Exceeded Fourth Quarter Revenue Guidance,

Delivering 7% Year-Over-Year Growth

Full-Year 2025 Adjusted EBITDA Outlook of 27%

to 28%

Full-Year 2025 Constant Currency ARR Outlook of

7% to 9% Year-Over-Year Growth

N-able, Inc. (NYSE:NABL), a global software company helping IT

services providers deliver security, data protection as-a-service

and unified endpoint management, today reported results for its

fourth quarter and full year ended December 31, 2024.

“We closed 2024 in a position of strength and we believe we are

poised for even greater success in 2025,” said N-able president and

CEO John Pagliuca. “Businesses everywhere need cyber-resilience,

and we are investing to further our security leadership, deepen our

channel partnerships, and deliver the critical protection our

customers deserve. Our guide calls for over $500 million of ARR and

strong profit margins. We are executing at scale with a durable

business model.”

“N-able made considerable progress across the business in 2024,”

added N-able CFO Tim O’Brien. “Our product and go-to-market teams

executed critical initiatives, the strategic acquisition of Adlumin

expanded the aperture of our business, and we once again operated

above the Rule of 40. We firmly believe we have the right pieces in

place to win in our markets, and are investing to seize an

expanding market opportunity and scale N-able to new heights.”

Fourth quarter 2024 financial highlights:

- Total revenue of $116.5 million, representing 7.5%

year-over-year growth, or 7.5% year-over-year growth on a constant

currency basis.

- Subscription revenue of $115.0 million, representing 8.5%

year-over-year growth, or 8.5% year-over-year growth on a constant

currency basis.

- GAAP gross margin of 80.0% and non-GAAP gross margin of

82.3%.

- GAAP net income of $3.3 million, or $0.02 per diluted share,

and non-GAAP net income of $18.8 million, or $0.10 per diluted

share.

- Adjusted EBITDA of $38.1 million, representing an adjusted

EBITDA margin of 32.7%.

Full-year 2024 financial highlights:

- Total revenue of $466.1 million, representing 10.5%

year-over-year growth, or 10.2% year-over-year growth on a constant

currency basis.

- Subscription revenue of $459.0 million, representing 11.4%

year-over-year growth, or 11.1% year-over-year growth on a constant

currency basis.

- Total ARR of $482.5 million, representing 8.6% year-over-year

growth, or 10.3% year-over-year growth on a constant currency

basis.

- GAAP gross margin of 82.7% and non-GAAP gross margin of

83.8%.

- GAAP net income of $31.0 million, or $0.16 per diluted share,

and non-GAAP net income of $89.6 million, or $0.48 per diluted

share.

- Adjusted EBITDA of $169.4 million, representing an adjusted

EBITDA margin of 36.3%.

For a reconciliation of our GAAP to non-GAAP results, please see

the tables below.

Additional highlights for the fourth quarter of 2024

include:

- N‑able acquires existing strategic partner Adlumin, adding

cloud-native XDR and MDR capabilities to its end-to-end security

and IT management platform. The acquisition will allow N‑able to

incorporate Adlumin’s innovative technology with N‑able’s

industry-leading platform that combines security, data

protection-as-a-service and unified endpoint management. This

powerful combination positions N‑able to deliver deeper insights

and remediation across the entire IT environment—advancing the

evolution of N‑able’s cybersecurity portfolio.

- N-able adds key hires to further strengthen its Channel

strategy. The addition of Jonathan Bartholomew, Vice President of

Channel Sales; Paul Monaghan, Vice President of EMEA Sales; and

Andy Hudson, Vice President of International Marketing, underscore

the expanding support N‑able has for the rapidly growing IT

services market and its multi-layered channel with an active

presence in over 140 countries.

Balance Sheet

As of December 31, 2024, total cash and cash equivalents were

$85.2 million and total debt, net of debt issuance costs, was

$333.1 million.

The financial results included in this press release are

preliminary and pending final review by the company and its

external auditors. Financial results will not be final until N-able

files its annual report on Form 10-K for the period. Information

about N-able's use of non-GAAP financial measures is provided below

under “Non-GAAP Financial Measures.”

Financial Outlook

As of March 3, 2025, N-able is providing its financial outlook

for the first quarter of 2025 and full-year 2025. The financial

information below represents forward-looking non-GAAP financial

information, including adjusted EBITDA. These non-GAAP financial

measures exclude, among other items mentioned below, amortization

of acquired intangible assets and developed technology,

depreciation expense, income tax expense, interest expense, net,

unrealized foreign currency (gains) losses, transaction related

costs, spin-off costs, stock-based compensation expense and related

employer-paid payroll taxes and restructuring and other costs. We

have not reconciled our estimates of these non-GAAP financial

measures to their most directly comparable GAAP measure as a result

of uncertainty regarding, and the potential variability of, these

excluded items in future periods. Accordingly, reconciliation is

not available without unreasonable effort, although it is important

to note that these excluded items could be material to our results

computed in accordance with GAAP in future periods. Our reported

results provide reconciliations of non-GAAP financial measures to

their nearest GAAP equivalents.

