Second Quarter 2023 Highlights:

- Completed accretive $100 million repurchase of Class B units

of Hess Midstream Operations LP in June 2023, which is the second

repurchase transaction during 2023.

- Increased quarterly cash distribution to $0.6011 per Class A

share for the second quarter of 2023, an approximate 2.7% increase

compared with the first quarter of 2023, consisting of a 1.5%

increase in the distribution level per Class A share in addition to

the quarterly 1.2% increase per Class A share consistent with the

target of at least 5% growth in annual distributions per Class A

share through 2025.

- Net income was $147.9 million. Net cash provided by

operating activities was $204.6 million.

- Net income attributable to Hess Midstream LP was $25.1

million, or $0.50 basic earnings per Class A share, after deduction

for noncontrolling interests.

- Adjusted EBITDA1 was $248.1 million, Distributable Cash

Flow1 was $202.6 million and Adjusted Free Cash Flow1 was $154.3

million.

Guidance:

- Following strong year-to-date operational performance, Hess

Midstream LP is increasing its full year 2023 guidance for gas

gathering and gas processing throughput volumes.

- Hess Midstream LP is updating its full year 2023 net income

guidance to $595 – $625 million and increasing its Adjusted EBITDA

guidance to $1,000 – $1,030 million.

- Hess Midstream LP continues to target at least 5% annual

distribution growth per Class A share through 2025 with expected

annual distribution coverage of at least 1.4x and continues to

prioritize financial strength with a long-term leverage target of

3x Adjusted EBITDA.

- Hess Midstream LP continues to expect organic throughput

volume growth across all systems for 2024 and 2025 relative to 2023

volume guidance.

Hess Midstream LP (NYSE: HESM) (“Hess Midstream”) today reported

second quarter 2023 net income of $147.9 million compared with net

income of $151.8 million for the second quarter of 2022. After

deduction for noncontrolling interests, net income attributable to

Hess Midstream was $25.1 million, or $0.50 basic earnings per Class

A share compared with $0.51 basic earnings per Class A share in the

second quarter of 2022. Hess Midstream generated Adjusted EBITDA of

$248.1 million. Distributable Cash Flow (“DCF”) for the second

quarter of 2023 was $202.6 million and Adjusted Free Cash Flow was

$154.3 million.

“Hess Midstream delivered another quarter of strong operational

and financial results driven by our continued focus on gas capture

and Hess Corporation's Bakken performance, supporting continued

return of capital to our shareholders,” said John Gatling,

President and Chief Operating Officer of Hess Midstream. “We are

increasing our 2023 gas throughput guidance and reiterating our

expectation for substantial volume growth across all of our systems

through 2025, which is expected to result in sustained excess free

cash flow generation and allow us to continue our demonstrated

track record of differentiated shareholder returns.”

Hess Midstream’s results contained in this release are

consolidated to include the noncontrolling interests in Hess

Midstream Operations LP owned by affiliates of Hess Corporation

(“Hess”) and Global Infrastructure Partners (“GIP” and together

with Hess, the “Sponsors”). We refer to certain results as

“attributable to Hess Midstream LP,” which exclude the

noncontrolling interests in Hess Midstream Operations LP owned by

the Sponsors.

(1) Adjusted EBITDA, Distributable Cash Flow and Adjusted Free

Cash Flow are non‑GAAP measures. Definitions and reconciliations of

these non‑GAAP measures to GAAP reporting measures appear in the

following pages of this release

Financial Results

Revenues and other income in the second quarter of 2023 were

$324.0 million compared with $313.4 million in the prior-year

quarter. Second quarter 2023 revenues included $18.6 million of

pass-through electricity, produced water trucking and disposal

costs and certain other fees and $2.2 million of shortfall fees

related to minimum volume commitments (“MVC”) compared with $19.9

million and $57.7 million, respectively, in the prior-year quarter.

