Hilton Grand Vacations Inc. (NYSE: HGV) (“HGV” or “the Company”)

today reports its second quarter 2024 results.

Second quarter of 2024 highlights1

- Total contract sales were $757 million.

- Member count was 720,000. Net Owner Growth (NOG) for the legacy

HGV-DRI business for the 12 months ended June 30, 2024, was

1.7%.

- Total revenues for the second quarter of 2024 were $1.235

billion compared to $1.007 billion for the same period in 2023.

- Total revenues were affected by a net deferral of $13 million

in the current period compared to a net deferral of $6 million in

the same period in 2023.

- Net income attributable to stockholders for the second quarter

was $2 million compared to $80 million net income attributable to

stockholders for the same period in 2023.

- Adjusted net income attributable to stockholders for the second

quarter was $65 million compared to $95 million for the same period

in 2023.

- Net income attributable to stockholders and adjusted net income

attributable to stockholders were affected by a net deferral of $8

million in the current period compared to a net deferral of $4

million in the same period in 2023.

- Diluted EPS for the second quarter was $0.02 compared to $0.71

for the same period in 2023.

- Adjusted diluted EPS for the second quarter was $0.62 compared

to $0.85 for the same period in 2023.

- Diluted EPS and adjusted diluted EPS were affected by a net

deferral of $8 million in the current period compared to a net

deferral of $4 million in the same period in 2023, or $(0.08) and

$(0.04) per share in the current period and the same period in

2023, respectively.

- Adjusted EBITDA attributable to stockholders for the second

quarter was $262 million compared to $248 million for the same

period in 2023.

- Adjusted EBITDA attributable to stockholders was affected by a

net deferral of $8 million in the current period compared to a net

deferral of $4 million in the same period in 2023.

- During the second quarter, the Company repurchased 2.3 million

shares of common stock for $100 million.

- Through July 31, 2024, the Company has repurchased

approximately 1.1 million shares for $46 million and currently has

$114 million of remaining availability under the 2023 Share

Repurchase Plan.

- On Aug. 7, 2024, HGV’s Board of Directors approved a new share

repurchase program authorizing the Company to repurchase up to an

aggregate of $500 million of its outstanding shares of common stock

over a two-year period (the “2024 Repurchase Plan”), which is in

addition to the amount remaining under the 2023 Share Repurchase

Plan.

- The Company is updating its guidance for the full year 2024

Adjusted EBITDA, excluding deferrals and recognitions, to a range

of $1.075 billion to $1.135 billion, or a reduction of $125 million

from its prior guidance range.

“Our results were below expectations this quarter, as we

experienced some sales challenges along with a pullback in consumer

spending behavior late in the quarter,” said Mark Wang, CEO of

Hilton Grand Vacations. “While we aren’t satisfied with our

performance, we’ve identified and are addressing those challenges,

and I remain confident in our business and our long-term path. Our

integration remains on track, and our underlying business

fundamentals are solid – with more members, more geographic

diversity, and more free cash flow than we’ve ever had.”

1.

The Company’s current period results and

prior year results include impacts related to deferrals of revenues

and direct expenses related to the Sales of VOIs under construction

that are recognized when construction is complete. These impacts

are reflected in the sub-bullets.

Overview

On Jan. 17, 2024, HGV completed the acquisition of Bluegreen

Vacations Holding Corporation (“Bluegreen” or “Bluegreen

Vacations”).

For the quarter ended June 30, 2024, diluted EPS was $0.02

compared to $0.71 for the quarter ended June 30, 2023. Net income

attributable to stockholders and Adjusted EBITDA attributable to

stockholders were $2 million and $262 million, respectively, for

the quarter ended June 30, 2024, compared to net income

attributable to stockholders and Adjusted EBITDA attributable to

stockholders of $80 million and $248 million, respectively, for the

quarter ended June 30, 2023. Total revenues for the quarter ended

June 30, 2024, were $1,235 million compared to $1,007 million for

the quarter ended June 30, 2023.

Net income attributable to stockholders and Adjusted EBITDA

attributable to stockholders for the quarter ended June 30, 2024,

included a net deferral of $8 million relating to the sales of

intervals of a project under construction in Hawaii during the

period. The Company anticipates recognizing revenues and related

expenses for projects in Hawaii in 2024 when it expects to complete

these projects and recognize the net deferral impacts.

Consolidated Segment Highlights – Second quarter of

2024

Real Estate Sales and Financing

For the quarter ended June 30, 2024, Real Estate Sales and

Financing segment revenues were $740 million, an increase of $136

million compared to the quarter ended June 30, 2023. Real Estate

Sales and Financing segment Adjusted EBITDA and Adjusted EBITDA

profit margin were $193 million and 26.1%, respectively, for the

quarter ended June 30, 2024, compared to $189 million and 31.3%,

respectively, for the quarter ended June 30, 2023. Real Estate

Sales and Financing segment revenues results in the second quarter

of 2024 increased primarily due to a $93 million increase in sales

revenue and a $26 million increase in financing revenue.

Real Estate Sales and Financing segment Adjusted EBITDA reflects

a net construction deferral of $8 million for the quarter ended

June 30, 2024, compared to $4 million net construction deferrals

for the quarter ended June 30, 2023, both of which decreased

reported Adjusted EBITDA attributable to stockholders.

Contract sales for the quarter ended June 30, 2024, increased

$145 million to $757 million compared to the quarter ended June 30,

2023. For the quarter ended June 30, 2024, tours increased by 39.4%

and VPG decreased by 10.9% compared to the quarter ended June 30,

2023. For the quarter ended June 30, 2024, fee-for-service contract

sales represented 19.5% of contract sales compared to 29.5% for the

quarter ended June 30, 2023.

Financing revenues for the quarter ended June 30, 2024,

increased by $26 million compared to the quarter ended June 30,

2023. This was driven primarily by an increase in the weighted

average interest rate of 50 basis points for the originated

portfolio and an increase in the carrying balance of the timeshare

financing receivables portfolio as of June 30, 2024, compared to

June 30, 2023.

Resort Operations and Club Management

For the quarter ended June 30, 2024, Resort Operations and Club

Management segment revenue was $386 million, an increase of $66

million compared to the quarter ended June 30, 2023. Resort

Operations and Club Management segment Adjusted EBITDA and Adjusted

EBITDA profit margin were $152 million and 39.4%, respectively, for

the quarter ended June 30, 2024, compared to $123 million and

38.4%, respectively, for the quarter ended June 30, 2023, primarily

due to an increase in management fees and higher average daily

rates, partially offset by an increase in development and

maintenance fees compared to the same period in 2023.

