Form NPORT-P - Monthly Portfolio Investments Report on Form N-PORT (Public)

27 November 2024 - 1:46AM

Edgar (US Regulatory)

Portfolio

of

Investments

September

30,

2024

JCE

(Unaudited)

SHARES

DESCRIPTION

VALUE

LONG-TERM

INVESTMENTS

-

100.1%

X

248,058,056

COMMON

STOCKS

-

98

.1

%

X

248,058,056

AUTOMOBILES

&

COMPONENTS

-

0.7%

7,140

(a)

Tesla

Inc

$

1,868,038

TOTAL

AUTOMOBILES

&

COMPONENTS

1,868,038

BANKS

-

3.2%

49,095

Bank

of

America

Corp

1,948,090

30,600

Citigroup

Inc

1,915,560

8,940

JPMorgan

Chase

&

Co

1,885,088

40,350

Wells

Fargo

&

Co

2,279,372

TOTAL

BANKS

8,028,110

CAPITAL

GOODS

-

4.8%

25,790

Flowserve

Corp

1,333,085

670

Fortive

Corp

52,883

3,770

Lockheed

Martin

Corp

2,203,791

3,380

Northrop

Grumman

Corp

1,784,877

2,140

Parker-Hannifin

Corp

1,352,095

17,870

RTX

Corp

2,165,129

5,290

Trane

Technologies

PLC

2,056,382

11,500

Vertiv

Holdings

Co,

Class

A

1,144,135

TOTAL

CAPITAL

GOODS

12,092,377

COMMERCIAL

&

PROFESSIONAL

SERVICES

-

1.9%

1,760

Cintas

Corp

362,349

10,580

Leidos

Holdings

Inc

1,724,540

25,540

Rollins

Inc

1,291,813

12,200

Veralto

Corp

1,364,692

TOTAL

COMMERCIAL

&

PROFESSIONAL

SERVICES

4,743,394

CONSUMER

DISCRETIONARY

DISTRIBUTION

&

RETAIL

-

5.5%

56,340

(a)

Amazon.com

Inc

10,497,832

68,720

(a)

Coupang

Inc

1,687,076

4,430

Home

Depot

Inc/The

1,795,036

TOTAL

CONSUMER

DISCRETIONARY

DISTRIBUTION

&

RETAIL

13,979,944

CONSUMER

SERVICES

-

2.7%

550

Booking

Holdings

Inc

2,316,666

29,430

(a)

Chipotle

Mexican

Grill

Inc

1,695,757

22,000

H&R

Block

Inc

1,398,100

3,280

Wingstop

Inc

1,364,742

TOTAL

CONSUMER

SERVICES

6,775,265

CONSUMER

STAPLES

DISTRIBUTION

&

RETAIL

-

2.6%

540

Costco

Wholesale

Corp

478,721

26,310

Kroger

Co/The

1,507,563

20,420

(a)

US

Foods

Holding

Corp

1,255,830

42,387

Walmart

Inc

3,422,750

TOTAL

CONSUMER

STAPLES

DISTRIBUTION

&

RETAIL

6,664,864

ENERGY

-

3.3%

119

Chevron

Corp

17,525

19,250

Civitas

Resources

Inc

975,398

17,630

ConocoPhillips

1,856,086

10,430

Exxon

Mobil

Corp

1,222,605

27,440

HF

Sinclair

Corp

1,223,001

5,350

Ovintiv

Inc

204,958

91,550

Permian

Resources

Corp

1,245,995

11,180

Phillips

66

1,469,611

TOTAL

ENERGY

8,215,179

EQUITY

REAL

ESTATE

INVESTMENT

TRUSTS

(REITS)

-

1.3%

8,720

Digital

Realty

Trust

Inc

1,411,157

28,590

Ventas

Inc

1,833,477

TOTAL

EQUITY

REAL

ESTATE

INVESTMENT

TRUSTS

(REITS)

3,244,634

Portfolio

of

Investments

September

30,

2024

(continued)

JCE

SHARES

DESCRIPTION

VALUE

FINANCIAL

SERVICES

-

9.2%

13,230

(a)

Berkshire

Hathaway

Inc,

Class

B

$

6,089,240

15,220

(a)

Block

Inc

1,021,718

8,060

CME

Group

Inc

1,778,439

44,530

Corebridge

Financial

Inc

1,298,495

11,780

Intercontinental

Exchange

Inc

1,892,339

33,230

Janus

Henderson

Group

PLC

1,265,066

1,631

Mastercard

Inc,

Class

A

805,388

2,230

MSCI

Inc

1,299,934

25,670

(a)

PayPal

Holdings

Inc

2,003,030

65,210

(a)

