UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy

Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No.

)

Filed by the

Registrant x

Filed by a Party other than the

Registrant ¨

Check the appropriate box:

| ¨ |

Preliminary Proxy Statement |

| ¨ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ¨ |

Definitive Proxy Statement |

| x |

Definitive Additional Materials |

| ¨ |

Soliciting Material under §240.14a-12 |

MGM

Resorts International

(Name of

Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| |

(1) |

Title of each class of securities to which transaction applies: |

| |

(2) |

Aggregate number of securities to which transaction applies: |

| |

(3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it

was determined): |

| |

(4) |

Proposed maximum aggregate value of transaction: |

| ¨ |

Fee paid previously with preliminary materials. |

| ¨ |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration

statement number, or the Form or Schedule and the date of its filing. |

| |

(1) |

Amount Previously Paid: |

| |

(2) |

Form, Schedule or Registration Statement No.: |

Investor Presentation

April 2015

OVERVIEW

M

MGM has delivered above industry average returns and is well positioned for continued growth

MGM has a history of value?generating strategic initiatives and delivering on commitments to drive strong

performance

The MGM Board has the right balance of independence, experience and

necessary skills to oversee ongoing execution of the Company’s strategy and continue to drive sustainable value

The Directors targeted all bring vital and unique skills that

greatly contribute to the oversight of our complex and diverse global operations

The proposed Board changes reflect a lack of understanding of the importance of diversity that has

strengthened the Company and added value for shareholders

Land & Buildings’ nominees are tied to a proposal that has

a narrow, short?term focus and makes numerous financial,

structural and tax assumptions that appear unsupported or are factually incorrect, which calls into question their credibility

Evercore has been added as an independent advisor to MGM’s

team of existing advisors

MGM has and will continue to actively evaluate strategic options

for the Company that drive value for shareholders

Protect your Investment in MGM –

vote for the nominees who have been and will continue 2 to serve your interests

I. HISTORICAL PERFORMANCE

TRACK RECORD OF DRIVING STRONG

PERFORMANCE AND DELIVERING SUPERIOR VALUE

MGM outperformed gaming peers and the Dow Jones US Gaming Index

on a one and three year basis

Total Shareholder Returns

Company 1 Year 3 Year 5 Year

DJ U.S. Gaming Index(18.8%) 54.1% 148.0%

Gaming Peers Median Returns (1)(17.7%) 59.5% 147.8%

MGM Resorts International(9.1%) 105.0% 134.4%

Note: Total Shareholder Returns for the trailing period ended December 31

(1)

Gaming Peers include: LVS, WYNN, BYD, PENN (inclusive of GLPI), CZR and PNK

4

STRONG OPERATING PERFORMANCE

Strong operating performance in net revenues and Adjusted Property EBITDA

Historical Net Revenue & Adjusted Property EBITDA (Consolidated)

$9,810 $10,082

$9,161

2012 2013 2014

Net Revenue ($ millions)

$2,469

,

24.5%

24.0%

$1,998

21.8%

2012 2013 2014

Adjusted Property EBITDA ($ millions) Adjusted Property EBITDA Margin

Source: Company filings

5

TRACK RECORD OF DRIVING STRONG

PERFORMANCE IN THE U.S.

Last year, MGM’s U.S. operations produced the highest level of Adjusted Property EBITDA in six years

and wholly owned domestic resorts achieved double digit Adjusted Property EBITDA growth over the last five years

U.S. (Wholly Owned) Historical Net Revenue & Adjusted Property EBITDA

$6,342

$1,518

$6,053 $1,443

$5,933

$5,893 $1,298 $1,325 23.9%

23.8%

$1,165

$5,634 22.3%

22.0%

20.7%

2010 2011 2012 2013 2014 2010 2011 2012 2013

2014

Net Revenue ($ millions) Adjusted Property EBITDA ($ millions)

Adjusted Property EBITDA Margin

U.S. (WHOLLY OWNED) CAGR

1 Year 3 Year 5 Year

Net Revenue 4.8% 2.5% 1.5%

Adjusted Property EBITDA 5.2% 5.4% 2.5%

U.S. (WHOLLY OWNED) Total Growth

1 Year 3 Year 5 Year

Net Revenue 4.8% 7.6% 7.9%

Adjusted Property EBITDA 5.2% 17.0% 13.0%

Source: Company filings

6

MGM CHINA CONSISTENTLY DELIVERS SUPERIOR

VALUE

MGM China achieved record Adjusted EBITDA in 2014 and has grown

Adjusted EBITDA at a CAGR of over 40% in the last five years

MGM China has paid $2.2 billion in dividends since its IPO in 2011 of which MGM Resorts has

received over $1 billion, representing its 51% share

MGM

China Historical Net Revenue & Adjusted EBITDA

$3,317 $3,283 $850

$814

$2,808

$2,606 $679

$630

25.

