Ladder Capital Corp (NYSE: LADR) (“we,” “our,” “Ladder,” or the

“Company”) today announced operating results for the quarter and

year ended December 31, 2024. GAAP income before taxes for the

three months ended December 31, 2024 was $33.0 million, and diluted

earnings per share (“EPS”) was $0.25. Distributable earnings was

$33.6 million, or $0.27 of distributable EPS. GAAP income before

taxes for the year ended December 31, 2024 was $110.9 million, and

diluted earnings per share (“EPS”) was $0.86. Distributable

earnings was $153.9 million, or $1.21 of distributable EPS.

“In the fourth quarter, Ladder generated strong earnings and

dividend coverage. Throughout 2024, our middle market by choice

business model continued to demonstrate success, as we received a

significant amount of loan payoffs and our credit performed well

overall. Our low leverage and robust liquidity position, which

includes our upsized $850 million corporate revolving credit

facility, enable us to focus on new investment opportunities as

2025 begins,” said Brian Harris, Ladder’s Chief Executive

Officer.

Supplemental

The Company issued a supplemental presentation detailing its

fourth quarter and full year 2024 operating results, which can be

viewed at http://ir.laddercapital.com.

Conference Call and

Webcast

We will host a conference call on Thursday, February 6, 2025 at

10:00 a.m. Eastern Time to discuss fourth quarter and full year

2024 results. The conference call can be accessed by dialing (877)

407-4018 domestic or (201) 689-8471 international. Individuals who

dial in will be asked to identify themselves and their

affiliations. For those unable to participate, an audio replay will

be available until midnight on Thursday, February 20, 2025. To

access the replay, please call (844) 512-2921 domestic or (412)

317-6671 international, access code 13750906. The conference call

will also be webcast though a link on Ladder’s Investor Relations

website at ir.laddercapital.com/event. A web-based archive of the

conference call will also be available at the above website.

About Ladder

Ladder is a leading diversified commercial real estate finance

platform that specializes in underwriting commercial real estate

across the capital stack. With $4.8 billion of assets, our

investment objective is to preserve and protect shareholder capital

while generating attractive risk-adjusted returns.

Since 2008, we have invested over $46 billion in debt and

equity, serving both institutional and middle-market clients. Our

primary business is originating fixed and floating rate first

mortgage loans secured by all commercial real estate property

types. We also own and operate commercial real estate, including

net leased commercial properties, and we invest in investment grade

securities secured by first mortgage loans on commercial real

estate.

We are internally managed and members of our management team and

board of directors collectively own more than 11% of Ladder’s

equity, making them the Company’s largest shareholder and aligning

their interests closely with fellow stakeholders. Since our

founding, their vision has been to support the Company’s investment

platform with a conservative and durable capital structure. Our

industry-leading credit ratings reflect this differentiated

financing strategy.

Ladder is headquartered in New York City with a regional office

in Miami, Florida. All amounts in this section are as of December

31, 2024.

Forward-Looking

Statements

Certain statements in this release may constitute

“forward-looking” statements. These statements are based on

management’s current opinions, expectations, beliefs, plans,

objectives, assumptions or projections regarding future events or

future results. These forward-looking statements are only

predictions, not historical fact, and involve certain risks and

uncertainties, as well as assumptions. Actual results, levels of

activity, performance, achievements and events could differ

materially from those stated, anticipated or implied by such

forward-looking statements. While Ladder believes that its

assumptions are reasonable, it is very difficult to predict the

impact of known factors, and, of course, it is impossible to

anticipate all factors that could affect actual results on the

Company's business. There are a number of risks and uncertainties

that could cause actual results to differ materially from

forward-looking statements made herein including, most prominently,

the risks discussed under the heading “Risk Factors” in each of the

Company’s Annual Report on Form 10-K for the year ended December

31, 2023, as well as its consolidated financial statements, related

notes, and other financial information appearing therein, and its

other filings with the U.S. Securities and Exchange Commission.

