false2024Q30001532286December 31xbrli:sharesiso4217:USDiso4217:USDxbrli:sharesnine:segmentxbrli:pure00015322862024-01-012024-09-3000015322862024-10-2800015322862024-09-3000015322862023-12-310001532286us-gaap:ServiceMember2024-07-012024-09-300001532286us-gaap:ServiceMember2023-07-012023-09-300001532286us-gaap:ServiceMember2024-01-012024-09-300001532286us-gaap:ServiceMember2023-01-012023-09-300001532286us-gaap:ProductMember2024-07-012024-09-300001532286us-gaap:ProductMember2023-07-012023-09-300001532286us-gaap:ProductMember2024-01-012024-09-300001532286us-gaap:ProductMember2023-01-012023-09-3000015322862024-07-012024-09-3000015322862023-07-012023-09-3000015322862023-01-012023-09-300001532286us-gaap:CommonStockMember2024-06-300001532286us-gaap:AdditionalPaidInCapitalMember2024-06-300001532286us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-06-300001532286us-gaap:RetainedEarningsMember2024-06-3000015322862024-06-300001532286us-gaap:CommonStockMember2024-07-012024-09-300001532286us-gaap:AdditionalPaidInCapitalMember2024-07-012024-09-300001532286us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-07-012024-09-300001532286us-gaap:RetainedEarningsMember2024-07-012024-09-300001532286us-gaap:CommonStockMember2024-09-300001532286us-gaap:AdditionalPaidInCapitalMember2024-09-300001532286us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-09-300001532286us-gaap:RetainedEarningsMember2024-09-300001532286us-gaap:CommonStockMember2023-06-300001532286us-gaap:AdditionalPaidInCapitalMember2023-06-300001532286us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-06-300001532286us-gaap:RetainedEarningsMember2023-06-3000015322862023-06-300001532286us-gaap:CommonStockMember2023-07-012023-09-300001532286us-gaap:AdditionalPaidInCapitalMember2023-07-012023-09-300001532286us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-07-012023-09-300001532286us-gaap:RetainedEarningsMember2023-07-012023-09-300001532286us-gaap:CommonStockMember2023-09-300001532286us-gaap:AdditionalPaidInCapitalMember2023-09-300001532286us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-09-300001532286us-gaap:RetainedEarningsMember2023-09-3000015322862023-09-300001532286us-gaap:CommonStockMember2023-12-310001532286us-gaap:AdditionalPaidInCapitalMember2023-12-310001532286us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-310001532286us-gaap:RetainedEarningsMember2023-12-310001532286us-gaap:CommonStockMember2024-01-012024-09-300001532286us-gaap:AdditionalPaidInCapitalMember2024-01-012024-09-300001532286us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-01-012024-09-300001532286us-gaap:RetainedEarningsMember2024-01-012024-09-300001532286us-gaap:CommonStockMember2022-12-310001532286us-gaap:AdditionalPaidInCapitalMember2022-12-310001532286us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310001532286us-gaap:RetainedEarningsMember2022-12-3100015322862022-12-310001532286us-gaap:CommonStockMember2023-01-012023-09-300001532286us-gaap:AdditionalPaidInCapitalMember2023-01-012023-09-300001532286us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-09-300001532286us-gaap:RetainedEarningsMember2023-01-012023-09-300001532286nine:CementMember2024-07-012024-09-300001532286nine:CementMember2023-07-012023-09-300001532286nine:CementMember2024-01-012024-09-300001532286nine:CementMember2023-01-012023-09-300001532286nine:CoiledTubingMember2024-07-012024-09-300001532286nine:CoiledTubingMember2023-07-012023-09-300001532286nine:CoiledTubingMember2024-01-012024-09-300001532286nine:CoiledTubingMember2023-01-012023-09-300001532286nine:WirelineMember2024-07-012024-09-300001532286nine:WirelineMember2023-07-012023-09-300001532286nine:WirelineMember2024-01-012024-09-300001532286nine:WirelineMember2023-01-012023-09-300001532286nine:ServiceRevenueMember2024-07-012024-09-300001532286nine:ServiceRevenueMember2023-07-012023-09-300001532286nine:ServiceRevenueMember2024-01-012024-09-300001532286nine:ServiceRevenueMember2023-01-012023-09-300001532286nine:ToolsMember2024-07-012024-09-300001532286nine:ToolsMember2023-07-012023-09-300001532286nine:ToolsMember2024-01-012024-09-300001532286nine:ToolsMember2023-01-012023-09-300001532286nine:ToolRevenueMember2024-07-012024-09-300001532286nine:ToolRevenueMember2023-07-012023-09-300001532286nine:ToolRevenueMember2024-01-012024-09-300001532286nine:ToolRevenueMember2023-01-012023-09-300001532286us-gaap:CustomerRelationshipsMember2024-09-300001532286us-gaap:TechnologyBasedIntangibleAssetsMember2024-09-300001532286us-gaap:CustomerRelationshipsMember2023-12-310001532286us-gaap:NoncompeteAgreementsMember2023-12-310001532286us-gaap:TechnologyBasedIntangibleAssetsMember2023-12-310001532286nine:TwoThousandTwentyEightSeniorNotesMemberus-gaap:SeniorNotesMember2024-09-300001532286nine:TwoThousandTwentyEightSeniorNotesMemberus-gaap:SeniorNotesMember2023-12-310001532286nine:TwoThousandAndEighteenABLCreditFacilityMemberus-gaap:LineOfCreditMember2024-09-300001532286nine:TwoThousandAndEighteenABLCreditFacilityMemberus-gaap:LineOfCreditMember2023-12-310001532286us-gaap:ShortTermDebtMember2024-09-300001532286us-gaap:ShortTermDebtMember2023-12-310001532286nine:PublicOfferingMember2023-01-302023-01-300001532286nine:TwoThousandTwentyEightSeniorNotesMemberus-gaap:SeniorNotesMembernine:PublicOfferingMember2023-01-300001532286nine:TwoThousandTwentyEightSeniorNotesMemberus-gaap:SeniorNotesMember2023-01-012023-03-310001532286nine:TwoThousandTwentyEightSeniorNotesMemberus-gaap:SeniorNotesMemberus-gaap:DebtInstrumentRedemptionPeriodOneMember2023-01-312023-01-310001532286nine:TwoThousandTwentyEightSeniorNotesMemberus-gaap:SeniorNotesMemberus-gaap:DebtInstrumentRedemptionPeriodTwoMember2023-01-312023-01-310001532286nine:TwoThousandTwentyEightSeniorNotesMemberus-gaap:SeniorNotesMemberus-gaap:DebtInstrumentRedemptionPeriodThreeMember2023-01-312023-01-310001532286nine:TwoThousandTwentyEightSeniorNotesMemberus-gaap:SeniorNotesMemberus-gaap:DebtInstrumentRedemptionPeriodOneMember2024-01-012024-09-300001532286nine:TwoThousandTwentyEightSeniorNotesMemberus-gaap:SeniorNotesMemberus-gaap:DebtInstrumentRedemptionPeriodTwoMember2024-01-012024-09-300001532286nine:TwoThousandTwentyEightSeniorNotesMemberus-gaap:SeniorNotesMemberus-gaap:DebtInstrumentRedemptionPeriodThreeMember2024-01-012024-09-300001532286nine:TwoThousandTwentyEightSeniorNotesMemberus-gaap:SeniorNotesMember2024-01-012024-09-300001532286nine:TwoThousandTwentyThreeSeniorNotesMemberus-gaap:SeniorNotesMember2018-10-250001532286nine:TwoThousandTwentyThreeSeniorNotesMembernine:ABLCreditFacilityMemberus-gaap:SeniorNotesMember2023-02-012023-02-010001532286nine:TwoThousandTwentyThreeSeniorNotesMembernine:ABLCreditFacilityMemberus-gaap:SeniorNotesMember2023-02-010001532286nine:TwoThousandTwentyThreeSeniorNotesMemberus-gaap:SeniorNotesMember2023-02-010001532286nine:TwoThousandAndEighteenABLCreditFacilityMemberus-gaap:LineOfCreditMember2018-10-250001532286nine:TwoThousandAndEighteenABLCreditFacilityMembernine:CanadianTrancheMemberus-gaap:LineOfCreditMember2018-10-250001532286nine:TwoThousandAndEighteenABLCreditFacilityMemberus-gaap:LetterOfCreditMemberus-gaap:LineOfCreditMember2018-10-250001532286nine:TwoThousandAndEighteenABLCreditFacilityMemberus-gaap:LetterOfCreditMemberus-gaap:LineOfCreditMemberus-gaap:SecuredOvernightFinancingRateSofrMember2018-10-252018-10-250001532286nine:TwoThousandAndEighteenABLCreditFacilityMemberus-gaap:LetterOfCreditMemberus-gaap:LineOfCreditMembernine:LIBOR1Membersrt:MinimumMember2018-10-252018-10-250001532286nine:TwoThousandAndEighteenABLCreditFacilityMemberus-gaap:LetterOfCreditMemberus-gaap:LineOfCreditMembernine:LIBOR1Membersrt:MaximumMember2018-10-252018-10-250001532286nine:TwoThousandAndEighteenABLCreditFacilityMemberus-gaap:LetterOfCreditMemberus-gaap:LineOfCreditMembernine:LondonInterbankOfferedRateLIBOR1Membersrt:MinimumMember2024-01-012024-09-300001532286nine:TwoThousandAndEighteenABLCreditFacilityMemberus-gaap:LetterOfCreditMemberus-gaap:LineOfCreditMembernine:LondonInterbankOfferedRateLIBOR1Membersrt:MaximumMember2024-01-012024-09-300001532286nine:TwoThousandAndEighteenABLCreditFacilityMemberus-gaap:LineOfCreditMember2023-01-300001532286nine:TwoThousandAndEighteenABLCreditFacilityMembernine:LoanLimitGreaterThanFifteenPercentageMembersrt:MaximumMember2024-09-300001532286nine:TwoThousandAndEighteenABLCreditFacilityMember2024-01-012024-09-300001532286nine:TwoThousandAndEighteenABLCreditFacilityMembernine:LoanLimitGreaterThanTwentyPercentageMember2024-09-300001532286nine:TwoThousandAndEighteenABLCreditFacilityMembernine:LoanLimitGreaterThanFifteenPercentageMember2023-01-300001532286nine:TwoThousandAndEighteenABLCreditFacilityMembernine:LoanLimitGreaterThanFifteenPercentageMember2024-09-300001532286nine:TwoThousandAndEighteenABLCreditFacilityMemberus-gaap:LineOfCreditMember2024-01-012024-09-300001532286nine:TwoThousandAndEighteenABLCreditFacilityMemberus-gaap:LineOfCreditMemberus-gaap:SubsequentEventMember2024-10-102024-10-1000015322862023-10-012023-12-310001532286srt:ExecutiveOfficerMember2024-07-012024-09-300001532286srt:ExecutiveOfficerMember2024-01-012024-09-300001532286srt:ExecutiveOfficerMember2023-07-012023-09-300001532286srt:ExecutiveOfficerMember2023-01-012023-09-300001532286srt:ExecutiveOfficerMembernine:EquipmentFromRelatedPartyMember2024-01-012024-09-300001532286srt:ExecutiveOfficerMembernine:EquipmentFromRelatedPartyMember2023-01-012023-12-310001532286us-gaap:RelatedPartyMembernine:NationalEnergyServicesReunitedMembernine:ProductsandRentalsMember2024-07-012024-09-300001532286us-gaap:RelatedPartyMembernine:NationalEnergyServicesReunitedMembernine:ProductsandRentalsMember2024-01-012024-09-300001532286us-gaap:RelatedPartyMembernine:NationalEnergyServicesReunitedMembernine:ProductsandRentalsMember2023-07-012023-09-300001532286us-gaap:RelatedPartyMembernine:NationalEnergyServicesReunitedMembernine:ProductsandRentalsMember2023-01-012023-09-300001532286us-gaap:RelatedPartyMembernine:NationalEnergyServicesReunitedMember2024-01-012024-09-300001532286us-gaap:RelatedPartyMembernine:NationalEnergyServicesReunitedMember2023-01-012023-12-310001532286us-gaap:RelatedPartyMembernine:DevonEnergyCorporationMembernine:RevenueFromRelatedPartyMember2024-07-012024-09-300001532286us-gaap:RelatedPartyMembernine:DevonEnergyCorporationMembernine:RevenueFromRelatedPartyMember2024-01-012024-09-300001532286us-gaap:RelatedPartyMembernine:DevonEnergyCorporationMembernine:RevenueFromRelatedPartyMember2023-07-012023-09-300001532286us-gaap:RelatedPartyMembernine:DevonEnergyCorporationMembernine:RevenueFromRelatedPartyMember2023-01-012023-09-300001532286us-gaap:RelatedPartyMembernine:DevonEnergyCorporationMember2024-01-012024-09-300001532286us-gaap:RelatedPartyMembernine:DevonEnergyCorporationMember2023-01-012023-12-310001532286nine:ScorpionAcquisitionMembernine:AccruedExpensesMember2023-12-310001532286nine:ScorpionAcquisitionMembernine:AccruedExpensesMember2024-09-300001532286nine:FracTechAcquisitionMember2023-12-310001532286nine:FracTechAcquisitionMember2024-01-012024-09-300001532286nine:FracTechAcquisitionMember2024-09-300001532286nine:FracTechAcquisitionMember2022-12-310001532286nine:FracTechAcquisitionMember2023-01-012023-09-300001532286nine:FracTechAcquisitionMember2023-09-300001532286srt:MinimumMember2024-09-300001532286srt:MaximumMember2024-09-300001532286nine:AccruedExpensesMember2024-09-300001532286nine:AccruedExpensesMember2023-12-310001532286us-gaap:OtherNoncurrentLiabilitiesMember2024-09-300001532286us-gaap:OtherNoncurrentLiabilitiesMember2023-12-310001532286us-gaap:StockOptionMember2024-07-012024-09-300001532286us-gaap:StockOptionMember2023-07-012023-09-300001532286us-gaap:StockOptionMember2024-01-012024-09-300001532286us-gaap:StockOptionMember2023-01-012023-09-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

