Materion Corporation (NYSE: MTRN) today reported fourth quarter

and full-year 2024 financial results, provided 2025 earnings

guidance and announced a new mid-term profitability target.

Fourth Quarter 2024 Financial Summary

- Net sales were $436.9 million; value-added sales1 were $296.1

million

- Net loss of $48.8 million, or $2.33 loss per share, diluted,

versus net income of $19.5 million, or $0.93 per share, in the

prior year quarter; record quarterly adjusted earnings of $1.55 per

share versus $1.41 in the prior year quarter

- Operating loss of $38.3 million versus operating profit of

$27.6 million in the prior year quarter; record quarterly adjusted

EBITDA2 of $61.5 million versus $53.3 million in the prior year

quarter

Full-Year 2024 Highlights

- Net sales were $1.68 billion; value-added sales were $1.10

billion

- Net income was $5.9 million, or $0.28 per share, diluted,

versus $95.7 million, or $4.58 per share, in the prior year period;

adjusted earnings of $5.34 per share versus $5.64 in the prior year

period

- Adjusted EBITDA of $221.2 million, versus $217.7 million in the

prior year

- Achieved mid-term target of 20% adjusted EBITDA margin for the

year, first time in company history

- Established new mid-term adjusted EBITDA margin target of 23%

based on the Company’s prospects and performance expectations

- Secured several significant new business wins and customer

partnerships further strengthening the organic pipeline

- Precision Optics transformation underway with appointment of

new business president

- Completed sale of non-core large area targets business in

Albuquerque, New Mexico

"The fourth-quarter and full-year results showcase the

significant impact of our initiatives to enhance operational

performance, streamline our cost structure, and optimize the

Company’s footprint. I am extremely proud of our global team for

their relentless efforts to serve our customers and drive

improvements across Materion, even in the face of ongoing

challenging market conditions," said Jugal Vijayvargiya, President

& CEO of Materion.

“2024 was a landmark year for Materion, as we achieved our

mid-term target of 20% adjusted EBITDA margin for the first time in

the Company's history. Achieving this level of performance in soft

market conditions gives us confidence to look ahead to what’s next,

as our end markets strengthen, and we deliver on our organic

initiatives while executing further operational improvements. With

this in mind, we have established a new mid-term adjusted EBITDA

margin target of 23%, delivering an additional 300 basis points of

improvement over the next several years. We expect to deliver

another year of strong performance in 2025, as a result of our

improved operational performance, and strengthening market

conditions as we move through the year.”

FOURTH QUARTER 2024

RESULTS

Net sales for the quarter were $436.9 million, compared to

$421.0 million in the prior year period. Value-added sales were

$296.1 million for the quarter, up 2% from the prior year period

primarily driven by strength in space & defense and improvement

in semiconductor. This increase was partially offset by continued

headwinds across automotive, industrial and energy.

Operating loss for the quarter was $38.3 million and net loss

was $48.8 million, or $2.33 loss per diluted share, compared to

operating profit of $27.6 million and net income of $19.5 million,

or $0.93 per share, in the prior year period.

Excluding special items3 including a non-cash goodwill and

intangible impairment in Precision Optics, adjusted EBITDA was a

quarterly record $61.5 million, or 20.8% of value-added sales,

compared to $53.3 million or 18.4% of value-added sales in the

prior year period. This record adjusted EBITDA was driven by higher

volume, favorable price/mix, strong cost management and operational

performance.

Adjusted net income was $32.4 million excluding acquisition

amortization, or $1.55 per diluted share, compared to $1.41 per

share in the prior year period.

FULL-YEAR 2024 RESULTS

Net sales for the year were $1.68 billion, compared to $1.67

billion in the prior year. Value-added sales were $1.10 billion for

the year, down 3% from the prior year due to weakness in several

key end markets including industrial, energy and automotive. This

decrease was partially offset by strength in space & defense

and precision clad strip.

Operating profit for the year was $47.2 million and net income

was $5.9 million, or $0.28 per diluted share, compared to operating

profit of $136.4 million and net income of $95.7 million, or $4.58

per diluted share, in the prior year.

