false

0001421461

0001421461

2024-09-30

2024-09-30

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report: September 30, 2024

(Date of earliest event

reported)

Intrepid

Potash, Inc.

(Exact name of registrant as specified in its

charter)

| Delaware |

|

001-34025 |

|

26-1501877 |

(State

or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(I.R.S.

Employer

Identification No.) |

707

17th Street, Suite

4200

Denver,

Colorado

80202

(Address of principal executive offices and zip

code)

(303)

296-3006

(Registrant’s telephone number, including

area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2.

below):

| ¨ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading symbol |

|

Name of each exchange on which registered |

| Common Stock, par value $0.001 per share |

|

IPI |

|

New

York Stock Exchange |

Indicate by checkmark whether the registrant is

an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter)

Emerging

growth company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 1.02 | Termination of a Material Definitive Agreement. |

The information set forth

in Item 5.02 regarding the Aircraft Lease and the Designation Agreement (as defined therein) is incorporated by reference herein.

| Item 5.02. | Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

On September 30, 2024, Intrepid Potash, Inc. (the “Company”)

entered into a Separation Agreement and General Release (the “Agreement”) with the court-appointed guardian of the Company’s

former principal executive officer, Robert Jornayvaz III. As previously disclosed, Mr. Jornayvaz was injured in a non-work related accident

in April 2024 and was granted a medical leave of absence from the Company. The Agreement’s effective date is expected to be October

8, 2024, unless revoked by Mr. Jornayvaz (the “Effective Date”). Shortly following the Effective Date, the Company will pay

to Mr. Jornayvaz $2,041,949 in cash in respect of all compensation owed to him for services rendered prior to the accident and certain

COBRA benefits. In addition, Mr. Jornayvaz will also receive certain medical benefits in connection with the injury and will forfeit

all unvested equity awards granted to him. Other terms of the Agreement include the following:

| · | Effective September 30, 2024, Mr. Jornayvaz resigned from all positions

with the Company and its subsidiaries and affiliates, including as the Chief Executive Officer and as a member of its Board of

Directors (the “Board”). As previously disclosed, Matthew Preston has been serving as the Company’s acting

principal executive officer since April 2024, and Mr. Preston will continue to serve in that role until a permanent Chief Executive

Officer is appointed by the Board. |

| · | Effective as of the Effective Date, the Company and Mr. Jornayvaz will terminate

(i) the Aircraft Dry Lease, dated January 9, 2009, and amended September 1, 2014, between the Company and an affiliate

of Mr. Jornayvaz (the “Aircraft Lease”) and (ii) the Director Designation and Voting Agreement, dated April 25, 2008, by and

among the Company, an affiliate of Mr. Jornayvaz and certain other parties (the “Designation Agreement”). The termination

of each of the Aircraft Dry Lease and the Designation Agreement are a result of Mr. Jornayvaz’s separation from the Company. There

are no penalties or other costs associated with the termination of these agreements. |

| · | Under the Separation Agreement, Mr. Jornayvaz will be eligible to be re-appointed

as a director of the Company on or before December 31, 2025, if he is capable of discharging the responsibilities of a member of the Board

and he continues to own 5% or more of the Company’s common stock. |

| · | Mr. Jornayvaz is subject to a customary “standstill”

agreement until December 31, 2025, pursuant to which he will be prohibited from taking certain actions with respect to the Company. |

The foregoing is not a complete description of the

terms of the Agreement and is qualified by reference to the full text of the Agreement, which is attached as Exhibit 10.1 to this Current

Report on Form 8-K and incorporated by reference herein.

| Item 7.01 | Regulation FD Disclosure. |

On October 4, 2024, the Company

issued a press release regarding Mr. Jornayvaz’s resignation from the Board and as Chief Executive Officer. A copy of the press

release is attached as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

The information furnished under

this Item 7.01, including Exhibit 99.1, will not be deemed “filed” for purposes of Section 18 of the Securities

Exchange Act of 1934 and will not be incorporated by reference into any filing under the Securities Act of 1933, except as expressly set

forth by specific reference in that filing.

| Item 9.01 | Financial Statements and Exhibits |

(d) Exhibits

SIGNATURES

Pursuant to the requirements of

the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

INTREPID POTASH, INC. |

| |

|

|

| Dated: October 4, 2024 |

By: |

/s/ Christina C. Sheehan |

| |

|

Christina C. Sheehan |

| |

|

General Counsel and Secretary |

Exhibit 10.1

EXECUTION VERSION

SEPARATION AGREEMENT AND GENERAL RELEASE

This

Separation Agreement and General Release (“Agreement”) is entered into by and between Intrepid Potash, Inc.,

a Delaware corporation (the “Company” or “Intrepid”),

and Louisa Craft Jornayvaz, as Guardian and Conservator for and on behalf of Robert P. Jornayvaz III (“Executive”)

(each a “Party” and collectively, the “Parties”).

RECITALS

WHEREAS, Executive served

as Chairman of the Company’s Board of Directors (the “Board”) from the Company’s formation in 2007 until

2010, and as Executive Chairman of the Board from 2010 until July 2024, and has been employed by Intrepid as the Company’s

Chief Executive Officer (“CEO”) since August 2014, and holds or has held similar positions with each of Intrepid’s

subsidiaries and affiliated companies;

WHEREAS, due to an off-work

accident on April 6, 2024, the Board on April 16, 2024 granted Executive a temporary medical leave of absence from his positions

at the Company;

WHEREAS, the Parties have

agreed that Executive is not able to perform the essential functions of his positions, with or without an accommodation;