Such forward-looking statements are made only as of the date of

this release. Ladder expressly disclaims any obligation or

undertaking to release any updates or revisions to any

forward-looking statements contained herein to reflect any change

in its expectations with regard thereto or changes in events,

conditions, or circumstances on which any such statement is

based.

Ladder Capital Corp

Consolidated Balance

Sheets

(Dollars in Thousands)

December 31,

December 31,

2024(1)

2023(1)

(Unaudited)

Assets

Cash and cash equivalents

$

1,323,481

$

1,015,678

Restricted cash

12,608

15,450

Mortgage loan receivables held for

investment, net, at amortized cost:

Mortgage loans receivable

1,591,322

3,155,089

Allowance for credit losses

(52,323

)

(43,165

)

Mortgage loan receivables held for

sale

26,898

26,868

Securities

1,080,839

485,533

Real estate and related lease intangibles,

net

670,803

726,442

Investments in and advances to

unconsolidated ventures

19,923

6,877

Derivative instruments

437

1,454

Accrued interest receivable

12,936

24,233

Other assets

158,149

98,218

Total assets

$

4,845,073

$

5,512,677

Liabilities and Equity

Liabilities

Debt obligations, net

$

3,135,617

$

3,783,946

Dividends payable

31,838

32,294

Accrued expenses

74,824

65,144

Other liabilities

69,855

99,095

Total liabilities

3,312,134

3,980,479

Commitments and contingencies

—

—

Equity

Class A common stock, par value $0.001 per

share, 600,000,000 shares authorized; 129,883,019 and 128,027,478

shares issued and 127,106,481 and 126,911,689 shares outstanding as

of December 31, 2024 and December 31, 2023, respectively.

127

127

Additional paid-in capital

1,777,118

1,756,750

Treasury stock, 2,776,538 and 1,115,789

shares, at cost

(30,475

)

(12,001

)

Retained earnings (dividends in excess of

earnings)

(206,874

)

(197,875

)

Accumulated other comprehensive income

(loss)

(4,866

)

(13,853

)

Total shareholders’ equity

1,535,030

1,533,148

Noncontrolling interests in consolidated

ventures

(2,091

)

(950

)

Total equity

1,532,939

1,532,198

Total liabilities and equity

$

4,845,073

$

5,512,677

(1) Includes amounts relating to

consolidated variable interest entities.

Ladder Capital Corp

Consolidated Statements of

Income

(Dollars in Thousands, Except

Per Share and Dividend Data)

Three Months Ended

Year Ended

December 31,

September 30,

December 31,

December 31,

2024

2024

2024

2023

(Unaudited)

(Unaudited)

Net interest income

Interest income

$

78,102

$

96,092

$

358,625

$

407,284

Interest expense

50,890

57,676

221,537

245,097

Net interest income (expense)

27,212

38,416

137,088

162,187

Provision for (release of) loan loss

reserves, net

47

3,063

13,933

25,096

Net interest income (expense) after

provision for (release of) loan loss reserves

27,165

35,353

123,155

137,091

Other income (loss)

Real estate operating income

23,368

25,294

98,681

96,950

Net result from mortgage loan receivables

held for sale

(608

)

1,092

30

(523

)

Gain (loss) on real estate, net

12,419

315

25,277

8,808

Fee and other income

4,753

6,609

18,700

8,931

Net result from derivative

transactions

1,549

(766

)

5,420

1,481

Earnings (loss) from investment in

unconsolidated ventures

(68

)

(14

)

(79

)

758

Gain (loss) on extinguishment of debt

(9

)

20

188

10,718

Total other income (loss)

41,404

32,550

148,217

127,123

Costs and expenses

Compensation and employee benefits

11,754

14,407

60,671

63,618

Operating expenses

4,863

4,508

19,193

19,503

Real estate operating expenses

9,637

10,751

40,568

37,587

Investment related expenses

1,809

1,628

7,718

8,847

Depreciation and amortization

7,466

8,146

32,327

29,914

Total costs and expenses

35,529

39,440

160,477

159,469

Income (loss) before taxes

33,040

28,463

110,895

104,745

Income tax expense (benefit)