Inventory

The estimated value of the Company’s total contract sales

pipeline is $12.8 billion at current pricing.

The total pipeline includes $8.7 billion of sales relating to

inventory that is currently available for sale at open or

soon-to-open projects. The remaining $4.1 billion of sales is

related to inventory at new or existing projects that will become

available for sale in the future upon registration, delivery or

construction.

Owned inventory represents 90.0% of the Company’s total

pipeline. Approximately 68.7% of the owned inventory pipeline is

currently available for sale.

Fee-for-service inventory represents 10.0% of the Company’s

total pipeline. Approximately 61.5% of the fee-for-service

inventory pipeline is currently available for sale.

Balance Sheet and Liquidity

Total cash and cash equivalents were $328 million and total

restricted cash was $273 million as of June 30, 2024.

As of June 30, 2024, the Company had $4,885 million of corporate

debt, net outstanding with a weighted average interest rate of

6.850% and $1,725 million of non-recourse debt, net outstanding

with a weighted average interest rate of 5.075%.

As of June 30, 2024, the Company’s liquidity position consisted

of $328 million of unrestricted cash and $446 million remaining

borrowing capacity under the revolver facility.

As of June 30, 2024, HGV has $750 million remaining borrowing

capacity in total under the Timeshare Facility. Of this amount, HGV

has $647 million of mortgage notes that are available to be

securitized and another $324 million of mortgage notes that the

Company expects will become eligible as soon as it meets typical

milestones, including receipt of first payment, deeding or

recording.

Free cash flow was $95 million for the quarter ended June 30,

2024, compared to $180 million for the same period in the prior

year. Adjusted free cash flow was $370 million for the quarter

ended June 30, 2024, compared to $(13) million for the same period

in the prior year. Adjusted free cash flow for the quarter ended

June 30, 2024, and 2023 includes add-backs of $62 million and $22

million, respectively for acquisition and integration related costs

and $13 million related to litigation settlement payment for the

quarter ended June 30, 2024.

As of June 30, 2024, the Company’s total net leverage on a

trailing 12-month basis, inclusive of all anticipated cost

synergies, was approximately 3.67x.

Total Construction Deferrals and/or Recognitions Included in

Results Reported Under Accounting Standards Codification Topic 606

(“ASC 606”)

The Company’s Adjusted EBITDA as reported under ASC 606 includes

construction-related recognitions and deferrals of revenues and

related expenses as detailed in Table T-1 below. Under ASC 606, the

Company defers revenues and related expenses pertaining to sales at

projects that occur during periods when that project is under

construction until the period when construction is completed.

T-1

NET CONSTRUCTION DEFERRAL

ACTIVITY

(in millions)

2024

NET CONSTRUCTION DEFERRAL

ACTIVITY

First Quarter

Second Quarter

Third Quarter

Fourth Quarter

Full Year

Sales of VOIs recognitions (deferrals)

$

2

$

(13

)

$

—

$

—

$

(11

)

Cost of VOI sales (deferrals)(1)

(1

)

(4

)

—

—

(5

)

Sales and marketing expense

(deferrals)

—

(1

)

—

—

(1

)

Net construction recognitions

(deferrals)(2)

$

3

$

(8

)

$

—

$

—

$

(5

)

Net (loss) income attributable to

stockholders

$

(4

)

$

2

$

—

$

—

$

(2

)

Net income attributable to noncontrolling

interest

2

2

—

—

4

Net (loss) income

(2

)

4

—

—

2

Interest expense

79

87

—

—

166

Income tax (benefit) expense

(11

)

3

—

—

(8

)

Depreciation and amortization

62

68

—

—

130

Interest expense and depreciation and

amortization included in equity in earnings from unconsolidated

affiliates

1

2

—

—

3

EBITDA

129

164

—

—

293

Other loss, net

5

3

—

—

8

Share-based compensation expense

9

18

—

—

27

Acquisition and integration-related

expense

109

48

—

—

157

Impairment expense

2

—

—

—

2

Other adjustment items(3)

22

33

—

—

55

Adjusted EBITDA

276

266

—

—

542

Adjusted EBITDA attributable to

noncontrolling interest

3

4

—

—

7

Adjusted EBITDA attributable to

stockholders

$

273

$

262

$

—

$

—

$

535

T-1

NET CONSTRUCTION DEFERRAL

ACTIVITY

(CONTINUED, in

millions)

2023

NET CONSTRUCTION DEFERRAL

ACTIVITY

First Quarter

Second Quarter

Third Quarter

Fourth Quarter

Full Year

Sales of VOIs recognitions (deferrals)

$

4

$

(6

)

$

(12

)

$

(21

)

$

(35

)

Cost of VOI sales recognitions

(deferrals)(1)

1

(1

)

(3

)

(6

)

(9

)

Sales and marketing expense recognitions

(deferrals)

1

(1

)

(2

)

(3

)

(5

)

Net construction recognitions

(deferrals)(2)

$

2

$

(4

)

$

(7

)

$

(12

)

$

(21

)

Net income attributable to

stockholders

$

73

$

80

$

92

$

68

$

313

Net income attributable to noncontrolling

interest

—

—

—

—

—

Net income

73

80

92

68

313

Interest expense

44

44

45

45

178

Income tax expense

17

35

44

40

136

Depreciation and amortization

51

52

53

57

213

Interest expense and depreciation and

amortization included in equity in earnings from unconsolidated

affiliates

—

1

—

1

2

EBITDA

185

212

234

211

842

Other (gain) loss, net

(1

)

(3

)

1

1

(2

)

Share-based compensation expense

10

16

12

2

40

Acquisition and integration-related

expense

17

13

12

26

68

Impairment expense

—

3

—

—

3

Other adjustment items(3)

7

7

10

30

54

Adjusted EBITDA

218

248

269

270

1,005

Adjusted EBITDA attributable to

noncontrolling interest

—

—

—

—

—

Adjusted EBITDA attributable to

stockholders

$

218

$

248

$

269

$

270

$

1,005

(1)

Includes anticipated Costs of VOI sales

related to inventory associated with Sales of VOIs under

construction that will be acquired once construction is

complete.

(2)

The table represents deferrals and

recognitions of Sales of VOIs revenue and direct costs for

properties under construction.

(3)

Includes costs associated with

restructuring, one-time charges and other non-cash items. This

amount also includes the amortization of premiums and discounts

resulting from purchase accounting.

Conference Call

Hilton Grand Vacations will host a conference call on Aug. 8,

2024, at 11 a.m. (ET) to discuss second quarter results.

