The information in this preliminary

pricing supplement is not complete and may be changed. This preliminary pricing supplement is not an offer to sell nor does it seek an

offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to completion dated November 13,

2024

|

Pricing supplement

To prospectus dated April 13, 2023,

prospectus supplement dated April 13, 2023 and

product supplement no. 1-I dated April 13, 2023 |

Registration Statement No. 333-270004

Dated November , 2024

Rule 424(b)(2) |

$

Callable Fixed to Floating Rate Notes due November

29, 2039

General

| · | The notes are unsecured and

unsubordinated obligations of JPMorgan Chase & Co. Any payment on the notes is subject to the credit risk of JPMorgan

Chase & Co. |

| · | After the Initial Interest

Periods, the notes will pay interest that is linked inversely to the Benchmark Rate, which will initially be Compounded SOFR. After the

Initial Interest Periods, the Interest Rate will benefit from decreases in the Benchmark Rate and will be adversely affected by increases

in the Benchmark Rate. The notes are designed for investors who (a) seek (i) periodic interest payments that (1) for the Initial Interest

Periods, are fixed at a rate equal to 8.00% per annum, and (2) for each Interest Period (other than the Initial Interest Periods) are

at a rate equal to 7.50% minus the Benchmark Rate, as determined on each Determination Date, multiplied by 1.50, provided

that this rate will not be less than the Minimum Interest Rate of 0.00% per annum with respect to the remaining Interest Periods (years

3 to 15), and (ii) the return of their principal amount at maturity and (b) who are also willing to accept the risk that the notes will

be called prior to the Maturity Date. Any payment on the notes is subject to the credit risk of JPMorgan Chase & Co. |

| · | At our option, we may redeem the notes, in whole but not in part, on any of the Redemption Dates specified

below. |

| · | These notes have a long maturity relative to other fixed income products. Longer-dated notes may be riskier

than shorter-dated notes. See “Selected Risk Considerations” in this pricing supplement. |

| · | The

notes may be purchased in minimum denominations of $1,000 and in integral multiples of $1,000 thereafter. |

Key Terms

| Issuer: |

JPMorgan Chase & Co. |

| Payment at Maturity: |

On the Maturity Date, we will pay you the principal amount of your notes plus any accrued and unpaid interest, provided that your notes are outstanding and have not previously been called on any Redemption Date. |

| Call Feature: |

On the last calendar day of February and the 29th calendar day of May, August and November of each year, beginning on November 29, 2026 and ending on August 29, 2039 (each, a “Redemption Date”), we may redeem your notes, in whole but not in part, at a price equal to the principal amount being redeemed plus any accrued and unpaid interest, subject to the Business Day Convention and the Interest Accrual Convention described below and in the accompanying product supplement. If we intend to redeem your notes, we will deliver notice to The Depository Trust Company on any business day after the Original Issue Date that is at least 5 business days before the applicable Redemption Date. |

| Interest: |

We will pay you interest in arrears on each Interest Payment Date based on the applicable Interest Rate and the applicable Day Count Fraction, subject to the Interest Accrual Convention described below and in the accompanying product supplement. |

| Initial Interest Period(s): |

The Interest Periods beginning on and including the Original Issue Date of the notes and ending on but excluding November 29, 2026 |

| Initial Interest Rate: |

8.00% per annum |

| Interest Periods: |

The period beginning on and including the Original Issue Date and ending on but excluding the first Interest Payment Date, and each successive period beginning on and including an Interest Payment Date and ending on but excluding the next succeeding Interest Payment Date, subject to any earlier redemption and the Interest Accrual Convention described below and in the accompanying product supplement |

| Interest Payment Dates: |

Interest on the notes will be payable in arrears on the last calendar day of February and the 29th calendar day of May, August and November of each year, beginning on February 28, 2025 to and including the Maturity Date (each, an “Interest Payment Date”), subject to any earlier redemption and the Business Day Convention and Interest Accrual Convention described below and in the accompanying product supplement. |

| Observation Periods: |

With respect to each Interest Period after the Initial Interest Periods, the period from, and including, the second U.S. Government Securities Business Day immediately preceding the first day in that Interest Period to, but excluding, the second U.S. Government Securities Business Day immediately preceding the Interest Payment Date for that Interest Period, provided that if any Interest Period (after the Initial Interest Periods) is adjusted due to the postponement of an Interest Payment Date, the corresponding Observation Period will not be adjusted and will be determined based on that Interest Period prior to its adjustment |

| Interest Rate: |

With respect to each Initial Interest Period, a rate per annum equal to the Initial Interest Rate, and, notwithstanding anything to the contrary in the accompanying product supplement, with respect to each Interest Period thereafter, a rate per annum equal to (a) 7.50% minus the Benchmark Rate, as determined on the applicable Determination Date (that difference, the “Benchmark Rate Spread”), multiplied by (b) 1.50 (the “Multiplier”), provided that this rate will not be less than the Minimum Interest Rate. |

| Minimum Interest Rate: |

0.00% per annum |

| Benchmark Rate: |

Initially, Compounded SOFR; provided that if a Benchmark Transition Event and its related Benchmark Replacement Date (each as defined in the accompanying product supplement) have occurred with respect to Compounded SOFR or the then-current Benchmark Rate, then the applicable Benchmark Replacement as determined by the alternative procedures set forth under “The Underlyings —Base Rates — Compounded SOFR — Effect of a Benchmark Transition Event” in the accompanying product supplement, as supplemented by “Supplemental Terms of the Notes — Benchmark Replacement” in this pricing supplement. |

| Determination Date: |

For each Interest Period after the Initial Interest Periods, the U.S. Government Securities Business Day immediately preceding the Interest Payment Date for that Interest Period |

| Pricing Date: |

November 26, 2024, subject to the Business Day Convention |

| Original Issue Date: |

November 29, 2024, subject to the Business Day Convention (Settlement Date) |

| Maturity Date: |

November 29, 2039, subject to the Business Day Convention |

| Other Key Terms: |

See “Additional Key Terms” in this pricing supplement. |

Investing in the notes involves a number of risks. See

“Risk Factors” beginning on page S-2 of the accompanying prospectus supplement, “Risk Factors” beginning on page

PS-11 of the accompanying product supplement and “Selected Risk Considerations” beginning on page PS-3 of this pricing supplement.

