Highwoods Announces Recent Investment and Financing Activity

04 February 2025 - 8:05AM

Highwoods Properties, Inc. (NYSE:HIW) is today

announcing investment and financing transactions that closed during

the fourth quarter of 2024 and to date in early 2025.

First, the Company has sold in a series of

transactions non-core buildings in Raleigh and Tampa for combined

gross proceeds of $166.4 million. Gross proceeds from dispositions

closed in the fourth quarter of 2024 totaled $21.4 million with the

remainder closing early in the first quarter of 2025. The sold

properties include one office building encompassing 170,000 square

feet in North Raleigh and three buildings encompassing 616,000

square feet in the Westshore submarket of Tampa. On a combined

basis, these properties are 88% occupied and were projected to

generate $13.6 million of GAAP net operating income and $13.0

million of cash net operating income in 2025.

Second, in the fourth quarter of 2024, the

Company acquired fee simple title to the land underneath its

Century Center assets for $50.6 million. The Company previously

held most of its buildings in Century Center, a 12-building office

park encompassing 1.7 million square feet and 13 acres of

developable land in the Chamblee/N. Druid Hills submarket of

Atlanta, pursuant to a long-term ground lease with a third party

who owned fee simple title to the land.

Third, in the fourth quarter of 2024, the

Company sold 1.59 million shares of its common stock at an average

gross sales price of $32.71 per share, raising net proceeds of

$51.3 million.

Ted Klinck, President and Chief Executive

Officer, stated, “Our recent disposition activity demonstrates our

continuing ability to execute on our long-standing strategy of

selling non-core assets with limited future upside and ultimately

using the proceeds to recycle into higher-quality buildings. The

nearly $220 million of proceeds from these non-core dispositions

and equity raised during the fourth quarter, further bolsters our

already strong balance sheet and creates dry powder for future

external growth opportunities in 2025.”

“Acquiring the land underneath our Century

Center assets consolidates our ownership of the buildings and the

land, which provides us with more long-term flexibility and

certainty,” added Mr. Klinck.

About HighwoodsHighwoods

Properties, Inc., headquartered in Raleigh, is a publicly-traded

(NYSE:HIW), fully-integrated office real estate investment trust

(“REIT”) that owns, develops, acquires, leases and manages

properties primarily in the best business districts (BBDs) of

Atlanta, Charlotte, Dallas, Nashville, Orlando, Raleigh, Richmond

and Tampa. Highwoods is in the work-placemaking business. We

believe that by creating environments and experiences where the

best and brightest can achieve together what they cannot apart, we

can deliver greater value to our customers, their teammates and, in

turn, our stakeholders. For more information about Highwoods,

please visit our website at www.highwoods.com.

Forward-Looking StatementsSome

of the information in this press release may contain

forward-looking statements. Such statements include, in particular,

statements about our plans, strategies and prospects such as the

following: the expected financial and operational results and the

related assumptions underlying our expected results; the planned

sales of non-core assets and expected pricing and impact with

respect to such sales, including the tax impact of such sales; the

anticipated total investment, projected leasing activity, estimated

replacement cost and expected net operating income of acquired

properties and properties to be developed; and expected future

leverage of the Company. You can identify forward-looking

statements by our use of forward-looking terminology such as “may,”

“will,” “expect,” “anticipate,” “estimate,” “continue” or other

similar words. Although we believe that our plans, intentions and

expectations reflected in or suggested by such forward-looking

statements are reasonable, we cannot assure you that our plans,

intentions or expectations will be achieved.

Factors that could cause our actual results to

differ materially from Highwoods’ current expectations include,

among others, the following: the financial condition of our

customers could deteriorate; our assumptions regarding potential

losses related to customer financial difficulties could prove

incorrect; counterparties under our debt instruments, particularly

our revolving credit facility, may attempt to avoid their

obligations thereunder, which, if successful, would reduce our

available liquidity; we may not be able to lease or re-lease second

generation space, defined as previously occupied space that becomes

available for lease, quickly or on as favorable terms as old

leases; we may not be able to lease newly constructed buildings as

quickly or on as favorable terms as originally anticipated; we may

not be able to complete development, acquisition, reinvestment,

disposition or joint venture projects as quickly or on as favorable

terms as anticipated; development activity in our existing markets

could result in an excessive supply relative to customer demand;

our markets may suffer declines in economic and/or office

employment growth; unanticipated increases in interest rates could

increase our debt service costs; unanticipated increases in

operating expenses could negatively impact our operating results;

natural disasters and climate change could have an adverse impact

on our cash flow and operating results; we may not be able to meet

our liquidity requirements or obtain capital on favorable terms to

fund our working capital needs and growth initiatives or repay or

refinance outstanding debt upon maturity; and the Company could

lose key executive officers.

This list of risks and uncertainties, however,

is not intended to be exhaustive. You should also review the other

cautionary statements we make in “Risk Factors” set forth in our

2023 Annual Report on Form 10-K. Given these uncertainties, you

should not place undue reliance on forward-looking statements. We

undertake no obligation to publicly release the results of any

revisions to these forward-looking statements to reflect any future

events or circumstances or to reflect the occurrence of

unanticipated events.

Contact: Brendan

Maiorana

Executive Vice President and Chief Financial

Officer Brendan.Maiorana@highwoods.com919-872-4924

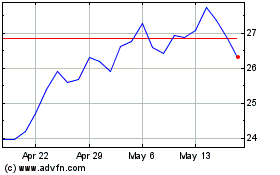

Highwoods Properties (NYSE:HIW)

Historical Stock Chart

From Jan 2025 to Feb 2025

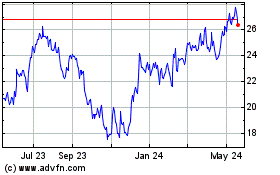

Highwoods Properties (NYSE:HIW)

Historical Stock Chart

From Feb 2024 to Feb 2025