The financial outlook provided below reflects N-able's

expectations, as of the date of this release, regarding the impact

on its business of changing foreign exchange rates and current

macroeconomic dynamics.

Financial Outlook for the First Quarter of 2025

N-able management currently expects to achieve the following

results for the first quarter of 2025:

- Total revenue in the range of $115.0 to $116.0 million,

representing approximately 1% to 2% year-over-year growth, or

approximately 3% to 4% growth on a constant currency basis.

- Adjusted EBITDA in the range of $27.5 to $28.5 million,

representing approximately 24% to 25% of total revenue.

Financial Outlook for Full-Year 2025

N-able management currently expects to achieve the following

results for the full-year 2025:

- Total ARR in the range of $514.0 to $522.0 million,

representing 7% to 8% year-over-year growth, or approximately 7% to

9% growth on a constant currency basis.

- Total revenue in the range of $486.5 to $492.5 million,

representing approximately 4% to 6% year-over-year growth, or

approximately 6% to 8% growth on a constant currency basis.

- Adjusted EBITDA in the range of $132.0 to $138.0 million,

representing approximately 27% to 28% of total revenue.

Additional details on the company's outlook will be provided on

the conference call.

Conference Call and Webcast

In conjunction with this announcement, N-able will host a

conference call today to discuss its financial results, business

and business outlook at 8:30 a.m. ET on March 3, 2025. A live

webcast of the call will be available on the N-able Investor

Relations website at http://investors.n-able.com. A replay of the

webcast will be available on a temporary basis shortly after the

event on the N-able Investor Relations website.

Forward-Looking Statements

This press release contains “forward-looking” statements, which

are subject to the safe harbor provisions of the Private Securities

Litigation Reform Act of 1995, including statements regarding our

financial outlook for the fourth quarter and full-year 2024 and the

impact of macroeconomic conditions on our business. These

forward-looking statements are based on management's beliefs and

assumptions and on information currently available to management.

Forward-looking statements include all statements that are not

historical facts and may be signified by terms such as “aim,”

“anticipate,” “believe,” “continue,” “expect,” “feel,” “intend,”

“estimate,” “seek,” “plan,” “may,” “can,” “could,” “should,”

“will,” “would” or similar expressions and the negatives of those

terms. Forward-looking statements involve known and unknown risks,

uncertainties and other factors that may cause our actual results,

performance or achievements to be materially and adversely

different from any future results, performance or achievements

expressed or implied by the forward-looking statements. Factors

that could cause or contribute to such differences include, but are

not limited to, the following: (a) the impact of adverse economic

conditions; (b) our ability to sell subscriptions to new customers,

to sell additional solutions to our existing customers and to

increase the usage of our solutions by our existing customers, as

well as our ability to generate and maintain customer loyalty; (c)

any decline in our renewal or net retention rates; (d) the

possibility that general economic, political, legal and regulatory

conditions and uncertainty may cause information technology

spending to be reduced or purchasing decisions to be delayed,

including as a result of inflation, actions taken by central banks

to counter inflation, rising interest rates, war and political

unrest, military conflict (including between Russia and Ukraine and

in the Middle East), terrorism, sanctions, trade or other issues in

the U.S. and internationally, including increased tariffs or trade

wars, or other geopolitical events globally, or that such factors

may otherwise harm our business, financial condition or results of

operations; (e) any inability to generate significant volumes of

high-quality sales leads from our digital marketing initiatives and

convert such leads into new business at acceptable conversion

rates; (f) any inability to successfully identify, complete and

integrate acquisitions and manage our growth effectively; (g) any

inability to resell third-party software or integrate third-party

software into our solutions, or find suitable replacements for such

third-party software; (h) risks associated with our international

operations; (i) foreign exchange gains and losses related to

expenses and sales denominated in currencies other than the

functional currency of an associated entity; (j) risks that

cyberattacks, including the cyberattack on SolarWinds’ Orion

Software Platform and internal systems announced by SolarWinds in

December 2020 (the “Cyber Incident”), and other security incidents

may result in compromises or breaches of our, our customers’, or

their SMB and mid-market customers’ systems, the insertion of

malicious code, malware, ransomware or other vulnerabilities into

our, our customers’, or their SMB and mid-market customers’