Robinhood

Markets

Inc,

Class

A

1,527,218

1,950

S&P

Global

Inc

1,007,409

12,260

Visa

Inc,

Class

A

3,370,887

TOTAL

FINANCIAL

SERVICES

23,359,163

FOOD,

BEVERAGE

&

TOBACCO

-

0.9%

1,040

Coca-Cola

Co/The

74,734

960

Coca-Cola

Consolidated

Inc

1,263,744

1,510

PepsiCo

Inc

256,776

5,890

Philip

Morris

International

Inc

715,046

TOTAL

FOOD,

BEVERAGE

&

TOBACCO

2,310,300

HEALTH

CARE

EQUIPMENT

&

SERVICES

-

6.0%

19,690

Abbott

Laboratories

2,244,857

22,770

(a)

Boston

Scientific

Corp

1,908,126

12,940

Cardinal

Health

Inc

1,430,129

19,390

(a)

Centene

Corp

1,459,679

27,440

CVS

Health

Corp

1,725,427

4,570

Humana

Inc

1,447,502

2,890

(a)

IDEXX

Laboratories

Inc

1,460,086

22,400

Medtronic

PLC

2,016,672

2,600

UnitedHealth

Group

Inc

1,520,168

TOTAL

HEALTH

CARE

EQUIPMENT

&

SERVICES

15,212,646

HOUSEHOLD

&

PERSONAL

PRODUCTS

-

2.1%

23,710

(a)

BellRing

Brands

Inc

1,439,671

16,470

Colgate-Palmolive

Co

1,709,751

4,670

Procter

&

Gamble

Co/The

808,844

13,340

Spectrum

Brands

Holdings

Inc

1,269,167

TOTAL

HOUSEHOLD

&

PERSONAL

PRODUCTS

5,227,433

INSURANCE

-

2.6%

8,100

Allstate

Corp/The

1,536,165

8,870

Marsh

&

McLennan

Cos

Inc

1,978,808

6,290

Progressive

Corp/The

1,596,151

4,900

Willis

Towers

Watson

PLC

1,443,197

TOTAL

INSURANCE

6,554,321

MATERIALS

-

0.7%

6,390

Ecolab

Inc

1,631,559

TOTAL

MATERIALS

1,631,559

MEDIA

&

ENTERTAINMENT

-

9.7%

29,870

Alphabet

Inc,

Class

A

4,953,940

34,900

Alphabet

Inc,

Class

C

5,834,931

43,200

Comcast

Corp,

Class

A

1,804,464

13,150

Meta

Platforms

Inc

7,527,586

4,230

(a)

Netflix

Inc

3,000,212

3,950

(a)

Spotify

Technology

SA

1,455,693

TOTAL

MEDIA

&

ENTERTAINMENT

24,576,826

PHARMACEUTICALS,

BIOTECHNOLOGY

&

LIFE

SCIENCES

-

7.3%

1,830

AbbVie

Inc

361,388

1,070

(a)

Biogen

Inc

207,409

34,890

Bristol-Myers

Squibb

Co

1,805,209

2,950

Eli

Lilly

&

Co

2,613,523

47,300

(a)

Exelixis

Inc

1,227,435

24,950

Gilead

Sciences

Inc

2,091,808

SHARES

DESCRIPTION

VALUE

PHARMACEUTICALS,

BIOTECHNOLOGY

&

LIFE

SCIENCES

(continued)

21,459

Johnson

&

Johnson

$

3,477,645

23,991

Merck

&

Co

Inc

2,724,418

54,670

Pfizer

Inc

1,582,150

4,003

Thermo

Fisher

Scientific

Inc

2,476,136

TOTAL

PHARMACEUTICALS,

BIOTECHNOLOGY

&

LIFE

SCIENCES

18,567,121

SEMICONDUCTORS

&

SEMICONDUCTOR

EQUIPMENT

-

9.8%

2,170

(a)

Advanced

Micro

Devices

Inc

356,054

19,190

Broadcom

Inc

3,310,275

2,280

KLA

Corp

1,765,655

139,580

NVIDIA

Corp

16,950,595

13,970

QUALCOMM

Inc

2,375,598

TOTAL

SEMICONDUCTORS

&

SEMICONDUCTOR

EQUIPMENT

24,758,177

SOFTWARE

&

SERVICES

-

12.1%

5,190

(a)

Adobe

Inc

2,687,278

20,680

(a)

Dynatrace

Inc

1,105,760

19,330

(a)

Fortinet

Inc

1,499,041

3,360

Intuit

Inc

2,086,560

1,570

(a)

Kyndryl

Holdings

Inc

36,079

41,995

Microsoft

Corp

18,070,448

5,111

Salesforce

Inc

1,398,932

19,980

(a)