WHEREAS, on August 28,

2024, the District Court, Arapahoe County, State of Colorado appointed Louisa Craft Jornayvaz as Conservator for Executive with all of

the powers granted to a conservator under C.R.S. 15-14-425, as well as any additional powers granted by law to a trustee in the state

of Colorado, including but not limited to the power to enter into this Agreement for and on behalf of Executive and bind him and any

who might claim through him to the waivers, promises, and representations contained herein;

WHEREAS, the Parties agree

and affirm that since April 18, 2022, Executive has been working without a formal employment agreement, and that no valid and enforceable

employment agreement is currently in place for Executive; rather, Executive was an at-will employee, though the Company made public disclosures

regarding his anticipated 2024 compensation prior to commencement of his medical leave of absence;

WHEREAS, as of July 31,

2024, at the latest, Executive has exhausted all FMLA and Colorado FAMLI leave available to him and, through his authorized representative,

has informed Intrepid that he does not intend to return to work as an officer or employee of the Company;

WHEREAS, as a result of his

inability to return to work Executive’s employment with Intrepid ended on September 30, 2024; and

WHEREAS, Intrepid and

Executive mutually desire to resolve all disputes Executive and anyone who might claim through him has or might have with Intrepid arising

from his employment with Intrepid or the separation of that employment.

NOW, THEREFORE, for good

and valuable consideration, the receipt and legal sufficiency of which is hereby acknowledged, and intending to be legally bound hereby,

the Parties hereto agree as follows:

TERMS

1. Separation

Date. Executive’s last day of employment was September 30, 2024 (the “Separation Date”). The execution,

revocation, and/or non-execution of this Agreement shall not affect the finality of the separation of Executive’s employment with

Intrepid as its CEO on the Separation Date.

2. Effective

Date. This Agreement shall become effective on the later of either (i) fourteen (14) calendar days after it and the accompanying

Notice were provided to Executive or his authorized representative or (ii) the eighth (8th) day after the Company receives this

Agreement signed by Executive (the “Effective Date”), provided that: (a) Executive, or his authorized representative,

does not revoke it within the Revocation Period, pursuant to Section 11 below; and (b) it is signed and delivered to the Company

after the Separation Date but on or before the close of business on October 2, 2024. If the Company does not receive the executed

Agreement by close of business on the 21st day after Executive’s receipt of the Agreement, and/or if it is revoked by Executive

during the Revocation Period, the Agreement will become null and void.

3. Consideration.

Provided that Executive signs this Agreement within the period outlined in Section 2 above, does not revoke his signature, and

Executive complies with all of the terms of this Agreement, on or before the seventh business day after the Effective Date, the Company

will pay to Executive a gross amount equal to $2,041,949.00, less applicable deductions, (the “Separation Payment”),

consisting of:

(i) two

million dollars and zero cents ($2,000,000.00); plus

(ii) forty-one

thousand nine hundred forty-nine dollars and zero cents ($41,949.00), which the Parties agree and affirm is the cost of COBRA coverage

for Executive and his enrolled family member(s) at the coverage and rates in effect as of the Separation Date for a period of twenty-nine

(29) months.

In addition to the Separation Payment, and as

additional consideration for the Executive’s promises and actions taken pursuant hereto, Intrepid shall:

(iii) while

in all instances fully complying with its legal obligations as a publicly traded company, use mutually agreed upon messaging related

to Executive’s separation, in which Executive shall be treated as having resigned from his position as CEO, in all public and personnel-facing

announcements;

(iv) directly

pay twenty-one thousand one hundred thirty-seven dollars and sixty cents ($21,137.60) to Medway Air Ambulance for transportation from

Florida to Colorado on May 3, 2024; and

(v) store

artwork owned by Executive and currently located at the Company’s headquarters until the earlier of either: (a) a reasonable

time after the Executive or his Authorized Representative provides written notice to the Company of his election to have it returned

to him; or (ii) the location of Intrepid’s headquarters is moved. Executive shall be responsible for the full cost of returning

this artwork, regardless of the reason or timing of the return. Notwithstanding the foregoing, Executive, on behalf of himself and all

other Releasees (defined below) or others who could claim a right to such artwork, specifically and completely waives and releases all

Released Parties (defined below) from any and all potential liability with respect to the artwork for the period to and through the time

at which it is returned to Executive and Executive shall be solely responsible for maintaining appropriate insurance coverage for this

artwork throughout such period.

This (iii), (iv), and (v), along with the Separation

Payment, are referred to herein as the “Separation Benefits.”

Executive acknowledges and

agrees that the Separation Benefits constitute valuable consideration for the promises and undertakings set forth in this Agreement.

4. Resignation

from Board of Directors and Affiliated Companies. As a material condition of being offered the consideration provided in Section 3

of this Agreement, Executive hereby resigns, as of the Separation Date, from any and all positions, including but not limited to as an

employee, officer, member of the Board or other governing body or fiduciary of the Company or any of its subsidiaries, affiliates, or

other related entities.

5. Termination

of Aircraft Dry Lease. The Company agrees, and Executive agrees to cause Intrepid Production Holdings, LLC, to enter into

a separate agreement to terminate the Aircraft Dry Lease, dated January 9, 2009, by and between Intrepid Potash, Inc. and Intrepid

Production Holdings, LLC, as amended September 1, 2014, in the form attached hereto as Exhibit A, such termination to

be effective as of the Effective Date.

