Filed by: The Interpublic Group of Companies, Inc.

Pursuant to Rule 425 Under the Securities Act of 1933

and deemed filed pursuant to Rule 14a-6(b)

under the Securities Exchange Act of 1934

Subject Company: The Interpublic Group of Companies, Inc.

SEC File No.: 001-06686

On February 25, 2025, The Interpublic Group of Companies, Inc. participated in the Barclays Communications and Content Symposium 2025.

SYMPOSIUM PARTICIPANTS

IPG PARTICIPANTS

Philippe Krakowsky

Chief Executive Officer

ANALYST PARTICIPANTS

Julien Roch

Barclays

Kannan Venkateshwar

Barclays

QUESTIONS AND ANSWERS

Julien Roch, Barclays:

Good morning, everybody. Thank you very much for being with us. We have Philippe Krakowsky, the CEO of IPG, which, as you all know, is in the middle of a deal with Omnicom. So we appreciate that he’s taking time out of his busy schedule.

I’ll start with maybe the usual current trading question. So you gave a minus 2% to minus 1% full-year 2025 organic guidance, including 4% to 5% drag from account losses, partly offset by underlying growth. Can you talk a bit more about the puts and takes and the outlook for the year? Anything to be said about the pacing of revenue between the quarters, maybe the different services industry? So, some more color on current organic evolution, please.

Philippe Krakowsky, Chief Executive Officer, The Interpublic Group of Companies, Inc.

Sure. I mean, it’s interesting because current trading, obviously, to your point, at the moment is very much on kind of two tracks. Or maybe for us, really, on three tracks. So there’s a very significant focus on seeing the merger through to successful completion. I’m sure we’ll talk about that over the course of the next half hour. And everything is on track there. Then there is what we announced on our call a couple of weeks ago, which is the business transformation effort that we’re focusing on, the standalone IPG over the course of the year.

And then, to your point, there’s a challenging year from the top-line perspective, which, as we said, so you’ve got a drag of about 4.5% to 5% from essentially three very sizable account losses that took place last year. And they do correlate very heavily to either what we’ve been talking about is happening in the media space, specifically around principal trading and/or in the case of one former client, I think a competitor who’s coming at the market with an approach that will be much easier to address or to counter when we’re part of a more significant company and when we’re sort of part of the platform that we can build with Omnicom.

So, against that, 4.5% to 5% guide would imply kind of an underlying business that’s growing in the range of 2.5% to 3%. I don’t know that there’s anything that I’d call out for you on a client-sector basis there. I mean, you’ve seen where there’s been strength for the last couple of years. You’ve seen the drag that tech & telco had on us meaningfully attenuate and begin to actually look like it’ll show some growth this year. And then we’ve said all along that we didn’t think that the rebound in what was a very important category for us — I think at its height it would have been like 14% or 15% of revenue — we didn’t think that that would be — we thought that that would sort of come in step changes.

And then in terms of the areas that are strong in the business kind of that helped us, healthcare has been a strong performer. (It’s kind of odd because I’m having a look

over this ledge and just the top of Julien’s head, which is odd.) But there is, in terms of puts and takes, it’s fairly straightforward, right? I mean, it’s fairly — we’ve talked about, again, as IPG stand-alone principal, which we built out in the U.S. and got about half the clients opted into what was going to be helpful to us more so in the out years, 2026 and beyond, but it’ll have — it’ll be a benefit in 2025.

And then some of the marketing services businesses that have performed, again, everything is relative, but better, whether it’s coming off of the challenges that we saw three, four years ago but experiential, and some of the kind of more the businesses that have more of a social influencer component. So I don’t see anything in all of those that, as industry followers, any of you would find unusual. It’s pretty straightforward.

Mr. Roch:

Okay. Very good. As you mentioned a couple of times already, I’ll move to that subject. So, John Wren and yourselves have pointed out to principal media buying and leveraging from the Acxiom and Interact as the two key sources of revenue synergies, among others. So what have been the main bottlenecks in building up your own principal media buying practice to date? And, by merging with Omnicom, how much of a gain versus the stand-alone plan would that represent?

Mr. Krakowsky:

Look, I think the degree to which the terms of trade in media have shifted in the last 18 months, it’s been very, very dramatic, right? So again, as an industry watcher, you know that seven, eight years ago, clients were very clear that that was not something that they were particularly supportive of. Our model was built, and very, very successful, with an approach that was very consultative and much more focused on providing advice and decisioning around those investment decisions. That was supported by the expertise inside of Mediabrands and then what Acxiom brought to the table.