_________________________________

FORM 10-Q

_________________________________

(Mark One)

| | | | | |

| ☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended September 30, 2024

OR

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number: 001-38347

__________________________________________________________________

Nine Energy Service, Inc.

(Exact name of registrant as specified in its charter)

__________________________________________________________________

| | | | | |

| Delaware | 80-0759121 |

(State or other jurisdiction of

incorporation or organization) | (I.R.S. Employer

Identification No.) |

2001 Kirby Drive, Suite 200

Houston, TX 77019

(Address of principal executive offices) (Zip Code)

(281) 730-5100

(Registrant’s telephone number, including area code)

| | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, par value $0.01 per share | NINE | New York Stock Exchange |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes x No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | |

| Large accelerated filer | ☐ | | Accelerated filer | ☒ |

| Non-accelerated filer | ☐ | | Smaller reporting company | ☒ |

| | | | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No x

The number of shares of the registrant’s common stock, par value $0.01 per share, outstanding at October 28, 2024 was 42,363,805.

TABLE OF CONTENTS

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Quarterly Report on Form 10-Q contains forward-looking statements that are subject to a number of risks and uncertainties, many of which are beyond our control. All statements other than statements of historical fact, including those regarding our strategy, future operations, financial position, estimated revenues and losses, projected costs, prospects, plans, and objectives of management, are forward-looking statements. When used in this Quarterly Report on Form 10-Q, the words “could,” “believe,” “anticipate,” “intend,” “estimate,” “expect,” “may,” “continue,” “predict,” “potential,” “project,” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain such identifying words.

All forward-looking statements speak only as of the date of this Quarterly Report on Form 10-Q; we disclaim any obligation to update these statements unless required by law, and we caution you not to place undue reliance on them. Although we believe that our plans, intentions, and expectations reflected in or suggested by the forward-looking statements we make in this Quarterly Report on Form 10-Q are reasonable, we can give no assurance that these plans, intentions, or expectations will be achieved.

We disclose important factors that could cause our actual results to differ materially from our expectations under “Risk Factors” in Item 1A of Part I in our Annual Report on Form 10-K for the year ended December 31, 2023. These factors, some of which are beyond our control, include the following:

•Our business is cyclical and depends on capital spending and well completions by the onshore oil and natural gas industry, and the level of such activity is volatile and strongly influenced by current and expected oil and natural gas prices. If the prices of oil and natural gas decline, our business, financial condition, results of operations, cash flows, and prospects may be materially and adversely affected. Significant factors that are likely to affect near-term commodity prices include actions by the members of the Organization of the Petroleum Exporting Countries (“OPEC”) and other oil exporting nations; U.S. energy, monetary, and trade policies; the pace of economic growth in the U.S. and throughout the world; and geopolitical and economic developments in the U.S. and globally, including conflicts, instability, acts of war, and terrorism, particularly in Russia, Ukraine, and the Middle East.

•Inflation may adversely affect our financial position and operating results; in particular, cost inflation with labor or materials could offset any price increases for our products and services.

•If we are unable to attract and retain key employees, technical personnel, and other skilled and qualified workers, our business, financial condition, or results of operations could suffer.

•We may be unable to maintain existing prices or implement price increases on our products and services, and intense competition in the markets for our dissolvable plug products may lead to pricing pressures, reduced sales, or reduced market share.

•Our success may be affected by our ability to implement new technologies and services.

•Our substantial debt obligations could have significant adverse consequences on our business and future prospects, and restrictions in our debt agreements could limit our growth and our ability to engage in certain activities.

