0000277135false00002771352025-01-312025-01-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

January 31, 2025

W.W. Grainger, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Illinois | | 1-5684 | 36-1150280 |

| (State or other jurisdiction of incorporation) | | (Commission file number) | (I.R.S. Employer Identification No.) |

| |

| 100 Grainger Parkway, | | | | | | 60045-5201 |

| Lake Forest, | Illinois | | | | | | (Zip Code) |

| (Address of principal executive offices) | | | | | | |

Registrant’s Telephone Number, including area code: (847) 535-1000

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of Each Class | Trading Symbol | Name of Each Exchange on Which Registered |

| Common Stock | GWW | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On January 31, 2025, W.W. Grainger, Inc. issued a press release announcing its financial results for the fourth quarter ended December 31, 2024. A copy is furnished as Exhibit 99.1 to this report.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

| | | | | |

| |

Exhibit No. | Description of Exhibit |

| |

| 104 | Cover Page Interactive Data File (the cover page XBRL tags are embedded within the inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: January 31, 2025

| | | | | | | | |

| W.W. GRAINGER, INC. |

| | |

| By: | /s/ Deidra C. Merriwether |

| Name: | Deidra C. Merriwether |

| Title: | Senior Vice President and Chief Financial Officer |

GRAINGER REPORTS RESULTS FOR THE FOURTH QUARTER AND FULL YEAR 2024

Focused execution driving strategy forward and powering continued solid results;

Issues 2025 guidance, including 4.0% - 6.5% daily, constant currency sales growth

Fourth Quarter 2024 Highlights

•Delivered sales of $4.2 billion, up 5.9%, or 4.7% on a daily, organic constant currency basis

•Achieved operating margin of 15.0%, up 110 basis points on a reported basis, or up 40 basis points on an adjusted basis

•Increased diluted EPS to $9.71, up 23.1% on a reported basis, or up 16.6% on an adjusted basis

Full Year 2024 Highlights

•Grew sales to $17.2 billion, up 4.2%, or 4.7% on a daily, organic constant currency basis

•Realized reported operating margin of 15.4%, or 15.5% on an adjusted basis, down 20 basis points

•Increased diluted EPS by 6.8% to $38.71 on a reported basis, or by 6.2% to $38.96 on an adjusted basis

•Produced $2.1 billion in operating cash flow and returned $1.6 billion to Grainger shareholders through dividends and share repurchases

CHICAGO, Jan. 31, 2025 - Grainger (NYSE: GWW) today reported results for the fourth quarter and full year 2024. Sales of $4.2 billion in the fourth quarter 2024 increased 5.9%, or 4.7% on a daily, organic constant currency basis versus the fourth quarter 2023. For the full year, sales of $17.2 billion increased 4.2%, or 4.7% on a daily, organic constant currency basis compared to the prior year.

"Amidst a stable, yet muted demand environment throughout 2024, our team delivered strong performance by staying focused on what matters and delivering an outstanding customer experience. Across both our High-Touch Solutions and Endless Assortment segments, we deepened our customer relationships and advanced our capabilities, all while delivering on our commitments to shareholders,” said D.G. Macpherson, Chairman and CEO. "Looking to 2025,

we remain committed to our purpose, We Keep the World Working®, as we continue to provide exceptional service for our customers."

2024 Financial Summary

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| ($ in millions), except per share amount | Q4 2024 | | Q4 2024 | FY 2024 | | FY 2024 |

Change vs. Prior

(Fav. vs. (Unfav.)) | Change vs. Prior

(Fav. vs. (Unfav.)) |

| | Reported | Adjusted | | | Reported | Adjusted(1) | Reported | Adjusted(2) | | | Reported | Adjusted(2) |

| Net Sales | $4,233 | $4,233 | | | 5.9% | 5.9% | $17,168 | $17,168 | | | 4.2% | 4.2% |

| Gross Profit | $1,676 | $1,676 | | | 7.2% | 7.2% | $6,758 | $6,758 | | | 4.0% | 4.0% |

| Operating Earnings | $633 | $633 | | | 13.6% | 8.6% | $2,637 | $2,653 | | | 2.8% | 2.4% |

| Net Earnings Attributable to W.W. Grainger, Inc. | $475 | $475 | | | 20.3% | 13.9% | $1,909 | $1,921 | | | 4.4% | 3.8% |

| Diluted Earnings Per Share | $9.71 | $9.71 | | | 23.1% | 16.6% | $38.71 | $38.96 | | | 6.8% | 6.2% |

| | | | | | | | | | | | | |

| Gross Profit Margin | 39.6% | 39.6% | | | 50 bps | 50 bps | 39.4% | 39.4% | | | — bps | — bps |

| Operating Margin | 15.0% | 15.0% | | | 110 bps | 40 bps | 15.4% | 15.5% | | | (20) bps | (20) bps |

| Effective Tax Rate | 20.1% | 20.1% | | | 370 bps | 340 bps | 23.0% | 23.0% | | | 90 bps | 80 bps |

