Key Points

- Achieved Commercial revenues of £85.3 million with a reduced

summer tour relative to last year

- The men’s first team participated in the revised format of

the UEFA Europa League, contributing to Broadcasting revenue for

the quarter of £31.3 million

- Matchday revenues remain resilient at £26.5 million, with 3

fewer fixtures relative to last year offset by strong Hospitality

and Matchday VIP revenues

- Club announced a new global sponsorship with Heineken until

June 2028, with Tiger Beer as the Official Beer Partner of

Manchester United and renewed global sponsorships with DHL, Hong

Kong Jockey Club and Konami during the quarter

- For Fiscal 2025, the company reiterates its prior guidance

of total revenues of £650 million to £670 million and adjusted

EBITDA of £145 million to £160 million

Manchester United (NYSE: MANU; the “Company” and the “Group”)

today announced financial results for the 2025 fiscal first quarter

ended 30 September 2024.

Management Commentary

Omar Berrada, Chief Executive Officer, commented, “The season is

now well underway for both our men’s and women’s team, and we are

keen to ensure both are as competitive as possible. We are

delighted to have appointed Ruben Amorim as head coach of our men’s

team and remain committed to returning Manchester United to the top

of domestic and European football. Our cost and headcount

reductions remain on track, and we are pleased to have seen further

commercial traction, and welcome new partner Heineken, through

their Tiger brand. Our renovation of the Carrington Training Centre

is progressing well, while the Old Trafford Regeneration Task Force

continues its work. Once it has delivered its recommendations, we

will then take some time to digest them and evaluate all our

options in the upcoming year.”

Outlook

For fiscal 2025, the Company reiterates its full year revenue

guidance of £650 million to £670 million and adjusted EBITDA

guidance of £145 million to £160 million. The club remains

committed to, and in compliance with, both the Premier League’s

Profit and Sustainability Rules and UEFA’s Financial Fair Play

Regulations.

Phasing of Premier League games

Quarter 1

Quarter 2

Quarter 3

Quarter 4

Total

2024/25 season

6

13

10

9

38

2023/24 season

7

13

9

9

38

2022/23 season

6

10

10

12

38

Key Financials

(unaudited)

£ million (except earnings/(loss) per

share)

Three months ended

30 September

2024

2023

Change

Commercial revenue

85.3

90.4

(5.6%)

Broadcasting revenue

31.3

39.3

(20.4%)

Matchday revenue

26.5

27.4

(3.3%)

Total revenue

143.1

157.1

(8.9%)

Adjusted EBITDA(1)

23.7

23.3

1.7%

Operating (loss)/profit

(6.9)

1.9

(463.2%)

Profit/(loss) for the period (i.e. net

profit/(loss)) (3)

1.4

(25.8)

105.4%

Basic earnings/(loss) per share

(pence)

0.78

(15.79)

104.9%

Adjusted loss for the period (i.e.

adjusted net loss)(1)

(0.3)

(8.6)

96.5%

Adjusted basic loss per share

(pence)(1)

(0.21)

(5.27)

96.0%

Non-current borrowings in USD (contractual

currency) (2)

$650.0

$650.0

0.0%

(1) Adjusted EBITDA, adjusted loss for the

period and adjusted basic loss per share are non-IFRS measures. See

“Non-IFRS Measures: Definitions and Use” on page 6 and the

accompanying Supplemental Notes for the definitions and

reconciliations for these non-IFRS measures and the reasons we

believe these measures provide useful information to investors

regarding the Group’s financial condition and results of

operations.

(2) In addition to non-current borrowings,

the Group maintains a revolving credit facility which varies based

on seasonal flow of funds. The outstanding balance of the revolving

credit facility as of 30 September 2024 was £230.0 million and

total current borrowings including accrued interest payable was

£232.3 million.

(3) Profit attributable primarily to

foreign exchange gains on unhedged US dollar borrowings as a result

of favourable movements in the USD/GBP exchange rates, from 1.2643

at 30 June 2024, to 1.3412 at 30 September 2024; the majority of

this gain is expected to be reversed during the second quarter of

Fiscal 2025.

Revenue Analysis

Commercial

Commercial revenue for the quarter was £85.3 million, a decrease

of £5.1 million, or 5.6%, over the prior year quarter.

- Sponsorship revenue was £51.8 million, a decrease of £4.4

million, or 7.8%, over the prior year quarter due to changes in

sponsorship agreements and the men’s first team playing 3 fewer

matches on their pre-season tour compared to the prior year

quarter.