•Our current and potential competitors may have longer operating histories, significantly greater financial or technical resources, and greater name recognition than we do.

•Our operations are subject to conditions inherent in the oilfield services industry, such as equipment defects, liabilities arising from accidents or damage involving our fleet of trucks or other equipment, explosions and uncontrollable flows of gas or well fluids, and loss of well control.

•If we are unable to accurately predict customer demand or if customers cancel their orders on short notice, we may hold excess or obsolete inventory, which would reduce gross margins. Conversely, insufficient inventory would result in lost revenue opportunities and potentially loss of market share and damaged customer relationships.

•We are dependent on customers in a single industry. The loss of one or more significant customers, including certain of our customers outside of the U.S., could adversely affect our financial condition, prospects, and results of operations. Sales to customers outside of the U.S. also exposes us to risks inherent in doing business internationally, including political, social, and economic instability and disruptions, export controls, economic sanctions, embargoes or trade restrictions, and fluctuations in foreign currency exchange rates.

•We may be subject to claims for personal injury and property damage or other litigation, which could materially adversely affect our financial condition, prospects, and results of operations.

•We are subject to federal, state, and local laws and regulations regarding issues of health, safety, and protection of the environment. Under these laws and regulations, we may become liable for penalties, damages, or costs of remediation or other corrective measures. Any changes in laws or government regulations could increase our costs of doing business.

•Our success may be affected by the use and protection of our proprietary technology as well as our ability to enter into license agreements. There are limitations to our intellectual property rights and, thus, our right to exclude others from the use of our proprietary technology.

•We may be adversely affected by disputes regarding intellectual property rights.

•If our systems for protecting against cybersecurity risks prove not to be sufficient, we could be adversely affected by, among other things, loss or damage of intellectual property, proprietary information, customer or business data; interruption of business operations; or additional costs to prevent, respond to, or mitigate cybersecurity attacks.

•Our future financial condition and results of operations could be adversely impacted by asset impairment charges.

•Increased attention to climate change and conservation measures may reduce demand for oil and natural gas and therefore our products and services and may increase our operating costs. Also, negative public perception of the oil and gas industry may adversely affect our ability to raise debt and equity capital, and increased activism against oil and natural gas exploration and development activities may cause operational delays or restrictions, increased operating costs, additional regulatory burdens, and increased risk of litigation. Increased scrutiny of sustainability matters could also have an adverse effect on our business.

•Seasonal and adverse weather conditions and the physical risks arising from climate change may have a negative impact on our business and result of operations, including by impacting operations, increasing costs, and adversely affecting demand for our products and services.

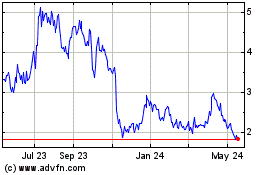

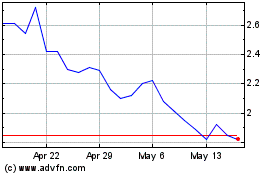

•We are currently out of compliance with the New York Stock Exchange’s (the “NYSE”) minimum market capitalization requirement and are at risk of the NYSE delisting our common stock; such a delisting could negatively impact us as it would likely reduce the liquidity and market price of our common stock, which in turn would, among other things, negatively impact our ability to raise equity financing.

Additional risks or uncertainties that are not currently known to us, that we currently deem to be immaterial, or that could apply to any company could also materially adversely affect our business, financial condition, or future results.

These cautionary statements qualify all forward-looking statements attributable to us or persons acting on our behalf.

PART I – FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS

NINE ENERGY SERVICE, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(In thousands, except share and per share amounts)

(Unaudited)

| | | | | | | | | | | |

| | September 30,

2024 | | December 31,

2023 |

| Assets | | | |

| Current assets | | | |

| Cash and cash equivalents | $ | 15,652 | | | $ | 30,840 | |

| Accounts receivable, net | 79,732 | | | 88,449 | |

| Income taxes receivable | 615 | | | 490 | |

| Inventories, net | 55,833 | | | 54,486 | |

| Prepaid expenses and other current assets | 5,784 | | | 9,368 | |

| Total current assets | 157,616 | | | 183,633 | |

| Property and equipment, net | 73,659 | | | 82,366 | |

| Operating lease right of use assets, net | 37,009 | | | 42,056 | |

| Finance lease right of use assets, net | 27 | | | 51 | |

| Intangible assets, net | 82,041 | | | 90,429 | |

| Other long-term assets | 2,880 | | | 3,449 | |

| Total assets | $ | 353,232 | | | $ | 401,984 | |

| Liabilities and Stockholders’ Equity (Deficit) | | | |

| Current liabilities | | | |

| Accounts payable | $ | 30,465 | | | $ | 33,379 | |

| Accrued expenses | 23,070 | | | 36,171 | |

| Current portion of long-term debt | — | | | 2,859 | |

| Current portion of operating lease obligations | 10,548 | | | 10,314 | |

| Current portion of finance lease obligations | 17 | | | 31 | |

| Total current liabilities | 64,100 | | | 82,754 | |

| Long-term liabilities | | | |

| Long-term debt | 318,469 | | | 320,520 | |

| Long-term operating lease obligations | 27,091 | | | 32,594 | |

| Other long-term liabilities | 1,133 | | | 1,746 | |

| Total liabilities | 410,793 | | | 437,614 | |

| Commitments and contingencies (Note 10) | | | |

| Stockholders’ equity (deficit) | | | |

Common stock (120,000,000 shares authorized at $0.01 par value; 42,363,805 and 35,324,861 shares issued and outstanding at September 30, 2024 and December 31, 2023, respectively) | 424 | | | 353 | |

| Additional paid-in capital | 805,509 | | | 795,106 | |

| Accumulated other comprehensive loss | (5,025) | | | (4,859) | |

| Accumulated deficit | (858,469) | | | (826,230) | |

| Total stockholders’ equity (deficit) | (57,561) | | | (35,630) | |

| Total liabilities and stockholders’ equity (deficit) | $ | 353,232 | | | $ | 401,984 | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

NINE ENERGY SERVICE, INC.

CONDENSED CONSOLIDATED STATEMENTS OF INCOME AND COMPREHENSIVE INCOME (LOSS)

(In thousands, except share and per share amounts)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| Revenues | | | | | | | |

| Service | $ | 106,744 | | | $ | 108,058 | | | $ | 313,608 | | | $ | 356,254 | |

| Product | 31,413 | | | 32,559 | | | 99,070 | | | 109,199 | |

| 138,157 | | | 140,617 | | | 412,678 | | | 465,453 | |

| Cost and expenses | | | | | | | |

| Cost of revenues (exclusive of depreciation and amortization shown separately below) | | | | | | | |

| Service | 89,142 | | | 91,131 | | | 266,415 | | | 287,928 | |

| Product | 24,309 | | | 26,545 | | | 75,090 | | | 84,308 | |

| General and administrative expenses | 12,366 | | | 13,060 | | | 37,113 | | | 47,007 | |

| Depreciation | 6,226 | | | 7,285 | | | 19,562 | | | 22,138 | |

| Amortization of intangibles | 2,796 | | | 2,895 | | | 8,388 | | | 8,687 | |

| Loss on revaluation of contingent liability | 383 | | | 493 | | | 191 | | | 412 | |

| (Gain) loss on sale of property and equipment | 484 | | | 21 | | | 485 | | | (407) | |

| Income (loss) from operations | 2,451 | | | (813) | | | 5,434 | | | 15,380 | |

| Interest expense | 12,879 | | | 12,858 | | | 38,453 | | | 38,306 | |

| Interest income | (196) | | | (462) | | | (660) | | | (946) | |

| Other income | (162) | | | (162) | | | (486) | | | (486) | |

| Loss before income taxes | (10,070) | | | (13,047) | | | (31,873) | | | (21,494) | |

| Provision for income taxes | 73 | | | 215 | | | 366 | | | 414 | |

| Net loss | $ | (10,143) | | | $ | (13,262) | | | $ | (32,239) | | | $ | (21,908) | |

| Loss per share | | | | | | | |

| Basic | $ | (0.26) | | | $ | (0.39) | | | $ | (0.89) | | | $ | (0.66) | |

| Diluted | $ | (0.26) | | | $ | (0.39) | | | $ | (0.89) | | | $ | (0.66) | |

| Weighted average shares outstanding | | | | | | | |

| Basic | 39,209,798 | | | 33,659,386 | | | 36,188,175 | | | 33,090,792 | |

| Diluted | 39,209,798 | | | 33,659,386 | | | 36,188,175 | | | 33,090,792 | |

| Other comprehensive loss, net of tax | | | | | | | |

Foreign currency translation adjustments, net of $0 tax in each period | $ | (9) | | | $ | (22) | | | $ | (166) | | | $ | (244) | |

| Total other comprehensive loss, net of tax | (9) | | | (22) | | | (166) | | | (244) | |

| Total comprehensive loss | $ | (10,152) | | | $ | (13,284) | | | $ | (32,405) | | | $ | (22,152) | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

NINE ENERGY SERVICE, INC.

