0001823466false0001823466us-gaap:CommonClassAMember2024-05-092024-05-090001823466us-gaap:WarrantMember2024-05-092024-05-0900018234662024-05-092024-05-09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): May 9, 2024 |

FISCALNOTE HOLDINGS, INC.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-39672 |

88-3772307 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

1201 Pennsylvania Avenue NW 6th Floor |

|

Washington, District of Columbia |

|

20004 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: (202) 793-5300 |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

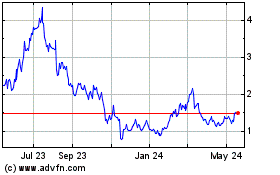

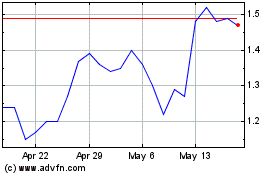

Class A common stock, par value $0.0001 per share |

|

NOTE |

|

The New York Stock Exchange |

Warrants to purchase one share of Class A common stock, each at an exercise price of $11.50 per share |

|

NOTE.WS |

|

The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

Item 7.01 Regulation FD Disclosure.

Financial Results for the Quarter Ended March 31, 2024

On May 9, 2024, FiscalNote Holdings, Inc. (the “Company”) issued a press release announcing its financial results for the quarter ended March 31, 2024. A copy of the press release, a supplemental presentation accompanying the press release and related conference call, and management’s prepared remarks for the related conference call is furnished as Exhibit 99.1, Exhibit 99.2 and Exhibit 99.3, respectively, to this Current Report on Form 8-K.

The information disclosed under Items 2.02 and/or Item 7.01, as applicable, including the exhibits hereto, is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, and shall not be deemed to be incorporated by reference in any filing made by the Company under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

|

(d) Exhibits. The following exhibits are furnished with this report: |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

FISCALNOTE HOLDINGS, INC. |

|

|

|

|

Date: |

May 9, 2024 |

By: |

/s/ Jon Slabaugh |

|

|

|

Name: Jon Slabaugh

Title: Chief Financial Officer |

|

|

|

|

Exhibit 99.1

FiscalNote Reports First Quarter 2024 Financial Results

Outlines Accelerated AI Product Strategy and Roadmap

•Reports Q1 2024 total revenues of $32.1 million and adjusted EBITDA of $1.2 million(1), both slightly exceeding previously provided guidance

•Reaffirms forecast for FY 2024 and issues forecast for Q2 2024

•Successfully completes Board.org divestiture for a total consideration of up to $103.0 million

•Accelerates its strategy of developing revolutionary AI Copilots to transform Legal, Regulatory, and Policy workflows using a new, proprietary modular framework

•Board of Directors continues to review all strategic options available to the Company to maximize shareholder value

WASHINGTON, D. C. – Thursday, May 9, 2024 – FiscalNote Holdings, Inc. (NYSE: NOTE) (“FiscalNote” or the “Company”), a leading information services company using AI-driven enterprise SaaS technology to provide global political, legislative and regulatory policy and market intelligence, today reported financial results for the first quarter ended March 31, 2024.

These results mark another quarter of delivering on expected results driven by a blue chip customer base, durable recurring revenue and high gross margins, which form the basis of its increasing adjusted EBITDA and ongoing leadership in delivering AI-enabled policy and market information. The first quarter of 2024 represented an $8.2 million improvement in adjusted EBITDA year over year and marked the third straight quarter of adjusted EBITDA profitability for FiscalNote.

The Company also unveiled an accelerated AI product strategy and roadmap that leverages the decade-long investment in collecting legislative, regulatory, and geopolitical information in 80 different countries as well as partnerships with OpenAI, Google, and Microsoft to launch FiscalNoteGPT, the company’s verticalized large language model, and Copilot Creator Reasoning Engine. These investments in AI are expected to drive an acceleration in generative AI Agents and Copilot products that have already begun to be sold in the market beginning in Q1 2024 (including StressLens and the Global Intelligence Copilot) and expected to continue through the remainder of 2024 and into 2025 and beyond to build the most powerful legal, regulatory, and geopolitical AI assistant and eventually the world’s most powerful AI lawyer.

The Company has also been approached by both existing and new business partners to explore data licensing and/or co-selling the Company’s Copilots and AI Agents. As a result, the Company is exploring working with several large language model companies to potentially license portions of the Company’s data and AI portfolio with the goal of exposing a larger universe of users to its data.

“The performance in the first quarter was a good start to the year and reflects initial progress following our strategic initiatives throughout 2023 to rationalize our cost structure, divest non-core assets, and tighten the focus of our product mix,” said Tim Hwang, Chairman, CEO, and Co-founder of FiscalNote. “The Company continues to solidify its leadership position in the global policy, risk mitigation, and market intelligence sector and, year to date, we have realized a large number of impactful operational and business successes, most notably our recent series of new product launches and updates. We are well positioned to further execute on our growth strategy, continue launching innovative AI products - including our recently-announced FiscalNote Global Intelligence Copilot - that deliver deep insights to our customers, and deliver on our profitability plans across the remainder of 2024 and beyond.”

Financial Highlights(2)

Q1 2024 vs. Q1 2023

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, |

|

|

|

|

($ in millions) |

|

|

2024 |

|

|

|

2023 |

|

|

% Change |

|

Total Revenues (formerly "GAAP Revenue") |

|

$ |

32.1 |

|

|

$ |

31.5 |

|

|

2 |

% |

Subscription Revenue as % of Total Revenues |

|

|

~92 |

% |

|

|

~90 |

% |

|

|

|

Gross Profit |

|

$ |

24.9 |

|

|

$ |

22.6 |

|

|

10 |

% |

Gross Margin |

|

|

77 |

% |

|

|

72 |

% |

|

500 |

bps |

Adjusted Gross Profit |

|

$ |

27.3 |

|

|

$ |

25.2 |

|

|

8 |

% |

Adjusted Gross Margin |

|

|

85 |

% |

|

|

80 |

% |

|

500 |

bps |

Net Income (Loss) |

|

$ |

50.6 |

|

|

$ |

(19.3) |

|

|

|

* |

Adjusted EBITDA |

|

$ |

1.2 |

|

|

$ |

(7.0) |

|

|

|

* |

Adjusted EBITDA Margin |

|

|

4 |

% |

|

|

(22) |

% |

|

|

|

Cash and Cash Equivalents |

|

$ |

43.6 |

|

|

$ |

46.7 |

|

|

|

|

bps - Basis Points |

|

|

|

|

|

|

|

|

|

|

|

* - percentage change is greater than +/- 100% |

|

|

|

|

|

|

|

|

|

|

|

First Quarter and Recent Operational Highlights

•Completed the divestiture of Board.org, a non-core product offering, for total consideration of up to $103.0 million, including $95.0 million in cash at close, $65.7 million of which was used to repay senior debt, delivering a strengthened balance sheet while also bolstering cash balances.

•Amended our Credit Agreement with our senior lenders to, among other things, extend the commencement of amortization payments to August 15, 2026, leaving the maturity date of July 2027 unchanged.

•Introduced the FiscalNote Global Intelligence Copilot, an AI-powered assistant to help customers assess the shifting global landscape, manage emerging developments, and mitigate risk involved with the world’s most pressing geopolitical, macroeconomic, security, and regulatory challenges. The Copilot is the first in a series of AI-powered copilots the Company will launch as it accelerates its roadmap of groundbreaking AI agents to transform legal, regulatory, and legislative workflows.