(1)Reflects the adjustment for the loss on divestiture of Grainger's subsidiary, E&R Industrial Sales, Inc., reported in the Company's HTS-N.A. segment completed in the fourth quarter of 2023.

(2)Reflects the adjustment for restructuring costs incurred in Grainger's HTS-N.A. segment and Other businesses in the second quarter of 2024 and the loss on divestiture of Grainger's subsidiary, E&R Industrial Sales Inc., reported in the Company's HTS-N.A. segment completed in the fourth quarter of 2023.

See the supplemental information of this release for further information regarding the Company's non-GAAP measures including reconciliations to the most directly comparable GAAP measure.

Revenue

For the fourth quarter 2024, total Company sales were up 5.9%, or up 4.2% on a daily basis compared to the fourth quarter 2023. Normalizing for the impact of foreign currency exchange and the divestiture of the Company's subsidiary, E & R Industrial Sales, Inc., sales on a daily, organic constant currency basis were up 4.7% versus the fourth quarter 2023.

In the High-Touch Solutions N.A. segment, sales were up 4.0%, or 3.0% on a daily, organic constant currency basis versus the fourth quarter 2023 driven by continued growth across all geographies. In the Endless Assortment segment, sales were up 15.1%, or 13.2% on a daily, constant currency basis versus the prior year quarter. Growth was driven by core B2B customers across the segment as well as enterprise customer growth at MonotaRO.

For the full year 2024, total Company sales increased 4.2% versus the full year 2023. Daily sales on an organic, constant currency basis increased 4.7% versus the prior year driven by growth in both segments.

Gross Profit Margin

For the fourth quarter 2024, total Company gross profit margin was 39.6%, up 50 basis points compared to the fourth quarter 2023.

In the High-Touch Solutions N.A. segment, gross margin increased 90 basis points compared to the fourth quarter 2023 driven by a lap of year-end inventory cost adjustments from the prior year period, as well as slight freight and mix favorability in the current year. In the Endless Assortment segment, gross margin declined by 10 basis points versus the fourth quarter 2023.

For the full year 2024, total Company gross profit margin was 39.4%, flat versus the prior year as various factors offset.

Earnings

For the fourth quarter 2024, reported operating earnings for the total Company were $633 million, up 13.6% over the fourth quarter 2023. Reported operating margin was 15.0%, a 110 basis point increase compared to the prior year quarter. On an adjusted basis, which excludes the impacts from the divestiture of the Company's subsidiary, E & R Industrial Sales, Inc., fourth quarter 2024 operating earnings were up 8.6% and operating margin was up 40 basis points over the fourth quarter 2023. The increase in adjusted operating margin was driven by High-Touch Solutions N.A. gross margin favorability coupled with strong expense leverage in Endless Assortment.

Diluted EPS for the fourth quarter 2024 was $9.71, up 23.1% on a reported basis, or up 16.6% on an adjusted basis versus the prior year quarter. The increase in earnings per share was primarily due to strong operating performance, aided by a lower share count and favorable tax rate versus the fourth quarter 2023.

For the full year 2024, reported operating earnings for the total Company of $2.6 billion were up 2.8% versus the prior year, and resulted in reported operating margin of 15.4%, a decrease of 20 basis points over prior year. On an adjusted basis, 2024 operating earnings of $2.7 billion were up 2.4%, and resulted in adjusted operating margin of 15.5%, a decrease of 20 basis points compared to 2023 as stable gross margin was partially offset by continued demand generation investment.

Diluted EPS for the full year 2024 was $38.71 on a reported basis, up 6.8% versus 2023. On an adjusted basis, 2024 diluted EPS was $38.96, up 6.2% versus the prior year. The increase in earnings per share was due primarily to the strong operating performance in the year, aided by a lower share count and favorable tax rate versus 2023.