Excluding special items, adjusted EBITDA for the year was $221.2

million, compared to $217.7 million in the prior year. The increase

was driven primarily by strong operational performance, cost

management and improved mix driven by new business.

Adjusted net income was $111.8 million excluding acquisition

amortization, or $5.34 per diluted share, compared to $5.64 per

diluted share in the prior year.

OUTLOOK

After a challenged macroenvironment in 2024, we remain

cautiously optimistic about the market dynamics entering 2025, and

are expecting mid-single digit top-line growth from our businesses,

excluding precision clad strip. The precision clad strip inventory

correction is expected to continue through 2025, returning to

growth in 2026. Despite this impact, we expect earnings growth in

2025 from market outperformance, continued operational excellence,

cost management and portfolio optimization actions. With this, we

are guiding to the range of $5.30 to $5.70 for full year 2025

adjusted earnings per share, an increase of 3% from prior year at

the midpoint.

ADJUSTED EARNINGS

GUIDANCE

It is not possible for the Company to identify the amount or

significance of future adjustments associated with potential

insurance and litigation claims, legacy environmental costs,

acquisition and integration costs, certain income tax items, or

other non-routine costs that the Company adjusts in the

presentation of adjusted earnings guidance. These items are

dependent on future events that are not reasonably estimable at

this time. Accordingly, the Company is unable to reconcile without

unreasonable effort the forecasted range of adjusted earnings

guidance for the full year to a comparable GAAP range. However,

items excluded from the Company's adjusted earnings guidance

include the historical adjustments noted in Attachments 4 through 8

to this press release.

CONFERENCE CALL

Materion Corporation will host an investor conference call with

analysts at 10:00 a.m. Eastern Time, February 19, 2025. The

conference call will be available via webcast through the Company’s

website at www.materion.com. By phone, please dial (888) 506-0062.

Calls outside the U.S. can dial (973) 528-0011; please reference

participant access code of 357106. A replay of the call will be

available until March 5, 2025 by dialing (877) 481-4010 or (919)

882-2331 if international; please reference replay ID number 51061.

The call will also be archived on the Company’s website.

FOOTNOTES 1 Value-added

sales deducts the impact of pass-through metals from net sales 2

EBITDA represents earnings before interest, taxes, depreciation,

depletion and amortization 3 Details of the special items can be

found in Attachments 4 through 8

ABOUT MATERION

Materion Corporation is a global leader in advanced materials

solutions for high-performance industries including semiconductor,

industrial, aerospace & defense, energy and automotive. With

nearly 100 years of expertise in specialty engineered alloy

systems, inorganic chemicals and powders, precious and non-precious

metals, beryllium and beryllium composites, and precision filters

and optical coatings, Materion partners with customers to enable

breakthrough solutions that move the world forward. Headquartered

in Mayfield Heights, Ohio, the Company employs more than 3,000

talented people worldwide, serving customers in more than 60

countries.