$1,571 24.5%

$358 24.2% 24.2%

22.8%

2010 2011 2012 2013 2014 2010 2011 2012 2013 2014

Net Revenue ($ millions) Adjusted EBITDA ($ millions)

Adjusted EBITDA Margin

MGM China

CAGR

1 Year 3 Year 5 Year

Net Revenue(1.0%) 8.0% 27.4%

Adjusted EBITDA 4.5% 10.5% 41.6%

MGM China Total Growth

1 Year 3 Year 5 Year

Net Revenue(1.0%) 26.0% 235.3%

Adjusted EBITDA 4.5% 35.1% 469.1%

Source: Company filings

7

IMPROVED BALANCE SHEET

Significantly de?levered balance sheet since the financial crisis

Corporate credit ratings were upgraded three levels by Moody’s and

S&P to B2/B+ Cost of long?term bond issuances decreased from 11.9% in 2009 to 6% in 2014

Maintained financial flexibility to invest in strategic growth initiatives Executing further opportunities to de?leverage the balance sheet:

? Regular dividend policy at MGM China and CityCenter

? $1.45 billion convert matured April 15, 2015

? Continued free cash flow growth

Source: Company filings

8

STRONG PORTFOLIO OF ASSETS WITH DIVERSE

GEOGRAPHIC REVENUE MIX

Leading gaming, entertainment and hospitality company with globally

recognized brands Strong geographic diversity with a continued focus on expansion in key markets

Net Revenue Contribution by Region(1)

12%

Las Vegas

34% 54%

Macau

U.S.

Regional

Geographic diversification strategy has benefitted MGM through various market cycles

Source: Company filings

(1) For the 12?month period December 31, 2014; Excludes management & other revenues

9

LAS VEGAS GROWTH: ROWTH: INVESTING IN THE FUTURE

Las Vegas continues its record rate of expansion as evidenced by McCarran passengers

at highest levels since 2008, driven by increased air capacity:

?

Record visits of 41 million in 2014, up 4% y?o?y

?

Occupancy highest since 2008 while room inventory remains flat

?

ADR +5% y?o?y representing five consecutive years of growth

Investing in the future of MGM in Las Vegas with:

?

Mandalay Bay ?room remodel and 350,000 square feet of convention space expansion

? AEG/MGM Arena – 20,000 seat world?class arena opening Spring 2016

? Park & entertainment district adjoining Monte Carlo and New York?New York and leading up to the arena

Las Vegas Trends

39 40 40 41

37

149 150 150 151 151

2010 2011 2012 2013 2014

Room Inventory (000’s) Visitor Volume (millions)

$117

$108 $111

$105

$95

87.4% 87.1% 89.1%

86.9%

83.5%

2010 2011 2012 2013 2014

ADR Occupancy

Source: Las Vegas Convention and Visitors Authority

10

MGM CHINA

As a leading global gaming operator, our presence in the

world’s largest gaming market is an integral component of our strategy

Macau operations facilitate our global marketing initiatives which are critical to the performance of our

domestic properties, as evidenced by significant growth in Las Vegas Baccarat play

Moreover, our success in Macau and ongoing commitment to the market provide an important

competitive advantage as we pursue other global development opportunities

2014 Gross Gaming Revenue (1)

($ in billions)

$44.0

$6.4

Las Vegas Strip Macau

Macau gaming market is nearly 7x the size of Las Vegas

Las Vegas Strip Gross Gaming Revenue Mix

2006 2014

Baccarat

12%

Baccarat

23%

Slots Slots

51% 46%

Non Baccarat

table Non Baccarat

37% table

31%

Baccarat has grown from 12% to 23% of Las Vegas Strip

gross gaming revenue from 2006 to 2014

Source: DICJ and Nevada Gaming Control Board

(1) Macau market

GGR assumed to be converted based on a 7.75 HKD to 1.00 USD exchange ratio

11

MGM CHINA

MGM China has been a significant contributor to MGM Resorts

consolidated financial results and is poised for future growth

?