Tax Rate

For the fourth quarter 2024, the reported effective tax rate was 20.1% compared to 23.8% in the fourth quarter 2023. On an adjusted basis, the tax rate was 20.1% compared to 23.5% in the prior year quarter.

For the full year 2024, the reported effective tax rate was 23.0% versus 23.9% in 2023. On an adjusted basis, the full year effective tax rate was 23.0% versus 23.8% in the prior year.

The variance for both the fourth quarter and full year reported and adjusted tax rates was primarily driven by the expiration of a statute of limitation period in 2024.

Cash Flow

During the fourth quarter 2024, the Company generated $428 million of cash flow from operating activities as solid net earnings were partially offset by investments in working capital. The Company invested $258 million in capital expenditures which was higher than prior year driven by the purchase of a new bulk warehouse. This resulted in free cash flow for the period of $170 million. During the quarter, the Company returned $562 million to Grainger shareholders through dividends and share repurchases.

For the full year 2024, the Company generated $2.1 billion of cash flow from operating activities as solid net earnings were slightly offset by unfavorable working capital. As compared to 2023, operating cash flow increased $80 million, up 3.9%. The Company invested $541 million in capital expenditures, resulting in free cash flow of $1.6 billion in 2024. During the year, the Company returned $1.6 billion to Grainger shareholders through dividends and share repurchases.

2025 Company Guidance

The Company is providing the following outlook for 2025:

| | | | | |

Total Company(1) | 2025 Guidance Range |

| Net Sales | $17.6 - $18.1 billion |

| Sales growth | 2.7% - 5.2% |

| Daily, constant currency sales growth | 4.0% - 6.5% |

| Gross Profit Margin | 39.1% - 39.4% |

| Operating Margin | 15.1% - 15.5% |

| Diluted Earnings per Share | $39.00 - $41.50 |

| Operating Cash Flow | $2.05 - $2.25 billion |

| CapEx (cash basis) | $0.45 - $0.55 billion |

| Share Buyback | $1.15 - $1.25 billion |

| Effective Tax Rate | ~23.8% |

| |

| Segment Operating Margin | |

| High-Touch Solutions N.A. | 17.0% - 17.4% |

| Endless Assortment | 8.5% - 9.0% |

(1)Guidance provided is on an adjusted basis. Daily, constant currency sales growth is adjusted for the impact of one less selling day in 2025 as compared to 2024 and changes in foreign currency exchange. The Company does not reconcile forward-looking non-GAAP financial measures. For further details see the supplemental information of this release.

Webcast

The Company will conduct a live conference call and webcast at 11:00 a.m. ET on January 31, 2025, to discuss the fourth quarter and full-year results. The event will be hosted by D.G. Macpherson, Chairman and CEO, and Deidra Merriwether, Senior Vice President and CFO, and can be accessed at invest.grainger.com. To access the conference call via phone, please send a request to InvestorRelations@grainger.com. For those unable to participate in the live event, a webcast replay will be available for 90 days at invest.grainger.com.

About Grainger

W.W. Grainger, Inc., is a leading broad line distributor with operations primarily in North America, Japan and the United Kingdom. At Grainger, We Keep the World Working® by serving more than 4.5 million customers worldwide with products and solutions delivered through innovative technology and deep customer relationships. Known for its commitment to service and award-winning culture, the Company had 2024 revenue of $17.2 billion across its two business models. In the High-Touch Solutions segment, Grainger offers approximately 2 million maintenance, repair and operating (MRO) products and services, including technical support and inventory management. In the Endless Assortment segment, Zoro.com offers customers access to more

than 14 million products, and MonotaRO.com offers more than 24 million products. For more information, visit www.grainger.com.

Visit invest.grainger.com to view information about the Company, including a supplement regarding 2024 fourth quarter results. Additional Company information can be found on the Grainger Investor Relations website which includes our Company snapshot and ESG report.