Neither the Securities and Exchange Commission (the “SEC”)

nor any state securities commission has approved or disapproved of the notes or passed upon the accuracy or the adequacy of this pricing

supplement or the accompanying product supplement, prospectus supplement and prospectus. Any representation to the contrary is a criminal

offense.

| |

Price to Public(1)(2) |

Fees and Commissions(2)(3) |

Proceeds to Issuer |

| Per note |

$1,000 |

$ |

$ |

| Total |

$ |

$ |

$ |

(1) The price to the public includes the estimated cost of hedging

our obligations under the notes through one or more of our affiliates.

(2) With respect to notes sold to eligible institutional investors

or fee-based advisory accounts for which an affiliated or unaffiliated broker-dealer is an investment adviser, the price to the public

will not be lower than $962.60 or greater than $1,000 per $1,000 principal amount note. Broker-dealers who purchase the notes for

these accounts may forgo some or all selling commissions related to these sales described in footnote (3) below. The per note price

to the public in the table above assumes a price to the public of $1,000 per $1,000 principal amount note. See “Plan of Distribution

(Conflicts of Interest)” in the accompanying product supplement.

(3) J.P. Morgan Securities LLC, which we refer

to as JPMS, acting as agent for JPMorgan Chase & Co., will pay all of the selling commissions it receives from us to

other affiliated or unaffiliated dealers. If the notes priced today, the selling commissions would be approximately $30.00 per

$1,000 principal amount note and in no event will these selling commissions exceed $50.00 per $1,000 principal amount note.

Broker-dealers who purchase the notes for sales to eligible institutional investors or fee-based advisory accounts may forgo some or

all of these selling commissions. See “Plan of Distribution (Conflicts of Interest)” in the accompanying product

supplement.

The notes are not bank deposits, are not insured by the Federal

Deposit Insurance Corporation or any other governmental agency and are not obligations of, or guaranteed by, a bank.

Additional Terms Specific

to the Notes

You may revoke your offer to purchase the notes at any time prior

to the time at which we accept such offer by notifying the applicable agent. We reserve the right to change the terms of, or reject any

offer to purchase, the notes prior to their issuance. In the event of any changes to the terms of the notes, we will notify you and you

will be asked to accept such changes in connection with your purchase. You may also choose to reject such changes in which case we may

reject your offer to purchase.

You should read this pricing supplement together with the accompanying

prospectus, as supplemented by the accompanying prospectus supplement relating to our Series E medium-term notes of which these notes

are a part, and the more detailed information contained in the accompanying product supplement. This pricing supplement, together with

the documents listed below, contains the terms of the notes and supersedes all other prior or contemporaneous oral statements as well

as any other written materials including preliminary or indicative pricing terms, correspondence, trade ideas, structures for implementation,

sample structures, fact sheets, brochures or other educational materials of ours. You should carefully consider, among other things, the

matters set forth in the “Risk Factors” sections of the accompanying prospectus supplement and the accompanying product supplement,

as the notes involve risks not associated with conventional debt securities. We urge you to consult your investment, legal, tax, accounting

and other advisers before you invest in the notes.

You may access these documents on the SEC website at www.sec.gov as

follows (or if such address has changed, by reviewing our filings for the relevant date on the SEC website):

| · | Prospectus supplement and prospectus, each dated April 13, 2023: |

http://www.sec.gov/Archives/edgar/data/19617/000095010323005751/crt_dp192097-424b2.pdf

Our Central Index Key, or CIK, on the SEC website is 19617. As used

in this pricing supplement, “we,” “us” and “our” refer to JPMorgan Chase & Co.

Additional Key Terms

| Compounded SOFR: |

With respect to the Observation Period corresponding to any Interest Period

(after the Initial Interest Periods), Compounded SOFR will be a compounded average of daily SOFR over such Observation Period, calculated

as follows:

where:

“d0” means the number of U.S. Government

Securities Business Days in that Observation Period;

“i” is a series of whole numbers from one

to d0, each representing the relevant U.S. Government Securities Business Days in chronological order from, and including,

the first U.S. Government Securities Business Day in that Observation Period;

“SOFRi” means, for any U.S. Government

Securities Business Day “i” in that Observation Period, Daily SOFR with respect to that day, determined as set forth

in the accompanying product supplement;

“ni” means, for any U.S. Government

Securities Business Day “i” in that Observation Period, the number of calendar days from, and including, that U.S.

Government Securities Business Day “i” up to, but excluding, the following U.S. Government Securities Business Day

(“i+1”); and

“d” means the number of calendar days in that Observation

Period. |

| Daily SOFR: |

With respect to any U.S. Government Securities Business Day prior to a Benchmark Replacement Date, the Secured Overnight Financing Rate (“SOFR”) published for such U.S. Government Securities Business Day as such rate appears on the SOFR administrator’s website at 3:00 p.m. (New York City time) on the immediately following U.S. Government Securities Business Day, provided that, if such rate does not so appear, then as determined by the alternative procedures set forth in the accompanying product supplement. |

| U.S. Government Securities Business Day: |

Any day except for a Saturday, a Sunday or a day on which the Securities Industry and Financial Markets Association recommends that the fixed income departments of its members be closed for the entire day for purposes of trading in U.S. government securities |

| Business Day: |

Notwithstanding anything to the contrary in the accompanying product supplement, any weekday that is a U.S. Government Securities Business Day and is not a legal holiday in New York City and is not a date on which banking institutions in New York City are authorized or required by law or regulation to be closed. |

| Business Day Convention: |

Following |

| Interest Accrual Convention: |

Unadjusted |

| Day Count Convention: |

30/360 |

| CUSIP: |

48130CVT9 |

Supplemental Terms of the

Notes

Benchmark Replacement. The section

entitled “The Underlyings — Base Rates — Compounded SOFR — Effect of a Benchmark Replacement Event — Benchmark

Replacement” in the accompanying product supplement is amended, replaced and superseded in its entirety by the following. Capitalized

terms are as defined in the accompanying product supplement.