environments, the exploitation of vulnerabilities in our, our

customers’, or their SMB and mid-market customers’ security, the

theft or misappropriation of our, our customers’, or their SMB and

mid-market customers’ proprietary and confidential information, and

interference with our, our customers’, or their SMB and mid-market

customers’ operations, exposure to legal and other liabilities,

higher customer and employee attrition and the loss of key

personnel, negative impacts to our sales, renewals and upgrades and

reputational harm and other serious negative consequences, any or

all of which could materially harm our business; (k) our status as

a controlled company; (l) our ability to attract and retain

qualified employees and key personnel; (m) the timing and success

of new product introductions and product upgrades by us or our

competitors; (n) our ability to maintain or grow our brands,

including the Adlumin brand; (o) our ability to protect and defend

our intellectual property and not infringe upon others’

intellectual property; (p) the possibility that our operating

income could fluctuate and may decline as a percentage of revenue

as we make further expenditures to expand our operations in order

to support growth in our business; (q) our indebtedness, including

increased borrowing costs resulting from rising interest rates,

potential restrictions on our operations and the impact of events

of default; (r) our ability to operate our business internationally

and increase sales of our solutions to our customers located

outside of the United States; (s) risks related to our spin-off

from SolarWinds into a newly created and separately-traded public

company, including that the spin-off may not achieve some or all of

any anticipated benefits with respect to our business; that the

distribution, together with certain related transactions, may not

qualify as a transaction that is generally tax-free for U.S.

federal income tax purposes, which could result in N-able incurring

significant tax liabilities, and, in certain circumstances,

requiring us to indemnify SolarWinds for material taxes and other

related amounts pursuant to indemnification obligations under the

tax matters agreement; and (t) such other risks and uncertainties

described more fully in documents filed with or furnished to the

Securities and Exchange Commission, including the risk factors

described in N-able’s Annual Report on Form 10-K for the year ended

December 31, 2023, that N-able filed with the SEC on February 29,

2024, and those that will be described in N-able’s Annual Report on

Form 10-K for the year ended December 31, 2024, that N-able

anticipates filing on or about March 3, 2025. All information

provided in this release is as of the date hereof and N-able

undertakes no duty to update this information except as required by

law.

Non-GAAP Financial Measures

In addition to financial measures prepared in accordance with

GAAP, we use certain non-GAAP financial measures to clarify and

enhance our understanding, and aid in the period-to-period

comparison, of our performance. We believe that these non-GAAP

financial measures provide supplemental information that is

meaningful when assessing our operating performance because they

exclude the impact of certain amounts that our management and board

of directors do not consider part of core operating results when

assessing our operational performance, allocating resources,

preparing annual budgets and determining compensation. Accordingly,

these non-GAAP financial measures may provide insight to investors

into the motivation and decision-making of management in operating

the business.

N-able also believes that these non-GAAP financial measures are

used by investors and securities analysts to (a) compare and

evaluate its performance from period to period and (b) compare its

performance to those of its competitors. These non-GAAP measures

exclude certain items that can vary substantially from company to

company depending upon their financing and accounting methods, the

book value of their assets, their capital structures and the method

by which their assets were acquired.

As a result, these non-GAAP financial measures have limitations

and should not be considered in isolation from, or as a substitute

for, their most comparable GAAP measures. These non-GAAP financial

measures are not prepared in accordance with GAAP, do not reflect a

comprehensive system of accounting and may not be completely

comparable to similarly titled measures of other companies due to

potential differences in the exact method of calculation between

companies. Certain items that are excluded from these non-GAAP

financial measures can have a material impact on operating and net

income.

N-able's management and board of directors compensate for these

limitations by using these non-GAAP financial measures as

supplements to GAAP financial measures and by reviewing the

reconciliations of the non-GAAP financial measures to their most

comparable GAAP financial measure. Set forth in the tables below

are the corresponding GAAP financial measures for each non-GAAP

financial measure presented. Investors are encouraged to review the

reconciliations of these non-GAAP financial measures to their most

comparable GAAP financial measures that are set forth in the tables

below.

Definitions of Non-GAAP and Other Metrics

Annual Recurring Revenue (ARR). We calculate ARR by

annualizing the recurring revenue and related usage revenue

inclusive of discounts, excluding the impacts of credits and

reserves, recognized during the last day of the reporting period

from both long-term and month-to-month subscriptions. We believe

ARR enhances the understanding of our business performance and the

growth of our relationships with our customers.

Non-GAAP Gross Margin, Non-GAAP Operating Income and Non-GAAP

Operating Margin. We provide non-GAAP total cost of revenue,

non-GAAP gross margin, non-GAAP operating expense and non-GAAP

operating income and related non-GAAP gross and operating margins

excluding such items as stock-based compensation expense and

related employer-paid payroll taxes, amortization of acquired

intangible assets, transaction related costs, spin-off costs and

restructuring costs and other. We define non-GAAP gross and

operating margins as non-GAAP gross profit and operating income

divided by total revenue. Management believes these measures are

useful for the following reasons:

- Stock-Based Compensation Expense and Related Employer-Paid

Payroll Taxes. We provide non-GAAP information that excludes

expenses related to stock-based compensation and related

employer-paid payroll taxes associated with our employees’

participation in N-able's stock-based incentive compensation plans.