Second quarter 2023 revenues and other income were up $10.6 million

compared to the prior-year quarter primarily due to higher tariff

rates partly offset by lower shortfall fees due to the transition

from higher MVC levels in 2022 to actual physical volumes in 2023

that are at or above MVCs. Total operating costs and expenses in

the second quarter of 2023 were $125.9 million, up from $118.1

million in the prior-year quarter. The increase was primarily

attributable to higher operating expenses and higher depreciation

expense for additional assets placed in service. Interest expense

in the second quarter of 2023 was $43.8 million, up from $37.4

million in the prior-year quarter primarily attributable to higher

interest rates on the Term Loan A and revolving credit

facilities.

Net income for the second quarter of 2023 was $147.9 million, or

$0.50 basic earnings per Class A share, after deduction for

noncontrolling interests, compared with $0.51 basic earnings per

Class A share in the prior-year quarter. Substantially all of

income tax expense was attributed to earnings of Class A shares

reflective of our organizational structure. Net cash provided by

operating activities for the second quarter of 2023 was $204.6

million.

Adjusted EBITDA for the second quarter of 2023 was $248.1

million. Relative to distributions, DCF for the second quarter of

2023 of $202.6 million resulted in an approximate 1.4x distribution

coverage ratio. Adjusted Free Cash Flow for the second quarter of

2023 was $154.3 million. At June 30, 2023, Hess Midstream had a

drawn balance of $198.0 million on its revolving credit

facility.

Operational Highlights

Throughput volumes increased 23% for gas processing and 19% for

gas gathering in the second quarter of 2023 compared with the

second quarter of 2022 primarily due to higher production,

including third-party volumes, higher gas capture, and recovery

from severe weather in the second quarter of 2022. Water gathering

volumes increased 34% reflecting continued steady organic growth of

our water handling business. Throughput volumes in the second

quarter of 2023 compared with the second quarter of 2022 increased

16% for terminaling and 7% for crude oil gathering primarily due to

higher production and higher third-party volumes.

Capital Expenditures

Capital expenditures for the second quarter of 2023 totaled

$52.1 million, including $48.3 million of expansion capital

expenditures and $3.8 million of maintenance capital expenditures,

and were primarily attributable to continued expansion of our gas

compression capacity. Capital expenditures in the prior-year

quarter were $71.7 million, including $70.5 million of expansion

capital expenditures and $1.2 million of maintenance capital

expenditures, and were also primarily attributable to expansion of

our gas compression capacity.

Quarterly Cash Distributions

On July 24, 2023, our general partner’s board of directors

declared a quarterly cash distribution of $0.6011 per Class A share

for the second quarter of 2023. The distribution represents an

approximate 2.7% increase in the quarterly distribution per Class A

share for the second quarter of 2023 as compared with the first

quarter of 2023. The increase consists of an approximate 1.5%

increase in Hess Midstream's distribution level per Class A share

in addition to the quarterly 1.2% increase per Class A share

consistent with its target of at least 5% growth in annual

distributions per Class A share through 2025. The distribution is

expected to be paid on August 14, 2023, to shareholders of record

as of the close of business on August 3, 2023.

Updated Guidance

Hess Midstream continues to target at least 5% annual

distribution growth per Class A share through 2025 from this new

higher distribution level with expected annual distribution

coverage of at least 1.4x and continues to prioritize financial

strength with a long-term leverage target of 3x Adjusted EBITDA.

For 2024 and 2025, Hess Midstream continues to expect organic

throughput volume growth across all systems relative to 2023 volume

guidance.

Hess Midstream is increasing its gas gathering and gas

processing throughput guidance for full year 2023 and updating its

full year 2023 net income, Adjusted EBITDA, DCF and Adjusted Free

Cash Flow guidance based on strong year-to-date operational

performance. Additionally, Hess Midstream is further updating its

net income, DCF and Adjusted Free Cash Flow guidance to include the

impact of an incremental $10 million in expected interest expense

on borrowings under its credit facility used to fund the Class B

unit repurchase transactions. The updated net income guidance also

includes the impact of an incremental $5 million in expected income

tax expense resulting from ownership changes following the

previously completed Class B unit repurchase and secondary equity

offering transactions.