“Benchmark Replacement. If the calculation

agent determines that a Benchmark Transition Event and its related Benchmark Replacement Date have occurred at or prior to the Reference

Time in respect of any determination of the Benchmark Rate on any date, the Benchmark Replacement will replace the then-current Benchmark

Rate for all purposes relating to the notes during the applicable Interest Period (after any Initial Interest Periods) in respect of such

determination on such date and all determinations on all subsequent dates (including, if applicable, for purposes of the determination

of the payment at maturity).”

| JPMorgan Structured Investments — | PS- 1 |

| Callable Fixed to Floating Rate Notes | |

Selected Purchase Considerations

| · | PRESERVATION OF CAPITAL AT MATURITY OR UPON REDEMPTION — Regardless

of the performance of the Benchmark Rate, we will pay you at least the principal amount of your notes if you hold the notes to maturity

or to the Redemption Date, if any, on which we elect to call the notes. Because the notes are our unsecured and unsubordinated obligations,

payment of any amount on the notes is subject to our ability to pay our obligations as they become due. |

| · | PERIODIC INTEREST PAYMENTS — The notes offer periodic interest

payments on each Interest Payment Date, subject to any earlier redemption. With respect to the Initial Interest Periods, your notes will

pay an annual interest rate equal to the Initial Interest Rate, and, for the applicable Interest Periods thereafter, your notes will pay

an interest rate per annum equal to the Benchmark Rate Spread times the Multiplier, provided that this rate will not be

less than the Minimum Interest Rate. After the Initial Interest Periods, the notes will pay interest that is linked inversely to the

Benchmark Rate. After the Initial Interest Periods, the Interest Rate will benefit from decreases in the Benchmark Rate and will be adversely

affected by increases in the Benchmark Rate. The yield on the notes may be less than the overall return you would receive from a conventional

debt security that you could purchase today with the same maturity as the notes. |

| · | POTENTIAL PERIODIC REDEMPTION BY US AT OUR OPTION — At our option,

we may redeem the notes, in whole but not in part, on any of the Redemption Dates set forth on the cover of this pricing supplement, at

a price equal to the principal amount being redeemed plus any accrued and unpaid interest, subject to the Business Day Convention

and the Interest Accrual Convention described on the cover of this pricing supplement and in the accompanying product supplement. Any

accrued and unpaid interest on the notes redeemed will be paid to the person who is the holder of record of these notes at the close of

business on the business day immediately preceding the applicable Redemption Date. Even in cases where the notes are called before maturity,

noteholders are not entitled to any fees or commissions described on the front cover of this pricing supplement. |

| · | TAX TREATMENT — You should review carefully the section entitled

“Material U.S. Federal Income Tax Consequences” in this pricing supplement and the section entitled “Material U.S. Federal

Income Tax Consequences” in the accompanying product supplement and consult your tax adviser regarding the U.S. federal income tax

consequences of an investment in the notes |

| · | INSOLVENCY AND RESOLUTION CONSIDERATIONS — The notes constitute

“loss-absorbing capacity” within the meaning of the final rules (the “TLAC rules”) issued by the Board of Governors

of the Federal Reserve System (the “Federal Reserve”) on December 15, 2016 regarding, among other things, the minimum levels

of unsecured external long-term debt and other loss-absorbing capacity that certain U.S. bank holding companies, including JPMorgan Chase & Co.,

are required to maintain. Such debt must satisfy certain eligibility criteria under the TLAC rules. If JPMorgan Chase & Co.

were to enter into resolution, either in a proceeding under Chapter 11 of the U.S. Bankruptcy Code or in a receivership administered by

the Federal Deposit Insurance Corporation (the “FDIC”) under Title II of the Dodd-Frank Wall Street Reform and Consumer Protection

Act of 2010 (the “Dodd-Frank Act”), holders of the notes and other debt and equity securities of JPMorgan Chase & Co.

will absorb the losses of JPMorgan Chase & Co. and its affiliates. |

Under Title I of the Dodd-Frank Act and applicable rules

of the Federal Reserve and the FDIC, JPMorgan Chase & Co. is required to submit periodically to the Federal Reserve and

the FDIC a detailed plan (the “resolution plan”) for the rapid and orderly resolution of JPMorgan Chase & Co.

and its material subsidiaries under the U.S. Bankruptcy Code and other applicable insolvency laws in the event of material financial distress

or failure. JPMorgan Chase & Co.’s preferred resolution strategy under its resolution plan contemplates that only

JPMorgan Chase & Co. would enter bankruptcy proceedings under Chapter 11 of the U.S. Bankruptcy Code pursuant to a “single

point of entry” recapitalization strategy. JPMorgan Chase & Co.’s subsidiaries would be recapitalized as needed

so that they could continue normal operations or subsequently be wound down in an orderly manner. As a result, JPMorgan Chase & Co.’s

losses and any losses incurred by its subsidiaries would be imposed first on holders of JPMorgan Chase & Co.’s equity

securities and thereafter on unsecured creditors, including holders of the notes and other securities of JPMorgan Chase & Co.

Claims of holders of the notes and those other debt securities would have a junior position to the claims of creditors of JPMorgan Chase & Co.’s

subsidiaries and to the claims of priority (as determined by statute) and secured creditors of JPMorgan Chase & Co. Accordingly,

in a resolution of JPMorgan Chase & Co. under Chapter 11 of the U.S. Bankruptcy Code, holders of the notes and other debt

securities of JPMorgan Chase & Co. would realize value only to the extent available to JPMorgan Chase & Co.

as a shareholder of JPMorgan Chase Bank, N.A. and its other subsidiaries and only after any claims of priority and secured creditors of

JPMorgan Chase & Co. have been fully repaid. If JPMorgan Chase & Co. were to enter into a resolution, none

of JPMorgan Chase & Co., the Federal Reserve or the FDIC is obligated to follow JPMorgan Chase & Co.’s

preferred resolution strategy under its resolution plan.