CONDENSED CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY (DEFICIT)

(In thousands, except share amounts)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Common Stock | | Additional

Paid-in Capital | | Accumulated

Other

Comprehensive

Income (Loss) | | Retained

Earnings

(Accumulated Deficit) | | Total

Stockholders’ Equity (Deficit) |

| Shares | | Amounts | | | | |

| Balance, June 30, 2024 | 41,167,385 | | | $ | 412 | | | $ | 803,215 | | | $ | (5,016) | | | $ | (848,326) | | | $ | (49,715) | |

| Issuance of common stock under stock compensation plan, net of forfeitures | 15,330 | | | — | | | — | | | — | | | — | | | — | |

| Stock-based compensation expense | — | | | — | | | 837 | | | — | | | — | | | 837 | |

| Issuance of common stock under ATM program | 1,181,090 | | | 12 | | | 1,457 | | | — | | | — | | | 1,469 | |

| Other comprehensive loss | — | | | — | | | — | | | (9) | | | — | | | (9) | |

| Net loss | — | | | — | | | — | | | — | | | (10,143) | | | (10,143) | |

| Balance, September 30, 2024 | 42,363,805 | | | $ | 424 | | | $ | 805,509 | | | $ | (5,025) | | | $ | (858,469) | | | $ | (57,561) | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Common Stock | | Additional

Paid-in Capital | | Accumulated

Other

Comprehensive

Income (Loss) | | Retained

Earnings

(Accumulated Deficit) | | Total

Stockholders’ Equity (Deficit) |

| Shares | | Amounts | | | | |

| Balance, June 30, 2023 | 35,375,614 | | | $ | 354 | | | $ | 793,947 | | | $ | (5,050) | | | $ | (802,663) | | | $ | (13,412) | |

| Issuance of common stock under stock compensation plan, net of forfeitures | (30,120) | | | (1) | | | 1 | | | — | | | — | | | — | |

| Stock-based compensation expense | — | | | — | | | 580 | | | — | | | — | | | 580 | |

| Other comprehensive loss | — | | | — | | | — | | | (22) | | | — | | | (22) | |

| Net loss | — | | | — | | | — | | | — | | | (13,262) | | | (13,262) | |

| Balance, September 30, 2023 | 35,345,494 | | | $ | 353 | | | $ | 794,528 | | | $ | (5,072) | | | $ | (815,925) | | | $ | (26,116) | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Common Stock | | Additional

Paid-in Capital | | Accumulated

Other

Comprehensive

Income (Loss) | | Retained

Earnings

(Accumulated Deficit) | | Total

Stockholders’ Equity (Deficit) |

| Shares | | Amounts | | | | |

| Balance, December 31, 2023 | 35,324,861 | | | $ | 353 | | | $ | 795,106 | | | $ | (4,859) | | | $ | (826,230) | | | $ | (35,630) | |

| Issuance of common stock under stock compensation plan, net of forfeitures | 1,658,780 | | | 17 | | | (17) | | | — | | | — | | | — | |

| Stock-based compensation expense | — | | | — | | | 2,225 | | | — | | | — | | | 2,225 | |

| Issuance of common stock under ATM program | 5,380,164 | | | 54 | | | 8,195 | | | — | | | — | | | 8,249 | |

| Other comprehensive loss | — | | — | | | — | | | (166) | | | — | | | (166) | |

| Net loss | — | | — | | | — | | | — | | | (32,239) | | | (32,239) | |

| Balance, September 30, 2024 | 42,363,805 | | | $ | 424 | | | $ | 805,509 | | | $ | (5,025) | | | $ | (858,469) | | | $ | (57,561) | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Common Stock | | Additional

Paid-in Capital | | Accumulated

Other

Comprehensive

Income (Loss) | | Retained

Earnings

(Accumulated Deficit) | | Total

Stockholders’ Equity (Deficit) |

| Shares | | Amounts | | | | |

| Balance, December 31, 2022 | 33,221,266 | | | $ | 332 | | | $ | 775,006 | | | $ | (4,828) | | | $ | (794,017) | | | $ | (23,507) | |

| Issuance of common stock associated with the Units offering | 1,500,000 | | | 15 | | | 17,939 | | | — | | | — | | | 17,954 | |

| Issuance of common stock under stock compensation plan, net of forfeitures | 623,711 | | | 6 | | | (6) | | | — | | | — | | | — | |

| Stock-based compensation expense | — | | | — | | | 1,591 | | | — | | | — | | | 1,591 | |

| Vesting of restricted stock and stock units | 517 | | | — | | | (2) | | | — | | | — | | | (2) | |

| Other comprehensive loss | — | | — | | | — | | | (244) | | | — | | | (244) | |

| Net loss | — | | — | | | — | | | — | | | (21,908) | | | (21,908) | |

| Balance, September 30, 2023 | 35,345,494 | | | $ | 353 | | | $ | 794,528 | | | $ | (5,072) | | | $ | (815,925) | | | $ | (26,116) | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

NINE ENERGY SERVICE, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(In thousands)

(Unaudited)

| | | | | | | | | | | |

| Nine Months Ended September 30, |

| | 2024 | | 2023 |

| Cash flows from operating activities | | | |

| Net loss | $ | (32,239) | | | $ | (21,908) | |

| Adjustments to reconcile net loss to net cash (used in) provided by operating activities | | | |

| Depreciation | 19,562 | | | 22,138 | |

| Amortization of intangibles | 8,388 | | | 8,687 | |

| Amortization of operating leases | 9,948 | | | 9,070 | |

| Amortization of deferred financing costs | 5,592 | | | 5,685 | |

| Provision for doubtful accounts | 457 | | | 333 | |

| Provision for inventory obsolescence | 987 | | | 1,965 | |

| Stock-based compensation expense | 2,225 | | | 1,591 | |

| (Gain) loss on sale of property and equipment | 485 | | | (407) | |

| Loss on revaluation of contingent liability | 191 | | | 412 | |

| Changes in operating assets and liabilities | | | |

| Accounts receivable, net | 8,251 | | | 19,841 | |

| Inventories, net | (2,396) | | | 1,278 | |

| Prepaid expenses and other current assets | 3,585 | | | 4,798 | |

| Accounts payable and accrued expenses | (15,961) | | | (23,044) | |

| Income taxes receivable/payable | (124) | | | (153) | |

| Operating lease obligations | (9,813) | | | (8,934) | |

| Other assets and liabilities | (931) | | | (167) | |

| Net cash (used in) provided by operating activities | (1,793) | | | 21,185 | |

| Cash flows from investing activities | | | |

| Proceeds from sales of property and equipment | 352 | | | 530 | |

| Proceeds from property and equipment casualty losses | — | | | 840 | |

| Purchases of property and equipment | (11,528) | | | (16,085) | |

| Net cash used in investing activities | (11,176) | | | (14,715) | |

| Cash flows from financing activities | | | |

| Proceeds from issuance of common stock under ATM program | 8,249 | | | — | |

| Proceeds from ABL Credit Facility | 3,000 | | | 40,000 | |

| Payments on ABL Credit Facility | (10,000) | | | (15,000) | |

| Proceeds from Units offering, net of discount | — | | | 279,750 | |

| Redemption of 2023 Notes | — | | | (307,339) | |

| Payments of short-term debt | (2,859) | | | (2,267) | |

| Cost of debt issuance | — | | | (6,290) | |

| Principal payments on finance leases | (40) | | | (197) | |

| Payments of contingent liability | (466) | | | (251) | |

| Vesting of restricted stock and stock units | — | | | (2) | |

| Net cash used in financing activities | (2,116) | | | (11,596) | |

| Impact of foreign currency exchange on cash | (103) | | | (160) | |

| Net decrease in cash and cash equivalents | (15,188) | | | (5,286) | |

| Cash and cash equivalents | | | |

| Cash and cash equivalents beginning of period | $ | 30,840 | | | $ | 17,445 | |

| | | | | | | | | | | |

| Cash and cash equivalents end of period | $ | 15,652 | | | $ | 12,159 | |

| | | |

| Supplemental disclosures of cash flow information: | | | |

| Cash paid for interest | $ | 42,681 | | | $ | 30,188 | |

| Cash paid for income taxes | $ | 487 | | | $ | 560 | |

| Cash paid for operating leases | $ | 9,813 | | | $ | 8,934 | |

| Right of use assets obtained in exchange for operating lease obligations | $ | 3,199 | | | $ | 14,364 | |

| Supplemental schedule of non-cash investing and financing activities: | | | |

| Right of use assets obtained in exchange for finance lease obligations | $ | 26 | | | $ | 56 | |

| Capital expenditures in accounts payable and accrued expenses | $ | 1,229 | | | $ | 3,507 | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

NINE ENERGY SERVICE, INC.