Safe Harbor Statement

All statements in this communication, other than those relating to historical facts, are “forward-looking statements.” Forward-looking statements can generally be identified by their use of terms such as “anticipate,” “estimate,” “believe,” “expect,” “could,” “forecast,” “may,” “intend,” “plan,” “predict,” “project,” “will,” or “would,” and similar terms and phrases, including references to assumptions. Forward-looking statements are not guarantees of future performance and are subject to a number of assumptions, risks and uncertainties, many of which are beyond our control, which could cause actual results to differ materially from such statements. Forward-looking statements include, but are not limited to, statements about future strategic plans and future financial and operating results. Important factors that could cause actual results to differ materially from those presented or implied in the forward-looking statements include, without limitation: inflation, higher product costs or other expenses, including operational and administrative expenses; a major loss of customers; loss or disruption of sources of supply; changes in customer or product mix; increased competitive pricing pressures; changes in third party practices regarding digital advertising; failure to enter into or sustain contractual arrangements on a satisfactory basis with group purchasing organizations; failure to develop, manage or implement new technology initiatives or business strategies, including with respect to Grainger’s eCommerce platforms and artificial intelligence; failure to adequately protect intellectual property or successfully defend against infringement claims; fluctuations or declines in Grainger’s gross profit margin; Grainger’s responses to market pressures; the outcome of pending and future litigation or governmental or regulatory proceedings, including with respect to wage and hour, anti-bribery and corruption, environmental, regulations related to advertising, marketing and the Internet, consumer protection, pricing (including disaster or emergency declaration pricing statutes), product liability, compliance or safety, trade and export compliance, general commercial disputes, or privacy and cybersecurity matters; investigations, inquiries, audits and changes in laws and regulations; failure to comply with laws, regulations and standards, including new or stricter environmental laws or regulations; government contract matters; the impact of any government shutdown; disruption or breaches of information technology or data security systems involving Grainger or third parties on which Grainger depends; general industry, economic, market or political conditions; general global economic conditions including existing, new, or increased tariffs, trade issues and changes in trade policies, inflation, and interest rates; currency exchange rate fluctuations; market volatility, including price and trading volume volatility or price declines of Grainger’s common stock; commodity price volatility; facilities disruptions or shutdowns; higher fuel costs or disruptions in transportation services; effects of outbreaks of pandemic disease or viral contagions, global conflicts, natural or human induced disasters, extreme weather, and other catastrophes or conditions; effects of climate change; failure to execute on our efforts and programs related to environmental, social and governance matters; competition for, or failure to attract, retain, train, motivate and develop executives and key employees; loss of key members of management or key employees; loss of operational flexibility and potential for work stoppages or slowdowns if employees unionize or join a collective bargaining arrangement; changes in effective tax rates; changes in credit ratings or outlook; Grainger's incurrence of indebtedness or failure to comply with restrictions and obligations under its debt agreements and instruments; and other factors that can be found in our filings with the Securities and Exchange Commission, including our most recent periodic reports filed on Form 10-K and Form 10-Q, which are available on our Investor Relations website. Forward-looking statements are given only as of the date of this communication and we disclaim any obligation to update or revise any forward-looking statement, whether as a result of new information, future events or otherwise, except as required by law.

Contacts:

| | | | | | | | | | | |

| Media: | | Investors: | |

| Erin Ptacek | | Kyle Bland | |

| VP, Communications & Public Affairs | VP, Investor Relations |

| | | |

| Communications@grainger.com | Andrew Ansay | |

| | Director, Investor Relations |

| | | |

| InvestorRelations@grainger.com |

| | | |

| | | |

| | | |

W.W. Grainger, Inc. and Subsidiaries

CONDENSED CONSOLIDATED STATEMENTS OF EARNINGS

(In millions of dollars, except for per share amounts)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Twelve Months Ended December 31, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Net sales | $ | 4,233 | | | $ | 3,997 | | | $ | 17,168 | | | $ | 16,478 | |

| Cost of goods sold | 2,557 | | | 2,434 | | | 10,410 | | | 9,982 | |

| Gross profit | 1,676 | | | 1,563 | | | 6,758 | | | 6,496 | |

| Selling, general and administrative expenses | 1,043 | | | 1,006 | | | 4,121 | | | 3,931 | |

| Operating earnings | 633 | | | 557 | | | 2,637 | | | 2,565 | |

| Other (income) expense: | | | | | | | |

| Interest expense – net | 17 | | | 23 | | | 77 | | | 93 | |

| Other – net | (6) | | | (7) | | | (24) | | | (28) | |

| Total other expense – net | 11 | | | 16 | | | 53 | | | 65 | |

| Earnings before income taxes | 622 | | | 541 | | | 2,584 | | | 2,500 | |

| Income tax provision | 125 | | | 129 | | | 595 | | | 597 | |

| Net earnings | 497 | | | 412 | | | 1,989 | | | 1,903 | |

| Less net earnings attributable to noncontrolling interest | 22 | | | 17 | | | 80 | | | 74 | |

| Net earnings attributable to W.W. Grainger, Inc. | $ | 475 | | | $ | 395 | | | $ | 1,909 | | | $ | 1,829 | |

| | | | | | | |

| Earnings per share: | | | | | | | |

| Basic | $ | 9.74 | | | $ | 7.93 | | | $ | 38.84 | | | $ | 36.39 | |

| Diluted | $ | 9.71 | | | $ | 7.89 | | | $ | 38.71 | | | $ | 36.23 | |

| Weighted average number of shares outstanding: | | | | | | | |

| Basic | 48.6 | | | 49.5 | | | 48.9 | | | 49.9 | |

| Diluted | 48.7 | | | 49.7 | | | 49.0 | | | 50.1 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

