0000763744FALSE00007637442025-02-112025-02-11

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 11, 2025

| | | | | | | | | | | | | | |

| LCI INDUSTRIES |

| | | | |

| | | | |

| (Exact name of registrant as specified in its charter) |

| | | | |

| Delaware | | 001-13646 | 13-3250533 |

| | | | |

| (State or other jurisdiction of incorporation) | | (Commission File Number) | (I.R.S. Employer

Identification No.) |

| | | | |

| 3501 County Road 6 East, | Elkhart, | Indiana | 46514 |

| | | | |

| (Address of principal executive offices) | (Zip Code) |

| | | | |

| Registrant's telephone number, including area code: | (574) | 535-1125 |

| | | | |

| | | | |

| N/A |

| | | | |

| (Former name or former address, if changed since last report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below): | | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $.01 par value | LCII | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition

On February 11, 2025, LCI Industries issued a press release setting forth LCI Industries' fourth quarter and full year 2024 results. A copy of the press release is attached hereto as Exhibit 99.1.

An investor presentation that LCI Industries will refer to during its conference call to discuss the results is attached hereto as Exhibit 99.2 and will be posted on LCI Industries' investor relations website in advance of the call.

The foregoing information is furnished pursuant to Item 2.02, "Results of Operations and Financial Condition." Such information, including the Exhibits attached hereto, is being furnished and shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, except as shall be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits

Exhibit Index:

| | | | | | | | |

| | |

| | Press Release dated February 11, 2025 |

| | |

| | Investor Presentation dated February 11, 2025 |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | |

LCI INDUSTRIES |

(Registrant) |

|

|

By: /s/ Lillian D. Etzkorn Lillian D. Etzkorn Chief Financial Officer |

|

|

| Dated: | February 11, 2025 |

Exhibit 99.1 | | | | | | | | |

FOR IMMEDIATE RELEASE | | |

Contact: Lillian D. Etzkorn, CFO |

Phone: (574) 535-1125 |

E Mail: LCII@lci1.com |

| |

LCI INDUSTRIES REPORTS FOURTH QUARTER AND FULL YEAR FINANCIAL RESULTS

Strong operational improvements drove a meaningful increase in profitability across diverse end markets

Fourth Quarter 2024 Highlights

•Net sales of $803 million in the fourth quarter, down 4% year-over-year

•Net income of $9.5 million, or $0.37 per diluted share, in the fourth quarter, up from a net loss of $2.4 million in the fourth quarter of 2023

•EBITDA of $46 million in the fourth quarter, or 5.7% of net sales, up 29% year-over-year

•Increased quarterly dividend to $1.15 per share, totaling $29 million paid in the fourth quarter

Full Year 2024 Highlights

•Net sales of $3.7 billion, down 1% year-over-year

•Net income of $143 million, or $5.60 per diluted share, up 123% year-over-year

•EBITDA of $344 million, or 9.2% of net sales, up 35% year-over-year

•Operating profit margin of 5.8% in 2024, up from 3.3% in 2023

•Cash flows from operating activities of $370 million

•Net repayments of indebtedness of $89 million

•Returned $109 million to shareholders through quarterly dividends in 2024

•Strong liquidity position with $166 million of cash and cash equivalents and $453 million of availability on revolving credit facility at December 31, 2024

•Introduced groundbreaking innovation with our Touring Coil Suspension product

Elkhart, Indiana - February 11, 2025 - LCI Industries (NYSE: LCII), a leading supplier of engineered components to the recreation and transportation markets, today reported fourth quarter and full year 2024 results.

“Lippert demonstrated continued market leadership and resilience in 2024, leveraging cost savings and operational improvements to increase EBITDA by $89 million over 2023. This performance came despite a challenging RV and marine industry backdrop, as meaningful investments toward innovations like our Touring Coil Suspension, anti-lock braking systems, our Chill Cube revolutionary RV air conditioning system, and our new RV window series fueled content expansion and further market share gains. Our diversified end markets—particularly our Aftermarket segment—helped us navigate volatility by expanding growth opportunities and bolstering profitability. Our Aftermarket business also continues to benefit from a growing presence within Camping World stores, as we achieved revenue growth of $12 million within the 14 newly upfitted locations against an environment that was declining only a year ago,” commented Jason Lippert, LCI Industries’ President and Chief Executive Officer.

“As we enter 2025, we are focused on continuing to expand profitability and remain committed to achieving further cost savings in addition to the significant strides made in 2024. We’re also seeing modest improvement in the RV market, with consolidated January sales up 6% year-over-year along with growing optimism from customers," Mr. Lippert continued. "Overall, not only is Lippert well positioned to capitalize on an industry recovery due to our operational flexibility and agility, but we have the playbook required to further expand business in our other end markets, including aftermarket, building products, transportation, and utility trailers. We believe these factors, along with our experienced leadership team and numerous competitive advantages, will enable us to achieve our target of $5 billion in net sales organically by 2027 as well as a return to double digit operating margins.”

“Thanks to the dedication of our experienced leadership team and team members, along with our focus on safety, quality, and customer service, we strengthened our leadership position within the recreation space in 2024. As we enter 2025, we remain committed to creating value for all stakeholders through disciplined execution and strategic growth initiatives,” commented Ryan Smith, LCI Industries' Group President - North America.

Fourth Quarter 2024 Results

Consolidated net sales for the fourth quarter of 2024 were $803.1 million, a decrease of 4% from 2023 fourth quarter net sales of $837.5 million. Net income in the fourth quarter of 2024 was $9.5 million, or $0.37 per diluted share, compared to a net loss of $2.4 million, or $(0.09) per diluted share, in the fourth quarter of 2023. EBITDA in the fourth quarter of 2024 was $45.8 million, compared to EBITDA of $35.6 million in the fourth quarter of 2023. Additional information regarding EBITDA, as well as reconciliations of this non-GAAP financial measure to the most directly comparable GAAP financial measure of net income (loss), is provided in the "Supplementary Information - Reconciliation of Non-GAAP Measures" section below.