6. Termination

of Designation Agreement; Right of Board Appointment; Standstill Agreement.

a) The

Parties agree to cause that certain Director Designation and Voting Agreement, dated as of April 25, 2008, by and among the Company,

Harvey Operating and Production Company, Intrepid Production Corporation (“IPC”), and Potash Acquisition, LLC

(the “Designation Agreement”) to be terminated as of the Effective Date by executing the Termination of Designation

Agreement in the form attached hereto as Exhibit B.

b) Upon

30 days’ advance notice to the Company, Executive shall be entitled to be appointed as a member of the Board on or prior to December 31,

2025 if Executive is capable of discharging the responsibilities of a member of the Board and so long as IPC and/or Executive continue

to beneficially own, without interruption, at least five percent of the Company’s outstanding voting stock. If Executive is appointed

to the Board pursuant to this Section 6(b) and his remaining term of office is less than nine months, Intrepid agrees

to nominate Executive as a candidate for director in its proxy statement prepared in connection with the next meeting of stockholders

at which directors of the relevant class are to be elected; at subsequent meetings, he shall be considered as a director candidate on

the same basis as other candidates. The rights and obligations under this Section 6(b) shall terminate at the earlier of such

time as IPC and/or Executive fail to beneficially own at least five percent of the Company’s outstanding voting stock, or Intrepid

fulfills its obligation as described above to nominate Executive as a candidate for director in its proxy statement.

c) Executive

agrees that from the date hereof until December 31, 2025 (the “Standstill Period”), Executive shall not, and

will cause his controlled affiliates not to, without the prior written consent of the Company, directly or indirectly: effect or seek,

publicly offer or publicly propose to effect, or cause or participate in: (A) (i) any acquisition of ownership (including,

but not limited to, any voting right or beneficial ownership as defined in Rule 13d-3 promulgated under the U.S. Securities Exchange

Act of 1934, as amended (together with the rules and regulations promulgated thereunder, the “Exchange Act”))

of any securities of the Company or any option, forward contract, swap or other position with a value derived from securities of the

Company or conveying the right to acquire or vote securities of the Company, or any ownership of any of the material assets or businesses

of the Company, (ii) any merger, amalgamation, arrangement or other business combination or takeover bid, tender or exchange offer

involving the Company, (iii) any recapitalization, restructuring, liquidation, dissolution or similar transaction with respect to

the Company or (iv) any “solicitation” of “proxies” (as such terms are used in the proxy rules of the

U.S. Securities and Exchange Commission), or make any communication exempted from the definition of “solicitation” by Rule 14a-1(l)(2)(iv) under

the Exchange Act with respect to the transactions contemplated by the foregoing clauses (i) – (iv), (B) other than solely

with its affiliates, form, join or in any way participate in a “group” (as defined under the Exchange Act) with respect to

the Company, (C) otherwise act, alone or in concert with others, to seek to control or influence the management, board of directors

or policies of the Company; (D) have any discussions or enter into any arrangements, understandings or agreements with, or advise,

finance, knowingly assist or knowingly encourage, any third party with respect to any of the matters set forth in this Section 6(c);

or (E) publicly disclose any intention, plan or arrangement that, if executed, would be prohibited by this Section 6(c).

During the Standstill Period, Executive agrees

to vote all shares of common stock of the Company, whether now owned or hereafter acquired, over which Executive exercises voting control,

in favor of the election to the Board of each person nominated by the Nominating Committee of the Board, and against any person not so

nominated, at any annual or special meeting of the Company’s stockholders at which directors are to be elected (or any action by

written consent in lieu of such a meeting).

7. Payment

of All Amounts Owed. On September 30, 2024, Executive received his final paycheck, which included all salary, bonuses, accrued

but unused paid time off, and expense reimbursement owed to Executive as of his Separation Date. By signing below, Executive acknowledges

and represents that, excluding the amounts payable pursuant to Section 3 of this Agreement, the Company has previously paid Executive

all amounts owed to him, including without limitation all salary, wages, bonuses, commissions, paid time off, and any and all other benefits

and compensation that Executive earned during his employment with Intrepid.

8. Forfeiture

of all Unvested Equity Awards. As a material term of this Agreement, effective as of the Effective Date, Executive hereby fully

and unequivocally forfeits all currently unvested equity awards previously granted to Executive, including all time-based vesting and

performance-based vesting restricted stock awards to the extent not yet vested, including, for the avoidance of doubt, specifically the

118,975 unvested shares granted in the following restricted stock agreements: the March 17, 2022, Restricted Stock Agreement (Time

Based-Vesting); the March 17, 2022, Restricted Stock Agreement (Performance-Vesting); the March 17, 2023, Restricted Stock

Agreement (Time Based-Vesting); and the March 17, 2023, Restricted Stock Agreement (Performance-Vesting). Executive hereby waives

any argument regarding Executive’s entitlement to any other awards or consideration, including under those awards, except that

the Parties agree an aggregate of 60,058 shares have vested pursuant to those awards prior to the Effective Date.

9. Health

Insurance. Executive’s group health insurance ceased on September 30, 2024. At that time, Executive became eligible

to continue his group health insurance benefits, subject to the terms and conditions of the benefit plan, federal COBRA law, and, as

applicable, state insurance laws. Executive received additional information regarding his right to elect, and how to pay for, continued

coverage under COBRA in a separate communication and it is Executive’s sole responsibility to elect such coverage, if he so chooses,

including but not limited to coverage for the 29-month period for which Intrepid has covered the cost of doing so through the amount

provided in Section 3 above.

10. Executive’s

Release of Claims. In exchange for the Separation Benefits described above, to which Executive would not otherwise be entitled,

Executive, on behalf of himself and his successors, heirs, and assigns (herein collectively referred to as the “Releasees”),

hereby fully and forever releases Intrepid and each of its respective current and former parent companies, subsidiaries, predecessor

and successor corporations, other affiliated companies, and assigns as well as any of their respective past, present, and future, insurers,

directors, officers, agents, shareholders, employees, investors, members, managers, administrators, or attorneys (herein collectively

referred to as “Released Parties”), and agrees not to sue, or in any manner to institute, prosecute or pursue, or

cause to be instituted, prosecuted, or pursued, any claim, duty, obligation or cause of action relating to any matters of any kind, whether

presently known or unknown, suspected or unsuspected, that he may possess or believe to possess against any of the Released Parties arising

from any omissions, acts or facts that have occurred up until and including the date that he signs this Agreement (collectively, the

“Claims”), including but not limited to any and all Claims relating to or arising from Executive’s employment

relationship with Intrepid and the termination of that relationship.