In 2014, MGM China represented 34% of Adjusted EBITDA on a consolidated basis and 21% of Adjusted EBITDA on a pro rata basis

? Cotai development positions MGM for substantial future growth

??The addition of 1,500 rooms will quadruple MGM China’s room

count in Macau

$814 $850

$630 $679

$358

2010 2011 2012 2013 2014

Adjusted EBITDA Margin 23% 24% 24% 25% 26%

MGM has received more than $1bn in dividends from MGM China since 2011 which has supported deleveraging

Note: $ in millions.

12

THE LONG TERM MACAU STORY

Mainland China penetration remains low

?

Macau Mass market represents 0.2% of China GDP, which is half of U.S. Mass % of GDP(1)

? China’s urban population’s visits to Macau annually ~2% vs ~10% U.S. visitors to Las Vegas(1)

Infrastructure projects

? Hong Kong?Zhuhai?Macau Bridge

?

China high?speed rail network build out

?

Light rail system within Macau

Potential travel policy reform in Mainland China

Extended border gate hours and increased room supply favorable to

demand and length of visitation Development of Hengqin

Source: DSEC

(1) Morgan Stanley

13

PURSUING OPPORTUNITIES IN NEW GEOGRAPHIES

MGM Cotai (opening Fall 2016)

MGM National Harbor (opening second half 2016)

MGM Springfield (opening second half 2017) Actively pursuing Japan and South Korea markets

14

HISTORY OF VALUE GENERATING STRATEGIC INITIATIVES AND DISCIPLINED USE OF CAPITAL

Board thoughtfully allocated capital by strategically enhancing existing

properties, including:

? New rooms at Bellagio and the MGM Grand

? Delano at Mandalay Bay

? New restaurants at The Mirage and Aria

New streetscape at New York?New York and Monte Carlo, among many

others

Board also supported trend setting capital?light strategies such as

partnerships that have led to the development of:

?

Hakkasan at MGM Grand

? Rock in Rio festival grounds

? Las Vegas Arena with AEG, is set to debut in Spring 2016

15

MGM HOSPITALITY

Diaoyutai

MGM, the Company’s hospitality affiliate in China, continues to make great progress

Best year ever at MGM Grand Sanya

Opened the Diaoyutai Boutique Chengdu

Topped off the Bellagio Shanghai

Signed an agreement to build a Bellagio in Beijing

In 2014, created MGM Hakkasan with the Hakkasan

Group, forming a hotel management company focused on providing non gaming hotel resorts and residential offerings

in key international cities around the world

16

II. LAND & BUILDINGS’ PROPOSAL IS SERIOUSLY

FLAWED

LAND & BUILDINGS’ PROPOSAL IS SERIOUSLY

FLAWED

Land & Buildings’ proposal makes numerous financial, structural and

tax assumptions that appear

unsupported or factually incorrect, leading to a questionable value

proposition as presented

Major challenging assumptions include, but are not limited to:

Unsubstantiated cash flow assumptions that drive Land & Buildings’

value creation proposition

Inconsistent and overlapping use of both net lease and lodging REIT

structures

Significant leveraging and untenable special distribution by MGM China

Unaddressed and oversimplified assessment of financial , structural and

tax issues associated with a

REIT conversion, asset sales and MGM China dividend

A narrow, short

term focus which fails to consider the complexities of operating and growing a global

gaming company to maximize long

term shareholder value, including a complex regulatory framework with which MGM’s