Twilio

Inc,

Class

A

1,303,096

5,760

(a)

VeriSign

Inc

1,094,170

20,160

(a)

Zoom

Video

Communications

Inc,

Class

A

1,405,958

TOTAL

SOFTWARE

&

SERVICES

30,687,322

TECHNOLOGY

HARDWARE

&

EQUIPMENT

-

9.6%

82,958

Apple

Inc

19,329,214

4,830

(a)

Arista

Networks

Inc

1,853,851

11,820

Jabil

Inc

1,416,391

5,580

TD

SYNNEX

Corp

670,046

14,570

(a)

Trimble

Inc

904,651

TOTAL

TECHNOLOGY

HARDWARE

&

EQUIPMENT

24,174,153

TRANSPORTATION

-

0.6%

34,480

(a)

Alaska

Air

Group

Inc

1,558,841

TOTAL

TRANSPORTATION

1,558,841

UTILITIES

-

1.5%

8,380

Duke

Energy

Corp

966,214

23,230

Evergy

Inc

1,440,492

35,060

Exelon

Corp

1,421,683

TOTAL

UTILITIES

3,828,389

TOTAL

COMMON

STOCKS

(Cost

$172,666,601)

248,058,056

SHARES

DESCRIPTION

VALUE

X

5,081,784

EXCHANGE-TRADED

FUNDS

-

2

.0

%

X

5,081,784

8,810

iShares

Core

S&P

500

ETF

$

5,081,784

TOTAL

EXCHANGE-TRADED

FUNDS

(Cost

$4,390,501)

5,081,784

TYPE

DESCRIPTION(b)

NUMBER

OF

CONTRACTS

NOTIONAL

AMOUNT

(c)

EXERCISE

PRICE

EXPIRATION

DATE

VALUE

OPTIONS

PURCHASED

-

0

.0

%

Call

Chicago

Board

Options

Exchange

SPX

Volatility

Index

25

$

100,000

$

40

12/18/24

1,863

Put

Chicago

Board

Options

Exchange

SPX

Volatility

Index

50

70,000

14

10/16/24

100

TOTAL

OPTIONS

PURCHASED

(Cost

$2,656)

75

$

170,000

1,963

TOTAL

LONG-TERM

INVESTMENTS

(Cost

$177,059,758)

253,141,803

Portfolio

of

Investments

September

30,

2024

(continued)

JCE

Investments

in

Derivatives

Part

F

of

Form

N-PORT

was

prepared

in

accordance

with

U.S.

generally

accepted

accounting

principles

(“U.S.

GAAP”)

and

in

conformity

with

the

applicable

rules

and

regulations

of

the

U.S.

Securities

and

Exchange

Commission

(“SEC”)

related

to

interim

filings.

Part

F

of

Form

N-PORT

does

not

include

all

information

and

footnotes

required

by

U.S.

GAAP

for

complete

financial

statements.

Certain

footnote

disclosures

normally

included

in

financial

statements

prepared

in

accordance

with

U.S.

GAAP

have

been

condensed

or

omitted

from

this

report

pursuant

to

the

rules

of

the

SEC.

For

a

full

set

of

the

Fund’s

notes

to

financial

statements,

please

refer

to

the

Fund’s

most

recently

filed

annual

or

semi-annual

report.

Fair

Value

Measurements

The

Fund’s

investments

in

securities

are

recorded

at

their

estimated

fair

value

utilizing

valuation

methods

approved

by

the

Board

of

Directors/

Trustees.

Fair

value

is

defined

as

the

price

that

would

be

received

upon

selling

an

investment

or

transferring

a

liability

in

an

orderly

transaction

to

an

independent

buyer

in

the

principal

or

most

advantageous

market

for

the

investment.

U.S.

GAAP

establishes

the

three-tier

hierarchy

which

is

used

to

maximize

the

use

of

observable

market

data

and

minimize

the

use

of

unobservable

inputs

and

to

establish

classification

of

fair

value

measurements

for

disclosure

purposes.

Observable

inputs

reflect

the

assumptions

market

participants

would

use

in

pricing

the

asset

or

liability.

Observable

inputs

are

based

on

market

data

obtained

from

sources

independent

of

the

reporting

entity.

Unobservable

inputs

reflect

management’s

assumptions

about

the

assumptions

market

participants

would

use

in

pricing

the

asset

or

liability.

Unobservable

inputs

are

based

on

the

best

information

available

in

the

circumstances.

The

following

is

a

summary

of

the

three-tiered

hierarchy

of

valuation

input

levels.

Level

1

–

Inputs

are

unadjusted

and

prices

are

determined

using

quoted

prices

in

active

markets

for

identical

securities.

