0000092380false00000923802024-07-252024-07-250000092380us-gaap:CommonStockMember2024-07-252024-07-250000092380luv:CommonStockPurchaseRightsMember2024-07-252024-07-25

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 25, 2024

| | |

| SOUTHWEST AIRLINES CO. |

| (Exact name of registrant as specified in its charter) |

| | | | | | | | | | | | | | |

| Texas | | 1-7259 | | 74-1563240 |

| (State or other jurisdiction | | (Commission | | (I.R.S. Employer |

| of incorporation) | | File Number) | | Identification No.) |

| | | | | | | | | | | |

| P. O. Box 36611 | | |

| Dallas, | Texas | | 75235-1611 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant's telephone number, including area code: (214) 792-4000

| | |

| Not Applicable |

| (Former name or former address, if changed since last report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the

filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act

(17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17

CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the

Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the

Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol | Name of each exchange on which registered |

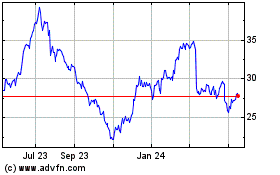

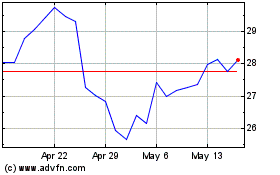

| Common Stock ($1.00 par value) | LUV | New York Stock Exchange |

| Common Stock Purchase Rights | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR 230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR 240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On July 25, 2024, the Registrant issued a press release announcing its financial results for second quarter 2024. The press release is furnished herewith as Exhibit 99.1 and is incorporated by reference into this Item 2.02.

Item 7.01 Regulation FD Disclosure.

On July 25, 2024, the Registrant also issued a press release announcing planned initiatives. The press release is furnished herewith as Exhibit 99.2 and is incorporated by reference into this Item 7.01.

The information furnished in Items 2.02 and 7.01, including Exhibit 99.1 and Exhibit 99.2, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section, nor shall such information be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, regardless of any general incorporation language in such filing, except as shall be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits:

104 Cover Page Interactive Data File (embedded within the Inline XBRL document).

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | SOUTHWEST AIRLINES CO. |

| | | |

| July 25, 2024 | By: | /s/ Tammy Romo |

| | | |

| | | Tammy Romo |

| | | Executive Vice President & Chief Financial Officer

|

| | | (Principal Financial and Accounting Officer) |

SOUTHWEST AIRLINES REPORTS SECOND QUARTER 2024 RESULTS

DALLAS, TEXAS - July 25, 2024 - Southwest Airlines Co. (NYSE: LUV) (the "Company") today reported its second quarter 2024 financial results:

•Net income of $367 million, or $0.58 per diluted share

•Net income, excluding special items1, of $370 million, or $0.58 per diluted share

•Record quarterly operating revenues of $7.4 billion

•Liquidity2 of $11.0 billion, well in excess of debt outstanding of $8.0 billion

Bob Jordan, President, Chief Executive Officer, & Vice Chairman of the Board of Directors, stated, "Our second quarter performance was impacted by both external and internal factors and fell short of what we believe we are capable of delivering. The Southwest Airlines Board of Directors, our Leadership Team, and I are all aligned and committed to serving the interests of and creating lasting value for our Shareholders, who have provided us with highly valuable and candid feedback on our performance and path forward. Our goal is to restore industry-leading margins and historical levels of Shareholder returns through our comprehensive plan to deliver transformational commercial initiatives, improved operational efficiency, and capital allocation discipline.

“We are taking urgent and deliberate steps to mitigate near-term revenue challenges and implement longer-term transformational initiatives that are designed to drive meaningful top and bottom-line growth. As we announced this morning, our implementation of assigned and premium seating is part of an ongoing and comprehensive upgrade to the Customer Experience, one that research shows Customers overwhelmingly prefer. With record numbers of Passengers choosing Southwest Airlines today and work underway to address the challenges we face, we are excited about what the future holds. We remain focused on developing and implementing a robust portfolio of initiatives to drive margin expansion and improve ROIC3 performance, all of which will be shared in detail at our Investor Day in late September.

“I want to thank our incredible Employees for their continued hard work, especially in this challenging environment. I am confident we have the right strategy, the right plan, and the right Team in place to continue evolving the business and driving Southwest Airlines forward.”

Guidance and Outlook:

The following tables introduce or update selected financial guidance for third quarter and full year 2024, as applicable:

| | | | | | | | | | | |

| | | 3Q 2024 Estimation | | |

| RASM (a), year-over-year | | | Flat to down 2% | | |

| ASMs (b), year-over-year | | | Up ~2% | | |

Economic fuel costs per gallon1,4 | | | $2.60 to $2.70 | | |

| Fuel hedging premium expense per gallon | | | $0.07 | | |

| Fuel hedging cash settlement gains per gallon | | | $0.04 | | |

| ASMs per gallon (fuel efficiency) | | | ~81 | | |

CASM-X (c), year-over-year1,5 | | | Up 11% to 13% | | |

| Scheduled debt repayments (millions) | | | ~$7 | | |

| Interest expense (millions) | | | ~$62 | | |

| | | | | | | | | | | | | | | |

| | |

2024 Estimation | | Previous estimation |

| ASMs (b), year-over-year | | | Up ~4% | | No change |

Economic fuel costs per gallon1,4 | | | $2.70 to $2.80 | | No change |

| Fuel hedging premium expense per gallon | | | $0.07 | | No change |

| Fuel hedging cash settlement gains per gallon | | | $0.03 | | $0.04 |

CASM-X (c), year-over-year1,5 | | | Up 7% to 8% | | No change |

| Scheduled debt repayments (millions) | | | ~$29 | | No change |

| Interest expense (millions) | | | ~$252 | | No change |

| Aircraft (d) | | | 802 | | No change |

| Effective tax rate | | | ~24% | | 24% to 25% |

| Capital spending (billions) | | | ~$2.5 | | No change |

(a) Operating revenue per available seat mile ("RASM" or "unit revenues").

(b) Available seat miles ("ASMs" or "capacity"). The Company's flight schedule is published for sale through March 5, 2025. The Company expects fourth quarter 2024 capacity to decrease approximately 4 percent, year-over-year.

(c) Operating expenses per available seat mile, excluding fuel and oil expense, special items, and profitsharing ("CASM-X").

(d) Aircraft on property, end of period. The Company continues to plan for approximately 20 Boeing 737-8 ("-8") aircraft deliveries and 35 aircraft retirements in 2024, comprised of 31 Boeing 737-700s ("-700") and four Boeing 737-800s ("-800"). The delivery schedule for the Boeing 737-7 ("-7") is dependent on the Federal Aviation Administration ("FAA") issuing required certifications and approvals to The Boeing Company ("Boeing") and the Company. The FAA will ultimately determine the timing of the -7 certification and entry into service, and Boeing may continue to experience manufacturing challenges, so the Company offers no assurances that current estimations and timelines will be met.

Revenue Results and Outlook:

•Second quarter 2024 operating revenues were an all-time quarterly record of $7.4 billion, a 4.5 percent increase, year-over-year

•Second quarter 2024 RASM decreased 3.8 percent, year-over-year

The Company's second quarter 2024 revenue performance was an all-time quarterly record driven by all-time quarterly record passengers carried, passenger revenue, and ancillary revenue. In addition, managed business revenues continued to improve on a year-over-year basis. The Company's second quarter 2024 unit revenue declined 3.8 percent relative to second quarter 2023, driven primarily by industry-wide domestic capacity growth outpacing demand. In addition, there was an estimated two points of year-over-year headwind from revenue management challenges as the Company sold an excess number of seats for the peak summer travel period too early in the booking curve. These headwinds were partially offset by the Company's commercial actions, particularly network optimization efforts and GDS maturation, which contributed more than three points of combined unit revenue benefit to second quarter 2024. Second quarter unit revenue came in slightly better than the Company's previous expectation of down 4.0 percent to 4.5 percent, year-over-year, aided by resilient operations during severe weather events in the final days of June and the resulting benefit from incremental bookings from other carrier cancellations.

The Company expects third quarter 2024 unit revenue to be in the range of flat to down 2 percent on a year-over-year basis with capacity up roughly 2 percent, also on a year-over-year basis. This guidance range contemplates a revenue management headwind similar to second quarter 2024 of two points from bookings already in place. In 2023, the Company transitioned to a modernized Origin and Destination ("O&D") revenue management system that consistently produced results superior to its prior leg-based revenue management system during an eighteen-month long parallel test prior to launch. The Company continues to gain experience with the system, particularly in periods with changing capacity and close-in changes to published schedules driven by Boeing's aircraft delivery challenges. The Company recently conducted an evaluation of its revenue management performance, including a third-party review, to identify opportunities to improve the revenue management of future bookings. Those opportunities are currently being actioned. The Company continues to believe that the new revenue management system will deliver better long-term performance compared with its prior system. In addition to revenue management actions, network optimization and capacity moderation in the second half of the year are expected to support sequential year-over-year unit revenue improvement. Summer, fall, and recently published winter base schedules all include changes to better match supply to demand with capacity expected to decline 4 percent year-over-year in fourth quarter,

and seats and trips to decline roughly 8 percent year-over-year in fourth quarter. As such, the Company expects unit revenue to inflect positively by fourth quarter 2024, on a year-over-year basis.

