McEwen Mining Inc. (NYSE: MUX) (TSX: MUX) reports

its results for the third quarter (Q3) and nine months ended

September 30th, 2023.

Operational and Financial

Highlights

- Consolidated GEO production

in Q3 improved by 8% compared to both Q2/23 and Q3/22.

We produced 38,500 GEOs(1) in Q3, and 104,400 GEOs for the

nine months ended September 30th. We reiterate our

consolidated production guidance is at the lower end of our range

of 150,000 to 170,000 GEOs for the year (see Table

1).

- We continue to meet safety

standards at our 100% owned operations. During Q3, we had

no lost-time incidents at our Fox Complex, Gold Bar Mine, and El

Gallo operations.

- In Q3, our Fox Mine Complex

performed well, producing 11,200 ounces (oz) gold and remains on

track to meet guidance of 42,000 to 48,000 oz gold for the year.

Cash costs(4) and AISC per GEO(4) sold for the Fox Complex were

$1,078 and $1,288, respectively. We expect annual cash

costs(4) per GEO(4) sold to be 10% above of our 2023 guidance.

Figure 1 highlights the turnaround in production

at Fox that has occurred since 2021.

- In Q3, the Gold Bar Mine

produced 9,500 oz of gold, an increase of 20% compared to

Q2/23. Production continues to increase quarterly, though

delays from extreme weather and labor constraints during 2023 have

impacted our annual outlook. We now expect production from Gold Bar

to be between 36,500 to 40,000 oz gold. Cash costs(4) and

AISC per GEO(4) sold for the Gold Bar mine were $1,529 and $2,160,

respectively. AISC was affected by a $4.5 million

sustaining capital investment in a heap leach pad expansion, which

was substantially completed during the quarter. Additional mining

crews and the completion of our heap leach expansion are expected

to result in increased production in Q4/23 (see Figure

2), allowing Gold Bar to quickly realize recoveries on

material stockpiled during the last quarter. While this should

reduce costs per ounce in the fourth quarter, we still expect the

average costs for the year to be 10% to 15% higher than our 2023

guidance.

- In Q3, the San José Mine

produced 17,800 GEOs, an increase of 3% compared to Q2/23 due to a

modest improvement in processed tonnes. Our joint venture

partner and mine operator, Hochschild Mining, reiterates production

guidance of 66,000 to 74,000 GEOs for the year. Cash

costs(4) and AISC per GEO(4) sold for San José were $1,445 and

$1,953, respectively. We expect costs to remain

approximately 15% above 2023 guidance due to additional capital

development costs associated with the operator’s revised mine

plan.

- We continue to advance our

exploration program at Los Azules aiming to deliver all information

required for the feasibility study. During Q3, we

completed planning and preparation work for the 2023-2024 drilling

campaign, which has a target of 157,000 feet (48,000 meters) and

includes additional exploration, infill, geotech, hydrological and

hydrogeological drilling. 14 out of a total of 18 to 20 planned

drill rigs are currently operating and we have drilled 19,600 feet

(6,000 meters) to date. We invested $18.5 million in our

Los Azules copper project during Q3

primarily to build a winter camp, further improve our road access,

and to construct a logistics facility in San Juan.

- Subsequent to the quarter

end, McEwen Copper closed financings with Stellantis and Nuton, a

Rio Tinto Venture, raising ARS$42 billion (Argentine Pesos) and

$10.0 million, respectively, at a price of $26 per share,

which implies a market value of $800.0 million for McEwen

Copper. As part of these private placements, McEwen Mining

received $6.0 million from the sale of 232,000 McEwen Copper

common shares. McEwen Copper’s share ownership structure is now:

McEwen Mining 47.7%, Stellantis 19.4%, Nuton 14.5%, Rob McEwen

12.9% and 5.5% other shareholders. The implied market value

represents a value accretion of $207 million for McEwen Mining

(from $175 million to $382 million of implied ownership value),

representing a value of $7.48 per fully diluted McEwen Mining

share.

- Consolidated cash and cash

equivalents were $49.1 million (of which $47.5 million is to be

used towards advancing the Los Azules copper project) and

consolidated working capital $72.3 million as of September 30,

2023. We also reported investments of $40.8 million, which

consist of liquid securities held in Argentina to mitigate

inflation and devaluation risks.

- In Q3, we reported a gross

profit of $3.8 million and cash gross profit(4) of $11.9 million

from our 100% owned precious metal operations, compared to

a gross profit of $1.5 million and cash gross profit(4) of $5.8

million in Q3/22. Higher revenues driven by a 34% increase in GEOs

sold and a 10% increase in realized gold prices led to improvements

in gross profit and cash gross profit(4). Including our 49%

ownership of the San José Mine, we reported a total cash gross

profit(4) of $22.3 million compared with a total cash gross

profit(4) of $13.8 million in Q3/22.

