Independence Realty Trust, Inc. (“IRT”) (NYSE MKT: IRT) today

announced second quarter 2014 financial results.

Highlights

- Core funds from operations (“CFFO”)

increased 160% to $3.4 million for the quarter ended June 30, 2014

from $1.3 million for the quarter ended June 30, 2013.

- Operating income increased 47% to $1.8

million for the quarter ended June 30, 2014 from $1.2 million for

the quarter ended June 30, 2013.

- Total revenues grew 148% to $11.6

million for the quarter ended June 30, 2014 from $4.7 million for

the quarter ended June 30, 2013.

- On July 21, 2014, IRT completed its

underwritten public offering selling 8,050,000 shares of IRT common

stock for $9.50 per share raising gross proceeds of $76.5 million.

RAIT Financial Trust (“RAIT”), IRT’s largest stockholder and the

parent company of IRT’s external advisor, purchased 300,000 shares

of common stock in the offering, at the public offering price, for

which no underwriting discounts and commissions were paid to the

underwriters. After giving effect to this offering, the percent of

IRT’s outstanding common stock held by RAIT was reduced from 39.4%

to 28.2%.

- IRT acquired 2 properties totaling 372

units for $41.8 million during the quarter ended June 30,

2014.

Financial Results

IRT reported CFFO, a non-GAAP financial measure, for the

three-month period ended June 30, 2014 of $3.4 million, or $0.19

per share – diluted based on 17.7 million weighted-average shares

outstanding – diluted, as compared to CFFO for the three-month

period ended June 30, 2013 of $1.3 million, or $0.23 per share –

diluted based on 5.6 million weighted-average shares outstanding –

diluted. IRT reported a net loss allocable to common stock for the

three-month period ended June 30, 2014 of $(0.1) million, or

$(0.01) per share – diluted based on 17.7 million weighted-average

shares outstanding – diluted, as compared to net income allocable

to common stock for the three-month period ended June 30, 2013 of

$0.05 million, or $0.01 per share – diluted based on 5.6 million

weighted-average shares outstanding – diluted.

IRT reported CFFO for the six-month period ended June 30, 2014

of $5.9 million, or $0.36 per share – diluted based on 16.5 million

weighted-average shares outstanding – diluted, as compared to CFFO

for the six-month period ended June 30, 2013 of $2.6 million, or

$0.46 per share – diluted based on 5.6 million weighted-average

shares outstanding – diluted. IRT reported a net income allocable

to common stock for the six-month period ended June 30, 2014 of

$2.8 million, or $0.17 per share – diluted based on 16.5 million

weighted-average shares outstanding – diluted, as compared to net

income allocable to common stock for the six-month period ended

June 30, 2013 of $0.05 million, or $0.01 per share – diluted based

on 5.6 million weighted-average shares outstanding – diluted.

A reconciliation of IRT's reported net income (loss) to its

funds from operations (“FFO”) and CFFO is included as Schedule I to

this release. Schedule I also includes management's rationale for

the usefulness of each of these non-GAAP financial measures.

Distributions

On July 10, 2014, IRT’s Board of Directors declared monthly cash

dividends for the third quarter of 2014 on IRT’s shares of common

stock in the amount of $0.06 per share per month. The monthly

dividends total $0.18 per share for the third quarter. The month

for which each dividend was declared is set forth below, with the

relevant amount per share, record date and payment date set forth

opposite the month:

Month

Amount

Record

Date

Payment

Date

June 2014 $0.06 7/31/2014 8/15/2014 July 2014 $0.06 8/29/2014

9/16/2014 August 2014 $0.06 9/30/2014 10/15/2014

Key Statistics

(Unaudited and dollars in thousands,

except per share and per unit information)

As of or For the Three-Month Periods

Ended

June 30, March 31, December

31, September 30, June 30,

2014 2014 2013

2013 2013 Financial Statistics: Total

revenue $11,649 $8,135 $5,768 $4,787 $4,700 Earnings (loss) per

share-diluted $(0.01) $0.19 $0.03 $0.03 $0.01 Funds from Operations

(“FFO”) per share $0.18 $0.33 $0.17 $0.17 $0.23 Core funds from

operations (“CFFO”) per share $0.19 $0.17 $0.20 $0.17 $0.23

Dividends declared per common share $0.18 $0.18 $0.16 $0.16 $0.16

Total Shares Outstanding 17,751,540 17,742,540 9,652,540 9,643,540

5,643,540

Apartment Property Portfolio: Reported

investments in real estate at cost $362,323 $320,437 $190,096

$166,665 $154,040 Net operating income $6,064 $4,147 $3,159 $2,373

$2,459 Number of properties owned 19 17 10 9 8 Multifamily units

owned 5,342 4,970 2,790 2,358 2,004 Portfolio weighted average

occupancy 93.1% 93.9% 94.6% 94.4% 94.2% Weighted average monthly

effective rent per unit (1) $764 $730 $765 $784 $784 (1)

Weighted average monthly effective rent per occupied unit

represents the average monthly rent collected for all occupied

units after giving effect to tenant concessions. We do not report

average effective rent per unit in the month of acquisition as it

is not representative of a full month of operations. Same Store

weighted average effective rent per unit was $798, $795, $792, $784

and $784 for the periods presented above, respectively.

