0000067887FALSE00000678872024-11-012024-11-010000067887us-gaap:CommonClassAMember2024-11-012024-11-010000067887us-gaap:CommonClassBMember2024-11-012024-11-01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

November 1, 2024

Date of Report (date of earliest event reported)

MOOG Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | |

| NY | 1-05129 | 16-0757636 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

| |

| 400 Jamison Rd | East Aurora, | New York | 14052-0018 |

(Address of Principal Executive Offices) | (Zip Code) |

(716) 652-2000

(Registrant's telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Class A common stock | MOG.A | New York Stock Exchange |

| Class B common stock | MOG.B | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

o

| | | | | |

| Item 2.02 | Results of Operations and Financial Condition |

On November 1, 2024, Moog Inc. (the “Company”) issued a press release discussing results of operations for the quarter and year ended September 28, 2024. A copy of the press release is included as exhibit 99.1 of this report.

The information in this report is being furnished pursuant to Item 2.02 of Form 8-K and shall not be deemed to be “filed” for purposes of Section 18 of the Securities and Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise be subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Exchange Act or the Securities Act of 1933, as amended, except as expressly stated by specific reference in such a filing.

On November 1, 2024, the Company issued a press release announcing that the Company’s Board of Directors declared a quarterly dividend of $0.28 per share on the Company's issued and outstanding shares of Class A common stock and Class B common stock. The dividend will be paid on December 6, 2024 to all shareholders of record as of the close of business on November 21, 2024. A copy of the press release is included as Exhibit 99.2 of this report.

| | | | | |

| Item 9.01 | Financial Statements and Exhibits |

(d)Exhibits.

| | | | | |

| Press release dated November 1, 2024, announcing Moog Inc.’s results of operations for the quarter and year ended September 28, 2024. |

| Press release dated November 1, 2024, announcing cash dividend. |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | | MOOG INC. |

| | | | |

| Dated: | November 1, 2024 | By: | /s/ Nicholas Hart |

| | | Name: | Nicholas Hart |

| | | | Controller |

Moog Inc. ▪ East Aurora, New York ▪ 14052 ▪ 716-652-2000

Press Information

| | | | | | | | | | | |

| Release Date: | November 1, 2024 | | |

| IMMEDIATE | | |

Moog Inc. Reports Strong Performance for Fourth Quarter 2024 and

Issues Positive Guidance for Fiscal 2025

East Aurora, NY -- Moog Inc. (NYSE: MOG.A and MOG.B), a worldwide designer, manufacturer and systems integrator of high-performance precision motion and fluid controls and control systems, today reported strong fiscal fourth quarter 2024 results that marked another record year.

"Our fourth quarter was strong, bringing to a close an exceptional year with record sales and expanded margins," said Pat Roche, CEO. "Our performance reflects the success in pricing and simplification initiatives that continue to build momentum into 2025, with stronger sales, expanded margin and improved cash flow generation."

| | | | | | | | | | | | | | | | | | | | | | | |

| (in millions, except per share results) | Three Months Ended | Twelve Months Ended | |

| Q4 2024 | Q4 2023 | Deltas | Q4 2024 | Q4 2023 | Deltas | | | |

| Net sales | $ | 917 | | $ | 872 | | 5% | $ | 3,609 | | $ | 3,319 | | 9 | % | | | |

| Operating margin | 9.1 | % | 10.1 | % | (100 bps) | 11.0 | % | 10.3 | % | 70 bps | | | |

| Adjusted operating margin | 12.5 | % | 12.5 | % | 0 bps | 12.4 | % | 10.9 | % | 150 bps | | | |

| Diluted net earnings per share | $ | 1.33 | | $ | 1.23 | | 8% | $ | 6.40 | | $ | 5.34 | | 20 | % | | | |

| Adjusted diluted net earnings per share | $ | 2.16 | | $ | 2.10 | | 3% | $ | 7.80 | | $ | 6.15 | | 27 | % | | | |

| Net cash provided by operating activities | $ | 156 | | $ | 153 | | $ | 3 | $ | 202 | | $ | 136 | | $ | 66 | | | |

| Free cash flow | $ | 109 | | $ | 105 | | $ | 5 | $ | 21 | | $ | (37) | | $ | 59 | | | |

| | | | | | | | | |

| See the reconciliations of adjusted financial results and free cash flow to reported results included in the financial statements herein for the periods ended September 28, 2024 and September 30, 2023. |

Quarter Highlights

•Net sales increased driven by growth in defense businesses.

•Operating margin declined due to higher levels of charges related to simplification initiatives.

•Adjusted operating margin improved within Military Aircraft, Industrial and Space and Defense, while Commercial Aircraft declined from a strong quarter a year ago.