We believe that the exclusion of stock-based compensation expense

provides for a better comparison of our operating results to prior

periods and to our peer companies as the calculations of

stock-based compensation vary from period to period and company to

company due to different valuation methodologies, subjective

assumptions and the variety of award types. Employer-paid payroll

taxes on stock-based compensation is dependent on our stock price

and the timing of the taxable events related to the equity awards,

over which our management has little control, and does not

necessarily correlate to the core operation of our business.

Because of these unique characteristics of stock-based compensation

and related employer-paid payroll taxes, management excludes these

expenses when analyzing the organization’s business

performance.

- Amortization of Acquired Technologies and Intangible Assets. We

provide non-GAAP information that excludes expenses related to

purchased technologies and intangible assets associated with our

acquisitions. We believe that eliminating this expense from our

non-GAAP measures is useful to investors because the amortization

of acquired technologies and intangible assets can be inconsistent

in amount and frequency and is significantly impacted by the timing

and magnitude of our acquisition transactions, which also vary in

frequency from period to period. Accordingly, we analyze the

performance of our operations in each period without regard to such

expenses.

- Transaction Related Costs. We exclude certain expense items

resulting from proposed and completed acquisitions, dispositions

and similar transactions, such as legal, accounting and advisory

fees, changes in fair value of contingent consideration, costs

related to integrating the acquired businesses, deferred

compensation, severance and retention expense. We consider these

adjustments, to some extent, to be unpredictable and dependent on a

significant number of factors that are outside of our control.

Furthermore, such proposed and completed transactions result in

operating expenses that would not otherwise have been incurred by

us in the normal course of our organic business operations. We

believe that providing non-GAAP measures that exclude transaction

related costs allows investors to better review and understand the

historical and current results of our continuing operations and

also facilitates comparisons to our historical results and results

of peer companies with different transaction related activities,

both with and without such adjustments.

- Spin-off Costs. We exclude certain expense items resulting from

the spin-off into a newly created and separately traded public

company. These costs include legal, accounting and advisory fees,

system implementation costs and other incremental costs incurred by

us related to the separation from SolarWinds. The spin-off

transaction results in operating expenses that would not otherwise

have been incurred by us in the normal course of our organic

business operations. We believe that providing non-GAAP measures

that exclude these costs facilitates a more meaningful evaluation

of our operating performance and comparisons to our past operating

performance.

- Restructuring Costs and Other. We provide non-GAAP information

that excludes restructuring costs such as severance, certain

employee relocation costs, and the estimated costs of exiting and

terminating facility lease commitments, as they relate to our

corporate restructuring and exit activities. These costs are

inconsistent in amount and are significantly impacted by the timing

and nature of these events. Therefore, although we may incur these

types of expenses in the future, we believe that eliminating these

costs for purposes of calculating the non-GAAP financial measures

facilitates a more meaningful evaluation of our operating

performance and comparisons to our past operating performance.

Non-GAAP Net Income and Non-GAAP Net Income Per Diluted

Share. We believe that the use of non-GAAP net income and

non-GAAP net income per diluted share is helpful to our investors

to clarify and enhance their understanding of past performance and

future prospects. Non-GAAP net income is calculated as net income

excluding the adjustments to non-GAAP gross profit and non-GAAP

operating income and the income tax effect of the non-GAAP

exclusions. We define non-GAAP net income per diluted share as

non-GAAP net income divided by the weighted average outstanding

common shares.

Adjusted EBITDA and Adjusted EBITDA Margin. We regularly

monitor adjusted EBITDA and adjusted EBITDA margin, as they are

measures we use to assess our operating performance. We define

adjusted EBITDA as net income or loss, excluding amortization of

acquired intangible assets and developed technology, depreciation

expense, income tax expense, interest expense, net, unrealized

foreign currency (gains) losses, transaction related costs,

spin-off costs, stock-based compensation expense and related

employer-paid payroll taxes and restructuring and other costs. We

define adjusted EBITDA margin as adjusted EBITDA divided by total

revenue. Adjusted EBITDA has limitations as an analytical tool, and

you should not consider it in isolation or as a substitute for

analysis of our results as reported under GAAP. Some of these

limitations include: although depreciation and amortization are

non-cash charges, the assets being depreciated and amortized may

have to be replaced in the future, and adjusted EBITDA does not

reflect cash capital expenditure requirements for such replacements

or for new capital expenditure requirements; adjusted EBITDA does

not reflect changes in, or cash requirements for, our working

capital needs; adjusted EBITDA does not reflect the significant

interest expense, or the cash requirements necessary to service

interest or principal payments, on our related party debt; adjusted

EBITDA does not reflect tax payments that may represent a reduction

in cash available to us; and other companies, including companies

in our industry, may calculate adjusted EBITDA differently, which

reduces its usefulness as a comparative measure.