1,711

901

3,448

4,244

Net income (loss)

31,329

27,562

107,447

100,501

Net (income) loss attributable to

noncontrolling interests in consolidated ventures

55

351

808

624

Net income (loss) attributable to Class

A common shareholders

$

31,384

$

27,913

$

108,255

$

101,125

Earnings per share:

Basic

$

0.25

$

0.22

$

0.86

$

0.81

Diluted

$

0.25

$

0.22

$

0.86

$

0.81

Weighted average shares

outstanding:

Basic

125,549,113

125,705,754

125,576,784

124,667,877

Diluted

125,870,042

125,905,528

125,785,295

124,882,398

Dividends per share of Class A common

stock

$

0.23

$

0.23

$

0.92

$

0.92

Non-GAAP Financial

Measures

During the first quarter of 2024, the Company refined its

definition of distributable earnings and its descriptions of the

adjustments to GAAP income. The refined definition and descriptions

do not change how distributable earnings or adjustments to GAAP

income are calculated for prior, current or future periods. The

Company utilizes distributable earnings, distributable EPS, and

after-tax distributable return on average equity (“ROAE”), non-GAAP

financial measures, as supplemental measures of our operating

performance. We believe distributable earnings, distributable EPS

and after-tax distributable ROAE assist investors in comparing our

operating performance and our ability to pay dividends across

reporting periods on a more relevant and consistent basis by

excluding from GAAP measures certain non-cash expenses and

unrealized results as well as eliminating timing differences

related to conduit securitization gains and changes in the values

of assets and derivatives. In addition, we use distributable

earnings, distributable EPS and after-tax distributable ROAE: (i)

to evaluate our earnings from operations because management

believes that they may be useful performance measures; and (ii)

because our board of directors considers distributable earnings in

determining the amount of quarterly dividends. Distributable EPS is

defined as after-tax distributable earnings divided by the weighted

average diluted shares outstanding during the period. In addition,

we believe it is useful to present distributable earnings and

distributable EPS prior to charge-offs of allowance for credit

losses to reflect our direct operating results and help existing

and potential future holders of our class A common stock assess the

performance of our business excluding such charge-offs.

Distributable earnings prior to charge-offs of allowance for credit

losses is used as an additional performance metric to consider when

declaring our dividends. Distributable EPS prior to charge-offs of

allowance for credit losses is defined as after-tax distributable

earnings prior to charge-offs of allowance for credit losses

divided by the weighted average diluted shares outstanding during

the period.

We define distributable earnings as income before taxes adjusted

for: (i) net (income) loss attributable to noncontrolling interests

in consolidated ventures; (ii) our share of real estate

depreciation, amortization and gain adjustments and (earnings) loss

from investments in unconsolidated ventures in excess of

distributions received; (iii) the impact of derivative gains and

losses related to hedging fair value variability of fixed rate

assets caused by interest rate fluctuations and overall portfolio

market risk as of the end of the specified accounting period; (iv)

economic gains or losses on loan sales, certain of which may not be

recognized under GAAP accounting in consolidation for which risk

has substantially transferred during the period, as well as the

exclusion of the related GAAP economics in subsequent periods; (v)

unrealized gains or losses related to our investments in securities

recorded at fair value in current period earnings; (vi) unrealized

and realized provision for loan losses and real estate impairment;

(vii) non-cash stock-based compensation; and (viii) certain

non-recurring transactional items.

We exclude the effects of our share of real estate depreciation

and amortization. Given GAAP gains and losses on sales of real

estate include the effects of previously-recognized real estate

depreciation and amortization, our adjustment eliminates the

portion of the GAAP gain or loss that is derived from depreciation

and amortization.