•Diluted net earnings per share increased due to improved operational performance, partially offset by the net of prior and current year one-time charges and benefits.

•Adjusted diluted net earnings per share increased due to incremental profit from higher sales and the benefit of capitalizing interest, partially offset by the absence of last year's favorable litigation settlement.

•Twelve-month backlog increased 3%, reaching a record level of $2.5 billion.

Year Highlights

•Net sales increased due to higher demand across our aerospace and defense businesses.

•Operating margin increased within Space and Defense and Military Aircraft, while Industrial and Commercial Aircraft declined.

•Adjusted operating margin expanded in Military Aircraft, Space and Defense and Industrial reflecting the benefits of pricing and simplification initiatives, while Commercial Aircraft declined from a strong prior year.

•Diluted net earnings per share increased due to largely the same factors as the fourth quarter.

•Adjusted diluted net earnings per share increased driven by operating margin expansion and incremental profit from higher sales.

Quarter Results

"We had a great quarter," said Jennifer Walter, CFO. "Sales were very strong, adjusted operating margin was robust and on plan, and adjusted earnings per share exceeded the high end of our guidance range. In addition, we generated a substantial amount of free cash flow."

Sales in the fourth quarter of 2024 increased compared to the fourth quarter of 2023, with notable growth in Military Aircraft and Space and Defense. Military Aircraft sales increased 17% to $216 million due to the ramp of the FLRAA and other production programs. Space and Defense sales increased 9% to $263 million driven by strong European defense demand and launch vehicle activity. Commercial Aircraft sales increased 2% to $197 million due to increased production volume, muted by the absence of last year's retroactive pricing benefit and inventory sale from exiting a mature product line. Industrial segment sales decreased 5% to $242 million due to a slowdown in orders for industrial automation applications, partially offset by higher medical product and automotive test business demand.

Operating margin decreased 100 basis points to 9.1% in the fourth quarter of 2024 compared to the fourth quarter of 2023. Commercial Aircraft operating margin declined 680 basis points to 11.0%, driven by the absence of last year's benefits. Operating margins in Space and Defense and in Industrial declined 200 basis points and 130 basis points, respectively, due to incremental charges related to simplification initiatives. Military Aircraft operating margin improved 590 basis points to 11.8%, driven by reduced research and development expense, improved sales mix and cost absorption on the FLRAA program.

Adjusted operating margin in the fourth quarter of 2024 was unchanged at 12.5% compared to the fourth quarter of 2023. We incurred charges primarily in Industrial and in Space and Defense. Adjusted operating margin in Industrial increased 90 basis points to 12.8% as the benefits of pricing more than offset an unfavorable sales mix and planned product transfers. Adjusted operating margin in Space and Defense increased 70 basis points to 13.5% associated with improved performance across the business.

Non-operating expenses in the fourth quarter of 2024 declined compared to the fourth quarter of 2023. The fourth quarter of 2024 included a $10 million adjustment to capitalize interest for 2023 and 2024. Non-operating expenses in the fourth quarter of 2023 included a pension settlement charge and a favorable litigation settlement.

Free cash flow in the fourth quarter was driven by strong customer collections and by timing of vendor payments.

Year Results

Sales in 2024 increased compared to 2023 with notable growth in Commercial Aircraft, Military Aircraft and Space and Defense. Commercial Aircraft sales increased 18% to $788 million due to increased production ramps on widebody, narrowbody and business jet programs. Military Aircraft sales increased 13% to $812 million due largely to having a full year's worth FLRAA sales. Space and Defense sales increased 7% to $1 billion due to strong, broad-based, defense demand. Industrial sales increased slightly at 1% to $991 million, as softening industrial automation sales were compensated by growth in other sub-markets.

Operating margin in 2024 increased compared to 2023, reflecting the benefits of pricing and simplification efforts, partially offset by higher amounts of charges related to simplifying our operations. Operating margin increased in Space and Defense and Military Aircraft, while Commercial Aircraft operating margin decreased, all due to the same factors as the fourth quarter. Also, Industrial operating margin decreased due to higher amounts of simplification charges.

Adjusted operating margin increased in 2024 compared to 2023, inclusive of a 40 basis-point contribution from the Employee Retention Credit, and increased in all of our segments except for Commercial Aircraft. Adjusted operating margin in Military Aircraft increased 300 basis points to 12.0% due to cost absorption on the FLRAA program and due to lower research and development expense. Adjusted operating margin in Space and Defense increased 290 basis points to 13.4% due to strong operational performance, including improved performance on space vehicle programs. Adjusted operating margin in Industrial increased 90 basis points to 12.4% due largely to pricing initiatives. Adjusted operating margin in Commercial Aircraft decreased 90 basis points to 11.8% due to the absence of the prior year's one-time benefits, partially offset by efficiencies from the current year's higher production sales volume.