This release applies to any

and all matters that Executive could have asserted in any state or federal judicial or administrative forum, up to the date of this Agreement,

other than a claim for vested benefits, unemployment compensation, or worker’s compensation. Specifically, but not limited to,

this release includes claims under the following statutes (in each case as the statute(s) may have been amended) and common law

claims:

| · | the

Equal Pay Act; |

| · | the

Fair Labor Standards Act; |

| · | the

National Labor Relations Act; |

| · | Title

VII of the Civil Rights Act of 1964; |

| · | the

Post-Civil War Reconstruction Acts (42 U.S.C. §§ 1981-1988); |

| · | the

Americans with Disabilities Act; |

| · | the

Age Discrimination in Employment Act; |

| · | the

Older Workers Benefit Protection Act; |

| · | the

Rehabilitation Act of 1973; |

| · | the

Worker Adjustment and Retraining Notification Act; |

| · | the

Employee Retirement Income Security Act; |

| · | the

Uniformed Services Employment and Reemployment Rights Act; |

| · | the

Occupational Safety and Health Act; |

| · | the

Pregnancy Discrimination Act; |

| · | the

Immigration Reform and Control Act; |

| · | the

Family and Medical Leave Act; |

| · | the

Genetic Information Nondiscrimination Act; |

| · | the

Families First Coronavirus Relief Act, or any similar state or local laws; |

| · | the

Fair Credit Reporting Act; |

| · | the

Colorado Wage Act, the Colorado Wage Orders, and any other state or local wage payment laws,

to the fullest extent permitted by law; |

| · | the

Colorado Anti-Discrimination Act; |

| · | Colorado’s

Protecting Opportunities and Workers’ Rights Act; |

| · | Colorado’s

Chance to Compete Act; |

| · | Colorado’s

Employment Opportunity Act; |

| · | Colorado’s

Equal Pay for Equal Work Act and Transparency in Pay and Opportunities Act; |

| · | Colorado’s

WARNING Act and interpreting rules; |

| · | Colorado’s

Healthy Families and Workplaces Act; |

| · | Colorado’s

Paid Family and Medical Leave Insurance law; |

| · | the

Colorado Public Health Emergency Whistleblower Act; |

| · | Colo.

Rev. Stat. § 8-2-113; |

| · | Colo.

Rev. Stat. § 24-24-402.5; |

| · | the

Colorado Employment Security Act; |

| · | Colorado’s

Social Media and the Workplace law; |

| · | Colorado’s

Pregnancy Discrimination and Workplace Accommodations for Nursing Mothers Acts; |

| · | any

other federal, state, or local statutes, ordinances, or common laws; |

| · | any

and all claims for unpaid compensation or benefits; |

| · | any

claim of retaliation or whistleblower discrimination; |

| · | any

claim of wrongful discharge against public policy; |

| · | any

claim of defamation, or for pain and suffering, intentional infliction of emotional distress

or similar claims; |

| · | any

claim in tort or contract, or for promissory estoppel or violation of a covenant of good

faith and fair dealing; |

| · | any

claims for violation of privacy, fraud, negligent misrepresentation, and/or negligence; |

| · | any

and all claims for monetary or equitable relief, including but not limited to attorneys’

fees, costs, back pay, front pay, reinstatement, experts’ fees, medical fees or expenses,

disbursements, punitive damages, liquidated damages, and/or penalties; and |

| · | any

other claim arising out of federal, state, or local statute, common law, acts, rules, ordinance,

regulations or other laws and their respective implementing regulations. |

Nothing in this Agreement waives or releases

any rights or claims that, by law, cannot be waived or released. For example, nothing in this Agreement shall be construed to prohibit

Executive from volunteering information or documents, filing a charge with, or otherwise participating in any investigation or proceedings

conducted by the Equal Employment Opportunity Commission, the National Labor Relations Board, the Securities and Exchange Commission,

or any other federal, state, or local government agency or commission (collectively “Government Agencies” and each

a “Government Agency”) charged with enforcement of any law. Further, nothing in this Agreement affects claims under

statutes that prohibit an employee from waiving or releasing such claims, including but not limited to claims for unemployment benefits,

workers’ compensation benefits, vested benefits under an ERISA plan, or statutory claims which, in accordance with the statutes

creating such claims, may not be waived or released. Notwithstanding the foregoing, Executive agrees that by executing this Agreement,

he affirms that the Separation Benefits are the only legal remedy he may receive as compensatory damages or for lost back or front wages

and waives any right to recover personally monetary damages or any other individual relief as a result of any charge, complaint, or lawsuit

filed by him or by anyone, including but not limited to a Government Agency, on his behalf to the fullest extent permitted under the

law. This Agreement does not limit Executive’s right to receive any award unrelated to any claim for damages for information provided

to any Government Agency.