Our derivative instruments do not qualify for hedge accounting

under GAAP and, therefore, any net payments under, or fluctuations

in the fair value of derivatives are recognized currently in our

income statement. The Company utilizes derivative instruments to

hedge exposure to interest rate risk associated with fixed rate

mortgage loans, fixed rate securities, and/or overall portfolio

market risks. Distributable earnings excludes the GAAP results from

derivative activity until the associated mortgage loan or security

for which the derivative position is hedging is sold or paid off,

or the hedge position for overall portfolio market risk is closed,

at which point any gain or loss is recognized in distributable

earnings in that period. For derivative activity associated with

securities or mortgage loans held for investment, any hedging gain

or loss is amortized over the expected life of the underlying asset

for distributable earnings. We believe that adjusting for these

specifically identified gains and losses associated with hedging

positions adjusts for timing differences between when we recognize

the gains or losses associated with our assets and the gains and

losses associated with derivatives used to hedge such assets.

We originate conduit loans, which are first mortgage loans on

stabilized, income producing commercial real estate properties that

we intend to sell into third-party CMBS securitizations. Mortgage

loans receivable held for sale are recorded at the lower of cost or

market under GAAP. For purposes of distributable earnings, we

exclude the impact of unrealized lower of cost or market

adjustments on conduit loans held for sale and include the realized

gains or losses in distributable earnings in the period when the

loan is sold. Our conduit business includes mortgage loans made to

third parties and may also include mortgage loans secured by real

estate owned in our real estate segment. Such mortgage loans

receivable secured by real estate owned in our real estate segment

are eliminated in consolidation within our GAAP financial

statements until the loans are sold in a third-party

securitization. Upon the sale of a loan to a third-party

securitization trust (for cash), the related mortgage note payable

is recognized on our GAAP financial statements. For purposes of

distributable earnings, we include adjustments for economic gains

and losses related to the sale of these inter-segment loans for

which risk has substantially transferred during the period and

exclude the resultant GAAP recognition of amortization of any

related premium/discount on such mortgage loans payable recognized

in interest expense during the subsequent periods. This adjustment

is reflected in distributable earnings when there is a true risk

transfer on the mortgage loan sale and settlement. Conversely, if

the economic risk was not substantially transferred, no adjustments

to net income would be made relating to those transactions for

distributable earnings purposes. Management believes recognizing

these amounts for distributable earnings purposes in the period of

transfer of economic risk is a useful supplemental measure of our

performance.

We invest in certain securities that are recorded at fair value

with changes in fair value recorded in current period earnings. For

purposes of distributable earnings, we exclude the impact of

unrealized gains and losses associated with these securities and

include realized gains or losses in connection with any disposition

of securities. Distributable earnings includes declines in fair

value deemed to be an impairment for GAAP purposes if the decline

is determined to be non-recoverable and the loss to be nearly

certain to be eventually realized. In those cases, an impairment is

included in distributable earnings for the period in which such

determination was made.

We include adjustments for unrealized provision for loan losses

and real estate impairment. For purposes of distributable earnings,

management recognizes realized losses on loans and real estate in

the period in which the asset is sold or when the Company

determines such amounts are no longer realizable and deemed

non-recoverable.

Set forth below is an unaudited reconciliation of income (loss)

before taxes to distributable earnings, and an unaudited

computation of distributable EPS (in thousands, except per share

data):

Three Months Ended

Year Ended

December 31,

September 30,

December 31,

December 31,

2024

2024

2024

2023

Income (loss) before taxes

$

33,040

$

28,463

$

110,895

$

104,745

Net (income) loss attributable to

noncontrolling interests in consolidated ventures

55

351

808

624

Our share of real estate depreciation,

amortization and gain adjustments (1)

(2,225

)

7,514

11,558

18,602

Adjustments for derivative results and

loan sale activity (2)

(474

)

128

2,005

112

Unrealized (gain) loss on fair value

securities

903

(5

)

925

(29

)

Adjustment for impairment (3)

47

3,063

13,933

25,096

Non-cash stock-based compensation

2,237

3,177

18,829

18,577

Distributable earnings prior to charge-off

of allowance for credit losses

33,583

42,691

158,953

167,727

Charge-off of allowance for credit losses

(3)

—

(5,023

)

(5,023

)