•Secured a six-figure, multi-year agreement with a major state legislature for FiscalNote’s Fireside constituent relationship management solution.

•Announced the launch of StressLens, a pioneering and innovative new AI product that equips FiscalNote customers with the real-time ability to quantify the behavioral impact of leading decision makers and influencers across the financial, regulatory, and government domains.

•European information, operational and security risk, and large enterprise business sectors showing strong, outperforming growth as Company invests behind growth.

Commenting on highlights from the first quarter, FiscalNote Chief Financial Officer, Jon Slabaugh, said, “During the quarter, we completed an important transaction with the divestiture of Board.org, a non-core product offering that represented approximately 10% of our prior year total revenue. Total consideration for the transaction was up to $103.0 million and represented approximately a 7x revenue multiple based on 2023 annual recurring revenue (ARR). Acquired by FiscalNote in 2021 for $10.0 million in cash and $4.3 million in convertible securities ($14.3 million in total consideration), the divestiture by FiscalNote represents a 9.5x cash-on-cash (125% IRR) return for FiscalNote in less than three years. The transaction enabled us to enhance our capital structure by reducing senior debt by approximately $66.0 million while adding approximately $15.0 million to cash. It also is an indication of the substantial intrinsic value of our underlying assets.”

First Quarter Financial Performance

Revenue(2)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, |

|

|

|

|

($ in millions) |

|

2024 |

|

|

2023 |

|

|

% Change |

|

Subscription revenue |

|

$ |

29.6 |

|

|

$ |

28.5 |

|

|

|

4 |

% |

Advisory, advertising, and other revenue |

|

|

2.5 |

|

|

|

3.0 |

|

|

|

(19 |

)% |

Total revenues |

|

$ |

32.1 |

|

|

$ |

31.5 |

|

|

|

2 |

% |

For Q1 2024, subscription revenue increased $1.1 million, or 4% versus the prior year, due principally to the full quarter impact of Dragonfly, which was acquired in January 2023 and did not have a full impact on the prior year period.

For Q1 2024, advisory, advertising, and other revenue decreased $0.6 million, or 19% versus prior year, due primarily to the discontinuation of certain non-strategic products and related services.

Key Performance Indicators(3)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As of March 31, |

|

|

|

|

($ in millions) |

|

2024 |

|

|

2023 |

|

|

% Change |

|

Run-Rate Revenue (RRR) |

|

$ |

122 |

|

|

$ |

134 |

|

|

|

(9 |

)% |

Pro Forma RRR* |

|

$ |

122 |

|

|

$ |

121 |

|

|

|

1 |

% |

Annual Recurring Revenue (ARR) |

|

$ |

110 |

|

|

$ |

119 |

|

|

|

(8 |

)% |

Pro Forma ARR* |

|

$ |

110 |

|

|

$ |

107 |

|

|

|

3 |

% |

Net Revenue Retention (NRR) |

|

|

96 |

% |

|

|

96 |

% |

|

|

|

*Pro forma RRR and Pro forma ARR adjusts prior periods for the impact of the divestiture of Board.org.

For Q1 2024, Run-Rate Revenue declined $12 million, or 9%, versus prior year, principally due to the impact of the divestiture of Board.org. Excluding Board.org, Run-Rate Revenue increased approximately $1 million, or 1%, compared to Q1 2023.

For Q1 2024, ARR declined $9 million, or 8%, versus prior year, principally due to the impact of the divestiture of Board.org. Excluding Board.org, ARR increased approximately $3 million, or 3%, compared to Q1 2023.

For Q1 2024, NRR was 96%, level with the prior year.

Operating Expenses(2)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, |

|

|

|

|

($ in millions) |

|

2024 |

|

|

2023 |

|

|

% Change |

|

Cost of revenues |

|

$ |

7.2 |

|

|

$ |

8.9 |

|

|

|

(19 |

)% |

Research and development |

|

|

3.5 |

|

|

|

5.1 |

|

|

|

(32 |

)% |

Sales and marketing |

|

|

9.4 |

|

|

|

12.3 |

|

|

|

(23 |

)% |

Editorial |

|

|

4.7 |

|

|

|

4.3 |

|

|

|

9 |

% |

General and administrative |

|

|

16.1 |

|

|

|

18.2 |

|

|

|

(12 |

)% |

Amortization of intangible assets |

|

|

2.7 |

|

|

|

2.8 |

|

|

|

(5 |

)% |

Other# |

|

|

0.0 |

|

|

|

7.2 |

|

|

NM |

|

Total operating expenses |

|

$ |

43.6 |

|

|

$ |

58.9 |

|

|

|

(26 |

)% |

# - Q1 2023 includes goodwill impairment charge as well as transaction costs incurred related to our historical acquisitions |

|

NM - Not meaningful |

|

|

|

|

|

|

|

|

|

In Q1 2024, operating expenses decreased versus prior year, primarily as a result of cost control measures instituted throughout 2023 as well as the impact of sunset products, partially offset by a full quarter of Dragonfly expenses in Q1 2024 vs Q1 2023.

Financial Forecast

The Company reaffirms prior financial forecasts for full year 2024 and issues financial forecasts for Q2 2024, in both instances reflecting management’s expectations based on the most recent information available, including factors such as the impact of the divestiture of Board.org and the discontinuation of certain non-strategic products. The Company expects 2024 to deliver its first full year of adjusted EBITDA profitability in the Company’s history.

Full Year 2024

|

|

|

|

|

|

|

|

|

|

|

|

($ in millions) |

Current Range As of 05/09/2024 |

|

Action |

|

Previous Range As of 03/12/2024 |

Total Revenues |

$123 - $127 |

|

Unchanged |

|

$123 - $127 |

Total Run-Rate Revenue (3) |

$126 - $134 |

|

Unchanged |

|

$126 - $134 |

Adjusted EBITDA (1) (4) |

$7 - $9 |

|

Unchanged |

|

$7 - $9 |

Q2 2024

|

|

|

Current Range |

($ in millions) |

As of 05/09/2024 |

Total Revenues |

Approximately $29 |

Adjusted EBITDA (1) (4) |

Approximately $1 |

The Company expects to return to double digit growth rates in 2025 as the Company re-allocates sales and product resources to high-performing offerings and as it realizes the benefits of its recent product and organizational initiatives – including changes to sales coverage models for enhanced cross-sell, upsell and retention, further scaling of new products, and accelerated product development.

Strategic Review

As previously announced, following the formation by the Company’s Board of Directors (the Board) of a Special Committee (the Committee) in November 2023, and receipt of inbound interest, the Board and the Committee along with their advisors continue to review the Company’s ongoing plans and evaluate all strategic value-maximizing options available to the Company. There can be no assurance that the strategic review will result in any transaction or other outcome. The Company has not set a timetable for completion of the review and does not intend to disclose developments or provide updates on the progress or status of the review unless and/or until it deems further disclosure is appropriate or required. Centerview Partners LLC and Skadden, Arps, Slate, Meagher & Flom LLP continue to be retained by the Company as independent advisors to the Committee.

Conference Call, Presentation Supplement, and Webcast Information

Company management will host a conference call, with an accompanying presentation supplement, at 10:00 am ET today, Thursday, May 9, 2024, to discuss financial results.