Board has a great deal of experience

18

WALL STREET SKEPTICAL OF LAND & BUILDINGS

PROPOSAL

“MGM Doesn’t Need To Be a REIT to Sell Assets and De

lever: MGM’s “While we believe shares are undervalued, we see the consummation of

regional properties were available for sale for some time but unable to a transaction of this nature

as a

low probability. We note that on our find buyers, and while

the market may be better now, the ability for

estimates, we believe shares are worth only a bit less than

the $33

MGM to sell assets and reduce debt is not related to a

REIT structure, assumption here for the split. Accordingly, given

the numerous . assumptions that underline the split math, we simply

don’t see REIT Case Not Actually Driven by REIT

Factors: Difference between meaningful equity value stemming from the

actual transaction itself, “upside” case of $55

and “base” case of $33/share includes $10 from a that

couldn’t otherwise be accomplished via execution in a strong

LV potential Japan project,

which we see as not only unlikely, but also Strip environment.” unrelated to whether MGM has REIT structure or not.” – Deutsche Bank

– UBS

“Our concern with a Las Vegas REIT is the complexity it would add to the reinvestment process

on the Strip, which has

been the underlying fundamental story for MGM. Further, fixed rent

leases on assets that are very cyclical, correlated to

consumer spending and offer no geographic diversity all appear contrary

to the typical REIT structure favoring more

stable income streams. Further, the re

risking of MGM China with incremental leverage ahead of a concession review in 2020 could be viewed unfavorably.

We also find it unlikely MGM would make such a destabilizing

move at such a critical point in its Cotai .

– Union Gaming

19

III. STRONG CORPORATE GOVERNANCE

MGM’S CURRENT EXPERIENCED AND DIVERSE BOARD

WILL CONTINUE TO DELIVER SUSTAINABLE VALUE

Strong, independent Board comprised of a diverse group of experienced directors who are deeply familiar with

MGM’s

businesses, are highly qualified to lead the Company in executing

its strategic plans and are focused on serving the

interests of all shareholders Board’s diversity has proven to be

an effective and powerful tool in implementing

the Company’s long

term strategy and short term milestones

Board has been critical to guiding the Company through challenging circumstances and setting the course for

sustainable profit growth

Gaming/ Public

C-Suite/ Real Government/

Shareholder New Since

Director Resort/ Finance Company

Leadership Estate Policy Representative 2010

Lodging Directorship

Robert Baldwin William Bible

Mary Chris Gay William Grounds Alexis Herman

Anthony Mandekic Rose McKinney-James James Murren Gregory

Spierkel Daniel Taylor

Board change at MGM is not warranted and could be damaging to

Board’s unified strength and complementary skills based construct

Source: Company filings

21

REPLACING FOUR DIRECTORS WOULD UNDERMINE

BOARD’S DIVERSITY AND EFFECTIVENESS

The MGM Board has the right balance of independence, experience and necessary skills to oversee ongoing

execution

of the Company’s strategy and continue to drive sustainable

value

The Directors targeted all bring vital and unique skills that

greatly contribute to the oversight of our complex and

diverse global operations

The proposed Board changes reflect a lack of understanding of the importance of diversity that has

strengthened the

Company and added value for shareholders given the markets we

operate in

Land & Buildings’ nominees are tied to a proposal that has

a narrow, short term focus and makes numerous financial, structural and tax assumptions that appear unsupported or are factually

incorrect, which calls into question the credibility of their nominees

22

EFFECTIVE BALANCE OF STRONG LEADERSHIP AND

NEW PERSPECTIVES

Principal Occupation/Other Directorships Director Qualifications

Robert H. Baldwin (64)

Director since 2000

Leadership experience—former Chief Executive Officer of Bellagio, LLC

and of Mirage Resorts,

Chief Design and Construction Officer of the Company since August

2007. President of Project CC,

Incorporated, and current President and Chief Executive Officer of the

CityCenter joint venture

LLC, the managing member of CityCenter

Holdings, LLC, since March 2005, and President and Chief

managing entity

Executive Officer of Project CC, LLC since August 2007. Previously named Chief Financial Officer of

Mirage Resorts, Incorporated in 1999 through 2000. Then served as

President and Chief Executive

Finance experience—former Chief Financial Officer of Mirage Resorts,

Incorporated

Officer of Mirage Resorts, Incorporated from June 2000 to August

2007. President and Chief

Executive Officer of Bellagio, LLC or its predecessor from June

1996 to March 2005.