The FDIC has similarly indicated that a single point of

entry recapitalization model could be a desirable strategy to resolve a systemically important financial institution, such as JPMorgan

Chase & Co., under Title II of the Dodd-Frank Act (“Title II”). Pursuant to that strategy, the FDIC would use

its power to create a “bridge entity” for JPMorgan Chase & Co.; transfer the systemically important and viable

parts of JPMorgan Chase & Co.’s business, principally the stock of JPMorgan Chase & Co.’s main

operating subsidiaries and any intercompany claims against such subsidiaries, to the bridge entity; recapitalize those subsidiaries using

assets of JPMorgan Chase & Co. that have been transferred to the bridge entity; and exchange external debt claims against

JPMorgan Chase & Co. for equity in the bridge entity. Under this Title II resolution strategy, the value of the stock of

the bridge entity that would be redistributed to holders of the notes and other debt securities of JPMorgan Chase & Co.

may not be sufficient to repay all or part of the principal amount and interest on the notes and those other securities. To date, the

FDIC has not formally adopted a single point of entry resolution strategy, and it is not obligated to follow such a strategy in a Title

II resolution of JPMorgan Chase & Co.

| JPMorgan Structured Investments — | PS- 2 |

| Callable Fixed to Floating Rate Notes | |

Selected Risk Considerations

An investment in the notes involves significant risks. These risks

are explained in more detail in the “Risk Factors” sections of the accompanying prospectus supplement and the accompanying

product supplement.

Risks Relating to the Notes Generally

| · | WE MAY CALL YOUR NOTES PRIOR TO THEIR SCHEDULED MATURITY DATE — We

may choose to call the notes early or choose not to call the notes early on any Redemption Date in our sole discretion. If the notes are

called early, you will receive the principal amount of your notes plus any accrued and unpaid interest to, but excluding, the applicable

Redemption Date. The aggregate amount that you will receive through and including the applicable Redemption Date will be less than the

aggregate amount that you would have received had the notes not been called early. If we call the notes early, your overall return may

be less than the yield that the notes would have earned if you held your notes to maturity and you may not be able to reinvest your funds

at the same rate as the original notes. We may choose to call the notes early, for example, if U.S. interest rates decrease or do not

rise significantly or if volatility of U.S. interest rates decreases significantly. |

| · | THE NOTES ARE NOT ORDINARY DEBT SECURITIES BECAUSE, OTHER THAN DURING THE

INITIAL INTEREST PERIODS, THE INTEREST RATE ON THE NOTES IS A FLOATING RATE AND MAY BE EQUAL TO THE MINIMUM INTEREST RATE —

With respect to the Initial Interest Periods, your notes will pay a rate equal to the Initial Interest Rate, and, for the applicable Interest

Periods thereafter, your notes will pay a rate per annum equal to the Benchmark Rate Spread times the Multiplier, provided

that this rate will not be less than the Minimum Interest Rate. The Interest Rate for an Interest Period after the Initial Interest

Periods will be equal to the Minimum Interest Rate if the Benchmark Rate on the applicable Determination Date is greater than or equal

to 7.50% per annum. Accordingly, if the Benchmark Rate on the Determination Dates for some or all of the Interest Periods after

the Initial Interest Periods is greater than or equal to 7.50% per annum, you may not receive any interest payments for an extended period

over the term of the notes. |

| · | AFTER THE INITIAL INTEREST PERIODS, THE INTEREST RATE ON THE NOTES IS LINKED

INVERSELY TO THE Benchmark RatE — After the Initial Interest Periods, the

notes will pay interest that is linked inversely to the Benchmark Rate. After the Initial Interest Periods, the Interest Rate will benefit

from decreases in the Benchmark Rate and will be adversely affected by increases in the Benchmark Rate. The amount of interest, if

any, payable on the notes will depend on a number of factors that could affect the levels of the Benchmark Rate, and in turn, could affect

the value of the notes. These factors include (but are not limited to) the expected volatility of the Benchmark Rate, interest and yield

rates in the market generally, the performance of capital markets, monetary policies, fiscal policies, regulatory or judicial events,

inflation, general economic conditions, and public expectations with respect to such factors. These and other factors may have a positive

impact on the Benchmark Rate, which will negatively affect the Interest Rate, and on the value of the notes in the secondary market. The

effect that any single factor may have on the Benchmark Rate may be partially offset by other factors. We cannot predict the factors that

may cause the Benchmark Rate to increase or decrease, and consequently the Interest Rate for an Interest Period (other than an Initial

Interest Period), to decrease or increase, respectively. An increase in the Benchmark Rate will result in a reduction of the applicable

Interest Rate used to calculate the Interest for any Interest Period (after the Initial Interest Periods). In addition, because the notes

provide inverse exposure to the Benchmark Rate, if an increase in interest rates causes the Benchmark Rate to increase during an Interest

Period (after the Initial Interest Periods), the present value of the notes will fall faster than the present value of a fixed rate note.

|

| · | FLOATING RATE NOTES DIFFER FROM FIXED RATE NOTES — After the

Initial Interest Periods, the rate of interest on your notes will be variable and determined based on the Benchmark Rate, provided

that this rate will not be less than the Minimum Interest Rate, which may be less than returns otherwise payable on notes issued by us

with similar maturities. You should consider, among other things, the overall potential annual percentage rate of interest to maturity

of the notes as compared to other investment alternatives. |

| · | THE BENCHMARK RATE WILL INITIALLY BE BASED ON COMPOUNDED SOFR, WHICH IS

RELATIVELY NEW IN THE MARKETPLACE — For each Interest Period (after the Initial Interest Periods), the Interest Rate is based

on the Benchmark Rate, which will initially be Compounded SOFR, a compounded average of Daily SOFR during the applicable Observation Period

calculated as described under “Key Terms — Compounded SOFR” in this pricing supplement, and not on Daily SOFR published

on or in respect of a particular date during that Observation Period. For this and other reasons, the Interest Rate for any Interest Period