So the credit to and the benefit that Omnicom and Publicis have had around either the pivot or the fact that that was a practice that stayed in effect. So I think that for us, I don’t know that there have been impediments per se, because, as we said, in building it out in the back half of last year, that went faster than we thought it would. But the focus was in the U.S. So I think there’ll be meaningful benefit in the combination, because they’ve got a sizable and high-end practice that is global. So we can clearly move much faster in the rest of world.

I think that the Acxiom asset will be beneficial because, as we’ve discussed, what you can bring to market now is an essentially proprietary way to trade that incorporates a technology component or layer, a data layer, as well as the media inventory trading. And in that regard, I think Acxiom will be a dimension that is beneficial to, in the same way that we’ll benefit from the breadth and the power that Omnicom has in the marketplace. So both the globality of it and the fact that it is already taking place at a

level, and it’s meaningfully bigger than what we currently do. And then the Acxiom side for both of us is a net plus.

But I mean, there’s a lot of other — when I think about the revenue synergies, I think John has talked a lot about the benefits that we think that we can generate by combining the Flywheel data set and the Flywheel capabilities in commerce and what they’re able to see across the retail digital ecosystem. And then the Acxiom data set, which is very, very robust around people and very, very deep against actual people’s — tens of thousands of attributes there. So the combination of those is going to give us an unparalleled line of sight into exactly what’s happening with a consumer at any given point in time, how to reach them, the results that are being driven by the work that we do.

And then there’s a lot of complementarity in other areas. Our healthcare businesses are both very powerful, and there’s a lot in each of them that works very well with the other. And then in terms of our fit geographically, there’s a lot of opportunity to sort of dial up and sell across where we are particularly strong in geographies and conversely where they are. So we see a lot of opportunity for revenue synergy.

But to your point, there’s which is the most evident one and which one can you move on, relatively speaking, more quickly, and then all of those others.

Mr. Roch:

Okay. Good. As we’ve just focused on the revenue side of the deal, maybe now moving on the cost side. So you’ve announced $750 million of synergies. And Omnicom in their full-year results call gave a lot of detail on the split of those, including salary savings of $200 million. So, that could create uncertainty. So how do you ensure that you retain key talent as you go through the deal?

Mr. Krakowsky:

Well, I mean, what’s interesting is, if you look at what John put out in those various buckets, and you look at that $200 million — and obviously, we have the benefit of having engaged with them as we were finalizing the transaction and gotten a high degree of comfort with that number, so that’s — you put two global public companies and two companies that have traditionally, like the industry at large, been somewhat federated, so a lot of those are either duplicative costs or costs that got built up over time because you were essentially putting businesses together, and it is a holding company.

So it’s not the case that you’re talking about in those buckets, whether it’s that $200 million or the G&A associated with it or some of the work that we’re clearly talking about in this year. That’s not front of house, that’s not client-facing or revenue-generating. Which is not to say that the question about talent flight is not a fair one.

But we get asked a lot — we just finished a couple of meetings ahead of this one — how is client response? And so, to the extent that you’ve got so much more in the way of tools and that the capability set is enhanced and that there’s this complementarity around what Omnicom brings, what we bring, and where we each bring it, I think that there’s a high level of enthusiasm on the part of the people who are actually engaging with clients, right?

Now, in terms of what we do for talent in the interim, that is likelier to be involved in the place where there are synergies or where there are redundancies, we’re thoughtful, and we’re focused on making sure that we secure them through the transaction.

And then we’re also spending time pointing out to them that we really are very focused on whoever is stronger or strongest in certain sort of — kind of even if we’re talking about functional areas that support the revenue-generating side of the business, making sure that there will be thoughtful decision-making around those and opportunity to the extent that you can, knowing that you’re still going to be looking for some sizable savings.

So I don’t know that — there’s no magic bullet, but it’s definitely more in the support structures to the folks who actually deal with clients and generate revenue. So, hopefully, that helps dimensionalize where the concern lies or should lie.

Mr. Roch:

Yeah. No, it’s very helpful. And maybe the last one on the deal: So the shareholder vote is scheduled for March 18. Looking at your shareholders today, I would expect that the proxy advisers’ recommendations to have some impact on how people are voting. And so when do you expect the Glass Lewis and the ISS to give their recommendations ahead of the shareholder meeting?

