MetLife, Inc. (NYSE: MET) today announced that John McCallion,

executive vice president and chief financial officer, MetLife,

Inc., and head of MetLife Investment Management, has provided a

third quarter 2024 financial update video.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20241030606174/en/

The video can be viewed on the company's website at

https://www.metlife.com/about-us/newsroom/#video.

About MetLife MetLife, Inc. (NYSE:

MET), through its subsidiaries and affiliates (“MetLife”), is one

of the world’s leading financial services companies, providing

insurance, annuities, employee benefits and asset management to

help individual and institutional customers build a more confident

future. Founded in 1868, MetLife has operations in more than 40

markets globally and holds leading positions in the United States,

Asia, Latin America, Europe and the Middle East. For more

information, visit www.metlife.com.

Forward-Looking Statements This

news release may contain or incorporate by reference information

that includes or is based upon forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995. Forward-looking statements give expectations or forecasts of

future events and do not relate strictly to historical or current

facts. They use words and terms such as “driving,” “enables,”

“executing,” “generating,” “growth,” “maintaining,” “momentum,”

“ongoing,” and “target,” and other words and terms of similar

meaning, or that are otherwise tied to future periods or future

performance, in each case in all derivative forms. They include

statements relating to future actions, prospective services or

products, future performance or results of current and anticipated

services or products, future sales efforts, future expenses, the

outcome of contingencies such as legal proceedings, and future

trends in operations and financial results.

Many factors determine the results of MetLife, Inc., its

subsidiaries and affiliates, and they involve unpredictable risks

and uncertainties. Our forward-looking statements depend on our

assumptions, our expectations, and our understanding of the

economic environment, but they may be inaccurate and may change.

MetLife, Inc. does not guarantee any future performance. Our

results could differ materially from those MetLife, Inc. expresses

or implies in forward-looking statements. The risks, uncertainties

and other factors identified in MetLife, Inc.’s filings with the

U.S. Securities and Exchange Commission, and others, may cause such

differences. These factors include:

(1)

economic condition difficulties, including

risks relating to interest rates, credit spreads, declining equity

or debt markets, real estate, obligors and counterparties,

government default, currency exchange rates, derivatives, climate

change, public health and terrorism and security;

(2)

global capital and credit market

adversity;

(3)

credit facility inaccessibility;

(4)

financial strength or credit ratings

downgrades;

(5)

unavailability, unaffordability, or

inadequate reinsurance, including reinsurance risks that arise from

reinsurers’ credit risk, and the potential shortfall or failure of

risk mitigants to protect against such risks;

(6)

statutory life insurance reserve financing

costs or limited market capacity;

(7)

legal, regulatory, and supervisory and

enforcement policy changes;

(8)

changes in tax rates, tax laws or

interpretations;

(9)

litigation and regulatory

investigations;

(10)

unsuccessful efforts to meet all

environmental, social, and governance standards or to enhance our

sustainability;

(11)

MetLife, Inc.’s inability to pay dividends

and repurchase common stock;

(12)

MetLife, Inc.’s subsidiaries’ inability to

pay dividends to MetLife, Inc.;

(13)

investment defaults, downgrades, or

volatility;

(14)

investment sales or lending

difficulties;

(15)

collateral or derivative-related

payments;

(16)

investment valuations, allowances or

impairments changes;

(17)

claims or other results that differ from

our estimates, assumptions, or models;

(18)

global political, legal, or operational

risks;

(19)

business competition;

(20)

technological changes;

(21)

catastrophes;

(22)

climate changes or responses to it;

(23)

deficiencies in our closed block;

(24)

goodwill or other asset impairment, or

deferred income tax asset allowance;

(25)

impairment of value of business acquired,

value of distribution agreements acquired or value of customer

relationships acquired;

(26)

product guarantee volatility, costs, and

counterparty risks;

(27)

risk management failures;

(28)

insufficient protection from operational

risks;

(29)

failure to protect confidentiality and

integrity of data or other cybersecurity or disaster recovery

failures;

(30)

accounting standards changes;

(31)

excessive risk-taking;

(32)

marketing and distribution

difficulties;

(33)

pension and other postretirement benefit

assumption changes;

(34)

inability to protect our intellectual

property or avoid infringement claims;

(35)

acquisition, integration, growth,

disposition, or reorganization difficulties;

(36)

Brighthouse Financial, Inc. separation

risks;

(37)

MetLife, Inc.’s Board of Directors

influence over the outcome of stockholder votes through the voting

provisions of the MetLife Policyholder Trust; and

(38)

legal- and corporate governance-related

effects on business combinations.

MetLife, Inc. does not undertake any obligation to publicly

correct or update any forward-looking statement if MetLife, Inc.

later becomes aware that such statement is not likely to be

achieved. Please consult any further disclosures MetLife, Inc.

makes on related subjects in subsequent reports to the U.S.

Securities and Exchange Commission.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241030606174/en/

For Media: Dave Franecki 973-264-7465

Dave.Franecki@metlife.com

For Investors: John Hall 212-578-7888

John.A.Hall@metlife.com

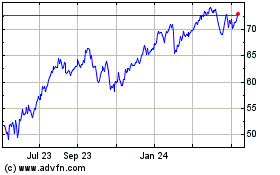

MetLife (NYSE:MET)

Historical Stock Chart

From Nov 2024 to Dec 2024

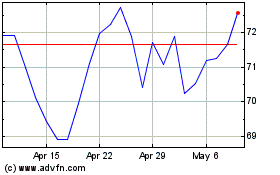

MetLife (NYSE:MET)

Historical Stock Chart

From Dec 2023 to Dec 2024