Monday, February 27, 2023

Dear Shareholders and Investors,

The 4Q 2022 Net result is more than $50 million better

than the same quarter 2021. The direction of NAT is unquestionably

upwards.

Highlights:

1) The average Time Charter Equivalent (TCE) for our

spot vessels (15) during the fourth quarter of 2022 came in at

$57,340 per day per ship. Including vessels on term contracts (4),

the total average NAT TCE was $49,035 per day per ship. This was

76% up from the third quarter of 2022. Our operating costs are

about $8,000 per day per vessel.

2) The net profit for 4Q 2022 more than

tripled from 3Q 2022 and landed at $36 million or an Earnings

per share (EPS) of $0.17. the previous quarter saw a net profit of

$10.0 million and an EPS of $0.05. Adjusted Earnings before

Interest, Taxes, Depreciation and Amortization (EBITDA) for 4Q 2022

came in with a positive $51.1 million, compared to an adjusted

EBITDA of $28.4 million in 3Q 2022. The bulk of our 2022 periodic

drydockings took place in the fourth quarter and as such affected

our revenues negatively.

3) Strong rates have continued into first quarter this

year. So far, 72% of our spot voyage days have been booked at an

average TCE of $60,630 per day per ship. With the 1Q 2023 bookings,

we expect the first quarter 2023 net results to further improve

vis-à-vis the strong 4Q 2022.

4) The dividend for the fourth quarter of 2022 will be

15 cents ($0.15) per share compared to 5 cents in the previous

quarter. The Dividend will be payable on March 28, 2023 to

shareholders on record as of March 14, 2023.

5) NAT has one of the lowest debt levels among publicly

listed tanker companies. Our net debt stood at $197 million equal

to $10.3 million per ship at December 31, 2022. The turnaround in

the market is further illustrated by our cash position that stood

at $59.6 million December 31, 2022 compared to $34.7 million same

time a year ago. Currently our cash position is about $90

million.

6) As we have seen in the past, political uncertainty

creates demand for the transport of oil. As a consequence of

Russia’s invasion of Ukraine and the West’s strong reaction, energy

security is of paramount concern. Oil will have to be sourced

from further away than in the past, creating longer voyages.

Uncertain times also encourage hoarding among some buyers, adding

to demand for oil and for the NAT tankers.

7) NAT in particular stands to benefit from the fact

that the supply of Suezmax tankers will remain at historic low

levels for at least the next two or three years.

Only 14 new ships are currently on order, representing only 2% of

the existing fleet. This is a 30 year low. Environmental

regulations, increased steel and production costs, and higher

interest rates make investing in new ships challenging. A small

order book for new tankers has always been positive for our

industry.

8) The NAT fleet of versatile suezmax tankers offers

flexibility in loading and discharging ports.

Through careful voyage planning and adjustment of speed of

our vessels, the NAT fleet is reducing emissions.

9) Financial information for the fourth quarter of 2022

and for other periods is enclosed in the full report

below.

Sincerely

Herbjørn Hansson

Founder, Chairman & CEO

Nordic American Tankers Ltd

www.nat.bm

CAUTIONARY STATEMENT REGARDING

FORWARD-LOOKING STATEMENTS

Matters discussed in this press release may constitute

forward-looking statements. The Private Securities Litigation

Reform Act of 1995 provides safe harbor protections for

forward-looking statements in order to encourage companies to

provide prospective information about their business.

Forward-looking statements include statements concerning plans,

objectives, goals, strategies, future events or performance, and

underlying assumptions and other statements, which are other than

statements of historical facts.

The Company desires to take advantage of the safe harbor

provisions of the Private Securities Litigation Reform Act of 1995

and is including this cautionary statement in connection with this

safe harbor legislation. The words “believe,” “anticipate,”

“intend,” “estimate,” “forecast,” “project,” “plan,” “potential,”

“will,” “may,” “should,” “expect,” “pending” and similar

expressions identify forward-looking statements.

The forward-looking statements in this press release are based

upon various assumptions, many of which are based, in turn, upon

further assumptions, including without limitation, our management’s

examination of historical operating trends, data contained in our

records and other data available from third parties. Although we

believe that these assumptions were reasonable when made, because

these assumptions are inherently subject to significant

uncertainties and contingencies which are difficult or impossible

to predict and are beyond our control, we cannot assure you that we

will achieve or accomplish these expectations, beliefs or

projections. We undertake no obligation to update any

forward-looking statement, whether as a result of new information,

future events or otherwise.

Important factors that, in our view, could cause actual results

to differ materially from those discussed in the forward-looking

statements include the strength of world economies and currencies,

general market conditions, including fluctuations in charter rates

and vessel values, changes in demand in the tanker market, as a

result of changes in OPEC’s petroleum production levels and

worldwide oil consumption and storage, changes in our operating

expenses, including bunker prices, drydocking and insurance costs,

the market for our vessels, availability of financing and

refinancing, changes in governmental rules and regulations or

actions taken by regulatory authorities, potential liability from

pending or future litigation, general domestic and international

political conditions, potential disruption of shipping routes due

to accidents or political events, vessels breakdowns and instances

of off-hires and other important factors described from time to

time in the reports filed by the Company with

the Securities and Exchange Commission, including the prospectus

and related prospectus supplement, our Annual Report on Form 20-F,

and our reports on Form 6-K.

Contacts:

Alexander Kihle, Finance ManagerNordic American Tankers LtdTel:

+47 91 724 171

Bjørn Giæver, CFONordic American Tankers LtdTel: +1 888 755

8391

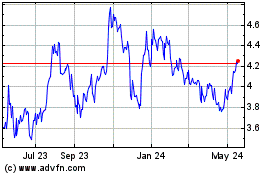

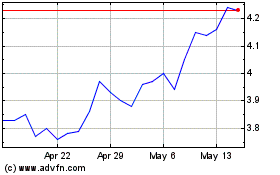

Nordic American Tankers (NYSE:NAT)

Historical Stock Chart

From Feb 2025 to Mar 2025

Nordic American Tankers (NYSE:NAT)

Historical Stock Chart

From Mar 2024 to Mar 2025