- In Q3, we reported a net

loss of $18.5 million, or $0.39 per share, compared to a

net loss of $10.5 million, or $0.21 per share in Q3/22. Compared to

our gross profit, our net loss was the result of higher

year-over-year exploration and advanced project expenditures,

including an $18.5 million investment in exploration activities at

our Los Azules copper project.

- In Q3, we reported an

adjusted net loss(4) of $4.2 million compared to an adjusted net

income(4) of $6.4 million in Q3/22. Adjusted net loss(4)

excludes the expenses of McEwen Copper and our interest in the

San José mine, a metric that we believe best

represents the results of our 100% owned precious metal operations.

Compared to our cash gross profit(4) of $11.9 million, the adjusted

net loss(4) includes $6.6 million in exploration and advanced

project expenditures at our Fox Complex, Gold Bar mine and Fenix

Project operations, $8.5 million in non-cash depreciation, and $3.7

million in general and administrative expenses.

- Revenues of $38.4 million

were reported from the sale of 20,620 GEOs from our 100% owned

operations at an average realized price(4) of $1,920 per

GEO. Including our 49% ownership of San José Mine,

Q3 revenue would have increased by $31.6 million. This

compares to Q3/22 revenues of $26.0 million from the sale of 15,400

GEOs from our 100% owned operations at a realized price of $1,742

per GEO. Including our 49% ownership of San José Mine, Q3/22

revenue would have increased by $32.0 million.

- It is important to note

that because of the recent McEwen Copper financing, MUX’s ownership

in McEwen Copper is below 50%, and we expect to no longer

consolidate the financials of McEwen Copper. From Q4/23 onward we

expect to begin to account for McEwen Copper as an equity

investment. The Company expects to conclude soon on the

accounting impacts of our recent financing. The resulting impact on

our financials on a go-forward basis, should McEwen Copper be

deconsolidated, will be noticeable. Specifically, the carrying

value of our investment in McEwen Copper ownership may increase

significantly in line with the recent financings, and we expect

that our cash and liquid assets and expenses will decline

markedly.

Webcast

A webcast will be held on Thursday,

November 9th, 2023 at 11:00 AM

EST, where management will discuss our financial results

and project developments and follow with a question-and-answer

session. Questions for the call can be emailed in advance to

info@mcewenmining.com, or can be asked directly by participants

over the phone during the webcast.

|

Q3 Results Conference Call - Thursday,

November 9th, 2023, at 11:00 AM

EST |

|

Calling in: |

Participant Toll-Free Dial-In Number: (888) 210-3454Participant

Toll Dial-In Number: (646) 960-0130Conference ID: 3232920 |

|

Webcast Registration Link: |

https://events.q4inc.com/attendee/253960288 |

An archived replay of the webcast will be

available approximately 2 hours following the conclusion of the

live event. Access the replay on the Company’s media page at

https://www.mcewenmining.com/media.

Table 1 below provides

production and cost results for Q3 & 9M 2023 with comparative

results for Q3 & 9M 2022 and our Forecast and Guidance for

2023. Our Forecast for 2023 reflects production to September 30th

and management's current estimates for Q4 2023.

