demand for oil and gas, oil and gas prices, our work program and

investment guidelines, regulatory approvals, reserves, exploration

resources, the discretionary share buyback program and shareholder

returns. Forward-looking statements are based on management’s

beliefs and assumptions, and on information currently available to

the management. Such statements are subject to risks and

uncertainties, and actual results may differ materially from those

expressed or implied in the forward-looking statements due to

various factors.

Forward-looking statements speak only as of the date they are

made, and the Company does not undertake any obligation to update

them in light of new information or future developments or to

release publicly any revisions to these statements in order to

reflect later events or circumstances, or to reflect the occurrence

of unanticipated events. For a discussion of the risks facing the

Company which could affect whether these forward-looking statements

are realized, see filings with the U.S. Securities and Exchange

Commission (SEC).

1 Indico 6 was shut in in December 2022

and Indico 7 was shut in in early January 2023.

2 Free cash flow is used here as Adjusted

EBITDA less capital expenditures, mandatory interest payments and

cash taxes. 2023 cash taxes include GeoPark’s preliminary estimates

of the full impact of the new tax reform in Colombia, irrespective

of the timing of its cash impact, expected in 2023 or early 2024.

The Company is unable to present a quantitative reconciliation of

the 2023 Adjusted EBITDA which is a forward-looking non-GAAP

measure, because the Company cannot reliably predict certain of its

necessary components, such as write-off of unsuccessful exploration

efforts or impairment loss on non-financial assets, etc. Since free

cash flow is calculated based on Adjusted EBITDA, for similar

reasons, the Company does not provide a quantitative reconciliation

of the 2023 free cash flow forecast. Adjusted EBITDA assumes a

Brent to Vasconia differential averaging $4-5 per bbl from May to

December 2023.

3 Based on GeoPark’s average market

capitalization from July 1 to July 12, 2023.

4 Unaudited.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230716186138/en/

INVESTORS: Stacy Steimel Shareholder Value Director T:

+562 2242 9600 ssteimel@geo-park.com

Miguel Bello Market Access Director T: +562 2242 9600

mbello@geo-park.com

Diego Gully Investor Relations Director T: +5411 4312 9400

dgully@geo-park.com

MEDIA: Communications Department

communications@geo-park.com

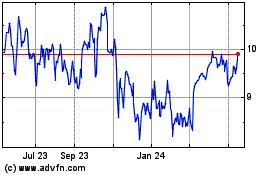

GeoPark (NYSE:GPRK)

Historical Stock Chart

From Dec 2024 to Jan 2025

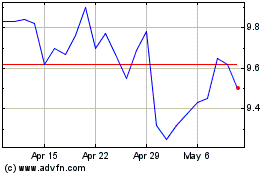

GeoPark (NYSE:GPRK)

Historical Stock Chart

From Jan 2024 to Jan 2025