Fuel Costs and Outlook:

•Second quarter 2024 economic fuel costs were $2.76 per gallon1—in line with the Company's previous expectations—and included $0.07 per gallon in premium expense and $0.04 per gallon in favorable cash settlements from fuel derivative contracts

•Second quarter 2024 fuel efficiency improved 1.1 percent, year-over-year, primarily due to more -8 aircraft, the Company's most fuel-efficient aircraft, as a percentage of its fleet

•As of July 17, 2024, the fair market value of the Company's fuel derivative contracts settling in third quarter 2024 through the end of 2026 was an asset of $194 million

The Company's multi-year fuel hedging program continues to provide protection against spikes in energy prices. The Company's current fuel derivative contracts contain a combination of instruments based on West Texas Intermediate and Brent crude oil, and refined products, such as heating oil. The economic fuel price per gallon sensitivities4 provided in the table below assume the relationship between Brent crude oil and refined products based on market prices as of July 17, 2024.

| | | | | | | | |

| Estimated economic fuel price per gallon,

including taxes and fuel hedging premiums |

Average Brent Crude Oil

price per barrel | 3Q 2024 | 4Q 2024 |

| | |

| $70 | $2.35 - $2.45 | $2.25 - $2.35 |

| $80 | $2.55 - $2.65 | $2.55 - $2.65 |

| Current Market (a) | $2.60 - $2.70 | $2.60 - $2.70 |

| $90 | $2.75 - $2.85 | $2.80 - $2.90 |

| $100 | $2.90 - $3.00 | $3.05 - $3.15 |

| $110 | $3.00 - $3.10 | $3.25 - $3.35 |

| | |

Fair market value of

fuel derivative contracts settling in period | $22 million | $23 million |

| Estimated premium costs | $39 million | $39 million |

(a) Brent crude oil average market prices as of July 17, 2024, were $84 and $82 per barrel for third quarter and fourth quarter 2024, respectively.

In addition, the Company is providing its maximum percentage of estimated fuel consumption6 covered by fuel derivative contracts in the following table: | | | | | | | | |

| Period | Maximum fuel hedged percentage (a) |

| 2024 | 58% |

| 2025 | 47% |

| 2026 | 30% |

(a) Based on the Company's current available seat mile plans. The Company is currently 57 percent hedged in third quarter 2024 and 59 percent hedged in fourth quarter 2024.

Non-Fuel Costs and Outlook:

•Second quarter 2024 operating expenses increased 11.4 percent, year-over-year, to $7.0 billion

•Second quarter 2024 operating expenses, excluding fuel and oil expense, special items, and profitsharing1, increased 15.1 percent, year-over-year

•Second quarter 2024 CASM-X increased 6.0 percent, year-over-year

The Company's second quarter CASM-X increase came in better than its previous expectation of an increase in the 6.5 percent to 7.5 percent range due in part to continued benefits from cost mitigation efforts, including meaningful participation in voluntary time off programs. The majority of the second quarter CASM-X increase, year-over-year, was attributable to anticipated cost increases, most notably market-driven rate inflation in salaries, wages, and benefits, and higher maintenance expenses.

The Company continues to expect similar cost pressures for the remainder of the year, driving third quarter 2024 CASM-X to an expected increase in the range of 11 percent to 13 percent, year-over-year. The sequential year-over-year increase from second quarter 2024 is primarily due to lower year-over-year capacity growth in third quarter 2024. The Company continues to expect full year 2024 CASM-X to increase in the range of 7 percent to 8 percent, year-over-year.

Fleet, Capacity, and Capital Spending:

During second quarter 2024, the Company received five -8 aircraft and retired six -700 aircraft and one -800 aircraft, ending second quarter with 817 aircraft. Given the Company's ongoing discussions with Boeing and expected aircraft delivery delays, the Company continues to plan for approximately 20 -8 aircraft deliveries in 2024, which differs from its contractual order book displayed in the table below. Likewise, the Company's retirement plans remain unchanged, with approximately 35 aircraft retirements in 2024 (31 -700s and four -800s), resulting in a fleet of roughly 802 aircraft at year-end 2024. While the Company has not further adjusted capacity expectations this quarter, it will continue to closely monitor the ongoing aircraft delivery delays with Boeing and adjust expectations, conservatively, as needed.

The Company's flight schedule is published for sale through March 5, 2025. The Company estimates third quarter 2024 capacity to increase approximately 2 percent, fourth quarter 2024 capacity to decrease approximately 4 percent, and full year 2024 capacity to increase approximately 4 percent, all year-over-year. The Company continues to plan for year-over-year capacity growth beyond 2024 to be at or below macroeconomic growth trends until the Company reaches its long-term financial goal to consistently achieve after-tax ROIC well above its weighted average cost of capital.

The Company’s second quarter 2024 capital expenditures were $494 million, driven primarily by aircraft-related capital spending, as well as technology, facilities, and operational investments. The Company continues to estimate its 2024 capital spending to be roughly $2.5 billion, which includes approximately $1.0 billion in aircraft capital spending, assuming approximately 20 -8 aircraft deliveries in 2024 and continued progress delivery payments for the Company's contractual 2025 firm orders. The Company and Boeing are in ongoing discussions regarding the negative financial impacts to the Company as a result of aircraft delivery delays. In accordance with applicable accounting guidance, any compensation negotiated and received from Boeing for financial damages associated with such delays would be expected to be realized as a reduction in the cost basis of certain aircraft either in the Company's fleet or associated with future deliveries from Boeing.

Since the previous financial results released on April 25, 2024, the Company exercised two -7 options for delivery in 2025 and converted two 2025 -7 firm orders into 2025 -8 firm orders. The following tables provide further information regarding the Company's contractual order book and compare its contractual order book as of July 25, 2024, with its previous order book as of April 25, 2024. The contractual order book as of July 25, 2024 does not include the impact of delivery delays and is subject to change based on ongoing discussions with Boeing.

Current 737 Contractual Order Book as of July 25, 2024:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | The Boeing Company | | | | | | |

| | | -7 Firm Orders | | -8 Firm Orders | | -7 or -8 Options | | | | Total | | |

| 2024 | | | 27 | | | 58 | | | — | | | | | 85 | | (c) | |

| 2025 | | | 40 | | | 21 | | | 12 | | | | | 73 | | | |

| 2026 | | | 59 | | | — | | | 27 | | | | | 86 | | | |

| 2027 | | | 19 | | | 46 | | | 25 | | | | | 90 | | | |

| 2028 | | | 15 | | | 50 | | | 25 | | | | | 90 | | | |

| 2029 | | | 38 | | | 34 | | | 18 | | | | | 90 | | | |

| 2030 | | | 45 | | | — | | | 45 | | | | | 90 | | | |

| 2031 | | | 45 | | | — | | | 45 | | | | | 90 | | | |

| | | 288 | | (a) | 209 | | (b) | 197 | | | | | 694 | | | |

(a) The delivery timing for the -7 is dependent on the FAA issuing required certifications and approvals to Boeing and the Company. The FAA will ultimately determine the timing of the -7 certification and entry into service, and the Company therefore offers no assurances that current estimations and timelines are correct.

(b) The Company has flexibility to designate firm orders or options as -7s or -8s, upon written advance notification as stated in the contract.

(c) Includes 10 -8 deliveries received year-to-date through June 30, 2024. Given the Company's continued discussions with Boeing and expected aircraft delivery delays, the Company continues to plan for approximately 20 -8 aircraft deliveries in 2024.

Previous 737 Order Book as of April 25, 2024 (a): | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | The Boeing Company | | | | | | |

| | | -7 Firm Orders | | -8 Firm Orders | | -7 or -8 Options | | | | Total | | |

| 2024 | | | 27 | | | 58 | | | — | | | | | 85 | | | |

| 2025 | | | 40 | | | 19 | | | 14 | | | | | 73 | | | |

| 2026 | | | 59 | | | — | | | 27 | | | | | 86 | | | |

| 2027 | | | 19 | | | 46 | | | 25 | | | | | 90 | | | |

| 2028 | | | 15 | | | 50 | | | 25 | | | | | 90 | | | |

| 2029 | | | 38 | | | 34 | | | 18 | | | | | 90 | | | |

| 2030 | | | 45 | | | — | | | 45 | | | | | 90 | | | |

| 2031 | | | 45 | | | — | | | 45 | | | | | 90 | | | |

| | | 288 | | | 207 | | | 199 | | | | | 694 | | | |

(a) The 'Previous 737 Order Book' is for reference and comparative purposes only. It should not be relied upon. See 'Current 737 Contractual Order Book' for the Company's current aircraft order book.