|

|

Q3 |

9M |

2023 Forecast(3) |

2023Guidance |

|

2022 |

2023 |

2022 |

2023 |

|

Consolidated Production |

|

|

|

|

|

|

Gold (oz) |

26,200 |

31,500 |

74,650 |

86,000 |

124,300-127,800 |

123,000-139,000 |

|

Silver (oz) |

853,000 |

580,200 |

1,894,100 |

1,531,200 |

2,300,000 |

2.3M-2.6M |

|

GEOs(1)(4) |

35,700 |

38,500 |

97,000 |

104,400 |

152,300-155,800 |

150,000-170,000 |

|

Gold Bar Mine, Nevada |

|

|

|

|

|

|

GEOs(1)(4) |

7,200 |

9,500 |

18,600 |

23,800 |

36,500-40,000 |

42,000-48,000 |

|

Cash Costs per GEO Sold(4) |

1,712 |

1,529 |

1,859 |

1,743 |

1,600 |

1,400 |

|

AISC per GEO Sold(4) |

2,049 |

2,160 |

2,251 |

2,203 |

1,900 |

1,680 |

|

Fox Complex, Canada |

|

|

|

|

|

|

GEOs(1)(4) |

9,000 |

11,200 |

27,900 |

34,200 |

45,500 |

42,000-48,000 |

|

Cash Costs per GEO Sold(4) |

774 |

1,078 |

978 |

1,129 |

1,100 |

1,000 |

|

AISC per GEO Sold(4) |

1.308 |

1,288 |

1,415 |

1,321 |

1,330 |

1,320 |

|

San José Mine, Argentina (49%)(2) |

|

|

|

|

|

|

Gold Production |

9,900 |

10,800 |

27,400 |

28,000 |

40,000 |

39,000-43,000 |

|

Silver Production |

852,200 |

580,200 |

1,892,400 |

1,531,200 |

2,300,000 |

2.3M-2.6M |

|

GEOs(1)(4) |

19,300 |

17,800 |

49,700 |

46,400 |

68,000 |

66,000-74,000 |

|

Cash Costs per GEO Sold(4) |

1,223 |

1,445 |

1,300 |

1,505 |

1,450 |

1,250 |

|

AISC per GEO Sold(4) |

1,562 |

1,953 |

1,718 |

1,971 |

1,800 |

1,550 |

Notes:(1) Gold Equivalent Ounces (GEOs) are

calculated based on a gold-to-silver price ratio of 90:1 for Q3

2022, 83:1 for 9M 2023, 82:1 for Q3 2022, and 83:1 for 9M 2022.

2023 production guidance is calculated based on an 85:1

gold-to-silver price ratio.(2) The San José Mine is 49% owned by

McEwen Mining Inc. and 51% owned and operated by Hochschild Mining

plc. Production is shown on a 49% basis.(3) El Gallo Mine (on care

and maintenance) is expected to recover 2,300 oz gold in 2023 from

plant and pond cleanout.(4) See disclosure below about Non-GAAP

Financial Performance Measures used in this release. (5) Production

figures may not add due to rounding.

Figure 1 below shows the Fox Mine Complex

actual annual production 2018-2022 and the 2023 forecast.

Figure 2 below shows Gold Bar Mine’s daily

ounces processed through the process plant from Jan 1, 2023 to Oct

31, 2023.

For the SEC Form 10-Q Financial Statements and MD&A

refer to:

http://www.sec.gov/cgi-bin/browse-edgar?action=getcompany&CIK=0000314203

Technical Information

The technical content of this news release

related to financial results, mining and development projects has

been reviewed and approved by William (Bill) Shaver, P.Eng., COO of

McEwen Mining and a Qualified Person as defined by SEC S-K 1300 and

the Canadian Securities Administrators National Instrument 43-101

"Standards of Disclosure for Mineral Projects."

Reliability of Information Regarding San

José

Minera Santa Cruz S.A. (“MSC”), the owner of the

San José Mine, is responsible for and has supplied to the Company

all reported results from the San José Mine. McEwen Mining's joint

venture partner, a subsidiary of Hochschild Mining plc, and its

affiliates other than MSC do not accept responsibility for the use

of project data or the adequacy or accuracy of this release.

NON-GAAP FINANCIAL PERFORMANCE MEASURES

We have included in this report certain non-GAAP

financial performance measures as detailed below. In the gold

mining industry, these are common performance measures but do not

have any standardized meaning and are considered non-GAAP measures.

We use these measures in evaluating our business and believe that,

in addition to conventional measures prepared in accordance with

GAAP, certain investors use such non-GAAP measures to evaluate our

performance and ability to generate cash flow. Accordingly, they

are intended to provide additional information and should not be

considered in isolation or as a substitute for measures of

performance prepared in accordance with GAAP. There are limitations

associated with the use of such non-GAAP measures. We compensate

for these limitations by relying primarily on our U.S. GAAP results

and using the non-GAAP measures supplementally. We do not provide a

reconciliation of forward-looking non-GAAP financial measures to

their most directly comparable GAAP financial measures on a

forward-looking basis because we are unable to predict items

contained in the GAAP financial measures without unreasonable

efforts.

The non-GAAP measures are presented for our

wholly-owned mines and the San José mine. The GAAP information used

for the reconciliation to the non-GAAP measures for the San José

mine may be found in Note 9, Investment in Minera Santa Cruz S.A.

(“MSC”) – San José Mine. The amounts in the tables labeled “49%

basis” were derived by applying to each financial statement line

item the ownership percentage interest used to arrive at our share

of net income or loss during the period when applying the equity

method of accounting. We do not control the interest in or

operations of MSC and the presentations of assets and liabilities

and revenues and expenses of MSC do not represent our legal claim

to such items. The amount of cash we receive is based upon specific

provisions of the Option and Joint Venture Agreement and varies

depending on factors including the profitability of the

operations.The presentation of these measures, including those for

MSC, has limitations as an analytical tool. Some of these

limitations include:

- The amounts shown on MSC’s

individual line items do not represent our legal claim to its

assets and liabilities, or the revenues and expenses; and

- Other companies in our industry may

calculate their cash gross profit, cash costs, cash cost per ounce,

all-in sustaining costs, all-in sustaining cost per ounce, average

realized price per ounce, and liquid assets differently than we do,

limiting the usefulness as a comparative measure.

Adjusted Net Income or Loss and Adjusted

Net Income or Loss Per Share

Adjusted net income or loss is a non-GAAP

financial measure and does not have any standardized meaning. We

use adjusted net income to evaluate our operating performance and

ability to generate cash flow from our wholly-owned operations in

production; we disclose this metric as we believe this measure

provides valuable assistance to investors and analysts in

evaluating our ability to finance our precious metal operations and

capital activities separately from our copper operations. The most

directly comparable measure prepared in accordance with GAAP is net

income or loss. Adjusted net income is calculated by adding back

McEwen Copper and MSC’s income or loss impacts to our consolidated

net income or loss.