Hess Midstream reiterates its guidance of at least 10% per year

expected growth in net income and Adjusted EBITDA in each of 2024

and 2025, and approximately 10% annualized growth in throughput

volumes across gas, oil and water systems from 2023 levels as

implied in our already-established MVCs for 2025.

Year Ending

December 31, 2023

(Unaudited)

Financials (in millions)

Net income

$

595 – 625

Adjusted EBITDA

$

1,000 – 1,030

Distributable cash flow

$

820 – 850

Expansion capital expenditures

$

210

Maintenance capital expenditures

$

15

Adjusted free cash flow

$

610 – 640

Year Ending

December 31, 2023

(Unaudited)

Throughput volumes

Gas gathering - MMcf of natural gas per

day

370 – 380

Crude oil gathering - MBbl of crude oil

per day

95 – 105

Gas processing - MMcf of natural gas per

day

355 – 365

Crude terminals - MBbl of crude oil per

day

105 – 115

Water gathering - MBbl of water per

day

85 – 95

Investor Webcast

Hess Midstream will review second quarter financial and

operating results and other matters on a webcast today at 12:00

p.m. Eastern Time. For details about the event, refer to the

Investor Relations sections of our website at

www.hessmidstream.com.

About Hess Midstream

Hess Midstream LP is a fee‑based, growth-oriented midstream

company that owns, operates, develops and acquires a diverse set of

midstream assets to provide services to Hess and third‑party

customers. Hess Midstream owns oil, gas and produced water handling

assets that are primarily located in the Bakken and Three Forks

Shale plays in the Williston Basin area of North Dakota. More

information is available at www.hessmidstream.com.

Reconciliation of U.S. GAAP to Non‑GAAP Measures

In addition to our financial information presented in accordance

with U.S. generally accepted accounting principles (“GAAP”),

management utilizes certain additional non‑GAAP measures to

facilitate comparisons of past performance and future periods.

“Adjusted EBITDA” presented in this release is defined as reported

net income (loss) before net interest expense, income tax expense,

depreciation and amortization and our proportional share of

depreciation of our equity affiliates, as further adjusted to

eliminate the impact of certain items that we do not consider

indicative of our ongoing operating performance, such as

transaction costs, other income and other non‑cash and

non‑recurring items, if applicable. “Distributable Cash Flow” or

“DCF” is defined as Adjusted EBITDA less net interest, excluding

amortization of deferred financing costs, cash paid for federal and

state income taxes and maintenance capital expenditures. DCF does

not reflect changes in working capital balances. We define

“Adjusted Free Cash Flow” as DCF less expansion capital

expenditures and ongoing contributions to equity investments. We

define "Gross Adjusted EBITDA Margin" as the ratio of Adjusted

EBITDA to total revenues, less pass-through revenues. We believe

that investors’ understanding of our performance is enhanced by

disclosing these measures as they may assist in assessing our

operating performance as compared to other publicly traded

companies in the midstream energy industry, without regard to

historical cost basis or, in the case of Adjusted EBITDA, financing

methods, and assessing the ability of our assets to generate

sufficient cash flow to make distributions to our shareholders.

These measures are not, and should not be viewed as, a substitute

for GAAP net income or cash flow from operating activities and

should not be considered in isolation. Reconciliations of Adjusted

EBITDA, DCF, Adjusted Free Cash Flow and Gross Adjusted EBITDA

Margin to reported net income (GAAP) and net cash provided by

operating activities (GAAP), are provided below. Hess Midstream is

unable to project net cash provided by operating activities with a

reasonable degree of accuracy because this metric includes the

impact of changes in operating assets and liabilities related to

the timing of cash receipts and disbursements that may not relate

to the period in which the operating activities occur. Therefore,

Hess Midstream is unable to provide projected net cash provided by

operating activities, or the related reconciliation of projected

Adjusted Free Cash Flow to projected net cash provided by operating

activities without unreasonable effort.