Non-GAAP Revenue on a Constant Currency Basis. We provide

non-GAAP revenue on a constant currency basis to provide a

framework for assessing our performance excluding the effect of

foreign currency rate fluctuations. To present this information,

current period results for revenue contracts denominated in

currencies other than U.S. Dollars are converted into U.S. Dollars

at the average exchange rates in effect during the corresponding

prior period presented. We believe that providing non-GAAP revenue

on a constant currency basis facilitates the comparison of non-GAAP

revenue to prior periods.

Unlevered Free Cash Flow. Unlevered free cash flow is a

measure of our liquidity used by management to evaluate cash flow

from operations, after the deduction of capital expenditures and

prior to the impact of our capital structure, transaction related

costs, restructuring costs, spin-off costs, employer-paid payroll

taxes on stock awards and other one-time items, that can be used by

us for strategic opportunities and strengthening our balance sheet.

However, given our debt obligations, unlevered free cash flow does

not represent residual cash flow available for discretionary

expenses.

About N-able

N-able fuels IT services providers with powerful software

solutions to monitor, manage, and secure their customers’ systems,

data, and networks. Built on a scalable platform, we offer secure

infrastructure and tools to simplify complex ecosystems, as well as

resources to navigate evolving IT needs. We help partners excel at

every stage of growth, protect their customers, and expand their

offerings with an ever-increasing, flexible portfolio of

integrations from leading technology providers. n-able.com

© 2025 N-able, Inc. All rights reserved.

Category: Financial

N-able, Inc.

Consolidated Balance

Sheets

(In thousands)

(Unaudited)

December 31,

2024

2023

Assets

Current assets:

Cash and cash equivalents

$

85,196

$

153,048

Accounts receivable, net of allowances of

$886 and $1,171 as of December 31, 2024 and 2023, respectively

44,909

40,013

Income tax receivable

3,563

8,001

Recoverable taxes

24,157

12,116

Current contract assets

12,786

1,124

Prepaid and other current assets

13,312

10,489

Total current assets

183,923

224,791

Property and equipment, net

36,162

36,838

Operating lease right-of-use assets

27,998

32,067

Deferred taxes

2,026

1,087

Goodwill

977,013

838,497

Intangible assets, net

83,150

6,717

Other assets, net

28,575

22,794

Total assets

$

1,338,847

$

1,162,791

Liabilities and stockholders' equity

Current liabilities:

Accounts payable

$

6,290

$

5,239

Accrued liabilities and other

56,557

49,366

Current deferred consideration

44,023

—

Current operating lease liabilities

6,018

6,443

Income taxes payable

9,733

4,523

Current portion of deferred revenue

23,977

12,646

Current debt obligation

3,500

3,500

Total current liabilities

150,098

81,717

Long-term liabilities:

Deferred revenue, net of current

portion

2,996

167

Non-current deferred taxes

3,448

1,820

Non-current operating lease

liabilities

30,069

33,064

Long-term debt, net of current portion

329,606

331,509

Non-current deferred consideration

54,089

—

Other long-term liabilities

9,253

3,154

Total liabilities

579,559

451,431

Commitments and contingencies

Stockholders’ equity:

Common stock, $0.001 par value:

550,000,000 shares authorized and 187,528,505 and 183,220,689

shares issued and outstanding as of December 31, 2024 and 2023,

respectively

187

183

Preferred stock, $0.001 par value:

50,000,000 shares authorized and no shares issued and outstanding

as of December 31, 2024 and 2023, respectively

—

—

Additional paid-in capital

708,992

666,522

Accumulated other comprehensive (loss)

income

(21,095

)

4,409

Retained earnings

71,204

40,246

Total stockholders' equity

759,288

711,360

Total liabilities and stockholders'

equity

$

1,338,847

$

1,162,791

N-able, Inc.