W.W. Grainger, Inc. and Subsidiaries

CONDENSED CONSOLIDATED BALANCE SHEETS

(In millions of dollars)

(Unaudited)

| | | | | | | | | | | |

| As of |

| (Unaudited) | | |

| Assets | December 31, 2024 | | December 31, 2023 |

| Current assets | | | |

| Cash and cash equivalents | $ | 1,036 | | | $ | 660 | |

Accounts receivable (less allowance for credit losses of $32 and $35, respectively) | 2,232 | | | 2,192 | |

| Inventories – net | 2,306 | | | 2,266 | |

| Prepaid expenses and other current assets | 163 | | | 156 | |

| Total current assets | 5,737 | | | 5,274 | |

| Property, buildings and equipment – net | 1,927 | | | 1,658 | |

| Goodwill | 355 | | | 370 | |

| Intangibles – net | 243 | | | 234 | |

| Operating lease right-of-use | 371 | | | 429 | |

| Other assets | 196 | | | 182 | |

| Total assets | $ | 8,829 | | | $ | 8,147 | |

| | | |

| Liabilities and Shareholders’ Equity | | | |

| | | |

| Current liabilities | | | |

| Current maturities | 499 | | | 34 | |

| Trade accounts payable | 952 | | | 954 | |

| Accrued compensation and benefits | 324 | | | 327 | |

| Operating lease liability | 78 | | | 71 | |

| Accrued expenses | 407 | | | 397 | |

| Income taxes payable | 45 | | | 48 | |

| Total current liabilities | 2,305 | | | 1,831 | |

| Long-term debt | 2,279 | | | 2,266 | |

| Long-term operating lease liability | 327 | | | 381 | |

| Deferred income taxes and tax uncertainties | 101 | | | 104 | |

| Other non-current liabilities | 114 | | | 124 | |

| Shareholders' equity | 3,703 | | | 3,441 | |

| Total liabilities and shareholders’ equity | $ | 8,829 | | | $ | 8,147 | |

W.W. Grainger, Inc. and Subsidiaries

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(In millions of dollars)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Twelve Months Ended December 31, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Cash flows from operating activities: | | | | | | | |

| Net earnings | $ | 497 | | | $ | 412 | | | $ | 1,989 | | | $ | 1,903 | |

| Adjustments to reconcile net earnings to net cash provided by operating activities: | | | | | | | |

| Provision for credit losses | 5 | | | 8 | | | 23 | | | 23 | |

| Deferred income taxes and tax uncertainties | (32) | | | (29) | | | (8) | | | (9) | |

| Depreciation and amortization | 62 | | | 57 | | | 237 | | | 214 | |

| Non-cash lease expense | 23 | | | 20 | | | 84 | | | 76 | |

| | | | | | | |

| Net losses (gains) from sales of assets and business divestitures | — | | | 21 | | | — | | | 17 | |

| Stock-based compensation | 14 | | | 13 | | | 62 | | | 62 | |

| | | | | | | |

| | | | | | | |

| Change in operating assets and liabilities: | | | | | | | |

| Accounts receivable | 73 | | | 253 | | | (110) | | | (98) | |

| Inventories | (163) | | | (58) | | | (77) | | | (16) | |

| Prepaid expenses and other assets | (10) | | | (3) | | | (36) | | | 101 | |

| Trade accounts payable | (79) | | | (120) | | | 20 | | | (65) | |

| Operating lease liabilities | (23) | | | (23) | | | (96) | | | (88) | |

| Accrued liabilities | (16) | | | 1 | | | 20 | | | (91) | |

| Income taxes – net | 61 | | | 30 | | | (3) | | | (4) | |

| Other non-current liabilities | 16 | | | 22 | | | 6 | | | 6 | |

| | | | | | | |

| Net cash provided by operating activities | 428 | | | 604 | | | 2,111 | | | 2,031 | |