Liquidity and Capital Deployment:

•The Company ended second quarter 2024 with $10.0 billion in cash and cash equivalents and short-term investments, and a fully available revolving credit line of $1.0 billion

•The Company continues to have a large base of unencumbered assets with a net book value of approximately $17.1 billion, including $14.3 billion in aircraft value and $2.8 billion in non-aircraft assets such as spare engines, ground equipment, and real estate

•The Company had a net cash position7 of $2.0 billion, and adjusted debt to invested capital ("leverage")8 of 46 percent as of June 30, 2024

•The Company has returned $215 million to its Shareholders through the payment of dividends year-to-date as of June 30, 2024

•The Company paid $8 million during second quarter 2024 to retire debt and finance lease obligations, including $1 million in principal related to lease return transactions and $7 million in scheduled lease payments

•The Company paid $6 million during June 2024 to repurchase and cancel its outstanding stock warrants, previously issued in connection with the Payroll Support Program

Awards and Recognitions:

•Ranked the #1 Airline for Economy Class Customer Satisfaction in the J.D. Power 2024 North America Airline Satisfaction Study9 for the third consecutive year

•Ranked No. 1 on Newsweek's 2024 America's Best Customer Service List in the Airlines and Low-Cost Airlines subcategories

•Ranked as the top airline on Forbes America's Best Employers for Veterans List

•Awarded by the Port of Seattle through its Sustainable Century Awards program as having the greatest airline use of ground power and pre-conditioned air systems to reduce emissions while docked at Seattle airport gates

Environmental, Social, and Governance ("ESG"):

•Published the Company's annual corporate social responsibility and environmental sustainability report—the Southwest Airlines One Report—a comprehensive, integrated report that includes information on the Company's Citizenship efforts and key topics including People, Performance, and Planet, along with reporting guided by the Global Reporting Initiatives ("GRI") Standards, Sustainability Accounting Standards Board ("SASB"), United Nations Sustainable Development Goals ("UNSDG"), and the Task Force on Climate-Related Financial Disclosures ("TCFD") frameworks

•Published the Southwest Airlines Diversity, Equity, & Inclusion ("DEI") Report, a companion piece to the One Report. This comprehensive report is focused on the Company's current DEI priorities and path forward

•Joined the Sustainable Aviation Fuel ("SAF") Coalition. Members of the SAF Coalition are working together to rapidly scale investment in the SAF sector and advocate for the incentives and policies necessary to promote U.S. economic competitiveness in the emerging SAF marketplace

•Received an ESG ranking from FTSE Russell (the trading name of FTSE International Limited and Frank Russell Company) of 4.3 out of 5 and, as a result, was included in the FTSE4Good Index Series which is designed to measure the performance of companies demonstrating strong ESG practices

•Celebrated 10 years of the Company's Repurpose with Purpose program, a global sustainability initiative that creates partnerships with social impact organizations to upcycle and transform aircraft seat leather removed during ongoing aircraft renovations and the aircraft retirement process

•Celebrated Asian American and Pacific Islander Heritage Month and LGBTQ Pride Month throughout May and June 2024, respectively, by highlighting the Company's Employee Resource Groups

•In honor of Global Volunteer and Earth Month, more than 2,000 Southwest Employees served more than 18,000 volunteer hours during April 2024, sharing their love for the environment and their communities

Conference Call:

The Company will discuss its second quarter 2024 results on a conference call at 12:30 p.m. Eastern Time today. To listen to a live broadcast of the conference call, please go to

https://www.southwestairlinesinvestorrelations.com.

Footnotes

1See Note Regarding Use of Non-GAAP Financial Measures for additional information on special items. In addition, information regarding special items and economic results is included in the accompanying table Reconciliation of Reported Amounts to Non-GAAP Measures (also referred to as "excluding special items").

2Includes $10.0 billion in cash and cash equivalents, short-term investments, and a fully available revolving credit line of $1.0 billion.

3Return on invested capital ("ROIC"). See Note Regarding Use of Non-GAAP Financial Measures for additional information on ROIC. In addition, information regarding ROIC and economic results is included in the accompanying table Non-GAAP Return on Invested Capital (ROIC).

4Based on the Company's existing fuel derivative contracts and market prices as of July 17, 2024, third quarter, fourth quarter, and full year 2024 economic fuel costs per gallon are estimated to be in the range of $2.60 to $2.70, $2.60 to $2.70, and $2.70 to $2.80, respectively. Economic fuel cost projections do not reflect the potential impact of special items because the Company cannot reliably predict or estimate the hedge accounting impact associated with the volatility of the energy markets, or the impact to its financial statements in future periods. Accordingly, the Company believes a reconciliation of non-GAAP financial measures to the equivalent GAAP financial measures for projected results is not meaningful or available without unreasonable effort. See Note Regarding Use of Non-GAAP Financial Measures.

5Projections do not reflect the potential impact of fuel and oil expense, special items, and profitsharing because the Company cannot reliably predict or estimate those items or expenses or their impact to its financial statements in future periods, especially considering the significant volatility of the fuel and oil expense line item. Accordingly, the Company believes a reconciliation of non-GAAP financial measures to the equivalent GAAP financial measures for these projected results is not meaningful or available without unreasonable effort.

6The Company's maximum fuel hedged percentage is calculated using the maximum number of gallons that are covered by derivative contracts divided by the Company's estimate of total fuel gallons to be consumed for each respective period. The Company's maximum number of gallons that are covered by derivative contracts may be at different strike prices and at strike prices materially higher than the current market prices. The volume of gallons covered by derivative contracts that are ultimately exercised in any given period may vary significantly from the volumes used to calculate the Company's maximum fuel hedged percentages, as market prices and the Company's fuel consumption fluctuate.

7Net cash position is calculated as the sum of cash and cash equivalents and short-term investments, less the sum of short-term and long-term debt.

8See Note Regarding Use of Non-GAAP Financial Measures for an explanation of the Company's leverage calculation.

9Southwest Airlines Co. received the highest score in the Economy Class segment of the J.D. Power 2022-2024 North American Airline Satisfaction Studies of passengers’ satisfaction with their airline experience. Visit jdpower.com/awards for more details.

Cautionary Statement Regarding Forward-Looking Statements

This news release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Specific forward-looking statements include, without limitation, statements related to (i) the Company’s initiatives, strategic priorities and focus areas, goals, and opportunities, including with respect to creating shareholder value, restoring margins, shareholder returns, improved operational efficiency, capital allocation, Customer Experience enhancements, and improved return on invested capital; (ii) the Company's financial and operational outlook, expectations, goals, plans, and projected results of operations, including with respect to its initiatives, and including factors and assumptions underlying the Company's expectations and projections; (iii) the Company’s plans and expectations with respect to its network, its capacity, its network optimization efforts, its network plan, and capacity and network adjustments, and including factors and assumptions underlying the Company's expectations and projections; (iv) the Company's expectations with respect to fuel costs, hedging gains, and fuel efficiency, and the Company's related management of risks associated with changing jet fuel prices, including factors underlying the Company's expectations; (v) the Company's plans, estimates, and assumptions related to repayment of debt obligations, interest expense, effective tax rate, and capital spending, including factors and assumptions underlying the Company's expectations and projections; (vi) the Company’s fleet plans and expectations, including with respect to fleet utilization, fleet modernization, flexibility, and expected fleet deliveries and retirements, and including factors and assumptions underlying the Company's plans and expectations; (vii) the Company’s