2025 Financial Guidance | | | | | | | | | | | |

| (in millions, except per share results) | FY 2025 | FY 2024 | | |

| | | | | |

| Net sales | $ | 3,700 | | $ | 3,609 | | | | |

| Operating margin | 13.0 | % | 11.0 | % | | | |

| Adjusted operating margin | 13.0 | % | 12.4 | % | | | |

| Diluted net earnings per share* | $ | 8.20 | | $ | 6.40 | | | | |

| Adjusted diluted net earnings per share* | $ | 8.20 | | $ | 7.80 | | | | |

| Free cash flow conversion | 50 - 75% | 8 | % | | | |

| *Diluted net earnings per share figures for 2025 are forecasted to be within range of +/- $0.20. | | |

When the company provides adjusted, non-GAAP figures on a forward-looking basis, a reconciliation of the differences between the non-GAAP expectations and the corresponding GAAP measures generally is not available without unreasonable effort.

Conference call information

In conjunction with today’s release, Pat Roche, CEO, and Jennifer Walter, CFO, will host a conference call today beginning at 10:00 a.m. ET, which will be simultaneously broadcast live online. Listeners can access the call and supplemental financial materials at www.moog.com/investors/communications.

Cautionary Statement

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, which can be identified by words such as: “may,” “will,” “should,” “believes,” “expects,” “expected,” “intends,” “plans,” “projects,” “approximate,” “estimates,” “predicts,” “potential,” “outlook,” “forecast,” “anticipates,” “presume,” “assume” and other words and terms of similar meaning (including their negative counterparts or other various or comparable terminology). These forward-looking statements are made pursuant to the Private Securities Litigation Reform Act of 1995, are neither historical facts nor guarantees of future performance and are subject to several factors, risks and uncertainties, the impact or occurrence of which could cause actual results to differ materially from the expected results described in the forward-looking statements.

Although it is not possible to create a comprehensive list of all factors that may cause our actual results to differ from the results expressed or implied by our forward-looking statements or that may affect our future results, some of these factors and other risks and uncertainties are described in Item 1A “Risk Factors” of our Annual Report on Form 10-K and in our other periodic filings with the Securities and Exchange Commission (“SEC”) and include, but are not limited to, risks relating to: (i) our operation in highly competitive markets with competitors who may have greater resources than we possess; (ii) our operation in cyclical markets that are sensitive to domestic and foreign economic conditions and events; (iii) our heavy dependence on government contracts that may not be fully funded or may be terminated; (iv) supply chain constraints and inflationary impacts on prices for raw materials and components used in our products; (v) failure of our subcontractors or suppliers to perform their contractual obligations; and (vi) our accounting estimations for over-time contracts and any changes we need to make thereto. You should evaluate all forward-looking statements made in this press release in the context of these risks and uncertainties.

While we believe we have identified and discussed in our SEC filings the material risks affecting our business, there may be additional factors, risks and uncertainties not currently known to us or that we currently consider immaterial that may affect the forward-looking statements we make herein. Given these factors, risks and uncertainties, investors should not place undue reliance on forward-looking statements as predictive of future results. Any forward-looking statement speaks only as of the date on which it is made, and we disclaim any obligation to update any forward-looking statement made in this press release, except as required by applicable law.

Contact: Aaron Astrachan

716.687.4225

| | |

| Moog Inc. |

| CONSOLIDATED STATEMENTS OF EARNINGS (UNAUDITED) |

| (dollars in thousands, except per share data) |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended | | Twelve Months Ended |

| | September 28,

2024 | | September 30,

2023 | | September 28,

2024 | | September 30,

2023 |

| Net sales | | $ | 917,272 | | | $ | 872,051 | | | $ | 3,609,160 | | | $ | 3,319,122 | |

| Cost of sales | | 666,541 | | | 623,808 | | | 2,605,214 | | | 2,423,245 | |

| Inventory write-down | | 5,252 | | | 4,345 | | | 7,027 | | | 4,345 | |

| Gross profit | | 245,479 | | | 243,898 | | | 996,919 | | | 891,532 | |

| Research and development | | 26,021 | | | 29,444 | | | 112,773 | | | 106,551 | |

| Selling, general and administrative | | 124,840 | | | 118,041 | | | 494,887 | | | 469,836 | |