| Cash flows from investing activities: | | | | | | | |

| Capital expenditures | (258) | | | (127) | | | (541) | | | (445) | |

| Proceeds from sale of assets and business divestitures | 1 | | | 10 | | | 3 | | | 21 | |

| Other – net | (1) | | | 2 | | | 18 | | | 2 | |

| | | | | | | |

| Net cash used in investing activities | (258) | | | (115) | | | (520) | | | (422) | |

| Cash flows from financing activities: | | | | | | | |

| Proceeds from debt | — | | | — | | | 503 | | | 7 | |

| Payments of debt | (1) | | | — | | | (39) | | | (37) | |

| Proceeds from stock options exercised | 4 | | | 5 | | | 30 | | | 34 | |

| Payments for employee taxes withheld from stock awards | (6) | | | (5) | | | (50) | | | (37) | |

| Purchases of treasury stock | (462) | | | (344) | | | (1,201) | | | (850) | |

| Cash dividends paid | (100) | | | (92) | | | (421) | | | (392) | |

| Other – net | — | | | (3) | | | (2) | | | (3) | |

| Net cash used in financing activities | (565) | | | (439) | | | (1,180) | | | (1,278) | |

| Exchange rate effect on cash and cash equivalents | (17) | | | 9 | | | (35) | | | 4 | |

| Net change in cash and cash equivalents | (412) | | | 59 | | | 376 | | | 335 | |

| Cash and cash equivalents at beginning of period | 1,448 | | | 601 | | | 660 | | | 325 | |

| Cash and cash equivalents at end of period | $ | 1,036 | | | $ | 660 | | | $ | 1,036 | | | $ | 660 | |

SUPPLEMENTAL INFORMATION - RECONCILIATION OF GAAP TO NON-GAAP

FINANCIAL MEASURES (Unaudited)

The Company supplements the reporting of financial information determined under U.S. generally accepted accounting principles (GAAP) with the non-GAAP financial measures as defined below. The Company believes these non-GAAP financial measures provide meaningful information to assist investors in understanding financial results and assessing prospects for future performance as they provide a better baseline for analyzing the ongoing performance of its business by excluding items that may not be indicative of core operating results.

Basis of presentation

The Company has a controlling ownership interest in MonotaRO, which is part of our Endless Assortment segment. MonotaRO’s results are fully consolidated, reflected in U.S. GAAP, and reported one-month in arrears. Results will differ from MonotaRO’s externally reported financials which follow Japanese GAAP.

Adjusted gross profit, adjusted SG&A, adjusted operating earnings, adjusted operating margin, adjusted net earnings, adjusted diluted EPS

Exclude certain non-recurring items, like restructuring charges, asset impairments, gains and losses associated with business divestitures and other non-recurring, infrequent or unusual gains and losses (together referred to as “non-GAAP adjustments”), from the Company’s most directly comparable reported U.S. GAAP figures (reported gross profit, SG&A, operating earnings, net earnings and EPS).The Company believes these non-GAAP adjustments provide meaningful information to assist investors in understanding financial results and assessing prospects for future performance as they provide a better baseline for analyzing the ongoing performance of its business by excluding items that may not be indicative of core operating results.

Free cash flow (FCF)

Calculated using total cash provided by operating activities less capital expenditures. The Company believes the presentation of FCF allows investors to evaluate the capacity of the Company's operations to generate free cash flow.

Daily sales

Refers to sales for the period divided by the number of U.S. selling days for the period.

Daily, constant currency sales

Refers to the daily sales adjusted for changes in foreign currency exchange rates.

Daily, organic constant currency sales

Refers to daily sales excluding the sales of certain divested businesses in the comparable prior year period post date of divestiture and changes in foreign currency exchange rates.

Foreign currency exchange

Calculated by dividing current period local currency daily sales by current period average exchange rate and subtracting the current period local currency daily sales divided by the prior period average exchange rate.