expectations with respect to GDS maturation; (viii) the Company’s plans and expectations with respect to its revenue management system; and (ix) the Company’s expectations with respect to any compensation received from Boeing for financial damages associated with aircraft delivery delays. These forward-looking statements are based on the Company's current estimates, intentions, beliefs, expectations, goals, strategies, and projections for the future and are not guarantees of future performance. Forward-looking statements involve risks, uncertainties, assumptions, and other factors that are difficult to predict and that could cause actual results to vary materially from those expressed in or indicated by them. Factors include, among others, (i) the impact of fears or actual outbreaks of diseases, extreme or severe weather and natural disasters, actions of competitors (including, without limitation, pricing, scheduling, capacity, and network decisions, and consolidation and alliance activities), consumer perception, economic conditions, banking conditions, fears or actual acts of terrorism or war, sociodemographic trends, and other factors beyond the Company's control, on consumer behavior and the Company's results of operations and business decisions, plans, strategies, and results; (ii) the Company's ability to timely and effectively implement, transition, operate, and maintain the necessary information technology systems and infrastructure to support its operations and initiatives, including with respect to revenue management; (iii) the cost and effects of the actions of activist shareholders; (iv) the Company’s ability to obtain and maintain adequate infrastructure and equipment to support its operations and initiatives; (v) the impact of fuel price changes, fuel price volatility, volatility of commodities used by the Company for hedging jet fuel, and any changes to the Company's fuel hedging strategies and positions, on the Company's business plans and results of operations; (vi) the Company's dependence on The Boeing Company (“Boeing”) and Boeing suppliers with respect to the Company's aircraft deliveries, Boeing MAX 7 aircraft certifications, fleet and capacity plans, operations, maintenance, strategies, and goals; (vii) the Company's dependence on the Federal Aviation Administration with respect to safety approvals for the new cabin layout and the certification of the Boeing MAX 7 aircraft; (viii) the Company's dependence on other third parties, in particular with respect to its technology plans, its plans and expectations related to revenue management, operational reliability, fuel supply, maintenance, Global Distribution Systems, and the impact on the Company's operations and results of operations of any third party delays or non-performance; (ix) the Company’s ability to timely and effectively prioritize its initiatives and focus areas and related expenditures; (x) the impact of labor matters on the Company's business decisions, plans, strategies, and results; (xi) the impact of governmental regulations and other governmental actions on the Company's business plans, results, and operations; (xii) the Company's dependence on its workforce, including its ability to employ and retain sufficient numbers of qualified Employees with appropriate skills and expertise to effectively and efficiently maintain its operations and execute the Company’s plans, strategies, and initiatives; (xiii) the emergence of additional costs or effects associated with the cancelled flights in December 2022, including litigation, government investigation and actions, and internal actions; and (xiv) other factors, as described in the Company's filings with the Securities and Exchange Commission, including the detailed factors discussed under the heading "Risk Factors" in the Company's Annual Report on Form 10-K for the fiscal year ended December 31, 2023.

Investor Contact:

Southwest Airlines Investor Relations

214-792-4415

Media Contact:

Southwest Airlines Media Relations

214-792-4847

swamedia@wnco.com

SW-QFS

Southwest Airlines Co.

Condensed Consolidated Statement of Income

(in millions, except per share amounts)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended | | | | Six months ended | | |

| June 30, | | | | June 30, | | |

| 2024 | | 2023 | | Percent Change | | 2024 | | 2023 | | Percent Change |

| OPERATING REVENUES: | | | | | | | | | | | |

| Passenger | $ | 6,712 | | | $ | 6,409 | | | 4.7 | | $ | 12,424 | | | $ | 11,514 | | | 7.9 |

| Freight | 45 | | | 47 | | | (4.3) | | 87 | | | 87 | | | — |

| Other | 597 | | | 581 | | | 2.8 | | 1,172 | | | 1,142 | | | 2.6 |

| Total operating revenues | 7,354 | | | 7,037 | | | 4.5 | | 13,683 | | | 12,743 | | | 7.4 |

| | | | | | | | | | | |

| OPERATING EXPENSES: | | | | | | | | | | | |

| Salaries, wages, and benefits | 2,999 | | | 2,786 | | | 7.6 | | 5,939 | | | 5,264 | | | 12.8 |

| | | | | | | | | | | |

| Fuel and oil | 1,599 | | | 1,403 | | | 14.0 | | 3,130 | | | 2,950 | | | 6.1 |

| Maintenance materials and repairs | 350 | | | 271 | | | 29.2 | | 711 | | | 511 | | | 39.1 |

| Landing fees and airport rentals | 511 | | | 459 | | | 11.3 | | 975 | | | 867 | | | 12.5 |

| Depreciation and amortization | 404 | | | 367 | | | 10.1 | | 812 | | | 731 | | | 11.1 |

| Other operating expenses | 1,093 | | | 956 | | | 14.3 | | 2,110 | | | 1,909 | | | 10.5 |

| Total operating expenses | 6,956 | | | 6,242 | | | 11.4 | | 13,677 | | | 12,232 | | | 11.8 |

| | | | | | | | | | | |

| OPERATING INCOME | 398 | | | 795 | | | (49.9) | | 6 | | | 511 | | | (98.8) |

| | | | | | | | | | | |

| OTHER INCOME: | | | | | | | | | | | |

| Interest expense | 63 | | | 65 | | | (3.1) | | 128 | | | 130 | | | (1.5) |

| Capitalized interest | (8) | | | (5) | | | 60.0 | | (15) | | | (11) | | | 36.4 |

| Interest income | (130) | | | (144) | | | (9.7) | | (271) | | | (269) | | | 0.7 |

| | | | | | | | | | | |

| Other (gains), net | (5) | | | (7) | | | (28.6) | | (17) | | | (21) | | | (19.0) |

| Total other income | (80) | | | (91) | | | (12.1) | | (175) | | | (171) | | | 2.3 |

| | | | | | | | | | | |

| INCOME BEFORE INCOME TAXES | 478 | | | 886 | | | (46.0) | | 181 | | | 682 | | | (73.5) |

| PROVISION FOR INCOME TAXES | 111 | | | 203 | | | (45.3) | | 44 | | | 158 | | | (72.2) |

| NET INCOME | $ | 367 | | | $ | 683 | | | (46.3) | | $ | 137 | | | $ | 524 | | | (73.9) |

| | | | | | | | | | | |

| NET INCOME PER SHARE: | | | | | | | | | | | |

| Basic | $ | 0.61 | | | $ | 1.15 | | | (47.0) | | $ | 0.23 | | | $ | 0.88 | | | (73.9) |

| Diluted | $ | 0.58 | | | $ | 1.08 | | | (46.3) | | $ | 0.23 | | | $ | 0.84 | | | (72.6) |

| | | | | | | | | | | |

| WEIGHTED AVERAGE SHARES OUTSTANDING: | | | | | | | | | | | |

| Basic | 599 | | | 595 | | | 0.7 | | 598 | | | 595 | | | 0.5 |

| Diluted | 643 | | | 639 | | | 0.6 | | 643 | | | 639 | | | 0.6 |

| | | | | | | | | | | |

Southwest Airlines Co.

Reconciliation of Reported Amounts to Non-GAAP Financial Measures (excluding special items)

(See Note Regarding Use of Non-GAAP Financial Measures)

(in millions, except per share and per ASM amounts)(unaudited) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended | | | | Six months ended | | |

| June 30, | | Percent | | June 30, | | Percent |

| 2024 | | 2023 | | Change | | 2024 | | 2023 | | Change |

| Fuel and oil expense, unhedged | $ | 1,581 | | | $ | 1,418 | | | | | $ | 3,091 | | | $ | 2,992 | | | |

| Add: Premium cost of fuel contracts designated as hedges | 40 | | | 30 | | | | | 79 | | | 61 | | | |

| Deduct: Fuel hedge gains included in Fuel and oil expense, net | (22) | | | (45) | | | | | (40) | | | (103) | | | |

| Fuel and oil expense, as reported | $ | 1,599 | | | $ | 1,403 | | | 14.0 | | $ | 3,130 | | | $ | 2,950 | | | 6.1 |

| Add: Fuel hedge contracts settling in the current period, but for which losses were reclassified from AOCI | 1 | | | — | | | | | 2 | | | — | | | |

| Deduct: Premium benefit of fuel contracts not designated as hedges | (1) | | | — | | | | | (1) | | | — | | | |

| Fuel and oil expense, excluding special items (economic) | $ | 1,599 | | | $ | 1,403 | | | 14.0 | | $ | 3,131 | | | $ | 2,950 | | | 6.1 |

| | | | | | | | | | | |

| Total operating expenses, net, as reported | $ | 6,956 | | | $ | 6,242 | | | | | $ | 13,677 | | | $ | 12,232 | | | |

| Deduct: Labor contract adjustment (a) (b) | — | | | (84) | | | | | (9) | | | (84) | | | |

| Add: Fuel hedge contracts settling in the current period, but for which losses were reclassified from AOCI | 1 | | | — | | | | | 2 | | | — | | | |

| | | | | | | | | | | |

| Deduct: Premium benefit of fuel contracts not designated as hedges | (1) | | | — | | | | | (1) | | | — | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Deduct: Litigation settlements | — | | | (12) | | | | | (7) | | | (12) | | | |

| Deduct: Professional advisory fees | (7) | | | — | | | | | (7) | | | — | | | |

| Total operating expenses, excluding special items | $ | 6,949 | | | $ | 6,146 | | | 13.1 | | $ | 13,655 | | | $ | 12,136 | | | 12.5 |