(after the Initial Interest Periods) may not be the same as the interest rate on other investments bearing interest at a rate based on

SOFR that use an alternative method to determine the applicable interest rate, including any compounded average SOFR published by the

Federal Reserve Bank of New York (“FRBNY”). Further, if Daily SOFR in respect of a particular date during an Observation Period

is positive, the inclusion of such Daily SOFR in the calculation of Compounded SOFR for the applicable Interest Period (after the Initial

Interest Periods) will reduce the Interest Rate and the interest payable on the notes for that Interest Period. |

In addition, very limited market precedent exists for

securities that use compounded SOFR as the base rate, and the method for calculating an interest rate based upon compounded SOFR in those

precedents varies. Accordingly, the specific formula and related conventions (for example, observation periods) used for the notes may

not be widely adopted by other market participants, if at all. Adoption of a different calculation method by the market likely would adversely

affect the return on, value of and market for the notes.

| · | INTEREST PAYMENTS WITH RESPECT TO EACH INTEREST PERIOD (AFTER THE INITIAL

INTEREST PERIODS) WILL BE DETERMINED ONLY NEAR THE END OF THAT INTEREST PERIOD — The level of the Benchmark Rate applicable

to each Interest Period (after the Initial Interest Periods) |

| JPMorgan Structured Investments — | PS- 3 |

| Callable Fixed to Floating Rate Notes | |

and, therefore, the amount of interest payable with respect to that Interest

Period will be determined on the Determination Date. Because each Determination Date is near the end of the relevant Interest Period,

you will not know the amount of interest payable with respect to that Interest Period until shortly prior to the related Interest Payment

Date and it may be difficult for you to reliably estimate the amount of interest that will be payable on each Interest Payment Date.

| · | LONGER-DATED NOTES MAY BE RISKIER THAN SHORTER-DATED NOTES — By

purchasing a note with a longer tenor, you are more exposed to fluctuations in interest rates than if you purchased a note with a shorter

tenor. The present value of a longer-dated note tends to be more sensitive to rising interest rates than the present value of a shorter-dated

note. If interest rates rise, the present value of a longer-dated note will fall faster than the present value of a shorter-dated note.

You should purchase these notes only if you are comfortable with owning a note with a longer tenor. |

| · | CREDIT RISK OF JPMORGAN CHASE & CO. — The notes

are subject to the credit risk of JPMorgan Chase & Co., and our credit ratings and credit spreads may adversely affect the

market value of the notes. Investors are dependent on JPMorgan Chase & Co.’s ability to pay all amounts due on the

notes. Any actual or potential change in our creditworthiness or credit spreads, as determined by the market for taking our credit risk,

is likely to adversely affect the value of the notes. If we were to default on our payment obligations, you may not receive any amounts

owed to you under the notes and you could lose your entire investment. |

| · | REINVESTMENT RISK — If we redeem the notes, the term of the notes

may be reduced and you will not receive interest payments after the applicable Redemption Date. There is no guarantee that you would be

able to reinvest the proceeds from an investment in the notes at a comparable return and/or with a comparable interest rate for a similar

level of risk in the event the notes are redeemed prior to the Maturity Date. |

| · | LACK OF

LIQUIDITY — The notes will not be listed on any securities exchange.

JPMS intends to offer to purchase the notes in the secondary market but is not required to do so. Even if there is a secondary market,

it may not provide enough liquidity to allow you to trade or sell the notes easily. Because other dealers are not likely to make a secondary

market for the notes, the price at which you may be able to trade your notes is likely to depend on the price, if any, at which JPMS is

willing to buy the notes. |

Risks Relating to Conflicts of Interest

| · | POTENTIAL CONFLICTS — We and our affiliates play a variety of

roles in connection with the issuance of the notes, including acting as calculation agent and as an agent of the offering of the notes

and hedging our obligations under the notes. In performing these duties, our economic interests and the economic interests of the calculation

agent and other affiliates of ours are potentially adverse to your interests as an investor in the notes. In addition, our business activities,

including hedging and trading activities for our own accounts or on behalf of customers, could cause our economic interests to be adverse

to yours and could adversely affect any payment on the notes and the value of the notes. It is possible that hedging or trading activities

of ours or our affiliates in connection with the notes could result in substantial returns for us or our affiliates while the value of

the notes declines. Please refer to “Risk Factors — Risks Relating to Conflicts of Interest” in the accompanying product

supplement for additional information about these risks. |

In addition, if the Benchmark Rate is not published or

if the calculation agent determines on or prior to a Determination Date that a Benchmark Transition Event and its related Benchmark Replacement

Date (each as defined in the accompanying product supplement) have occurred with respect to the Benchmark Rate, then the Benchmark Rate

will be determined by the alternative procedures set forth under “The Underlyings —Base Rates — Compounded SOFR —

Effect of a Benchmark Transition Event” in the accompanying product supplement, as supplemented by “Supplemental Terms of

the Notes — Benchmark Replacement” in this pricing supplement, which may adversely affect the return on and the market value

of the notes.

Risks Relating to Secondary Market Prices of the

Notes

| · | CERTAIN BUILT-IN COSTS ARE LIKELY TO AFFECT ADVERSELY THE VALUE OF THE

NOTES PRIOR TO MATURITY — While the payment at maturity described in this pricing supplement is based on the full principal

amount of your notes, the original issue price of the notes includes the agent’s commission, if any, and the estimated cost of hedging

our obligations under the notes through one or more of our affiliates. As a result, the price, if any, at which JPMS will be willing to

purchase notes from you in secondary market transactions, if at all, will likely be lower than the original issue price and any sale prior

to the Maturity Date could result in a substantial loss to you. This secondary market price will also be affected by a number of factors

aside from the agent’s commission, if any, and hedging costs, including those referred to under “— Many Economic and

Market Factors Will Impact the Value of the Notes” below. |

The notes are not designed to be short-term trading instruments.