To access the live teleconference, please dial 1-877-407-0784 in

the U.S./Canada (or +1-201-689-8560 internationally) approximately

15 minutes prior to the teleconference’s start time. A live webcast

will also be available by logging onto the HGV Investor Relations

website at https://investors.hgv.com.

In the event of audio difficulties during the call on the

toll-free number, participants are advised that accessing the call

using the +1-201-689-8560 dial-in number may bypass the source of

audio difficulties.

A replay will be available within 24 hours after the

teleconference’s completion through Aug. 15, 2024. To access the

replay, please dial 1-844-512-2921 in the U.S. (+1-412-317-6671

internationally) using ID#13743187. A webcast replay and transcript

will also be available within 24 hours after the live event at

https://investors.hgv.com.

Forward Looking Statements

This press release contains forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933, as

amended and Section 21E of the Securities Exchange Act of 1934, as

amended. Forward-looking statements convey management’s

expectations as to the future of HGV, and are based on management’s

beliefs, expectations, assumptions and such plans, estimates,

projections and other information available to management at the

time HGV makes such statements. Forward-looking statements include

all statements that are not historical facts, and may be identified

by terminology such as the words “outlook,” “believe,” “expect,”

“potential,” “goal,” “continues,” “may,” “will,” “should,” “could,”

“would,” “seeks,” “approximately,” “projects,” “predicts,”

“intends,” “plans,” “estimates,” “anticipates,” “future,”

“guidance,” “target,” or the negative version of these words or

other comparable words, although not all forward-looking statements

may contain such words. The forward-looking statements contained in

this press release include statements related to HGV’s revenues,

earnings, taxes, cash flow and related financial and operating

measures, and expectations with respect to future operating,

financial and business performance and other anticipated future

events and expectations that are not historical facts, including,

related to the acquisition and integration of Bluegreen Vacations

Holding Corporation (“Bluegreen”).

HGV cautions you that our forward-looking statements involve

known and unknown risks, uncertainties and other factors, including

those that are beyond HGV’s control, which may cause the actual

results, performance or achievements to be materially different

from the future results. Any one or more of these risks or

uncertainties, including those related to HGV's acquisition and

integration of Bluegreen, could adversely impact HGV’s operations,

revenue, operating profits and margins, key business operational

metrics, financial condition or credit rating.

For a more detailed discussion of these factors, see the

information under the captions “Risk Factors” and “Management’s

Discussion and Analysis of Financial Condition and Results of

Operations” in HGV’s most recent Annual Report on Form 10-K, which

may be supplemented and updated by the risk factors in HGV’s

quarterly reports, current reports and other filings HGV makes with

the SEC.

HGV’s forward-looking statements speak only as of the date of

this communication or as of the date they are made. HGV disclaims

any intent or obligation to update any “forward-looking statement”

made in this communication to reflect changed assumptions, the

occurrence of unanticipated events or changes to future operating

results over time.

Non-GAAP Financial Measures

The Company refers to certain non-GAAP financial measures in

this press release, including Adjusted Net Income or Loss, Adjusted

Diluted EPS, EBITDA, Adjusted EBITDA, Adjusted EBITDA Attributable

to Stockholders, EBITDA profit margin, Adjusted EBITDA profit

margin, Free Cash Flow and Adjusted Free Cash Flow, profits and

profit margins for HGV’s key activities - real estate, financing,

resort and club management, and rental and ancillary services.

Please see the tables in this press release and “Definitions” for

additional information and reconciliations of such non-GAAP

financial measures.

The Company believes these additional measures are also

important in helping investors understand the performance and

efficiency with which we are able to convert revenues for each of

these key activities into operating profit, both in dollars and as

margins, and are frequently used by securities analysts, investors

and other interested parties as one of common performance measures

to compare results or estimate valuations across companies in our

industry.

The Company refers to Adjusted EBITDA guidance excluding

deferrals and recognitions, which does not take into account any

future deferrals of revenues and direct expenses related to the

sales of VOIs under construction that are recognized, only on a

non-GAAP basis, as the quantification of reconciling items to the

most directly comparable U.S. GAAP financial measure is not readily

available without unreasonable effort due to uncertainties

associated with the timing and amount of such items. These items

may create a material difference between the non-GAAP and

comparable U.S. GAAP results. We define Adjusted EBITDA

Attributable to Stockholders as Adjusted EBITDA excluding amounts

attributable to the noncontrolling interest in HGV/Big Cedar

Vacations in which HGV owns a 51% interest (“Big Cedar”).

About Hilton Grand Vacations Inc.

Hilton Grand Vacations Inc. (NYSE:HGV) is recognized as a

leading global timeshare company and is the exclusive vacation

ownership partner of Hilton. With headquarters in Orlando, Florida,

Hilton Grand Vacations develops, markets, and operates a system of

brand-name, high-quality vacation ownership resorts in select

vacation destinations. Hilton Grand Vacations has a reputation for

delivering a consistently exceptional standard of service, and

unforgettable vacation experiences for guests and approximately

720,000 Club Members. Membership with the Company provides

best-in-class programs, exclusive services and maximum flexibility

for our Members around the world.

For more information, visit www.corporate.hgv.com. Follow us on

Instagram, Facebook, LinkedIn, X (formerly Twitter), Pinterest and

YouTube.

HILTON GRAND VACATIONS INC.

DEFINITIONS

EBITDA, Adjusted EBITDA and Adjusted EBITDA Attributable to

Stockholders

EBITDA, presented herein, is a financial measure that is not

recognized under U.S. GAAP that reflects net income, before

interest expense (excluding non-recourse debt), a provision for

income taxes and depreciation and amortization.

Adjusted EBITDA, presented herein, is calculated as EBITDA, as

previously defined, further adjusted to exclude certain items,

including, but not limited to, gains, losses and expenses in

connection with: (i) other gains, including asset dispositions and

foreign currency transactions; (ii) debt

restructurings/retirements; (iii) non-cash impairment losses; (iv)

share-based and other compensation expenses; and (v) other items,

including but not limited to costs associated with acquisitions,

restructuring, amortization of premiums and discounts resulting

from purchase accounting, and other non-cash and one-time

charges.

Adjusted EBITDA Attributable to Stockholders is calculated as

Adjusted EBITDA, as previously defined, excluding amounts

attributable to the noncontrolling interest in Big Cedar.

EBITDA profit margin, presented herein, represents EBITDA, as

previously defined, divided by total revenues. Adjusted EBITDA

profit margin, presented herein, represents Adjusted EBITDA, as

previously defined, divided by total revenues.