- Retail, Merchandising, Apparel & Product Licensing revenue

was £33.5 million, a decrease of £0.7 million, or 2.0%, over the

prior year quarter.

Broadcasting

Broadcasting revenue for the quarter was £31.3 million, a

decrease of £8.0 million, or 20.4%, over the prior year quarter,

primarily due to our men’s first team participating in the UEFA

Europa League compared to the UEFA Champions League in the prior

year quarter.

Matchday

Matchday revenue for the quarter was £26.5 million, a decrease

of £0.9 million, or 3.3%, over the prior year quarter.

Other Financial

Information

Operating expenses

Total operating expenses for the quarter were £185.6 million, an

increase of £0.9 million, or 0.5%, over the prior year quarter.

This increase is explained by category below.

Employee benefit expenses

Employee benefit expenses for the quarter were £80.2 million, a

decrease of £10.1 million, or 11.2%, over the prior year quarter,

primarily due to changes in the make-up of the first team playing

squad.

Other operating expenses

Other operating expenses for the quarter were £39.2 million, a

decrease of £4.3 million, or 9.9%, over the prior year quarter.

This is primarily due to reduced costs associated with the men’s

first team’s pre-season tour in the current year quarter.

Depreciation and amortization

Depreciation for the quarter was £4.3 million, an increase of

£0.2 million, or 4.9%, over the prior year quarter. Amortization

for the quarter was £53.3 million, an increase of £6.5 million, or

13.9%, over the prior year quarter, due to investment in the first

team playing squad and transactions made in the Summer transfer

window. The unamortized balance of registrations at 30 September

2024 was £559.3 million, compared to £539.9 million at 30 September

2023.

Exceptional items

Exceptional items for the quarter were a cost of £8.6 million.

This comprises costs incurred in relation to the restructuring of

the Group’s operations, including the redundancy scheme implemented

in the first quarter of financial year 2025. Exceptional items in

the prior year quarter were £nil.

Profit on disposal of intangible assets

Profit on disposal of intangible assets for the quarter, namely

player sales was £35.6 million, an increase of £6.1 million, or

20.7%, from £29.5 million in the prior year quarter.

Net finance income/(costs)

Net finance income for the quarter was £8.6 million, compared to

net finance costs of £34.7 million in the prior year quarter. This

is primarily due to a favorable swing in foreign exchange rates

resulting in unrealized foreign exchange gains on unhedged USD

borrowings.

Income tax

The income tax expense for the quarter was £0.3 million,

compared to an income tax credit of £7.0 million in the prior year

quarter.

Cash flows

Overall cash and cash equivalents (including the effects of

exchange rate movements) increased by £76.0 million in the quarter

to 30 September 2024 compared to the cash position at 30 June

2024.

Net cash inflow from operating activities for the quarter was

£13.3 million, compared to net cash inflow of £21.5 million in the

prior year quarter.

Net capital expenditure on property, plant and equipment for the

quarter was £10.3 million, an increase of £1.2 million over the

prior year quarter, primarily due to expenditure relating to the

redevelopment of our Carrington Training Centre.

Net capital expenditure on intangible assets for the quarter was

£120.2 million, an increase of £13.7 million over the prior year

quarter, due to increased investment in the first team playing

squad.

Net cash inflow from financing activities for the quarter was

£199.9 million, compared to a net cash inflow of £99.8m in the

prior year quarter. This is due to a drawdown of £200.0 million on

our revolving facilities in the current year quarter compared to a

drawdown of £100.0 million in the prior year quarter.

Balance sheet

Our USD non-current borrowings as of 30 September 2024 were $650

million, which was unchanged from 30 September 2023. As a result of

the year-on-year change in the USD/GBP exchange rate from 1.2208 at

30 September 2023 to 1.3412 at 30 September 2024, our non-current

borrowings when converted to GBP were £481.7 million, compared to

£528.8 million at the prior year quarter.

In addition to non-current borrowings, the Group maintains a

revolving credit facility which varies based on seasonal flow of

funds. Current borrowings at 30 September 2024 were £232.3 million

compared to £204.4 million at 30 September 2023.

As of 30 September 2024, cash and cash equivalents were £149.6

million compared to £80.8 million at the prior year quarter.

About Manchester United

Manchester United is one of the most popular and successful

sports teams in the world, playing one of the most popular

spectator sports on Earth. Through our 147-year football heritage

we have won 69 trophies, enabling us to develop what we believe is

one of the world’s leading sports and entertainment brands with a

global community of 1.1 billion fans and followers. Our large,

passionate and highly engaged fan base provides Manchester United

with a worldwide platform to generate significant revenue from

multiple sources, including sponsorship, merchandising, product

licensing, broadcasting and matchday initiatives which in turn,

directly fund our ability to continuously reinvest in the club.

