KUKE Music Reports Receipt of NYSE Non-Compliance Notices Regarding Continued Listing Standards

25 October 2024 - 7:10AM

Kuke Music Holding Limited (“Kuke” or the “Company”) (NYSE: KUKE),

a leading classical music service platform in China, today

announced that it has received notifications from the New York

Stock Exchange (the “NYSE”) that the Company is not in compliance

with the NYSE’s continued listing standards. On September 24, 2024,

the NYSE notified the Company that it was below the continued

listing standards as its total market capitalization was less than

$50 million over a 30 trading-day period and its stockholders’

equity was less than $50 million (the “September Notice”). As set

forth in the September Notice, as of September 23, 2024, the 30

trading-day average global market capitalization of the Company was

approximately $47 million and the Company’s last reported

shareholders’ equity as of December 31, 2023 was approximately $3.3

million. The Company received another notice from the NYSE on

October 8, 2024 (the “October Notice”) of non-compliance with the

$1.00 average closing price standard. As set forth in the October

Notice, as of October 7, 2024, the 30 trading-day average closing

price of the Company’s American Depositary Shares (“ADSs”) was

approximately $0.98.

According to the September Notice, the Company

must respond to the NYSE within 45 days of the September Notice

with a business plan demonstrating actions to bring the Company

into conformity with the average market capitalization and

stockholders’ equity standards within 9 months of receiving the

September Notice. If the Company’s plan is not submitted on a

timely basis or is not accepted, the NYSE will initiate suspension

and delisting proceedings. If the NYSE accepts the Company’s plan,

the Company will be subject to quarterly monitoring for compliance

with the plan.

According to the October Notice, the Company

shall bring its share price and average share price back above

$1.00 within 6 months following the receipt of the October Notice.

In the event that at the expiration of the cure period, both a

US$1.00 closing ADS price and a US$1.00 average closing ADS price

over the preceding 30 trading-day period are not attained, the NYSE

will commence suspension and delisting procedures.

The Company intends to comply the requirements

set forth in both notices and regain compliance with the relevant

continued listing standards within the applicable cure periods. The

foregoing notices have no immediate impact on the listing or

trading of the Company’s ADSs, which will continue to be listed and

traded on the NYSE, subject to compliance with the requirements set

forth in the notices, other NYSE continued listing standards and

other rights of the NYSE to delist the ADSs. The notices do not

affect the Company’s business operations or its reporting

obligations with the Securities and Exchange Commission.

About Kuke Music Holding Limited (NYSE:

KUKE)

Kuke is a leading classical music service

platform in China encompassing the entire value chain from content

provision to music learning services, with approximately 3 million

audio and video music tracks. By collaborating with its strategic

global business partner Naxos, the largest independent classical

music content provider in the world, the foundation of Kuke’s

extensive classical music content library is its unparalleled

access to more than 900 top-tier labels and record companies.

Leveraging its market leadership in international copyrighted

classical music content, Kuke provides highly scalable classical

music licensing services to various online music platforms, and

classical music subscription services to over 800 universities,

libraries and other institutions across China. In addition, it has

hosted Beijing Music Festival (“BMF”), the most renowned music

festival in China, for 24 consecutive years. Through KUKEY, the

Company’s proprietary smart music learning solutions, Kuke aims to

democratize music learning via technological innovation, bring

fascinating music content and professional music techniques to more

students, and continuously improve the efficiency and penetration

of music learning in China. For more information about Kuke, please

visit https://ir.kuke.com/.

Forward-looking Statements

This announcement contains forward looking

statements. These statements are made under the “safe harbor”

provisions of the U.S. Private Securities Litigation Reform Act of

1995. These forward-looking statements can be identified by

terminology such as “will,” “expects,” “anticipates,” “aims,”

“future,” “intends,” “plans,” “believes,” “estimates,” “confident,”

“potential,” “continue” or other similar expressions. Statements

that are not historical facts, including but not limited to

statements about Kuke’s beliefs and expectations, are

forward-looking statements. Forward-looking statements involve

inherent risks and uncertainties. A number of factors could cause

actual results to differ materially from those contained in any

forward-looking statement, including those in Kuke’s registration

statement filed with the Securities and Exchange Commission.

Further information regarding these and other risks is included in

Kuke’s filings with the SEC. All information provided in this press

release is as of the date of this press release, and Kuke

undertakes no obligation to update any forward-looking statement,

except as required under applicable law.

For further information, please

contact:

Kuke Music Holding LimitedInvestor

RelationsEmail: ir@kuke.com

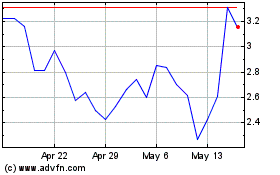

Kuke Music (NYSE:KUKE)

Historical Stock Chart

From Jan 2025 to Feb 2025

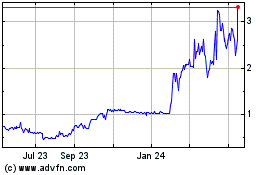

Kuke Music (NYSE:KUKE)

Historical Stock Chart

From Feb 2024 to Feb 2025