Mach Natural Resources LP (NYSE: MNR) (“Mach” or the “Company”)

announced today the pricing of its public offering (the “Offering”)

of 7,272,728 common units representing limited partner interests in

Mach (the “common units”) at a price to the public of $16.50 per

common unit. Mach has granted the underwriters an option to

purchase up to an additional 1,090,909 common units at the public

offering price, less underwriting discounts and commissions. Mach

intends to use the net proceeds from the Offering to fund its two

pending acquisitions of certain oil and gas assets located in the

Ardmore Basin of Oklahoma and the Anadarko Basin of Kansas and

Oklahoma, and for general partnership purposes which may include

future acquisitions. Mach’s common units trade on the New York

Stock Exchange under the ticker symbol “MNR.” The Offering is

expected to close on September 9, 2024, subject to customary

closing conditions.

Mach expects to receive net proceeds of approximately $112.9

million, after deducting underwriting discounts and commissions and

estimated offering expenses and excluding any exercise of the

underwriters’ option to purchase additional common units. Mach

intends to use the net proceeds to fund pending acquisitions and

for general partnership purposes, which may include future

acquisitions.

Raymond James & Associates, Inc., Stifel, Nicolaus &

Company, Incorporated and Truist Securities, Inc. are acting as

joint book-running managers for the Offering. Johnson Rice &

Company L.L.C. and Stephens Inc. are serving as co-managers for the

Offering. The Offering of these securities is being made only by

means of a prospectus meeting the requirements of Section 10 of the

Securities Act of 1933, as amended. When available, a copy of the

final prospectus may be obtained from any of the following

sources:

Raymond James & Associates, Inc.

Attention: Syndicate

Stifel, Nicolaus & Company,

Incorporated

Attention: Syndicate Department

Truist Securities, Inc

Attention: Equity Capital Markets

880 Carillon Parkway

1 South Street, 15th Floor

3333 Peachtree Road NE, 9th Floor

St. Petersburg, Florida 33716

Baltimore, MD 21202

Atlanta, GA 30326

Telephone: (800) 248-8863

Telephone: (855) 300-7136

Telephone: (800) 685-4786

Email: prospectus@raymondjames.com

Email: syndprospectus@stifel.com

Email: truistsecurities.prospectus@truist.com

Important Information

A registration statement relating to these securities has been

filed with, and declared effective by, the Securities and Exchange

Commission (the “SEC”) on September 6, 2024. This press release

does not constitute an offer to sell or the solicitation of an

offer to buy securities, and shall not constitute an offer,

solicitation or sale in any jurisdiction in which such offer,

solicitation or sale would be unlawful prior to registration or

qualification under the securities laws of that jurisdiction.

About Mach Natural Resources LP

Mach Natural Resources LP is an independent upstream oil and gas

Company focused on the acquisition, development and production of

oil, natural gas and NGL reserves in the Anadarko Basin region of

Western Oklahoma, Southern Kansas and the panhandle of Texas.

Cautionary Note Regarding Forward-Looking Statements

This release contains statements that express Mach’s opinions,

expectations, beliefs, plans, objectives, assumptions or

projections regarding future events or future results, in contrast

with statements that reflect historical facts. All statements,

other than statements of historical fact included in this release

regarding our strategy, future operations, financial position,

estimated revenues and losses, projected costs, prospects, plans

and objectives of management are forward-looking statements,

including, but not limited to, statements regarding the size of the

Offering and our ability to complete the Offering. When used in

this release, words such as “may,” “assume,” “forecast,” “could,”

“should,” “will,” “plan,” “believe,” “anticipate,” “intend,”

“estimate,” “expect,” “project,” “budget” and similar expressions

are used to identify forward-looking statements, although not all

forward-looking statements contain such identifying words. These

forward-looking statements are based on management’s current

belief, based on currently available information as to the outcome

and timing of future events at the time such statement was made.

Such statements are subject to a number of assumptions, risk and

uncertainties, many of which are beyond the control of Mach,

including prevailing market conditions and other factors. Please

read Mach’s filings with the SEC, including “Risk Factors” in

Mach’s Annual Report on Form 10-K, which is on file with the SEC,

for a discussion of risks and uncertainties that could cause actual

results to differ from those in such forward-looking

statements.

As a result, these forward-looking statements are not a

guarantee of our performance, and you should not place undue

reliance on such statements. Any forward-looking statement speaks

only as of the date on which such statement is made, and Mach

undertakes no obligation to correct or update any forward-looking

statement, whether as a result of new information, future events or

otherwise.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240906851931/en/

Mach Natural Resources LP Investor Relations Contact:

ir@machnr.com

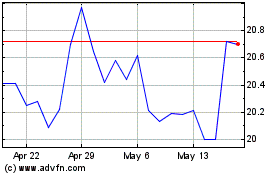

Mach Natural Resources (NYSE:MNR)

Historical Stock Chart

From Oct 2024 to Nov 2024

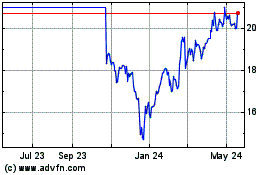

Mach Natural Resources (NYSE:MNR)

Historical Stock Chart

From Nov 2023 to Nov 2024