LIVE

•Dial for the U.S. or Canada 1 (888) 660-6510 or for International 1 (929) 203-0882 and use the conference ID 1271923.

•Visit the Investor Relations section of the Company’s website.

REPLAY

•By phone (available through Thursday, May 23, 2024)

•Dial for the U.S. or Canada 1 (800) 770-2030 or for International 1 (609) 800-9909 and enter the conference ID 1271923.

•Visit the Investor Relations section of the Company’s website.

Footnotes

(1)Non-GAAP measure. See “Non-GAAP Financial Measures” and the reconciliation tables for the definitions and reconciliations of these non-GAAP financial measures to the most closely related GAAP financial measures.

(2)All financial information incorporated within this press release is unaudited.

(3)“Run-Rate Revenue,” “Annual Recurring Revenue,” and “Net Retention Revenue” are key performance indicators (KPIs). See “Key Performance Indicators” for the definitions and important disclosures related to these measures.

(4)Because of the variability of items impacting net income and the unpredictability of future events, management is unable to reconcile without unreasonable effort the Company's forecasted adjusted EBITDA to a comparable GAAP measure. The unavailable information could have a significant impact on the non-GAAP measures.

About FiscalNote

FiscalNote (NYSE: NOTE) is a leader in policy and global intelligence. By uniquely combining data, technology, and insights, FiscalNote empowers customers to manage political and business risk. Since 2013, FiscalNote has pioneered technology that delivers critical insights and the tools to turn them into action. Home to CQ, FrontierView, Oxford Analytica, VoterVoice, and many other industry-leading brands, FiscalNote serves thousands of customers worldwide with global offices in North America, Europe, Asia, and Australia. To learn more about FiscalNote and its family of brands, visit FiscalNote.com and follow @FiscalNote.

Contacts:

Media

Nicholas Graham

FiscalNote

press@fiscalnote.com

Investor Relations

FiscalNote

IR@fiscalnote.com

Safe Harbor Statement

Certain statements in this press release may be considered forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements generally relate to future events or FiscalNote’s future financial or operating performance. For example, statements regarding FiscalNote’s financial outlook for future periods, expectations regarding profitability, capital resources and anticipated growth in the industry in which FiscalNote operates are forward-looking statements. In some cases, you can identify forward-looking statements by terminology such as “pro forma,” “may,” “should,” “could,” “might,” “plan,” “possible,” “project,” “strive,” “budget,” “forecast,” “expect,” “intend,” “will,” “estimate,” “anticipate,” “believe,” “predict,” “potential” or “continue,” or the negatives of these terms or variations of them or similar terminology. Such forward-looking statements are subject to risks, uncertainties, and other important factors that could cause actual results to differ materially from those expressed or implied by such forward-looking statements.

Factors that may impact such forward-looking statements include FiscalNote’s ability to effectively manage its growth; changes in FiscalNote’s strategy, future operations, financial position, estimated revenue and losses, forecasts, projected costs, prospects and plans; the terms of any proposal FiscalNote may receive for a go-private transaction; the impact of the previous announcement of the formation of the Special Committee and its strategic review on FiscalNote’s business and its ability to implement any transaction; FiscalNote’s future capital requirements; demand for FiscalNote’s services and the drivers of that demand; FiscalNote’s ability to provide highly useful, reliable, secure and innovative products and services to its customers; FiscalNote’s ability to attract new customers, retain existing customers, expand its products and service

offerings with existing customers, expand into geographic markets or identify areas of higher growth; FiscalNote’s ability to successfully identify acquisition opportunities, make acquisitions on terms that are commercially satisfactory, successfully integrate potential acquired businesses and services, and subsequently grow acquired businesses; risks associated with international operations, including compliance complexity and costs, increased exposure to fluctuations in currency exchange rates, political, social and economic instability, and supply chain disruptions; FiscalNote’s ability to develop, enhance, and integrate its existing platforms, products, and services; FiscalNote’s estimated total addressable market and other industry and performance projections; FiscalNote's reliance on third-party systems and data, its ability to integrate such systems and data with its solutions and its potential inability to continue to support integration; potential technical disruptions, cyberattacks, security, privacy or data breaches or other technical or security incidents that affect FiscalNote’s networks or systems or those of its service providers; FiscalNote’s ability to obtain and maintain accurate, comprehensive, or reliable data to support its products and services; FiscalNote’s ability to introduce new features, integrations, capabilities, and enhancements to its products and services; FiscalNote’s ability to maintain and improve its methods and technologies, and anticipate new methods or technologies, for data collection, organization, and analysis to support its products and services; competition and competitive pressures in the markets in which FiscalNote operates, including larger well-funded companies shifting their existing business models to become more competitive with FiscalNote; FiscalNote’s ability to protect and maintain its brands; FiscalNote’s ability to comply with laws and regulations in connection with selling products and services to U.S. and foreign governments and other highly regulated industries; FiscalNote’s ability to retain or recruit key personnel; FiscalNote’s ability to effectively maintain and grow its research and development team and conduct research and development; FiscalNote’s ability to adapt its products and services for changes in laws and regulations or public perception, or changes in the enforcement of such laws, relating to artificial intelligence, machine learning, data privacy and government contracts; adverse general economic and market conditions reducing spending on our products and services; the outcome of any known and unknown litigation and regulatory proceedings; FiscalNote’s ability to successfully establish and maintain public company-quality internal control over financial reporting; and the ability to adequately protect FiscalNote’s intellectual property rights.

These and other important factors discussed in FiscalNote’s SEC filings, including its most recent reports on Forms 10-K and 10-Q, particularly the "Risk Factors" sections of those reports, could cause actual results to differ materially from those indicated by the forward-looking statements made in this press release. These forward-looking statements are based upon estimates and assumptions that, while considered reasonable by FiscalNote and its management, are inherently uncertain. Nothing in this press release should be regarded as a representation by any person that the forward-looking statements set forth herein will be achieved or that any of the contemplated results of such forward-looking statements will be achieved. You should not place undue reliance on forward-looking statements, which speak only as of the date they are made. FiscalNote undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws.

FiscalNote Holdings, Inc.

Consolidated Statements of Operations

(Unaudited)

(in thousands, except shares and per share data)

