$174 Million Acquisition Financing and Joint Venture Equity for New Jersey Multifamily Asset Arranged by Marcus & Millichap’s IPA Capital Markets

08 January 2025 - 10:48AM

Business Wire

IPA Capital Markets, a division of Marcus & Millichap

(NYSE:MMI) specializing in capital markets services for major

private and institutional clients, has secured $174 million in

joint venture equity and debt financing for the acquisition of 55

Riverwalk Place, a 348-unit multifamily property located in West

New York, New Jersey. Built in 2006, the property is located

adjacent to the Hudson River, directly across from Manhattan.

The New York-based IPA Capital Markets team of Marko Kazanjian,

Max Herzog, Andrew Cohen and Max Hulsh arranged acquisition

financing with Bank of America on behalf of their client, a new

joint venture between a NYC-based multifamily owner/operator

focused on acquiring value-add apartment assets in the Northeast

and a global institutional investment manager.

“The acquisition represents a significant value-add opportunity

for the sponsor,” said Kazanjian. “In Q4 2024 alone, our team

secured approximately $150 million in JV equity partnerships with

an additional $100 million in progress. We are excited about the

continued momentum as we begin 2025 and look forward to further

expanding our business. With over $1.5 billion currently in the

market, we remain active and committed to delivering exceptional

opportunities for our clients.”

About IPA Capital Markets

IPA Capital Markets is a division of Marcus & Millichap

(NYSE: MMI). IPA Capital Markets provides major private and

institutional clients with commercial real estate capital markets

financing solutions, including debt, mezzanine financing, preferred

and joint venture equity, and sponsor equity. For more information,

please visit institutionalpropertyadvisors.com/capital-markets.

About Marcus & Millichap, Inc. (NYSE: MMI)

Marcus & Millichap, Inc. is a leading brokerage firm

specializing in commercial real estate investment sales, financing,

research and advisory services with offices throughout the United

States and Canada. As of December 31, 2023, the company had 1,783

investment sales and financing professionals in over 80 offices who

provide investment brokerage and financing services to sellers and

buyers of commercial real estate. The company also offers market

research, consulting and advisory services to clients. Marcus &

Millichap closed 7,546 transactions in 2023, with a sales volume of

approximately $43.6 billion. For additional information, please

visit www.MarcusMillichap.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250107481503/en/

Gina Relva, VP of Public Relations

Gina.Relva@MarcusMillichap.com

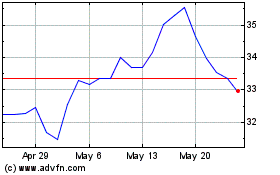

Marcus and Millichap (NYSE:MMI)

Historical Stock Chart

From Dec 2024 to Jan 2025

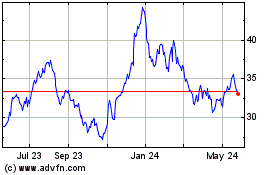

Marcus and Millichap (NYSE:MMI)

Historical Stock Chart

From Jan 2024 to Jan 2025