The decrease in year-over-year net sales for the fourth quarter of 2024 was primarily driven by lower sales to North American marine and utility trailer OEMs, declines in wholesale shipments of motorhome RV units and an increased shift in unit mix towards lower content single axle travel trailers, partially offset by increased North American RV wholesale shipments of travel trailers and fifth-wheels and market share gains in the automotive aftermarket.

Full Year 2024 Results

Consolidated net sales for the full year 2024 were $3.7 billion, a decrease of 1% from full year 2023 net sales of $3.8 billion. Net income for the full year 2024 was $142.9 million, or $5.60 per diluted share, compared to net income of $64.2 million, or $2.52 per diluted share, for the full year 2023. EBITDA for the year ended December 31, 2024 was $343.9 million, compared to EBITDA of $255.2 million for the year ended December 31, 2023. Additional information regarding EBITDA, as well as reconciliations of this non-GAAP financial measure to the most directly comparable GAAP financial measure of net income (loss), is provided in the "Supplementary Information - Reconciliation of Non-GAAP Measures" section below.

The decrease in year-over-year net sales was primarily driven by decreased industry production levels in the North American marine, utility trailer, and European RV markets and an increased shift in RV unit mix towards lower content single axle travel trailers, partially offset by a 7% increase in total North American RV wholesale shipments and sales from acquisitions. Net sales from acquisitions completed in 2023 and 2024 contributed approximately $21.4 million in 2024.

January 2025 Results

January 2025 consolidated net sales were approximately $328 million, up 6% from January 2024, primarily due to increases in RV OEM sales of 17% and aftermarket sales of 6%, partially offset by softness in international and other adjacent markets.

OEM Segment - Fourth Quarter Performance

OEM net sales for the fourth quarter of 2024 were $621.6 million, a decrease of $36.5 million compared to the same period of 2023. RV OEM net sales for the fourth quarter of 2024 were $376.1 million, down 3% compared to the same prior year period, primarily driven by a 21% decrease in motorhome wholesale shipments and a shift in RV unit mix towards lower content single axle travel trailers, partially offset by a 7% increase in North American travel trailer and fifth-wheel wholesale shipments and market share gains. Adjacent Industries OEM net sales for the fourth quarter of 2024 were $245.5 million, down 9% year-over-year, primarily due to lower sales to North American marine and utility trailers OEMs. This decline was driven by current dealer inventory levels, inflation,

and elevated interest rates impacting retail consumers. North American marine OEM net sales in the fourth quarter of 2024 were $55.1 million, down 15% year-over-year.

Operating profit of the OEM Segment was $1.9 million in the fourth quarter of 2024, or 0.3% of net sales, compared to an operating loss of $11.7 million, or (1.8)% of net sales, in the same period in 2023. The operating profit expansion of the OEM Segment for the quarter was primarily driven by operational improvements, partially offset by the impact of fixed costs spread over decreased sales.

Aftermarket Segment - Fourth Quarter Performance

Aftermarket net sales for the fourth quarter of 2024 were $181.6 million, an increase of 1% compared to the same period of 2023. Resiliency in the Aftermarket Segment was primarily driven by market share gains in the automotive aftermarket, partially offset by lower volumes within the marine aftermarket. Operating profit of the Aftermarket Segment was $14.3 million in the fourth quarter of 2024, or 7.9% of net sales, in line with the same period of 2023. The operating profit margin of the Aftermarket Segment for the quarter was impacted by increased labor costs due to product mix and increased facility costs resulting from investments to expand capacity within the automotive aftermarket, partially offset by decreased material costs.

“Our automotive aftermarket business has consistently outperformed, achieving a 7% increase in sales in the full year 2024 that has helped offset softness in the RV and marine aftermarkets," commented Jamie Schnur, LCI Industries’ Group President – Aftermarket. "This growth was further fueled by Lippert’s increasing content on RVs, which drives demand for our replacement and repair parts. By continuing to differentiate ourselves through high-quality product offerings and exceptional service, we are building further trust with both dealers and consumers. Moving forward, we remain focused on expanding our presence in premium markets to support Lippert’s long-term, profitable growth.”

Income Taxes

The Company's effective tax rate was 24.5% and 13.5% for the year and quarter ended December 31, 2024, respectively, compared to 22.7% and 65.2% for the year and quarter ended December 31, 2023, respectively. The increase in the effective tax rate for the full year 2024 compared to 2023 was primarily due to an increase in the state tax rate. Due to certain operating losses in the fourth quarter of 2023, discrete adjustments related to an increase in life insurance contract assets had a proportionately larger impact on the tax rate in that period.

Balance Sheet and Other Items

At December 31, 2024, the Company's cash and cash equivalents balance was $165.8 million, compared to $66.2 million at December 31, 2023. The Company used $109.5 million for dividend payments to shareholders, $89.2 million for the repayment of debt (net of borrowings), $42.3 million for capital expenditures, and $20.0 million for an acquisition in the twelve months ended December 31, 2024.

The Company's outstanding long-term indebtedness, including current maturities, was $757.3 million at December 31, 2024, and the Company was in compliance with its debt covenants. As of December 31, 2024, the Company had $452.5 million of borrowing availability under the revolving credit facility.

Conference Call & Webcast

LCI Industries will host a conference call to discuss its fourth quarter results on Tuesday, February 11, 2025, at 8:30 a.m. Eastern time, which may be accessed by dialing (833) 470-1428 for participants in the U.S. and (929) 526-1599 for participants outside the U.S. using the required conference ID 823178. Due to the high volume of companies reporting earnings at this time, please be prepared for hold times of up to 15 minutes when dialing in to the call. In addition, an online, real-time webcast, as well as a supplemental earnings presentation, can be accessed on the Company's website, www.investors.lci1.com.