Interest (1) | | 9,262 | | | 18,227 | | | 62,112 | | | 63,578 | |

| Asset impairment and fair value adjustment | | 15,287 | | | 12,974 | | | 22,149 | | | 14,628 | |

| Restructuring | | 11,165 | | | 3,260 | | | 23,788 | | | 7,997 | |

| Loss on sale of businesses | | — | | | 900 | | | — | | | 900 | |

| Gain on sale of buildings | | (979) | | | — | | | (979) | | | (10,030) | |

| | | | | | | | |

| Pension settlement | | — | | | 12,542 | | | — | | | 12,542 | |

| Other | | 4,335 | | | (599) | | | 14,376 | | | 9,478 | |

| Earnings before income taxes | | 55,548 | | | 49,109 | | | 267,813 | | | 216,052 | |

| Income taxes | | 12,503 | | | 9,527 | | | 60,593 | | | 45,054 | |

| Net earnings | | $ | 43,045 | | | $ | 39,582 | | | $ | 207,220 | | | $ | 170,998 | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Net earnings per share | | | | | | | | |

| Basic | | $ | 1.35 | | | $ | 1.24 | | | $ | 6.48 | | | $ | 5.37 | |

| Diluted | | $ | 1.33 | | | $ | 1.23 | | | $ | 6.40 | | | $ | 5.34 | |

| | | | | | | | |

| Weighted average common shares outstanding | | | | | | | | |

| Basic | | 31,988,662 | | | 31,893,646 | | | 31,954,689 | | | 31,831,687 | |

| Diluted | | 32,458,411 | | | 32,187,501 | | | 32,359,338 | | | 32,044,226 | |

(1) During the three months ended September 28, 2024, we capitalized interest associated with major capital projects for a total of $9,847, which included an adjustment of $4,023 related to 2023 and an adjustment of $4,206 related to the nine months ended June 29, 2024. |

| | |

| Moog Inc. |

| RECONCILIATION TO ADJUSTED NET EARNINGS BEFORE TAXES, INCOMES TAXES, NET EARNINGS AND DILUTED NET EARNINGS PER SHARE (UNAUDITED) |

| (dollars in thousands) |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Twelve Months Ended |

| | September 28,

2024 | | September 30,

2023 | | September 28,

2024 | | September 30,

2023 |

| As Reported: | | | | | | | | |

| Earnings before income taxes | | $ | 55,548 | | | $ | 49,109 | | | $ | 267,813 | | | $ | 216,052 | |

| Income taxes | | 12,503 | | | 9,527 | | | 60,593 | | | 45,054 | |

| Effective income tax rate | | 22.5 | % | | 19.4 | % | | 22.6 | % | | 20.9 | % |

| | | | | | | | |

| Net earnings | | 43,045 | | | 39,582 | | | 207,220 | | | 170,998 | |

| Diluted net earnings per share | | $ | 1.33 | | | $ | 1.23 | | | $ | 6.40 | | | $ | 5.34 | |

| | | | | | | | |

| Inventory Write-down, Restructuring and Other Charges: | | | | | | |

| Earnings before income taxes | | $ | 16,930 | | | $ | 7,605 | | | $ | 32,226 | | | $ | 13,391 | |

| Income taxes | | 4,270 | | | 1,746 | | | 8,122 | | | 3,050 | |

| Net earnings | | 12,660 | | | 5,859 | | | 24,104 | | | 10,341 | |

| Diluted net earnings per share | | $ | 0.39 | | | $ | 0.18 | | | $ | 0.74 | | | $ | 0.32 | |

| | | | | | | | |

| Asset Impairment | | | | | | | | |

| Earnings before income taxes | | $ | 391 | | | $ | 12,974 | | | $ | 7,253 | | | $ | 14,628 | |

| Income taxes | | 92 | | | 937 | | | 462 | | | 1,285 | |

| Net earnings | | 299 | | | 12,037 | | | 6,791 | | | 13,343 | |

| Diluted net earnings per share | | $ | 0.01 | | | $ | 0.37 | | | $ | 0.21 | | | $ | 0.42 | |

| | | | | | | | |

| Loss (Gain) on Sale of Businesses, Buildings and Fair Value Adjustments: | | | | |

| Earnings before income taxes | | $ | 13,918 | | | $ | 900 | | | $ | 13,918 | | | $ | (9,130) | |

| Income taxes | | (245) | | | 212 | | | (245) | | | (1,874) | |

| Net earnings | | 14,163 | | | 688 | | | 14,163 | | | (7,256) | |

| Diluted net earnings per share | | $ | 0.44 | | | $ | 0.02 | | | $ | 0.44 | | | $ | (0.23) | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Pension Settlement: | | | | | | | | |

| Earnings before income taxes | | $ | — | | | $ | 12,542 | | | $ | — | | | $ | 12,542 | |