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(unaudited)

1. Company and Organization

Background

Nine Energy Service, Inc. (the “Company” or “Nine”), a Delaware corporation, is an oilfield services business that provides services integral to the completion of unconventional wells through a full range of tools and methodologies. The Company is headquartered in Houston, Texas.

The Company’s chief operating decision maker (the “CODM”), which is its Chief Executive Officer, and its board of directors allocate resources and assess performance based on financial information presented at a consolidated level. Accordingly, the Company determined that it operates as one reportable segment, known as Completion Solutions.

Risks and Uncertainties

As Nine is a spot-market business, the Company’s business and its pricing depends, to a significant extent, on the level of unconventional resource development activity and corresponding capital spending of oil and natural gas companies. These activity and spending levels are strongly influenced by current and expected oil and natural gas prices, which have been extremely volatile historically and in recent years. In addition, the Company’s earnings are affected by its ability to maintain current pricing levels, the impact of wage and labor inflation, labor shortages, and supply chain constraints. Due to the spot-market nature of its business, the Company’s revenue and profitability generally moves very similarly to rig, frac, and stage counts in U.S. rig count.

2. Basis of Presentation

Condensed Consolidated Financial Information

In the opinion of the Company, the accompanying unaudited condensed consolidated financial statements contain all adjustments, consisting of only normal recurring adjustments, necessary for a fair statement of its financial position as of September 30, 2024, and its results of operations for the three and nine months ended September 30, 2024 and 2023, and cash flows for the nine months ended September 30, 2024 and 2023. These condensed consolidated financial statements have been prepared pursuant to the rules and regulations of the Securities and Exchange Commission, in a manner consistent with the accounting policies described in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023, unless otherwise disclosed herein, and should be read in conjunction therewith. The Condensed Consolidated Balance Sheet at December 31, 2023 was derived from audited financial statements but does not include all disclosures required by accounting principles generally accepted in the United States of America (“GAAP”). Operating results for interim periods are not necessarily indicative of the results that may be expected for the full year.

Principles of Consolidation

The condensed consolidated financial statements include the accounts of Nine and its wholly owned subsidiaries. All inter-company accounts and transactions have been eliminated in the consolidation.

Use of Estimates

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the condensed consolidated financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates. These estimates are based on management’s best knowledge of current events and actions that the Company may undertake in the future. Such estimates include fair value assumptions used in analyzing long-lived assets for possible impairment, useful lives used in depreciation and amortization expense, recognition of provisions for contingencies, and stock-based compensation fair value. It is at least reasonably possible that the estimates used will change within the next year.

Reclassifications

Certain reclassifications have been made to prior period amounts to conform to the current period financial statement presentation. These reclassifications relate to presenting “Operating lease obligations” as a separate line item in the Company’s Condensed Consolidated Statements of Cash Flows.

3. New Accounting Standards

In December 2023, the Financial Accounting Standards Board (the “FASB”) issued Accounting Standards Update (“ASU”) 2023-09, Income Taxes (Topic 740): Improvements to Income Tax Disclosures. The amendments require disclosure of specific categories in the rate reconciliation and provide additional information for reconciling items that meet a quantitative threshold and further disaggregation of income taxes paid for individually significant jurisdictions. The ASU is effective for fiscal years beginning after December 15, 2024. The Company is currently evaluating the impact that this guidance will have on the disclosures within its condensed consolidated financial statements.

In November 2023, the FASB issued ASU 2023-07, Segment Reporting (Topic 280): Improvements to Reportable Segment Disclosures. The new guidance requires disclosures of significant segment expenses provided to the CODM and included in reported measures of segment profit and loss. The guidance also requires interim and annual disclosures about a reportable segment’s profit or loss and assets. Additionally, the guidance requires disclosure of other segment items by reportable segment including a description of its composition. The amendments in ASU 2023-07 are effective for fiscal years beginning after December 15, 2023, and interim periods within fiscal years beginning after December 15, 2024, on a retrospective basis. The Company is currently evaluating the impact that this guidance will have on the disclosures within its condensed consolidated financial statements.

4. Revenues

Disaggregation of Revenues

Disaggregated revenues for the three and nine months ended September 30, 2024 and 2023 were as follows:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| (in thousands) |

| Cement | $ | 51,185 | | | $ | 51,867 | | | $ | 145,262 | | | $ | 172,449 | |

| Coiled tubing | 27,654 | | | 27,867 | | | 84,603 | | | 94,888 | |

| Wireline | 27,905 | | | 28,324 | | | 83,743 | | | 88,917 | |

| Service revenues | $ | 106,744 | | | $ | 108,058 | | | $ | 313,608 | | | $ | 356,254 | |

| | | | | | | |

| Tools | $ | 31,413 | | | $ | 32,559 | | | $ | 99,070 | | | $ | 109,199 | |

| Product revenues | $ | 31,413 | | | $ | 32,559 | | | $ | 99,070 | | | $ | 109,199 | |

| | | | | | | |

| Total revenues | $ | 138,157 | | | $ | 140,617 | | | $ | 412,678 | | | $ | 465,453 | |

The Company recognizes revenues from the sales of products at a point in time and revenues from the sales of services over time.

5. Inventories

Inventories, consisting primarily of finished goods and raw materials, are stated at the lower of cost or net realizable value. Cost is determined on an average cost basis. The Company reviews its inventory balances and writes down its inventory for estimated obsolescence or excess inventory equal to the difference between the cost of inventory and the estimated market value based upon assumptions about future demand and market conditions. The reserve for obsolescence was $5.4 million and $6.2 million at September 30, 2024 and December 31, 2023, respectively.

Inventories, net as of September 30, 2024 and December 31, 2023 were comprised of the following:

| | | | | | | | | | | |

| | September 30, 2024 | | December 31, 2023 |

| | (in thousands) |

| Raw materials | $ | 32,098 | | | $ | 31,235 | |

| Work in progress | 757 | | | 542 | |

| Finished goods | 28,334 | | | 28,867 | |

| Inventories | 61,189 | | | 60,644 | |

| Reserve for obsolescence | (5,356) | | | (6,158) | |

| Inventories, net | $ | 55,833 | | | $ | 54,486 | |

6. Intangible Assets

The gross carrying amount and accumulated amortization of intangible assets as of September 30, 2024 and December 31, 2023 was as follows:

| | | | | | | | | | | | | | | | | | | | | | | |

| September 30, 2024 |

| Gross Carrying Amount | | Accumulated Amortization | | Net Carrying Amount | | Weighted Average Amortization Period |

| (in thousands, except weighted average amortization period information) |

| Customer relationships | $ | 63,270 | | | $ | (54,705) | | | $ | 8,565 | | | 3.1 |

| Technology | 125,110 | | | (51,634) | | | 73,476 | | | 9.0 |

| Total | $ | 188,380 | | | $ | (106,339) | | | $ | 82,041 | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| December 31, 2023 |

| Gross Carrying Amount | | Accumulated Amortization | | Net Carrying Amount | | Weighted Average Amortization Period |

| (in thousands, except weighted average amortization period information) |

| Customer relationships | $ | 63,270 | | | $ | (52,622) | | | $ | 10,648 | | | 3.8 |

| Non-compete agreements | 6,500 | | | (6,500) | | | — | | | 0.0 |

| Technology | 125,110 | | | (45,329) | | | 79,781 | | | 9.7 |

| Total | $ | 194,880 | | | $ | (104,451) | | | $ | 90,429 | | | |

Amortization of intangibles expense was $2.8 million and $8.4 million for the three and nine months ended September 30, 2024, respectively. Amortization of intangibles expense was $2.9 million and $8.7 million for the three and nine months ended September 30, 2023, respectively.

Future estimated amortization of intangibles (in thousands) is as follows:

| | | | | |

| Year Ending December 31, | |

| Remainder of 2024 | $ | 2,795 | |

| 2025 | 11,183 | |

| 2026 | 11,082 | |

| 2027 | 10,315 | |

| 2028 | 8,000 | |

| 2029 | 8,000 | |

| Thereafter | 30,666 | |

| Total | $ | 82,041 | |

7. Accrued Expenses

Accrued expenses as of September 30, 2024 and December 31, 2023 consisted of the following:

| | | | | | | | | | | |

| September 30, 2024 | | December 31, 2023 |

| (in thousands) |

| Accrued interest | $ | 7,366 | | | $ | 17,216 | |

| Accrued compensation and benefits | 7,693 | | | 9,784 | |

| Accrued bonus | 1,036 | | | 1,169 | |

| Accrued legal fees and settlements | 110 | | | 68 | |

| Other accrued expenses | 6,865 | | | 7,934 | |

| Accrued expenses | $ | 23,070 | | | $ | 36,171 | |

8. Debt Obligations

The Company’s debt obligations as of September 30, 2024 and December 31, 2023 were as follows:

| | | | | | | | | | | |

| | September 30, 2024 | | December 31, 2023 |

| | (in thousands) |

| 2028 Notes | $ | 300,000 | | | $ | 300,000 | |

| ABL Credit Facility | 50,000 | | | 57,000 | |

Short-term debt (1) | — | | | 2,859 | |

| Total debt before deferred financing costs | $ | 350,000 | | | $ | 359,859 | |

| Deferred financing costs | (31,531) | | | (36,480) | |

| Total debt | $ | 318,469 | | | $ | 323,379 | |

| Less: Current portion of long-term debt | — | | | (2,859) | |

| Long-term debt | $ | 318,469 | | | $ | 320,520 | |

(1)The weighted average interest rate of short-term debt outstanding was 8.2% at December 31, 2023.