Cautionary Statements

This press release contains forward-looking statements. You

should not place undue reliance on such statements because they are

subject to numerous risks and uncertainties relating to the

Company’s operations and business environment, all of which are

difficult to predict and many are beyond the Company’s control.

These statements often include words such as “may,” “might,”

“will,” “could,” “would,” “should,” “expect,” “plan,” “anticipate,”

“intend,” “seek,” “believe,” “estimate,” “predict,” “potential,”

“continue,” “contemplate,” “possible” or similar expressions. The

forward-looking statements contained in this press release are

based on our current expectations and estimates of future events

and trends, which affect or may affect our businesses and

operations. You should understand that these statements are not

guarantees of performance or results. They involve known and

unknown risks, uncertainties and assumptions. Although the Company

believes that these forward-looking statements are based on

reasonable assumptions, you should be aware that many factors could

affect its actual financial results or results of operations and

could cause actual results to differ materially from those in these

forward-looking statements. These factors are more fully discussed

in the “Risk Factors” section and elsewhere in the Company’s

Registration Statement on Form F-1, as amended (File No.

333-182535) and the Company’s Annual Report on Form 20-F (File No.

001-35627) as supplemented by the risk factors contained in the

Company’s other filings with the Securities and Exchange

Commission.

Non-IFRS Measures: Definitions and

Use

1. Adjusted EBITDA

Adjusted EBITDA is defined as profit/(loss) for the period

before depreciation, amortization, profit on disposal of intangible

assets, net finance income/costs, exceptional items and tax.

Adjusted EBITDA is useful as a measure of comparative operating

performance from period to period and among companies as it is

reflective of changes in pricing decisions, cost controls and other

factors that affect operating performance, and it removes the

effect of our asset base (primarily depreciation and amortization),

material volatile items (primarily profit on disposal of intangible

assets and exceptional items), capital structure (primarily finance

income/costs), and items outside the control of our management

(primarily taxes). Adjusted EBITDA has limitations as an analytical

tool, and you should not consider it in isolation, or as a

substitute for an analysis of our results as reported under IFRS as

issued by the IASB. A reconciliation of profit/(loss) for the

period to adjusted EBITDA is presented in supplemental note 2.

2. Adjusted loss for the period (i.e.

adjusted net loss)

Adjusted loss for the period is calculated, where appropriate,

by adjusting for foreign exchange losses/gains on unhedged US

dollar denominated borrowings (including foreign exchange

gains/losses immediately reclassified from the hedging reserve

following change in contract currency denomination of future

revenues), and fair value movements on embedded foreign exchange

derivatives, subtracting/adding the actual tax credit/expense for

the period, and adding the adjusted tax credit for the period

(based on an normalized tax rate of 25%; 2023: 21%). The normalized

tax rate of 25% is the current UK corporation tax rate (2023: US

federal corporate income tax rate of 21%).

In assessing the comparative performance of the business, in

order to get a clearer view of the underlying financial performance

of the business, it is useful to strip out the distorting effects

of the items referred to above and then to apply a ‘normalized’ tax

rate (for both the current and prior periods) of the UK corporation

tax rate of 25% (2023: US federal corporate income tax rate of 21%

) applicable during the financial year. A reconciliation of

profit/(loss) for the period to adjusted loss/profit for the period

is presented in supplemental note 3.

3. Adjusted basic and diluted loss per

share

Adjusted basic and diluted loss per share are calculated by

dividing the adjusted loss for the period by the weighted average

number of ordinary shares in issue during the period. Adjusted

diluted loss per share is calculated by adjusting the weighted

average number of ordinary shares in issue during the period to

assume conversion of all dilutive potential ordinary shares. There

is one category of dilutive potential ordinary shares: share awards

pursuant to the 2012 Equity Incentive Plan (the “Equity Plan”).

Share awards pursuant to the Equity Plan are assumed to have been

converted into ordinary shares at the beginning of the financial

year. Adjusted basic and diluted loss per share are presented in

supplemental note 3.