A replay of the conference call will be available for two weeks by dialing (866) 813-9403 for participants in the U.S. and (44) 204-525-0658 for participants outside the U.S. and referencing access code 151640. A replay of the webcast will be available on the Company’s website immediately following the conclusion of the call.

About LCI Industries

LCI Industries (NYSE: LCII), through its Lippert subsidiary, is a global leader in supplying engineered components to the outdoor recreation and transportation markets. We believe our innovative culture, advanced manufacturing capabilities, and dedication to enhancing the customer experience have established Lippert as a reliable partner for both OEM and aftermarket customers. For more information, visit www.lippert.com.

Forward-Looking Statements

This press release contains certain "forward-looking statements" with respect to our financial condition, results of operations, profitability, margins, business strategies, operating efficiencies or synergies, competitive position, growth opportunities, acquisitions, plans and objectives of management, markets for the Company's common stock, the impact of legal proceedings, and other matters. Statements in this press release that are not historical facts are "forward-looking statements" for the purpose of the safe harbor provided by Section 21E of the Securities Exchange Act of 1934, as amended, and Section 27A of the Securities Act of 1933, as amended, and involve a number of risks and uncertainties.

Forward-looking statements, including, without limitation, those relating to production levels, future business prospects, net sales, expenses and income (loss), operating margins, capital expenditures, tax rate, cash flow, financial condition, liquidity, covenant compliance, retail and wholesale demand, integration of acquisitions, R&D investments, commodity prices, addressable markets, and industry trends, whenever they occur in this press release are necessarily estimates reflecting the best judgment of the Company's senior management at the time such statements were made. There are a number of factors, many of which are beyond the Company's control, which could cause actual results and events to differ materially from those described in the forward-looking statements. These factors include, in addition to other matters described in this press release, the impacts of future pandemics, geopolitical tensions, armed conflicts, or natural disasters on the global economy and on the Company's customers, suppliers, employees, business and cash flows, pricing pressures due to domestic and foreign competition, costs and availability of, and tariffs on, raw materials (particularly steel and aluminum) and other components, seasonality and cyclicality in the industries to which we sell our products, availability of credit for financing the retail and wholesale purchase of products for which we sell our components, inventory levels of retail dealers and manufacturers, availability of transportation for products for which we sell our components, the financial condition of our customers, the financial condition of retail dealers of products for which we sell our components, retention and concentration of significant customers, the costs, pace of and successful integration of acquisitions and other growth initiatives, availability and costs of production facilities and labor, team member benefits, team member retention, realization and impact of expansion plans, efficiency improvements and cost reductions, the disruption of business resulting from natural disasters or other unforeseen events, the successful entry into new markets, the costs of compliance with environmental laws, laws of foreign jurisdictions in which we operate, other operational and financial risks related to conducting business internationally, and increased governmental regulation and oversight, information technology performance and security, the ability to protect intellectual property, warranty and product liability claims or product recalls, interest rates, oil and gasoline prices, and availability, the impact of international, national and regional economic conditions and consumer confidence on the retail sale of products for which we sell our components, and other risks and uncertainties discussed more fully under the caption "Risk Factors" in the Company's Annual Report on Form 10-K for the year ended December 31, 2023, and in the Company's subsequent filings with the Securities and Exchange Commission. Readers of this press release are cautioned not to place undue reliance on these forward-looking statements, since there can be no assurance that these forward-looking statements will prove to be accurate. The Company disclaims any obligation or undertaking to update forward-looking statements to reflect circumstances or events that occur after the date the forward-looking statements are made, except as required by law.

###

LCI INDUSTRIES

OPERATING RESULTS

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

December 31, | | Twelve Months Ended

December 31, | | |

| | 2024 | | 2023 | | 2024 | | 2023 | | |

| (In thousands, except per share amounts) | | | | | | | | | |

| | | | | | | | | |

| Net sales | $ | 803,138 | | | $ | 837,544 | | | $ | 3,741,208 | | | $ | 3,784,808 | | | |

| Cost of sales | 633,732 | | | 676,493 | | | 2,861,493 | | | 3,008,618 | | | |

| Gross profit | 169,406 | | | 161,051 | | | 879,715 | | | 776,190 | | | |

| Selling, general and administrative expenses | 153,272 | | | 158,430 | | | 661,478 | | | 652,762 | | | |

| | | | | | | | | |

| Operating profit | 16,134 | | | 2,621 | | | 218,237 | | | 123,428 | | | |

| Interest expense, net | 5,100 | | | 9,456 | | | 28,899 | | | 40,424 | | | |

| Income (loss) before income taxes | 11,034 | | | (6,835) | | | 189,338 | | | 83,004 | | | |

| Provision (benefit) for income taxes | 1,487 | | | (4,458) | | | 46,471 | | | 18,809 | | | |

| Net income (loss) | $ | 9,547 | | | $ | (2,377) | | | $ | 142,867 | | | $ | 64,195 | | | |

| | | | | | | | | |

| Net income (loss) per common share: | | | | | | | | | |

| Basic | $ | 0.37 | | | $ | (0.09) | | | $ | 5.61 | | | $ | 2.54 | | | |

| Diluted | $ | 0.37 | | | $ | (0.09) | | | $ | 5.60 | | | $ | 2.52 | | | |

| | | | | | | | | |

| Weighted average common shares outstanding: | | | | | | | | | |

| Basic | 25,481 | | | 25,342 | | | 25,447 | | | 25,305 | | | |

| Diluted | 25,599 | | | 25,342 | | | 25,507 | | | 25,436 | | | |

| | | | | | | | | |

| Depreciation | $ | 16,482 | | | $ | 18,719 | | | $ | 70,393 | | | $ | 74,693 | | | |

| Amortization | $ | 13,211 | | | $ | 14,231 | | | $ | 55,300 | | | $ | 57,075 | | | |

| Capital expenditures | $ | 10,943 | | | $ | 12,149 | | | $ | 42,333 | | | $ | 62,209 | | | |