Consolidated Statements of

Operations

(In thousands, except per

share information)

(Unaudited)

Three Months Ended December

31,

Twelve Months Ended December

31,

2024

2023

2024

2023

Revenue:

Subscription and other revenue

$

116,509

$

108,415

$

466,147

$

421,880

Cost of revenue:

Cost of revenue

21,184

17,164

77,159

66,369

Amortization of acquired technologies

2,134

457

3,520

1,839

Total cost of revenue

23,318

17,621

80,679

68,208

Gross profit

93,191

90,794

385,468

353,672

Operating expenses:

Sales and marketing

34,632

33,579

135,592

134,691

Research and development

23,246

19,384

90,714

78,180

General and administrative

19,087

16,008

76,514

69,885

Amortization of acquired intangibles

234

12

278

597

Total operating expenses

77,199

68,983

303,098

283,353

Operating income

15,992

21,811

82,370

70,319

Other expense:

Interest expense, net

(7,269

)

(7,720

)

(30,031

)

(30,252

)

Other (expense) income, net

(1,765

)

2,690

1,931

4,259

Total other expense, net

(9,034

)

(5,030

)

(28,100

)

(25,993

)

Income before income taxes

6,958

16,781

54,270

44,326

Income tax expense

3,668

7,430

23,312

20,914

Net income

$

3,290

$

9,351

$

30,958

$

23,412

Net income per share:

Basic earnings per share

$

0.02

$

0.05

$

0.17

$

0.13

Diluted earnings per share

$

0.02

$

0.05

$

0.16

$

0.13

Weighted-average shares used to compute

net income per share:

Shares used in computation of basic

earnings per share

186,571

183,072

185,277

182,371

Shares used in computation of diluted

earnings per share

188,349

186,495

188,426

185,980

N-able, Inc.

Consolidated Statements of

Cash Flows

(In thousands)

(Unaudited)

Three Months Ended December

31,

Twelve Months Ended December

31, 2024

2024

2023

2024

2023

Cash flows from operating activities

Net income

$

3,290

$

9,351

$

30,958

$

23,412

Adjustments to reconcile net income to net

cash provided by operating activities:

Depreciation and amortization

7,948

5,481

25,725

21,623

Benefit from doubtful accounts

(213

)

(546

)

(285

)

(159

)

Stock-based compensation expense

10,488

10,677

45,351

43,570

Deferred taxes

(2,041

)

350

(1,952

)

330

Amortization of debt issuance costs

400

404

1,598

1,601

Operating lease right-of-use assets,

net

386

(500

)

438

(1,550

)

Loss (gain) on foreign currency exchange

rates

2,009

(1,779

)

2,702

358

Gain on contingent consideration

(2,570

)

(485

)

(6,281

)

(1,443

)

Deferred consideration expense

1,843

—

1,843

—

Loss on lease modification

4

—

1,063

—

Other non-cash expenses

(247

)

92

(263

)

220

Changes in operating assets and

liabilities, net of assets acquired and liabilities assumed in

business combinations:

Accounts receivable

(1,290

)

(939

)

(2,131

)

(7,060

)

Income tax receivable

11,573

8,700

4,685

(174

)

Recoverable taxes

(3,227

)

(4,633

)

(12,965

)

(11,392

)

Current contract assets

3,466

(417

)

(11,430

)

(894

)

Prepaid expenses and other assets

3,478

2,248

(1,253

)

1,463

Accounts payable

(1,612

)

1,451

(461

)

1,833

Accrued liabilities and other

2,437

7,381

630

16,065

Income taxes payable

(11,012

)

(6,525

)

4,881

2,966

Deferred revenue

3,903

1,127

2,261

684

Other long-term assets

(3,103

)

(68

)

(5,721

)

(1,274

)

Other long-term liabilities

76

(150

)

44

(90

)

Net cash provided by operating

activities

25,986

31,220

79,437

90,089

Cash flows from investing activities

Purchases of property and equipment

(7,150

)

(3,293

)

(17,570

)

(13,780

)

Purchases of intangible assets

(991

)

(1,881

)

(6,157

)

(8,556

)

Acquisitions, net of cash acquired

(98,694

)

—

(98,694

)

—

Net cash used in investing activities

(106,835

)

(5,174

)

(122,421

)

(22,336

)

Cash flows from financing activities

Payments of tax withholding obligations

related to restricted stock units

(2,324

)

(1,748

)

(20,489

)

(11,976

)

Exercise of stock options

—

—

12

72

Proceeds from issuance of common stock

under employee stock purchase plan

—

—

2,382

1,681

Deferred acquisition payments

—

(600

)

(1,000

)

(1,450

)

Repayments of borrowings from Credit

Agreement

(875

)

(875

)

(3,500

)

(3,500

)

Net cash used in financing activities

(3,199

)

(3,223

)

(22,595

)

(15,173

)

Effect of exchange rate changes on cash

and cash equivalents

(5,201

)

2,792

(2,273

)

1,621

Net (decrease) increase in cash and cash

equivalents

(89,249

)

25,615

(67,852

)

54,201

Cash and cash equivalents

Beginning of period

174,445

127,433

153,048

98,847

End of period

$

85,196

$

153,048

$

85,196

$

153,048

Supplemental disclosure of cash flow

information:

Cash paid for interest

$

6,930

$

7,318

$

28,690

$

28,437

Cash paid for income taxes

$

4,610

$

3,888

$

12,772

$

14,934

Supplemental disclosure of non-cash

activities:

Change in purchases of property, equipment

and leasehold improvements included in accounts payable and accrued

expenses

$

22

$

175

$

24

$

(378

)

Right-of-use assets obtained in exchange

for operating lease liabilities

$

—

$

2,805

$

2,628

$

5,123

Non-cash consideration exchanged in

business combinations

$

14,678

$

—

$

14,678

$

—

N-able, Inc.