FORWARD-LOOKING

STATEMENTS

Portions of the narrative set forth in this document that are

not statements of historical or current facts are forward-looking

statements. Our actual future performance may materially differ

from that contemplated by the forward-looking statements as a

result of a variety of factors. These factors include, in addition

to those mentioned elsewhere herein: the global economy, including

inflationary pressures, potential future recessionary conditions

and the impact of tariffs and trade agreements; the impact of any

U.S. Federal Government shutdowns or sequestrations; the condition

of the markets which we serve, whether defined geographically or by

segment; changes in product mix and the financial condition of

customers; our success in developing and introducing new products

and new product ramp-up rates; our success in passing through the

costs of raw materials to customers or otherwise mitigating

fluctuating prices for those materials, including the impact of

fluctuating prices on inventory values; our success in identifying

acquisition candidates and in acquiring and integrating such

businesses; the impact of the results of acquisitions on our

ability to fully achieve the strategic and financial objectives

related to these acquisitions; our success in implementing our

strategic plans and the timely and successful start-up and

completion of any capital projects; other financial and economic

factors, including the cost and availability of raw materials (both

base and precious metals), physical inventory valuations, metal

consignment fees, tax rates, exchange rates, interest rates,

pension costs and required cash contributions and other employee

benefit costs, energy costs, regulatory compliance costs, the cost

and availability of insurance, credit availability, and the impact

of the Company’s stock price on the cost of incentive compensation

plans; the uncertainties related to the impact of war, terrorist

activities, and acts of God; changes in government regulatory

requirements and the enactment of new legislation that impacts our

obligations and operations; the conclusion of pending litigation

matters in accordance with our expectation that there will be no

material adverse effects; the disruptions in operations from, and

other effects of, catastrophic and other extraordinary events

including outbreaks from infectious diseases and the conflict

between Russia and Ukraine and other hostilities; realization of

expected financial benefits expected from the Inflation Reduction

Act of 2022; and the risk factors set forth in Part 1, Item 1A of

the Company's 2023 Annual Report on Form 10-K and in other reports

that we file with the SEC.

Attachment 1

Materion Corporation and

Subsidiaries

Consolidated Statements of

Income

(Unaudited)

Fourth Quarter Ended

Year Ended

(In thousands except per share

amounts)

December 31, 2024

December 31, 2023

December 31, 2024

December 31, 2023

Net sales

$

436,871

$

421,043

$

1,684,739

$

1,665,187

Cost of sales

343,895

341,328

1,358,754

1,316,145

Gross margin

92,976

79,715

325,985

349,042

Selling, general, and administrative

expense

41,134

39,858

145,588

157,911

Research and development expense

6,316

6,442

29,028

27,540

Goodwill impairment

56,067

—

56,067

—

Long-lived asset impairment

17,134

—

17,134

—

Loss on asset disposal

6,412

—

6,412

—

Restructuring expense

687

630

6,848

3,824

Other — net

3,573

5,145

17,685

23,323

Operating profit (loss)

(38,347

)

27,640

47,223

136,444

Other non-operating (income)

expense—net

(518

)

(569

)

(2,443

)

(2,710

)

Interest expense — net

8,844

8,503

34,764

31,323

Income (loss) before income

taxes

(46,673

)

19,706

14,902

107,831

Income tax (benefit) expense

2,177

238

9,014

12,129

Net income (loss)

$

(48,850

)

$

19,468

$

5,888

$

95,702

Basic earnings per share:

Net income (loss) per share of common

stock

$

(2.35

)

$

0.94

$

0.28

$

4.64

Diluted earnings per share:

Net income (loss) per share of common

stock

$

(2.33

)

$

0.93

$

0.28

$

4.58

Weighted-average number of shares of

common stock outstanding:

Basic

20,758

20,644

20,732

20,619

Diluted

20,923

20,936

20,928

20,911

Attachment 2

Materion Corporation and

Subsidiaries

Consolidated Balance

Sheets

(Unaudited)

(Thousands)

December 31, 2024

December 31, 2023

Assets

Current assets

Cash and cash equivalents

$

16,713

$

13,294

Accounts receivable, net

193,793

192,747

Inventories, net

441,299

441,597

Prepaid and other current assets

72,419

61,744

Total current assets

724,224

709,382

Deferred income taxes

2,964

4,908

Property, plant, and equipment

1,315,586

1,281,622

Less allowances for depreciation,

depletion, and amortization

(804,781

)

(766,939

)

Property, plant, and equipment—net

510,805

514,683

Operating lease, right-of-use assets

64,449

57,645

Intangible assets

109,312

133,571

Other assets

22,140

21,664

Goodwill

263,738

320,873

Total Assets

$

1,697,632

$

1,762,726

Liabilities and Shareholders’

Equity

Current liabilities

Short-term debt

$

34,274

$

38,597

Accounts payable

105,901

125,663

Salaries and wages

20,939

25,912

Other liabilities and accrued items

47,523

45,773

Income taxes

4,906

5,207

Unearned revenue

13,191

13,843

Total current liabilities

226,734

254,995

Other long-term liabilities

12,013

13,300

Operating lease liabilities

62,626

53,817

Finance lease liabilities

12,404

13,744

Retirement and post-employment

benefits

26,411

26,334

Unearned income

75,769

103,983

Long-term income taxes

1,818

3,815

Deferred income taxes

3,242

20,109

Long-term debt

407,734

387,576

Shareholders’ equity

868,881

885,053

Total Liabilities and Shareholders’