EBITDA, Adjusted EBITDA and Adjusted EBITDA Attributable to

Stockholders are not recognized terms under U.S. GAAP and should

not be considered as alternatives to net income or other measures

of financial performance or liquidity derived in accordance with

U.S. GAAP. In addition, our definitions of EBITDA, Adjusted EBITDA

and Adjusted EBITDA Attributable to Stockholders may not be

comparable to similarly titled measures of other companies.

HGV believes that EBITDA, Adjusted EBITDA and Adjusted EBITDA

Attributable to Stockholders provide useful information to

investors about us and our financial condition and results of

operations for the following reasons: (i) EBITDA, Adjusted EBITDA

and Adjusted EBITDA Attributable to Stockholders are among the

measures used by our management team to evaluate our operating

performance and make day-to-day operating decisions; and (ii)

EBITDA and Adjusted EBITDA are frequently used by securities

analysts, investors and other interested parties as a common

performance measure to compare results or estimate valuations

across companies in our industry.

EBITDA, Adjusted EBITDA and Adjusted EBITDA Attributable to

Stockholders have limitations as analytical tools and should not be

considered either in isolation or as a substitute for net income,

cash flow or other methods of analyzing our results as reported

under U.S. GAAP. Some of these limitations are:

- EBITDA, Adjusted EBITDA and Adjusted EBITDA Attributable to

Stockholders do not reflect changes in, or cash requirements for,

our working capital needs;

- EBITDA, Adjusted EBITDA and Adjusted EBITDA Attributable to

Stockholders do not reflect our interest expense (excluding

interest expense on non-recourse debt), or the cash requirements

necessary to service interest or principal payments on our

indebtedness;

- EBITDA, Adjusted EBITDA and Adjusted EBITDA Attributable to

Stockholders do not reflect our tax expense or the cash

requirements to pay our taxes;

- EBITDA, Adjusted EBITDA and Adjusted EBITDA Attributable to

Stockholders do not reflect historical cash expenditures or future

requirements for capital expenditures or contractual

commitments;

- EBITDA, Adjusted EBITDA and Adjusted EBITDA Attributable to

Stockholders do not reflect the effect on earnings or changes

resulting from matters that we consider not to be indicative of our

future operations;

- EBITDA, Adjusted EBITDA and Adjusted EBITDA Attributable to

Stockholders do not reflect any cash requirements for future

replacements of assets that are being depreciated and amortized;

and

- EBITDA, Adjusted EBITDA and Adjusted EBITDA Attributable to

Stockholders may be calculated differently from other companies in

our industry limiting their usefulness as comparative

measures.

Because of these limitations, EBITDA, Adjusted EBITDA and

Adjusted EBITDA Attributable to Stockholders should not be

considered as discretionary cash available to us to reinvest in the

growth of our business or as measures of cash that will be

available to us to meet our obligations.

Adjusted Net Income, Adjusted Net Income Attributable to

Stockholders and Adjusted Diluted EPS Attributable to

Stockholders

Adjusted Net Income, presented herein, is calculated as net

income further adjusted to exclude certain items, including, but

not limited to, gains, losses and expenses in connection with costs

associated with acquisitions, restructuring, amortization of

premiums and discounts resulting from purchase accounting, and

other non-cash and one-time charges. Adjusted Net Income

Attributable to Stockholders, presented herein, is calculated as

Adjusted Net Income, as defined above, excluding amounts

attributable to the noncontrolling interest in Big Cedar. Adjusted

Diluted EPS, presented herein, is calculated as Adjusted Net Income

Attributable to Stockholders, as defined above, divided by diluted

weighted average shares outstanding.

Adjusted Net Income, Adjusted Net Income Attributable to

Stockholders and Adjusted Diluted EPS are not recognized terms

under U.S. GAAP and should not be considered as alternatives to net

income (loss) or other measures of financial performance or

liquidity derived in accordance with U.S. GAAP. In addition, our

definition may not be comparable to similarly titled measures of

other companies.

Adjusted Net Income, Adjusted Net Income Attributable to

Stockholders and Adjusted Diluted EPS are useful to assist our

investors in evaluating our ongoing operating performance for the

current reporting period and, where provided, over different

reporting periods.

Free Cash Flow and Adjusted Free Cash Flow

Free Cash Flow represents cash from operating activities less

non-inventory capital spending.

Adjusted Free Cash Flow represents free cash flow further

adjusted to exclude net non-recourse debt activities and other

one-time adjustment items including, but not limited to, costs

associated with acquisitions.

We consider Free Cash Flow and Adjusted Free Cash Flow to be

liquidity measures not recognized under U.S. GAAP that provides

useful information to both management and investors about the

amount of cash generated by operating activities that can be used

for investing and financing activities, including strategic

opportunities and debt service. We do not believe these non-GAAP

measures to be a representation of how we will use excess cash.

Non-GAAP Measures within Our Segments

Sales revenue represents sales of VOIs, net, and

Fee-for-service commissions and brand fees earned from the

sale of fee-for-service VOIs. Fee-for-service commissions and brand

fees represents sales, marketing, brand and other fees, which

corresponds to the applicable line item from our condensed

consolidated statements of operations, adjusted by marketing

revenue and other fees earned primarily from discounted marketing

related packages which encompass a sales tour to prospective

owners. Real estate expense represents costs of VOI sales

and Sales and marketing expense, net. Sales and marketing

expense, net represents sales and marketing expense, which

corresponds to the applicable line item from our condensed

consolidated statements of operations, adjusted by marketing

revenue and other fees earned primarily from discounted marketing

related packages which encompass a sales tour to prospective

owners. Both fee-for-service commissions and brand fees and sales

and marketing expense, net, represent non-GAAP measures. We present

these items net because it provides a meaningful measure of our

underlying real estate profit related to our primary real estate

activities which focus on the sales and costs associated with our

VOIs.

Real estate profit represents sales revenue less real

estate expense. Real estate margin is calculated as a percentage by

dividing real estate profit by sales revenue. We consider real

estate profit margin to be an important non-GAAP operating measure

because it measures the efficiency of our sales and marketing

spending, management of inventory costs, and initiatives intended

to improve profitability.

Financing profit represents financing revenue, net of

financing expense, both of which correspond to the applicable line

items from our condensed consolidated statements of operations.

Financing profit margin is calculated as a percentage by dividing

financing profit by financing revenue. We consider this to be an

important non-GAAP operating measure because it measures the

efficiency and profitability of our financing business in

connection with our VOI sales.