LCI INDUSTRIES

SEGMENT RESULTS

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

December 31, | | Twelve Months Ended

December 31, | | |

| 2024 | | 2023 | | 2024 | | 2023 | | |

| (In thousands) | | | | | | | | | |

| Net sales: | | | | | | | | | |

| OEM Segment: | | | | | | | | | |

| RV OEMs: | | | | | | | | | |

| Travel trailers and fifth-wheels | $ | 328,254 | | | $ | 325,987 | | | $ | 1,514,578 | | | $ | 1,358,853 | | | |

| Motorhomes | 47,808 | | | 62,952 | | | 233,066 | | | 269,356 | | | |

| Adjacent Industries OEMs | 245,491 | | | 269,156 | | | 1,112,806 | | | 1,275,533 | | | |

| Total OEM Segment net sales | 621,553 | | | 658,095 | | | 2,860,450 | | | 2,903,742 | | | |

| Aftermarket Segment: | | | | | | | | | |

| Total Aftermarket Segment net sales | 181,585 | | | 179,449 | | | 880,758 | | | 881,066 | | | |

| Total net sales | $ | 803,138 | | | $ | 837,544 | | | $ | 3,741,208 | | | $ | 3,784,808 | | | |

| | | | | | | | | |

| Operating profit (loss): | | | | | | | | | |

| OEM Segment | $ | 1,858 | | | $ | (11,725) | | | $ | 107,081 | | | $ | 17,361 | | | |

| Aftermarket Segment | 14,276 | | | 14,346 | | | 111,156 | | | 106,067 | | | |

| | | | | | | | | |

| | | | | | | | | |

| Total operating profit | $ | 16,134 | | | $ | 2,621 | | | $ | 218,237 | | | $ | 123,428 | | | |

| | | | | | | | | |

| Depreciation and amortization: | | | | | | | | | |

| OEM Segment depreciation | $ | 12,446 | | | $ | 14,557 | | | $ | 53,484 | | | $ | 58,397 | | | |

| Aftermarket Segment depreciation | 4,036 | | | 4,162 | | | 16,909 | | | 16,296 | | | |

| Total depreciation | $ | 16,482 | | | $ | 18,719 | | | $ | 70,393 | | | $ | 74,693 | | | |

| | | | | | | | | |

| OEM Segment amortization | $ | 9,417 | | | $ | 10,375 | | | $ | 39,843 | | | $ | 41,579 | | | |

| Aftermarket Segment amortization | 3,794 | | | 3,856 | | | 15,457 | | | 15,496 | | | |

| Total amortization | $ | 13,211 | | | $ | 14,231 | | | $ | 55,300 | | | $ | 57,075 | | | |

LCI INDUSTRIES

BALANCE SHEET INFORMATION

(unaudited)

| | | | | | | | | | | | | |

| | December 31, | | | | December 31, |

| | 2024 | | | | 2023 |

| (In thousands) | | | | | |

| | | | | |

| ASSETS | | | | | |

| Current assets | | | | | |

| Cash and cash equivalents | $ | 165,756 | | | | | $ | 66,157 | |

| | | | | |

| Accounts receivable, net | 199,560 | | | | | 214,707 | |

| Inventories, net | 736,604 | | | | | 768,407 | |

| Prepaid expenses and other current assets | 58,318 | | | | | 67,599 | |

| Total current assets | 1,160,238 | | | | | 1,116,870 | |

| Fixed assets, net | 432,728 | | | | | 465,781 | |

| Goodwill | 585,773 | | | | | 589,550 | |

| Other intangible assets, net | 392,018 | | | | | 448,759 | |

| Operating lease right-of-use assets | 224,313 | | | | | 245,388 | |

| | | | | |

| Other long-term assets | 99,669 | | | | | 92,971 | |

| Total assets | $ | 2,894,739 | | | | | $ | 2,959,319 | |

| | | | | |

| LIABILITIES AND STOCKHOLDERS' EQUITY | | | | | |

| Current liabilities | | | | | |

| Current maturities of long-term indebtedness | $ | 423 | | | | | $ | 589 | |

| Accounts payable, trade | 187,684 | | | | | 183,697 | |

| | | | | |

| Current portion of operating lease obligations | 38,671 | | | | | 36,269 | |

| Accrued expenses and other current liabilities | 185,275 | | | | | 174,437 | |

| Total current liabilities | 412,053 | | | | | 394,992 | |

| Long-term indebtedness | 756,830 | | | | | 846,834 | |

| Operating lease obligations | 199,929 | | | | | 222,680 | |

| Deferred taxes | 26,110 | | | | | 32,345 | |

| Other long-term liabilities | 112,931 | | | | | 107,432 | |

| Total liabilities | 1,507,853 | | | | | 1,604,283 | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| Total stockholders' equity | 1,386,886 | | | | | 1,355,036 | |

| Total liabilities and stockholders' equity | $ | 2,894,739 | | | | | $ | 2,959,319 | |