Key Performance

Indicators

Three months ended

30 September

2024

2023

Revenue

Commercial % of total revenue

59.6%

57.5%

Broadcasting % of total revenue

21.9%

25.0%

Matchday % of total revenue

18.5%

17.5%

2024/25

Season

2023/24

Season

Home Matches Played

PL

3

4

UEFA competitions

1

-

Domestic Cups

1

1

Away Matches Played

PL

3

3

UEFA competitions

-

1

Domestic Cups

-

-

Other

Employee benefit expenses % of revenue

56.0%

57.5%

CONSOLIDATED STATEMENT OF

PROFIT OR LOSS

(unaudited; in £ thousands,

except per share and shares outstanding data)

Three months ended

30 September

2024

2023

Revenue from contracts with

customers

143,065

157,096

Operating expenses

(185,585

)

(184,762

)

Profit on disposal of intangible

assets

35,552

29,481

Operating (loss)/profit

(6,968

)

1,815

Finance costs

(19,776

)

(34,968

)

Finance income

28,372

349

Net finance income/(costs)

8,596

(34,619

)

Profit/(loss) before income tax

1,628

(32,804

)

Income tax (expense)/credit

(299

)

7,047

Profit/(loss) for the period

1,329

(25,757

)

Basic and diluted earnings/(loss) per

share:

Basic and diluted earnings/(loss) per

share (pence) (1) (2)

0.78

(15.79

)

Weighted average number of ordinary shares

used as the denominator in calculating basic and diluted

earnings/(loss) per share (thousands) (1) (2)

169,318

163,159

(1) For the three months ended 30

September 2023, potential ordinary shares are anti-dilutive, as

their inclusion in the diluted loss per share calculation would

reduce the loss per share, and hence have been excluded.

(2) For the three months ended 30

September 2024, potential ordinary shares are dilutive as their

inclusion reduces the earnings per share, however this dilution

does not have an impact upon rounding the earnings per share to two

decimal places.

CONSOLIDATED BALANCE

SHEET

(unaudited; in £

thousands)

As of

30 September

2024

30 June

2024

30 September

2023

ASSETS

Non-current assets

Property, plant and equipment

265,432

256,118

256,961

Right-of-use assets

7,912

8,195

8,417

Investment properties

19,643

19,713

19,923

Intangible assets

987,674

837,564

966,766

Deferred tax asset

16,848

17,607

6,244

Trade receivables

59,512

27,930

45,014

Derivative financial instruments

101

380

190

1,357,122

1,167,507

1,303,515

Current assets

Inventories

12,441

3,543

5,046

Prepayments

36,555

18,759

36,418

Contract assets – accrued revenue

45,759

39,778

47,343

Trade receivables

39,355

36,999

28,920

Other receivables

2,162

2,735

11,677

Derivative financial instruments

11

1,917

6,646

Cash and cash equivalents

149,558

73,549

80,829

285,841

177,280

216,879

Total assets

1,642,963

1,344,787

1,520,394

CONSOLIDATED BALANCE SHEET

(continued)

(unaudited; in £

thousands)

As of

30 September

2024

30 June

2024

30 September

2023

EQUITY AND LIABILITIES

Equity

Share capital

55

55

53

Share premium

227,361

227,361

68,822

Treasury shares

(21,305

)

(21,305

)

(21,305

)

Merger reserve

249,030

249,030

249,030

Hedging reserve

583

(1,000

)

(2,947

)

Retained deficit

(307,545

)

(309,251

)

(221,669

)

148,179

144,890

71,984

Non-current liabilities

Deferred tax liabilities

-

-

-

Contract liabilities - deferred

revenue

7,269

5,347

7,816

Trade and other payables

210,555

175,894

203,853

Borrowings

481,714

511,047

528,787

Lease liabilities

8,227

7,707

7,766

Derivative financial instruments

3,192

4,911

850

Provisions

-

-

95

710,957

704,906

749,167

Current liabilities

Contract liabilities - deferred

revenue

224,842

198,628

214,666

Trade and other payables

309,542

249,030

267,728

Income tax liabilities

914

427

684

Borrowings

232,317

35,574

204,380

Lease liabilities

446

934

971

Derivative financial instruments

7,890

2,603

499

Provisions

7,876

7,795

10,315

783,827

494,991

699,243

Total equity and liabilities

1,642,963

1,344,787

1,520,394

CONSOLIDATED STATEMENT OF CASH

FLOWS

(unaudited; in £

thousands)

Three months ended

30 September

2024

2023

Cash flow from operating

activities

Cash generated from operations (see

supplemental note 4)

23,208

25,871

Interest paid

(11,370

)

(10,574

)

Interest received

1,060

349

Tax refunded

419

5,817

Net cash inflow from operating

activities

13,317

21,463

Cash flow from investing

activities

Payments for property, plant and

equipment

(10,299

)