Second Quarter

(unaudited)

2023

2022

(in millions, except ratio and per-share

data)

Reconciliation of Adjusted EBITDA and

Distributable Cash Flow to net income:

Net income

$

147.9

$

151.8

Plus:

Depreciation expense

47.0

45.0

Proportional share of equity affiliates'

depreciation

1.3

1.3

Interest expense, net

43.8

37.4

Income tax expense (benefit)

8.1

7.1

Adjusted EBITDA

248.1

242.6

Less:

Interest, net(1)

41.7

35.2

Maintenance capital expenditures

3.8

1.2

Distributable cash flow

$

202.6

$

206.2

Reconciliation of Adjusted EBITDA,

Distributable Cash Flow and Adjusted Free Cash Flow to net cash

provided by operating activities:

Net cash provided by operating

activities

$

204.6

$

213.2

Changes in assets and liabilities

1.0

(6.3

)

Amortization of deferred financing

costs

(2.1

)

(2.2

)

Proportional share of equity affiliates'

depreciation

1.3

1.3

Interest expense, net

43.8

37.4

Earnings from equity investments

1.7

1.0

Distribution from equity investments

(1.8

)

(1.4

)

Other

(0.4

)

(0.4

)

Adjusted EBITDA

$

248.1

$

242.6

Less:

Interest, net(1)

41.7

35.2

Maintenance capital expenditures

3.8

1.2

Distributable cash flow

$

202.6

$

206.2

Less:

Expansion capital expenditures

48.3

70.5

Adjusted free cash flow

$

154.3

$

135.7

Distributed cash flow

140.0

133.3

Distribution coverage ratio

1.4

x

1.5

x

Distribution per Class A share

$

0.6011

$

0.5559

(1) Excludes amortization of deferred

financing costs.

Second Quarter

(Unaudited)

2023

2022

(in millions)

Reconciliation of gross Adjusted EBITDA

margin to net income:

Net income

$

147.9

$

151.8

Plus:

Depreciation expense

47.0

45.0

Proportional share of equity affiliates'

depreciation

1.3

1.3

Interest expense, net

43.8

37.4

Income tax expense (benefit)

8.1

7.1

Adjusted EBITDA

$

248.1

$

242.6

Total revenues

$

324.0

$

313.4

Less: pass-through revenues

18.6

19.9

Revenues excluding pass-through

$

305.4

$

293.5

Gross Adjusted EBITDA margin

81

%

83

%

Guidance

Year Ending

December 31, 2023

(Unaudited)

(in millions)

Reconciliation of Adjusted EBITDA,

Distributable Cash Flow and Adjusted Free Cash Flow to net

income:

Net income

$

595 – 625

Plus:

Depreciation expense*

195

Interest expense, net

175

Income tax expense

35

Adjusted EBITDA

$

1,000 – 1,030

Less:

Interest, net, and maintenance capital

expenditures

180

Distributable cash flow

$

820 – 850

Less:

Expansion capital expenditures

210

Adjusted free cash flow

$

610 – 640

*Includes proportional share of equity

affiliates' depreciation

Cautionary Note Regarding Forward-looking

Information

This press release contains “forward-looking statements” within

the meaning of U.S. federal securities laws. Words such as

“anticipate,” “estimate,” “expect,” “forecast,” “guidance,”

“could,” “may,” “should,” “would,” “believe,” “intend,” “project,”

“plan,” “predict,” “will,” “target” and similar expressions

identify forward-looking statements, which are not historical in

nature. Our forward-looking statements may include, without

limitation: our future financial and operational results; our

business strategy; our industry; our expected revenues; our future

profitability; our maintenance or expansion projects; our projected

budget and capital expenditures and the impact of such expenditures

on our performance; and future economic and market conditions in

the oil and gas industry.