LCI INDUSTRIES

SUMMARY OF CASH FLOWS

(unaudited)

| | | | | | | | | | | |

| | Twelve Months Ended

December 31, |

| | 2024 | | 2023 |

| (In thousands) | | | |

| Cash flows from operating activities: | | | |

| Net income | $ | 142,867 | | | $ | 64,195 | |

| Adjustments to reconcile net income to cash flows provided by operating activities: | | | |

| Depreciation and amortization | 125,693 | | | 131,768 | |

| Stock-based compensation expense | 18,653 | | | 18,229 | |

| Deferred taxes | (7,073) | | | 2,067 | |

| Other non-cash items | 7,209 | | | 7,716 | |

| Changes in assets and liabilities, net of acquisitions of businesses: | | | |

| Accounts receivable, net | 13,469 | | | 1,594 | |

| Inventories, net | 46,335 | | | 235,347 | |

| Prepaid expenses and other assets | 4,532 | | | 25,954 | |

| Accounts payable, trade | 3,474 | | | 38,737 | |

| Accrued expenses and other liabilities | 15,125 | | | 1,622 | |

| Net cash flows provided by operating activities | 370,284 | | | 527,229 | |

| Cash flows from investing activities: | | | |

| Capital expenditures | (42,333) | | | (62,209) | |

| Acquisitions of businesses | (19,957) | | | (25,851) | |

| | | |

| | | |

| Other investing activities | 1,192 | | | 4,312 | |

| Net cash flows used in investing activities | (61,098) | | | (83,748) | |

| Cash flows from financing activities: | | | |

| Vesting of stock-based awards, net of shares tendered for payment of taxes | (9,159) | | | (9,628) | |

| Proceeds from revolving credit facility | 86,248 | | | 248,900 | |

| Repayments under revolving credit facility | (138,752) | | | (464,822) | |

| | | |

| Repayments under term loan and other borrowings | (36,655) | | | (61,099) | |

| | | |

| | | |

| | | |

| | | |

| Payment of dividends | (109,471) | | | (106,336) | |

| Payment of contingent consideration and holdbacks related to acquisitions | (2) | | | (31,857) | |

| | | |

| Other financing activities | (430) | | | (1,342) | |

| Net cash flows used in financing activities | (208,221) | | | (426,184) | |

| Effect of exchange rate changes on cash and cash equivalents | (1,366) | | | 1,361 | |

| Net increase in cash and cash equivalents | 99,599 | | | 18,658 | |

| Cash and cash equivalents at beginning of period | 66,157 | | | 47,499 | |

| Cash and cash equivalents at end of period | $ | 165,756 | | | $ | 66,157 | |

LCI INDUSTRIES

SUPPLEMENTARY INFORMATION

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Twelve Months Ended | | | |

| December 31, | | December 31, | | | |

| 2024 | | 2023 | | 2024 | | 2023 | | | |

Industry Data(1) (in thousands of units): | | | | | | | | | | |

| Industry Wholesale Production: | | | | | | | | | | |

| Travel trailer and fifth-wheel RVs | 67.7 | | | 63.4 | | | 291.6 | | | 259.1 | | | | |

| Motorhome RVs | 8.0 | | | 10.1 | | | 34.9 | | | 45.9 | | | | |

| Industry Retail Sales: | | | | | | | | | | |

| Travel trailer and fifth-wheel RVs | 54.8 | | | 53.7 | | | 307.0 | | | 327.0 | | | | |

| Impact on dealer inventories | 12.9 | | | 9.7 | | | (15.4) | | | (67.9) | | | | |

| Motorhome RVs | 7.9 | | | 8.0 | | | 40.0 | | | 45.3 | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | Twelve Months Ended | | | |

| | | | | December 31, | | | |

| | | | | 2024 | | 2023 | | | |

| Lippert Content Per Industry Unit Produced: | | | | | | | |

| Travel trailer and fifth-wheel RV | | | | | $ | 5,097 | | | $ | 5,058 | | | | |

| Motorhome RV | | | | | $ | 3,742 | | | $ | 3,506 | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | December 31, | | | |

| | | | | 2024 | | 2023 | | | |

Balance Sheet Data (debt availability in millions): | | | | | | | |

Remaining availability under the revolving credit facility (2) | | $ | 452.5 | | | $ | 245.3 | | | | |

| Days sales in accounts receivable, based on last twelve months | | 29.9 | | | 30.1 | | | | |

| Inventory turns, based on last twelve months | | 4.0 | | | 3.5 | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | 2025 | | | |

| Estimated Full Year Data: | | | | | | | | | | |

| Capital expenditures | | | | | $50 - $70 million | | | |

| Depreciation and amortization | | | | | $115 - $125 million | | | |

| Stock-based compensation expense | | | | | $18 - $23 million | | | |

Annual tax rate | | | | | 24% - 26% | | | |

| | | | | | | | | | |

(1) Industry wholesale production data for travel trailer and fifth-wheel RVs and motorhome RVs provided by the Recreation Vehicle Industry Association. Industry retail sales data provided by Statistical Surveys, Inc.

(2) Remaining availability under the revolving credit facility is subject to covenant restrictions.

LCI INDUSTRIES

SUPPLEMENTARY INFORMATION

RECONCILIATION OF NON-GAAP MEASURES

(unaudited)

The following table reconciles net income to EBITDA and net income as a percentage of net sales to EBITDA as a percentage of net sales.

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Twelve Months Ended December 31, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| (In thousands) | | | | | | | |

| Net income (loss) | $ | 9,547 | | | $ | (2,377) | | | $ | 142,867 | | | $ | 64,195 | |

| Interest expense, net | 5,100 | | | 9,456 | | | 28,899 | | | 40,424 | |

| Provision (benefit) for income taxes | 1,487 | | | (4,458) | | | 46,471 | | | 18,809 | |

| Depreciation expense | 16,482 | | | 18,719 | | | 70,393 | | | 74,693 | |

| Amortization expense | 13,211 | | | 14,231 | | | 55,300 | | | 57,075 | |

| EBITDA | $ | 45,827 | | | $ | 35,571 | | | $ | 343,930 | | | $ | 255,196 | |

| | | | | | | |

| Net sales | $ | 803,138 | | | $ | 837,544 | | | $ | 3,741,208 | | | $ | 3,784,808 | |

| Net income (loss) as a percentage of net sales | 1.2 | % | | (0.3 | %) | | 3.8 | % | | 1.7 | % |

| EBITDA as a percentage of net sales | 5.7 | % | | 4.2 | % | | 9.2 | % | | 6.7 | % |

| | | | | | | |

| | | | | | | |

In addition to reporting financial results in accordance with U.S. GAAP, the Company has provided the non-GAAP performance measures of EBITDA and EBITDA as a percentage of net sales to illustrate and improve comparability of its results from period to period. EBITDA is defined as net income (loss) before interest expense, net, provision/benefit for income taxes, depreciation expense, and amortization expense during the three and twelve month periods ended December 31, 2024 and 2023. The Company considers these non-GAAP measures in evaluating and managing the Company's operations and believes that discussion of results adjusted for these items is meaningful to investors because it provides a useful analysis of ongoing underlying operating trends. These measures are not in accordance with, nor are they substitutes for, GAAP measures, and they may not be comparable to similarly titled measures used by other companies.