| Income taxes | | — | | | 2,960 | | | — | | | 2,960 | |

| Net earnings | | — | | | 9,582 | | | — | | | 9,582 | |

| Diluted net earnings per share | | $ | — | | | $ | 0.30 | | | $ | — | | | $ | 0.30 | |

| | | | | | | | |

| As Adjusted: | | | | | | | | |

| Earnings before income taxes | | $ | 86,787 | | | $ | 83,130 | | | $ | 321,210 | | | $ | 247,483 | |

| Income taxes | | 16,620 | | | 15,382 | | | 68,932 | | | 50,475 | |

| Effective income tax rate | | 19.2 | % | | 18.5 | % | | 21.5 | % | | 20.4 | % |

| | | | | | | | |

| Net earnings | | 70,167 | | | 67,748 | | | 252,278 | | | 197,008 | |

| Diluted net earnings per share | | $ | 2.16 | | | $ | 2.10 | | | $ | 7.80 | | | $ | 6.15 | |

| The diluted net earnings per share associated with the adjustments in the table above may not reconcile when totaled due to rounding. |

Results shown above have been adjusted to exclude impacts associated with restructuring and other charges related to continued portfolio shaping activities, asset impairments and other charges due to program termination and the devaluation of an investment, fair value adjustments from businesses being held for sale at year end, a one-time pension settlement charge, as well as impacts from the sale of buildings and a business. While management believes that these adjusted financial measures may be useful in evaluating the financial condition and results of operations of the Company, this information should be considered supplemental and is not a substitute for financial information prepared in accordance with GAAP.

| | |

| Moog Inc. |

| CONSOLIDATED SALES AND OPERATING PROFIT (UNAUDITED) |

| (dollars in thousands) |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Twelve Months Ended |

| | September 28,

2024 | | September 30,

2023 | | September 28,

2024 | | September 30,

2023 |

| Net sales: | | | | | | | | |

| Space and Defense | | $ | 262,824 | | | $ | 241,211 | | | $ | 1,018,148 | | | $ | 947,251 | |

| Military Aircraft | | 215,645 | | | 183,562 | | | 811,566 | | | 720,332 | |

| Commercial Aircraft | | 197,119 | | | 193,297 | | | 788,300 | | | 668,815 | |

| Industrial | | 241,684 | | | 253,981 | | | 991,146 | | | 982,724 | |

| Net sales | | $ | 917,272 | | | $ | 872,051 | | | $ | 3,609,160 | | | $ | 3,319,122 | |

| Operating profit: | | | | | | | | |

| Space and Defense | | $ | 27,179 | | | $ | 29,563 | | | $ | 127,354 | | | $ | 95,949 | |

| | 10.3 | % | | 12.3 | % | | 12.5 | % | | 10.1 | % |

| Military Aircraft | | 25,535 | | | 10,891 | | | 85,858 | | | 60,416 | |

| | 11.8 | % | | 5.9 | % | | 10.6 | % | | 8.4 | % |

| Commercial Aircraft | | 21,634 | | | 34,444 | | | 91,472 | | | 84,387 | |

| | 11.0 | % | | 17.8 | % | | 11.6 | % | | 12.6 | % |

| Industrial | | 9,065 | | | 12,982 | | | 90,657 | | | 102,165 | |

| | 3.8 | % | | 5.1 | % | | 9.1 | % | | 10.4 | % |

| Total operating profit | | 83,413 | | | 87,880 | | | 395,341 | | | 342,917 | |

| | 9.1 | % | | 10.1 | % | | 11.0 | % | | 10.3 | % |

| Deductions from operating profit: | | | | | | | | |

| Interest expense | | 9,262 | | | 18,227 | | | 62,112 | | | 63,578 | |

| Equity-based compensation expense | | 3,658 | | | 2,461 | | | 14,959 | | | 10,582 | |

| Pension settlement | | — | | | 12,542 | | | — | | | 12,542 | |

| Non-service pension expense | | 3,119 | | | 2,986 | | | 12,685 | | | 12,324 | |

| Corporate and other expenses, net | | 11,826 | | | 2,555 | | | 37,772 | | | 27,839 | |

| Earnings before income taxes | | $ | 55,548 | | | $ | 49,109 | | | $ | 267,813 | | | $ | 216,052 | |

| | |

| Moog Inc. |

| RECONCILIATION TO ADJUSTED OPERATING PROFIT AND MARGINS (UNAUDITED) |

| (dollars in thousands) |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Twelve Months Ended |

| | September 28,

2024 | | September 30,

2023 | | September 28,

2024 | | September 30,

2023 |

| Space and Defense operating profit - as reported | | $ | 27,179 | | | $ | 29,563 | | | $ | 127,354 | | | $ | 95,949 | |

