HCI Group, Inc. (NYSE: HCI), a

holding company with operations in homeowners insurance,

information technology services, real estate, and reinsurance,

along with its majority owned subsidiary, TypTap Insurance Group,

Inc., announced today the undertaking of several strategic steps

designed to increase operational and capital flexibility and to

better position the company for future growth opportunities. These

steps include the modification of the company’s relationship with

Centerbridge Partners L.P., including extending the warrant held by

Centerbridge and redeeming all outstanding preferred shares of

TypTap Insurance Group held by Centerbridge.

“We are taking steps to simplify our balance sheet and give us

maximum flexibility to pursue attractive opportunities in the

future,” said Paresh Patel, HCI’s chairman and chief executive

officer. “We believe this modification could lead to an immediate

benefit to HCI’s financial results by eliminating future dividends

that would have otherwise accrued on the preferred shares, but more

importantly, gives the company added autonomy and flexibility to

pursue future growth opportunities that could unlock additional

shareholder value in the future.”

As part of the transaction, Centerbridge and HCI have agreed to

extend the expiration date of the warrant currently held by

Centerbridge to purchase up to 750,000 shares of HCI common stock.

The amended and restated warrant extends the expiration as to

450,000 underlying warrant shares in 150,000-share increments

during the period December 31, 2026 through December 31, 2028, and

the expiration of the remaining 300,000 underlying warrant shares

will remain the same as the originally scheduled expiration date of

February 26, 2025. HCI will recognize a one-time non-cash deemed

dividend related to the warrant extension in the first quarter of

2024. HCI and Centerbridge also entered into a registration rights

agreement to grant resale registration rights to Centerbridge with

respect to Centerbridge’s warrant and the shares of HCI common

stock issuable pursuant to the warrant.

TypTap has also redeemed all of the TypTap Series A Preferred

Stock held by Centerbridge -- more than one year before

Centerbridge’s optional February 26, 2025 redemption date. The

redemption totaled approximately $100 million plus accrued and

unpaid dividends of approximately $2.9 million. The redemption

results in the elimination of any future dividends that would have

otherwise accrued on the preferred shares, including dividends at

the increased dividend rate of 9.5% that would have commenced in

February 2024. The redemption is being funded with cash on hand, as

well as approximately $50 million from HCI’s existing credit

facility with Fifth Third Bank.

HCI also announced today that it has filed a shelf registration

statement on Form S-3 (the “Shelf Registration”). The Shelf

Registration, which automatically became effective immediately on

filing, replaces the company’s old universal shelf registration

statement filed in September 2023 and permits the Company to offer

and sell its common stock, preferred stock, debt securities,

warrants, and stock purchase contracts and units, from time to

time, subject to market conditions and our capital needs. The Shelf

Registration will also enable Centerbridge to sell all or portion

of the above-described amended and restated warrant or the shares

issuable pursuant to the warrant.

As a part of the Shelf Registration, HCI also announced today

the implementation of an “at-the-market” facility (the “ATM

facility”) under which we would have the ability to raise up to $75

million through the issuance of new shares of common stock into the

market if it were to so choose.

While the Company has no immediate plans to issue shares

pursuant to the ATM facility or the Shelf Registration, which are

intended to provide financial flexibility going forward, the use of

proceeds of any such securities offered by the company will be

described in detail in a prospectus supplement at the time of any

such offering and which for the ATM facility are for working

capital and other general corporate purposes, to the extent such

shares are offered. Prospective investors, if we are to sell under

the ATM facility, should read the company’s filings related to such

offering and copies of the prospectus supplement and related

prospectus may be obtained from Truist Securities, Inc., Attention:

Prospectus Department, 303 Peachtree Street, Atlanta, GA 30308,

telephone: 800-685-4786, or e-mail: TSIdocs@Truist.com. You may

also obtain these documents free of charge by visiting EDGAR on the

SEC’s website at www.sec.gov.