Q 4 + F u l l Y e a r 2 0 2 4 E a r n i n g s C o n f e r e n c e C a l l 2 . 1 1 . 2 0 2 5

This presentation contains certain “forward-looking statements” with respect to our financial condition, results of operations, profitability, margin growth, business strategies, operating efficiencies or synergies, competitive position, growth opportunities, acquisitions, plans and objectives of management, markets for the Company’s common stock, the impact of legal proceedings, and other matters. Statements in this presentation that are not historical facts are “forward-looking statements” for the purpose of the safe harbor provided by Section 21E of the Securities Exchange Act of 1934, as amended, and Section 27A of the Securities Act of 1933, as amended, and involve a number of risks and uncertainties. Forward-looking statements, including, without limitation, those relating to the Company's future business prospects, net sales, expenses and income (loss), capital expenditures, tax rate, cash flow, financial condition, liquidity, covenant compliance, growth strategy, retail and wholesale demand and shipments, integration of acquisitions, R&D investments, commodity prices and industry trends, whenever they occur in this presentation are necessarily estimates reflecting the best judgment of the Company's senior management at the time such statements were made. There are a number of factors, many of which are beyond the Company’s control, which could cause actual results and events to differ materially from those described in the forward-looking statements. These factors include, in addition to other matters described in this presentation, the impacts of future pandemics, geopolitical tensions, armed conflicts, or natural disaster on the global economy and on the Company's customers, suppliers, employees, business and cash flows, pricing pressures due to domestic and foreign competition, costs and availability of, and tariffs on, raw materials (particularly steel and aluminum) and other components, seasonality and cyclicality in the industries to which we sell our products, availability of credit for financing the retail and wholesale purchase of products for which we sell our components, inventory levels of retail dealers and manufacturers, availability of transportation for products for which we sell our components, the financial condition of our customers, the financial condition of retail dealers of products for which we sell our components, retention and concentration of significant customers, the costs, pace and successful integration of acquisitions and other growth initiatives, availability and costs of production facilities and labor, team member benefits, team member retention, realization and impact of expansion plans, efficiency improvements and cost reductions, the disruption of business resulting from natural disasters or other unforeseen events, the successful entry into new markets, the costs of compliance with environmental laws, laws of foreign jurisdictions in which we operate, other operational and financial risks related to conducting business internationally, and increased governmental regulation and oversight, information technology performance and security, the ability to protect intellectual property, warranty and product liability claims or product recalls, interest rates, oil and gasoline prices and availability, the impact of international, national and regional economic conditions and consumer confidence on the retail sale of products for which we sell our components, and other risks and uncertainties discussed more fully under the caption “Risk Factors” in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023, and in the Company’s subsequent filings with the Securities and Exchange Commission, including the Company's Quarterly Reports on Form 10-Q. Readers of this presentation are cautioned not to place undue reliance on these forward-looking statements, since there can be no assurance that these forward-looking statements will prove to be accurate. The Company disclaims any obligation or undertaking to update forward-looking statements to reflect circumstances or events that occur after the date the forward-looking statements are made, except as required by law. This presentation includes certain non-GAAP financial measures, such as EBITDA, EBITDA as a percentage of net sales, net debt to EBITDA leverage, and free cash flow. These non-GAAP financial measures should not be considered a substitute for the comparable GAAP financial measures. Reconciliations of these non-GAAP financial measures to the most directly comparable GAAP financial measure are included in the presentation. 2 Forward-Looking Statements

Financial Performance • Full year net sales of $4 billion, down 1% year-over- year • Full year net income of $143 million ($5.60 per diluted share), or 3.8% of net sales, up 123% year-over-year • Full year EBITDA1 of $344 million, or 9.2% of net sales, up 35% year-over-year • Net sales of $803 million with net income of $10 million in the fourth quarter of 2024 Executing Cost Management and Continuous Improvement Initiatives • Full year operating profit margin of 5.8%, up 250 bps year-over year • Lowered material costs through supply chain improvements • Product quality initiatives helped significantly reduce warranty costs year-over-year • Implemented $28+ million in non-material cost reductions in 2024 Gaining Share through Innovation • Grew sales to RV OEMs in our top 5 product categories despite negative mix shift • Delivered towable organic content growth both sequentially over 3Q24 and year-over-year2 • Highly successful new product launch with 2025 RV model year - including ABS, A/C innovation, coil spring suspension, new window designs, and new patented Sun Deck 3 1 Additional information regarding EBITDA and EBITDA as a percentage of net sales, and reconciliations of these non-GAAP financial measures to the most directly comparable GAAP financial measures, are provided in the Appendix 2 For twelve months ended December 31, 2024 Capital Allocation • Strong liquidity position with $166 million of cash and cash equivalents and $453 million of availability on revolving credit facility at December 31, 2024 • Increased quarterly dividend to $1.15 per share in the fourth quarter, returning $109 million of capital to shareholders with quarterly dividends for the full year ended December 31, 2024 • Continuing to evaluate strategic acquisition opportunities • Investing in R&D and innovation to drive profitable growth Fourth Quarter and Full Year 2024 Highlights Strong operational improvements drove profitability across diverse end markets