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, |

|

|

|

2024 |

|

|

2023 |

|

Revenues: |

|

|

|

|

|

|

Subscription |

|

$ |

29,626 |

|

|

$ |

28,467 |

|

Advisory, advertising, and other |

|

|

2,486 |

|

|

|

3,062 |

|

Total revenues |

|

|

32,112 |

|

|

|

31,529 |

|

Operating expenses: (1) |

|

|

|

|

|

|

Cost of revenues |

|

|

7,244 |

|

|

|

8,937 |

|

Research and development |

|

|

3,480 |

|

|

|

5,120 |

|

Sales and marketing |

|

|

9,415 |

|

|

|

12,298 |

|

Editorial |

|

|

4,660 |

|

|

|

4,265 |

|

General and administrative |

|

|

16,076 |

|

|

|

18,221 |

|

Amortization of intangible assets |

|

|

2,685 |

|

|

|

2,814 |

|

Impairment of goodwill |

|

|

- |

|

|

|

5,837 |

|

Transaction (gains) costs, net |

|

|

(4 |

) |

|

|

1,408 |

|

Total operating expenses |

|

|

43,556 |

|

|

|

58,900 |

|

Operating loss |

|

|

(11,444 |

) |

|

|

(27,371 |

) |

|

|

|

|

|

|

|

Gain on sale |

|

|

(71,599 |

) |

|

|

- |

|

Interest expense, net |

|

|

7,362 |

|

|

|

6,681 |

|

Change in fair value of financial instruments |

|

|

527 |

|

|

|

(14,680 |

) |

Other expense (income), net |

|

|

241 |

|

|

|

(129 |

) |

Net income (loss) before income taxes |

|

|

52,025 |

|

|

|

(19,243 |

) |

Provision from income taxes |

|

|

1,426 |

|

|

|

30 |

|

Net income (loss) |

|

|

50,599 |

|

|

|

(19,273 |

) |

Other comprehensive income (loss) |

|

|

5,591 |

|

|

|

(359 |

) |

Total comprehensive income (loss) |

|

$ |

56,190 |

|

|

$ |

(19,632 |

) |

|

|

|

|

|

|

|

Earnings (Loss) per share attributable to common shareholders (Note 14): |

|

|

|

|

|

|

Basic |

|

$ |

0.39 |

|

|

$ |

(0.14 |

) |

Diluted |

|

$ |

0.37 |

|

|

$ |

(0.14 |

) |

Weighted average shares used in computing earnings (loss) per share attributable to common shareholders: |

|

|

|

|

|

|

Basic |

|

|

130,712,032 |

|

|

|

133,082,639 |

|

Diluted |

|

|

146,027,085 |

|

|

|

133,082,639 |

|

(1) Amounts include stock-based compensation expenses, as follows: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, |

|

|

|

2024 |

|

|

2023 |

|

Cost of revenues |

|

$ |

101 |

|

|

$ |

58 |

|

Research and development |

|

|

310 |

|

|

|

390 |

|

Sales and marketing |

|

|

426 |

|

|

|

360 |

|

Editorial |

|

|

100 |

|

|

|

66 |

|

General and administrative |

|

|

5,238 |

|

|

|

5,632 |

|

FiscalNote Holdings, Inc.

Consolidated Balance Sheets

(Unaudited)

(in thousands, except shares, and par value)

|

|

|

|

|

|

|

|

|

|

|

March 31, 2024 |

|

|

December 31, 2023 |

|

Assets |

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

36,464 |

|

|

$ |

16,451 |

|

Restricted cash |

|

|

852 |

|

|

|

849 |

|

Short-term investments |

|

|

7,134 |

|

|

|

7,134 |

|

Accounts receivable, net |

|

|

14,381 |

|

|

|

16,931 |

|

Costs capitalized to obtain revenue contracts, net |

|

|

3,156 |

|

|

|

3,326 |

|

Prepaid expenses |

|

|

4,000 |

|

|

|

2,593 |

|

Other current assets |

|

|

3,679 |

|

|

|

2,521 |

|

Total current assets |

|

|

69,666 |

|

|

|

49,805 |

|

|

|

|

|

|

|

|

Property and equipment, net |

|

|

5,859 |

|

|

|

6,141 |

|

Capitalized software costs, net |

|

|

13,762 |

|

|

|

13,372 |

|

Noncurrent costs capitalized to obtain revenue contracts, net |

|

|

3,790 |

|

|

|

4,257 |

|

Operating lease assets |

|

|

18,070 |

|

|

|

17,782 |

|

Goodwill |

|

|

164,334 |

|

|

|

187,703 |

|

Customer relationships, net |

|

|

46,720 |

|

|

|

53,917 |

|

Database, net |

|

|

18,274 |

|

|

|

18,838 |

|

Other intangible assets, net |

|

|

16,786 |

|

|

|

18,113 |

|

Other non-current assets |

|

|

499 |

|

|

|

633 |

|

Total assets |

|

$ |

357,760 |

|

|

$ |

370,561 |

|

|

|

|

|

|

|

|

Liabilities and Stockholders' Equity |

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

Current maturities of long-term debt |

|

$ |

67 |

|

|

$ |

105 |

|

Accounts payable and accrued expenses |

|

|

11,101 |

|

|

|

12,909 |

|

Deferred revenue, current portion |

|

|

45,034 |

|

|

|

43,530 |

|

Customer deposits |

|

|

839 |

|

|

|

3,032 |

|

Contingent liabilities from acquisitions, current portion |

|

|

113 |

|

|

|

130 |

|

Operating lease liabilities, current portion |

|

|

3,395 |

|

|

|

3,066 |

|

Other current liabilities |

|

|

3,212 |

|

|

|

2,878 |

|

Total current liabilities |

|

|

63,761 |

|

|

|

65,650 |

|

|

|

|

|

|

|

|

Long-term debt, net of current maturities |

|

|

152,962 |

|

|

|

222,310 |

|

Deferred tax liabilities |

|

|

2,062 |

|

|

|

2,178 |

|

Deferred revenue, net of current portion |

|

|

389 |

|

|

|

875 |

|

Operating lease liabilities, net of current portion |

|

|

25,845 |

|

|

|

26,162 |

|

Public and private warrant liabilities |

|

|

3,840 |

|

|

|

4,761 |

|

Other non-current liabilities |

|

|

2,805 |

|

|

|

5,166 |

|

Total liabilities |

|

|

251,664 |

|

|

|

327,102 |

|

Commitment and contingencies (Note 17) |

|

|

|

|

|

|

Stockholders' equity: |

|

|

|

|

|

|

Class A Common stock ($0.0001 par value, 1,700,000,000 authorized, 122,749,497 and 121,679,829 issued and outstanding at March 31, 2024 and December 31, 2023, respectively) |

|

|

11 |

|

|

|

11 |

|

Class B Common stock ($0.0001 par value, 9,000,000 authorized, 8,290,921 issued and outstanding at March 31, 2024 and December 31, 2023, respectively) |

|

|

1 |

|

|

|

1 |

|

Additional paid-in capital |

|

|

866,932 |

|

|

|

860,485 |

|

Accumulated other comprehensive income ( loss) |

|

|

4,969 |

|

|

|

(622 |

) |

Accumulated deficit |

|

|

(765,817 |

) |

|

|

(816,416 |

) |

Total stockholders' equity |

|

|

106,096 |

|

|

|

43,459 |

|

Total liabilities and stockholders' equity |

|

$ |

357,760 |

|

|

$ |

370,561 |

|

FiscalNote Holdings, Inc.