The following tables present a reconciliation of

adjusted net income to the most directly comparable GAAP measure,

net income:

|

|

|

Three months ended September 30, |

|

Nine months ended September 30, |

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

Adjusted net income or loss |

|

(in thousands) |

|

(in thousands) |

|

Net loss after income and mining taxes |

|

$ |

(29,661 |

) |

|

$ |

(10,542 |

) |

|

$ |

(109,332 |

) |

|

$ |

(44,012 |

) |

|

Adjusted for: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Advanced Projects – McEwen Copper (Note 2) |

|

|

18,478 |

|

|

|

7,623 |

|

|

|

78,883 |

|

|

|

31,460 |

|

|

Exploration – McEwen Copper (Note 2) |

|

|

— |

|

|

|

141 |

|

|

|

386 |

|

|

|

629 |

|

|

General and administrative – McEwen Copper |

|

|

1,456 |

|

|

|

3,185 |

|

|

|

3,026 |

|

|

|

6,708 |

|

|

Interest and other finance (income) loss – McEwen Copper |

|

|

(24,554 |

) |

|

|

590 |

|

|

|

(57,937 |

) |

|

|

476 |

|

|

Foreign currency loss (gain) – McEwen Copper |

|

|

25,120 |

|

|

|

6,118 |

|

|

|

35,639 |

|

|

|

(1,577 |

) |

|

Income tax (recovery) expense – McEwen Copper |

|

|

989 |

|

|

|

24 |

|

|

|

(132 |

) |

|

|

24 |

|

|

Loss (income) from investment in Minera Santa Cruz S.A. (Note

9) |

|

|

2,672 |

|

|

|

(758 |

) |

|

|

7,047 |

|

|

|

(2,149 |

) |

|

Adjusted net (loss) income |

|

$ |

(5,500 |

) |

|

$ |

6,380 |

|

|

$ |

(42,419 |

) |

|

$ |

(8,441 |

) |

|

Weighted average shares outstanding (thousands) |

|

|

47,429 |

|

|

|

50,778 |

|

|

|

47,428 |

|

|

|

48,218 |

|

|

Adjusted net loss per share |

|

$ |

(0.12 |

) |

|

$ |

0.13 |

|

|

$ |

(0.89 |

) |

|

$ |

(0.18 |

) |

Cash Gross Profit or Loss

Cash gross profit or loss is a non-GAAP

financial measure and does not have any standardized meaning. We

use cash gross profit to evaluate our operating performance and

ability to generate cash flow; we disclose cash gross profit as we

believe this measure provides valuable assistance to investors and

analysts in evaluating our ability to finance our ongoing business

and capital activities. The most directly comparable measure

prepared in accordance with GAAP is gross profit or loss. Cash

gross profit is calculated by adding back the depreciation and

depletion expense to gross profit or loss.

The following tables present a reconciliation of

cash gross profit or loss to the most directly comparable GAAP

measure, gross profit or loss:

|

|

|

Three months ended September 30, 2023 |

|

Nine months ended September 30, 2023 |

|

|

|

Gold Bar |

|

Fox Complex |

|

El Gallo |

|

Total (100% owned) |

|

Gold Bar |

|

Fox Complex |

|

El Gallo |

|

Total (100% owned) |

|

|

|

(in thousands) |

|

(in thousands) |

|

Revenue from gold and silver sales |

|

$ |

17,967 |

|

|

$ |

20,259 |

|

|

$ |

178 |

|

$ |

38,404 |

|

|

$ |

45,526 |

|

|

$ |

61,847 |

|

|

$ |

178 |

|

$ |

107,551 |

|

|

Less: Production costs applicable to sales |

|

|

(14,406 |

) |

|

|

(12,069 |

) |

|

|

— |

|

|

(26,475 |

) |

|

|

(41,453 |

) |

|

|

(38,597 |

) |

|

|

— |

|

|

(80,050 |

) |

|

Less: Depreciation and depletion |

|

|

(2,647 |

) |

|

|

(5,534 |

) |

|

|

— |

|

|

(8,181 |

) |

|

|

(7,170 |

) |

|

|

(16,200 |

) |

|

|

— |

|

|

(23,370 |

) |

|

Gross profit |

|

$ |

914 |

|

|

$ |

2,656 |

|

|

$ |

178 |

|

$ |

3,748 |

|

|

$ |

(3,097 |

) |

|

$ |

7,050 |

|

|

$ |

178 |

|

$ |

4,131 |

|

|

Add: Depreciation and depletion |

|

|

2,647 |

|

|

|

5,534 |

|

|

|

— |

|

|

8,181 |

|

|

|

7,170 |

|

|

|

16,200 |

|

|

|

— |

|

|

23,370 |

|

|

Cash gross profit |

|

$ |

3,561 |

|

|

$ |

8,190 |

|

|

$ |

178 |

|

$ |

11,929 |

|

|

$ |

4,073 |

|

|

$ |

23,250 |

|

|

$ |

178 |

|

$ |

27,501 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended September 30, 2022 |