11. Age

Discrimination in Employment Act Notice and Waiver. Executive expressly acknowledges and agrees that, by entering into this Agreement,

Executive is waiving any and all rights or claims that Executive may have a rising under the Age Discrimination in Employment Act, as

amended (the “ADEA”), which have arisen on or before the date that Executive signs this Agreement. Executive further

acknowledges and agrees that:

a) In

return for this Agreement, Executive will receive compensation beyond that which Executive was already entitled to receive before entering

into this Agreement;

b) Executive

is hereby advised in writing to consult with an attorney before signing this Agreement and has, in fact, done so;

c) Executive

was provided this Agreement on September 11, 2024. Executive has twenty-one (21) days within which to consider the Agreement, the

21-day period to consider this Agreement will not re start or be extended if any changes (whether material or immaterial) are made to

this Agreement after the date it is first provided to Executive, and if Executive, or his authorized representative, signs this Agreement

before the end of such 21-day period, Executive acknowledges and agrees that Executive will have done so voluntarily and with full knowledge

that Executive is waiving Executive’s right to have 21 days to consider this Agreement;

d) Executive

has seven (7) days following the date that Executive, or his authorized representative, signs this Agreement in which to revoke

the Agreement (“Revocation Period”), and this Agreement will become null and void if Executive elects revocation during

that time. Any revocation must be in writing and must be received by the Company via email by Christina Sheehan, General Counsel and

Corporate Secretary for Intrepid, at christina.sheehan@intrepidpotash.com during the seven-day

revocation period. In the event that Executive exercises his right of revocation, neither Intrepid nor Executive will have any obligations

under this Agreement; and

e) Nothing

in this Agreement prevents or precludes Executive from challenging or seeking a determination in good faith of the validity of this waiver

under the ADEA, nor does it impose any condition precedent, penalties, or costs for doing so, unless specifically authorized by federal

law.

12. No

Pending or Future Lawsuits. Executive represents that he has no lawsuits, claims, or actions pending in his name, or on behalf

of any other person or entity, against Intrepid or any other Released Parties in any state or federal court, any arbitral forum, or any

state, federal, or local administrative or governmental agency. Executive also promises to opt out of any class or representative action

and to take such other steps as he has the power to take to disassociate himself from and waive any rights or remedies that might be

received from any class or representative action seeking relief against the Company and/or any other Released Party regarding any of

the released Claims.

Executive agrees, covenants,

and represents that he shall not voluntarily aid, assist, cooperate with or encourage any person or company in connection with the pursuit

of any claim or dispute against Intrepid, unless compelled by deposition or other proper legal process. Except as specifically permitted

under this Agreement, Executive further agrees not to voluntarily involve himself or participate in any action in which Intrepid or any

of the other Released Parties is a party without first obtaining Intrepid’s advance written consent. Executive, and his authorized

representatives, further agree, covenant, and represent that Executive and/or such authorized representatives shall provide advance written

notice to Intrepid in the event Executive or such representatives are subpoenaed to testify, or provide documents at deposition or at

trial, relating to (i) any actual, possible, or perceived violation by Intrepid or any other Released Parties of any federal, state,

local, or administrative law, rule, or regulation; (ii) the negotiations relating to, and the terms of, this Agreement; and (iii) any

acts or omissions by Intrepid or any of the other Released Parties occurring prior to the Effective Date of this Agreement. This paragraph

is intended to preclude voluntary aid or involvement of Executive, as described above, and nothing in this paragraph is intended to interfere

with any protected right to file charges, testify, assist or participate in any manner in a Government Agency investigation, hearing

or proceeding, and nothing in this paragraph is intended to influence the substance of such aid or involvement which is properly compelled

by legal process.

13. Acknowledgements

and Representations. Executive acknowledges and represents that he has not been denied any leave, benefits, or rights to which

he may have been entitled under the Family Medical Leave Act (“FMLA”), Colorado’s Family and Medical Leave Insurance

law, or any other federal or state law, and that he has not suffered any injuries at work for which he might still be entitled to compensation

or relief. Executive further acknowledges and represents that, except as expressly provided in this Agreement, Executive has been paid

all wages, bonuses, compensation, benefits, and other amounts that the Company or any other Released Party has ever owed to him.

14. Non-Disparagement.

Executive agrees not to make any oral or written statement or take any other action that disparages, criticizes, or damages the reputations

of Intrepid, its officers, directors, agents, or employees, products or services; or impairs the normal operations of the Company. Intrepid

agrees not to make any oral or written statement or take any other action that disparages, criticizes, or damages the professional reputation

of Executive. With respect to any employment reference or verification for Executive that Intrepid may receive, the Company will provide

only the dates of his employment and title of position(s) held. Nothing in this Agreement, including but not limited to this Section 14,

shall be interpreted to hold Intrepid liable for unauthorized statements by anyone affiliated with Intrepid. Nothing in this Agreement,

including but not limited to this Section 14 and/or the confidentiality provision in Section 15 below, is intended or shall

be construed to: 1) prohibit disclosures necessary to pursue legal enforcement of any provision of this Agreement; 2) infringe on any

employee’s right to engage in protected concerted activity or other conduct covered by Section 7 of the National Labor Relations

Act; 3) restrain any employee from disclosing the underlying facts of any alleged discriminatory or unfair employment practice to a Permissible

Third Party (defined below) or pursuant to a court order; 4) prohibit disclosure to any local, state, or federal Government Agency for

any reason, including disclosing the existence and terms of this Agreement, without first notifying the other Party; 5) prohibit disclosure

in response to legal process, such as a subpoena to testify at a deposition or in a court, including disclosing the existence and terms

of this Agreement, without first notifying the other Party; or 6) prohibit disclosure for all other purposes required by law. For purposes

of this Agreement, a “Permissible Third Party” is a Party’s immediate family members, medical or mental health

providers, mental or behavioral health therapeutic support group, tax or religious advisors, legal counsel, insurer, or reinsurer (collectively

“Permissible Third Parties”).

If Intrepid violates this

non-disparagement provision, Intrepid may not seek to enforce this non-disparagement provision, or the confidentiality provision

in Section 15 below to the extent it restrains Executive’s ability to disclose or discuss, either orally or in writing, any

alleged discriminatory or unfair employment practice, or seek damages against Executive for any such violation of this provision or Section 15,

but all other remaining terms of the Agreement remain enforceable as written and to the fullest extent permitted under the law.