Reconciliation of GAAP to

Non-GAAP Financial Measures

(In thousands, except per

share information)

(Unaudited)

Three Months Ended December

31,

Twelve Months Ended December

31,

2024

2023

2024

2023

GAAP cost of revenue

$

23,318

$

17,621

$

80,679

$

68,208

Stock-based compensation expense and

related employer-paid payroll taxes

(411

)

(363

)

(1,715

)

(1,434

)

Amortization of acquired technologies

(2,134

)

(457

)

(3,520

)

(1,839

)

Transaction related costs

(28

)

—

(28

)

—

Restructuring costs and other

(76

)

(36

)

(76

)

(74

)

Non-GAAP cost of revenue

$

20,669

$

16,765

$

75,340

$

64,861

GAAP gross profit

$

93,191

$

90,794

$

385,468

$

353,672

Stock-based compensation expense and

related employer-paid payroll taxes

411

363

1,715

1,434

Amortization of acquired technologies

2,134

457

3,520

1,839

Transaction related costs

28

—

28

—

Restructuring costs and other

76

36

76

74

Non-GAAP gross profit

$

95,840

$

91,650

$

390,807

$

357,019

GAAP sales and marketing expense

$

34,632

$

33,579

$

135,592

$

134,691

Stock-based compensation expense and

related employer-paid payroll taxes

(3,689

)

(3,715

)

(15,836

)

(15,287

)

Transaction related costs

(154

)

4

(213

)

(24

)

Restructuring costs and other

(165

)

(263

)

(583

)

(290

)

Non-GAAP sales and marketing expense

$

30,624

$

29,605

$

118,960

$

119,090

GAAP research and development expense

$

23,246

$

19,384

$

90,714

$

78,180

Stock-based compensation expense and

related employer-paid payroll taxes

(2,634

)

(2,225

)

(10,886

)

(8,995

)

Transaction related costs

(285

)

—

(330

)

(8

)

Restructuring costs and other

(348

)

(87

)

(442

)

(926

)

Non-GAAP research and development

expense

$

19,979

$

17,072

$

79,056

$

68,251

GAAP general and administrative

expense

$

19,087

$

16,008

$

76,514

$

69,885

Stock-based compensation expense and

related employer-paid payroll taxes

(4,058

)

(4,565

)

(19,304

)

(19,377

)

Transaction related costs

(1,967

)

474

(3,575

)

1,128

Restructuring costs and other

(147

)

(109

)

(3,660

)

(823

)

Spin-off costs

—

(112

)

(51

)

(735

)

Non-GAAP general and administrative

expense

$

12,915

$

11,696

$

49,924

$

50,078

GAAP operating income

$

15,992

$

21,811

$

82,370

$

70,319

Amortization of acquired technologies

2,134

457

3,520

1,839

Amortization of acquired intangibles

234

12

278

597

Stock-based compensation expense and

related employer-paid payroll taxes

10,791

10,868

47,741

45,093

Transaction related costs

2,434

(478

)

4,146

(1,096

)

Restructuring costs and other

736

495

4,761

2,113

Spin-off costs

—

112

51

735

Non-GAAP operating income

$

32,321

$

33,277

$

142,867

$

119,600

GAAP operating margin

13.7

%

20.1

%

17.7

%

16.7

%

Non-GAAP operating margin

27.7

%

30.7

%

30.6

%

28.3

%

GAAP net income

$

3,290

$

9,351

$

30,958

$

23,412

Amortization of acquired technologies

2,134

457

3,520

1,839

Amortization of acquired intangibles

234

12

278

597

Stock-based compensation expense and

related employer-paid payroll taxes

10,791

10,868

47,741

45,093

Transaction related costs

2,434

(478

)

4,146

(1,096

)

Restructuring costs and other

736

495

4,761

2,113

Spin-off costs

—

112

51

735

Tax benefits associated with above

adjustments (1)

(781

)

(992

)

(1,885

)

(4,472

)

Non-GAAP net income

$

18,838

$

19,825

$

89,570

$

68,221

GAAP diluted earnings per share

$

0.02

$

0.05

$

0.16

$

0.13

Non-GAAP diluted earnings per share

$

0.10

$

0.11

$

0.48

$

0.37

Shares used in computation of diluted

earnings per share:

188,349

186,495

188,426

185,980

_________________

(1) The tax benefits associated with

non-GAAP adjustments for the three and twelve months ended December

31 2024, and 2023, respectively, is calculated utilizing the

Company's individual statutory tax rates for each impacted

subsidiary.

