Dorian LPG Ltd. (NYSE: LPG) (the "Company" or "Dorian LPG"),

today updated its financial and operational outlook for the quarter

ended September 30, 2024, announced that its Board of Directors has

declared an irregular cash dividend of $1.00 per share of the

Company’s common stock, returning $42.8 million of capital to

shareholders. The dividend is payable on or about November 25, 2024

to all shareholders of record as of the close of business on

November 5, 2024. In addition, the Company's Board of Directors

(the "Board") authorized the increase in its size to eight

directors and appointed Mr. Mark Ross to fill the vacancy,

effective immediately. The Company plans to issue a press release

on Thursday, October 31, 2024 prior to the market open, announcing

its unaudited financial results for the quarter and year ended

September 30, 2024.

Earnings Conference Call

A conference call to discuss the results will be held on

Thursday, October 31, 2024 at 10:00 a.m. ET. The conference call

can be accessed live by dialing 1-800-245-3047, or for

international callers, 1-203-518-9848, and requesting to be joined

into the Dorian LPG call. A live webcast of the conference call

will also be available under the investor section at

www.dorianlpg.com.

A replay will be available at 1:00 p.m. ET the same day and can

be accessed by dialing 1-844-512-2921, or for international

callers, 1-412-317-6671. The passcode for the replay is 11157466.

The replay will be available until November 7, 2024, at 11:59 p.m.

ET.

Outlook for the Quarter Ended September 30, 2024

The following unaudited financial data for the quarter ended

September 30, 2024, is preliminary and based on information

available to the Company at this time. The financial data has been

prepared by and is the responsibility of the Company’s management

and does not present all information necessary for an understanding

of the Company’s financial condition as of September 30, 2024, and

its results of operations for the three months ended September 30,

2024. Based on information available to the Company at this time,

the Company expects that for the quarter ended September 30,

2024:

Time charter equivalent(1) revenues to be

between

$80,700,000 — $82,700,000

Vessel operating expenses (including

drydock-related expenses) to be between

$18,500,000 — $20,500,000

Charter hire expenses to be between

$8,900,000 — $10,900,000

General and administrative expenses

(excluding stock-based compensation and certain cash bonuses) to be

between

$5,300,000 — $7,300,000

Stock-based compensation and certain cash

bonuses to be between

$9,900,000 — $10,300,000

Calendar days

1,932

Time chartered-in days

340

Available days

2,207

Cash and cash equivalents

$347,600,000 — $349,600,000

Long-term debt obligations(2)

$582,700,000 — $584,700,000

(1)

Time charter equivalent (“TCE”) is a

non-U.S. GAAP measure. Refer to the reconciliation of revenues to

TCE revenues included in this press release below.

(2)

Long-term debt obligations presented

before the effect of deferred financing fees.

The Company has not finalized its financial statement closing

process for the second quarter ended September 30, 2024. During the

course of that process, the Company may identify items that would

require it to make adjustments, which may be material to the

information provided. As a result, the provided information

constitutes forward-looking statements and is subject to risks and

uncertainties, including possible adjustments to the preliminary

results disclosed. Providing this information for this period does

not constitute an obligation or intention to update this

information for future time periods. Except as otherwise provided

herein, capitalized terms used herein but not otherwise defined

herein shall have the meanings set forth in the Company’s Annual

Report on Form 10-K.

Reconciliation to Non-GAAP Financial Information

Time Charter Equivalent Revenues

TCE revenues are a shipping industry non-U.S. GAAP measure of

the revenue performance of a vessel used primarily to compare

period‑to‑period changes in a shipping company’s performance

despite changes in the mix of charter types (such as time charters,

voyage charters) under which the vessels may be employed between

the periods. The Company’s method of calculating TCE revenues is to

subtract voyage expenses from shipping revenues for the relevant

time period, which may not be calculated the same by other

companies.