|

Nine months ended September 30, 2022 |

|

|

|

Gold Bar |

|

Fox Complex |

|

El Gallo |

|

Total (100% owned) |

|

Gold Bar |

|

Fox Complex |

|

El Gallo |

|

Total (100% owned) |

|

|

|

(in thousands) |

|

(in thousands) |

|

Revenue from gold and silver sales |

|

$ |

12,596 |

|

|

$ |

13,058 |

|

|

$ |

334 |

|

|

$ |

25,988 |

|

|

$ |

34,334 |

|

|

$ |

46,200 |

|

|

$ |

1,643 |

|

|

$ |

82,177 |

|

|

Less: Production costs applicable to sales |

|

|

(12,357 |

) |

|

|

(6,196 |

) |

|

|

(1,619 |

) |

|

|

(20,172 |

) |

|

|

(34,834 |

) |

|

|

(26,103 |

) |

|

|

(10,002 |

) |

|

|

(70,939 |

) |

|

Less: Depreciation and depletion |

|

|

(1,514 |

) |

|

|

(2,799 |

) |

|

|

— |

|

|

|

(4,313 |

) |

|

|

(3,275 |

) |

|

|

(8,219 |

) |

|

|

— |

|

|

|

(11,494 |

) |

|

Gross profit (loss) |

|

$ |

(1,275 |

) |

|

$ |

4,063 |

|

|

$ |

(1,285 |

) |

|

$ |

1,503 |

|

|

$ |

(3,775 |

) |

|

$ |

11,878 |

|

|

$ |

(8,359 |

) |

|

$ |

(256 |

) |

|

Add: Depreciation and depletion |

|

|

1,514 |

|

|

|

2,799 |

|

|

|

— |

|

|

|

4,313 |

|

|

|

3,275 |

|

|

|

8,219 |

|

|

|

— |

|

|

|

11,494 |

|

|

Cash gross profit (loss) |

|

$ |

239 |

|

|

$ |

6,862 |

|

|

$ |

(1,285 |

) |

|

$ |

5,816 |

|

|

$ |

(500 |

) |

|

$ |

20,097 |

|

|

$ |

(8,359 |

) |

|

$ |

11,238 |

|

|

|

|

Three months ended September 30, |

|

Nine months ended September 30, |

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

San José mine cash gross profit (100% basis) |

|

(in thousands) |

|

Revenue from gold and silver sales |

|

$ |

64,495 |

|

|

$ |

65,278 |

|

|

$ |

177,947 |

|

|

$ |

176,808 |

|

|

Less: Production costs applicable to sales |

|

|

(43,380 |

) |

|

|

(48,930 |

) |

|

|

(131,434 |

) |

|

|

(130,231 |

) |

|

Less: Depreciation and depletion |

|

|

(15,190 |

) |

|

|

(9,376 |

) |

|

|

(37,783 |

) |

|

|

(21,629 |

) |

|

Gross profit (loss) |

|

$ |

5,925 |

|

|

$ |

6,972 |

|

|

$ |

8,730 |

|

|

$ |

24,948 |

|

|

Add: Depreciation and depletion |

|

|

15,190 |

|

|

|

9,376 |

|

|

|

37,783 |

|

|

|

21,629 |

|

|

Cash gross profit |

|

$ |

21,115 |

|

|

$ |

16,348 |

|

|

$ |

46,513 |

|

|

$ |

46,577 |

|

|

Cash gross profit (49% basis) |

|

$ |

10,346 |

|

|

$ |

8,011 |

|

|

$ |

22,791 |

|

|

$ |

22,823 |

|

|

|

|

Three months ended September 30, |

|

Nine months ended September 30, |

|

|

|

2023 |

|

2022 |

|

2023 |

|

2022 |

|

Total cash gross profit |

|

(in thousands) |

|

Cash gross profit from 100% owned operations |

|

$ |

11,936 |

|

$ |

5,816 |

|

$ |

27,508 |

|

$ |

11,238 |

|

Cash gross profit from San José mine (49% basis) |

|

|

10,346 |

|

|

8,011 |

|

|

22,791 |

|

|

22,823 |

|

Total cash gross profit |

|

$ |

22,282 |

|

$ |

13,827 |

|

$ |

50,299 |

|

$ |

34,061 |

Cash Costs and All-In Sustaining Costs

(AISC)

The terms cash costs, cash cost per ounce,

all-in sustaining costs (“AISC”), and all-in sustaining cost per

ounce used in this report are non-GAAP financial measures. We

report these measures to provide additional information regarding

operational efficiencies on an individual mine basis, and believe

these measures used by the mining industry provide investors and

analysts with useful information about our underlying costs of

operations.

