Form SD - Specialized disclosure report

26 September 2024 - 6:02AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM SD

Specialized Disclosure Report

| | | | | | | | |

| | |

| Magnolia Oil & Gas Corporation |

| (Exact name of registrant as specified in its charter) |

| | |

| Delaware | 001-38083 | 81-5365682 |

(State or other jurisdiction

of incorporation) | (Commission

File Number) | (I.R.S. Employer

Identification Number) |

| | |

| Nine Greenway Plaza, Suite 1300 Houston, Texas 77046 | |

| (Address of principal executive offices, including zip code) |

| | |

| Timothy D. Yang, (713) 842-9050 | |

| (name and telephone number, including area code, of the person to contact in connection with this report.) |

Check the appropriate box to indicate the rule pursuant to which this form is being filed:

☐ Rule 13p-1 under the Securities Exchange Act (17 CFR 240.13p-1) for the reporting period from January 1 to December 31, .

☒ Rule 13q-1 under the Securities Exchange Act (17 CFR 240.13q-1) for the fiscal year ended December 31, 2023.

Section 1 — Conflict Minerals Disclosure

Item 1.01 Conflict Minerals Disclosure and Report

Not applicable.

Item 1.02 Exhibit

Not applicable.

Section 2 — Resource Extraction Issuer Disclosure

Item 2.01 Resource Extraction Issuer Disclosure and Report

Disclosure of Payments by Resource Extraction Issuer

The specified payment disclosure required by Form SD is included in Exhibit 99.1 to this Form SD.

Section 3 — Exhibits

Item 3.01 Exhibits

The following exhibit is filed as part of this report.

| | | | | |

| |

| Exhibit | |

| Number | Description |

| 99.1 | |

| |

| 104 | Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL document (included as Exhibit 101) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | |

| |

| MAGNOLIA OIL & GAS CORPORATION |

| |

| |

Date: September 25, 2024 | By: /s/ Timothy D. Yang |

| Name: Timothy D. Yang |

| Title: Executive Vice President,

General Counsel, Corporate Secretary and Land |

Exhibit 99.1

Disclosure of Payment by Resource Extraction Issuer

| | | | | | | | |

| The type and total amount of such payments, by payment type listed in paragraph (d)(9)(iii) of Item 2.01 of Form SD, made for each project of the resource extraction issuer relating to the commercial development of oil, natural gas, or minerals: | | Project: Eagle Ford Shale, Texas •Taxes - $34.2 million |

| | |

| The type and total amount of such payments, by payment type listed in paragraph (d)(9)(iii) of Item 2.01 of Form SD, for all projects made to each government: | | See above for amount of payments; all payments were made to the U.S. federal government as specified below. |

| | |

| The total amounts of the payments, by payment type listed in paragraph (d)(9)(iii) of Item 2.01 of Form SD: | | See above. |

| | |

| The currency used to make the payments: | | USD |

| | |

| The fiscal year in which the payments were made: | | December 31, 2023 |

| | |

| The business segment of the resource extraction issuer that made the payments: | | Upstream segment |

| | |

| The governments (including any foreign government or the Federal Government) that received the payments and the country in which each such government is located: | | Internal Revenue Service, Department of the Treasury of the United States of America |

| | |

| The project of the resource extraction issuer to which the payments relate: | | Eagle Ford Shale, Texas |

| | |

| The particular resource that is the subject of commercial development: | | Oil and natural gas |

| | |

| The method of extraction used in the project: | | Wells |

| | |

| The major subnational political jurisdiction of the project: | | Texas |

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe three character ISO 4217 code for the currency used for reporting purposes. Example: 'USD'.

| Name: |

dei_EntityReportingCurrencyISOCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:currencyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

v3.24.3

Payments, by Category - USD ($)

$ in Millions |

Taxes |

Total Payments |

| Total |

$ 34.2

|

$ 34.2

|

v3.24.3

| X |

- Details

| Name: |

rxp_ProjectAxis=mgy_EagleFordShaleTexasMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_CountryAxis=country_US |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

rxp_GovernmentAxis=mgy_InternalRevenueServiceDepartmentOfTheTreasuryMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

v3.24.3

Payments, Details - USD ($)

|

Amount |

Type |

Country |

Subnat. Juris. |

Govt. |

Project |

Resource |

Segment |

Ext. Method |

| #: 1 |

|

|

|

|

|

|

|

|

|

|

$ 34,200,000

|

Taxes

|

UNITED STATES

|

snj:US-TX

|

Internal Revenue Service Department of the Treasury [Member]

|

Eagle Ford Shale Texas [Member]

|

Oil And Natural Gas [Member]

|

Upstream [Member]

|

Well

|

| X |

- Details

| Name: |

rxp_PmtAxis=1 |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

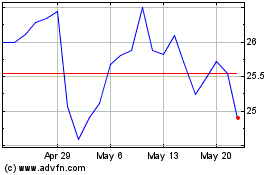

Magnolia Oil and Gas (NYSE:MGY)

Historical Stock Chart

From Dec 2024 to Jan 2025

Magnolia Oil and Gas (NYSE:MGY)

Historical Stock Chart

From Jan 2024 to Jan 2025