| Inventory write-down | | 1,918 | | | — | | | 1,918 | | | — | |

| Asset impairment | | — | | | — | | | 416 | | | 219 | |

| | | | | | | | |

| Restructuring and other | | 6,307 | | | 1,348 | | | 6,307 | | | 2,902 | |

| Space and Defense operating profit - as adjusted | | $ | 35,404 | | | $ | 30,911 | | | $ | 135,995 | | | $ | 99,070 | |

| | 13.5 | % | | 12.8 | % | | 13.4 | % | | 10.5 | % |

| | | | | | | | |

| Military Aircraft operating profit - as reported | | $ | 25,535 | | | $ | 10,891 | | | $ | 85,858 | | | $ | 60,416 | |

| Inventory write-down | | — | | | 1,616 | | | 175 | | | 1,616 | |

| Asset impairment | | — | | | 235 | | | 6,446 | | | 1,332 | |

| Loss on sale of business | | — | | | 900 | | | — | | | 900 | |

| Restructuring and other | | 335 | | | 124 | | | 4,732 | | | 399 | |

| Military Aircraft operating profit - as adjusted | | $ | 25,870 | | | $ | 13,766 | | | $ | 97,211 | | | $ | 64,663 | |

| | 12.0 | % | | 7.5 | % | | 12.0 | % | | 9.0 | % |

| | | | | | | | |

| Commercial Aircraft operating profit - as reported | | $ | 21,634 | | | $ | 34,444 | | | $ | 91,472 | | | $ | 84,387 | |

| | | | | | | | |

| Asset impairment | | 391 | | | — | | | 391 | | | 338 | |

| Gain on sale of buildings | | (979) | | | — | | | (979) | | | — | |

| Restructuring and other | | 1,342 | | | 44 | | | 1,750 | | | 44 | |

| Commercial Aircraft operating profit - as adjusted | | $ | 22,388 | | | $ | 34,488 | | | $ | 92,634 | | | $ | 84,769 | |

| | 11.4 | % | | 17.8 | % | | 11.8 | % | | 12.7 | % |

| | | | | | | | |

| Industrial operating profit - as reported | | $ | 9,065 | | | $ | 12,982 | | | $ | 90,657 | | | $ | 102,165 | |

| Inventory write-down | | 3,334 | | | 2,729 | | | 4,934 | | | 2,729 | |

| Asset impairment | | — | | | 12,739 | | | — | | | 12,739 | |

| Fair value adjustment | | 14,897 | | | — | | | 14,897 | | | — | |

| | | | | | | | |

| Gain on sale of buildings | | — | | | — | | | — | | | (10,030) | |

| Restructuring and other | | 3,694 | | | 1,744 | | | 12,410 | | | 5,701 | |

| Industrial operating profit - as adjusted | | $ | 30,990 | | | $ | 30,194 | | | $ | 122,898 | | | $ | 113,304 | |

| | 12.8 | % | | 11.9 | % | | 12.4 | % | | 11.5 | % |

| | | | | | | | |

| Total operating profit - as adjusted | | $ | 114,652 | | | $ | 109,359 | | | $ | 448,738 | | | $ | 361,806 | |

| | 12.5 | % | | 12.5 | % | | 12.4 | % | | 10.9 | % |

While management believes that these adjusted financial measures may be useful in evaluating the financial condition and results of operations of the Company, this information should be considered supplemental and is not a substitute for financial information prepared in accordance with GAAP.