Equity

$

1,697,632

$

1,762,726

Attachment 3

Materion Corporation and

Subsidiaries

Consolidated Statements of

Cash Flows

(Thousands)

December 31, 2024

December 31, 2023

Cash flows from operating activities:

Net income

$

5,888

$

95,702

Adjustments to reconcile net income to net

cash provided by operating activities:

Depreciation, depletion, and

amortization

68,676

61,644

Amortization of deferred financing costs

in interest expense

1,714

1,712

Stock-based compensation expense

(non-cash)

10,560

10,092

Amortization of pension and

post-retirement costs

(307

)

(1,318

)

Loss on sale of property, plant, and

equipment

1,201

20

Deferred income tax (benefit) expense

(16,598

)

(7,005

)

Impairment charges

73,201

—

Loss on asset disposal

6,412

—

Net pension curtailments and

settlements

—

142

Changes in assets and liabilities, net of

acquired assets and liabilities:

Decrease (increase) in accounts

receivable

(3,723

)

23,359

Decrease (increase) in inventory

(468

)

(18,700

)

Decrease (increase) in prepaid and other

current assets

(11,345

)

(22,663

)

Increase (decrease) in accounts payable

and accrued expenses

(15,757

)

6,631

Increase (decrease) in unearned

revenue

(24,692

)

(17,361

)

Increase (decrease) in interest and taxes

payable

(2,619

)

3,771

Increase (decrease) in unearned income due

to customer prepayments

—

16,676

Other — net

(4,326

)

(8,288

)

Net cash provided by operating

activities

87,817

144,414

Cash flows from investing activities:

Payments for purchase of property, plant,

and equipment

(68,649

)

(110,550

)

Payments for mine development

(12,159

)

(9,326

)

Proceeds from sale of property, plant, and

equipment

1,203

654

Net cash used in investing

activities

(79,605

)

(119,222

)

Cash flows from financing activities:

Proceeds from (repayment of) borrowings

under credit facilities, net

45,692

8,065

Repayment of debt

(30,342

)

(15,415

)

Principal payments under finance lease

obligations

(683

)

(1,645

)

Cash dividends paid

(11,087

)

(10,621

)

Deferred financing costs

(156

)

—

Payments of withholding taxes for

stock-based compensation awards

(7,610

)

(5,234

)

Net cash used in financing

activities

(4,186

)

(24,850

)

Effects of exchange rate changes

(607

)

(149

)

Net change in cash and cash

equivalents

3,419

193

Cash and cash equivalents at beginning

of period

13,294

13,101

Cash and cash equivalents at end of

period

$

16,713

$

13,294

Attachment 4

Materion Corporation and

Subsidiaries

Reconciliation of Non-GAAP

Measure - Value-added Sales, Operating Profit, and EBITDA

(Unaudited)

Fourth Quarter Ended

Year Ended

(Millions)

December 31, 2024

December 31, 2023

December 31, 2024

December 31, 2023

Net Sales

Performance Materials

$

211.0

$

201.1

$

744.5

$

755.5

Electronic Materials

204.2

193.9

845.7

805.8

Precision Optics

21.7

26.0

94.5

103.9

Other

—

—

—

—

Total

$

436.9

$

421.0

$

1,684.7

$

1,665.2

Less: Pass-through Metal Cost

Performance Materials

$

15.2

$

15.1

$

56.5

$

66.9

Electronic Materials

125.6

116.2

530.4

471.1

Precision Optics

—

—

0.2

0.1

Other

—

—

—

—

Total

$

140.8

$

131.3

$

587.1

$

538.1

Value-added Sales (non-GAAP)

Performance Materials

$

195.8

$

186.0

$

688.0

$

688.6

Electronic Materials

78.6

77.7

315.3

334.7

Precision Optics

21.7

26.0

94.3

103.8

Other

—

—

—

—

Total

$

296.1

$

289.7

$

1,097.6

$

1,127.1

Gross Margin

Performance Materials(1)