Properties

The following table presents an overview

of our apartment portfolio as of June 30, 2014:

Average Monthly

Year Effective Acquisition Built or

Physical Rent per Property Name

Location Date

Renovated(1)

Units(2)

Occupancy(3)

Occupied Unit(4)

Belle Creek

Henderson, Colorado 4/29/2011

2011

162(5)

97.5% $989 Copper Mill Austin, Texas 4/29/2011 2010 320 97.5% 786

Crestmont Marietta, Georgia 4/29/2011 2010 228 99.1% 716 Cumberland

Glen Smyrna, Georgia 4/29/2011 2010 222 96.4% 704 Heritage Trace

Newport News, Virginia 4/29/2011 2010 200 90.5% 687 Tresa at

Arrowhead Phoenix, Arizona 4/29/2011 2006 360 95.0% 821 Centrepoint

Tucson, Arizona 12/16/2011 2006 320 95.9% 816 Runaway Bay

Indianapolis, Indiana 10/11/2012 2002 192 95.3% 909 Berkshire

Square Indianapolis, Indiana 9/19/2013 2012 354 92.1% 584 The

Crossings Jackson, Mississippi 11/22/2013 2006 432 92.4% 735

Reserve at Eagle Ridge Waukegan, Illinois 1/31/2014 2008 370 94.6%

934 Windrush Edmond, Oklahoma 2/28/2014 2011 160 85.6% 775 Heritage

Park Oklahoma City, Oklahoma 2/28/2014 2011 453 90.5% 619 Raindance

Oklahoma City, Oklahoma 2/28/2014 2011 504 90.5% 532 Augusta

Oklahoma City, Oklahoma 2/28/2014 2011 197 82.2% 724 Invitational

Oklahoma City, Oklahoma 2/28/2014 2011 344 93.0% 673 King’s Landing

Creve Coeur, Missouri 3/31/2014 2005 152 93.6% 1,460 Carrington

Park Little Rock, Arkansas 5/07/2014 1999 202 92.6% 1,066 Arbors at

the Reservoir Ridgeland, Mississippi 6/04/2014 2000 170 93.5% — (6)

Total/Weighted Average 5,342 93.1% $764 (1)

All dates are for the year in which a significant renovation

program was completed, except for Runaway Bay, Arbors at the

Reservoir and King’s Landing, which is the year construction was

completed. (2) Units represents the total number of apartment units

available for rent at June 30, 2014. (3) Physical occupancy for

each of our properties is calculated as (i) total units rented as

of June 30, 2014 divided by (ii) total units available as of June

30, 2014, expressed as a percentage. (4) Average monthly effective

rent per occupied unit represents the average monthly rent for all

occupied units for the three-month period ended June 30, 2014. (5)

Includes 6,256 square feet of retail space in six units, of which

1,010 square feet of space is occupied by RAIT Residential for use

as the leasing office. The remaining 5,246 square feet of space is

86% occupied by four tenants with an average monthly base rent of

$1,603, or $16 per square foot per year. These four tenants are

principally engaged in the following businesses: grocery, retail

and various retail services. (6) We do not report average effective

rent per unit in the month of acquisition as it is not

representative of a full month of operations. As of June 2014, the

average monthly effective rent per occupied unit was $1,064.

Conference Call

All interested parties can listen to the live conference call

webcast at 9:00 AM ET on Friday, August 1, 2014 from the investor

relations section of the IRT website at www.irtreit.com or by

dialing 877.280.4956, access code 81504352. For those who are not

available to listen to the live call, the replay will be available

shortly following the live call on IRT’s website and telephonically

until Friday, August 8, 2014, by dialing 888.286.8010, access code

49252720.

About Independence Realty Trust, Inc.

Independence Realty Trust, Inc. (NYSE MKT: IRT) is a real estate

investment trust that seeks to own well-located apartment

properties in geographic submarkets that it believes support strong

occupancy and the potential for growth in rental rates. IRT seeks

to provide stockholders with attractive risk-adjusted returns, with

an emphasis on distributions and capital appreciation. IRT is

externally advised by a wholly-owned subsidiary of RAIT Financial

Trust (NYSE: RAS).