| Deduct: Fuel and oil expense, excluding special items (economic) | (1,599) | | | (1,403) | | | | | (3,131) | | | (2,950) | | | |

| Operating expenses, excluding Fuel and oil expense and special items | $ | 5,350 | | | $ | 4,743 | | | 12.8 | | $ | 10,524 | | | $ | 9,186 | | | 14.6 |

| Deduct: Profitsharing expense | (31) | | | (121) | | | | | (31) | | | (121) | | | |

| Operating expenses, excluding Fuel and oil expense, special items, and profitsharing | $ | 5,319 | | | $ | 4,622 | | | 15.1 | | $ | 10,493 | | | $ | 9,065 | | | 15.8 |

| | | | | | | | | | | |

| Operating income, as reported | $ | 398 | | | $ | 795 | | | | | $ | 6 | | | $ | 511 | | | |

| Add: Labor contract adjustment (a) (b) | — | | | 84 | | | | | 9 | | | 84 | | | |

| Deduct: Fuel hedge contracts settling in the current period, but for which losses were reclassified from AOCI | (1) | | | — | | | | | (2) | | | — | | | |

| | | | | | | | | | | |

| Add: Premium benefit of fuel contracts not designated as hedges | 1 | | | — | | | | | 1 | | | — | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Add: Litigation settlements | — | | | 12 | | | | | 7 | | | 12 | | | |

| Add: Professional advisory fees | 7 | | | — | | | | | 7 | | | — | | | |

| Operating income, excluding special items | $ | 405 | | | $ | 891 | | | (54.5) | | $ | 28 | | | $ | 607 | | | (95.4) |

| | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended | | | | Six months ended | | |

| June 30, | | Percent | | June 30, | | Percent |

| 2024 | | 2023 | | Change | | 2024 | | 2023 | | Change |

| Other gains, net, as reported | $ | (5) | | | $ | (7) | | | | | $ | (17) | | | $ | (21) | | | |

| Deduct: Mark-to-market impact from fuel contracts settling in future periods | (2) | | | (6) | | | | | (3) | | | (6) | | | |

| Add: Premium benefit of fuel contracts not designated as hedges | 1 | | | — | | | | | 1 | | | — | | | |

| | | | | | | | | | | |

| Add: Unrealized mark-to-market adjustment on available for sale securities | — | | | — | | | | | — | | | 4 | | | |

| Other gains, net, excluding special items | $ | (6) | | | $ | (13) | | | (53.8) | | $ | (19) | | | $ | (23) | | | (17.4) |

| | | | | | | | | | | |

| Income before income taxes, as reported | $ | 478 | | | $ | 886 | | | | | $ | 181 | | | $ | 682 | | | |

| Add: Labor contract adjustment (a) (b) | — | | | 84 | | | | | 9 | | | 84 | | | |

| Deduct: Fuel hedge contracts settling in the current period, but for which losses were reclassified from AOCI | (1) | | | — | | | | | (2) | | | — | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Add: Mark-to-market impact from fuel contracts settling in future periods | 2 | | | 6 | | | | | 3 | | | 6 | | | |

| Add: Litigation settlements | — | | | 12 | | | | | 7 | | | 12 | | | |

| Add: Professional advisory fees | 7 | | | — | | | | | 7 | | | — | | | |

| | | | | | | | | | | |

| Deduct: Unrealized mark-to-market adjustment on available for sale securities | — | | | — | | | | | — | | | (4) | | | |

| | | | | | | | | | | |

| Income before income taxes, excluding special items | $ | 486 | | | $ | 988 | | | (50.8) | | $ | 205 | | | $ | 780 | | | (73.7) |

| | | | | | | | | | | |

| Provision for income taxes, as reported | $ | 111 | | | $ | 203 | | | | | $ | 44 | | | $ | 158 | | | |

| Add: Net income tax impact of fuel and special items (c) | 5 | | | 27 | | | | | 9 | | | 27 | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Provision for income taxes, net, excluding special items | $ | 116 | | | $ | 230 | | | (49.6) | | $ | 53 | | | $ | 185 | | | (71.4) |

| | | | | | | | | | | |

| Net income, as reported | $ | 367 | | | $ | 683 | | | | | $ | 137 | | | $ | 524 | | | |

| Add: Labor contract adjustment (a) (b) | — | | | 84 | | | | | 9 | | | 84 | | | |

| Deduct: Fuel hedge contracts settling in the current period, but for which losses were reclassified from AOCI | (1) | | | — | | | | | (2) | | | — | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Add: Mark-to-market impact from fuel contracts settling in future periods | 2 | | | 6 | | | | | 3 | | | 6 | | | |

| | | | | | | | | | | |

| Add: Litigation settlements | — | | | 12 | | | | | 7 | | | 12 | | | |

| Add: Professional advisory fees | 7 | | | — | | | | | 7 | | | — | | | |

| Deduct: Unrealized mark-to-market adjustment on available for sale securities | — | | | — | | | | | — | | | (4) | | | |

| Deduct: Net income tax impact of special items (c) | (5) | | | (27) | | | | | (9) | | | (27) | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Net income, excluding special items | $ | 370 | | | $ | 758 | | | (51.2) | | $ | 152 | | | $ | 595 | | | (74.5) |

| | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended | | | | Six months ended | | |

| June 30, | | Percent | | June 30, | | Percent |

| 2024 | | 2023 | | Change | | 2024 | | 2023 | | Change |

| Net income per share, diluted, as reported | $ | 0.58 | | | $ | 1.08 | | | | | $ | 0.23 | | | $ | 0.84 | | | |

| Add: Impact of special items | 0.01 | | | 0.14 | | | | | 0.03 | | | 0.01 | | | |

| Add: Net impact of net income above from fuel contracts divided by dilutive shares | — | | | 0.01 | | | | | — | | | 0.01 | | | |

| Deduct: Net income tax impact of special items (c) | (0.01) | | | (0.04) | | | | | (0.01) | | | (0.01) | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Net income per share, diluted, excluding special items | $ | 0.58 | | | $ | 1.19 | | | (51.3) | | $ | 0.25 | | | $ | 0.85 | | | (70.6) |

| | | | | | | | | | | |

| Operating expenses per ASM (cents) | ¢ | 15.04 | | | ¢ | 14.66 | | | | | ¢ | 15.46 | | | ¢ | 15.17 | | | |

| Deduct: Impact of special items | (0.02) | | | (0.23) | | | | | (0.02) | | | (0.12) | | | |

| Deduct: Fuel and oil expense divided by ASMs | (3.46) | | | (3.29) | | | | | (3.54) | | | (3.66) | | | |

| Deduct: Profitsharing expense divided by ASMs | (0.06) | | | (0.29) | | | | | (0.04) | | | (0.15) | | | |

| Operating expenses per ASM, excluding Fuel and oil expense, special items, and profitsharing (cents) | ¢ | 11.50 | | | ¢ | 10.85 | | | 6.0 | | ¢ | 11.86 | | | ¢ | 11.24 | | | 5.5 |

(a) Represents changes in estimate related to the contract ratification bonus for the Company’s Ramp, Operations, Provisioning, and Cargo Agents as part of the tentative agreement ratified in March 2024 with TWU 555. The Company began accruing for all of its open labor contracts on April 1, 2022.

(b) The Company had not previously included an approximate $84 million adjustment associated with on-going labor contract negotiations during second quarter 2023 as a special item, and provided revised second quarter 2023 results in the Company's third quarter 2023 Form 10-Q. The Company has included the adjustment amount in its calculation of Non-GAAP financial measures for both the second quarter and year-to-date periods ending June 30, 2023. See the Note Regarding Use of Non-GAAP Financial Measures for further information.

(c) Tax amounts for each individual special item are calculated at the Company's effective rate for the applicable period and totaled in this line item.

Southwest Airlines Co.