$

62.6

$

50.5

$

203.2

$

216.5

Electronic Materials(1)

26.0

21.5

99.5

100.4

Precision Optics(1)

4.4

7.7

23.3

32.1

Other

—

—

—

—

Total(1)

$

93.0

$

79.7

$

326.0

$

349.0

(1) See reconciliation of gross margin to

adjusted gross margin in Attachment 8

Note: Quarterly information presented

within this document and previously disclosed quarterly information

may not equal the total computed for the year due to rounding

Fourth Quarter Ended

Year Ended

(Millions)

December 31, 2024

December 31, 2023

December 31, 2024

December 31, 2023

Operating Profit (Loss)

Performance Materials

$

43.4

$

33.0

$

132.1

$

143.9

Electronic Materials

2.9

3.8

29.4

28.6

Precision Optics

(77.0

)

(0.4

)

(84.7

)

(2.0

)

Other

(7.6

)

(8.8

)

(29.6

)

(34.1

)

Total

$

(38.3

)

$

27.6

$

47.2

$

136.4

Non-Operating (Income) Expense

Performance Materials

$

0.1

$

0.2

$

0.5

$

0.6

Electronic Materials

—

(0.1

)

—

(0.1

)

Precision Optics

—

—

(0.4

)

(0.6

)

Other

(0.6

)

(0.7

)

(2.5

)

(2.7

)

Total

$

(0.5

)

$

(0.6

)

$

(2.4

)

$

(2.8

)

Depreciation, Depletion, and

Amortization

Performance Materials

$

10.1

$

7.6

$

37.7

$

31.2

Electronic Materials

4.4

4.3

18.0

17.0

Precision Optics

2.4

2.6

11.0

11.3

Other

0.4

0.6

2.0

2.1

Total

$

17.3

$

15.1

$

68.7

$

61.6

Segment EBITDA

Performance Materials

$

53.4

$

40.4

$

169.3

$

174.5

Electronic Materials

7.3

8.2

47.4

45.7

Precision Optics

(74.6

)

2.2

(73.3

)

9.9

Other

(6.6

)

(7.5

)

(25.1

)

(29.3

)

Total

$

(20.5

)

$

43.3

$

118.3

$

200.8

Special Items(2)

Performance Materials

$

0.2

$

5.6

$

9.5

$

6.7

Electronic Materials

7.4

2.8

14.6

7.3

Precision Optics

73.5

1.6

75.2

2.8

Other

0.9

—

3.6

0.1

Total

$

82.0

$

10.0

$

102.9

$

16.9

Adjusted EBITDA Excluding Special

Items

Performance Materials

$

53.6

$

46.0

$

178.8

$

181.2

Electronic Materials

14.7

11.0

62.0

53.0

Precision Optics

(1.1

)

3.8

1.9

12.7

Other

(5.7

)

(7.5

)

(21.5

)

(29.2

)

Total

$

61.5

$

53.3

$

221.2

$

217.7

The cost of gold, silver, platinum, palladium, copper,

ruthenium, iridium, rhodium, rhenium, and osmium is passed through

to customers and, therefore, the trends and comparisons of net

sales are affected by movements in the market price of these

metals. Internally, management also reviews net sales on a

value-added basis. Value-added sales is a non-GAAP financial

measure that deducts the value of the pass-through metals sold from

net sales. Value-added sales allows management to assess the impact

of differences in net sales between periods or segments and analyze

the resulting margins and profitability without the distortion of

the movements in pass-through market metal prices. The dollar

amount of gross margin and operating profit is not affected by the

value-added sales calculation. The Company sells other metals and

materials that are not considered direct pass throughs, and these

costs are not deducted from net sales to calculate value-added

sales.

The Company’s pricing policy is to pass the cost of these metals

on to customers in order to mitigate the impact of price volatility

on the Company’s results from operations. Value-added information

is being presented since changes in metal prices may not directly

impact profitability. It is the Company’s intent to allow users of

the financial statements to review sales with and without the

impact of the pass-through metals.

(2) See additional details of special items in Attachment 5.

