Independence Realty Trust, Inc. (NYSE: IRT) (“IRT”) announced

that on January 8, 2025 its operating partnership, Independence

Realty Operating Partnership, LP, entered into an amended and

restated unsecured credit facility. The new facility increases the

borrowing capacity under IRT’s existing revolver from $500 million

to $750 million and extends the maturity date of the revolver from

January 2026 to January 2029. As of closing, the amount outstanding

under the revolver was $214 million. Proceeds from the expanded

revolver will be used for general corporate purposes.

The amended and restated unsecured credit facility also reduces

the margin on IRT’s existing $200 million term loan. Borrowings

under the $200 million term loan now bear interest at SOFR plus

0.80% to 1.60%. Borrowings under the revolver now bear interest at

SOFR plus 0.725% to 1.40%. At closing, the interest rates on the

$200 million term loan and revolver were SOFR plus 0.85% and SOFR

plus 0.775%, respectively, based on our BBB investment grade

rating. Overall, this reflects a weighted average reduction in

margin of approximately 34 basis points compared to the interest

rate margins in place prior to our investment grade rating.

“This expanded unsecured credit facility is the result of our

continued efforts to increase our financial flexibility to drive

profitable growth, underpinned by our investment grade ratings from

Fitch Ratings and S&P Global Ratings, as well as, our lower

consolidated leverage ratio,” said James Sebra, President and Chief

Financial Officer of IRT. “Through this credit facility, we have

extended our maturities, strengthened our balance sheet and created

long-term value for our stakeholders through lower interest

costs.”

KeyBank National Association is the Administrative Agent under

the unsecured credit facility. KeyBanc Capital Markets, Inc. and

Citibank, N.A. are Joint Bookrunners under the unsecured credit

facility. KeyBanc Capital Markets, Citibank, N.A., PNC Capital

Markets LLC, Capital One National Association, The Huntington

National Bank, Regions Capital Markets, BMO Bank N.A. and Truist

Securities, Inc. are the Joint Arrangers. The facilities’

Co-Syndication Agents include Citibank, N.A., Capital One National

Association, PNC Bank National Association, Regions Bank, BMO Bank

N.A., The Huntington National Bank and Truist Bank, and the

Co-Documentation Agents are Bank of America, N.A., Barclays Bank

PLC and Royal Bank of Canada.

About Independence Realty Trust, Inc.

Independence Realty Trust, Inc. (NYSE: IRT) is a real estate

investment trust that owns and operates multifamily communities,

across non-gateway U.S. markets including Atlanta, GA, Dallas, TX,

Denver, CO, Columbus, OH, Indianapolis, IN, Raleigh-Durham, NC,

Oklahoma City, OK, Nashville, TN, Houston, TX, and Tampa, FL. IRT’s

investment strategy is focused on gaining scale near major

employment centers within key amenity rich submarkets that offer

good school districts and high-quality retail. IRT aims to provide

stockholders with attractive risk-adjusted returns through diligent

portfolio management, strong operational performance, and a

consistent return on capital through distributions and capital

appreciation. More information may be found on the Company’s

website www.irtliving.com.

Forward-Looking Statements

This release contains certain forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. Such forward-looking statements include, but are not

limited to, our earnings guidance, and the assumptions underlying

such guidance, anticipated enhancements to our financial results

and future growth from our Portfolio Optimization and Deleveraging

Strategy, our planned use of proceeds from our recent sales of

common stock on a forward basis, and our unsecured notes in a

private placement. All statements in this release that address

financial and operating performance, events or developments that we

expect or anticipate will occur or be achieved in the future are

forward-looking statements.

Our forward-looking statements are not guarantees of future

performance and involve estimates, projections, forecasts and

assumptions, including as to matters that are not within our

control, and are subject to risks and uncertainties including,

without limitation, risks and uncertainties related to changes in

market demand for rental apartment homes and pricing pressures,

including from competitors, that could lead to declines in

occupancy and rent levels, uncertainty and volatility in capital

and credit markets, including changes that reduce availability, and

increase costs, of capital, unexpected changes in our intention or

ability to repay certain debt prior to maturity, increased costs on

account of inflation, increased competition in the labor market,

failure to realize cost savings, efficiencies and other benefits

that we expect to result from our Portfolio Optimization and

Deleveraging Strategy, and our planned use of proceeds from our

recent sales of common stock on a forward basis and our unsecured

notes in a private placement, inability to sell certain assets,

including those assets designated as held for sale, within the time

frames or at the pricing levels expected, failure to achieve

expected benefits from the redeployment of proceeds from asset

sales, delays in completing, and cost overruns incurred in

connection with, our value add initiatives and failure to achieve

rent increases and occupancy levels on account of the value add

initiatives, unexpected impairments or impairments in excess of our

estimates, increased regulations generally and specifically on the

rental housing market, including legislation that may regulate

rents and fees or delay or limit our ability to evict non-paying

residents, risks endemic to real estate and the real estate

industry generally, the impact of potential outbreaks of infectious

diseases and measures intended to prevent the spread or address the

effects thereof, the effects of natural and other disasters,

unknown or unexpected liabilities, including the cost of legal

proceedings, costs and disruptions as the result of a cybersecurity

incident or other technology disruption, unexpected capital needs,

inability to obtain appropriate insurance coverages at reasonable

rates, or at all, or losses from catastrophes in excess of our

insurance coverages, and share price fluctuations. Please refer to

the documents filed by us with the SEC, including specifically the

“Risk Factors” sections of our Annual Report on Form 10-K for the

year ended December 31, 2023, and our other filings with the SEC,

which identify additional factors that could cause actual results

to differ from those contained in forward-looking statements.

These forward-looking statements are based upon the beliefs and

expectations of our management at the time of this release and our

actual results may differ materially from the expectations,

intentions, beliefs, plans or predictions of the future expressed

or implied by such forward-looking statements. We undertake no

obligation to update these forward-looking statements to reflect

events or circumstances after the date hereof or to reflect the

occurrence of unanticipated events, except as may be required by

law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250108729343/en/

Independence Realty Trust, Inc. Edelman Smithfield Lauren

Torres 917-365-7979 IRT@edelman.com

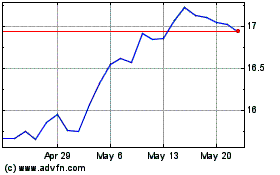

Independence Realty (NYSE:IRT)

Historical Stock Chart

From Feb 2025 to Mar 2025

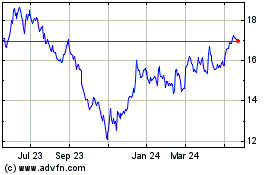

Independence Realty (NYSE:IRT)

Historical Stock Chart

From Mar 2024 to Mar 2025