TCE revenues are not a recognized measure under U.S. GAAP and

should not be regarded as a substitute for revenues. The Company’s

presentation of TCE revenues does not imply, and should not be

construed as an inference, that its future results will be

unaffected by unusual or non-recurring items and should not be

considered in isolation or as a substitute for a measure of

performance prepared in accordance with U.S. GAAP.

The following table sets forth a reconciliation of revenues to

TCE revenues (unaudited) for the period presented:

Three months ended

(In U.S. dollars)

September 30, 2024(1)

Revenues

$

82,400,000

Voyage expenses

(700,000)

TCE revenues

$

81,700,000

(1)

Based on the midpoint of the preliminary

projection for the second quarter ended September 30, 2024,

included herein.

Appointment of Director

On October 23, 2024, the Board, on the recommendation of its

Nominating and Corporate Governance Committee, unanimously

authorized the increase in the size of the Board from seven to

eight directors, and, to fill the resulting vacancy, appointed Mark

Ross to serve as a Class III director effective immediately. Mr.

Ross had a distinguished 34-year career at Chevron Corporation,

most recently serving as the president of Chevron Shipping

Company.

About Dorian LPG Ltd.

Dorian LPG is a leading owner and operator of modern Very Large

Gas Carriers (“VLGCs”) that transport liquefied petroleum gas

globally. Our fleet currently consists of twenty-five modern VLGCs,

including twenty ECO VLGCs and four dual-fuel ECO VLGCs. Dorian LPG

has offices in Stamford, Connecticut, USA; Copenhagen, Denmark; and

Athens, Greece.

Visit our website at www.dorianlpg.com. Information on the

Company’s website does not constitute a part of and is not

incorporated by reference into this press release.

Forward-Looking & Other Cautionary Statements

The cash dividend referenced in this release is an irregular

dividend. All declarations of dividends are subject to the

determination and discretion of our Board of Directors based on its

consideration of various factors, including the Company’s results

of operations, financial condition, level of indebtedness,

anticipated capital requirements, contractual restrictions,

restrictions in its debt agreements, restrictions under applicable

law, its business prospects and other factors that our Board of

Directors may deem relevant.

This press release contains "forward-looking statements."

Statements that are predictive in nature, that depend upon or refer

to future events or conditions, or that include words such as

"expects," "anticipates," "intends," "plans," "believes,"

"estimates," "projects," "forecasts," "may," "will," "should" and

similar expressions are forward-looking statements. These

statements are not historical facts but instead represent only the

Company's current expectations and observations regarding future

results, many of which, by their nature are inherently uncertain

and outside of the Company's control. Where the Company expresses

an expectation or belief as to future events or results, such

expectation or belief is expressed in good faith and believed to

have a reasonable basis. However, the Company’s forward-looking

statements are subject to risks, uncertainties, and other factors,

which could cause actual results to differ materially from future

results expressed, projected, or implied by those forward-looking

statements. The Company’s actual results may differ, possibly

materially, from those anticipated in these forward-looking

statements as a result of certain factors, including changes in the

Company’s financial resources and operational capabilities and as a

result of certain other factors listed from time to time in the

Company's filings with the U.S. Securities and Exchange Commission.

For more information about risks and uncertainties associated with

Dorian LPG’s business, please refer to the “Management’s Discussion

and Analysis of Financial Condition and Results of Operations” and

“Risk Factors” sections of Dorian LPG’s SEC filings, including, but

not limited to, its annual report on Form 10-K and quarterly

reports on Form 10-Q. The Company does not assume any obligation to

update the information contained in this press release.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241024704483/en/

Ted Young Chief Financial Officer +1 (203) 674-9900

IR@dorianlpg.com

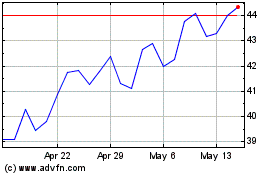

Dorian LPG (NYSE:LPG)

Historical Stock Chart

From Dec 2024 to Jan 2025

Dorian LPG (NYSE:LPG)

Historical Stock Chart

From Jan 2024 to Jan 2025