Accordingly, you should be able and willing to hold your notes to maturity.

| · | MANY ECONOMIC AND MARKET FACTORS WILL IMPACT

THE VALUE OF THE NOTES — In addition to the Benchmark Rate, which

will initially be Compounded SOFR, on any day, the value of the notes will be affected by a number of economic and market factors that

may either offset or magnify each other, including, but not limited to: |

| · | any

actual or potential change in our creditworthiness or credit spreads; |

| · | the

actual and expected volatility of the Benchmark Rate; |

| · | the

actual or potential cessation of Compounded SOFR; |

| · | the

time to maturity of the notes; |

| · | interest

and yield rates in the market generally, as well as the volatility of those rates; |

| · | the

likelihood, or expectation, that the notes will be redeemed by us, based on prevailing market interest rates or otherwise; and |

| JPMorgan Structured Investments — | PS- 4 |

| Callable Fixed to Floating Rate Notes | |

| · | a

variety of economic, financial, political, regulatory or judicial events. |

Risks Relating to the Benchmark Rate

| · | SOFR WILL BE AFFECTED BY A NUMBER OF FACTORS

AND MAY BE VOLATILE — The amount of interest payable on the notes

(after the Initial Interest Periods) will initially depend on SOFR. SOFR will depend on a number of factors, including, but not limited

to: |

| · | supply

and demand for overnight U.S. Treasury repurchase agreements; |

| · | sentiment

regarding underlying strength in the U.S. and global economies; |

| · | expectations

regarding the level of price inflation; |

| · | sentiment

regarding credit quality in the U.S. and global credit markets; |

| · | central

bank policy regarding interest rates; |

| · | inflation

and expectations concerning inflation; |

| · | performance

of capital markets; and |

| · | any

statements from public government officials regarding the cessation of SOFR. |

These and other factors may have a positive effect

on the performance of SOFR, which may have a negative effect on the payment of interest on the notes and on the value of the notes in

the secondary market.

Since the initial publication of SOFR, daily changes in

the rate have, on occasion, been more volatile than daily changes in other benchmark or market rates during corresponding periods. In

addition, although changes in compounded SOFR generally are not expected to be as volatile as changes in Daily SOFR, the return on, value

of and market for the notes may fluctuate more than floating rate debt securities with interest rates based on less volatile rates.

| · | THE COMPOSITION AND CHARACTERISTICS OF SOFR

ARE NOT THE SAME AS THOSE OF LIBOR AND THERE IS NO GUARANTEE THAT SOFR (OR COMPOUNDED SOFR) IS A COMPARABLE SUBSTITUTE FOR LIBOR —

In June 2017, the Federal Reserve Bank of New York’s Alternative

Reference Rates Committee (the “ARRC”) announced SOFR as its recommended alternative to USD LIBOR. However, the composition

and characteristics of SOFR are not the same as those of USD LIBOR. SOFR is a broad Treasury repo financing rate that represents overnight

secured funding transactions and is not the economic equivalent of USD LIBOR. While SOFR is a secured rate, USD LIBOR is an unsecured

rate. In addition, while SOFR currently is an overnight rate only, USD LIBOR is a forward-looking rate that represents interbank funding

for a specified term. As a result, there can be no assurance that SOFR will perform in the same way as USD LIBOR would have at any time,

including, without limitation, as a result of changes in interest and yield rates in the market, bank credit risk, market volatility or

global or regional economic, financial, political, regulatory, judicial or other events. For the same reasons, SOFR is not expected to

be a comparable substitute, successor or replacement for USD LIBOR. |

| · | THE SECONDARY MARKET FOR THE NOTES MAY BE LIMITED

— If SOFR does not prove to be widely used as a benchmark in securities

that are similar or comparable to the notes, the trading price of the notes may be lower than those of debt securities with interest rates

based on rates that are more widely used. Similarly, market terms for debt securities with interest rates based on SOFR, including, but

not limited to, the spread over the reference rate reflected in the interest rate provisions or manner of compounding the reference rate,

may evolve over time, and as a result, trading prices of the notes may be lower than those of later-issued debt securities that are based

on SOFR. Investors in the notes may not be able to sell the notes at all or may not be able to sell the notes at prices that will provide

them with a yield comparable to similar investments that have a developed secondary market, and may consequently suffer from increased

pricing volatility and market risk. |

| · | THE ADMINISTRATOR OF SOFR MAY MAKE CHANGES THAT COULD ADVERSELY AFFECT

THE LEVEL OF SOFR OR DISCONTINUE SOFR AND HAS NO OBLIGATION TO CONSIDER YOUR INTEREST IN DOING SO — SOFR is a relatively new

rate, and FRBNY (or a successor), as administrator of SOFR, may make methodological or other changes that could change the value of SOFR,

including changes related to the method by which SOFR is calculated, eligibility criteria applicable to the transactions used to calculate

SOFR, or timing related to the publication of SOFR. If the manner in which SOFR is calculated is changed, that change may result in a

reduction of the amount of interest payable on the notes, which may adversely affect the trading prices of the notes. The administrator

of SOFR may withdraw, modify, amend, suspend or discontinue the calculation or dissemination of SOFR in its sole discretion and without

notice and has no obligation to consider the interests of holders of the notes in calculating, withdrawing, modifying, amending, suspending

or discontinuing SOFR. For purposes of the formula used to calculate interest with respect to the notes, Daily SOFR in respect of a particular

date will not be adjusted for any modifications or amendments to SOFR data that the administrator of SOFR may publish after the Interest

Rate for the applicable Interest Period (after the Initial Interest Periods) has been determined. |

| · | COMPOUNDED SOFR MAY BE REPLACED BY A SUCCESSOR OR SUBSTITUTE INTEREST RATE

— If the calculation agent determines that a Benchmark Transition Event and its related Benchmark Replacement Date have occurred

with respect to Compounded SOFR, then a Benchmark Replacement will be selected by the calculation agent in accordance with the benchmark

transition provisions of the notes described under “The Underlyings — Base Rates — Compounded SOFR — Effect of

a Benchmark Transition Event” in the accompanying product supplement, as supplemented by “Supplemental Terms of the Notes

— Benchmark Replacement” in this pricing supplement. The selection of a Benchmark Replacement, and any decisions, determinations

or elections made by the calculation agent or by us in connection with implementing a Benchmark Replacement with respect to the notes

in accordance with the benchmark transition provisions, could result in adverse consequences to the relevant Interest Rate on the notes

during the applicable Interest Period (after the Initial Interest Periods), which could adversely affect the return on, value of and market

for the notes. Further, there is no assurance that the characteristics of any Benchmark Replacement will be similar to Compounded |

| JPMorgan Structured Investments — | PS- 5 |

| Callable Fixed to Floating Rate Notes | |

SOFR, or that any Benchmark Replacement will produce the economic equivalent

of Compounded SOFR.