15. Confidential

Information. Executive hereby promises and agrees not to knowingly use, disclose, or divulge to any person or entity in any manner,

any confidential or proprietary information originating with or belonging to Intrepid, or with respect to any of the officers, directors,

members, employees, or partners of Intrepid or any of its parents, subsidiaries, affiliates, or portfolio companies (“Confidential

Information”). Confidential Information includes but is not limited to inventions, research and development, engineering, products,

designs, manufacturing, methods, systems, improvements, trade secrets, formulas, processes, marketing, merchandising, selling, licensing,

servicing, pricing, personnel information, financial information, consultants and consultant lists, business records, manuals, business

strategies, and business plans that are treated and maintained as confidential by the Company. Confidential Information, as used in this

Agreement, does not include: (1) information that arises from Executive’s general training, knowledge, skill, or experience

(whether gained on the job or otherwise); (2) information that is readily ascertainable to the public; or (3) information that

Executive otherwise has a right to disclose as legally protected conduct. For example, nothing in this Agreement, including but not limited

to in this Confidentiality provision, is intended to limit Executive’s rights to discuss the terms, wages, and working conditions

of Executive’s employment with Intrepid in an effort to address work-related issues or problems in the workplace, attempt to induce

group action to improve pay or working conditions, take action for mutual aid or protection regarding terms and conditions of employment,

or engage in any other protected concerted activity as protected by applicable law, including but not limited to Section 7 of the

National Labor Relations Act (“NLRA”). This obligation is in addition to and not in lieu of any and all similar obligation(s) Executive

has under prior contracts entered into with the Company or as a matter of law.

16. Cooperation.

For a period of three years following the Separation Date, upon reasonable request, Executive and his authorized representatives

shall, to the best of their ability, make themselves available to Intrepid to furnish full and truthful information concerning any event

that took place during Executive’s employment. Executive shall furnish the information as soon as is practical after a request

from Intrepid is received, and no later than two business days after the request is received.

17. Return

of Company Property. Executive’s authorized representative represents that she has made a good faith effort to collect

and return to Intrepid all of its property and documents, as well as all other material and documentation relating to Intrepid, including

but not limited to Company-owned vehicles, computers (and any software, power cords, manuals, computer bags, and other equipment that

was provided to Executive with any such computers), cellular telephones, personal digital assistants, keys, access cards, files, software,

credit cards, instructional and management manuals, books, computer discs or drives, any other form of magnetic or electronic data storage,

and any documents that contain Confidential Information, including all copies maintained on paper or in any electronic format (e.g. emails,

memoranda, marketing materials, customer lists, communications, contracts and proposals with customers, excel spread sheets, reports,

PowerPoint presentations, and other documents maintained on any computers, personal digital assistants, phones, iPods, iPads, tablets,

or any other electronic storage device or disc, or any email, cloud storage or social media account). Executive and his authorized representatives

agree that he/she will not retain any copies, duplicates, or excerpts of information obtained during, or as a result of, Executive’s

employment with Intrepid, including but not limited to materials containing Confidential Information and, in the event Company property

that has not been returned is discovered to be in their possession any time after the Effective Date, it will promptly be returned to

the Company upon such discovery. To the extent necessary to access Intrepid’s property, Executive and/or Executive’s authorized

representative(s) agree to, to the best of their ability, provide Intrepid with any and all work-related account user-names and

passwords or passcodes as well as information related to technical services or other operational logistics Executive previously managed,

as necessary to ensure no interruption in Intrepid operations.

18. No

Liens. Executive’s conservator, by signing below, represents and warrants that (a) she has the capacity to act on

Executive’s behalf, and on behalf of all who might claim through Executive, to bind them to the terms and conditions of this Agreement;

and (b) there are no liens or claims of any lien or assignment in law or equity or otherwise of or against any of the Claims released

herein.

19. Entire

Agreement. Except as otherwise provided herein, this Agreement constitutes the entire agreement between Executive and the Company

concerning his employment with and separation from the Company, and supersedes and replaces any and all prior negotiations, agreements,

and understandings, both written and oral, concerning his relationship with and separation of employment from Intrepid. For the avoidance

of doubt, the Parties specifically agree and affirm that the aviation dry lease and the Designation Agreement are included in the agreements

that, upon the Effective Date of this Agreement, become null and void.

20. No

Admission of Liability. This Agreement constitutes a compromise and settlement of any and all potential disputed Claims. No action

taken by a Party hereto in connection with this Agreement shall be deemed or construed to be: (a) an admission of the truth or falsity

of any actual or potential Claims; or (b) an acknowledgment or admission by the Company of any fault or liability whatsoever to

a Party or to any third party.

21. Acknowledgement

of Opportunity to Negotiate. The Parties have had the opportunity to negotiate these terms, and any uncertainty or ambiguity

shall not be construed for or against any Party based on attribution of drafting to any Party.

22. Voluntary

Execution of Agreement. This Agreement is executed voluntarily and without any duress or undue influence on the part or behalf

of the Parties hereto, with the full intent of Executive releasing all claims. The Parties acknowledge that (a) they have read this

Agreement; (b) they have had the opportunity to seek legal counsel of their own choice; (c) they understand the terms and consequences

of this Agreement and of the releases it contains; and (d) they are fully aware of the legal and binding effect of this Agreement.

Executive further represents that the Company and other Released Parties have made no representations, promises, agreements, stipulations,

or statements related to the terms of this Agreement, other than the terms contained herein. Executive represents that she voluntarily

signs this Agreement as her own free act, and that she is not acting under any coercion or duress.

23. Successors.

This Agreement shall be binding upon each of the Parties and upon his or its respective heirs, administrators, representatives, executors,

and successors, and shall inure to the benefit of each Party and to his or its heirs, administrators, representatives, executors, and

successors.