Industry experience—has held Chief Executive Officer and various other

leadership positions in

entities involved in the gaming and resort industry for many years

William A. Bible (70)

Director since 2010

Leadership experience—former chairman of Nevada gaming regulatory body

for 10 years; former

President of the Nevada Resort Association from 1999 to March 2010,

prior to joining the

President of a gaming and resort industry advocacy group

Company’s Board. Director of the Las Vegas Monorail Company from

2007 to 2008. Chairman of

the Nevada State Gaming Control Board from 1988 to 1998. Various

positions as a state official

Finance experience—former state official overseeing financial matters

overseeing financial matters from 1971 to 1988, including, after 1983,

Director of Administration

and Chief of the Budget Division (State Budget Director). Member,

National Gambling Impact

Industry experience—former President of a gaming and resort industry

advocacy group

Study Commission from June 1997 to June 1999. Former management

trustee of a number of

trusts.

Government experience—former chairman of Nevada gaming regulatory body

for 10 years;

various positions within the Nevada state government overseeing financial

matters

Diverse Board has proven to be effective and we believe will

continue to create upside

23

EFFECTIVE BALANCE OF STRONG LEADERSHIP AND

NEW PERSPECTIVES (CONT’D…)

Principal Occupation/Other Directorships Director Qualifications

Mary Chris Gay (47)47)

Director since 2014

Served as Senior Vice President, portfolio manager and equity analyst

focused on research in the Leadership experience—former Senior Vice President of one of the largest international asset

gaming and lodging industries at Legg Mason Global Asset Management,

an international asset management firms

management firm, from 1989 until her planned departure in 2013.

Since then, served as

consultant and advisor to start

up companies in early stage financings. Industry experience—served as an equity analyst researching the gaming and lodging industries

Finance experience—served as Senior Vice President of an asset

management firm responsible for,

among other things, assessing the performance of companies and

evaluating their financial

statements

William W. Grounds (59)59)

Director since 2013

Director, President and Chief Operating Officer of Infinity World

Development Corp, a private Leadership experience—President and Chief Operating Officer of Infinity World Development

investment entity which owns half of CityCenter, since November 2009,

having joined Infinity Corp.; senior level

executive at multiple real estate and development companies

World in April 2008. Member of CityCenter

Board of Directors since December 2009. Before

joining Infinity World, held various senior executive positions in the

real estate investment and Industry experience—Officer of investment entity that owns half of CityCenter; senior level

development industries, including General Manager at Unlisted Funds of

Investa Property Group executive at multiple real estate and development companies responsible for, among other things,

Ltd. from April 2002 to May 2007 and CEO of Property and

Finance at MFS Ltd. from June 2007 to developing mixed

use real estate projects

March 2008. Board Member of Lend Lease Property Services and Civil & Civic from 1997 to 1998.

Board member of Grand Avenue L.A. LLC, a mixed use real estate

development joint venture with Finance experience—former Chief Executive Officer of Property and Finance at MFS Ltd., and

The Related Companies. Director and member of the Audit Committee,

Compensation Committee General Manager at

Unlisted Funds, both real estate investment management firms

and Nominating & Governance Committee of Remark Media Inc. (MARK)

since October 2013.

Public company directorship experience—director and board committee member

of a global

digital media company

24

EFFECTIVE BALANCE OF STRONG LEADERSHIP AND

NEW PERSPECTIVES (CONT’D…)

Alexis M. Herman (67)67)

Director since 2002

Chair and Chief Executive Officer of New Ventures LLC, a corporate

consulting company, since 2001. Lead Leadership

experience—Chief Executive Officer of a consulting firm; former United

States Secretary of

Director, Chair of the Governance and Nominating Committee, and member

of the Audit Committee, Labor; member of

the board of trustees of a civil rights organization

Compensation Committee, and Executive Committee of Cummins Inc. Director

and member of the

Personnel Committee and Chair of the Corporate Governance Committee of

Entergy Corp. Director and Finance

experience—member of the audit committee of a public company that

designs, manufactures,

member of the Compensation Committee and Public Issues and Diversity

Review Committee of The Coca sells and services diesel engines and related technology around the world

Cola Company. Serves as Chair of the Diversity & Inclusion Business Advisory Board of Sodexo, Inc.

and as

Chair of Toyota Motor Corporation’s North American Diversity Advisory

Board. United States Secretary of Government

experience—former United States Secretary of Labor

Labor from 1997 to 2001. Member of the Board of Trustees of

the National Urban League, a civil rights

organization.