Forward-Looking Statements

This press release may contain certain forward-looking

statements within the meaning of Section 27A of the Securities Act

of 1933, as amended, and Section 21E of the Securities Exchange Act

of 1934, as amended. Such forward-looking statements can generally

be identified by our use of forward-looking terminology such as

"may," “trend”, "will," "expect," "intend," "anticipate,"

"estimate," "believe," "continue," “seek” or other similar words.

Because such statements include risks, uncertainties and

contingencies, actual results may differ materially from the

expectations, intentions, beliefs, plans or predictions of the

future expressed or implied by such forward-looking statements.

These risks, uncertainties and contingencies include, but are not

limited to, those disclosed in IRT’s filings with the Securities

and Exchange Commission. IRT undertakes no obligation to update

these forward-looking statements to reflect events or circumstances

after the date hereof or to reflect the occurrence of unanticipated

events, except as may be required by law.

Independence Realty Trust, Inc.

Consolidated Statements of Operations

(Dollars in thousands, except share and

per share information)

(unaudited)

For the Three-Month For the Six-Month

Period Ended Period Ended June 30 June

30 2014 2013 2014

2013 Revenues: Rental income $ 10,613 $

4,218 $ 17,966 $ 8,396 Tenant reimbursement income 436 220 802 443

Other income

600 262

1,016 549

Total revenue 11,649 4,700 19,784 9,388

Expenses:

Property operating expenses 5,585 2,241 9,573 4,406 General and

administrative expenses 378 94 546 271 Asset management fees 501 79

647 161 Acquisition expenses 152 - 514 - Depreciation and

amortization

3,232

1,063 5,355

2,099 Total expenses

9,848

3,477 16,635

6,937 Operating income

1,801 1,223 3,149 2,451 Interest expense (1,930 ) (899 ) (3,229 )

(1,787 ) Interest income 1 - 5 - Gain (loss) on assets

- -

2,882 - Net

income (loss): (128 ) 324 2,807 664 (Income) loss allocated to

preferred stock - (4 ) - (8 ) (Income) loss allocated to

non-controlling interests

-

(272 ) -

(604 ) Net income (loss)

allocable to common stock $ (128

) $ 48 $

2,807 $ 52

Earnings (loss) per share: Basic

$

(0.01 ) $ 0.01

$ 0.17 $

0.03 Diluted

$ (0.01

) $ 0.01

$ 0.17 $

0.03 Weighted-average shares: Basic

17,707,287 3,556,349

16,459,623

1,959,998 Diluted

17,707,287 3,556,349

16,484,357 1,959,998

Dividends declared per common share $

0.18 $ 0.16

$ 0.36 $

0.31

Independence Realty Trust, Inc.

Consolidated Balance Sheets

(Dollars in thousands, except share and

per share information)

(unaudited)

As of As of June 30, December

31, 2014 2013 Assets: Investments

in real estate: Investments in real estate at cost $ 362,323 $

190,096 Accumulated depreciation

(18,804

) (15,775 )

Investments in real estate, net 343,519 174,321 Cash and cash

equivalents 8,054 3,334 Restricted cash 2,698 1,122 Accounts

receivable and other assets 2,682 1,731 Intangible assets, net of

accumulated amortization of $2,513 and $569, respectively 1,126 517

Deferred costs, net of accumulated amortization of $293 and $151,

respectively

1,568

846 Total assets $

359,647 $ 181,871

Liabilities and Equity: Indebtedness $ 215,628

$ 103,303 Accounts payable and accrued expenses 5,725 2,374 Accrued

interest payable 30 63 Dividends payable 1,076 515 Other

liabilities

946 708

Total liabilities 223,405 106,963

Equity:

Stockholders’ equity:

Preferred stock, $0.01 par value;

50,000,000 shares authorized, 0 and 0 shares issued and

outstanding, respectively

-

-

Common stock, $0.01 par value; 300,000,000 shares authorized,

17,751,540 and 9,652,540 shares issued and outstanding, including

40,000 unvested restricted common share awards as of June 30, 2014

177

96

Additional paid-in capital 140,973 78,112 Retained earnings

(accumulated deficit) (6,867 ) (3,300 )

Total shareholders’ equity 134,283 74,908 Non-controlling

interests 1,959 -

Total

Equity 136,242 74,908

Total liabilities and equity $ 359,647 $

181,871

Schedule I

Independence Realty Trust, Inc.