Consolidated Statements of Cash Flows

(Unaudited)

(in thousands)

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, |

|

|

|

2024 |

|

|

2023 |

|

Operating Activities: |

|

|

|

|

|

|

Net income (loss) |

|

$ |

50,599 |

|

|

$ |

(19,273 |

) |

Adjustments to reconcile net income (loss) to net cash provided by (used in) operating activities: |

|

|

|

|

|

|

Depreciation |

|

|

304 |

|

|

|

336 |

|

Amortization of intangible assets and capitalized software development costs |

|

|

5,113 |

|

|

|

5,411 |

|

Amortization of deferred costs to obtain revenue contracts |

|

|

1,009 |

|

|

|

832 |

|

Gain on sale of business |

|

|

(71,599 |

) |

|

|

- |

|

Impairment of goodwill |

|

|

- |

|

|

|

5,837 |

|

Non-cash operating lease expense |

|

|

297 |

|

|

|

1,832 |

|

Stock-based compensation |

|

|

6,175 |

|

|

|

6,506 |

|

Other non-cash expenses |

|

|

- |

|

|

|

190 |

|

Bad debt expense |

|

|

29 |

|

|

|

156 |

|

Change in fair value of acquisition contingent consideration |

|

|

(4 |

) |

|

|

(156 |

) |

Unrealized loss on securities |

|

|

49 |

|

|

|

- |

|

Change in fair value of financial instruments |

|

|

527 |

|

|

|

(14,680 |

) |

Deferred income taxes |

|

|

(71 |

) |

|

|

(218 |

) |

Paid-in-kind interest, net |

|

|

2,035 |

|

|

|

970 |

|

Non-cash interest expense |

|

|

737 |

|

|

|

1,074 |

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

Accounts receivable, net |

|

|

1,320 |

|

|

|

(696 |

) |

Prepaid expenses and other current assets |

|

|

(1,924 |

) |

|

|

619 |

|

Costs capitalized to obtain revenue contracts, net |

|

|

(932 |

) |

|

|

(1,126 |

) |

Other non-current assets |

|

|

148 |

|

|

|

27 |

|

Accounts payable and accrued expenses |

|

|

460 |

|

|

|

(3,225 |

) |

Deferred revenue |

|

|

10,436 |

|

|

|

10,002 |

|

Customer deposits |

|

|

(1,239 |

) |

|

|

(1,923 |

) |

Other current liabilities |

|

|

318 |

|

|

|

(1,222 |

) |

Contingent liabilities from acquisitions, net of current portion |

|

|

(13 |

) |

|

|

(39 |

) |

Operating lease liabilities |

|

|

(969 |

) |

|

|

(4,052 |

) |

Other non-current liabilities |

|

|

(64 |

) |

|

|

(8 |

) |

Net cash provided by (used in) operating activities |

|

|

2,741 |

|

|

|

(12,826 |

) |

|

|

|

|

|

|

|

Investing Activities: |

|

|

|

|

|

|

Capital expenditures |

|

|

(1,692 |

) |

|

|

(1,869 |

) |

Cash proceeds from the sale of business, net |

|

|

90,884 |

|

|

|

- |

|

Cash paid for business acquisitions, net of cash acquired |

|

|

- |

|

|

|

(5,010 |

) |

Net cash provided by (used in) investing activities |

|

|

89,192 |

|

|

|

(6,879 |

) |

|

|

|

|

|

|

|

Financing Activities: |

|

|

|

|

|

|

Proceeds from long-term debt, net of issuance costs |

|

|

801 |

|

|

|

6,000 |

|

Principal payments of long-term debt |

|

|

(65,727 |

) |

|

|

(27 |

) |

Payment of deferred financing costs |

|

|

(7,068 |

) |

|

|

- |

|

Proceeds from exercise of stock options and ESPP purchases |

|

|

196 |

|

|

|

264 |

|

Net cash (used in) provided by financing activities |

|

|

(71,798 |

) |

|

|

6,237 |

|

|

|

|

|

|

|

|

Effects of exchange rates on cash |

|

|

(119 |

) |

|

|

(251 |

) |

|

|

|

|

|

|

|

Net change in cash, cash equivalents, and restricted cash |

|

|

20,016 |

|

|

|

(13,719 |

) |

Cash, cash equivalents, and restricted cash, beginning of period |

|

|

17,300 |

|

|

|

61,223 |

|

Cash, cash equivalents, and restricted cash, end of period |

|

$ |

37,316 |

|

|

$ |

47,504 |

|

|

|

|

|

|

|

|

Supplemental Noncash Investing and Financing Activities: |

|

|

|

|

|

|

Warrants issued in conjunction with long-term debt issuance |

|

$ |

- |

|

|

$ |

178 |

|

Amounts held in escrow related to the sale of Board.org |

|

$ |

785 |

|

|

$ |

- |

|

Property and equipment purchases included in accounts payable |

|

$ |

124 |

|

|

$ |

121 |

|

|

|

|

|

|

|

|

Supplemental Cash Flow Activities: |

|

|

|

|

|

|

Cash paid for interest |

|

$ |

5,303 |

|

|

$ |

4,740 |

|

Cash paid for taxes |

|

$ |

2 |

|

|

$ |

112 |

|

Non-GAAP Financial Measures

In addition to financial measures prepared in accordance with U.S. generally accepted accounting principles (“GAAP”), we use certain non-GAAP financial measures to clarify and enhance our understanding, and aid in the period-to-period comparison, of our performance. Where applicable, we provide reconciliations of these non-GAAP measures to the corresponding most closely related GAAP measure. Investors are encouraged to review the reconciliation of each of these non-GAAP financial measures to its most comparable GAAP financial measure. While we believe that these non-GAAP financial measures provide useful supplemental information, non-GAAP financial measures have limitations and should not be considered in isolation from, or as a substitute for, their most comparable GAAP measures. These non-GAAP financial measures are not prepared in accordance with GAAP, do not reflect a comprehensive system of accounting and may not be comparable to similarly titled measures of other companies due to potential differences in their financing and accounting methods, the book value of their assets, their capital structures, the method by which their assets were acquired and the manner in which they define non-GAAP measures.

Adjusted Gross Profit and Adjusted Gross Profit Margin

We define Adjusted Gross Profit as Total Revenue minus cost of revenues, before amortization of intangible assets that are included in costs of revenues. We define Adjusted Gross Profit Margin as Adjusted Gross Profit divided by Total Revenues.

We use Adjusted Gross Profit and Adjusted Gross Profit Margin to understand and evaluate our core operating performance and trends. We believe these metrics are useful measures to us and to our investors to assist in evaluating our core operating performance because they provide consistency and direct comparability with our past financial performance and between fiscal periods, as the metrics eliminate the non-cash effects of amortization of intangible assets that may fluctuate for reasons unrelated to overall operating performance.

Adjusted Gross Profit and Adjusted Gross Profit Margin have limitations as analytical tools, and you should not consider them in isolation, or as a substitute for analysis of our results as reported under GAAP. They should not be considered as replacements for gross profit and gross profit margin, as determined by GAAP, or as measures of our profitability. We compensate for these limitations by relying primarily on our GAAP results and using non-GAAP measures only for supplemental purposes. Adjusted Gross Profit and Adjusted Gross Profit Margin as presented herein are not necessarily comparable to similarly titled measures presented by other companies.

EBITDA, Adjusted EBITDA, and Adjusted EBITDA Margin

EBITDA, Adjusted EBITDA and Adjusted EBITDA Margin are non-GAAP financial measures. EBITDA represents earnings before interest expense, income taxes, depreciation and amortization. Adjusted EBITDA reflects further adjustments to EBITDA to exclude certain non-cash items and other items that management believes are not indicative of ongoing operations. We define Adjusted EBITDA Margin as Adjusted EBITDA divided by Total Revenues.