JPMS, an affiliate of ours, is currently the calculation

agent for the notes. In the future, we may appoint another firm, ourselves or another affiliate of ours as the calculation agent. If the

calculation agent fails to make any determination, decision or election that it is required to make pursuant to the benchmark transition

provisions described above, then we will make that determination, decision or election.

| · | UNCERTAINTY AS TO SOME OF THE POTENTIAL BENCHMARK REPLACEMENTS AND ANY

BENCHMARK REPLACEMENT CONFORMING CHANGES WE MAKE MAY ADVERSELY AFFECT THE RETURN ON AND THE MARKET VALUE OF THE NOTES — Under

the benchmark transition provisions of the notes, if the calculation agent determines that a Benchmark Transition Event and its related

Benchmark Replacement Date have occurred with respect to Compounded SOFR, then a Benchmark Replacement will be selected by the calculation

agent. If a particular Benchmark Replacement or Benchmark Replacement Adjustment cannot be determined, then the next-available Benchmark

Replacement or Benchmark Replacement Adjustment will apply. These replacement rates and adjustments may be selected or formulated by (i) the

Relevant Governmental Body (such as the Alternative Reference Rates Committee of FRBNY), (ii) the International Swaps and Derivatives

Association (“ISDA”) or (iii) in certain circumstances, us. In addition, the benchmark transition provisions expressly authorize

us to make Benchmark Replacement Conforming Changes with respect to, among other things, the determination of Interest Periods, Observation

Periods and the timing and frequency of determining rates and making payments of interest. The application of a Benchmark Replacement

and Benchmark Replacement Adjustment, and any implementation of Benchmark Replacement Conforming Changes, could result in adverse consequences

to the amount of interest payable on the notes during the applicable Interest Period (after the Initial Interest Periods), which could

adversely affect the return on, value of and market for the notes. Further, there is no assurance that the characteristics of any Benchmark

Replacement will be similar to the then-current Benchmark Rate that it is replacing, or that any Benchmark Replacement will produce the

economic equivalent of the then-current Benchmark Rate that it is replacing. |

Hypothetical Interest Rate for an Interest Period

(Other Than an Initial Interest Period)

The following table illustrates the Interest Rate determination for

an Interest Period (other than an Initial Interest Period) for a hypothetical range of performance of the Benchmark Rate and reflects

the Minimum Interest Rate set forth on the cover of this pricing supplement. The hypothetical Benchmark Rate and interest payments set

forth in the following examples are for illustrative purposes only and may not be the actual Benchmark Rate or interest payment applicable

to a purchaser of the notes.

| Hypothetical Benchmark Rate |

|

Hypothetical Interest Rate

for Years 3 to 15* |

| 9.00% |

|

0.00%* |

| 8.00% |

|

0.00%* |

| 7.50% |

|

0.00%* |

| 7.00% |

|

0.75% |

| 6.00% |

|

2.25% |

| 5.00% |

|

3.75% |

| 4.00% |

|

5.25% |

| 3.00% |

|

6.75% |

| 2.00% |

|

8.25% |

| 1.00% |

|

9.75% |

| 0.00% |

|

11.25% |

| -1.00% |

|

12.75% |

| -2.00% |

|

14.25% |

*The Interest Rate cannot be less than the Minimum Interest Rate of

0.00% per annum with respect to years 3 to 15.

| JPMorgan Structured Investments — | PS- 6 |

| Callable Fixed to Floating Rate Notes | |

Hypothetical

Examples of Interest Rate Calculation for an Interest Period (Other Than an Initial Interest Period)

The following examples illustrate how the hypothetical Interest Rate

is calculated for a particular Interest Period occurring after the Initial Interest Periods and assume that that the Day Count Fraction

for the applicable Interest Period is equal to 90/360. The actual Day Count Fraction for an Interest Period will be calculated in the

manner set forth in the accompanying product supplement. The hypothetical Interest Rates in the following examples are for illustrative

purposes only and may not correspond to the actual Interest Rate for any Interest Period applicable to a purchaser of the notes. The numbers

appearing in the following examples have been rounded for ease of analysis.

Example 1: After the Initial Interest Periods, with respect to

a particular Interest Period, the Benchmark Rate is 6.00% on the applicable Determination Date. The Interest Rate applicable to this

Interest Period is 2.25% per annum, calculated as follows:

(7.50% - 6.00%) × 1.50 = 2.25%

The corresponding interest payment per $1,000

principal amount note is calculated as follows:

$1,000 × 2.25% × (90/360) = $5.625

Example 2: After the Initial Interest Periods, with respect to

a particular Interest Period, the Benchmark Rate is 3.00% on the applicable Determination Date. The Interest Rate applicable to this

Interest Period is 6.75% per annum, calculated as follows:

(7.50% - 3.00%) × 1.50 = 6.75%

The corresponding interest payment per $1,000

principal amount note is calculated as follows:

$1,000 × 6.75% × (90/360) = $16.875

Example 3: After the Initial Interest Periods, with respect to

a particular Interest Period, the Benchmark Rate is 9.00% on the applicable Determination Date. Because the Benchmark Rate Spread

of -1.50% (7.50% minus 9.00%) multiplied by the Multiplier of 1.50 is less than the Minimum Interest Rate of 0.00% per annum,

the Interest Rate for this Interest Period is 0.00% per annum, and no interest is payable with respect to this Interest Period.