Reconciliation of Net income (loss)

Allocable to Common Stock and

Funds From Operations (“FFO”) and

Core Funds From Operations (“CFFO”)

(1)

(Dollars in thousands, except share and

per share amounts)

(unaudited)

For the Three-Month Period

Ended

For the Six-Month Period Ended

June 30,

June 30,

2014 2013

2014 2013

Per Share Per Share

Per Share Per Share

Amount

(2)

Amount

(3)

Amount

(2)

Amount

(3)

Funds From Operations: Net income (loss) $(128) $(0.01) $324

$0.06 $2,807 $0.17 $664 $0.12 Adjustments: Income allocated to

preferred shares - - (4) 0.00 - - (8) 0.00 Income allocated to

preferred units - - (88) (0.02) - - (175) (0.03) Real estate

depreciation and amortization 3,232 0.19 1,063

0.19 5,355 0.32 2,099 0.37 Funds From

Operations $3,104 $0.18 $1,295 $0.23

$8,162 $0.49 $2,580 $0.46

Core Funds

From Operations: Funds From Operations $3,104 $0.18 $1,295

$0.23 $8,162 $0.49 $2,580 $0.46 Adjustments: Acquisition fees and

expenses 152 0.01 - - 514 0.03 - - Equity based compensation 112

0.00 - - 142 0.01 - - (Gains) losses on assets - - -

- (2,882) (0.17) - - Core Funds

From Operations $3,368 $0.19 $1,295 $0.23

$5,936 $0.36 $2,580 $0.46 (1)

IRT believes that FFO and Core FFO, each of which is a

non-GAAP measure, are additional appropriate measures of the

operating performance of a REIT and IRT in particular. IRT computes

FFO in accordance with the standards established by the National

Association of Real Estate Investment Trusts, or NAREIT, as net

income or loss allocated to common stock (computed in accordance

with GAAP), excluding real estate-related depreciation and

amortization expense, gains or losses on sales of real estate and

the cumulative effect of changes in accounting principles.

Core FFO is a computation made by analysts

and investors to measure a real estate company’s operating

performance by removing the effect of items that do not reflect

ongoing property operations, including acquisition expenses,

expensed costs related to the issuance of shares of our common

stock, gains or losses on real estate transactions and equity-based

compensation expenses, from the determination of FFO. IRT incurs

acquisition expenses in connection with acquisitions of real estate

properties and expenses those costs when incurred in accordance

with U.S. GAAP. As these expenses are one-time and reflective of

investing activities rather than operating performance, IRT adds

back these costs to FFO in determining Core FFO.

IRT’s calculation of Core FFO differs from

the methodology used for calculating Core FFO by certain other

REITs and, accordingly, IRT’s Core FFO may not be comparable to

Core FFO reported by other REITs. IRT’s management utilizes FFO and

Core FFO as measures of IRT’s operating performance, and believes

they are also useful to investors, because they facilitate an

understanding of IRT’s operating performance after adjustment for

certain non-cash items, such as depreciation and amortization

expenses, and acquisition expenses and pursuit costs that are

required by GAAP to be expensed but may not necessarily be

indicative of current operating performance and that may not

accurately compare IRT’s operating performance between periods.

Furthermore, although FFO, Core FFO and other supplemental

performance measures are defined in various ways throughout the

REIT industry, IRT also believes that FFO and Core FFO may provide

IRT and our investors with an additional useful measure to compare

IRT’s financial performance to certain other REITs. IRT also uses

Core FFO for purposes of determining the quarterly incentive fee,

if any, payable to our advisor beginning with the second quarter of

2013. Neither FFO nor Core FFO is equivalent to net income or cash

generated from operating activities determined in accordance with

GAAP. Furthermore, FFO and Core FFO do not represent amounts

available for management’s discretionary use because of needed

capital replacement or expansion, debt service obligations or other

commitments or uncertainties. Neither FFO nor Core FFO should be

considered as an alternative to net income as an indicator of IRT’s

operating performance or as an alternative to cash flow from

operating activities as a measure of IRT’s liquidity.

(2)

Based on 17,707,287 and 16,484,357

weighted-average shares outstanding-diluted for the three and

six-month periods ended June 30, 2014.

(3)

Based on 5,643,122 and 5,632,028

weighted-average shares outstanding-diluted for the three and

six-month periods ended June 30, 2013.

Independence Realty Trust, Inc.Andres Viroslav,

215-243-9000aviroslav@irtreit.com

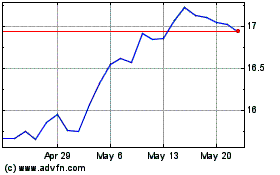

Independence Realty (NYSE:IRT)

Historical Stock Chart

From Jan 2025 to Feb 2025

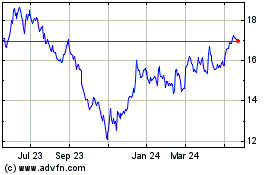

Independence Realty (NYSE:IRT)

Historical Stock Chart

From Feb 2024 to Feb 2025