We disclose EBITDA, Adjusted EBITDA and Adjusted EBITDA Margin herein because these non-GAAP measures are key measures used by management to evaluate our business, measure our operating performance and make strategic decisions. We believe that EBITDA, Adjusted EBITDA and Adjusted EBITDA Margin are useful for investors and others in understanding and evaluating our operating results in the same manner as management. EBITDA, Adjusted EBITDA and Adjusted EBITDA Margin are not financial measures calculated in accordance with GAAP and should not be considered as substitutes for net income (loss), net income (loss) before income taxes, or any other operating performance measure calculated in accordance with GAAP. Using these non-GAAP financial measures to analyze our business would have material limitations because the calculations are based on the subjective determination of management regarding the nature and classification of events and circumstances that investors may find significant. In addition, although other companies in our industry may report measures titled EBITDA, Adjusted EBITDA and Adjusted EBITDA Margin or similar measures, such non-GAAP financial measures may be calculated differently from how we calculate non-GAAP financial measures, which reduces their comparability. Because of these limitations, you should consider EBITDA, Adjusted EBITDA, and

Adjusted EBITDA Margin alongside other financial performance measures, including net income and our other financial results presented in accordance with GAAP.

Adjusted Gross Profit and Adjusted Gross Profit Margin

The following table presents our calculation of Adjusted Gross Profit and Adjusted Gross Profit Margin for the periods presented:

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, |

|

(In thousands) |

|

2024 |

|

|

2023 |

|

Total revenues |

|

$ |

32,112 |

|

|

$ |

31,529 |

|

Costs of revenue |

|

|

(7,244 |

) |

|

|

(8,937 |

) |

Amortization of intangible assets |

|

|

2,428 |

|

|

|

2,597 |

|

Adjusted Gross Profit |

|

$ |

27,296 |

|

|

$ |

25,189 |

|

Adjusted Gross Profit Margin |

|

|

85 |

% |

|

|

80 |

% |

EBITDA, Adjusted EBITDA, and Adjusted EBITDA Margin

The following table presents our calculation of EBITDA, Adjusted EBITDA, and Adjusted EBITDA Margin for the periods presented:

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, |

|

(In thousands) |

|

2024 |

|

|

2023 |

|

Net loss |

|

$ |

50,599 |

|

|

$ |

(19,273 |

) |

Provision from income taxes |

|

|

1,426 |

|

|

|

30 |

|

Depreciation and amortization |

|

|

5,417 |

|

|

|

5,747 |

|

Interest expense, net |

|

|

7,362 |

|

|

|

6,681 |

|

EBITDA |

|

|

64,804 |

|

|

|

(6,815 |

) |

Gain on disposal of Board.org (a) |

|

|

(71,599 |

) |

|

|

- |

|

Stock-based compensation |

|

|

6,175 |

|

|

|

6,506 |

|

Change in fair value of financial instruments (b) |

|

|

527 |

|

|

|

(14,680 |

) |

Other non-cash charges (c) |

|

|

45 |

|

|

|

5,873 |

|

Acquisition and disposal related costs (d) |

|

|

704 |

|

|

|

1,222 |

|

Employee severance costs (e) |

|

|

107 |

|

|

|

369 |

|

Non-capitalizable debt raising costs |

|

|

254 |

|

|

|

206 |

|

Business Combination with DSAC (f) |

|

|

- |

|

|

|

184 |

|

Loss contingency (g) |

|

|

- |

|

|

|

168 |

|

Costs incurred related to the Special Committee (h) |

|

|

200 |

|

|

|

- |

|

Adjusted EBITDA |

|

$ |

1,217 |

|

|

$ |

(6,967 |

) |

Adjusted EBITDA Margin |

|

|

3.8 |

% |

|

|

(22.0 |

)% |

(a)Reflects the gain on disposal from the sale of Board.org on March 11, 2024.

(b)Reflects the non-cash impact from the mark to market adjustments on our financial instruments.

(c)Reflects the non-cash impact of the following: (i) charge of $49 in the first quarter of 2024 related to the unrealized loss on investments; (ii) gain of $4 in the first quarter of 2024 from the change in fair value related to the contingent consideration and contingent compensation related to the 2021, 2022, and 2023 Acquisitions (iii) impairment of goodwill of $5,837 in the first quarter of 2023, (iv) loss from equity method investment of $34 in the first quarter of 2023; and (v) charge of $2 in the first quarter of 2023 from the change in fair value related to the contingent consideration and contingent compensation related to the 2021, 2022, and 2023 Acquisitions.

(d)In 2024 reflects the costs incurred related to the sale of Board.org, principally consisting of accounting, tax, and legal fees. In 2023 reflects the costs incurred to identify, consider, and complete business combination transactions consisting of advisory, legal, and other professional and consulting costs.

(e)Severance costs associated with workforce changes related to business realignment actions.

(f)Includes non-capitalizable transaction costs incurred within one year of the Business Combination with DSAC.

(g)Reflects accounting and legal costs incurred associated with the settlement with GPO FN Noteholder LLC totaling $168 in the first quarter of 2023.

(h)Reflects costs incurred related to the Special Committee.

Key Performance Indicators

We monitor the following key performance indicators to evaluate growth trends, prepare financial projections, make strategic decisions, and measure the effectiveness of our sales and marketing efforts. Our management team assesses our performance based on these key performance indicators because it believes they reflect the underlying trends and indicators of our business and serve as meaningful indicators of our continuous operational performance.

Annual Recurring Revenue (“ARR”)

Approximately 90% of our revenues are subscription based, which leads to high revenue predictability. Our ability to retain existing subscription customers is a key performance indicator that helps explain the evolution of our historical results and is a leading indicator of our revenues and cash flows for subsequent periods. We use ARR as a measure of our revenue trend and an indicator of our future revenue opportunity from existing recurring subscription customer contracts. We calculate ARR on a parent account level by annualizing the contracted subscription revenue, and our total ARR as of the end of a period is the aggregate thereof. ARR is not adjusted for the impact of any known or projected future customer cancellations, upgrades or downgrades, or price increases or decreases. The amount of actual revenue that we recognize over any 12-month period is likely to differ from ARR at the beginning of that period, sometimes significantly. This may occur due to timing of the revenue bookings during the period, cancellations, upgrades, or downgrades and pending renewals. ARR should be viewed independently of revenue as it is an operating metric and is not intended to be a replacement or forecast of revenue. Our calculation of ARR may differ from similarly titled metrics presented by other companies.

Run-Rate Revenue

Management also monitors Run-Rate Revenue, which we define as ARR plus non-subscription revenue earned during the last 12 months. We believe Run-Rate Revenue is an indicator of our total revenue growth, incorporating the non-subscription revenue that we believe is a meaningful contribution to our business as a whole. Although our non-subscription business is non-recurring, we regularly sell different advisory services to repeat customers. The amount of actual subscription and non-subscription revenue that we recognize over any 12-month period is likely to differ from Run-Rate Revenue at the beginning of that period, sometimes significantly.

Net Revenue Retention (“NRR”)

Our NRR, which we use to measure our success in retaining and growing recurring revenue from our existing customers, compares our recognized recurring revenue from a set of customers across comparable periods. We calculate our NRR for a given period as ARR at the end of the period minus ARR contracted from new clients for which there is no historical revenue booked during the period, divided by the beginning ARR for the period. For our federal government clients, we consider subdivisions of the same executive branch department or independent agency (for example, divisions of a single federal department or agency) to be a single customer for purposes of calculating our account-level NRR. For our commercial clients, we calculate NRR at a parent account level. Customers from acquisitions are not included in NRR until they have been part of our consolidated results for 12 months. Accordingly, the 2022 and 2023 Acquisitions are not included in our NRR for the three months ended March 31, 2023. Our calculation of NRR for any fiscal period includes the positive recurring revenue impacts of selling additional licenses and services to existing customers and the negative recognized recurring revenue impacts of contraction and attrition among this set of customers. Our NRR may fluctuate as a result of a number of factors, including the growing level of our revenue base, the level of penetration within our customer base, expansion of products and features, and our ability to retain our customers.