Comparative Consolidated Operating Statistics

(unaudited)

Relevant comparative operating statistics for the three and six months ended June 30, 2024 and 2023 are included below. The Company provides these operating statistics because they are commonly used in the airline industry and, as such, allow readers to compare the Company’s performance against its results for the prior year period, as well as against the performance of the Company’s peers.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended | | | | Six months ended | | |

| June 30, | | Percent | | June 30, | | Percent |

| | 2024 | | 2023 | | Change | | 2024 | | 2023 | | Change |

| Revenue passengers carried (000s) | 37,509 | | | 35,715 | | | 5.0 | | 70,381 | | | 65,947 | | | 6.7 |

| Enplaned passengers (000s) | 47,267 | | | 44,787 | | | 5.5 | | 88,164 | | | 82,452 | | | 6.9 |

| Revenue passenger miles (RPMs) (in millions) (a) | 38,221 | | | 35,505 | | | 7.6 | | 71,308 | | | 65,052 | | | 9.6 |

| Available seat miles (ASMs) (in millions) (b) | 46,250 | | | 42,579 | | | 8.6 | | 88,497 | | | 80,641 | | | 9.7 |

| Load factor (c) | 82.6 | % | | 83.4 | % | | (0.8) pts. | | 80.6 | % | | 80.7 | % | | (0.1) pts. |

| Average length of passenger haul (miles) | 1,019 | | | 994 | | | 2.5 | | 1,013 | | | 986 | | | 2.7 |

| Average aircraft stage length (miles) | 766 | | | 728 | | | 5.2 | | 760 | | | 722 | | | 5.3 |

| Trips flown | 375,749 | | | 365,089 | | | 2.9 | | 725,728 | | | 699,210 | | | 3.8 |

| Seats flown (000s) (d) | 59,775 | | | 57,904 | | | 3.2 | | 115,469 | | | 110,622 | | | 4.4 |

| Seats per trip (e) | 159.1 | | | 158.6 | | | 0.3 | | 159.1 | | | 158.2 | | | 0.6 |

| Average passenger fare | $ | 178.94 | | | $ | 179.44 | | | (0.3) | | $ | 176.52 | | | $ | 174.60 | | | 1.1 |

| Passenger revenue yield per RPM (cents) (f) | 17.56 | | | 18.05 | | | (2.7) | | 17.42 | | | 17.70 | | | (1.6) |

| RASM (cents) (g) | 15.90 | | | 16.53 | | | (3.8) | | 15.46 | | | 15.80 | | | (2.2) |

| PRASM (cents) (h) | 14.51 | | | 15.05 | | | (3.6) | | 14.04 | | | 14.28 | | | (1.7) |

| CASM (cents) (i) | 15.04 | | | 14.66 | | | 2.6 | | 15.46 | | | 15.17 | | | 1.9 |

| CASM, excluding Fuel and oil expense (cents) | 11.58 | | | 11.37 | | | 1.8 | | 11.92 | | | 11.51 | | | 3.6 |

| CASM, excluding special items (cents) (j) | 15.03 | | | 14.43 | | | 4.2 | | 15.43 | | | 15.05 | | | 2.5 |

| CASM, excluding Fuel and oil expense and special items (cents) (j) | 11.57 | | | 11.14 | | | 3.9 | | 11.89 | | | 11.39 | | | 4.4 |

| CASM, excluding Fuel and oil expense, special items, and profitsharing expense (cents) (j) | 11.50 | | | 10.85 | | | 6.0 | | 11.86 | | | 11.24 | | | 5.5 |

| Fuel costs per gallon, including fuel tax (unhedged) | $ | 2.73 | | | $ | 2.63 | | | 3.8 | | $ | 2.80 | | | $ | 2.93 | | | (4.4) |

| Fuel costs per gallon, including fuel tax | $ | 2.76 | | | $ | 2.60 | | | 6.2 | | $ | 2.84 | | | $ | 2.88 | | | (1.4) |

| Fuel costs per gallon, including fuel tax (economic) | $ | 2.76 | | | $ | 2.60 | | | 6.2 | | $ | 2.84 | | | $ | 2.88 | | | (1.4) |

| Fuel consumed, in gallons (millions) | 577 | | | 538 | | | 7.2 | | 1,101 | | | 1,021 | | | 7.8 |

| Active fulltime equivalent Employees | 74,081 | | | 71,299 | | | 3.9 | | 74,081 | | | 71,299 | | | 3.9 |

| Aircraft at end of period (k) | 817 | | | 803 | | | 1.7 | | 817 | | | 803 | | | 1.7 |

(a) A revenue passenger mile is one paying passenger flown one mile. Also referred to as "traffic," which is a measure of demand for a given period.

(b) An available seat mile is one seat (empty or full) flown one mile. Also referred to as "capacity," which is a measure of the space available to carry passengers in a given period.

(c) Revenue passenger miles divided by available seat miles.

(d) Seats flown is calculated using total number of seats available by aircraft type multiplied by the total trips flown by the same aircraft type during a particular period.

(e) Seats per trip is calculated by dividing seats flown by trips flown.

(f) Calculated as passenger revenue divided by revenue passenger miles. Also referred to as "yield," this is the average cost paid by a paying passenger to fly one mile, which is a measure of revenue production and fares.

(g) RASM (unit revenue) - Operating revenue yield per ASM, calculated as operating revenue divided by available seat miles. Also referred to as "operating unit revenues," this is a measure of operating revenue production based on the total available seat miles flown during a particular period.

(h) PRASM (Passenger unit revenue) - Passenger revenue yield per ASM, calculated as passenger revenue divided by available seat miles. Also referred to as “passenger unit revenues,” this is a measure of passenger revenue production based on the total available seat miles flown during a particular period.

(i) CASM (unit costs) - Operating expenses per ASM, calculated as operating expenses divided by available seat miles. Also referred to as "unit costs" or "cost per available seat mile," this is the average cost to fly an aircraft seat (empty or full) one mile, which is a measure of cost efficiencies.

(j) The Company had not previously included an approximate $84 million adjustment associated with on-going labor contract negotiations during second quarter 2023 as a special item, and provided revised second quarter 2023 results in the Company's third quarter 2023 Form 10-Q. The Company has included the adjustment amount in its calculation of Non-GAAP financial measures for both the second quarter and year-to-date periods ending June 30, 2023. See the Note Regarding Use of Non-GAAP Financial Measures for further information.

(k) Included three Boeing 737 Next Generation aircraft in storage as of June 30, 2023.

Southwest Airlines Co.

Non-GAAP Return on Invested Capital (ROIC)

(See Note Regarding Use of Non-GAAP Financial Measures)

(in millions)

(unaudited)

| | | | | | | | | | |

| Twelve months ended | | | |

| June 30, 2024 | | | |

| Operating loss, as reported | $ | (281) | | | | |

| Professional advisory fees | 7 | | | | |

| TWU 555 contract adjustment | 9 | | | | |

| TWU 556 contract adjustment | 95 | | | | |

| SWAPA contract adjustment | 354 | | | | |

| Net impact from fuel contracts | 16 | | | | |

| DOT settlement | 107 | | | | |

| Litigation settlements | 7 | | | | |

| | | | |

| Operating income, non-GAAP | $ | 314 | | | | |

| Net adjustment for aircraft leases (a) | 127 | | | | |

| Adjusted operating income, non-GAAP (A) | $ | 441 | | | | |

| | | | |

| Non-GAAP tax rate (B) | 23.8 | % | (d) | | |

| | | | |

| Net operating profit after-tax, NOPAT (A* (1-B) = C) | $ | 336 | | | | |

| | | | |

| Debt, including finance leases (b) | $ | 8,008 | | | | |

| | | | |

| | | | |

| Equity (b) | 10,604 | | | | |

| Net present value of aircraft operating leases (b) | 949 | | | | |

| Average invested capital | $ | 19,561 | | | | |

| Equity adjustment for hedge accounting (c) | (61) | | | | |

| Adjusted average invested capital (D) | $ | 19,500 | | | | |

| | | | |

| Non-GAAP ROIC, pre-tax (A/D) | 2.3 | % | | | |

| | | | |

| Non-GAAP ROIC, after-tax (C/D) | 1.7 | % | | | |

(a) Net adjustment related to presumption that all aircraft in fleet are owned (i.e., the impact of eliminating aircraft rent expense and replacing with estimated depreciation expense for those same aircraft). The Company makes this adjustment to enhance comparability to other entities that have different capital structures by utilizing alternative financing decisions.

(b) Calculated as an average of the five most recent quarter end balances or remaining obligations. The Net present value of aircraft operating leases represents the assumption that all aircraft in the Company’s fleet are owned, as it reflects the remaining contractual commitments discounted at the Company's estimated incremental borrowing rate as of the time each individual lease was signed.

(c) The Equity adjustment in the denominator adjusts for the cumulative impacts, in Accumulated other comprehensive income and Retained earnings, of gains and/or losses that will settle in future periods, including those associated with the Company's fuel hedges. The current period impact of these gains and/or losses is reflected in the Net impact from fuel contracts in the numerator.

(d) The GAAP twelve month rolling tax rate as of June 30, 2024, was 41.0 percent, and the Non-GAAP twelve month rolling tax rate was 23.8 percent. See Note Regarding Use of Non-GAAP Financial Measures for additional information.

Southwest Airlines Co.