N-able, Inc.

Reconciliation of GAAP Net

Income to Adjusted EBITDA

(In thousands)

(Unaudited)

Three Months Ended December

31,

Twelve Months Ended December

31,

2024

2023

2024

2023

Net income

$

3,290

$

9,351

$

30,958

$

23,412

Amortization

3,929

1,571

9,769

6,396

Depreciation

4,018

3,910

15,956

15,227

Income tax expense

3,668

7,430

23,312

20,914

Interest expense, net

7,269

7,720

30,031

30,252

Unrealized foreign currency losses

(gains)

2,009

(1,779

)

2,702

358

Transaction related costs

2,434

(478

)

4,146

(1,096

)

Spin-off costs

—

112

51

735

Stock-based compensation expense and

related employer-paid payroll taxes

10,791

10,868

47,741

45,093

Restructuring costs and other

736

495

4,761

2,113

Adjusted EBITDA

$

38,144

$

39,200

$

169,427

$

143,404

Adjusted EBITDA margin

32.7

%

36.2

%

36.3

%

34.0

%

N-able, Inc.

Reconciliation of GAAP Revenue

to Non-GAAP Revenue on a Constant Currency Basis

(In thousands, except

percentages)

(Unaudited)

Three Months Ended December

31,

Twelve Months Ended December

31,

2024

2023

Growth Rate

2024

2023

Growth Rate

GAAP subscription revenue

$

115,033

$

106,067

8.5

%

$

458,961

$

412,072

11.4

%

Estimated foreign currency impact (1)

17

—

—

(1,048

)

—

(0.3

)

Non-GAAP subscription revenue on a

constant currency basis

$

115,050

$

106,067

8.5

%

$

457,913

$

412,072

11.1

%

GAAP other revenue

$

1,476

$

2,348

(37.1

)%

$

7,186

$

9,808

(26.7

)%

Estimated foreign currency impact (1)

(1

)

—

—

6

—

—

Non-GAAP other revenue on a constant

currency basis

$

1,475

$

2,348

(37.2

)%

$

7,192

$

9,808

(26.7

)%

GAAP subscription and other revenue

$

116,509

$

108,415

7.5

%

$

466,147

$

421,880

10.5

%

Estimated foreign currency impact (1)

16

—

—

(1,042

)

—

(0.3

)

Non-GAAP subscription and other revenue on

a constant currency basis

$

116,525

$

108,415

7.5

%

$

465,105

$

421,880

10.2

%

_________________

(1) The estimated foreign currency impact

is calculated using the average foreign currency exchange rates in

the comparable prior year monthly periods and applying those rates

to foreign-denominated revenue in the corresponding monthly periods

for the three and twelve months ended December 31, 2024.

N-able, Inc.

Reconciliation of Unlevered

Free Cash Flow

(In thousands)

(Unaudited)

Three Months Ended December

31,

Twelve Months Ended December

31,

2024

2023

2024

2023

Net cash provided by operating

activities

$

25,986

$

31,220

$

79,437

$

90,089

Purchases of property and equipment

(7,150

)

(3,293

)

(17,570

)

(13,780

)

Purchases of intangible assets

(991

)

(1,881

)

(6,157

)

(8,556

)

Free cash flow

17,845

26,046

55,710

67,753

Cash paid for interest, net of cash

interest received

6,930

7,318

28,690

28,437

Cash paid for transaction related costs,

restructuring costs, spin-off costs, employer-paid payroll taxes on

stock awards and other one-time items

4,196

1,243

14,280

6,128

Unlevered free cash flow

$

28,971

$

34,607

$

98,680

$

102,318

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250302816735/en/

Investors: Griffin Gyr ir@n-able.com Media: Kim

Cecchini Phone: 202.391.5205 pr@n-able.com

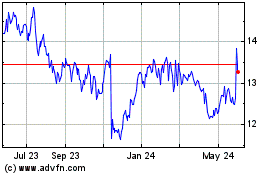

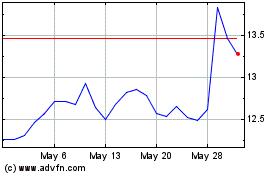

N able (NYSE:NABL)

Historical Stock Chart

From Feb 2025 to Mar 2025

N able (NYSE:NABL)

Historical Stock Chart

From Mar 2024 to Mar 2025