Attachment 5

Materion Corporation and

Subsidiaries

Reconciliation of Net Sales to

Value-added Sales, Net Income to EBITDA and Adjusted EBITDA

(Unaudited)

Fourth Quarter Ended

Twelve Months Ended

(Millions)

December 31, 2024

December 31, 2023

December 31, 2024

December 31, 2023

Net sales

$

436.9

$

421.0

$

1,684.7

$

1,665.2

Pass-through metal cost

140.8

131.3

587.1

538.1

Value-added sales

$

296.1

$

289.7

$

1,097.6

$

1,127.1

Net income (loss)

$

(48.8

)

$

19.5

$

5.9

$

95.7

Income tax expense

2.2

0.2

9.0

12.2

Interest expense - net

8.8

8.5

34.7

31.3

Depreciation, depletion and

amortization

17.3

15.1

68.7

61.6

Consolidated EBITDA

$

(20.5

)

$

43.3

$

118.3

$

200.8

Net Income as a % of Net sales

(11.2

)%

4.6

%

0.4

%

5.7

%

Net Income as a % of Value-added sales

(16.5

)%

6.7

%

0.5

%

8.5

%

EBITDA as a % of Net sales

(4.7

)%

10.3

%

7.0

%

12.1

%

EBITDA as a % of Value-added sales

(6.9

)%

14.9

%

10.8

%

17.8

%

Special items

Restructuring and cost reduction

$

0.7

$

4.2

$

11.4

$

11.1

Electronic Materials inventory

adjustment

—

—

2.8

—

Business transformation costs

0.7

—

1.3

—

Pension settlement

—

0.2

—

0.2

Additional start up resources and

scrap

—

5.6

6.1

5.6

Precision Optics impairments

73.2

—

73.2

—

Merger, acquisition and divestiture

related costs

7.4

—

8.1

—

Total special items

82.0

10.0

102.9

16.9

Adjusted EBITDA

$

61.5

$

53.3

$

221.2

$

217.7

Adjusted EBITDA as a % of Net sales

14.1

%

12.7

%

13.1

%

13.1

%

Adjusted EBITDA as a % of Value-added

sales

20.8

%

18.4

%

20.2

%

19.3

%

In addition to presenting financial statements prepared in

accordance with U.S. generally accepted accounting principles

(GAAP), this earnings release contains financial measures,

including operating profit, segment operating profit, earnings

before interest, taxes, depreciation, depletion and amortization

(EBITDA), net income, and earnings per share, on a non-GAAP basis.

As detailed in the above reconciliation and Attachment 6, we have

adjusted the results for certain special items, including the

following:

- Restructuring and cost reduction – Costs include restructuring

charges, costs associated with temporarily idled facilities as a

result of decreased demand and costs associated with disposal of

assets associated with obsolete products.

- Electronic Materials inventory adjustment – During the third

quarter of 2024, the Company determined that material costs from

prior years were understated due to unrecognized metal refine

expense and other inventory adjustments.

- Business transformation costs – Represents project management

and implementation expenses related to the Company's automation and

transformation initiatives.

- Pension settlement - Represents settlement charges related to

the Company's international pension plans.

- Additional start up resources and scrap – Represents

incremental resource, consulting and specialists costs incurred

related to the ramp of the precision clad strip facility and scrap

related to product qualifications.

- Precision Optics impairments - Represents goodwill and

long-lived asset impairment charges within the Precision Optics

segment taken in the fourth quarter of 2024.

- Merger, acquisition and divestiture related costs – Includes

due diligence costs associated with potential merger, acquisition

and divestitures as well as loss on asset disposals.

Internally, management reviews the results of operations without

the impact of these costs in order to assess the profitability from

ongoing activities. We are providing this information because we

believe it will assist investors in analyzing our financial results

and, when viewed in conjunction with the GAAP results, provide a

more comprehensive understanding of the factors and trends

affecting our operations.