The hypothetical payments on the notes shown above apply only if you

hold the notes for their entire term or until earlier redemption. These hypotheticals do not reflect fees or expenses that

would be associated with any sale in the secondary market. If these fees and expenses were included, the hypothetical payments shown

above would likely be lower.

| JPMorgan Structured Investments — | PS- 7 |

| Callable Fixed to Floating Rate Notes | |

What Is SOFR?

SOFR is intended to be a broad measure of the cost of borrowing cash

overnight collateralized by U.S. Treasury securities. For more information about SOFR, see “The Underlyings — Base Rates —

Compounded SOFR” in the accompanying product supplement.

Historical Information

The following graph sets forth the historical weekly performance of

Daily SOFR from January 4, 2019 through November 8, 2024. Daily SOFR on November 12, 2024 was 4.60%. We obtained the levels of Daily SOFR

above and below from the Bloomberg Professional® service (“Bloomberg”), without independent verification.

The historical rates do not reflect the daily compounding method

used to calculate Compounded SOFR. The historical rates should not be taken as an indication of future performance, and no assurance

can be given as to the level of Compounded SOFR or any Benchmark Replacement on any Determination Date. There can be no assurance that

the performance of Compounded SOFR will result in an Interest Rate for any Interest Period (after the Initial Interest Periods) that is

greater than the Minimum Interest Rate.

Material U.S. Federal Income Tax Consequences

You should review carefully the section entitled “Material U.S.

Federal Income Tax Consequences,” and in particular the subsection thereof entitled “Tax Consequences to U.S. Holders—Notes

Treated as Contingent Payment Debt Instruments” in the accompanying product supplement no. 1-I. Except as described below, the discussions

therein and below apply to you only if you purchase the notes at the stated principal amount of $1,000 per note. We intend to treat the

notes as having an “issue price” equal to the stated principal amount of the notes. Unlike a traditional debt instrument that

provides for periodic payments of interest at a single fixed rate, with respect to which a cash-method investor generally recognizes income

only upon receipt of stated interest, the notes will be treated as “contingent payment debt instruments” for U.S. federal

income tax purposes. As discussed in that subsection, you generally will be required to accrue original issue discount (“OID”)

on your notes in each taxable year at the “comparable yield,” as determined by us, subject to certain adjustments to reflect

the difference between the actual and projected amounts of any payments you receive during the year, with the result that your taxable

income in any year may differ significantly from the aggregate amount of the Interest Payments you receive in that year. Upon sale or

exchange (including an early redemption or at maturity), you will recognize taxable income or loss equal to the difference between the

amount received from the sale or exchange, and your adjusted basis in the note, which generally will equal the cost thereof, increased

by the amount of OID you have accrued in respect of the note and decreased by the amount of any prior projected payments in respect of

the note. You generally must treat any income as interest income and any loss as ordinary loss to the extent of previous net interest

inclusions, and the balance as capital loss. The deductibility of capital losses is subject to limitations. The discussions herein and

in the accompanying product supplement do not address the consequences to taxpayers subject to special tax accounting rules under Section

451(b) of the Code. Purchasers who are not initial purchasers of notes at their issue price (as described above) should consult their

tax advisers with respect to the tax consequences of an investment in notes, including the treatment of the difference, if any, between

the basis in their notes and the notes’ adjusted issue price.

The discussions in the preceding paragraph, when read in combination

with the section entitled “Material U.S. Federal Income Tax Consequences” (and in particular the subsection thereof entitled

“— Tax Consequences to U.S. Holders— Notes Treated as Contingent Payment Debt Instruments”) in the accompanying

product supplement, constitute the full opinion of Davis Polk & Wardwell LLP regarding the material U.S. federal income tax consequences

of owning and disposing of notes.

| JPMorgan Structured Investments — | PS- 8 |

| Callable Fixed to Floating Rate Notes | |

Comparable Yield and Projected Payment Schedule

We will determine the comparable yield for the notes and will provide

that comparable yield and the related projected payment schedule (or information about how to obtain them) in the pricing supplement for

the notes, which we will file with the SEC. Although it is not entirely clear how the comparable yield and projected payment schedule

should be determined when a debt instrument may be redeemed by the issuer prior to maturity, we will determine the comparable yield based

upon the term to maturity of the notes assuming no early redemption occurs and a variety of other factors, including actual market conditions

and our borrowing costs for debt instruments of comparable maturities at the time of issuance. The comparable yield and projected payment

schedule are determined solely to calculate the amount on which you will be taxed with respect to the notes in each year and are neither

a prediction nor a guarantee of what the actual yield or timing of the payment or payments will be.

Supplemental Plan of Distribution

With respect to notes sold to eligible institutional investors or

fee-based advisory accounts for which an affiliated or unaffiliated broker-dealer is an investment adviser, the price to the public will

not be lower than $962.60 or greater than $1,000 per $1,000 principal amount note. Broker-dealers who purchase the notes for these

accounts may forgo some or all selling commissions related to these sales described below. See “Plan of Distribution (Conflicts

of Interest)” in the accompanying product supplement.

JPMS, acting as agent for JPMorgan Chase & Co., will

pay all of the selling commissions it receives from us to other affiliated or unaffiliated dealers. If the notes priced today, the

selling commissions would be approximately $30.00 per $1,000 principal amount note and in no event will these selling commissions exceed

$50.00 per $1,000 principal amount note. Broker-dealers who purchase the notes for sales to eligible institutional investors or

fee-based advisory accounts may forgo some or all of these selling commissions. See “Plan of Distribution (Conflicts of Interest)”

in the accompanying product supplement.

| JPMorgan Structured Investments — | PS- 9 |

| Callable Fixed to Floating Rate Notes | |

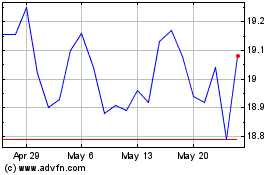

JP Morgan Chase (NYSE:JPM-M)

Historical Stock Chart

From Oct 2024 to Nov 2024

JP Morgan Chase (NYSE:JPM-M)

Historical Stock Chart

From Nov 2023 to Nov 2024