Cash costs consist of mining, processing,

on-site general and administrative expenses, community and

permitting costs related to current operations, royalty costs,

refining and treatment charges (for both doré and concentrate

products), sales costs, export taxes and operational stripping

costs, but exclude depreciation and amortization (non-cash items).

The sum of these costs is divided by the corresponding gold

equivalent ounces sold to determine a per ounce amount.

All-in sustaining costs consist of cash costs

(as described above), plus accretion of retirement obligations and

amortization of the asset retirement costs related to operating

sites, environmental rehabilitation costs for mines with no

reserves, sustaining exploration and development costs, sustaining

capital expenditures and sustaining lease payments. Our all-in

sustaining costs exclude the allocation of corporate general and

administrative costs. The following is additional information

regarding our all-in sustaining costs:

- Sustaining operating costs

represent expenditures incurred at current operations that are

considered necessary to maintain current annual production at the

mine site and include mine development costs and ongoing

replacement of mine equipment and other capital facilities.

Sustaining capital costs do not include the costs of expanding the

project that would result in improved productivity of the existing

asset, increased existing capacity or extended useful life.

- Sustaining exploration and

development costs include expenditures incurred to sustain current

operations and to replace reserves and/or resources extracted as

part of the ongoing production. Exploration activity performed

near-mine (brownfield) or new exploration projects (greenfield) are

classified as non-sustaining.

The sum of all-in sustaining costs is divided by

the corresponding gold equivalent ounces sold to determine a per

ounce amount.

Costs excluded from cash costs and all-in

sustaining costs, in addition to depreciation and depletion, are

income and mining tax expense, all corporate financing charges,

costs related to business combinations, asset acquisitions and

asset disposals, impairment charges and any items that are deducted

for the purpose of normalizing items.

The following tables reconcile these non-GAAP

measures to the most directly comparable GAAP measure, production

costs applicable to sales:

|

|

|

Three months ended September 30, 2023 |

|

Nine months ended September 30, 2023 |

|

|

|

Gold Bar |

|

Fox Complex |

|

Total |

|

Gold Bar |

|

Fox Complex |

|

Total |

|

|

|

(in thousands, except

per ounce) |

|

(in thousands, except

per ounce) |

|

Production costs applicable to sales - Cash costs (100%

owned) |

|

$ |

14,406 |

|

$ |

12,069 |

|

$ |

26,475 |

|

$ |

41,453 |

|

$ |

38,597 |

|

$ |

80,050 |

|

In‑mine exploration |

|

|

1,457 |

|

|

— |

|

|

1,457 |

|

|

3,054 |

|

|

— |

|

|

3,054 |

|

Capitalized underground mine development (sustaining) |

|

|

— |

|

|

2,227 |

|

|

2,227 |

|

|

— |

|

|

6,058 |

|

|

6,058 |

|

Capital expenditures on plant and equipment (sustaining) |

|

|

4,478 |

|

|

— |

|

|

4,478 |

|

|

7,655 |

|

|

— |

|

|

7,655 |

|

Sustaining leases |

|

|

8 |

|

|

124 |

|

|

132 |

|

|

237 |

|

|

523 |

|

|

760 |

|

All‑in sustaining costs |

|

$ |

20,349 |

|

$ |

14,420 |

|

$ |

34,770 |

|

$ |

52,399 |

|

$ |

45,178 |

|

$ |

97,577 |

|

Ounces sold, including stream (GEO)(1) |

|

|

9.4 |

|

|

11.2 |

|

|

20.6 |

|

|

23.8 |

|

|

34.2 |

|

|

58.0 |

|

Cash cost per ounce sold ($/GEO) |

|

$ |

1,529 |

|

$ |

1,078 |

|

$ |

1,284 |

|

$ |

1,743 |

|

$ |

1,129 |

|

$ |

1,381 |

|

AISC per ounce sold ($/GEO) |

|

$ |

2,160 |

|

$ |

1,288 |

|

$ |

1,686 |

|

$ |

2,203 |

|

$ |

1,321 |

|

$ |

1,683 |

|

|

|

Three months ended September 30, 2022 |

|

Nine months ended September 30, 2022 |

|

|

|

Gold Bar |

|

Fox Complex |

|

Total |

|

Gold Bar |

|

Fox Complex |

|

Total |

|

|

|

(in thousands, except per ounce) |

|

(in thousands, except per ounce) |

|

Production costs applicable to sales - Cash costs (100% owned) |

|

$ |

12,357 |

|

$ |

6,196 |

|

$ |

18,553 |

|

$ |

34,834 |

|

$ |

26,103 |

|

$ |

60,937 |

|

Mine site reclamation, accretion and amortization |

|

|

202 |

|

|

— |

|

|

202 |

|

|

1,435 |

|

|

— |

|

|

1,435 |

|

In‑mine exploration |

|

|

767 |

|

|

— |

|

|

767 |

|

|

2,830 |

|

|

— |

|

|

2,830 |

|

Capitalized underground mine development (sustaining) |

|

|

— |

|

|

4,080 |

|

|

4,080 |

|

|

— |

|

|

11,130 |

|

|

11,130 |

|

Capital expenditures on plant and equipment (sustaining) |

|

|

1,012 |

|

|

— |

|

|

1,012 |

|

|

1,508 |

|

|

— |

|

|

1,508 |

|

Sustaining leases |

|

|

448 |

|

|

198 |

|

|

646 |

|

|

1,563 |

|

|

509 |

|

|

2,072 |

|

All‑in sustaining costs |

|

$ |

14,786 |

|

$ |

10,474 |

|

$ |

25,260 |

|

$ |

42,170 |

|

$ |

37,742 |

|

$ |

79,912 |

|

Ounces sold, including stream (GEO)(1) |

|

|

7.2 |

|

|

8.0 |

|

|

15.2 |

|

|

18.7 |

|

|

26.7 |

|

|

45.4 |

|

Cash cost per ounce sold ($/GEO) |

|

$ |

1,712 |

|

$ |

774 |

|

$ |

1,219 |

|

$ |

1,859 |

|

$ |

978 |

|

$ |

1,342 |

|

AISC per ounce sold ($/GEO) |

|

$ |

2,049 |

|

$ |

1,308 |

|

$ |

1,659 |

|

$ |

2,251 |

|

$ |

1,460 |

|

$ |

1,760 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended September 30, |

|

Nine months ended September 30, |

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

San José mine cash costs (100% basis) |

|

(in thousands, except

per ounce) |

|

Production costs applicable to sales - Cash

costs |

|

$ |

43,380 |

|

|

$ |

48,930 |

|

|

$ |

131,434 |

|

|

$ |

130,231 |

|

|

Mine site reclamation, accretion and amortization |

|

|

0 |

|

|

|

25 |

|

|

|

386 |

|

|

|

213 |

|

|

Site exploration expenses |

|

|

2,538 |

|

|

|

1,961 |

|

|

|

7,336 |

|

|

|

6,788 |

|

|

Capitalized underground mine development (sustaining) |

|

|

11,890 |

|

|

|

10,051 |

|

|

|

27,939 |

|

|

|

27,758 |

|

|

Less: Depreciation |

|

|

(909 |

) |

|

|

(476 |

) |

|

|

(2,162 |

) |

|

|

(1,491 |

) |

|

Capital expenditures (sustaining) |

|

|

1,718 |

|

|

|

1,998 |

|

|

|

7,119 |

|

|

|

8,630 |

|

|

All‑in sustaining costs |

|

$ |

58,617 |

|

|

$ |

62,489 |

|

|

$ |

172,052 |

|

|

$ |

172,130 |

|

|

Ounces sold (GEO) |

|

|

30.0 |

|

|

|

40.0 |

|

|

|

87.3 |

|

|

|

100.2 |

|

|

Cash cost per ounce sold ($/GEO) |

|

$ |

1,445 |

|

|

$ |

1,223 |

|

|

$ |

1,505 |

|

|

$ |

1,300 |

|

|

AISC per ounce sold ($/GEO) |

|

$ |

1,953 |

|

|

$ |

1,562 |

|

|

$ |

1,971 |

|

|

$ |

1,718 |

|

Average Realized Price

The term average realized price per ounce used

in this report is also a non-GAAP financial measure. We prepare

this measure to evaluate our performance against the market (London

P.M. Fix). The average realized price for our 100% owned properties

is calculated as gross sales of gold and silver, less streaming

revenue, divided by the number of net ounces sold in the period,

less ounces sold under the streaming agreement.

The following table reconciles the average

realized prices to the most directly comparable U.S. GAAP

measure, revenue from gold and silver sales.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended September 30, |