—

Distributable earnings

$

33,583

$

37,668

$

153,930

$

167,727

Estimated corporate tax (expense) benefit

(4)

478

(140

)

(2,131

)

(496

)

After-tax distributable earnings

$

34,061

$

37,528

$

151,799

$

167,231

Weighted average diluted shares

outstanding

125,870

125,906

125,785

124,882

Distributable EPS

$

0.27

$

0.30

$

1.21

$

1.34

Per share impact of charge-off of

allowance for credit losses

—

0.04

0.04

—

Distributable EPS prior to charge-off of

allowance for credit losses

$

0.27

$

0.34

$

1.25

$

1.34

(1)

The following is an unaudited reconciliation of GAAP

depreciation and amortization to our share of real estate

depreciation, amortization and gain adjustments and (earnings) loss

from investment in unconsolidated ventures in excess of

distributions received ($ in thousands):

Three Months Ended

Year Ended

December 31,

September 30,

December 31,

December 31,

2024

2024

2024

2023

Total GAAP depreciation and

amortization

$

7,466

$

8,146

$

32,327

$

29,914

Depreciation and amortization related to

non-rental property fixed assets

(110

)

(110

)

(440

)

(431

)

Non-controlling interests in consolidated

ventures’ share of depreciation and amortization

(115

)

(111

)

(441

)

(410

)

Our share of operating lease income from

above/below market lease intangible amortization

(413

)

(425

)

(1,700

)

(1,797

)

Our share of real estate depreciation and

amortization

6,828

7,500

29,746

27,276

Accumulated depreciation and amortization

on real estate sold (a)

(9,121

)

—

(18,267

)

(8,016

)

Adjustment for (earnings) loss from

investments in unconsolidated ventures in excess of distributions

received

68

14

79

(658

)

Our share of real estate depreciation,

amortization and gain adjustments

$

(2,225

)

$

7,514

$

11,558

$

18,602

(a)

GAAP gains/losses on sales of real estate include the effects of

previously-recognized real estate depreciation and amortization.

For purposes of distributable earnings, our share of real estate

depreciation and amortization is eliminated and, accordingly, the

resultant gains/losses also must be adjusted. The following is an

unaudited reconciliation of the related consolidated GAAP amounts

to the amounts reflected in distributable earnings ($ in

thousands):

Three Months Ended

Year Ended December

31,

December 31,

September 30,

December 31,

December 31,

2024

2024

2024

2023

GAAP realized gain/loss on sale of real

estate, net

$

12,419

$

315

$

25,277

$

8,808

Adjusted gain/loss on sale of real estate

for purposes of distributable earnings

(3,298

)

(315

)

(7,010

)

(792

)

Accumulated depreciation and

amortization on real estate sold

$

9,121

$

—

$

18,267

$

8,016

(2)

The following is an unaudited

reconciliation of GAAP net results from derivative transactions to

our adjustments for derivative results and loan sale activity

within distributable earnings ($ in thousands):

Three Months Ended

Year Ended

December 31,

September 30,

December 31,

December 31,

2024

2024

2024

2023

GAAP net results from derivative

transactions

$

(1,549

)

$

766

$

(5,420

)

$

(1,481

)

Realized results of loan sales, net (a)

(b)

—

(198

)

2,856

—

Unrealized lower of cost or market

adjustments related to loans held for sale

608

(1,092

)

(30

)

523

Amortization of (premium)/discount on

mortgage loan financing included in interest expense (b)

(209

)

(216

)

(767

)

(604

)

Recognized derivative results

676

868

5,366

1,674

Adjustments for derivative results and

loan sale activity

$

(474

)

$

128

$

2,005

$

112

(a)

Includes realized gains from sales of

conduit mortgage loans collateralized by net lease properties in

our real estate segment of $2.7 million and net hedge related gain

on such mortgage loan sales of $0.2 million, for the twelve months

ended December 31, 2024 and realized gains from sales of conduit

mortgage loans collateralized by net lease properties in our real

estate segment of $0.1 million and net hedge related (loss) on such

mortgage loan sales of $(0.3) million, for the three months ended

September 30, 2024.