Public company directorship experience—director and member of various board committees of several

public companies; member of advisory boards to public companies

Roland Hernandez (57)57)

Director since 2002

Director, officer or partner and owner of minority interests in privately held companies engaged in real

Leadership

experience—former Chairman and Chief Executive Officer of a Spanish

language television

estate, investment, media and security services for more than the

past five years. Chairman of the Board broadcast

network; chairman of a hotel and adventure travel company

of Directors of Belmond Ltd. (formerly Orient

Express Hotels Ltd.). Lead Director, Chair of the Nominating

& Governance Committee, and member of the Audit Committee of

Vail Resorts, Inc. Director of US Finance

experience—audit committee member of a large bank and audit

committee member of a

Bancorp (USB) and member of the Audit Committee and the Community

Reinvestment and Public Policy mountain

resort company; formerly chairman of the audit committee of an

international retail company

Committee. Director and member of the Nominating Committee of Sony

Corporation from 2008 to June and former

member of the audit committee and finance committee of a real

estate/home construction

2013. Director of The Ryland Group, Inc., a real estate/home

construction company, from 2001 to April company

2012. Director and member of the Finance Committee of Lehman

Brothers Holdings Inc. from 2005 to

March 2012. Director and Chairman of the Audit Committee of Wal

Mart Stores, Inc. from 1998 to June Industry experience—director of a mountain resort company; chairman of a hotel and adventure

travel

2008. Formerly Chairman and Chief Executive Officer of Telemundo

Group, Inc. company

Public company directorship experience—director and board committee member

of several public

companies in the recreation, finance and real estate industries

25

EFFECTIVE BALANCE OF STRONG LEADERSHIP AND

NEW PERSPECTIVES (CONT’D…)

Anthony Mandekic (73)

Director since 2006

Chief Executive Officer and President of Tracinda, a privately held

investment firm, since June 15, 2012. Finance

experience—over 30 years of experience as Treasurer of Tracinda

Secretary and Treasurer of Tracinda

since 1976. Director of Delta Petroleum Corporation from May 2009 to

. ,

President, Vice President and Director of the Stars Desert Inn,

which operated the former Desert Inn resort,

from 1991 to 1993.

Public company directorship experience—former director and board committee of a public oil and gas

company

Leadership experience—chief executive officer of Tracinda

Rose McKinney James (63)63)

Director since 2005

Managing Principal of Energy Works Consulting LLC and McKinney James

& Associates, providing consulting

Leadership experience—former President and CEO of a not for

profit corporation focused on solar and

services regarding public affairs in the areas of energy, education,

and environmental policy, in each case renewable

energy technologies; former leader of two Nevada state government agencies

for more than the past five years. Director of Marketing and

External Affairs of Nevada State Bank Public

Finance since 2007. Member of the Audit Committee and chair of

the CRA Committee of Toyota Financial Finance

experience—finance committee member of a company that provides

workers’ compensation

Savings Bank. Former Director and Chair of the Board Governance and

Nominating Committee and insurance and

services to small businesses; member of audit committee of Toyota

Financial Savings Bank

member of the Finance Committee of Employers Holdings, Inc. from

2005 to June 2013. Serves on the

board of directors of MGM Grand Detroit, LLC. Chairman of the

Board of Directors of Nevada Partners and Industry

experience—former director of Mandalay Resort Group prior to its

acquisition by the Company

a former director of The Energy Foundation. Formerly the President

and Chief Executive Officer of the

Corporation for Solar Technologies and Renewable Resources for five

years. Former Commissioner with the

Government experience—former leader of two Nevada state government agencies

Nevada Public Service Commission and former Director of the Nevada

Department of Business and

Industry.