Resort and club management profit represents resort and

club management revenue, net of resort and club management expense,

both of which correspond to the applicable line items from our

condensed consolidated statements of operations. Resort and club

management profit margin is calculated as a percentage by dividing

resort and club management profit by resort and club management

revenue. We consider this to be an important non-GAAP operating

measure because it measures the efficiency and profitability of our

resort and club management business that support our VOI sales

business.

Rental and ancillary services profit represents rental

and ancillary services revenues, net of rental and ancillary

services expenses, both of which correspond to the applicable line

items from our condensed consolidated statements of operations.

Rental and ancillary services profit margin is calculated as a

percentage by dividing rental and ancillary services profit by

rental and ancillary services revenue. We consider this to be an

important non-GAAP operating measure because it measures our

ability to convert available inventory and unoccupied rooms into

revenue and profit by transient rentals, as well as profitability

of other services, such as food and beverage, retail, spa offerings

and other guest services.

Real Estate Metrics

Contract sales represents the total amount of VOI

products (fee-for-service, just-in-time, developed, and

points-based) under purchase agreements signed during the period

where we have received a down payment of at least 10% of the

contract price. Contract sales differ from revenues from the Sales

of VOIs, net that we report in our condensed consolidated

statements of operations due to the requirements for revenue

recognition, as well as adjustments for incentives. While we do not

record the purchase price of sales of VOI products developed by

fee-for-service partners as revenue in our condensed consolidated

financial statements, rather recording the commission earned as

revenue in accordance with U.S. GAAP, we believe contract sales to

be an important operational metric, reflective of the overall

volume and pace of sales in our business and believe it provides

meaningful comparability of HGV’s results the results of our

competitors which may source their VOI products differently. HGV

believes that the presentation of contract sales on a combined

basis (fee-for-service, just-in-time, developed, and points-based)

is most appropriate for the purpose of the operating metric;

additional information regarding the split of contract sales, is

included in Item 2. Management’s Discussion and Analysis of

Financial Condition and Results of Operations in our most recent

Quarterly Report on form 10-Q for the period ended June 30,

2024.

Developed Inventory refers to VOI inventory that is

sourced from projects developed by HGV.

Fee-for-Service Inventory refers to VOI inventory HGV

sells and manages on behalf of third-party developers.

Just-in-Time Inventory refers to VOI inventory primarily

sourced in transactions that are designed to closely correlate the

timing of the acquisition with HGV’s sale of that inventory to

purchasers.

Points-Based Inventory refers to VOI sales that are

backed by physical real estate that is or will be contributed to a

trust.

NOG or Net Owner Growth represents the year-over-year

change in membership.

Tour flow represents the number of sales presentations

given at HGV’s sales centers during the period.

Volume per guest (“VPG”) represents the sales

attributable to tours at HGV’s sales locations and is calculated by

dividing contract sales, excluding telesales, by tour flow. HGV

considers VPG to be an important operating measure because it

measures the effectiveness of HGV’s sales process, combining the

average transaction price with closing rate.

HILTON GRAND VACATIONS

INC.

FINANCIAL TABLES

CONDENSED CONSOLIDATED BALANCE SHEETS

T-2

CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS

T-3

CONDENSED CONSOLIDATED STATEMENTS OF CASH

FLOWS

T-4

FREE CASH FLOW RECONCILIATION

T-5

SEGMENT REVENUE RECONCILIATION

T-6

SEGMENT EBITDA, ADJUSTED EBITDA TO NET

INCOME AND ADJUSTED EBITDA ATTRIBUTABLE TO STOCKHOLDERS

T-7

REAL ESTATE SALES PROFIT DETAIL

SCHEDULE

T-8

CONTRACT SALES MIX BY TYPE SCHEDULE

T-9

FINANCING PROFIT DETAIL SCHEDULE

T-10

RESORT AND CLUB PROFIT DETAIL SCHEDULE

T-11

RENTAL AND ANCILLARY PROFIT DETAIL

SCHEDULE

T-12

REAL ESTATE SALES AND FINANCING SEGMENT

ADJUSTED EBITDA

T-13

RESORT AND CLUB MANAGEMENT SEGMENT

ADJUSTED EBITDA

T-14

ADJUSTED NET INCOME ATTRIBUTABLE TO

STOCKHOLDERS AND ADJUSTED DILUTED EARNINGS PER SHARE - DILUTED

(Non-GAAP)

T-15

RECONCILIATION OF NON-GAAP PROFIT MEASURES

TO GAAP MEASURE

T-16

T-2

HILTON GRAND VACATIONS

INC.

CONDENSED CONSOLIDATED BALANCE

SHEETS

(in millions, except share and

per share data)

June 30, 2024

December 31, 2023

(unaudited)

ASSETS

Cash and cash equivalents

$

328

$

589

Restricted cash

273

296

Accounts receivable, net

524

507

Timeshare financing receivables, net

2,976

2,113

Inventory

1,929

1,400

Property and equipment, net

902

758

Operating lease right-of-use assets,

net

84

61

Investments in unconsolidated

affiliates

78

71

Goodwill

1,933

1,418

Intangible assets, net

1,887

1,158

Other assets

553

314

TOTAL ASSETS

$

11,467

$

8,685

LIABILITIES AND EQUITY

Accounts payable, accrued expenses and

other

$

1,159

$

952

Advanced deposits

224

179

Debt, net

4,885

3,049

Non-recourse debt, net

1,725

1,466

Operating lease liabilities

101

78

Deferred revenue

321

215

Deferred income tax liabilities

972

631

Total liabilities

9,387

6,570

Equity:

Preferred stock, $0.01 par value;

300,000,000 authorized shares, none issued or outstanding as of

June 30, 2024 and December 31, 2023

—

—

Common stock, $0.01 par value;

3,000,000,000 authorized shares, 102,485,583 shares issued and

outstanding as of June 30, 2024 and 105,961,160 shares issued and

outstanding as of December 31, 2023

1

1

Additional paid-in capital

1,456

1,504

Accumulated retained earnings

456

593

Accumulated other comprehensive income

5

17

Total stockholders' equity

1,918

2,115

Noncontrolling interest

162

—

Total equity

2,080

2,115

TOTAL LIABILITIES AND EQUITY

$

11,467

$

8,685

T-3

HILTON GRAND VACATIONS

INC.