Mr. Krakowsky:

That’s not something that they would necessarily make us privy to. But I think a good, sort of broadly speaking, the benchmark is that, a couple weeks before the meeting range and bearing — is that two weeks? Is that two-and-a-half weeks? — they will issue their recommendations. So I think you probably sort of are on the lookout for something from them in the next, I don’t know, what is that, I’ve lost sight of, to your point —

Mr. Roch:

Next week. Next week, I suppose.

Mr. Krakowsky:

Yeah, I would say, yeah, we’re at the end of February; it’s got to be in the next 7 to 10 days.

Mr. Roch:

Okay.

Mr. Krakowsky:

Not that they’ve, as I said, told us. But that’s a good guesstimate.

Mr. Roch:

All right. Moving away from the transaction, you unveiled yourself a $250 million cost-cutting exercise, which is the equivalent of 270 basis point of margin, using my estimates of full-year 2025 net sales, which is a big number. So can you explain how we get there? What are the main actions you’re taking to generate those $250 million of cost savings?

And the second question is, can you have that much margin uplift and put the $750 million of transaction synergies on top?

Mr. Krakowsky:

So, on the second part of your question, yes, we’re very confident that the two are not — I think we said so on the call that there’s minimal overlap.

And so, to your first question, just a little earlier, having spent the time with John and his team sizing the benefits and the synergies of the deal, we’re looking at quite different levers here. So if in the case of — You mentioned the $200 million. There’s the associated G&A there. There’s the benefits of the combined kind of purchasing power and/or kind of how you think about procured spend on that side. And then there’s certain areas, like, they talk about IT and how you’re essentially putting those same investments, but your still back-of-house investments, against a much bigger company, a much bigger business.

In our case, the $250 million that we identified are kind of an extension of the work that you saw us begin last year, where we started to say, okay, you’ve got to standardize much more. You’ve got to think about more of the business that can be run from sort of, I guess, you could kind of call a platform approach to some of the underlying support services. So we are taking certain areas that have functional corporate areas, like finance and HR, and those are being centralized. So there’s — that’s a meaningful lever of the $250 million that we’ll generate, independent of the deal synergies this year.

Then there are certain capabilities areas where we’re already down the tracks. And you think about kind of the analytics work that gets done against all of the data that — whether it’s Acxiom data or Acxiom data married to client data or even to third-party data. So further centralization or centers of excellence there. In the production area where I think that most of the competitors — I think we’re all on that same journey in terms of production and at more or less the same place, other than perhaps WPP with

the Hogarth. Although even there it seems like they’ve got a whole other set of activity that happens in production that isn’t fully baked into that. But that’s an aside.

So all of those are, as a stand-alone company, things that make sense and that we clearly have an obligation, particularly given the top-line challenge, to move forward on. And the focus is definitely on the in-year savings of all that activity. And some of it will lead to a modicum of more, again, of what we’ve been talking about when it comes to nearshoring and offshoring.

And it’s interesting, because I think Omnicom specifically called out the nearshoring and offshoring, or incremental nearshoring and offshoring, was outside of the scope of the $750 million. So I think that there’ll be the opportunity for us to collectively look at that once the deal closes.

So, that’s kind of how our $250 million is focused, and then the fact that it fits into or sits outside of the $750 million.

Mr. Roch:

Yeah, great. Changing track altogether, net new business, anything large you’re currently defending or anything large you are trying to win without being the incumbent that is somewhat public and you can talk about?

Mr. Krakowsky:

Not really that’s somewhat public or we can talk about. So, look, I think last year was unfortunate in that we had a couple of longstanding incumbent relationships — and whether it’s just a function of they’ve been, they were due for review or perhaps, as I said, the underlying trading terms in media have shifted. But we don’t have something that looks like that.

And then in terms of opportunities, I mean, we’re seeing a reasonable amount of activity kind of in terms of new business. Nothing necessarily at that scale as yet. It’s early in the year. So I’d say that solid new business environment/pipeline. And relative to your first question, thankfully, no.

Mr. Roch:

Okay. Great. So you don’t have to look at the top of my head across the ledge —

[Crosstalk.]

I’ll let Kannan ask a few questions.