24. Governing

Law. Except to the extent superseded by federal law, the laws of the State of Colorado govern this Agreement, regardless of the

laws that might otherwise govern under applicable principles of conflict of law.

25. Severability.

In the event that any portion of this Agreement or the application thereof, becomes or is declared by a court of competent jurisdiction

to be illegal, void, or unenforceable, the remainder of this Agreement will continue in full force and effect and the application of

such portion to other persons or circumstances will be interpreted so as to reasonably effect the intent of the parties hereto, except

that, in the event a court of competent jurisdiction finds the release provisions of Sections 10 and 11 of this Agreement to be unenforceable

or invalid, then this Agreement shall become null and void. Under such circumstances, Executive shall repay any and all Separation Benefits

paid by Intrepid pursuant to this Agreement back to Intrepid within a reasonable period of time, not to exceed 30 days.

26. Arbitration.

Any disputes between the Parties arising out of or related to Executive’s employment with the Company, or the termination

of that employment, including but not limited to disputes related to the enforcement, construction, interpretation, or validity of this

Agreement and Executive’s Release of Claims in Sections 10 and 11 of this Agreement, shall be submitted to final and binding arbitration

before a single arbitrator; provided, however, that either Party may seek provisional injunctive relief to ensure that the relief sought

in arbitration is not rendered ineffectual by interim harm pending the arbitration. Each Party acknowledges and agrees that it or he

is waiving its or his right to a trial by jury. The arbitration fees shall be paid by the Company, and each Party shall be responsible

for its or his own attorney’s fees and costs.

27. Modifications.

This Agreement may not be modified, amended, altered, or supplemented except by the execution and delivery of a written agreement

executed by Executive and an authorized representative of the Company or by a court of competent jurisdiction.

28. Section Headings.

Section and other headings contained in this Agreement are for convenience of reference only and shall not affect in any way

the meaning or interpretation of this Agreement.

29. Counterparts.

This Agreement may be executed in counterparts, and each counterpart shall have the same force and effect as an original and shall

constitute an effective, binding agreement on the part of each of the undersigned. Either Party may execute this Agreement by signing

on the designated signature block below, and by transmitting such signature page via facsimile or e-mail (via PDF format) to the

other Party. Any signature made and transmitted by facsimile or e-mail (via PDF format) for the purpose of executing this Agreement shall

be deemed an original signature for purposes of this Agreement and shall be binding upon the Party transmitting its or her signature

by facsimile or e-mail (via PDF format).

signature page to follow

THE UNDERSIGNED

HAVE READ THE FOREGOING

AGREEMENT AND ACCEPT AND AGREE TO

THE PROVISIONS CONTAINED THEREIN,

AND HEREBY EXECUTE IT, KNOWINGLY AND

VOLUNTARILY, AND WITH FULL

UNDERSTANDING OF ITS CONSEQUENCES.

| Dated: |

September 30, 2024 |

|

Louisa

Craft Jornayvaz, AS guardian |

| |

|

and conservator

for Robert P. |

| |

|

Jornayvaz

III |

| |

|

|

| |

|

/s/

Louisa Jornayvaz |

| |

|

|

| Dated: |

September 30, 2024 |

|

INTREPID POTASH, INC. |

| |

|

|

|

| |

|

/s/

Barth Witham |

| |

|

By: Barth Whitham |

| |

|

Its: Chairman of the Board of Directors |

EXECUTION VERSION

Exhibit A

Form of Aircraft Lease Termination

(See attached).

Termination of Aircraft Dry Lease

THIS TERMINATION OF AIRCRAFT

DRY LEASE AGREEMENT (this “Termination”) is dated as of [Effective Date], 2024, and terminates in its entirety that

Aircraft Dry Lease Agreement dated as of January 9, 2009, and amended September 1, 2014 (the “Agreement”),

among Intrepid Potash, Inc., a Delaware corporation (“Intrepid”) and Intrepid Production Holdings, LLC, a Colorado

limited liability company (“IPH”).

WHEREAS, each of Intrepid

and IPH desire to terminate the Agreement as of [Effective Date], 2024.

Now, therefore, in consideration

of the covenants and agreements contained herein and other good and valuable consideration, the receipt and sufficiency of which are

hereby acknowledged, Intrepid and IPH agree to terminate the Agreement as of [Effective Date], 2024.

IN WITNESS WHEREOF, the parties

hereto have caused this Agreement to be executed on the day and year first above written.

| |

INTREPID: |

| |

|

| |

INTREPID POTASH, INC. |

| |

|

|

| |

By: |

|

| |

Name: |

|

| |

Title: |

|

| |

|

| |

|

| |

IPH: |

| |

|

| |

INTREPID PRODUCTION

HOLDINGS, LLC. |

| |

|

|

| |

By: |

|

| |

Name: |

|

| |

Title: |

|

Exhibit B

Form of Designation Agreement Termination

(See attached).

TERMINATION OF DIRECTOR DESIGNATION AND VOTING

AGREEMENT

THIS TERMINATION OF DIRECTOR

DESIGNATION AND VOTING AGREEMENT (this “Agreement”) is dated as of [Effective Date], 2024, and terminates in its entirety

that Director Designation and Voting Agreement dated as of April 25, 2008 (the “Agreement”), by and among Intrepid

Potash, Inc., a Delaware corporation (“Intrepid”), Harvey Operating and Production Company, a Colorado corporation

(“HOPCO”), Intrepid Production Corporation, a Colorado corporation (“IPC”), and Potash Acquisition,

LLC, a Delaware limited liability company (“PAL”).