Units Offering and 2028 Notes

Units

On January 30, 2023, the Company completed its public offering of 300,000 units with an aggregate stated amount of $300.0 million (the “Units”). Each Unit consisted of $1,000 principal amount of the Company’s 13.000% Senior Secured Notes due 2028 (collectively, the “2028 Notes”) and five shares of common stock of the Company. The Company received proceeds of $279.8 million from the Units offering, after deducting underwriting discounts and commission, which was used to fund a portion of the redemption price of the 2023 Notes (as defined and described below). These proceeds were allocated to the 2028 Notes and the common stock based on their relative fair value at the time of issuance.

Each Unit separated into its constituent securities (the 2028 Notes and shares of common stock) automatically on October 27, 2023. A holder of Units could have elected to separate its Units into its constituent securities, in whole but not in part, on or after March 31, 2023. Prior to such date, the Units could not be separated at the option of the holder.

In the first quarter of 2023, the Company recorded approximately $41.7 million of deferred financing costs in connection with the Units offering. These costs are direct deductions from the carrying amount of the 2028 Notes and are being amortized through interest expense through the maturity date of the 2028 Notes using the effective interest method. The unamortized portion of these deferred financing costs was $31.5 million at September 30, 2024.

2028 Notes

On January 30, 2023, the Company and certain of its subsidiaries entered into an indenture, dated as of January 30, 2023 (the “2028 Notes Indenture”), with U.S. Bank Trust Company, National Association, as the trustee and as notes collateral agent, pursuant to which the 2028 Notes were issued. The 2028 Notes will mature on February 1, 2028 and bear interest at an annual rate of 13.000% payable in cash semi-annually in arrears on each of February 1 and August 1, commencing August 1, 2023. The 2028 Notes are senior secured obligations of the Company and are guaranteed on a senior secured basis by each of

the Company’s current domestic subsidiaries and will be so guaranteed by certain future subsidiaries, in each case, subject to agreed guaranty and security principles and certain exclusions.

Prior to February 1, 2026, the Company may, on any one or more occasions, redeem all or a part of the 2028 Notes at a redemption price equal to 100.0% of the principal amount of the 2028 Notes redeemed, plus a “make-whole” premium, plus accrued and unpaid interest, if any, to, but excluding, the date of redemption. In addition, prior to February 1, 2026, the Company may, from time to time, redeem up to 35.0% of the aggregate principal amount of the 2028 Notes with an amount of cash not greater than the net cash proceeds of certain equity offerings at a redemption price equal to 113.0% of the principal amount of the 2028 Notes redeemed, plus accrued and unpaid interest, if any, to, but excluding, the date of redemption, provided that at least 65.0% of the aggregate principal amount of the 2028 Notes originally issued under the 2028 Notes Indenture on January 30, 2023 remains outstanding immediately after such redemption and the redemption occurs within 180 days of the closing date of such equity offering. Also, prior to February 1, 2026, the Company may redeem during each 12-month period beginning on January 30, 2023, up to 10% of the aggregate principal amount of the 2028 Notes outstanding at a redemption price equal to 103.0% of the aggregate principal amount of the 2028 Notes being redeemed, plus accrued and unpaid interest, if any, to, but excluding, the date of redemption.

On and after February 1, 2026, the Company may redeem the 2028 Notes, in whole or in part, at the redemption prices (expressed as percentages of principal amount of the 2028 Notes to be redeemed) set forth below, plus accrued and unpaid interest, if any, to, but excluding the date of redemption, if redeemed during the periods indicated:

| | | | | | | | |

| | Redemption Price |

| February 1, 2026 to January 31, 2027 | | 106.500 | % |

| February 1, 2027 to October 31, 2027 | | 103.250 | % |

| November 1, 2027 and thereafter | | 100.000 | % |

On each May 15 and November 14, commencing November 14, 2023 (each, an “Excess Cash Flow Offer Date”), the Company is required to make an offer (an “Excess Cash Flow Offer”) to all holders of the 2028 Notes and, if required by the terms of any Pari Passu Notes Lien Indebtedness (as defined in the 2028 Notes Indenture), to any holders of any Pari Passu Notes Lien Indebtedness to purchase, prepay or redeem, together on a pro-rata basis, the maximum principal amount of the 2028 Notes and any such Pari Passu Notes Lien Indebtedness (plus all accrued interest (including additional interest, if any) on the 2028 Notes and any such Pari Passu Notes Lien Indebtedness and the amount of all fees and expenses, including premiums, incurred in connection therewith) that may be purchased, prepaid or redeemed using an amount of cash equal to the Excess Cash Flow Amount (as defined in the 2028 Notes Indenture and which is 75.0% of Excess Cash Flow (as defined in the 2028 Notes Indenture), as determined immediately prior to the Excess Cash Flow Offer Date), if any, subject to certain exceptions set forth in the 2028 Notes Indenture. The offer price in any such offer will be equal to 100% of the principal amount of the 2028 Notes and any such Pari Passu Notes Lien Indebtedness (or, in respect of any such Pari Passu Notes Lien Indebtedness, such lesser price, if any, as may be provided for by the terms of such Pari Passu Notes Lien Indebtedness), plus accrued and unpaid interest and additional interest, if any, to, but excluding, the date of purchase, prepayment or redemption, subject to the rights of holders of the 2028 Notes or any such Pari Passu Notes Lien Indebtedness on the relevant record date to receive interest due on an interest payment date that is on or prior to the date of purchase, prepayment or redemption, and will be payable in cash.

If the Company experiences certain changes of control, each holder of 2028 Notes may require the Company to repurchase all or a portion of its 2028 Notes for cash at a price equal to 101.0% of the principal amount of such 2028 Notes, plus any accrued but unpaid interest, if any, to, but excluding, the date of repurchase.

The 2028 Notes Indenture contains covenants that, among other things and subject to certain exceptions and qualifications, limit the Company’s ability and the ability of its restricted subsidiaries to (i) incur additional indebtedness and guarantee indebtedness; (ii) pay dividends or make other distributions of capital stock; (iii) prepay, redeem or repurchase certain debt; (iv) issue certain preferred stock or similar equity securities, (v) make loans and investments; (vi) sell assets; (vii) incur liens; (viii) enter into transactions with affiliates; (ix) enter into agreements restricting its subsidiaries’ ability to pay dividends; or (x) consolidate, merge, or sell all or substantially all of its assets. The Company was in compliance with all covenants contained in the 2028 Notes Indenture at September 30, 2024.

Upon an event of default, the trustee of the 2028 Notes or the holders of at least 25% in aggregate principal amount of then outstanding 2028 Notes may declare the 2028 Notes immediately due and payable, except that a default resulting from certain events of bankruptcy or insolvency with respect to the Company, any significant subsidiary or any group of restricted subsidiaries that, taken together, would constitute a significant subsidiary, will automatically cause all outstanding 2028 Notes to become due and payable.

2023 Notes

On October 25, 2018, the Company issued $400.0 million principal amount of 8.750% Senior Notes due 2023 (the “2023 Notes”). The 2023 Notes were issued under an indenture, dated as of October 25, 2018, by and among the Company, certain subsidiaries of the Company and Wells Fargo, National Association, as trustee. The 2023 Notes bore interest at an annual rate of 8.750% payable on May 1 and November 1 of each year, commencing May 1, 2019. The 2023 Notes were senior unsecured obligations of the Company and were fully and unconditionally guaranteed on a senior unsecured basis by each of the Company’s domestic subsidiaries.

On February 1, 2023, with proceeds received from its public offering of Units and borrowings under its ABL Credit Facility (as defined and described below), the Company redeemed all of the outstanding 2023 Notes at a redemption price of 100.0% of outstanding principal amount thereof ($307.3 million), plus accrued and unpaid interest ($6.7 million). The Company also wrote off unamortized deferred financing costs in the amount of $1.2 million associated with the 2023 Notes in conjunction with the redemption.