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS (UNAUDITED)

(in millions, except per share

data)

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

Revenues

Sales of VOIs, net

$

471

$

355

$

909

$

673

Sales, marketing, brand and other fees

167

173

312

331

Financing

102

76

206

150

Resort and club management

171

133

337

264

Rental and ancillary services

195

173

376

331

Cost reimbursements

129

97

251

192

Total revenues

1,235

1,007

2,391

1,941

Expenses

Cost of VOI sales

65

48

113

98

Sales and marketing

453

336

854

637

Financing

44

24

83

48

Resort and club management

48

44

102

86

Rental and ancillary services

188

154

361

306

General and administrative

58

48

103

90

Acquisition and integration-related

expense

48

13

157

30

Depreciation and amortization

68

52

130

103

License fee expense

40

34

75

64

Impairment expense

—

3

2

3

Cost reimbursements

129

97

251

192

Total operating expenses

1,141

853

2,231

1,657

Interest expense

(87

)

(44

)

(166

)

(88

)

Equity in earnings from unconsolidated

affiliates

3

2

8

5

Other (loss) gain, net

(3

)

3

(8

)

4

Income (loss) before income

taxes

7

115

(6

)

205

Income tax (expense) benefit

(3

)

(35

)

8

(52

)

Net income

4

80

2

153

Net income attributable to noncontrolling

interest

2

—

4

—

Net income (loss) attributable to

stockholders

$

2

$

80

$

(2

)

$

153

Earnings per share attributable to

stockholders(1):

Basic

$

0.02

$

0.72

$

(0.02

)

$

1.37

Diluted

$

0.02

$

0.71

$

(0.02

)

$

1.35

(1)

Earnings per share is calculated using

whole numbers.

T-4

HILTON GRAND VACATIONS

INC.

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS (UNAUDITED)

(in millions)

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

Operating Activities

Net income

$

4

$

80

$

2

$

153

Adjustments to reconcile net income to net

cash provided by operating activities:

Depreciation and amortization

68

52

130

103

Amortization of deferred financing costs,

acquisition premiums and other

38

7

63

14

Provision for financing receivables

losses

95

41

159

71

Impairment expense

—

3

2

3

Other loss (gain), net

3

(3

)

8

(4

)

Share-based compensation

18

16

27

26

Equity in earnings from unconsolidated

affiliates

(3

)

(2

)

(8

)

(5

)

Return on investment in unconsolidated

affiliates

—

6

—

6

Net changes in assets and liabilities, net

of effects of acquisitions:

Accounts receivable, net

(9

)

18

15

26

Timeshare financing receivables, net

(118

)

(72

)

(196

)

(96

)

Inventory

(6

)

34

(31

)

(67

)

Purchases and development of real estate

for future conversion to inventory

(17

)

(4

)

(50

)

(6

)

Other assets

91

110

(154

)

(134

)

Accounts payable, accrued expenses and

other

(33

)

(52

)

55

32

Advanced deposits

5

11

5

35

Deferred revenue

(23

)

(51

)

86

63

Net cash provided by operating

activities

113

194

113

220

Investing Activities

Acquisitions, net of cash, cash

equivalents and restricted cash acquired

10

—

(1,444

)

—

Capital expenditures for property and

equipment (excluding inventory)

(7

)

(4

)

(17

)

(9

)

Software capitalization costs

(11

)

(10

)

(20

)

(16

)

Other

(1

)

—

(1

)

—

Net cash used in investing activities

(9

)

(14

)

(1,482

)

(25

)

Financing Activities

Proceeds from debt

25

—

2,085

438

Proceeds from non-recourse debt

615

—

905

175

Repayment of debt

(289

)

(4

)

(397

)

(157

)

Repayment of non-recourse debt

(415

)

(215

)

(1,231

)

(397

)

Payment of debt issuance costs

(12

)

—

(51

)

—

Repurchase and retirement of common

stock

(100

)

(121

)

(199

)

(206

)

Payment of withholding taxes on vesting of

restricted stock units

—

—

(21

)

(14

)

Proceeds from employee stock plan

purchases

5

4

5

4

Proceeds from stock option exercises

1

2

7

7

Other

(1

)

(1

)

(2

)

(2

)

Net cash (used in) provided by financing

activities

(171

)

(335

)

1,101

(152

)

Effect of changes in exchange rates on

cash, cash equivalents & restricted cash

(10

)

(9

)

(16

)

(10

)

Net (decrease) increase in cash, cash

equivalents and restricted cash

(77

)

(164

)

(284

)

33

Cash, cash equivalents and restricted

cash, beginning of period

678

752

885

555

Cash, cash equivalents and restricted

cash, end of period

601

588

601

588

Less: Restricted cash

273

336

273

336

Cash and cash equivalents

$

328

$

252

$

328

$

252

T-5

HILTON GRAND VACATIONS

INC.

FREE CASH FLOW

RECONCILIATION

(in millions)

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

Net cash provided by operating

activities

$

113

$

194

$

113

$

220

Capital expenditures for property and

equipment

(7

)

(4

)

(17

)

(9

)

Software capitalization costs

(11

)

(10

)

(20

)

(16

)

Free Cash Flow

$

95

$

180

$

76

$

195

Non-recourse debt activity, net

200

(215

)

(326

)

(222

)

Acquisition and integration-related

expense

48

13

157

30

Litigation settlement payment

13

—

63

—

Other adjustment items(1)

14

9

26

17

Adjusted Free Cash Flow

$

370

$

(13

)

$

(4

)

$

20

(1)

Includes capitalized acquisition and

integration-related costs.

T-6

HILTON GRAND VACATIONS

INC.

SEGMENT REVENUE

RECONCILIATION

(in millions)

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

Revenues:

Real estate sales and financing

$

740

$

604

$

1,427

$

1,154

Resort operations and club management

386

320

746

622

Total segment revenues

1,126

924

2,173

1,776

Cost reimbursements

129

97

251

192

Intersegment eliminations

(20

)

(14

)

(33

)

(27

)

Total revenues

$

1,235

$

1,007

$

2,391

$

1,941

T-7

HILTON GRAND VACATIONS

INC.