RECITALS

| A. | HOPCO and PAL had certain rights under

the Agreement that, pursuant to Section 2.2 of the Original Agreement, have terminated

as of the date hereof. |

| B. | HOPCO was dissolved pursuant to the filing

of Articles of Dissolution in December 2023 with the Secretary of State of the State

of Colorado and PAL was dissolved pursuant to the filing in December 2009 of a Certificate

of Dissolution filed with the Secretary of State of the State of Delaware. |

D. Each

of Intrepid and IPC desire to terminate the l Agreement.

AGREEMENT

In consideration of the covenants

and agreements contained herein and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged,

the parties hereto agree as follows.

1. Termination

of Agreement. The Parties hereby terminate the Agreement, effective as of [Effective Date],

2024.

2. Miscellaneous.

2.1 Governing

Law. This Agreement shall be governed by and construed in all respects in accordance with the

laws of the State of Delaware without giving effect to principles of conflicts of law.

2.2 Benefit

of Parties; Assignment. This Agreement shall be binding upon and shall inure to the benefit

of the parties hereto and their respective successors, legal representatives and permitted assigns. Nothing herein contained shall confer

or is intended to confer on any third party or entity that is not a party to this Agreement any rights under this Agreement.

2.3 Entire

Agreement. This Agreement sets forth the entire understanding of the parties hereto and supersedes

all other agreements and understandings between the parties hereto relating to the subject matter hereof.

2.4 Counterparts

and Facsimiles. This Agreement may be executed in one or more counterparts, all of which shall

be considered one and the same agreement, and shall become effective when one or more counterparts have been signed by each of the parties

and delivered to the others. The parties hereto may execute the signature pages hereof and exchange such signature pages by

facsimile transmission.

[Signature page to follow]

IN WITNESS WHEREOF, the parties

hereto have caused this Agreement to be executed on the day and year first above written.

| |

INTREPID: |

| |

|

| |

INTREPID POTASH, INC. |

| |

|

|

| |

By: |

|

| |

Name: |

|

| |

Title: |

|

| |

|

| |

|

| |

IPC: |

| |

|

| |

INTREPID PRODUCTION

CORPORATION |

| |

|

|

| |

By: |

|

| |

Name: |

|

| |

Title: |

|

Exhibit 99.1

Intrepid Potash Provides Leadership Update

Bob Jornayvaz Steps Down as Chief Executive

Officer and Director Following Extended Medical Leave of Absence

Denver, CO, October 4, 2024 -- Intrepid Potash, Inc. ("Intrepid,”

“we," “the Company” or "our") (NYSE: IPI) today announced that Bob Jornayvaz has stepped down as Chief

Executive Officer and as a Director of the Board following his extended medical leave of absence.

“We are thankful to Bob for his immeasurable contributions to

the Company over the last two decades,” said Barth Whitham, Chair of the Board. “Bob led numerous initiatives that strengthened

our customer relationships, modernized our operations, and capitalized on our unique position as the only domestic producer of potash.

He took great pride in the Company and its contributions to the domestic and global agriculture industry. Bob and his family remain in

our thoughts, and we continue to wish him well in his recovery.”

Intrepid’s Chief Financial Officer, Matt Preston, will continue

to serve as acting principal executive officer as the Board of Directors’ search to identify a successor Chief Executive Officer

remains ongoing. Mr. Whitham continued, “The Board’s search for a CEO is well underway. In the interim, we are pleased

to continue to have Matt and the rest of the management team lead the execution of Intrepid’s strategic plan.”

About Intrepid

Intrepid is a diversified mineral company that delivers potassium,

magnesium, sulfur, salt, and water products essential for customer success in agriculture, animal feed and the oil and gas industry. Intrepid

is the only U.S. producer of muriate of potash, which is applied as an essential nutrient for healthy crop development, utilized in several

industrial applications and used as an ingredient in animal feed. In addition, Intrepid produces a specialty fertilizer, Trio®,

which delivers three key nutrients, potassium, magnesium, and sulfate, in a single particle. Intrepid also provides water, magnesium chloride,

brine, and various oilfield services. Intrepid serves diverse customers in markets where a logistical advantage exists and is a leader

in the use of solar evaporation for potash production, resulting in lower cost and more environmentally friendly production. Intrepid’s

mineral production comes from three solar solution potash facilities and one conventional underground Trio® mine.

Intrepid routinely

posts important information, including information about upcoming investor presentations and press releases, on its website under the

Investor Relations tab. Investors and other interested parties are encouraged to enroll at intrepidpotash.com,

to receive automatic email alerts or RSS feeds for new postings.

Contact:

Evan Mapes, CFA, Investor Relations Manager

Phone: 303-996-3042

Email: evan.mapes@intrepidpotash.com

v3.24.3

Cover

|

Sep. 30, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Sep. 30, 2024

|

| Entity File Number |

001-34025

|

| Entity Registrant Name |

Intrepid

Potash, Inc.

|

| Entity Central Index Key |

0001421461

|

| Entity Tax Identification Number |

26-1501877

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

707

17th Street

|

| Entity Address, Address Line Two |

Suite

4200

|

| Entity Address, City or Town |

Denver

|

| Entity Address, State or Province |

CO

|

| Entity Address, Postal Zip Code |

80202

|

| City Area Code |

303

|

| Local Phone Number |

296-3006

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.001 per share

|

| Trading Symbol |

IPI

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

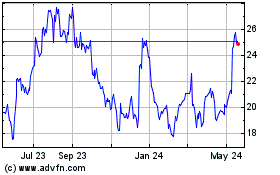

Intrepid Potash (NYSE:IPI)

Historical Stock Chart

From Dec 2024 to Jan 2025

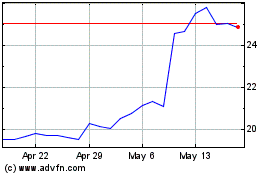

Intrepid Potash (NYSE:IPI)

Historical Stock Chart

From Jan 2024 to Jan 2025