This press release shall not constitute an offer to sell or the

solicitation of an offer to buy nor shall there be any sale of

these securities in any state in which such offer, solicitation or

sale would be unlawful prior to registration or qualification under

the securities laws of any such state. Any offering may be made

only by means of the prospectus included in the registration

statement and one or more related prospectus supplements that may

be used with respect to such offering.

HCI management will host a call to discuss events related to

this press release.

Interested parties can listen to the live presentation by

dialing the listen-only number below or by clicking the webcast

link available on the Investor Information section of the company's

website at www.hcigroup.com.

Date: Monday, January 22, 2024Time: 4:45 p.m. Eastern time (1:45

p.m. Pacific time)Toll Free: 888-506-0062International:

973-528-0011Participant Access Code: 973164

Please call the conference telephone number 10 minutes before

the start time. An operator will register your name and

organization. If you have any difficulty connecting with the

conference call, please contact Gateway Group at 949-574-3860.

A replay of the call will be available after 8:00 p.m. Eastern

time on the same day as the call and via the Investor Information

section of the HCI Group website at www.hcigroup.com.

Toll Free: 877-481-4010International: 919-882-2331Replay

Passcode: 49741

About HCI Group, Inc.HCI Group, Inc. owns

subsidiaries engaged in diverse, yet complementary, business

activities, including homeowners insurance, information technology

services, insurance management, real estate, and reinsurance. HCI’s

leading insurance operation, TypTap Insurance Company, is a

technology-driven homeowners insurance company. TypTap’s operations

are powered in large part by insurance-related information

technology developed by HCI’s software subsidiary, Exzeo USA, Inc.

HCI’s largest subsidiary, Homeowners Choice Property & Casualty

Insurance Company, Inc., provides homeowners insurance primarily in

Florida. HCI’s real estate subsidiary, Greenleaf Capital, LLC, owns

and operates multiple properties in Florida, including office

buildings, retail centers and marinas.

The company's common shares trade on the New York Stock Exchange

under the ticker symbol "HCI" and are included in the Russell 2000

and S&P SmallCap 600 Index. HCI Group, Inc. regularly publishes

financial and other information in the Investor Information section

of the company’s website. For more information about HCI Group and

its subsidiaries, visit www.hcigroup.com.

Forward-Looking StatementsThis news release may

contain forward-looking statements made pursuant to the Private

Securities Litigation Reform Act of 1995. Words such as

“anticipate,” “estimate,” “expect,” “intend,” “plan,” “confident,”

“prospects” and “project” and other similar words and expressions

are intended to signify forward-looking statements. Forward-looking

statements are not guarantees of future results and conditions but

rather are subject to various risks and uncertainties. For example,

HCI Group can give no assurance that the actions described herein

will provide an immediate benefit to the company’s financial

results. Some of these risks and uncertainties are identified in

the company’s filings with the Securities and Exchange Commission.

Should any risks or uncertainties develop into actual events, these

developments could have material adverse effects on the company’s

business, financial condition and results of operations. HCI Group,

Inc. disclaims all obligations to update any forward-looking

statements.

Company Contact:Bill Broomall, CFA Investor

RelationsHCI Group, Inc.Tel (813) 776-1012wbroomall@typtap.com

Investor Relations Contact:Matt GloverGateway

Group, Inc. Tel 949-574-3860HCI@gateway-grp.com

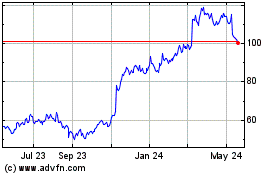

HCI (NYSE:HCI)

Historical Stock Chart

From Feb 2025 to Mar 2025

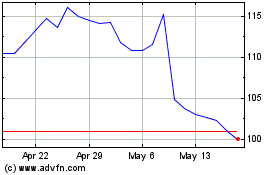

HCI (NYSE:HCI)

Historical Stock Chart

From Mar 2024 to Mar 2025