4 RV OEM Performance and Trends • 67,700 North American wholesale towable units shipped in Q4 2024, up 7% YoY • 54,800 estimated North American retail towable units sold in Q4 2024, up 2% YoY • Total North American wholesale unit shipments for the year ended December 31, 2024 of 333,700 and retail unit sales of 355,100, signaling healthy dealer inventory reduction • Gained share in our top 5 RV product categories: appliances, awnings, chassis, furniture, and windows for the year ended December 31, 2024 • Q4 2024 RV OEM sales down 3% YoY, as mix shifts toward lower content towables more than offset share gains Net Sales (in thousands) $388,939 $376,062 Q4 2023 Q4 2024 NA RV Wholesale/Retail/Inventory Change Retail Wholesale Inventory Linear (Inventory) 1Q 21 2Q 21 3Q 21 4Q 21 1Q 22 2Q 22 3Q 22 4Q 22 1Q 23 2Q 23 3Q 23 4Q 23 1Q 24 2Q 24 3Q 24 4Q 24 0 50,000 100,000 150,000 200,000 250,000 (80,000) (60,000) (40,000) (20,000) — 20,000 40,000 60,000 80,000

5 Touring Coil Suspension Furrion® 18K Chill Cube Air Conditioner * "Other" includes impact of RV unit shipments versus industry production, index sales price adjustments, and the impact of acquisitions and divestitures New Window Designs and Integrated Shades Innovation Driving RV Content Growth, Share Gains Sequential Towable Content Growth (LTM) YoY Towable Content Growth (LTM) Key 2025 Model Year Product Wins +1% +2%

6 Adjacent Industries OEM Performance and Trends • Q4 2024 Adjacent Industries sales down 9% YoY • Decrease primarily due to lower sales to North American marine and utility trailer OEMs • Pressured by current dealer inventory levels, inflation, and elevated interest rates impacting retail consumers • Expanding presence in transportation and building markets: • Supplying axles to top trailer brands, which produce 500k+ utility and cargo trailers annually • Adding windows in off-road vehicles, school buses, and manufactured housing Net Sales (in thousands) $269,156 $245,491 Q4 2023 Q4 2024 Q4 2024 Adjacent Industries OEM Net Sales by Market (in millions) $58 $55 $45 $44 $41 $2 Utility Trailers Marine Building Products Transportation International Other Q4 2023 Adjacent Industries OEM Net Sales by Market (in millions) $62 $65 $43 $48 $46 $5 Utility Trailers Marine Building Products Transportation International Other

7 Aftermarket Segment Performance and Trends • Q4 2024 sales up slightly from the prior year; resiliency driven by market share gains in automotive aftermarket, partially offset by softness in RV and Marine aftermarkets • 10 bps YoY margin contraction primarily driven by increased labor costs due to product mix and increased production facility costs from investments to expand capacity in the automotive aftermarket • Driving portfolio expansion in diversified markets with towing and truck accessories, boating accessories, appliances, and electronics • Meeting heightened repair and replacement demand as RV ownership has reached record levels in recent years • 2021 and 2022 model year units are exiting warranty period and shifting into aftermarket sales opportunity Net Sales (in thousands) $179,449 $181,585 Q4 2023 Q4 2024

8 Innovation Driving Growth Continued focus on innovation driving an ongoing increase of new product introductions Helux Coil Spring Pin Box Bi Fold Sundeck Anti-Lock Braking Systems 4000 Series Windows Chill Cube Air Conditioner Touring Coil Suspension Residential Windows

9 Capture Share of $12 Billion of Addressable Opportunities in Diversified Markets • Leveraging the expertise we gained as a market leader in the RV space • Delivering innovative products through leading, nimble manufacturing capabilities • Utilizing manufacturing synergies to enhance offerings in the transportation and building products markets • Capitalizing on opportunities as RVs enter the repair and replacement cycle with Lippert content Growth Strategy Expanding share across diversified portfolio with cutting-edge innovations and best-in-class service Focus on Delivering Unparalleled Customer Experience • Developing innovations that enhance the outdoor experience with a focus on safety, durability, and enjoyment • Building upon long-term relationships by offering trainings and online resources to further cement Lippert as a trusted partner Capital Allocation Strategy • Focusing on strategic acquisitions to expand presence in existing markets • Investing in R&D and innovation to drive profitable growth • Returning capital to shareholders • Maintaining a strong balance sheet

10 Q4 2024 Financial Performance Operating Margin 0.3% 2.0% Fourth Quarter 2023 Fourth Quarter 2024 (in th ou sa nd s) Consolidated Net Income (Loss) $(2,377) $9,547 Fourth Quarter 2023 Fourth Quarter 2024 (in th ou sa nd s) EBITDA* $35,571 $45,827 Fourth Quarter 2023 Fourth Quarter 2024 * Additional information regarding EBITDA, as well as reconciliation of this non-GAAP financial measure to the most directly comparable GAAP financial measure, is provided in the Appendix. (in th ou sa nd s) Consolidated Net Sales $837,544 $803,138 Fourth Quarter 2023 Fourth Quarter 2024 -4% +170 bps +29%

11 FY 2024 Financial Performance * Additional information regarding EBITDA, as well as reconciliation of this non-GAAP financial measure to the most directly comparable GAAP financial measure, is provided in the Appendix. Operating Margin 3.3% 5.8% 2023 2024 (in th ou sa nd s) Consolidated Net Income $64,195 $142,867 2023 2024 (in th ou sa nd s) EBITDA* $255,196 $343,930 2023 2024 (in th ou sa nd s) Consolidated Net Sales $3,784,808 $3,741,208 2023 2024 -1% +250 bps +35%+123%

12 Liquidity and Cash Flow As of and for the twelve months ended December 31 2024 2023 Cash and Cash Equivalents $166M $66M Remaining Availability under Revolving Credit Facility(1) $453M $245M Capital Expenditures $42M $62M Dividends $109M $106M Debt / Net Income (TTM) 5.3x 13.2x Net Debt/EBITDA (TTM)(2) 1.7x 3.1x Cash from Operating Activities $370M $527M Free Cash Flow(2) $328M $465M 1 Remaining availability under the revolving credit facility is subject to covenant restrictions. 2 Additional information regarding net debt to EBITDA and free cash flow, as well as a reconciliation of these non-GAAP financial measures to the most directly comparable GAAP financial measures, is provided in the Appendix.

