Marcus & Millichap Closes $94.5 Million Multifamily Portfolio Sale in New York City

25 December 2024 - 5:25AM

Business Wire

Marcus & Millichap (NYSE:MMI), a leading commercial real

estate brokerage firm specializing in investment sales, financing,

research and advisory services, announced the sale of The Chelsea

Collection, a 13-property multifamily portfolio of 147 units in New

York City’s Chelsea neighborhood. The portfolio traded for $94.5

million, representing one of the most notable multifamily sales in

Chelsea this year.

“Portfolios of this nature rarely trade in New York, and this

was the fourth portfolio transaction we closed in the last 12

months with assumable financing,” said Joe Koicim, based in Marcus

& Millichap’s Manhattan office. “The Chelsea Collection is

comprised of quality multifamily assets located in one of the top

residential sub-markets in the city that traded for just under

$1,000 per square foot. The portfolio’s unique combination of

location, quality, and future upside made it an attractive asset

for investors looking to capitalize on New York’s market rebound.”

Koicim, Logan Markley, Chris Dintrone, and Kory Barbanel all with

the NYM Group at Marcus & Millichap, exclusively represented

the seller, Josh Gotlib’s BlackSpruce Management, and procured the

out-of-town buyer.

“With our team’s specialization in this asset type and our

ability to attract outside capital, we were able to procure The

Westover Companies, a well-qualified, experienced, real-estate

investment group to step up and execute this portfolio in a timely

manner,” said Koicim. John Wood and Rob Verrone of Iron Hound

Management successfully handled the assumption process of the

existing CMBS loan.

“Joe has had another phenomenal year,” said John Horowitz, head

of Marcus & Millichap’s Northeast Division. “He has grown a

business and a team at Marcus & Millichap that is built around

his ability to develop strong personal relationships with owners.

Then, once hired, Joe delivers repeatedly, resulting in one of the

strongest brands in the market. In addition to this 13-property

multifamily closing in Chelsea, Joe and his team closed on the sale

of 95 buildings in NYC in 2024, valued at over half a billion

dollars, including closings with three prominent New York real

estate families. Joe did it all amid one of the most challenging

New York City markets in years.”

Located on the west side of the Chelsea neighborhood between

West 19th Street and West 29th Street, the buildings in the

98,000-square-foot portfolio are all within a short distance of one

another. The sale of The Chelsea Collection further strengthens the

ongoing demand for multifamily properties in New York City,

underscoring the city’s resilience and continuing appeal to

investors in the face of evolving market dynamics.

About Marcus & Millichap, Inc. (NYSE: MMI)

Marcus & Millichap, Inc. is a leading brokerage firm

specializing in commercial real estate investment sales, financing,

research and advisory services with offices throughout the United

States and Canada. As of December 31, 2023, the company had 1,783

investment sales and financing professionals in over 80 offices who

provide investment brokerage and financing services to sellers and

buyers of commercial real estate. The company also offers market

research, consulting and advisory services to clients. Marcus &

Millichap closed 7,546 transactions in 2023, with a sales volume of

approximately $43.6 billion. For additional information, please

visit www.MarcusMillichap.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241224340017/en/

Gina Relva, VP of Public Relations

Gina.Relva@MarcusMillichap.com

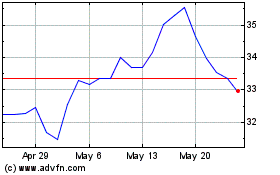

Marcus and Millichap (NYSE:MMI)

Historical Stock Chart

From Nov 2024 to Dec 2024

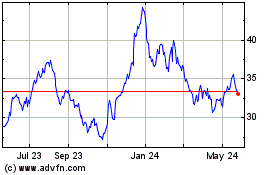

Marcus and Millichap (NYSE:MMI)

Historical Stock Chart

From Dec 2023 to Dec 2024