Public company directorship experience—former director and board committee member of a company

that provides workers’ compensation insurance and services to small businesses

26

EFFECTIVE BALANCE OF STRONG LEADERSHIP AND

NEW PERSPECTIVES (CONT’D…)

James J. Murren (53)53)

Director since 1998

Chairman and Chief Executive Officer of the Company since December

2008. President from December

Leadership experience—Chairman and Chief Executive Officer of the

Company; has held key executive

1999 to December 2012. Chief Operating Officer from August 2007

through December 2008. Prior to that, positions

with the Company for over 10 years; co

founder, former director and board committee member

2007. Chairman of the American Gaming Association. Director of the

Nevada Cancer Institute from 2002 to

2012. Director of Delta Petroleum Corporation from February 2008 to

November 2011. Prior to joining the Finance

experience—former Chief Financial Officer and Treasurer of the Company;

served as Managing

Company, worked in the financial industry for over 10 years,

serving as Managing Director and Co Director Director and Co

Director of Research for Deutsche Morgan Grenfell and Director of Research and Managing

of Research for Deutsche Morgan Grenfell and Director of Research and Managing Director for Deutsche

Director for

Deutsche Bank

Bank. Serves on the Board of Trustees of the Brookings Institute.

Industry experience—involved in the Las Vegas hotel and casino industry for over 10 years; director of

a

gaming and resort industry advocacy group

Public company directorship experience—former director and board committee

member of a public oil and

gas company

Gregory M. Spierkel (58)58)

Director since 2013

Joined Ingram Micro Inc., a worldwide distributor of technology

products, in 1997 as Senior Vice President Leadership

experience—former Chief Executive Officer of a public worldwide

distributor of technology

and President of Ingram Micro Asia Pacific, before being named

Executive Vice President and President of products

Ingram Micro Europe and later President of Ingram Micro Inc. in

2004. Then served as Chief Executive

Officer and Director of Ingram Micro Inc. from 2005 until his

departure in 2012. Since then, consultant and Finance

experience—serves on the audit committee of a truck manufacturer

and technology company

advisor to private equity firms investing in the IT sector.

Director, Chair of the Compensation Committee

and member of the Audit Committee of PACCAR Inc., a truck

manufacturer and technology company, since Public

company directorship experience—former director of a public worldwide

distributor of technology

2008. Director of Schneider Electric SE since October 2014 and

member of the Audit Committee and products, current

director of a truck manufacturer and technology company, and current

director of a

Strategy Committee. Member of the Advisory Board at The Merage

School of Business at the University of global energy company

California, Irvine.

27

EFFECTIVE BALANCE OF STRONG LEADERSHIP AND

NEW PERSPECTIVES (CONT’D…)

Daniel J. Taylor (58)

Director since 2007

Employed as an executive of Tracinda since 2007. Non

Executive Chairman of the Board of Directors of Leadership experience—Chairman of the Board of a manufacturer and distributor of LED

lighting products;

Light Efficient Design, a division of TADD LLC since July 2014,

a manufacturer and distributor of LED lighting

former President of a motion picture, television, home video, and

theatrical production and distribution

, . .

April 2005 to January 2006 and Senior Executive Vice President and

Chief Financial Officer of MGM Studios

from June 1998 to April 2005. Vice President –

Taxes at MGM/UA Communications Co., the predecessor Finance experience—former Chief Financial Officer of a motion picture, television, home video,

and

company of MGM Studios, from 1985 to 1991. Tax Manager specializing

in the entertainment and gaming theatrical

production and distribution company; former Vice President –

Taxes of a motion picture,

practice at Arthur Andersen & Co. from 1978 to 1985. Director

of Inforte Corp. from October 2005 to 2007. television, home video, and theatrical production and distribution company; former

tax manager at a

Chairman of the Board of Directors of Delta Petroleum Corporation from May 2009 to August 2012 (and

a public

accounting firm

director from February 2008 to August 2012), and a former member of the Audit Committee and

Nominating and Corporate Governance Committee of such company.

Industry experience—former Tax Manager specializing in the entertainment and gaming practice at Arthur

Andersen & Co.

Public company directorship experience—former director and board committee

member of a public oil and

gas company; former director of a management consulting company

28

BOARD HIGHLY FOCUSED ON GOOD CORPORATE

GOVERNANCE THAT ENHANCES SHAREHOLDER RIGHTS

Received favorable ISS governance and executive compensation scores in 2014

Significantly overhauled Board to bring fresh perspectives, including adding

four new directors in the past five years Adopted a majority voting standard for the election of directors

Eight of our 11 directors are independent Three are representatives of MGM’s shareholders (Tracinda

~16% has two seats, Infinity World ~5% has one seat) Annually elected directors

Shareholder ability to call special meetings or act by written consent

Say on pay consistently supported by shareholders (in excess of 95%

annually)