U.S. selling days:

2023: Q1-64, Q2-64, Q3-63, Q4-63, FY-254

2024: Q1-64, Q2-64, Q3-64, Q4-64, FY-256

2025: Q1-63, Q2-64, Q3-64, Q4-64, FY-255

As non-GAAP financial measures are not standardized, it may not be possible to compare these measures with other companies' non-GAAP measures having the same or similar names. These non-GAAP measures should not be considered in isolation or as a substitute for reported results. These non-GAAP measures reflect an additional way of viewing aspects of operations that, when viewed with GAAP results, provide a more complete understanding of the business. This press release also includes certain non-GAAP forward-looking information. The Company believes that a quantitative reconciliation of such forward-looking information to the most comparable financial measure calculated and presented in accordance with GAAP cannot be made available without unreasonable efforts. A reconciliation of these non-GAAP financial measures would require the Company to predict the timing and likelihood of future restructurings, asset impairments, and other charges. Neither of these forward-looking measures, nor their probable significance, can be quantified with a reasonable degree of accuracy. Accordingly, a reconciliation of the most directly comparable forward-looking GAAP measures is not provided.

The reconciliations provided below reconciles GAAP financial measures to non-GAAP financial measures used in this release: daily sales; daily, organic constant currency sales; free cash flow; adjusted operating margin; and adjustments reflected in the consolidated statements of earnings.

Sales growth for the three and twelve months ended December 31, 2024

(percent change compared to prior year period)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Total Company | | High-Touch Solutions - N.A. | | Endless Assortment |

| Q4 2024 | | | | FY 2024 | | Q4 2024 | | FY 2024 | | Q4 2024 | | FY 2024 |

| Reported sales | 5.9% | | | | 4.2% | | 4.0% | | 3.4% | | 15.1% | | 7.5% |

| Daily impact | (1.7)% | | | | (0.8)% | | (1.7)% | | (0.8)% | | (1.8)% | | (0.9)% |

Daily sales(1) | 4.2% | | | | 3.4% | | 2.3% | | 2.6% | | 13.3% | | 6.6% |

Business divestiture(2) | 0.3% | | | | 0.4% | | 0.4% | | 0.5% | | —% | | —% |

Foreign currency exchange(3) | 0.2% | | | | 0.9% | | 0.3% | | 0.1% | | (0.1)% | | 5.0% |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Daily, organic constant currency sales | 4.7% | | | | 4.7% | | 3.0% | | 3.2% | | 13.2% | | 11.6% |

| | | | | | | | | | | | | |

(1) Based on U.S. selling days, there were 64 and 63 selling days in Q4 2024 and Q4 2023, respectively; there were 256 and 254 selling days in 2024 and 2023, respectively.

(2) Reflects the divestiture of Grainger's subsidiary, E & R Industrial Sales, Inc., in the fourth quarter of 2023.

(3) Excludes the impact of year-over-year foreign currency exchange rate fluctuations.

Free cash flow (FCF) for the three and twelve months ended December 31, 2024

(in millions of dollars)

(unaudited)

| | | | | | | | | | | |

| Q4 2024 | | FY 2024 |

| Net cash flows provided by operating activities | $ | 428 | | | $ | 2,111 | |

| Capital expenditures | (258) | | | (541) | |

| Free cash flow | $ | 170 | | | $ | 1,570 | |

Income statement adjustments for the three and twelve months ended December 31, 2024

(in millions of dollars)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Q4 2024 | | Reported | | Adjusted(4) | | Reported | | Adjusted |

| Reported | | Adjustment(1) | | Adjusted | | % of Net sales | | Y/Y(2) |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Earnings reconciliation: | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| SG&A | $ | 1,043 | | | $ | — | | | $ | 1,043 | | | 24.6 | % | | 24.6 | % | | 3.7 | % | | 6.4 | % |

| Operating earnings | 633 | | | — | | | 633 | | | 15.0 | | | 15.0 | | | 13.6 | | | 8.6 | |

| Other expense — net | (11) | | | — | | | (11) | | | (0.3) | | | (0.3) | | | (31.3) | | | (31.3) | |

| Earnings before income taxes | 622 | | | — | | | 622 | | | 14.7 | | | 14.7 | | | 15.0 | | | 9.7 | |

Income tax provision(3) | (125) | | | — | | | (125) | | | (3.0) | | | (3.0) | | | (3.1) | | | (6.0) | |

| Net earnings | 497 | | | — | | | 497 | | | 11.7 | | | 11.7 | | | 20.6 | | | 14.5 | |

Noncontrolling interest(5) | (22) | | | — | | | (22) | | | (0.5) | | | (0.5) | | | (29.4) | | | 29.4 | |

| Net earnings attributable to W.W. Grainger, Inc. | $ | 475 | | | $ | — | | | $ | 475 | | | 11.2 | % | | 11.2 | % | | 20.3 | % | | 13.9 | % |

| | | | | | | | | | | | | |

| Diluted earnings per share: | $ | 9.71 | | | $ | — | | | $ | 9.71 | | | | | | | 23.1 | % | | 16.6 | % |

| | | | | | | | | | | | | |

(1) There were no non-GAAP adjustments for the fourth quarter of 2024.