(b)

Prior to the first quarter of 2024, the

Company presented these adjustments within “Adjustment for economic

gain on loan sales not recognized under GAAP for which risk has

been substantially transferred, net of reversal/amortization.”

(3)

During the three months ended September

30, 2024 and twelve months ended December 31, 2024, the Company

recorded a provision for loan loss of $3.1 million and $13.9

million, respectively. During the three months ended September 30,

2024 and twelve months ended December 31, 2024, the Company

determined a portion of the allowance for loan loss to be

non-recoverable and charged-off $5.0 million.

(4)

Estimated corporate tax benefit (expense)

is based on an effective tax rate applied to distributable earnings

generated by the activity within our taxable REIT subsidiaries.

After-tax distributable ROAE is presented on an annualized basis

and is defined as after-tax distributable earnings divided by the

average total shareholders’ equity during the period. Set forth

below is an unaudited computation of after-tax distributable ROAE

($ in thousands):

Three Months Ended

Year Ended December

31,

December 31,

September 30,

December 31,

December 31,

2024

2024

2024

2023

After-tax distributable earnings

$

34,061

$

37,528

$

151,799

$

167,231

Average shareholders’ equity

1,533,826

1,531,345

1,530,500

1,533,307

After-tax distributable ROAE

8.9

%

9.8

%

9.9

%

10.9

%

Non-GAAP Measures -

Limitations

Our non-GAAP financial measures have limitations as analytical

tools. Some of these limitations are:

- distributable earnings, distributable EPS, after-tax

distributable ROAE and distributable earnings and distributable EPS

prior to charge-off of allowance for credit losses do not reflect

the impact of certain cash charges resulting from matters we

consider not to be indicative of our ongoing operations and are not

necessarily indicative of cash necessary to fund cash needs;

- distributable EPS, distributable EPS prior to charge-off of

allowance for credit losses, and after-tax distributable ROAE are

based on a non-GAAP estimate of our effective tax rate, including

the impact of Unincorporated Business Tax and the impact of our

election to be taxed as a REIT effective January 1, 2015. Our

actual tax rate may differ materially from this estimate; and

- other companies in our industry may calculate non-GAAP

financial measures differently than we do, limiting their

usefulness as comparative measures.

Because of these limitations, our non-GAAP financial measures

should not be considered in isolation or as a substitute for net

income (loss) attributable to shareholders, earnings per share or

book value per share, or any other performance measures calculated

in accordance with GAAP. Our non-GAAP financial measures should not

be considered an alternative to cash flows from operations as a

measure of our liquidity.

In addition, distributable earnings should not be considered to

be the equivalent to REIT taxable income calculated to determine

the minimum amount of dividends the Company is required to

distribute to shareholders to maintain REIT status. In order for

the Company to maintain its qualification as a REIT under the

Internal Revenue Code, we must annually distribute at least 90% of

our REIT taxable income. The Company has declared, and intends to

continue declaring, regular quarterly distributions to its

shareholders in an amount approximating the REIT’s net taxable

income.

In the future, we may incur gains and losses that are the same

as or similar to some of the adjustments in this presentation. Our

presentation of non-GAAP financial measures should not be construed

as an inference that our future results will be unaffected by

unusual or non-recurring items.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250205491489/en/

Investor Contact Ladder

Investor Relations (917) 369-3207

investor.relations@laddercapital.com

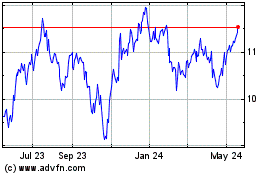

Ladder Capital (NYSE:LADR)

Historical Stock Chart

From Jan 2025 to Feb 2025

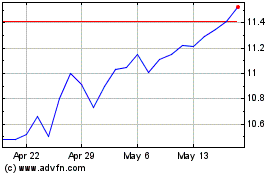

Ladder Capital (NYSE:LADR)

Historical Stock Chart

From Feb 2024 to Feb 2025