SEGMENT EBITDA, ADJUSTED

EBITDA TO NET INCOME AND

ADJUSTED EBITDA ATTRIBUTABLE

TO STOCKHOLDERS

(in millions)

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

Net income (loss) attributable to

stockholders

$

2

$

80

$

(2

)

$

153

Net income attributable to noncontrolling

interest

2

—

4

—

Net income

4

80

2

153

Interest expense

87

44

166

88

Income tax expense (benefit)

3

35

(8

)

52

Depreciation and amortization

68

52

130

103

Interest expense, depreciation and

amortization included in equity in earnings from unconsolidated

affiliates

2

1

3

1

EBITDA

164

212

293

397

Other loss (gain), net

3

(3

)

8

(4

)

Share-based compensation expense

18

16

27

26

Acquisition and integration-related

expense

48

13

157

30

Impairment expense

—

3

2

3

Other adjustment items(1)

33

7

55

14

Adjusted EBITDA

266

248

542

466

Adjusted EBITDA attributable to

noncontrolling interest

4

—

7

—

Adjusted EBITDA attributable to

stockholders

$

262

$

248

$

535

$

466

Segment Adjusted EBITDA:

Real estate sales and financing(2)

$

193

$

189

$

399

$

358

Resort operations and club

management(2)

152

123

286

232

Adjustments:

Adjusted EBITDA from unconsolidated

affiliates

5

3

11

6

License fee expense

(40

)

(34

)

(75

)

(64

)

General and administrative(3)

(44

)

(33

)

(79

)

(66

)

Adjusted EBITDA

266

248

542

466

Adjusted EBITDA attributable to

noncontrolling interest

4

—

7

—

Adjusted EBITDA attributable to

stockholders

$

262

$

248

$

535

$

466

Adjusted EBITDA profit margin

21.5

%

24.6

%

22.7

%

24.0

%

EBITDA profit margin

13.3

%

21.1

%

12.3

%

20.5

%

(1)

Includes costs associated with

restructuring, one-time charges and other non-cash items. This

amount also includes the amortization of premiums and discounts

resulting from purchase accounting.

(2)

Includes intersegment transactions,

share-based compensation, depreciation and other adjustments

attributable to the segments.

(3)

Excludes segment related share-based

compensation, depreciation and other adjustment items.

T-8

HILTON GRAND VACATIONS

INC.

REAL ESTATE SALES PROFIT

DETAIL SCHEDULE

(in millions, except Tour Flow

and VPG)

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

Tour flow

226,388

162,444

400,526

292,712

VPG

$

3,320

$

3,728

$

3,441

$

3,835

Owned contract sales mix

80.5

%

70.5

%

82.1

%

68.8

%

Fee-for-service contract sales mix

19.5

%

29.5

%

17.9

%

31.2

%

Contract sales

$

757

$

612

$

1,388

$

1,135

Adjustments:

Fee-for-service sales(1)

(148

)

(180

)

(248

)

(354

)

Provision for financing receivables

losses

(94

)

(41

)

(158

)

(71

)

Reportability and other:

Net (deferral) of sales of VOIs under

construction(2)

(13

)

(6

)

(11

)

(2

)

Fee-for-service sale upgrades, net

—

7

—

12

Other(3)

(31

)

(37

)

(62

)

(47

)

Sales of VOIs, net

$

471

$

355

$

909

$

673

Plus:

Fee-for-service commissions and brand

fees

88

111

152

218

Sales revenue

559

466

1,061

891

Cost of VOI sales

65

48

113

98

Sales and marketing expense, net

374

274

694

524

Real estate expense

439

322

807

622

Real estate profit

$

120

$

144

$

254

$

269

Real estate profit margin(4)

21.5

%

30.9

%

23.9

%

30.2

%

Reconciliation of fee-for-service

commissions:

Sales, marketing, brand and other fees

$

167

$

173

$

312

$

331

Less: Marketing revenue and other

fees(5)

(79

)

(62

)

(160

)

(113

)

Fee-for-service commissions and brand

fees

$

88

$

111

$

152

$

218

Reconciliation of sales and marketing

expense:

Sales and marketing expense

$

453

$

336

$

854

$

637

Less: Marketing revenue and other

fees(5)

(79

)

(62

)

(160

)

(113

)

Sales and marketing expense, net

$

374

$

274

$

694

$

524

(1)

Represents contract sales from

fee-for-service properties on which we earn commissions and brand

fees.

(2)

Represents the net impact related to

deferrals of revenues and direct expenses related to the Sales of

VOIs under construction that are recognized when construction is

complete.

(3)

Includes adjustments for revenue

recognition, including amounts in rescission and sales

incentives.

(4)

Excluding the marketing revenue and other

fees adjustment, Real Estate profit margin was 18.8% and 27.3% for

the three months ended June 30, 2024 and 2023, respectively. and

20.8% and 26.8%. for the six months ended June 30, 2024, and 2023,

respectively.

(5)

Includes revenue recognized through our

marketing programs for existing owners and prospective first-time

buyers and revenue associated with sales incentives, title service

and document compliance.

T-9

HILTON GRAND VACATIONS

INC.

CONTRACT SALES MIX BY TYPE

SCHEDULE

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

Just-In-Time Contract Sales Mix

20.9

%

13.6

%

22.6

%

15.1

%

Fee-For-Service Contract Sales Mix

19.5

%

29.5

%

17.9

%

31.2

%

Total Capital-Efficient Contract Sales

Mix

40.4

%

43.1

%

40.5

%

46.3

%

T-10

HILTON GRAND VACATIONS

INC.

FINANCING PROFIT DETAIL

SCHEDULE

(in millions)

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

Interest income

$

116

$

68

$

228

$

138

Other financing revenue

14

11

22

19

Premium amortization of acquired timeshare

financing receivables

(28

)

(3

)

(44

)

(7

)

Financing revenue

102

76

206

150

Consumer financing interest expense

22

11

45

23

Other financing expense

20

13

34

26

Amortization of acquired non-recourse debt

discounts and premiums, net

2

—

4

(1

)

Financing expense

44

24

83

48

Financing profit

$

58

$

52

$

123

$

102

Financing profit margin

56.9

%

68.4

%

59.7

%

68.0

%

T-11

HILTON GRAND VACATIONS

INC.

RESORT AND CLUB PROFIT DETAIL

SCHEDULE

(in millions, except for

Members and Net Owner Growth)

Twelve Months Ended June

30,

2024

2023

Total members

720,069

522,156

Net Owner Growth (NOG)(1)

8,776

14,204

Net Owner Growth % (NOG)(1)

1.7

%

2.8

%

(1)

NOG is a trailing-twelve-month concept for

which the twelve months ended June 30, 2024 and ended June 30, 2023

includes member count for HGV Max and Legacy HGV-DRI members only

on a consolidated basis.

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

Club management revenue

$

67

$

53

$

130

$

104

Resort management revenue

104

80

207

160

Resort and club management revenues

171

133

337

264

Club management expense

21

15

41

30

Resort management expense

27

29

61

56

Resort and club management expenses

48

44

102

86

Resort and club management profit

$

123

$

89

$

235

$

178

Resort and club management profit

margin

71.9

%

66.9

%

69.7

%

67.4

%

T-12

HILTON GRAND VACATIONS

INC.