Kannan Venkateshwar, Barclays:

So, maybe zooming out a little bit, Philippe, I mean, when I look at the U.S. media space, which we cover here, the broad focus is some of the structural trends, right? Things like AI, for instance is a big theme. And your business, obviously, it has multiple aspects to it. So maybe if you could just provide some framework on what

parts of your business this complements, where is it a supplement, and maybe we could start with that framework.

Mr. Krakowsky:

Sure. That’s a good question. I think, unsurprisingly, the parts of our business that have, over the last five-ish, five-plus years, had more data where we’ve applied technology, and there’s been more analytics work — so be that the media business or be that the kind of parts of marketing that are more precision- and performance-based — they’ve already incorporated AI to a meaningful degree, again, over the last three, four years, right? And so if you’ve got these massive data sets, and you’re looking for patterns in them, if you’re doing predictive modeling against them, if you are looking for ways to align with clients and have more pay for performance, then when you’re engaged in CRM work or in media activation, there’s already quite a bit of that in those parts of the business.

Where — I think GenAI in the last 12 months has had, I don’t know if I’d say more, impact yet, it’s clearly — it’s raised a lot of the kinds of questions that you’d point to is, as you then think about everything that happens in some of those businesses, generating a unit of content becomes something you can do more efficiently.

The need for a lot more content is a fact. And so in terms of those individuals, it’s kind of, alright, are they using the tools? How are they using the tools? Are they moving their skill set upstream such that for the client’s perspective, there’s still meaningful value in having them as part of this sort of bigger integrated solution? What used to not get done, it can get done as you’re automating certain parts of that stack. And so all of that is very, very kind of nascent and work in progress. And I think that it’ll have a number of implications.

So you’ll — and we saw this in the media business six, seven years ago, where we definitely moved upstream and became a higher-value, more consultative partner to clients. I mean, I think it needs to be part of a system, right? So we clearly will use the technology to generate more content. Some of that content will be generated in ways that are the traditional ways we currently do. Some of that content will be generated in a human-being-with-a-machine way. Some of that content will be automated. And then how do you make sure all of that is connected to kind of a more systemic approach? So the question that Julien hinted at, when you talked about the benefits of Omni and Interact, we’ve had a lot of, lot of adoption across the “not the media, not the precision.”

In the last six months, as you turn out a lot of consoles, it put those capabilities into the hands of strategists and creative people and business leadership in some of the areas of the business that haven’t been touched by this. That can be an experiential business/agency. That can be a “traditional ad agency.” But I think it’s still very early days.

And I think that it’ll have — there’ll be more performance-based work. There’ll be the shift of where the labor goes. And then there’ll be the how do you incorporate it into a more integrated model that has kind of more addressability and accountability, the way that like the media business has had.

Mr. Venkateshwar:

Got it. We have one more minute. Maybe I can just squeeze in one more on retail media. It’s a new phenomenon, I guess. So could you talk about maybe your assets, capabilities in that space, and how you see that evolving over time as an opportunity?

Mr. Krakowsky:

Sure. I mean, look, I think, to your point, it’s a very — I think it will continue to be a high-growth channel or channels. For us, it’s been something we’ve built up inside of the media business, informed and fueled by Acxiom. We made an acquisition — or we announced the acquisition, it hasn’t fully closed — of an asset that is a technology that pulls massive amounts of retail data and does analytics against it.

But it’s also an area where the combination’s going to be really powerful because of what Omnicom has with Flywheel. So whether it’s our existing capability inside of the media business, kind of how we are or would evolve it independently with the acquisition we made. But then clearly, as I said earlier, when you think about the nature of what Flywheel has line of sight to and then the kind of data that sits inside of Acxiom and then coming at retail media, not just from a media perspective, but from a holistic helping clients solve for how they go to market. And that can be in marketing channels or in sales channels, because retail media is so front and center for clients in trying to figure out how they go to market.

Mr. Venkateshwar:

And we are out of time looks like. Thank you, Philippe. Thanks for being here. Julien?

Mr. Krakowsky:

Thank you.