ABL Credit Facility

On October 25, 2018, the Company entered into a credit agreement dated as of October 25, 2018 (the “2018 ABL Credit Agreement”), by and among the Company, Nine Energy Canada, Inc., JP Morgan Chase Bank, N.A., as administrative agent and as an issuing lender, and certain other financial institutions party thereto as lenders and issuing lenders. The 2018 ABL Credit Agreement permitted aggregate borrowings of up to $200.0 million, subject to a borrowing base, including a Canadian tranche with a sub-limit of up to $25.0 million and a sub-limit of $50.0 million for letters of credit (the “ABL Credit Facility”). Pursuant to the 2018 ABL Credit Agreement, loans to the Company and its domestic related subsidiaries (the “U.S. Credit Parties”) under the ABL Credit Facility were base rate loans or London Interbank Offered Rate (“LIBOR”) loans; and loans to Nine Energy Canada Inc., a corporation organized under the laws of Alberta, Canada, and its restricted subsidiaries (the “Canadian Credit Parties”) under the Canadian tranche were Canadian Dollar Offered Rate (“CDOR”) loans or Canadian prime rate loans.

On January 17, 2023, the Company entered into the First Amendment to Credit Agreement (the “First ABL Facility Amendment”) with JP Morgan Chase Bank, N.A., as administrative agent, and the lender parties thereto, which became effective on January 30, 2023. Pursuant to the First ABL Facility Amendment, the maturity date of the ABL Credit Facility was extended from October 25, 2023 to January 29, 2027. In addition, the First ABL Facility Amendment, among other changes, revised the terms of the ABL Credit Facility as follows: (a) decreased the size of the ABL Credit Facility from $200.0 million to $150.0 million, subject to the borrowing base (the “Loan Limit”), (b) changed the interest rate benchmark from LIBOR to Term Secured Overnight Financing Rate with a 10 basis point spread adjustment and increased pricing from the existing range of 1.75% to 2.25% to a range of 2.00% to 2.50%, in each case depending on the Company’s leverage ratio, (c) modified the financial covenant, enhanced reporting and cash dominion triggers in the ABL Credit Facility from the existing minimum availability threshold of the greater of $18.75 million and 12.5% of the Loan Limit to a minimum availability threshold of (i) $12.5 million from January 30, 2023 until May 31, 2023 and (ii) the greater of $17.5 million and 12.5% of the Loan Limit thereafter, (d) decreased the Canadian tranche sub-limit from $25.0 million to $5.0 million, (e) decreased the letter of credit sub-limit from $50.0 million to $10.0 million and (f) made satisfaction of the Payment Conditions (as defined in the First ABL Facility Amendment) a condition to an Excess Cash Flow Offer in addition to a condition to voluntary payments of the 2028 Notes. The Payment Conditions in summary are (A) no default or event of default on a pro forma basis and (B) immediately after and at all times during the 30 days prior, on a pro forma basis, (1) (x) availability under the ABL Credit Facility shall not be less than the greater of 15% of the Loan Limit and $22.5 million and (y) the fixed charge coverage ratio shall be at least 1.00 to 1.00 or (2) availability under the ABL Credit Facility shall not be less than the greater of 20% of the Loan Limit and $30.0 million.

On June 7, 2024, the Company entered into the Second Amendment to Credit Agreement (together with the First ABL Facility Amendment, the “ABL Facility Amendments”) with JP Morgan Chase Bank, N.A., as administrative agent, and the lender parties thereto, to change the interest rate benchmark for borrowings denominated in Canadian dollars from CDOR to a rate based on the Canadian Overnight Repo Rate Average (CORRA), effective as of June 14, 2024.

The 2018 ABL Credit Agreement, as amended by the ABL Facility Amendments (the “ABL Credit Agreement”), contains various affirmative and negative covenants, including financial reporting requirements and limitations on indebtedness, liens, mergers, consolidations, liquidations and dissolutions, sales of assets, dividends and other restricted payments, investments (including acquisitions), and transactions with affiliates. In addition, the ABL Credit Agreement contains a financial covenant requiring a minimum fixed charge ratio of 1.00 to 1.00 that is tested quarterly when (a) the availability under the ABL Credit Facility drops below (i) at any time on or before May 31, 2023, $12.5 million and (ii) at any time thereafter, the greater of $17.5 million and 12.5% of the Loan Limit or (b) a default has occurred. This financial covenant applies until the

availability exceeds the applicable threshold for 30 consecutive days and no default is ongoing. The Company was in compliance with all covenants contained in the ABL Credit Agreement at September 30, 2024.

Pursuant to the ABL Credit Agreement, all of the obligations under the ABL Credit Facility are secured by security interests (subject to permitted liens) in substantially all of the personal property of U.S. Credit Parties, excluding certain assets. The obligations under the Canadian tranche are further secured by security interests (subject to permitted liens) in substantially all of the personal property of Canadian Credit Parties, excluding certain assets.

At September 30, 2024, the Company had $50.0 million outstanding borrowings under the ABL Credit Facility, and its availability under the ABL Credit Facility was approximately $27.6 million, net of outstanding letters of credit of $2.2 million. On October 10, 2024, the Company repaid $3.0 million of outstanding borrowings under the ABL Credit Facility.

Short-Term Debt

In the fourth quarter of 2023, the Company renewed certain insurance policies, and it financed the premium for its excess policy for $4.7 million. At September 30, 2024, there was no outstanding balance on this premium.

Fair Value of Debt Instruments

The estimated fair value of the Company’s debt obligations as of September 30, 2024 and December 31, 2023 was as follows:

| | | | | | | | | | | |

| | September 30, 2024 | | December 31, 2023 |

| | (in thousands) |

| 2028 Notes | $ | 238,500 | | | $ | 264,750 | |

| ABL Credit Facility | $ | 50,000 | | | $ | 57,000 | |

| Short-term debt | $ | — | | | $ | 2,859 | |

The fair value of the 2028 Notes, ABL Credit Facility, and short-term debt is classified as Level 2 in the fair value hierarchy. The fair value of the 2028 Notes is established based on observable inputs in less active markets. The fair value of the ABL Credit Facility and short-term debt approximates their carrying value.

9. Related Party Transactions

The Company leases office space, yard facilities, and equipment and purchases building maintenance and repair services from entities owned by David Crombie, an executive officer of the Company. Total lease expense and building maintenance and repair expense associated with these entities was $0.2 million and $0.8 million for the three and nine months ended September 30, 2024, respectively, and $0.3 million and $1.1 million for the three and nine months ended September 30, 2023, respectively. The Company also purchased $1.1 million and $2.6 million of products and services during the three and nine months ended September 30, 2024, respectively, and $0.8 million and $2.7 million for the three and nine months ended September 30, 2023, respectively, from an entity in which Mr. Crombie is a limited partner. There were outstanding payables due to entities associated with Mr. Crombie of $0.5 million and $0.2 million at September 30, 2024 and December 31, 2023, respectively.

The Company provides products and rentals to National Energy Reunited Corp. (“NESR”), where one of the Company’s directors serves as a director. The Company billed NESR $0.2 million and $1.1 million for the three and nine months ended September 30, 2024, respectively, and $0.5 million and $1.1 million for the three and nine months ended September 30, 2023, respectively. Total outstanding receivables due to the Company from NESR were $0.2 million and $0.4 million at September 30, 2024 and December 31, 2023, respectively.

Ann G. Fox, President and Chief Executive Officer and a director of the Company, is a director of Devon Energy Corporation (“Devon”). The Company generated revenue from Devon of $1.2 million and $4.2 million for the three and nine months ended September 30, 2024, respectively, and $1.0 million and $1.9 million for the three and nine months ended September 30, 2023, respectively. There were outstanding receivables due from Devon of $0.3 million and $0.7 million at September 30, 2024 and December 31, 2023, respectively.

10. Commitments and Contingencies

Litigation

The Company records accruals related to litigation and other legal proceedings when they are either known or considered probable and can be reasonably estimated. Legal proceedings are inherently unpredictable and subject to significant uncertainties, and significant judgment is required to determine both probability and the estimated amount. Some of these uncertainties include the stage of litigation, available facts, uncertainty as to the outcome of any legal proceedings or settlement discussions, and any novel legal issues presented. Because of such uncertainties, accruals are based on the best information available at the time. As additional information becomes available, the Company reassesses the potential liability related to pending litigation. The estimated liability for legal matters was $0.1 million at both September 30, 2024 and December 31, 2023, and is included under the caption “Accrued expenses” in its Condensed Consolidated Balance Sheets.

From time to time, the Company has various claims, lawsuits, and administrative proceedings that are pending or threatened with respect to personal injury, workers’ compensation, contractual matters, and other matters. Although no assurance can be given with respect to the outcome of these claims, lawsuits, or proceedings or the effect such outcomes may have, the Company believes any ultimate liability resulting from the outcome of such claims, lawsuits, or administrative proceedings, to the extent not otherwise provided for or covered by insurance, will not have a material adverse effect on its business, operating results, or financial condition.