(2) For prior year financial information regarding Grainger's non-GAAP measures, including reconciliations to the most directly comparable GAAP measures, refer to the Company's Form 8-K filed with the SEC on February 2, 2024.

(3) Reported and adjusted effective tax rate was 20.1% for the fourth quarter of 2024.

(4) Calculated on the basis of reported net sales for the fourth quarter of 2024.

(5) The Company has a controlling ownership interest in MonotaRO, with the residual representing noncontrolling interest.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| FY 2024 | | Reported | | Adjusted(4) | | Reported | | Adjusted |

| Reported | | Adjustment(1) | | Adjusted | | % of Net sales | | Y/Y(2) |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Earnings reconciliation: | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| SG&A | $ | 4,121 | | | $ | (16) | | | $ | 4,105 | | | 24.0 | % | | 23.9 | % | | 4.8 | % | | 5.1 | % |

| Operating earnings | 2,637 | | | 16 | | | 2,653 | | | 15.4 | | | 15.5 | | | 2.8 | | | 2.4 | |

| Other expense — net | (53) | | | — | | | (53) | | | (0.3) | | | (0.3) | | | (18.5) | | | (18.5) | |

| Earnings before income taxes | 2,584 | | | 16 | | | 2,600 | | | 15.1 | | | 15.2 | | | 3.4 | | | 2.9 | |

Income tax provision(3) | (595) | | | (4) | | | (599) | | | (3.5) | | | (3.5) | | | (0.3) | | | (0.3) | |

| Net earnings | 1,989 | | | 12 | | | 2,001 | | | 11.6 | | | 11.7 | | | 4.5 | | | 3.9 | |

Noncontrolling interest(5) | (80) | | | — | | | (80) | | | (0.5) | | | (0.5) | | | (8.1) | | | 8.1 | |

| Net earnings attributable to W.W. Grainger, Inc. | $ | 1,909 | | | $ | 12 | | | $ | 1,921 | | | 11.1 | % | | 11.2 | % | | 4.4 | % | | 3.8 | % |

| | | | | | | | | | | | | |

| Diluted earnings per share: | $ | 38.71 | | | $ | 0.25 | | | $ | 38.96 | | | | | | | 6.8 | % | | 6.2 | % |

| | | | | | | | | | | | | |

(1) Reflects restructuring costs incurred in the second quarter of 2024 of $15M and $1M in Grainger's HTS-N.A. segment and Other businesses, respectively.

(2) For prior year financial information regarding Grainger's non-GAAP measures, including reconciliations to the most directly comparable GAAP measures, refer to the Company's Form 8-K filed with the SEC on February 2, 2024.

(3) Reported and adjusted effective tax was 23.0% for the year ending December 31, 2024.

(4) Calculated on the basis of reported net sales for the year ending December 31, 2024.

(5) The Company has a controlling ownership interest in MonotaRO, with the residual representing noncontrolling interest.

v3.24.4

Cover

|

Jan. 31, 2025 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jan. 31, 2025

|

| Entity File Number |

1-5684

|

| Entity Registrant Name |

W.W. Grainger, Inc.

|

| Entity Central Index Key |

0000277135

|

| Entity Tax Identification Number |

36-1150280

|

| Entity Incorporation, State or Country Code |

IL

|

| Entity Address, Address Line One |

100 Grainger Parkway,

|

| Entity Address, City or Town |

Lake Forest,

|

| Entity Address, State or Province |

IL

|

| Entity Address, Postal Zip Code |

60045-5201

|

| City Area Code |

847

|

| Local Phone Number |

535-1000

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

GWW

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

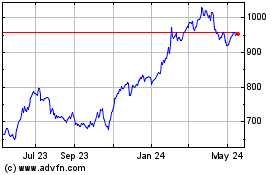

WW Grainger (NYSE:GWW)

Historical Stock Chart

From Jan 2025 to Feb 2025

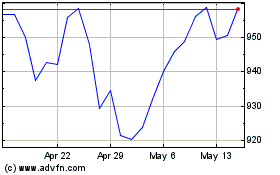

WW Grainger (NYSE:GWW)

Historical Stock Chart

From Feb 2024 to Feb 2025