Forward-looking statements are based on our current

understanding, assessments, estimates and projections of relevant

factors and reasonable assumptions about the future.

Forward-looking statements are subject to certain known and unknown

risks and uncertainties that could cause actual results to differ

materially from our historical experience and our current

projections or expectations of future results expressed or implied

by these forward-looking statements. The following important

factors could cause actual results to differ materially from those

in our forward-looking statements: the ability of Hess and other

parties to satisfy their obligations to us, including Hess’ ability

to meet its drilling and development plans on a timely basis or at

all, its ability to deliver its nominated volumes to us, and the

operation of joint ventures that we may not control; our ability to

generate sufficient cash flow to pay current and expected levels of

distributions; reductions in the volumes of crude oil, natural gas,

natural gas liquids (“NGLs”) and produced water we gather, process,

terminal or store; the actual volumes we gather, process, terminal

or store for Hess in excess of our MVCs and relative to Hess'

nominations; fluctuations in the prices and demand for crude oil,

natural gas and NGLs; changes in global economic conditions and the

effects of a global economic downturn or inflation on our business

and the business of our suppliers, customers, business partners and

lenders; the direct and indirect effects of an epidemic or outbreak

of an infectious disease, such as COVID-19 and its variants, on our

business and those of our business partners, suppliers and

customers, including Hess; our ability to comply with government

regulations or make capital expenditures required to maintain

compliance, including our ability to obtain or maintain permits

necessary for capital projects in a timely manner, if at all, or

the revocation or modification of existing permits; our ability to

successfully identify, evaluate and timely execute our capital

projects, investment opportunities and growth strategies, whether

through organic growth or acquisitions; costs or liabilities

associated with federal, state and local laws, regulations and

governmental actions applicable to our business, including

legislation and regulatory initiatives relating to environmental

protection and health and safety, such as spills, releases,

pipeline integrity and measures to limit greenhouse gas emissions

and climate change; our ability to comply with the terms of our

credit facility, indebtedness and other financing arrangements,

which, if accelerated, we may not be able to repay; reduced demand

for our midstream services, including the impact of weather or the

availability of the competing third-party midstream gathering,

processing and transportation operations; potential disruption or

interruption of our business due to catastrophic events, such as

accidents, severe weather events, labor disputes, information

technology failures, constraints or disruptions and cyber-attacks;

any limitations on our ability to access debt or capital markets on

terms that we deem acceptable, including as a result of weakness in

the oil and gas industry or negative outcomes within commodity and

financial markets; liability resulting from litigation; and other

factors described in Item 1A—Risk Factors in our Annual Report on

Form 10-K and any additional risks described in our other filings

with the Securities and Exchange Commission.

As and when made, we believe that our forward-looking statements

are reasonable. However, given these risks and uncertainties,

caution should be taken not to place undue reliance on any such

forward-looking statements since such statements speak only as of

the date when made and there can be no assurance that such

forward-looking statements will occur and actual results may differ

materially from those contained in any forward-looking statement we

make. Except as required by law, we undertake no obligation to

publicly update or revise any forward-looking statements, whether

because of new information, future events or otherwise.

HESS MIDSTREAM LP

SUPPLEMENTAL FINANCIAL DATA

(UNAUDITED)

(IN MILLIONS)

Second

Second

First

Quarter

Quarter

Quarter

2023

2022

2023

Statement of operations

Revenues

Affiliate services

$

321.9

$

313.0

$

303.4

Other income

2.1

0.4

1.6

Total revenues

324.0

313.4

305.0

Costs and expenses

Operating and maintenance expenses

(exclusive of depreciation shown separately below)

73.1

67.8

62.5

Depreciation expense

47.0

45.0

47.4

General and administrative expenses

5.8

5.3

6.4

Total operating costs and expenses

125.9

118.1

116.3

Income from operations

198.1

195.3

188.7

Income from equity investments

1.7

1.0

1.6

Interest expense, net

43.8

37.4

41.6

Income before income tax expense

(benefit)