Source: FiscalNote

Disclaimer Forward Looking Statements Certain statements herein may be considered forward-looking statements within the meaning of the federal securities laws. Forward-looking statements generally relate to future events or FiscalNote’s future financial or operating performance. Statements regarding FiscalNote’s financial outlook for future periods, expectations regarding profitability, capital resources and anticipated growth in the industry in which FiscalNote operates are forward-looking statements. In some cases, you can identify forward-looking statements by terminology such as “pro forma,” “may,” “should,” “could,” “might,” “plan,” “possible,” “project,” “strive,” “budget,” “forecast,” “expect,” “intend,” “will,” “estimate,” “anticipate,” “believe,” “predict,” “potential” or “continue,” or the negatives of these terms or variations of them or similar terminology. Such forward-looking statements are subject to risks, uncertainties, and other important factors that could cause actual results to differ materially from those expressed or implied by such forward-looking statements. Factors that may impact such forward-looking statements include FiscalNote’s ability to effectively manage its growth; changes in FiscalNote’s strategy, future operations, financial position, estimated revenue and losses, forecasts, projected costs, prospects and plans; the terms of any proposal FiscalNote may receive for a go-private transaction; the impact of the previous announcement of the formation of the Special Committee and its strategic review on FiscalNote’s business and its ability to implement any transaction; FiscalNote’s future capital requirements; demand for FiscalNote’s services and the drivers of that demand; FiscalNote’s ability to attract and retain customers, and expand its offerings with existing customers; FiscalNote’s ability to successfully execute its acquisition strategy; FiscalNote’s ability to develop, enhance, and integrate its existing platforms, products, and services; risks associated with international operations; potential technical disruptions, cyberattacks, security, privacy or data breaches or other technical or security incidents; competition and competitive pressures; FiscalNote’s ability to retain or recruit key personnel; the outcome of any known and unknown litigation and regulatory proceedings; and FiscalNote’s ability to adequately protect its intellectual property rights. These and other factors discussed in FiscalNote’s SEC filings, including its most recent reports on Forms 10-K and 10-Q, particularly the "Risk Factors" sections of those reports, could cause actual results to differ materially from those indicated by the forward-looking statements made herein. These forward-looking statements are based upon estimates and assumptions that, while considered reasonable by FiscalNote and its management, are inherently uncertain. Nothing herein should be regarded as a representation by any person that the forward-looking statements set forth herein will occur or that any of the contemplated results of such forward-looking statements will be achieved. You should not place undue reliance on forward-looking statements, which speak only as of the date they are made. FiscalNote undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws. Trademarks FiscalNote owns or has rights to various trademarks, service marks and trade names it uses in connection with the operation of its businesses. This presentation may also contain trademarks, service marks, trade names and copyrights of third parties, which are the property of their respective owners. The use or display of third parties’ trademarks, service marks, trade names or products in this presentation is not intended to, and does not imply, a relationship with FiscalNote or an endorsement or sponsorship by or of FiscalNote. Solely for convenience, the trademarks, service marks, trade names and copyrights referred to in this presentation may appear without the TM, SM, * or © symbols, but such references are not intended to indicate, in any way, that FiscalNote will not assert, to the fullest extent under applicable law, its rights or the right of the applicable licensor to these trademarks, service marks, trade names and copyrights. Use of Data This presentation contains information concerning FiscalNote’s products, services and industry, including market size and growth rates of the markets in which FiscalNote participates, that are based on industry surveys and publications or other publicly available information, other third-party survey data and research reports. This information involves many assumptions and limitations; therefore, there can be no guarantee as to the accuracy or reliability of such assumptions and you are cautioned not to give undue weight to this information. Further, no representation is made as to the reasonableness of the assumptions made within or the accuracy or completeness of any projections or modeling or any other information contained herein. Any data on past performance or modeling contained herein is not an indication as to future performance. This modeling data is subject to change. FiscalNote has not independently verified this third-party information. Similarly, other third-party survey data and research reports commissioned by FiscalNote, while believed by FiscalNote to be reliable, are based on limited sample sizes and have not been independently verified by FiscalNote. In addition, projections, assumptions, estimates, goals, targets, plans and trends of the future performance of the industry in which FiscalNote operates, and its future performance, are necessarily subject to uncertainty and risk due to a variety of factors, including those described above. These and other factors could cause results to differ materially from those expressed in the estimates made by independent parties and by FiscalNote. FiscalNote assumes no obligation to update such information.

Q1 2024 Financials

Q1 2024 Financial Summary (1) Non-GAAP measure. Please see "Non-GAAP Financial Measures" for definitions and important disclosures regarding these financial measures, including reconciliations to the most directly comparable GAAP measure. (2) As of March 31, 2024 and inclusive of short-term investments. $32.1M�(+2% YoY) Total�Revenues $1.2M�(4% adjusted EBITDA margin) Adjusted�EBITDA1 $27.3M�(85% adjusted gross margin) Adjusted�Gross Profit1 $24.9M (77% gross margin) Gross Profit Cash2 $43.6M $50.6M Net �Income FINANCIAL HIGHLIGHTS

Q1 2024 Financial Summary (1) “Run-Rate Revenue,” “Annual Recurring Revenue,” and “Net Retention Revenue” are key performance indicators (KPIs). See “Key Performance Indicators” for the definitions and important disclosures related to these measures. $122M Run-Rate�Revenue�(RRR) $110M Annual Recurring Revenue�(ARR) Net Revenue Retention 96% KEY PERFORMANCE INDICATORS1

Forecast (1) Run-Rate Revenue is a key performance indicators (KPI). See “Key Performance Indicators” for the definitions and important disclosures related to these measures (2) Non-GAAP measure. Please see "Non-GAAP Financial Measures" for definitions and important disclosures regarding these financial measures. (3) Because of the variability of items impacting net income and unpredictability of future events, management is unable to reconcile without unreasonable effort the Company's forecasted adjusted EBITDA to a comparable GAAP measure. Metric Forecast as of �May 9, 2024 Vs. Prior Guidance Provided on March 12, 2024 Total Revenue $123M to $127M UNCHANGED Run-Rate Revenue1 $126M to $134M UNCHANGED Adjusted EBITDA2,3 $7M to $9M UNCHANGED Full Year 2024 Metric Initial Range as of May 9, 2024 Total Revenue ~ $29M Adjusted EBITDA2,3 ~ $1M Q2 2024

AI Product Strategy Building the most powerful legal, regulatory, and geopolitical AI assistant and eventually the world’s most powerful AI lawyer