Attachment 6

Materion Corporation and

Subsidiaries

Reconciliation of Net Income

to Adjusted Net Income

and Diluted Earnings per Share

to Adjusted Diluted Earnings per Share (Unaudited)

Fourth Quarter Ended

Twelve Months Ended

(Millions)

December 31, 2024

Diluted EPS

December 31, 2023

Diluted EPS

December 31,

2024

Diluted EPS

December 31, 2023

Diluted EPS

Net income (loss) and EPS

$

(48.8

)

$

(2.33

)

$

19.5

$

0.93

$

5.9

$

0.28

$

95.7

$

4.58

Special items

Restructuring and cost reduction

0.7

4.2

11.4

11.1

Electronic Materials inventory

adjustment

—

—

2.8

—

Business transformation costs

0.7

—

1.3

—

Pension settlement

—

0.2

—

0.2

Additional start up resources and

scrap

—

5.6

6.1

5.6

Precision Optics impairments

73.2

—

73.2

—

Merger, acquisition and divestiture

related costs

7.4

—

8.1

—

Provision for income taxes (1)

(3.0

)

(2.4

)

(6.6

)

(4.4

)

Total special items

79.0

3.77

7.6

0.36

96.3

4.60

12.5

0.60

Adjusted net income and adjusted EPS

$

30.2

$

1.44

$

27.1

$

1.29

$

102.2

$

4.88

$

108.2

$

5.17

Acquisition amortization (net of tax)

2.2

0.11

2.5

0.12

9.6

0.46

9.8

0.47

Adjusted net income and adjusted EPS excl.

amortization

$

32.4

$

1.55

$

29.6

$

1.41

$

111.8

$

5.34

$

118.0

$

5.64

(1) Provision for income taxes includes the net tax impact on

pre-tax adjustments (listed above), the impact of certain discrete

tax items recorded during the respective periods as well as other

adjustments to reflect the use of one overall effective tax rate on

adjusted pre-tax income in interim periods.

Attachment 7

Reconciliation of Segment Net

sales to Segment Value-added sales and Segment EBITDA to Adjusted

Segment EBITDA (Unaudited)

Performance Materials

Fourth Quarter Ended

Twelve Months Ended

(Millions)

December 31, 2024

December 31, 2023

December 31, 2024

December 31, 2023

Net sales

$

211.0

$

201.1

$

744.5

$

755.5

Pass-through metal cost

15.2

15.1

56.5

66.9

Value-added sales

$

195.8

$

186.0

$

688.0

$

688.6

EBITDA

$

53.4

$

40.4

$

169.3

$

174.5

Restructuring and cost reduction

0.1

—

2.9

1.1

Additional start up resources and

scrap

—

5.6

6.1

5.6

Business transformation costs

0.1

—

0.5

—

Adjusted EBITDA

$

53.6

$

46.0

$

178.8

$

181.2

EBITDA as a % of Net sales

25.3

%

20.1

%

22.7

%

23.1

%

EBITDA as a % of Value-added sales

27.3

%

21.7

%

24.6

%

25.3

%

Adjusted EBITDA as a % of Net sales

25.4

%

22.9

%

24.0

%

24.0

%

Adjusted EBITDA as a % of Value-added

sales

27.4

%

24.7

%

26.0

%

26.3

%

Electronic Materials

Fourth Quarter Ended

Twelve Months Ended

(Millions)

December 31, 2024

December 31, 2023

December 31, 2024

December 31, 2023

Net sales

$

204.2

$

193.9

$

845.7

$

805.8

Pass-through metal cost

125.6

116.2

530.4

471.1

Value-added sales

$

78.6

$

77.7

$

315.3

$

334.7

EBITDA

$

7.3

$

8.2

$

47.4

$

45.7

Restructuring and cost reduction

0.2

2.8

4.5

7.3

Merger, acquisition and divestiture

related costs

7.0

—

7.0

—

Business transformation costs

0.2

—

0.3

—

Electronic Materials inventory

adjustment

—

—

2.8

—

Adjusted EBITDA

$

14.7

$

11.0

$

62.0

$

53.0

EBITDA as a % of Net sales

3.6

%

4.2

%

5.6

%

5.7

%

EBITDA as a % of Value-added sales

9.3

%

10.6

%

15.0

%

13.7

%

Adjusted EBITDA as a % of Net sales

7.2

%

5.7

%

7.3

%

6.6

%

Adjusted EBITDA as a % of Value-added

sales

18.7

%

14.2

%

19.7

%

15.8

%

Precision Optics

Fourth Quarter Ended

Twelve Months Ended

(Millions)