RENTAL AND ANCILLARY PROFIT

DETAIL SCHEDULE

(in millions)

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

Rental revenues

$

181

$

162

$

350

$

309

Ancillary services revenues

14

11

26

22

Rental and ancillary services revenues

195

173

376

331

Rental expenses

177

144

340

287

Ancillary services expense

11

10

21

19

Rental and ancillary services expenses

188

154

361

306

Rental and ancillary services profit

$

7

$

19

$

15

$

25

Rental and ancillary services profit

margin

3.6

%

11.0

%

4.0

%

7.6

%

T-13

HILTON GRAND VACATIONS

INC.

REAL ESTATE SALES AND

FINANCING SEGMENT ADJUSTED EBITDA

(in millions)

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

Sales of VOIs, net

$

471

$

355

$

909

$

673

Sales, marketing, brand and other fees

167

173

312

331

Financing revenue

102

76

206

150

Real estate sales and financing segment

revenues

740

604

1,427

1,154

Cost of VOI sales

(65

)

(48

)

(113

)

(98

)

Sales and marketing expense

(453

)

(336

)

(854

)

(637

)

Financing expense

(44

)

(24

)

(83

)

(48

)

Marketing package stays

(20

)

(14

)

(33

)

(27

)

Share-based compensation

3

3

6

6

Other adjustment items

32

4

49

8

Real estate sales and financing segment

adjusted EBITDA

$

193

$

189

$

399

$

358

Real estate sales and financing segment

adjusted EBITDA profit margin

26.1

%

31.3

%

28.0

%

31.0

%

T-14

HILTON GRAND VACATIONS

INC.

RESORT AND CLUB MANAGEMENT

SEGMENT ADJUSTED EBITDA

(in millions)

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

Resort and club management revenues

$

171

$

133

$

337

$

264

Rental and ancillary services

195

173

376

331

Marketing package stays

20

14

33

27

Resort and club management segment

revenue

386

320

746

622

Resort and club management expenses

(48

)

(44

)

(102

)

(86

)

Rental and ancillary services expenses

(188

)

(154

)

(361

)

(306

)

Share-based compensation

2

1

3

2

Resort and club segment adjusted

EBITDA

$

152

$

123

$

286

$

232

Resort and club management segment

adjusted EBITDA profit margin

39.4

%

38.4

%

38.3

%

37.3

%

T-15

HILTON GRAND VACATIONS

INC.

ADJUSTED NET INCOME

ATTRIBUTABLE TO STOCKHOLDERS AND

ADJUSTED DILUTED EARNINGS PER

SHARE ATTRIBUTABLE TO STOCKHOLDERS (Non-GAAP)

(in millions except per share

data)

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

Net income (loss) attributable to

stockholders

$

2

$

80

$

(2

)

$

153

Net income attributable to noncontrolling

interest

2

—

4

—

Net income

4

80

2

153

Income tax expense (benefit)

3

35

(8

)

52

Income (loss) before income

taxes

7

115

(6

)

205

Certain items:

Other loss (gain), net

3

(3

)

8

(4

)

Impairment expense

—

3

2

3

Acquisition and integration-related

expense

48

13

157

30

Other adjustment items(1)

33

7

55

14

Adjusted income before income

taxes

91

135

216

248

Income tax (expense)

(24

)

(40

)

(48

)

(63

)

Adjusted net income

67

95

168

185

Net income attributable to noncontrolling

interest

2

—

4

—

Adjusted net income attributable to

stockholders

$

65

$

95

$

164

$

185

Weighted average shares

outstanding

Diluted

104.3

112.2

104.3

113.3

Earnings per share attributable to

stockholders(2):

Diluted

$

0.02

$

0.71

$

(0.02

)

$

1.35

Adjusted diluted

$

0.62

$

0.85

$

1.57

$

1.63

(1)

Includes costs associated with

restructuring, one-time charges, the amortization of premiums and

discounts resulting from purchase accounting and other non-cash

items.

(2)

Earnings per share amounts are calculated

using whole numbers.

T-16

HILTON GRAND VACATIONS

INC.

RECONCILIATION OF NON-GAAP

PROFIT MEASURES TO GAAP MEASURE

(in millions)

Three Months Ended June

30,

Six Months Ended June

30,

($ in millions)

2024

2023

2024

2023

Net income (loss) attributable to

stockholders

$

2

$

80

$

(2

)

$

153

Net income attributable to noncontrolling

interest

2

—

4

—

Net income

4

80

2

153

Interest expense

87

44

166

88

Income tax (benefit) expense

3

35

(8

)

52

Depreciation and amortization

68

52

130

103

Interest expense, depreciation and

amortization included in equity in earnings from unconsolidated

affiliates

2

1

3

1

EBITDA

164

212

293

397

Other loss (gain), net

3

(3

)

8

(4

)

Equity in earnings from unconsolidated

affiliates(1)

(5

)

(3

)

(11

)

(6

)

Impairment expense

—

3

2

3

License fee expense

40

34

75

64

Acquisition and integration-related

expense

48

13

157

30

General and administrative

58

48

103

90

Profit

$

308

$

304

$

627

$

574

Real estate profit

$

120

$

144

$

254

$

269

Financing profit

58

52

123

102

Resort and club management profit

123

89

235

178

Rental and ancillary services profit

7

19

15

25

Profit

$

308

$

304

$

627

$

574

(1)

Excludes impact of interest expense,

depreciation and amortization included in equity in earnings from

unconsolidated affiliates of $2 million and $3 million,

respectively, for the three and six months ended June 30, 2024 and

$1 million for both the three and six months ended June 30,

2023.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240807079846/en/

Investor Contact: Mark Melnyk 407-613-3327

mark.melnyk@hgv.com

Media Contact: Lauren George 407-613-8431

lauren.george@hgv.com

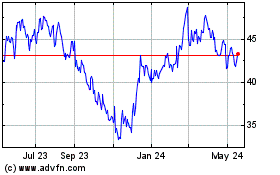

Hilton Grand Vacations (NYSE:HGV)

Historical Stock Chart

From Oct 2024 to Nov 2024

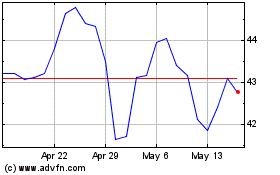

Hilton Grand Vacations (NYSE:HGV)

Historical Stock Chart

From Nov 2023 to Nov 2024