Accelerating Our AI Products to Drive Growth FN AI and LLM Technology Platform Copilot Creator FiscalNoteGPT Proprietary Aggregation of Content and Data Sets StressLens Global Intelligence Copilot Legislative Copilot�(Beta) Future Copilots �and Agents Data and AI Agent Licensing Developed proprietary technology and deep expertise in aggregating and creating valuable global content and data sets Created Reasoning Platform to facilitate creation of AI Agents adapted for legal, regulatory, and geopolitical Launched AI Agents and Copilots blending AI with �authoritative information Exploring licensing opportunities to broaden impact Partnerships with OpenAI, Microsoft, Google International, federal, state, and local legislation/regulations across 80 countries, 80,000+ cities, all 50 states, every major federal regulatory agency; deep profiles of tens of thousands of policymakers, millions of legislative and regulatory votes, geopolitical and risk information from around the world

Constellation of Skills Policy Impact Assessment Geopolitical Risk Assessment Communication Drafting Document Q&A Regulatory Analysis Legislative Analysis Contract Review & Analysis Compliance Monitoring Issue & Trend Reporting Sample present and future AI skills powering FiscalNote’s products to perform domain-specific workflows using generative AI Building a powerful legal, regulatory, and geopolitical AI assistant, powered by Generative AI

Why FiscalNote Can Win AI and Workflow Expertise: FiscalNote is already the leading provider of AI-powered software for people to understand policy, legislation, and regulations. We have been investing in AI since 2013 with deep embedded workflows and already announced partnerships in 2023 with OpenAI, Microsoft, and Google with FiscalNote’s world class AI team. Decade of Data Accumulation and Content Creation: Developed proprietary technology and deep expertise in aggregating global policy, regulatory, geopolitical, economic and related data sets. Acquired, created and continue to add to our library of proprietary, high quality, and authoritative data for legal, regulatory and global intelligence. Deep Market Insight and Distribution: Leveraging FiscalNote distribution of Fortune 500s, governments, and NGO’s to bring new customer-driven AI capabilities. Over a decade of building a unique global dataset and AI capabilities

FiscalNote’s AI Master Plan Build the Data Foundation: Aggregate, clean, and structure a massive repository of legislative, regulatory, and geopolitical information Develop and Launch AI Solutions: Create AI Copilots and Agents that integrate this data to drive customer value and enhance decision-making for existing customers. Develop and Launch More AI Solutions: Expand AI Copilots and Agents to new markets and sectors. License and Co-Sell AI Technology: Partner with other industry players to extend the reach and functionality of our AI solutions. Building the future of AI solutions for law and strategic risk

Key Takeaways FiscalNote already a leading provider of AI-powered sector-specific, information, and analytics for the legal, regulatory, and policy industry Invested the last 10 years to create a deep reservoir of technical expertise, world-class team, proprietary data and analytical tools Launched FiscalNoteGPT and Co-Pilot Creator to rapidly accelerate creation of AI Agents and Co-Pilots without incremental R&D expenses Exploring opportunity to license data to LLMs and white label AI Co-Pilots to other verticals Accelerating our AI offerings to broad distribution of thousands of customers / extensive sales and customer support in N. America, Europe, and APAC to accelerate revenue growth and improve retention 1 2 3 4 5 Building the most powerful legal, regulatory, and geopolitical AI assistant and eventually the world’s most powerful AI lawyer

APPENDIX

In addition to financial measures prepared in accordance with U.S. generally accepted accounting principles (“GAAP”), we use certain non-GAAP financial measures to clarify and enhance our understanding, and aid in the period-to-period comparison, of our performance. Where applicable, we provide reconciliations of these non-GAAP measures to the corresponding most closely related GAAP measure. Investors are encouraged to review the reconciliation of each of these non-GAAP financial measures to its most comparable GAAP financial measure. While we believe that these non-GAAP financial measures provide useful supplemental information, non-GAAP financial measures have limitations and should not be considered in isolation from, or as a substitute for, their most comparable GAAP measures. These non-GAAP financial measures are not prepared in accordance with GAAP, do not reflect a comprehensive system of accounting and may not be comparable to similarly titled measures of other companies due to potential differences in their financing and accounting methods, the book value of their assets, their capital structures, the method by which their assets were acquired and the manner in which they define non-GAAP measures. Adjusted Gross Profit and Adjusted Gross Profit Margin We define Adjusted Gross Profit as Total Revenue minus cost of revenues, before amortization of intangible assets that are included in costs of revenues. We define Adjusted Gross Profit Margin as Adjusted Gross Profit divided by Total Revenues. We use Adjusted Gross Profit and Adjusted Gross Profit Margin to understand and evaluate our core operating performance and trends. We believe these metrics are useful measures to us and to our investors to assist in evaluating our core operating performance because they provide consistency and direct comparability with our past financial performance and between fiscal periods, as the metrics eliminate the non-cash effects of amortization of intangible assets and deferred revenue, which are non-cash impacts that may fluctuate for reasons unrelated to overall operating performance. Adjusted Gross Profit and Adjusted Gross Profit Margin have limitations as analytical tools, and you should not consider them in isolation, or as a substitute for analysis of our results as reported under GAAP. They should not be considered as replacements for gross profit and gross profit margin, as determined by GAAP, or as measures of our profitability. We compensate for these limitations by relying primarily on our GAAP results and using non-GAAP measures only for supplemental purposes. Adjusted Gross Profit and Adjusted Gross Profit Margin as presented herein are not necessarily comparable to similarly titled measures presented by other companies. EBITDA, Adjusted EBITDA, and Adjusted EBITDA Margin EBITDA, Adjusted EBITDA and Adjusted EBITDA Margin are non-GAAP financial measures. EBITDA represents earnings before interest expense, income taxes, depreciation and amortization. Adjusted EBITDA reflects further adjustments to EBITDA to exclude certain non-cash items and other items that management believes are not indicative of ongoing operations. We define Adjusted EBITDA Margin as Adjusted EBITDA divided by Total Revenue. We disclose EBITDA, Adjusted EBITDA and Adjusted EBITDA Margin herein because these non-GAAP measures are key measures used by management to evaluate our business, measure our operating performance and make strategic decisions. We believe that EBITDA, Adjusted EBITDA and Adjusted EBITDA Margin are useful for investors and others in understanding and evaluating our operating results in the same manner as management. EBITDA, Adjusted EBITDA and Adjusted EBITDA Margin are not financial measures calculated in accordance with GAAP and should not be considered as substitutes for net loss, net loss before income taxes, or any other operating performance measure calculated in accordance with GAAP. Using these non-GAAP financial measures to analyze our business would have material limitations because the calculations are based on the subjective determination of management regarding the nature and classification of events and circumstances that investors may find significant. In addition, although other companies in our industry may report measures titled EBITDA, Adjusted EBITDA and Adjusted EBITDA Margin or similar measures, such non-GAAP financial measures may be calculated differently from how we calculate non-GAAP financial measures, which reduces their comparability. Because of these limitations, you should consider EBITDA, Adjusted EBITDA, and Adjusted EBITDA Margin alongside other financial performance measures, including net income and our other financial results presented in accordance with GAAP. Non-GAAP Financial Measures

Reconciliation Table - Adjusted Gross Profit and Adjusted Gross Profit Margin Three Months Ended March 31, ($ in thousands) 2024 2023 Total Revenue $ 32,112 $ 31,529 Costs of revenue (7,244) (8,937) Amortization of intangible assets 2,428 2,597 Adjusted Gross Profit $ 27,296 $ 25,189 Adjusted Gross Margin 85% 80%