13 2025 Outlook RV Industry • Our current full year 2025 North American forecast is 335 - 350k wholesale unit shipments and 345 - 360k retail unit shipments • Continued momentum and product placement with newly launched products • Consolidated January 2025 sales up 6% YoY, driven by a 17% increase in RV OEM sales for the month Other Markets • Aftermarket - Continued focus on organic and inorganic growth • Marine - Expect continued slowness in the first half of 2025 with improvement in the back half • Transportation, Building Products and Utility Trailer Markets - modest industry headwinds Cost Reductions • Continue to identify savings in fixed overhead and G&A costs on top of the $28M of reductions in 2024

14 Appendix Reconciliation of Non-GAAP Measures EBITDA Three Months Ended December 31, EBITDA Twelve months ended December 31, ($ in thousands) 2024 2023 ($ in thousands) 2024 2023 Net income (loss) $ 9,547 $ (2,377) Net income $ 142,867 $ 64,195 Interest expense, net 5,100 9,456 Interest expense, net 28,899 40,424 Provision (benefit) for income taxes 1,487 (4,458) Provision for income taxes 46,471 18,809 Depreciation and amortization 29,693 32,950 Depreciation and amortization 125,693 131,768 EBITDA $ 45,827 $ 35,571 EBITDA $ 343,930 $ 255,196 Net sales $ 803,138 $ 837,544 Net sales $ 3,741,208 $ 3,784,808 Net income (loss) as a % of Net Sales 1.2 % (0.3) % Net income as a % of Net Sales 3.8 % 1.7 % EBITDA as a % of Net Sales 5.7 % 4.2 % EBITDA as a % of Net Sales 9.2 % 6.7 % FREE CASH FLOW Twelve Months Ended December 31, NET DEBT/EBITDA (TTM) December 31, 2024 December 31, 2023 ($ in thousands) 2024 2023 Total debt $ 757,253 $ 847,423 Net cash flows provided by Less cash and cash equivalents 165,756 66,157 operating activities $ 370,284 $ 527,229 Net debt $ 591,497 $ 781,266 Capital expenditures (42,333) (62,209) Free cash flow $ 327,951 $ 465,020 Total Debt/Net Income (TTM) 5.3x 13.2x Net Debt/EBITDA (TTM) 1.7x 3.1x EBITDA, EBITDA as a percentage of net sales, and free cash flow are non-GAAP performance measures included to illustrate and improve comparability of the Company's results from period to period. EBITDA is defined as net income (loss) before interest expense, provision (benefit) for income taxes, and depreciation and amortization expense. Free cash flow is defined as net cash flows provided by operating activities less capital expenditures. The Company considers these non-GAAP measures in evaluating and managing the Company's operations and believes that discussion of results adjusted for these items is meaningful to investors because they provide a useful analysis of ongoing underlying trends. The adjusted measures are not in accordance with, nor are they a substitute for, GAAP measures, and they may not be comparable to similarly titled measures used by other companies. The net debt to EBITDA ratio on a trailing twelve month basis is a non-GAAP performance measure included because the Company believes it is useful to investors in evaluating the Company's leverage. The net debt to EBITDA ratio is defined as total debt, less cash and cash equivalents, divided by EBITDA. The net debt to EBITDA ratio is a non-GAAP measure and should not be considered a substitute for the ratio of total debt to net income determined in accordance with GAAP. The Company's calculation of its net debt to EBITDA ratio might not be calculated in the same manner as, and thus might not be comparable to, similarly titled measures used by other companies.

15 Appendix Historical Unit Mix as Percentage of LCI RV OEM Chassis Shipments 15.5% 15.8% 15.5% 15.9% 15.4% 18.6% 17.9% 20.5% 19.3% 18.9% 23.0% 24.3% 84.5% 84.2% 84.5% 84.1% 84.6% 81.4% 82.1% 79.5% 80.7% 81.1% 77.0% 75.7% Single Axle Travel Trailer Multi Axle TT and Fifth Wheels 1Q22 2Q22 3Q22 4Q22 1Q23 2Q23 3Q23 4Q23 1Q24 2Q24 3Q24 4Q24 —% 20.0% 40.0% 60.0% 80.0% 100.0%

Q&A

v3.25.0.1

Cover

|

Feb. 11, 2025 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Feb. 11, 2025

|

| Entity Registrant Name |

LCI INDUSTRIES

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-13646

|

| Entity Tax Identification Number |

13-3250533

|

| Entity Address, Address Line One |

3501 County Road 6 East,

|

| Entity Address, City or Town |

Elkhart,

|

| Entity Address, State or Province |

IN

|

| Entity Address, Postal Zip Code |

46514

|

| City Area Code |

(574)

|

| Local Phone Number |

535-1125

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Title of 12(b) Security |

Common Stock, $.01 par value

|

| Trading Symbol |

LCII

|

| Security Exchange Name |

NYSE

|

| Entity Central Index Key |

0000763744

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

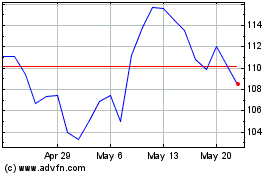

LCI Industries (NYSE:LCII)

Historical Stock Chart

From Jan 2025 to Feb 2025

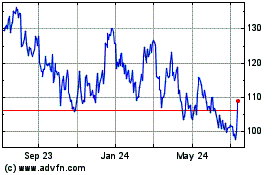

LCI Industries (NYSE:LCII)

Historical Stock Chart

From Feb 2024 to Feb 2025