| | |

| Moog Inc. |

| CONSOLIDATED BALANCE SHEETS (UNAUDITED) |

| (dollars in thousands) |

| | | | | | | | | | | | | | |

| | September 28,

2024 | | September 30,

2023 |

| ASSETS | | | | |

| Current assets | | | | |

| Cash and cash equivalents | | $ | 61,694 | | | $ | 68,959 | |

| Restricted cash | | 123 | | | 185 | |

| Receivables, net | | 388,517 | | | 434,723 | |

| Unbilled receivables | | 775,294 | | | 706,601 | |

| Inventories, net | | 863,702 | | | 724,002 | |

| Prepaid expenses and other current assets | | 86,245 | | | 50,862 | |

| Total current assets | | 2,175,575 | | | 1,985,332 | |

| Property, plant and equipment, net | | 929,357 | | | 814,696 | |

| Operating lease right-of-use assets | | 52,591 | | | 56,067 | |

| Goodwill | | 833,764 | | | 821,301 | |

| Intangible assets, net | | 63,479 | | | 71,637 | |

| Deferred income taxes | | 20,991 | | | 8,749 | |

| Other assets | | 52,695 | | | 50,254 | |

| Total assets | | $ | 4,128,452 | | | $ | 3,808,036 | |

| LIABILITIES AND SHAREHOLDERS’ EQUITY | | | | |

| Current liabilities | | | | |

| | | | |

| | | | |

| Accounts payable | | $ | 292,988 | | | $ | 264,573 | |

| Accrued compensation | | 101,127 | | | 111,154 | |

| Contract advances and progress billings | | 334,558 | | | 377,977 | |

| | | | |

| Accrued liabilities and other | | 305,180 | | | 211,769 | |

| Total current liabilities | | 1,033,853 | | | 965,473 | |

| Long-term debt, excluding current installments | | 874,139 | | | 863,092 | |

| Long-term pension and retirement obligations | | 167,161 | | | 157,455 | |

| Deferred income taxes | | 27,738 | | | 37,626 | |

| Other long-term liabilities | | 164,928 | | | 148,303 | |

| Total liabilities | | 2,267,819 | | | 2,171,949 | |

| | | | |

| | | | |

| Shareholders’ equity | | | | |

| Common stock - Class A | | 43,835 | | | 43,822 | |

| Common stock - Class B | | 7,445 | | | 7,458 | |

| Additional paid-in capital | | 784,509 | | | 608,270 | |

| Retained earnings | | 2,668,723 | | | 2,496,979 | |

| Treasury shares | | (1,082,240) | | | (1,057,938) | |

| Stock Employee Compensation Trust | | (194,049) | | | (114,769) | |

| Supplemental Retirement Plan Trust | | (163,821) | | | (93,126) | |

| Accumulated other comprehensive loss | | (203,769) | | | (254,609) | |

| Total shareholders’ equity | | 1,860,633 | | | 1,636,087 | |

| | | | |

| | | | |

| Total liabilities and shareholders’ equity | | $ | 4,128,452 | | | $ | 3,808,036 | |

| | |

| Moog Inc. |

| CONSOLIDATED STATEMENTS OF CASH FLOWS (UNAUDITED) |

| (dollars in thousands) |

| | | | | | | | | | | | | | |

| | Twelve Months Ended |

| | September 28,

2024 | | September 30,

2023 |

| CASH FLOWS FROM OPERATING ACTIVITIES | | | | |

| Net earnings | | $ | 207,220 | | | $ | 170,998 | |

| Adjustments to reconcile net earnings to net cash provided (used) by operating activities: | | | | |

| Depreciation | | 82,957 | | | 78,692 | |

| Amortization | | 10,149 | | | 11,541 | |

| Deferred income taxes | | (31,735) | | | (35,531) | |

| Equity-based compensation expense | | 14,959 | | | 10,582 | |

| | | | |

| Loss on sale of businesses | | — | | | 900 | |

| Gain on sale of buildings | | (979) | | | (10,030) | |

| Inventory write-down, asset impairment and fair value adjustments | | 29,176 | | | 18,973 | |

| Pension settlement | | — | | | 12,542 | |

| Other | | 6,512 | | | 6,244 | |

| Changes in assets and liabilities providing (using) cash: | | | | |

| Receivables | | 54,716 | | | (56,575) | |

| Unbilled receivables | | (63,424) | | | (87,915) | |

| Inventories | | (126,978) | | | (130,378) | |

| Accounts payable | | 26,446 | | | 28,641 | |

| Contract advances and progress billings | | (49,470) | | | 79,983 | |

| Accrued expenses | | 43,989 | | | (1,692) | |

| Accrued income taxes | | 16,219 | | | 22,869 | |

| Net pension and post retirement liabilities | | 11,791 | | | 13,940 | |

| Other assets and liabilities | | (29,204) | | | 2,151 | |

| Net cash provided (used) by operating activities | | 202,344 | | | 135,935 | |

| CASH FLOWS FROM INVESTING ACTIVITIES | | | | |

| Acquisitions of businesses, net of cash acquired | | (5,911) | | | — | |

| Purchase of property, plant and equipment | | (156,018) | | | (173,286) | |

| Net proceeds from businesses sold | | 1,627 | | | 1,892 | |

| Net proceeds from buildings sold | | 1,453 | | | 19,702 | |

| Other investing transactions | | (766) | | | (11,455) | |

| Net cash provided (used) by investing activities | | (159,615) | | | (163,147) | |