CAUTIONARY STATEMENT

This transcript contains forward-looking statements. Statements in this transcript that are not historical facts, including statements regarding goals, intentions, and expectations as to future plans, trends, events, or future results of operations or financial position, constitute forward-looking statements. Without limiting the generality of the foregoing, words such as “may,” “will,” “expect,” “believe,” “anticipate,” “estimate,” “project,” “forecast,” “plan,” “intend,” “could,” “would,” “should,” “estimate,” “will likely result” or comparable terminology are intended to identify forward-looking statements. Forward-looking statements are based on current expectations and assumptions that are subject to risks and uncertainties, which could cause our actual results and outcomes to differ materially from those reflected in the forward-looking statements, and are subject to change based on a number of factors, including those outlined under Item 1A, Risk Factors, in our most recent Annual Report on Form 10-K, and our other filings with the Securities and Exchange Commission (“SEC”). Forward-looking statements speak only as of the date they are made, and we undertake no obligation to update publicly any of them in light of new information or future events.

On December 8, 2024, we entered into an Agreement and Plan of Merger (the “Merger Agreement”) with Omnicom Group Inc. (“Omnicom”), pursuant to which a merger subsidiary of Omnicom will merge with and into IPG, with IPG surviving the merger as a direct wholly owned subsidiary of Omnicom. The forward-looking statements in this transcript, other than the statements regarding the proposed merger transaction with Omnicom, do not assume the consummation of the proposed transactions unless specifically stated otherwise.

Actual results and outcomes could differ materially for a variety of reasons, including, among others:

•risks relating to the pending merger transaction with Omnicom, including: the occurrence of any event, change, or other circumstances that could delay or prevent closing of the proposed transactions with Omnicom, or give rise to the termination of the Merger Agreement; unanticipated costs or restrictions resulting from regulatory review of the merger transactions; restrictions on our business activities imposed by the Merger Agreement; costs incurred in connection with the merger and subsequent integration with Omnicom; litigation risks relating to the merger; any failure to integrate successfully the business and operations of Omnicom and IPG in the expected time frame, to realize all of the anticipated benefits of the combination or to effectively manage the combined companies’ expanded operations; and any merger-related loss of clients, service providers, vendors, or other business counterparties;

•the effects of a challenging economy on the demand for our advertising and marketing services, on our clients’ financial condition and on our business or financial condition;

•our ability to attract new clients and retain existing clients; including as a result of the announced merger transaction with Omnicom;

•our ability to retain and attract key employees; including as a result of the announced merger transaction with Omnicom;

•unanticipated changes in the competitive environment in the marketing and communications services industry, including risks and challenges from new or developing technologies such as artificial intelligence (AI);

•risks associated with the effects of global, national and regional economic and political conditions, including counterparty risks and fluctuations in interest rates, inflation rates and currency exchange rates;

•the economic or business impact of military or political conflict in key markets; or any significant market disruptions as a result of factors like public health crises;

•developments from changes in the regulatory and legal environment for advertising and marketing services companies around the world, including laws and regulations related to data protection and consumer privacy;

•the impact on our business as a result of general or directed cybersecurity events; and

•risks associated with assumptions we make in connection with our critical accounting estimates, including changes in assumptions associated with any effects of a challenging economy, and potential adverse effects if we are required to recognize impairment charges or other adverse accounting-related developments.

Investors should carefully consider the foregoing factors and the other risks and uncertainties that may affect our business, including those outlined under Item 1A, Risk Factors, in our most recent Annual Report on Form 10-K, and our other SEC filings. Investors are cautioned not to place undue reliance on forward-looking statements, which speak only as of the date they are made. We undertake no obligation to update or revise publicly any of them in light of new information, future events, or otherwise.

NO OFFER OR SOLICITATION

This communication is not intended to be, and shall not constitute, an offer to buy or sell or the solicitation of an offer to buy or sell any securities, or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made, except by means of a prospectus meeting the requirements of Section 10 of the U.S. Securities Act of 1933, as amended.

ADDITIONAL INFORMATION ABOUT THE TRANSACTION WITH OMNICOM AND WHERE TO FIND IT

In connection with the proposed transaction, IPG and Omnicom have filed a joint proxy statement with the SEC on January 17, 2025, and Omnicom has filed with the SEC a registration statement on Form S-4 on January 17, 2025 (File No.333-284358) (“Form S-4”) that includes the joint proxy statement of IPG and Omnicom and that also constitutes a prospectus of Omnicom. Each of IPG and Omnicom may also file other relevant documents with the SEC regarding the proposed transaction. This document is not a substitute for the joint proxy statement/prospectus or registration statement or any other document that IPG or Omnicom may file with the SEC. The definitive joint proxy statement/prospectus have been mailed to stockholders of IPG and Omnicom. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE REGISTRATION STATEMENT, JOINT PROXY STATEMENT/PROSPECTUS AND ANY OTHER RELEVANT DOCUMENTS THAT HAVE BEEN AND MAY BE FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY IF AND WHEN THEY BECOME AVAILABLE BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT IPG, OMNICOM AND THE PROPOSED TRANSACTION.