|

Nine months ended September 30, |

|

|

|

2023 |

|

2022 |

|

2023 |

|

2022 |

|

Average realized price - 100% owned |

|

(in thousands, except

per ounce) |

|

Revenue from gold and silver sales |

|

$ |

38,404 |

|

$ |

25,988 |

|

$ |

107,551 |

|

$ |

82,177 |

|

Less: revenue from gold sales, stream |

|

|

527 |

|

|

426 |

|

|

1,567 |

|

|

1,237 |

|

Revenue from gold and silver sales, excluding stream |

|

$ |

37,877 |

|

$ |

25,562 |

|

$ |

105,984 |

|

$ |

80,940 |

|

GEOs sold |

|

|

20.6 |

|

|

15.4 |

|

|

58.0 |

|

|

46.3 |

|

Less: gold ounces sold, stream |

|

|

0.9 |

|

|

0.7 |

|

|

2.7 |

|

|

2.2 |

|

GEOs sold, excluding stream |

|

|

19.7 |

|

|

14.7 |

|

|

55.3 |

|

|

44.1 |

|

Average realized price per GEO sold, excluding stream |

|

$ |

1,920 |

|

$ |

1,742 |

|

$ |

1,916 |

|

$ |

1,833 |

CAUTION CONCERNING FORWARD-LOOKING

STATEMENTS

This news release contains certain

forward-looking statements and information, including

"forward-looking statements" within the meaning of the Private

Securities Litigation Reform Act of 1995. The forward-looking

statements and information expressed, as at the date of this news

release, McEwen Mining Inc.'s (the "Company") estimates, forecasts,

projections, expectations or beliefs as to future events and

results. Forward-looking statements and information are necessarily

based upon a number of estimates and assumptions that, while

considered reasonable by management, are inherently subject to

significant business, economic and competitive uncertainties, risks

and contingencies, and there can be no assurance that such

statements and information will prove to be accurate. Therefore,

actual results and future events could differ materially from those

anticipated in such statements and information. Risks and

uncertainties that could cause results or future events to differ

materially from current expectations expressed or implied by the

forward-looking statements and information include, but are not

limited to, effects of the COVID-19 pandemic, fluctuations in the

market price of precious metals, mining industry risks, political,

economic, social and security risks associated with foreign

operations, the ability of the corporation to receive or receive in

a timely manner permits or other approvals required in connection

with operations, risks associated with the construction of mining

operations and commencement of production and the projected costs

thereof, risks related to litigation, the state of the capital

markets, environmental risks and hazards, uncertainty as to the

calculation of mineral resources and reserves, and other risks.

Readers should not place undue reliance on forward-looking

statements or information included herein, which speak only as of

the date hereof. The Company undertakes no obligation to reissue or

update forward-looking statements or information as a result of new

information or events after the date hereof except as may be

required by law. See McEwen Mining's Annual Report on Form 10-K for

the fiscal year ended December 31, 2022 and other filings with the

Securities and Exchange Commission, under the caption "Risk

Factors", for additional information on risks, uncertainties and

other factors relating to the forward-looking statements and

information regarding the Company. All forward-looking statements

and information made in this news release are qualified by this

cautionary statement.

The NYSE and TSX have not reviewed and do not accept

responsibility for the adequacy or accuracy of the contents of this

news release, which has been prepared by management of McEwen

Mining Inc.

ABOUT MCEWEN MINING

McEwen Mining is a gold and silver producer with

operations in Nevada, Canada, Mexico and Argentina. In addition, it

owns approximately 47.7% of McEwen Copper which owns the large,

advanced stage Los Azules copper project in Argentina. The

Company’s goal is to improve the productivity and life of its

assets with the objective of increasing its share price and

providing a yield. Rob McEwen, Chairman and Chief Owner has

personally provided the Company with $220 million and takes an

annual salary of $1.

|

WEB SITEwww.mcewenmining.comCONTACT

INFORMATION150 King Street West Suite 2800, PO Box

24 Toronto, ON, Canada M5H 1J9 Relationship with

Investors: (866)-441-0690 Toll

free (647)-258-0395 Mihaela

Iancu ext. 320 info@mcewenmining.com |

SOCIAL MEDIA |

|

| |

McEwen Mining |

|

Facebook:LinkedIn:Twitter:Instagram: |

facebook.com/mcewenmininglinkedin.com/company/mcewen-mining-inc- twitter.com/mcewenmininginstagram.com/mcewenmining |

| |

| |

McEwen Copper |

|

Facebook:LinkedIn:Twitter:Instagram: |

facebook.com/

mcewencopperlinkedin.com/company/mcewencoppertwitter.com/mcewencopperinstagram.com/mcewencopper |

| |

| |

Rob

McEwen |

|

Facebook:LinkedIn:Twitter: |

facebook.com/mcewenroblinkedin.com/in/robert-mcewen-646ab24twitter.com/robmcewenmux |

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/1a598401-7ec1-4ced-ab1e-4e722388b05f

https://www.globenewswire.com/NewsRoom/AttachmentNg/9968702e-4a8d-4bf6-a0f0-5c658e49b4ec

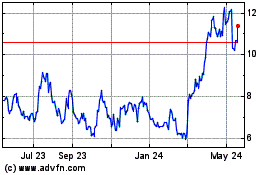

McEwen Mining (NYSE:MUX)

Historical Stock Chart

From Feb 2025 to Mar 2025

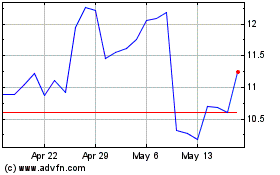

McEwen Mining (NYSE:MUX)

Historical Stock Chart

From Mar 2024 to Mar 2025