| CASH FLOWS FROM FINANCING ACTIVITIES | | | | |

| | | | |

| Proceeds from revolving lines of credit | | 1,038,500 | | | 1,044,101 | |

| Payments on revolving lines of credit | | (1,029,500) | | | (1,017,420) | |

| | | | |

| Payments on long-term debt | | — | | | (916) | |

| | | | |

| | | | |

| | | | |

| Payments on finance lease obligations | | (6,496) | | | (4,620) | |

| Payment of dividends | | (35,476) | | | (34,074) | |

| Proceeds from sale of treasury stock | | 15,685 | | | 19,785 | |

| Purchase of outstanding shares for treasury | | (36,738) | | | (29,306) | |

| Proceeds from sale of stock held by SECT | | 28,202 | | | 15,713 | |

| Purchase of stock held by SECT | | (22,837) | | | (14,251) | |

| | | | |

| | | | |

| | | | |

| Other financing transactions | | — | | | (2,027) | |

| Net cash provided (used) by financing activities | | (48,660) | | | (23,015) | |

| Effect of exchange rate changes on cash | | 1,324 | | | 2,043 | |

| Increase (decrease) in cash, cash equivalents and restricted cash | | (4,607) | | | (48,184) | |

| Cash, cash equivalents and restricted cash at beginning of year | | 69,144 | | | 117,328 | |

Cash, cash equivalents and restricted cash at end of year (1) | | $ | 64,537 | | | $ | 69,144 | |

(1) End of year cash balance at September 28, 2024 includes cash related to assets held for sale of $2,720. |

| | | | |

| | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | |

| Moog Inc. |

| RECONCILIATION OF NET CASH PROVIDED BY OPERATING ACTIVITIES TO FREE CASH FLOW (UNAUDITED) |

| (dollars in thousands) |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended | | Twelve Months Ended |

| | September 28,

2024 | | September 30,

2023 | | September 28,

2024 | | September 30,

2023 |

| Net cash provided by operating activities | | $ | 155,789 | | | $ | 153,032 | | | $ | 202,344 | | | $ | 135,935 | |

| Purchase of property, plant and equipment | | (46,402) | | | (48,212) | | | (156,018) | | | (173,286) | |

| | | | | | | | |

| Receivables Purchase Agreement | | — | | | — | | | (25,000) | | | — | |

| Free cash flow | | $ | 109,387 | | | $ | 104,820 | | | $ | 21,326 | | | $ | (37,351) | |

| Adjusted net earnings | | $ | 70,167 | | | $ | 67,748 | | | $ | 252,278 | | | $ | 197,008 | |

| Free cash flow conversion | | 156 | % | | 155 | % | | 8 | % | | (19) | % |

Free cash flow is defined as net cash provided (used) by operating activities, less purchase of property, plant and equipment, less the benefit from the Receivables Purchase Agreement. Free cash flow conversion is defined as free cash flow divided by adjusted net earnings. Free cash flow and free cash flow conversion are not measures determined in accordance with GAAP and may not be comparable with the measures as used by other companies. However, management believes these adjusted financial measures may be useful in evaluating the liquidity, financial condition and results of operations of the Company. This information should be considered supplemental and is not a substitute for financial information prepared in accordance with GAAP.

Moog Inc. ▪ East Aurora, New York ▪ 14052 ▪ 716-652-2000

Press Information

| | | | | | | | | | | |

| Release Date: | November 1, 2024 | | |

| | IMMEDIATE | | |

Moog Inc. Announces Cash Dividend

East Aurora, NY – The Board of Directors of Moog Inc. (NYSE: MOG.A and MOG.B) declared a quarterly dividend of $0.28 per share on the Company’s issued and outstanding shares of Class A and Class B common stock. The dividend will be paid on December 6, 2024 to all shareholders of record as of the close of business on November 21, 2024.

The dividend represents a net use of cash of approximately $9 million. Future declarations of quarterly dividends are subject to the determination and discretion of Moog’s Board of Directors.

About Moog Inc.

Moog Inc. is a worldwide designer, manufacturer, and integrator of precision control components and systems. Moog’s high-performance systems control military and commercial aircraft, satellites, space vehicles, launch vehicles, defense systems, missiles, automated industrial machinery, marine and medical equipment. Additional information about the company can be found at www.moog.com.

Contact: Aaron Astrachan

716.687.4225

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonClassAMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonClassBMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

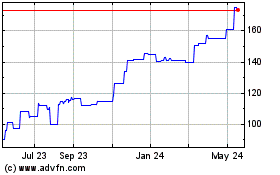

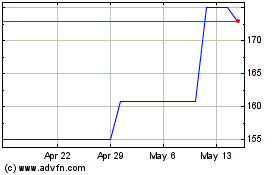

Moog (NYSE:MOG.B)

Historical Stock Chart

From Oct 2024 to Nov 2024

Moog (NYSE:MOG.B)

Historical Stock Chart

From Nov 2023 to Nov 2024