Condensed Consolidated Balance Sheet

(in millions)

(unaudited)

| | | | | | | | | | | |

| June 30, 2024 | | December 31, 2023 |

| ASSETS | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 8,142 | | | $ | 9,288 | |

| Short-term investments | 1,860 | | | 2,186 | |

| Accounts and other receivables | 1,346 | | | 1,154 | |

| Inventories of parts and supplies, at cost | 784 | | | 807 | |

| Prepaid expenses and other current assets | 619 | | | 520 | |

| Total current assets | 12,751 | | | 13,955 | |

| Property and equipment, at cost: | | | |

| Flight equipment | 26,274 | | | 26,060 | |

| Ground property and equipment | 7,704 | | | 7,460 | |

| Deposits on flight equipment purchase contracts | 466 | | | 236 | |

| Assets constructed for others | 77 | | | 62 | |

| | 34,521 | | | 33,818 | |

| Less allowance for depreciation and amortization | 14,856 | | | 14,443 | |

| | 19,665 | | | 19,375 | |

| Goodwill | 970 | | | 970 | |

| Operating lease right-of-use assets | 1,132 | | | 1,223 | |

| Other assets | 1,045 | | | 964 | |

| | $ | 35,563 | | | $ | 36,487 | |

| LIABILITIES AND STOCKHOLDERS' EQUITY | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 2,028 | | | $ | 1,862 | |

| Accrued liabilities | 1,870 | | | 3,606 | |

| Current operating lease liabilities | 198 | | | 208 | |

| Air traffic liability | 7,086 | | | 6,551 | |

| Current maturities of long-term debt | 2,931 | | | 29 | |

| Total current liabilities | 14,113 | | | 12,256 | |

| | | |

| Long-term debt less current maturities | 5,065 | | | 7,978 | |

| Air traffic liability - noncurrent | 1,990 | | | 1,728 | |

| Deferred income taxes | 2,089 | | | 2,044 | |

| | | |

| Noncurrent operating lease liabilities | 915 | | | 985 | |

| Other noncurrent liabilities | 926 | | | 981 | |

| Stockholders' equity: | | | |

| Common stock | 888 | | | 888 | |

| Capital in excess of par value | 4,151 | | | 4,153 | |

| Retained earnings | 16,218 | | | 16,297 | |

| Accumulated other comprehensive income | 11 | | | — | |

| Treasury stock, at cost | (10,803) | | | (10,823) | |

| Total stockholders' equity | 10,465 | | | 10,515 | |

| $ | 35,563 | | | $ | 36,487 | |

Southwest Airlines Co.

Condensed Consolidated Statement of Cash Flows

(in millions) (unaudited) | | | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended June 30, | | Six months ended June 30, | |

| 2024 | | 2023 | | 2024 | | 2023 | |

| CASH FLOWS FROM OPERATING ACTIVITIES: | | | | | | | | |

| Net income | $ | 367 | | | $ | 683 | | | $ | 137 | | | $ | 524 | | |

| Adjustments to reconcile net loss to cash provided by (used in) operating activities: | | | | | | | | |

| Depreciation and amortization | 404 | | | 367 | | | 812 | | | 731 | | |

| | | | | | | | |

| | | | | | | | |

| Unrealized mark-to-market adjustment on available for sale securities | — | | | — | | | — | | | (4) | | |

| Unrealized/realized loss on fuel derivative instruments | 1 | | | 6 | | | 2 | | | 6 | | |

| Deferred income taxes | 110 | | | 209 | | | 43 | | | 157 | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Changes in certain assets and liabilities: | | | | | | | | |

| Accounts and other receivables | 34 | | | 44 | | | (274) | | | (188) | | |

| Other assets | 32 | | | 58 | | | 18 | | | 109 | | |

| Accounts payable and accrued liabilities | (576) | | | 364 | | | (1,473) | | | 293 | | |

| Air traffic liability | (317) | | | (137) | | | 798 | | | 809 | | |

| Other liabilities | (45) | | | (44) | | | (117) | | | (90) | | |

| Cash collateral provided to derivative counterparties | (20) | | | (16) | | | (20) | | | (46) | | |

| Other, net | (13) | | | (118) | | | (54) | | | (178) | | |

| Net cash provided by (used in) operating activities | (23) | | | 1,416 | | | (128) | | | 2,123 | | |

| | | | | | | | |

| CASH FLOWS FROM INVESTING ACTIVITIES: | | | | | | | | |

| Capital expenditures | (494) | | | (925) | | | (1,077) | | | (1,971) | | |

| | | | | | | | |

| Assets constructed for others | (6) | | | (8) | | | (16) | | | (14) | | |

| | | | | | | | |

| Purchases of short-term investments | (1,532) | | | (1,522) | | | (3,210) | | | (3,727) | | |

| Proceeds from sales of short-term and other investments | 1,820 | | | 1,828 | | | 3,540 | | | 3,508 | | |

| Other, net | 6 | | | — | | | (28) | | | — | | |

| Net cash used in investing activities | (206) | | | (627) | | | (791) | | | (2,204) | | |

| | | | | | | | |

| CASH FLOWS FROM FINANCING ACTIVITIES: | | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Payroll Support Program stock warrants repurchase | (6) | | | — | | | (6) | | | — | | |

| Proceeds from Employee stock plans | 15 | | | 14 | | | 30 | | | 22 | | |

| | | | | | | | |

| | | | | | | | |

| Payments of long-term debt and finance lease obligations | (8) | | | (8) | | | (16) | | | (67) | | |

| | | | | | | | |

| | | | | | | | |

| Payments of cash dividends | — | | | — | | | (215) | | | (214) | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Other, net | 3 | | | 4 | | | (20) | | | 6 | | |

| Net cash provided by (used in) financing activities | 4 | | | 10 | | | (227) | | | (253) | | |

| | | | | | | | |

| NET CHANGE IN CASH AND CASH EQUIVALENTS | (225) | | | 799 | | | (1,146) | | | (334) | | |

| | | | | | | | |

| CASH AND CASH EQUIVALENTS AT BEGINNING OF PERIOD | 8,367 | | | 8,359 | | | 9,288 | | | 9,492 | | |

| | | | | | | | |

| CASH AND CASH EQUIVALENTS AT END OF PERIOD | $ | 8,142 | | | $ | 9,158 | | | $ | 8,142 | | | $ | 9,158 | | |

NOTE REGARDING USE OF NON-GAAP FINANCIAL MEASURES

The Company's unaudited Condensed Consolidated Financial Statements are prepared in accordance with accounting principles generally accepted in the United States ("GAAP"). These GAAP financial statements may include (i) unrealized noncash adjustments and reclassifications, which can be significant, as a result of accounting requirements and elections made under accounting pronouncements relating to derivative instruments and hedging and (ii) other charges and benefits the Company believes are unusual and/or infrequent in nature and thus may make comparisons to its prior or future performance difficult.

As a result, the Company also provides financial information in this release that was not prepared in accordance with GAAP and should not be considered as an alternative to the information prepared in accordance with GAAP. The Company provides supplemental non-GAAP financial information (also referred to as "excluding special items"), including results that it refers to as "economic," which the Company's management utilizes to evaluate its ongoing financial performance and the Company believes provides additional insight to investors as supplemental information to its GAAP results. The non-GAAP measures provided that relate to the Company’s performance on an economic fuel cost basis include Operating expenses, non-GAAP excluding Fuel and oil expense; Operating expenses, non-GAAP excluding Fuel and oil expense and profitsharing; Operating income, non-GAAP; Other gains, net, non-GAAP; Income before income taxes, non-GAAP; Provision for income taxes, net, non-GAAP; Net income, non-GAAP; Net income per share, diluted, non-GAAP; and Operating expenses per ASM, non-GAAP, excluding Fuel and oil expense and profitsharing (cents). The Company's economic Fuel and oil expense results differ from GAAP results in that they only include the actual cash settlements from fuel hedge contracts - all reflected within Fuel and oil expense in the period of settlement. Thus, Fuel and oil expense on an economic basis has historically been utilized by the Company, as well as some of the other airlines that utilize fuel hedging, as it reflects the Company’s actual net cash outlays for fuel during the applicable period, inclusive of settled fuel derivative contracts. Any net premium costs paid related to option contracts that are designated as hedges are reflected as a component of Fuel and oil expense, for both GAAP and non-GAAP (including economic) purposes in the period of contract settlement. The Company believes these economic results provide further insight into the impact of the Company's fuel hedges on its operating performance and liquidity since they exclude the unrealized, noncash adjustments and reclassifications that are recorded in GAAP results in accordance with accounting guidance relating to derivative instruments, and they reflect all cash settlements related to fuel derivative contracts within Fuel and oil expense. This enables the Company's management, as well as investors and analysts, to consistently assess the Company's operating performance on a year-over-year or quarter-over-quarter basis after considering all efforts in place to manage fuel expense. However, because these measures are not determined in accordance with GAAP, such measures are susceptible to varying calculations, and not all companies calculate the measures in the same manner. As a result, the aforementioned measures, as presented, may not be directly comparable to similarly titled measures presented by other companies.