Level

2

–

Prices

are

determined

using

other

significant

observable

inputs

(including

quoted

prices

for

similar

securities,

interest

rates,

credit

spreads,

etc.).

Level

3

–

Prices

are

determined

using

significant

unobservable

inputs

(including

management’s

assumptions

in

determining

the

fair

value

of

investments).

The

following

table

summarizes

the

market

value

of

the

Fund's

investments

as

of

the

end

of

the

reporting

period,

based

on

the

inputs

used

to

value

them:

PRINCIPAL

DESCRIPTION

RATE

MATURITY

VALUE

SHORT-TERM

INVESTMENTS

-

2.4%

X

5,936,135

REPURCHASE

AGREEMENTS

-

2

.4

%

X

5,936,135

$

5,936,135

(d)

Fixed

Income

Clearing

Corporation

1

.520

%

10/01/24

$

5,936,135

TOTAL

REPURCHASE

AGREEMENTS

(Cost

$5,936,135)

5,936,135

TOTAL

SHORT-TERM

INVESTMENTS

(Cost

$5,936,135)

5,936,135

TOTAL

INVESTMENTS

-

102

.5

%

(Cost

$

182,995,893

)

259,077,938

OTHER

ASSETS

&

LIABILITIES,

NET

- (2.5)%

(

6,240,570

)

NET

ASSETS

APPLICABLE

TO

COMMON

SHARES

-

100%

$

252,837,368

Options

Written

Type

Description

(b)

Number

of

Contracts

Notional

Amount

(c)

Exercise

Price

Expiration

Date

Value

Call

S&P

500

Index

(10)

$

(

5,650,000

)

$

5,650

10/18/24

$

(

148,450

)

Call

S&P

500

Index

(75)

(

42,750,000

)

5,700

10/18/24

(

821,250

)

Call

S&P

500

Index

(35)

(

20,300,000

)

5,800

10/18/24

(

163,800

)

Call

S&P

500

Index

(20)

(

11,800,000

)

5,900

10/31/24

(

54,300

)

Total

Options

Written

(premiums

received

$399,586)

(140)

$(80,500,000)

$(1,187,800)

Level

1

Level

2

Level

3

Total

Long-Term

Investments:

Common

Stocks

$

248,058,056

$

–

$

–

$

248,058,056

Exchange-Traded

Funds

5,081,784

–

–

5,081,784

Options

Purchased

1,963

–

–

1,963

Short-Term

Investments:

Repurchase

Agreements

–

5,936,135

–

5,936,135

Investments

in

Derivatives:

Options

Written

(1,187,800)

–

–

(1,187,800)

Total

$

251,954,003

$

5,936,135

$

–

$

257,890,138

For

Fund

portfolio

compliance

purposes,

the

Fund’s

industry

classifications

refer

to

any

one

or

more

of

the

industry

sub-classifications

used

by

one

or

more

widely

recognized

market

indexes

or

ratings

group

indexes,

and/or

as

defined

by

Fund

management.

This

definition

may

not

apply

for

purposes

of

this

report,

which

may

combine

industry

sub-classifications

into

sectors

for

reporting

ease.

All

percentages

shown

in

the

Portfolio

of

Investments

are

based

on

net

assets

applicable

to

common

shares

unless

otherwise

noted.

(a)

Non-income

producing;

issuer

has

not

declared

an

ex-dividend

date

within

the

past

twelve

months.

(b)

Exchange-traded,

unless

otherwise

noted.

(c)

For

disclosure

purposes,

Notional

Amount

is

calculated

by

multiplying

the

Number

of

Contracts

by

the

Exercise

Price

by

100.

(d)

Agreement

with

Fixed

Income

Clearing

Corporation,

1.520%

dated

9/30/24

to

be

repurchased

at

$5,936,386

on

10/1/24,

collateralized

by

Government

Agency

Securities,

with

coupon

rate

3.500%

and

maturity

date

9/30/26,

valued

at

$6,055,008.

ETF

Exchange-Traded

Fund

S&P

Standard

&

Poor's

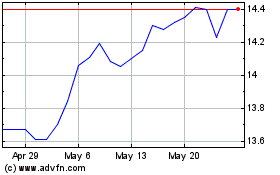

Nuveen Core Equity Alpha (NYSE:JCE)

Historical Stock Chart

From Oct 2024 to Nov 2024

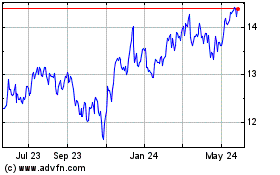

Nuveen Core Equity Alpha (NYSE:JCE)

Historical Stock Chart

From Nov 2023 to Nov 2024