On April 18, 2020, the Company was named as a defendant in a patent infringement lawsuit regarding its Breakthru Casing Flotation Device. On January 18, 2022, the Company received an adverse judgment in this matter. The Company has posted a $1.9 million letter of credit representing the judgment amount and accrued royalties from the judgment date through September 30, 2024. While the Company believes it is probable that it will prevail on appeal resulting in no liability, in the event the Company does not prevail on appeal, the Company will be liable for the aggregate letter of credit posted through the date of appeal plus any future royalties awarded.

However, due to the inherent uncertainties of litigation, the Company is unable to determine the exact amount of any potential loss at this time, and thus, no accrual has been made for this matter in the Company’s condensed consolidated financial statements. The Company will continue to monitor the progress of this litigation and will adjust its accrual as necessary if and when additional information becomes available.

Self-insurance

The Company uses a combination of third-party insurance and self-insurance for health insurance claims. The self-insured liability represents an estimate of the undiscounted ultimate cost of uninsured claims incurred as of the balance sheet date. The estimate is based on an analysis of trailing months of incurred medical claims to project the amount of incurred but not reported claims liability. The estimated liability for self-insured medical claims was $1.6 million at both September 30, 2024 and December 31, 2023 and is included under the caption “Accrued expenses” in the Company’s Condensed Consolidated Balance Sheets.

Although the Company does not expect the amounts ultimately paid to differ significantly from the estimates, the self-insurance liability could be affected if future claims experience differs significantly from historical trends and actuarial assumptions.

Contingent Liabilities

On October 1, 2018, pursuant to the terms and conditions of a Securities Purchase Agreement (the “Frac Tech Purchase Agreement”), the Company acquired Frac Technology AS (“Frac Tech”), a Norwegian private limited company focused on the development of downhole technology, including a casing flotation tool and a number of patented downhole completion tools. The Frac Tech Purchase Agreement, as amended, includes, among other things, the potential for additional future payments, based on certain Frac Tech revenue metrics through December 31, 2025 (the “Frac Tech Earnout”).

The Company’s contingent liability (Level 3) associated with the Frac Tech Earnout (in thousands) at September 30, 2024 and 2023 was as follows:

| | | | | |

| |

| Balance at December 31, 2023 | $ | 1,219 | |

| Revaluation adjustments | 191 | |

| Payments | (466) | |

| Balance at September 30, 2024 | $ | 944 | |

| | | | | |

| |

| Balance at December 31, 2022 | $ | 1,169 | |

| Revaluation adjustments | 412 | |

| Payments | (251) | |

| Balance at September 30, 2023 | $ | 1,330 | |

All contingent liabilities that relate to contingent consideration are reported at fair value, based on a Monte Carlo simulation model. Significant inputs used in the fair value measurement include forecasted sales of the plugs, terms of the agreement, a risk-adjusted discount factor (ranging from 4.2% to 5.0%), and a credit-adjusted rate (ranging from 10.3% to 10.4%). Contingent liabilities include $0.7 million and $0.8 million reported in “Accrued expenses” at September 30, 2024 and December 31, 2023, respectively, and $0.2 million and $0.4 million reported in “Other long-term liabilities” at September 30, 2024 and December 31, 2023, respectively, in the Company’s Condensed Consolidated Balance Sheets. The impact of the revaluation adjustments is included in the Company’s Condensed Consolidated Statements of Income and Comprehensive Income (Loss).

11. Taxes

The Company’s provision (benefit) for income taxes included in its Condensed Consolidated Statements of Income and Comprehensive Income (Loss) was as follows:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| (in thousands, except percentages) |

| Provision for income taxes | $ | 73 | | | $ | 215 | | | $ | 366 | | | $ | 414 | |

| Effective tax rate | (0.7) | % | | (1.6) | % | | (1.1) | % | | (1.9) | % |

The Company’s provision for income taxes for the three and nine months ended September 30, 2024 was primarily attributed to state and non-U.S. income taxes. At September 30, 2024, the Company continued to record a full valuation allowance against its net deferred tax asset positions in the U.S. and Canada.

12. Earnings (Loss) Per Share

Basic earnings (loss) per share is computed by dividing net income (loss) by the weighted average number of shares of common stock outstanding for the period. Diluted earnings (loss) per share is based on the weighted average number of shares outstanding for the period, including the dilutive effect of equity awards.

Basic and diluted earnings (loss) per share of common stock was computed as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, 2024 | | Three Months Ended September 30, 2023 |

| Net Loss | | Average Shares Outstanding | | Loss Per Share | | Net Loss | | Average Shares Outstanding | | Loss Per Share |

| (in thousands, except share and per share amounts) |

| Basic | $ | (10,143) | | | 39,209,798 | | | $ | (0.26) | | | $ | (13,262) | | | 33,659,386 | | | $ | (0.39) | |

| Unvested restricted stock and stock units | — | | | — | | | — | | | — | | | — | | | — | |

| Assumed exercise of stock options | — | | | — | | | — | | | — | | | — | | | — | |

| Diluted | $ | (10,143) | | | 39,209,798 | | | $ | (0.26) | | | $ | (13,262) | | | 33,659,386 | | | $ | (0.39) | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Nine Months Ended September 30, 2024 | | Nine Months Ended September 30, 2023 |

| Net Loss | | Average Shares Outstanding | | Loss Per Share | | Net Loss | | Average Shares Outstanding | | Loss Per Share |

| (in thousands, except share and per share amounts) |

| Basic | $ | (32,239) | | | 36,188,175 | | | $ | (0.89) | | | $ | (21,908) | | | 33,090,792 | | | $ | (0.66) | |

| Unvested restricted stock and stock units | — | | | — | | | — | | | — | | | — | | | — | |

| Assumed exercise of stock options | — | | | — | | | — | | | — | | | — | | | — | |

| Diluted | $ | (32,239) | | | 36,188,175 | | | $ | (0.89) | | | $ | (21,908) | | | 33,090,792 | | | $ | (0.66) | |

The diluted earnings (loss) per share calculation excludes all stock options, unvested restricted stock, and unvested restricted stock units for the three and nine months ended September 30, 2024 and 2023 because their inclusion would be anti-dilutive given the Company was in a net loss position. The average number of securities that were excluded from diluted earnings (loss) per share that would potentially dilute earnings (loss) per share for the periods in which the Company experienced a net loss were as follows:

| | | | | | | | | | | |

| 2024 | | 2023 |

| Three months ended September 30, | 151,898 | | 806,722 |

| Nine months ended September 30, | 333,128 | | 1,267,609 |

ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion and analysis of our financial condition and results of operations should be read in conjunction with the accompanying unaudited condensed consolidated financial statements included in Item 1 of Part I of this Quarterly Report on Form 10-Q and the consolidated financial statements and the section titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” including “Critical Accounting Estimates,” included in our Annual Report on Form 10-K for the year ended December 31, 2023.

This section contains forward-looking statements based on our current expectations, estimates, and projections about our operations and the industry in which we operate. Our actual results may differ materially from those anticipated in these forward-looking statements because of various risks and uncertainties, including those described in the sections titled “Cautionary Note Regarding Forward-Looking Statements” in this Quarterly Report on Form 10-Q and “Risk Factors” in Item 1A of Part I of our Annual Report on Form 10-K for the year ended December 31, 2023.

OVERVIEW

Company Description

Nine Energy Service, Inc. (either individually or together with its subsidiaries, as the context requires, the “Company,” “Nine,” “we,” “us,” and “our”) is a leading completion services provider that targets unconventional oil and gas resource development. We partner with our exploration and production (“E&P”) customers across all major onshore basins in both the U.S. and Canada as well as abroad to design and deploy downhole solutions and technology to prepare horizontal, multistage wells for production. We focus on providing our customers with cost-effective and comprehensive completion solutions designed to maximize their production levels and operating efficiencies. We believe our success is a product of our culture, which is driven by our intense focus on performance and wellsite execution as well as our commitment to forward-leaning technologies that aid us in the development of smarter, customized applications that drive efficiencies and reduce emissions.

We provide (i) cementing services, which consist of blending high-grade cement and water with various solid and liquid additives to create a cement slurry that is pumped between the casing and the wellbore of the well, (ii) an innovative portfolio of completion tools, including those that provide technologies used for completing the toe stage of a horizontal well and fully-composite, dissolvable, and extended range frac plugs to isolate stages during plug-and-perf operations, (iii) wireline services, the majority of which consist of plug-and-perf completions, which is a multistage well completion technique for cased-hole wells that consists of deploying perforating guns and isolation tools to a specified depth, and (iv) coiled tubing services, which perform wellbore intervention operations utilizing a continuous steel pipe that is transported to the wellsite wound on a large spool, providing a cost-effective solution for well work due to the ability to deploy efficiently and safely into a live well.

How We Generate Revenue and the Costs of Conducting Our Business