Regularly evaluates corporate governance to ensure alignment with best

practices and priorities expressed by shareholders

29

IV. RIGHT IGHT BOARD, RIGHT STRATEGY

MGM HAS THE RIGHT BOARD TO CONTINUE

GENERATING SUBSTANTIAL VALUE FOR ITS SHAREHOLDERS

Last five years the Board has driven significant growth

The Board and management have positioned the Company for success with development opportunities and

investment in existing resorts

Further room for balance sheet improvement

Existing Board has performed and will continue to do so

31

Cautionary Statement Concerning Forward Looking Statements: Statements in this presentation that are not historical facts are forward looking statements, within the meaning of the Private

Securities Litigation Reform Act of 1995 and involve risks and/or uncertainties, including those described in the Company’s public filings with the Securities and Exchange Commission. The Company has based forward looking statements on

management’s current expectations and assumptions and not on historical facts. Examples of these statements include, but are not limited to, statements regarding strategic transactions the Company may pursue in the future and the timing of the

Company’s development projects. Among the important factors that could cause actual results to differ

other destination travel locations throughout the United States and the world, the design, timing and costs of expansion

projects, risks relating to international operations, permits, licenses, financings, approvals and other contingencies in connection with growth in new or existing jurisdictions and additional risks and uncertainties described in the Company’s

Form 10 K, Form 10 Qand Form 8 K reports (including all amendments to those reports). In providing forward looking statements, the Company is not undertaking any duty or obligation to update these statements publicly as a result of new information,

future events or otherwise, except as required by law. If the Company updates one or more forward looking statements, no inference should be drawn that it will make additional updates with respect to other forward looking statements.

Important Additional Information: MGM has filed aproxy statement on Schedule 14A and other relevant documentswith the

Securities and Exchange Commission (“SEC”) in connection with the solicitation of proxies for its 2015 Annual Meeting of Stockholders or any adjournment or postponement thereof (the “2015 Annual Meeting”) and has mailed the

definitive proxy statement and a WHITE proxy card to each stockholder of record entitled to vote at the 2015 Annual Meeting. STOCKHOLDERS ARE STRONGLY ADVISED TO READ MGM’s 2015 PROXY STATEMENT (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO)

AND ANY OTHER DOCUMENTS FILED WITH THE SEC WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Stockholders may obtain a free copy of the 2015 proxy statement, any amendments or supplements to the proxy statement and other

documents that MGM files with the SEC from the SEC’s website at www.sec.gov or MGM’s website at http://mgmresorts.investorroom.com/ as soon as reasonably practicable after such materials are electronically filed with, or furnished to, the

SEC.

Participants in Solicitation: MGM, its directors, its executive officers and its nominees for election as

director may be deemed participants in the solicitation of proxies from stockholders in connection with the matters to be considered at the 2015 Annual Meeting. Information regarding the persons who may, under the rules of the SEC, be considered

participants in the solicitation of MGM’s stockholders in connection with the 2015 Annual Meeting, and their direct or indirect interests, by security holdings or otherwise, which may be different from those of MGM’s stockholders

generally, are set forth in MGM’s definitive proxy statement for the 2015 Annual Meeting on Schedule 14A that has been filed with the SEC and the other relevant documents filed with the SEC.

Use of Non GAAP Financial Measures: The financial information included in this presentation includes non GAAP financial

measures. The Company’s management uses non GAAP financial measures to evaluate the Company’s performance and provides them to investors as a supplement to the Company’s reported results, as they believe this information provides

additional insight into the Company’s operating performance by disregarding certain non recurring items. Reconciliations can be found in the financial schedules accompanying the Company’s earnings releases.

32

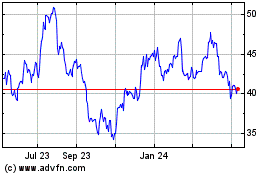

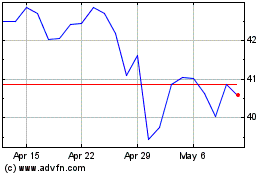

MGM Resorts (NYSE:MGM)

Historical Stock Chart

From Oct 2024 to Nov 2024

MGM Resorts (NYSE:MGM)

Historical Stock Chart

From Nov 2023 to Nov 2024