Mohawk Industries, Inc. Announces Earnings Guidance Adjustment

28 September 2005 - 7:11AM

PR Newswire (US)

CALHOUN, Ga., Sept. 27 /PRNewswire-FirstCall/ -- Mohawk Industries,

Inc. (NYSE:MHK) today announced an adjustment to its earnings

forecast for the third quarter of 2005 due to the impact of

Hurricane Katrina on raw materials and energy costs. Katrina has

severely disrupted the petrochemical industry causing significant

cost increases in carpet raw materials and possible supply

disruptions. These cost increases reflect higher oil prices and

shortages of refining capacity raising chemical costs used in our

raw materials. At this point, these chemicals have not stabilized

and may continue to escalate in price. Additionally, energy costs

have increased substantially in the third quarter with natural gas

going up more than 50%. Internal and external transportation cost

increases have not been fully recovered in our prices and

surcharges. We expect raw material costs and chemical supply

disruptions to stabilize. However, to mitigate these increases,

Mohawk has announced a price increase on October 3rd for its carpet

products of 5% to 8% and higher freight charges. We are also

increasing our ceramic and other hard surface product prices to

recover higher gas and transportation costs. Due to our accelerated

change in cost, the Company is implementing the price increases

more quickly than in the past. The Company is concerned that

Katrina and rising energy costs will have a short-term negative

effect on consumer confidence and the overall economy. Our product

mix has shifted to offset some of the rising costs. As a result of

all these factors, we are adjusting our third quarter forecast to

range from $1.60 to $1.63 diluted earnings per share (EPS) and our

fourth quarter EPS forecast is $1.49 to $1.58. The impact, if any,

of Hurricane Rita on the Company's fourth quarter results has not

been included in this forecast. Mohawk stands ready to support

areas impacted by these storms by participating in the rebuilding

effort. The replacement of damaged homes and buildings in the Gulf

Coast region should increase industry shipments in the future.

Also, August 2005 existing home sales were 7.2 million on an

annualized basis, representing the second highest month on record.

Next year we believe the economy should continue to grow and

employment expand. We believe our industry has long-term strength

and will continue to grow. Mohawk is well positioned as a full

service flooring company to grow in the industry. The Company

expects to incur one-time non-cash purchase accounting adjustments

which will be determined after closing the Unilin acquisition.

Before these adjustments, the Unilin acquisition is not anticipated

to have a significant impact on the fourth quarter and is estimated

to be accretive in 2006. After closing in the fourth quarter, the

Company will permanently finance the Unilin acquisition with 100%

debt using a combination of prepayable debt and term debt. This

will improve the return to our shareholders while maintaining

financial flexibility using the Company's strong cash flow to pay

down debt. The acquisition of Unilin represents a major step in

diversifying to a total flooring company. Unilin is the only fully

integrated U.S. laminate producer and a leader in product

innovation. In addition, their superior European management will

provide the support necessary to participate in the worldwide

laminate market. Certain of the statements in the immediately

preceding paragraphs, particularly anticipating future performance,

business prospects, growth and operating strategies, proposed

acquisitions, and similar matters, and those that include the words

"believes," "anticipates," "forecasts," "estimates," or similar

expressions constitute "forward-looking statements." For those

statements, Mohawk claims the protection of the safe harbor for

forward- looking statements contained in the Private Securities

Litigation Reform Act of 1995. There can be no assurance that the

forward-looking statements will be accurate because they are based

on many assumptions, which involve risks and uncertainties. The

following important factors could cause future results to differ:

changes in economic or industry conditions; competition; raw

material and energy prices; timing and level of capital

expenditures; integration of acquisitions; introduction of new

products; rationalization of operations; and other risks identified

in Mohawk's SEC reports and public announcements. Mohawk is a

leading supplier of flooring for both residential and commercial

applications. Mohawk offers a complete selection of broadloom

carpet, ceramic tile, wood, stone, laminate, vinyl, rugs and other

home products. These products are marketed under the premier brands

in the industry, which include Mohawk, Karastan, Ralph Lauren,

Lees, Bigelow, Dal- Tile and American Olean. Mohawk's unique

merchandising and marketing assist our customers in creating the

consumers' dream. Mohawk provides a premium level of service with

its own trucking fleet and over 250 local distribution locations.

There will be a conference call Wednesday, September 28, 2005 at

11:00 AM Eastern Time. The telephone number to call is

1-800-603-9255 for US/Canada and 1-706-634-2294 for

International/Local. A conference call replay will also be

available until Wednesday, October 5, 2005 by dialing

1-800-642-1687 for US/local calls and (706) 645-9291 for

international calls and entering Conference ID # 9828127 The

webcast can be accessed (live or replay) from the Investor

Relations section of Mohawk Industries' website at

http://www.mohawkind.com/. DATE FOR FUTURE PRESS RELEASE AND

CONFERENCE CALL: PRESS RELEASE CONFERENCE CALL 3rd QUARTER 2005

OCTOBER 19, 2005 OCTOBER 20, 2005 11:00AM (800-603-9255)

DATASOURCE: Mohawk Industries, Inc. CONTACT: Frank H. Boykin, Chief

Financial Officer of Mohawk Industries, Inc., +1-706-624-2695 Web

site: http://www.mohawkind.com/

Copyright

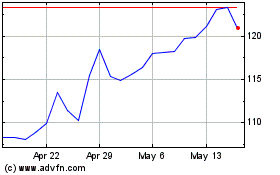

Mohawk Industries (NYSE:MHK)

Historical Stock Chart

From Jun 2024 to Jul 2024

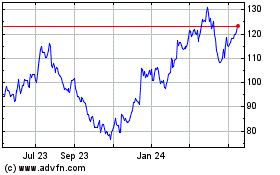

Mohawk Industries (NYSE:MHK)

Historical Stock Chart

From Jul 2023 to Jul 2024