156.0

158.9

148.7

Income tax expense (benefit)

8.1

7.1

6.5

Net income

$

147.9

$

151.8

$

142.2

Less: Net income attributable to

noncontrolling interest

122.8

129.8

121.5

Net income attributable to Hess Midstream

LP

$

25.1

$

22.0

$

20.7

Net income attributable to Hess Midstream

LP per Class A share:

Basic

$

0.50

$

0.51

$

0.47

Diluted

$

0.50

$

0.50

$

0.47

Weighted average Class A shares

outstanding

Basic

50.1

43.7

44.0

Diluted

50.2

43.7

44.1

HESS MIDSTREAM LP

SUPPLEMENTAL FINANCIAL DATA

(UNAUDITED)

(IN MILLIONS)

Six Months Ended June

30,

2023

2022

Statement of operations

Revenues

Affiliate services

$

625.3

$

625.1

Other income

3.7

0.7

Total revenues

629.0

625.8

Costs and expenses

Operating and maintenance expenses

(exclusive of depreciation shown separately below)

135.6

134.3

Depreciation expense

94.4

89.4

General and administrative expenses

12.2

11.3

Total operating costs and expenses

242.2

235.0

Income from operations

386.8

390.8

Income from equity investments

3.3

1.4

Interest expense, net

85.4

68.7

Income before income tax expense

(benefit)

304.7

323.5

Income tax expense (benefit)

14.6

12.1

Net income

$

290.1

$

311.4

Less: Net income attributable to

noncontrolling interest

244.3

272.5

Net income attributable to Hess Midstream

LP

$

45.8

$

38.9

Net income attributable to Hess Midstream

LP per Class A share:

Basic:

$

0.97

$

1.01

Diluted:

$

0.97

$

0.99

Weighted average Class A shares

outstanding

Basic

47.1

38.7

Diluted

47.1

38.8

HESS MIDSTREAM LP

SUPPLEMENTAL FINANCIAL DATA

(UNAUDITED)

(IN MILLIONS)

Second Quarter 2023

Gathering

Processing and Storage

Terminaling and Export

Interest and Other

Total

Statement of operations

Revenues

Affiliate services

$

174.1

$

121.6

$

26.2

$

-

$

321.9

Other income

0.4

1.2

0.5

-

2.1

Total revenues

174.5

122.8

26.7

-

324.0

Costs and expenses

Operating and maintenance expenses

(exclusive of depreciation shown separately below)

43.8

23.8

5.5

-

73.1

Depreciation expense

28.2

14.5

4.3

-

47.0

General and administrative expenses

2.5

1.1

0.2

2.0

5.8

Total operating costs and expenses

74.5

39.4

10.0

2.0

125.9

Income (loss) from operations

100.0

83.4

16.7

(2.0

)

198.1

Income from equity investments

-

1.7

-

-

1.7

Interest expense, net

-

-

-

43.8

43.8

Income before income tax expense

(benefit)

100.0

85.1

16.7

(45.8

)

156.0

Income tax expense (benefit)

-

-

-

8.1

8.1

Net income (loss)

100.0

85.1

16.7

(53.9

)

147.9

Less: Net income (loss) attributable to

noncontrolling interest

78.7

66.8

13.3

(36.0

)

122.8

Net income (loss) attributable to Hess

Midstream LP

$

21.3

$

18.3

$

3.4

$

(17.9

)

$

25.1

Second Quarter 2022

Gathering

Processing and Storage

Terminaling and Export

Interest and Other

Total

Statement of operations

Revenues

Affiliate services

$

166.2

$

116.5

$

30.3

$

-

$

313.0

Other income

-

-

0.4

-

0.4

Total revenues

166.2

116.5

30.7

-

313.4

Costs and expenses

Operating and maintenance expenses

(exclusive of depreciation shown separately below)

