loanDepot Announces Closing of $300 Million Asset-Backed Transaction

01 October 2024 - 7:12AM

Business Wire

loanDepot, Inc. (NYSE: LDI) today announced the closing of a

$300 million transaction through an offering of notes by Mello

Warehouse Securitization Trust 2024-1 (“MWST Notes”). This marks

the tenth transaction of this kind that loanDepot has successfully

consummated.

The MWST Notes are backed by a revolving warehouse line of

credit, secured by newly originated, first-lien, fixed-rate or

adjustable-rate residential mortgage loans. These loans are

originated in accordance with the criteria of Fannie Mae or Freddie

Mac for the purchase of mortgage loans or in accordance with the

criteria of Ginnie Mae for the guarantee of securities backed by

mortgage loans and certain other eligibility criteria.

"This transaction further demonstrates the strength and breadth

of loanDepot’s financing strategy and attractive capital raising

alternatives, as we continue our focus on delivering exceptional

service to our customers throughout the entirety of their

homeownership journey," said loanDepot Chief Financial Officer

David Hayes.

About loanDepot

At loanDepot (NYSE: LDI), we know home means everything. That’s

why we are on a mission to support homeowners with a suite of

products and services that fuel the American Dream. Our portfolio

of digital-first home purchase, home refinance and home equity

lending products make homeownership more accessible, achievable,

and rewarding, especially for the increasingly diverse communities

of first-time homebuyers we serve. Headquartered in Southern

California with local market offices nationwide, loanDepot and its

sister real estate and home services company, mellohome, are

dedicated to helping customers put down roots and bring dreams to

life – all while building stronger communities and a better

tomorrow.

Forward-Looking Statements

This press release may contain "forward-looking statements,"

which reflect loanDepot's current views with respect to, among

other things, our future operations, performance, financial

condition, plans, strategies, capital raising alternatives and

customer service. These forward-looking statements can be

identified by the fact that they do not relate strictly to

historical or current facts and may contain the words “outlook,”

“potential,” “believe,” “anticipate,” “expect,” “intend,” “plan,”

“predict,” “estimate,” “project,” “will be,” “will continue,” “will

likely result,” or other similar words and phrases or future or

conditional verbs such as “will,” “may,” “might,” “should,”

“would,” or “could” and the negatives of those terms. These

forward-looking statements are based on current available

operating, financial, economic and other information, and are not

guarantees of future performance and are subject to risks,

uncertainties and assumptions, including but not limited to, the

following: our ability to maintain an operating platform and

management system sufficient to conduct our business; failure for

our new products, services, enhancements or expansions to achieve

sufficient market acceptance or result in anticipated efficiencies

and revenues; our ability to successfully adapt to and implement

technological changes; our reliance on warehouse lines of credit

and other sources of capital and liquidity to meet the financing

requirements of our business; adverse changes in macroeconomic and

U.S residential real estate and mortgage market conditions,

including increases in interest rate levels; changing federal,

state and local laws, as well as changing regulatory enforcement

policies and priorities; and other risks detailed in the "Risk

Factors" section of loanDepot, Inc.'s Annual Report on Form 10-K

for the year ended December 31, 2023 and Quarterly Reports on Form

10-Q as well as any subsequent filings with the Securities and

Exchange Commission, which are difficult to predict. Therefore,

current plans, anticipated actions, financial results, as well as

the anticipated development of the industry, may differ materially

from what is expressed or forecasted in any forward-looking

statement. loanDepot does not undertake any obligation to publicly

update or revise any forward-looking statement to reflect future

events or circumstances, except as required by applicable law.

LDI-IR

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240930300458/en/

Investor Relations Contact: Gerhard Erdelji Senior Vice

President, Investor Relations (949) 822-4074

gerdelji@loandepot.com

Media Contact: Rebecca Anderson Senior Vice President,

Communications & Public Relations (949) 822-4024

rebeccaanderson@loandepot.com

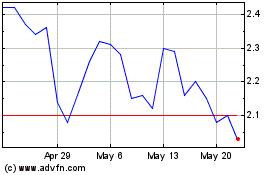

loanDepot (NYSE:LDI)

Historical Stock Chart

From Oct 2024 to Nov 2024

loanDepot (NYSE:LDI)

Historical Stock Chart

From Nov 2023 to Nov 2024