Further information on (i) the Company's fuel hedging program, (ii) the requirements of accounting for derivative instruments, and (iii) the causes of hedge ineffectiveness and/or mark-to-market gains or losses from derivative instruments is included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023.

The Company’s GAAP results in the applicable periods may include other charges or benefits that are also deemed "special items," that the Company believes make its results difficult to compare to prior periods, anticipated future periods, or industry trends. Financial measures identified as non-GAAP (or as excluding special items) have been adjusted to exclude special items. For the periods presented, in addition to the items discussed above, special items include:

1.Accruals associated with the recently ratified Ramp, Operations, Provisioning, and Cargo Agents contract. These amounts accrued in 2024 relate to additional compensation for services performed by Employees outside of this fiscal year;

2.Charges associated with tentative litigation settlements regarding certain California state meal-and-rest-break regulations for flight attendants and an arbitration award in favor of the Company's Pilots relating to a collective-bargaining matter;

3.Unrealized mark-to-market adjustment associated with certain available for sale securities;

4.Incremental expense associated with the recently ratified Pilot and Flight Attendant contracts. The change in estimate recognized in 2023 relates to additional compensation for services performed by Employees outside of the applicable fiscal period;

5.A charge associated with a settlement reached with the Department of Transportation as a result of the Company's December 2022 operational disruption; and

6.Expenses associated with incremental professional advisory fees related to activist investor activities, which were not budgeted by the Company, are not associated with the ongoing operation of the airline, and are difficult to predict in future periods.

Because management believes special items can distort the trends associated with the Company’s ongoing performance as an airline, the Company believes that evaluation of its financial performance can be enhanced by a supplemental presentation of results that exclude the impact of special items in order to enhance consistency and comparativeness with results in prior periods that do not include such items and as a basis for evaluating operating results in future periods. The following measures are often provided, excluding special items, and utilized by the Company’s management, analysts, and investors to enhance comparability of year-over-year results, as well as to industry trends: Operating expenses, non-GAAP excluding Fuel and oil expense; Operating expenses, non-GAAP excluding Fuel and oil expense and profitsharing; Operating income, non-GAAP; Other gains, net, non-GAAP; Income before income taxes, non-GAAP; Provision for income taxes, net, non-GAAP; Net income, non-GAAP; Net income per share, diluted, non-GAAP; and Operating expenses per ASM, non-GAAP, excluding Fuel and oil expense and profitsharing (cents).

The Company has also provided its calculation of return on invested capital, which is a measure of financial performance used by management to evaluate its investment returns on capital. Return on invested capital is not a substitute for financial results as reported in accordance with GAAP and should not be utilized in place of such GAAP results. Although return on invested capital is not a measure defined by GAAP, it is calculated by the Company, in part, using non-GAAP financial measures. Those non-GAAP financial measures are utilized for the same reasons as those noted above for Net income, non-GAAP and Operating income, non-GAAP. The comparable GAAP measures include charges or benefits that are deemed "special items" that the Company believes make its results difficult to compare to prior periods, anticipated future periods, or industry trends, and the Company’s profitability targets and estimates, both internally and externally, are based on non-GAAP results since "special items" cannot be reliably predicted or estimated. The Company believes non-GAAP return on invested capital is a meaningful measure because it quantifies the Company's effectiveness in generating returns relative to the capital it has invested in its business. Although return on invested capital is commonly used as a measure of capital efficiency, definitions of return on invested capital differ; therefore, the Company is providing an explanation of its calculation for non-GAAP return on invested capital in the accompanying reconciliation in order to allow investors to compare and contrast its calculation to the calculations provided by other companies.

The Company has also provided adjusted debt, invested capital, and adjusted debt to invested capital (leverage), which are non-GAAP measures of financial performance. Management believes these supplemental measures can provide a more accurate view of the Company's leverage and risk, since they consider the Company’s debt and debt-like obligation profile and capital. Leverage ratios are widely used by investors, analysts, and rating agencies in the valuation, comparison, rating, and investment recommendations of companies. Although adjusted debt, invested capital, and leverage ratios are commonly-used financial measures, definitions of each differ; therefore, the Company is providing an explanation of its calculations for non-GAAP adjusted debt and adjusted equity in the accompanying reconciliation below in order to allow investors to compare and contrast its calculations to the calculations provided by other companies. Invested capital is adjusted debt plus adjusted equity. Leverage is calculated as adjusted debt divided by invested capital.

| | | | | |

| June 30, 2024 |

| (in millions) | |

| Current maturities of long-term debt, as reported | $ | 2,931 | |

| Long-term debt less current maturities, as reported | 5,065 | |

| Total debt | 7,996 | |

| Add: Net present value of aircraft rentals | 870 | |

| Adjusted debt (A) | $ | 8,866 | |

| |

| Total stockholders' equity, as reported | $ | 10,465 | |

| Deduct: Accumulated other comprehensive income, as reported | 11 | |

| Deduct: Cumulative retained earnings impact of unrealized gains (losses) associated with ineffective fuel hedge derivatives | (3) | |

| Adjusted equity (B) | $ | 10,457 | |

| |

| Invested capital (A+B) | $ | 19,323 | |

| |

| Leverage: Adjusted debt to invested capital (A/(A+B)) | 46 | % |

SOUTHWEST AIRLINES LAUNCHES ENHANCEMENTS TO TRANSFORM CUSTOMER EXPERIENCE AND IMPROVE FINANCIAL PERFORMANCE • Decides to assign seats and offer premium seating options to meet evolving Customer preferences and increase revenue opportunities • Introduces redeye flights for sale to further optimize the network and increase aircraft utilization • Dedicates Southwest Officer Ryan Green to lead new efforts as Executive Vice President Commercial Transformation DALLAS—July 25, 2024— As the next step in a continuing strategic transformation, Southwest Airlines Co. (NYSE: LUV) (the “Company”) is announcing several new initiatives designed to elevate the Customer experience, improve financial performance, and drive Shareholder value. As part of its ongoing focus on product evolution, the airline is moving forward with plans to assign seats, offer premium seating options, redesign the boarding model, and introduce redeye flying. Southwest continually reviews Customer expectations. During its quarterly financial results in April, the airline shared that it was studying product preferences and expectations, including onboard seating. In addition to meeting Customer demand, the new amenities are expected to produce additional revenue and strengthen financial performance. Southwest will provide more details on its comprehensive plan to deliver transformational commercial initiatives, improved operational efficiency and capital allocation discipline during its Investor Day in late September. Assigned and Premium Seating After listening carefully to Customers and conducting extensive research, Southwest decided it will assign seats and offer premium seating options on all flights. The airline has been known for its unique open seating model for more than 50 years, but preferences have evolved with more Customers taking longer flights where a seat assignment is preferred. Additionally, News Release

2 Southwest conducted robust operational testing that included live and over 8 million simulation-based boarding trials. The airline is confident that these Customer enhancements will meet expectations and not compromise the airline’s operational efficiency. The research is clear and indicates that 80% of Southwest Customers, and 86% of potential Customers, prefer an assigned seat. When a Customer elects to stop flying with Southwest and chooses a competitor, open seating is cited as the number one reason for the change. By moving to an assigned seating model, Southwest expects to broaden its appeal and attract more flying from its current and future Customers. In addition to assigning seats, Southwest will offer a premium, extended legroom portion of the cabin that research shows many Customers strongly prefer. While specific cabin layout details are still in design, Southwest expects roughly one-third of seats across the fleet to offer extended legroom, in line with that offered by industry peers on narrowbody aircraft. The decision to update the seating and boarding model is part of Southwest’s ongoing modernization efforts. During the past two years, Southwest has enhanced its onboard offerings with improvements such as faster WiFi, in-seat power, and larger overhead bins. Work is well underway on a refreshed cabin design, including new, more comfortable RECARO seats. The addition of assigned and premium seating will give Customers more choice and is expected to further enhance the all-in value Southwest Airlines is known for. “Moving to assigned seating and offering premium legroom options will be a transformational change that cuts across almost all aspects of the Company,” said Bob Jordan, President, CEO, & Vice Chairman of the Board. “Although our unique open seating model has been a part of Southwest Airlines since our inception, our thoughtful and extensive research makes it clear this is the right choice— at the right time—for our Customers, our People, and our Shareholders. We are excited to incorporate Customer and Employee feedback to design a unique experience that only Southwest can deliver. We have been building purposefully to this change as part of a comprehensive upgrade to the Southwest experience as we focus on