(9,029

)

Payments for intangible assets

(153,740

)

(132,213

)

Proceeds from sale of intangible

assets

33,568

25,669

Net cash outflow from investing

activities

(130,471

)

(115,573

)

Cash flow from financing

activities

Proceeds from borrowings

200,000

100,000

Principal elements of lease payments

(128

)

(200

)

Net cash inflow from financing

activities

199,872

99,800

Effect of exchange rate changes on cash

and cash equivalents

(6,709

)

(880

)

Net increase in cash and cash

equivalents

76,009

4,810

Cash and cash equivalents at beginning of

period

73,549

76,019

Cash and cash equivalents at end of

period

149,558

80,829

SUPPLEMENTAL NOTES

1 General information

Manchester United plc (the “Company”) and its subsidiaries

(together the “Group”) is a men’s and women’s professional football

club together with related and ancillary activities. The Company

incorporated under the Companies Law (as amended) of the Cayman

Islands.

2 Reconciliation of profit/(loss) for the period to adjusted

EBITDA

Three months ended

30 September

2024

£’000

2023

£’000

Profit/(loss) for the period

1,329

(25,757

)

Adjustments:

Income tax expense/(credit)

299

(7,047

)

Net finance (income)/costs

(8,596

)

34,619

Profit on disposal of intangible

assets

(35,552

)

(29,481

)

Amortization

53,270

46,845

Depreciation

4,256

4,102

Exceptional items

8,638

-

Adjusted EBITDA

23,644

23,281

3 Reconciliation of profit/(loss) for the period to adjusted

loss for the period and adjusted basic and diluted loss per

share

Three months ended

30 September

2024

£’000

2023

£’000

Profit/(loss) for the period

1,329

(25,757

)

Exceptional items

8,638

-

Foreign exchange (gains)/losses on

unhedged US dollar denominated borrowings

(16,684

)

13,753

Fair value movement on embedded foreign

exchange derivatives

5,952

8,163

Income tax expense/(credit)

299

(7,047

)

Adjusted loss before income tax

(466

)

(10,888

)

Adjusted income tax credit (using a

normalized tax rate of 25% (2023: 21%))

117

2,286

Adjusted loss for the period (i.e.

adjusted net loss)

(349

)

(8,602

)

Adjusted basic and diluted loss per

share:

Adjusted basic and diluted loss per share

(pence)(1)

(0.21

)

(5.27

)

Weighted average number of ordinary shares

used as the denominator in calculating basic and diluted loss per

share (thousands) (1)

169,318

163,159

(1) For the three months ended 30

September 2024 and the three months ended 30 September 2023

potential ordinary shares are anti-dilutive, as their inclusion in

the diluted loss per share calculation would reduce the loss per

share, and hence have been excluded.

4 Cash generated from operations

Three months ended

30 September

2024

£’000

2023

£’000

Profit/(loss) for the period

1,329

(25,757

)

Income tax expense/(credit)

299

(7,047

)

Profit/(loss) before income tax

1,628

(32,804

)

Adjustments for:

Depreciation

4,256

4,102

Amortization

53,270

46,845

Profit on disposal of intangible

assets

(35,552

)

(29,481

)

Net finance (income)/costs

(8,596

)

34,619

Non-cash employee benefit expense -

equity-settled share-based payments

376

740

Foreign exchange gains on operating

activities

(714

)

(142

)

Reclassified from hedging reserve

2,759

(252

)

Changes in working capital:

Inventories

(8,898

)

(1,881

)

Prepayments

(18,098

)

(20,119

)

Contract assets – accrued revenue

(5,981

)

(4,011

)

Trade receivables

(14,230

)

(5,245

)

Other receivables

573

(1,749

)

Contract liabilities – deferred

revenue

28,136

46,199

Trade and other payables

24,306

(8,237

)

Provisions

(27

)

(2,713

)

Cash generated from operations

23,208

25,871

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241122260124/en/

Investors: Corinna Freedman Head of Investor Relations

Corinna.Freedman@manutd.co.uk

Media: Toby Craig Chief Communications Officer

Toby.Craig@manutd.co.uk

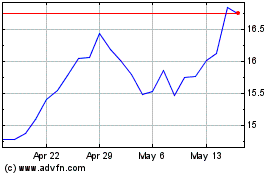

Manchester United (NYSE:MANU)

Historical Stock Chart

From Feb 2025 to Mar 2025

Manchester United (NYSE:MANU)

Historical Stock Chart

From Mar 2024 to Mar 2025