41.8

20.8

5.2

-

67.8

Depreciation expense

26.6

14.4

4.0

-

45.0

General and administrative expenses

2.6

1.0

0.2

1.5

5.3

Total operating costs and expenses

71.0

36.2

9.4

1.5

118.1

Income (loss) from operations

95.2

80.3

21.3

(1.5)

195.3

Income from equity investments

-

1.0

-

-

1.0

Interest expense, net

-

-

-

37.4

37.4

Income before income tax expense

(benefit)

95.2

81.3

21.3

(38.9)

158.9

Income tax expense (benefit)

-

-

-

7.1

7.1

Net income (loss)

95.2

81.3

21.3

(46.0)

151.8

Less: Net income (loss) attributable to

noncontrolling interest

77.6

66.3

17.5

(31.6)

129.8

Net income (loss) attributable to Hess

Midstream LP

$

17.6

$

15.0

$

3.8

$

(14.4)

$

22.0

HESS MIDSTREAM LP

SUPPLEMENTAL FINANCIAL DATA

(UNAUDITED)

(IN MILLIONS)

First Quarter 2023

Gathering

Processing and Storage

Terminaling and Export

Interest and Other

Total

Statement of operations

Revenues

Affiliate services

$

164.4

$

113.8

$

25.2

$

-

$

303.4

Other income

0.3

0.6

0.7

-

1.6

Total revenues

164.7

114.4

25.9

-

305.0

Costs and expenses

Operating and maintenance expenses

(exclusive of depreciation shown separately below)

38.4

20.2

3.9

-

62.5

Depreciation expense

28.8

14.5

4.1

-

47.4

General and administrative expenses

2.4

1.2

0.3

2.5

6.4

Total operating costs and expenses

69.6

35.9

8.3

2.5

116.3

Income (loss) from operations

95.1

78.5

17.6

(2.5

)

188.7

Income from equity investments

-

1.6

-

-

1.6

Interest expense, net

-

-

-

41.6

41.6

Income before income tax expense

(benefit)

95.1

80.1

17.6

(44.1

)

148.7

Income tax expense (benefit)

-

-

-

6.5

6.5

Net income (loss)

95.1

80.1

17.6

(50.6

)

142.2

Less: Net income (loss) attributable to

noncontrolling interest

77.7

65.6

14.3

(36.1

)

121.5

Net income (loss) attributable to Hess

Midstream LP

$

17.4

$

14.5

$

3.3

$

(14.5

)

$

20.7

HESS MIDSTREAM LP

SUPPLEMENTAL OPERATING DATA

(UNAUDITED)

(IN THOUSANDS)

Second

Second

First

Quarter

Quarter

Quarter

2023

2022

2023

Throughput volumes

Gas gathering - Mcf of natural gas per

day

369

309

347

Crude oil gathering - bopd

94

88

93

Gas processing - Mcf of natural gas per

day

358

292

338

Crude terminals - bopd

108

93

104

NGL loading - blpd

12

9

9

Water gathering - blpd

87

65

79

Six Months Ended

June 30,

2023

2022

Throughput volumes

Gas gathering - Mcf of natural gas per

day

358

318

Crude oil gathering - bopd

94

95

Gas processing - Mcf of natural gas per

day

348

304

Crude terminals - bopd

106

100

NGL loading - blpd

11

12

Water gathering - blp

83

68

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230726509521/en/

For Hess Midstream LP Investors: Jennifer Gordon

(212) 536-8244 Media: Robert Young (713) 496-6076

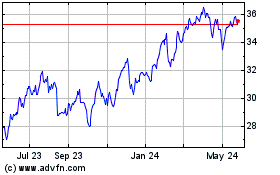

Hess Midstream (NYSE:HESM)

Historical Stock Chart

From Oct 2024 to Nov 2024

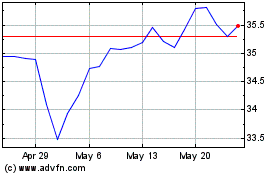

Hess Midstream (NYSE:HESM)

Historical Stock Chart

From Nov 2023 to Nov 2024