Investors and security holders are able to obtain free copies of the registration statement, joint proxy statement/prospectus and other documents containing important information about IPG, Omnicom and the proposed transaction, through the website maintained by the SEC at http://www.sec.gov. Copies of the registration statement, joint proxy statement/prospectus and other documents (if and when available) filed with the SEC by IPG may be obtained free of charge on IPG’s website at https://investors.interpublic.com/sec-filings/financial-reports or, alternatively, by directing a request by mail to IPG’s Corporate Secretary at The Interpublic Group of Companies, Inc., 909 Third Avenue, New York, NY 10022, Attention: SVP & Secretary. Copies of the registration statement and joint proxy statement/prospectus and other documents (if and when available) filed with the SEC by Omnicom may be obtained free of charge on Omnicom’s website at https://investor.omnicomgroup.com/financials/sec-filings/default.aspx or, alternatively, by directing a request by mail to Omnicom’s Corporate Secretary at Omnicom Group Inc., 280 Park Avenue, New York, New York 10017.

PARTICIPANTS IN THE SOLICITATION

IPG, Omnicom, and certain of their respective directors and executive officers may be deemed to be participants in the solicitation of proxies in respect of the proposed transaction. Information about the directors and executive officers of IPG, including a description of their direct or indirect interests, by security holdings or otherwise, is set forth in IPG’s Annual Report on Form 10-K, including under the heading “Executive Officers of the Registrant,” and proxy statement for IPG’s 2024 Annual Meeting of Stockholders, which was filed with the SEC on April 12, 2024, including under the headings “Board Composition,” “Non-Management Director Compensation,” “Executive Compensation” and “Outstanding Shares and Ownership of Common Stock.” To the extent holdings of IPG common stock by the directors and executive officers of IPG have changed from the amounts reflected therein, such changes have been or will be reflected on Initial Statements of Beneficial Ownership of Securities on Form 3 (“Form 3”), Statements of Changes in Beneficial Ownership on Form 4 (“Form 4”) or Annual Statements of Changes in Beneficial Ownership of Securities on Form 5 (“Form 5”), subsequently filed by IPG’s directors and executive officers with the SEC. Information about the directors and executive officers of Omnicom, including a description of their direct or indirect interests, by security holdings or otherwise, is set forth in Omnicom’s Annual Report on Form 10-K, including under the heading “Information About Our Executive Officers,” and proxy statement for Omnicom’s 2024 Annual Meeting of Stockholders, which was filed with the SEC on March 28, 2024, including under the headings “Executive Compensation,” “Omnicom Board of Directors,” “Directors’ Compensation for Fiscal Year 2023” and “Stock Ownership Information.” To the extent holdings of Omnicom common stock by the directors and executive officers of Omnicom have changed from the amounts reflected therein, such changes have been or will be reflected on Forms 3, Forms 4 or Forms 5, subsequently filed by Omnicom’s directors and executive officers with the SEC. Other information regarding the participants in the proxy solicitations and a description of their direct and indirect interests, by security holdings or otherwise, is contained in the registration statement and joint proxy statement/prospectus and other relevant materials filed or to be filed with the SEC regarding the proposed transaction when such materials become available. Investors and security holders should read the registration statement and joint proxy statement/prospectus carefully before making any voting or investment decisions. You may obtain free copies of any of the documents referenced herein from IPG or Omnicom using the sources indicated above.

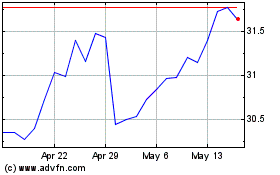

Interpublic Group of Com... (NYSE:IPG)

Historical Stock Chart

From Feb 2025 to Mar 2025

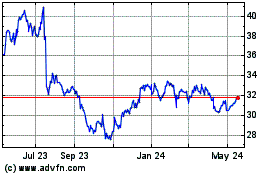

Interpublic Group of Com... (NYSE:IPG)

Historical Stock Chart

From Mar 2024 to Mar 2025