December 31, 2024

December 31, 2023

December 31, 2024

December 31, 2023

Net sales

$

21.7

$

26.0

$

94.5

$

103.9

Pass-through metal cost

—

—

0.2

0.1

Value-added sales

$

21.7

$

26.0

$

94.3

$

103.8

EBITDA

$

(74.6

)

$

2.2

$

(73.3

)

$

9.9

Restructuring and cost reduction

0.3

1.4

2.0

2.6

Pension settlement

—

0.2

—

0.2

Precision Optics impairments

73.2

—

73.2

—

Adjusted EBITDA

$

(1.1

)

$

3.8

$

1.9

$

12.7

EBITDA as a % of Net sales

(343.8

)%

8.5

%

(77.6

)%

9.5

%

EBITDA as a % of Value-added sales

(343.8

)%

8.5

%

(77.7

)%

9.5

%

Adjusted EBITDA as a % of Net sales

(5.1

)%

14.6

%

2.0

%

12.2

%

Adjusted EBITDA as a % of Value-added

sales

(5.1

)%

14.6

%

2.0

%

12.2

%

Other

Fourth Quarter Ended

Twelve Months Ended

(Millions)

December 31, 2024

December 31, 2023

December 31, 2024

December 31, 2023

EBITDA

$

(6.6

)

$

(7.5

)

$

(25.1

)

$

(29.3

)

Restructuring and cost reduction

0.1

—

2.0

0.1

Business transformation costs

0.4

—

0.5

—

Merger, acquisition and divestiture

related costs

0.4

—

1.1

—

Adjusted EBITDA

$

(5.7

)

$

(7.5

)

$

(21.5

)

$

(29.2

)

Attachment 8

Materion Corporation and

Subsidiaries

Reconciliation of Non-GAAP

Measure - Gross Margin to Adjusted Gross Margin

(Unaudited)

Fourth Quarter Ended

Twelve Months Ended

(Millions)

December 31, 2024

December 31, 2023

December 31, 2024

December 31, 2023

Gross Margin

Performance Materials

$

62.6

$

50.5

$

203.2

$

216.5

Electronic Materials

26.0

21.5

99.5

100.4

Precision Optics

4.4

7.7

23.3

32.1

Other

—

—

—

—

Total

$

93.0

$

79.7

$

326.0

$

349.0

Special Items (1)

Performance Materials

$

—

$

5.6

$

7.5

$

6.4

Electronic Materials

—

1.5

4.7

3.9

Precision Optics

—

1.0

0.2

1.3

Other

—

—

—

—

Total

$

—

$

8.1

$

12.4

$

11.6

Adjusted Gross Margin

Performance Materials

$

62.6

$

56.1

$

210.7

$

222.9

Electronic Materials

26.0

23.0

104.2

104.3

Precision Optics

4.4

8.7

23.5

33.4

Other

—

—

—

—

Total

$

93.0

$

87.8

$

338.4

$

360.6

(1) Special items impacting gross margin represent restructuring

and cost reduction, the Electronic Materials inventory adjustment,

and additional start up resources and scrap in 2024, and

restructuring and cost reduction and additional start up resources

and scrap in 2023.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250218125060/en/

Investor Contact: Kyle Kelleher

(216) 383-4931 kyle.kelleher@materion.com Media Contact: Jason Saragian (216) 383-6893

jason.saragian@materion.com https://materion.com Mayfield Hts-g

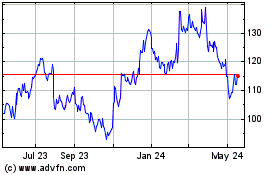

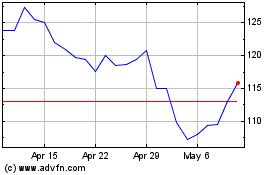

Materion (NYSE:MTRN)

Historical Stock Chart

From Jan 2025 to Feb 2025

Materion (NYSE:MTRN)

Historical Stock Chart

From Feb 2024 to Feb 2025