Form NPORT-P - Monthly Portfolio Investments Report on Form N-PORT (Public)

29 October 2024 - 12:42AM

Edgar (US Regulatory)

Nuveen

Virginia

Quality

Municipal

Income

Fund

Portfolio

of

Investments

August

31,

2024

(Unaudited)

Principal

Amount

(000)

Description

(a)

Optional

Call

Provisions

(b)

Value

LONG-TERM

INVESTMENTS

-

164.3% (100.0%

of

Total

Investments)

X

369,421,682

MUNICIPAL

BONDS

-

164.3% (100.0%

of

Total

Investments)

X

369,421,682

CONSUMER

STAPLES

-

6.2%

(3.8%

of

Total

Investments)

$

1,000

Children's

Trust

Fund,

Puerto

Rico,

Tobacco

Settlement

Asset-Backed

Bonds,

Refunding

Series

2002,

5.625%,

5/15/43

9/24

at

100.00

$

1,011,612

Guam

Economic

Development

&

Commerce

Authority,

Tobacco

Settlement

Asset-Backed

Bonds,

Series

2007A:

490

5.250%,

6/01/32

9/24

at

100.00

489,958

705

5.625%,

6/01/47

9/24

at

100.00

702,733

5,135

Tobacco

Settlement

Financing

Corporation

of

Virginia,

Tobacco

Settlement

Asset

Backed

Bonds,

Series

2007B1,

5.000%,

6/01/47

9/24

at

100.00

5,135,605

6,645

Tobacco

Settlement

Financing

Corporation

of

Virginia,

Tobacco

Settlement

Asset-Backed

Bonds,

Series

2007B2,

5.200%,

6/01/46

9/24

at

100.00

6,646,329

TOTAL

CONSUMER

STAPLES

13,986,237

EDUCATION

AND

CIVIC

ORGANIZATIONS

-

12.7%

(7.7%

of

Total

Investments)

1,000

Alexandria

Industrial

Development

Authority,

Virginia,

Educational

Facilities

Revenue

Bonds,

Episcopal

High

School,

Refunding

Series

2021C,

4.000%,

1/01/46

1/31

at

100.00

964,598

Alexandria

Industrial

Development

Authority,

Virginia,

Educational

Facilities

Revenue

Bonds,

Episcopal

High

School,

Series

2017:

1,105

4.000%,

1/01/37

1/27

at

100.00

1,111,868

565

4.000%,

1/01/40

1/27

at

100.00

564,425

170

Amherst

Industrial

Development

Authority,

Virginia,

Revenue

Bonds,

Sweet

Briar

College,

Series

2006,

5.000%,

9/01/26

9/24

at

100.00

168,257

1,000

(c)

Industrial

Development

Authority

of

the

City

of

Lexington,

Virginia,

Washington

and

Lee

University,

Educational

Facility

Revenue

Bonds,

Refunding

Series

2018A,

5.000%,

1/01/43

1/28

at

100.00

1,040,291

1,500

Loudoun

County

Industrial

Development

Authority,

Virginia,

Multi-Modal

Revenue

Bonds,

Howard

Hughes

Medical

Institute,

Series

2022A,

4.000%,

10/01/52

10/32

at

100.00

1,507,711

2,000

Madison

County

Industrial

Development

Authority,

Virginia,

Educational

Facilities

Revenue

Bonds,

Woodberry

Forest

School,

Series

2021,

3.000%,

10/01/50

10/30

at

100.00

1,581,708

500

Montgomery

County

Economic

Development

Authority,

Virginia,

Revenue

Bonds,

Virginia

Tech

Foundation,

Refunding

Series

2017A,

4.000%,

6/01/36

6/27

at

100.00

507,385

750

Roanoke

Economic

Development

Authority,

Virginia,

Educational

Facilities

Revenue

Bonds,

Lynchburg

College,

Series

2018A,

5.000%,

9/01/43

9/28

at

100.00

753,852

1,000

Salem

Economic

Development

Authority,

Virginia,

Educational

Facilities

Revenue

Bonds,

Roanoke

College,

Series

2020,

4.000%,

4/01/45

4/30

at

100.00

900,884

2,500

The

Rector

and

Visitors

of

the

University

of

Virginia,

General

Pledge

Revenue

Bonds,

Green

Series

2015A-2,

5.000%,

4/01/45

4/25

at

100.00

2,522,037

1,515

The

Rector

and

Visitors

of

the

University

of

Virginia,

General

Pledge

Revenue

Bonds,

Refunding

Series

2017A,

5.000%,

4/01/39

4/27

at

100.00

1,580,378

9,000

(c)

The

Rector

and

Visitors

of

the

University

of

Virginia,

General

Pledge

Revenue

Bonds,

Refunding

Series

2017A,

5.000%,

4/01/39,

(UB)

4/27

at

100.00

9,388,383

1,000

(d)

Virginia

College

Building

Authority,

Educational

Facilities

Revenue

Bonds,

Marymount

University

Project,

Green

Series

2015B,

5.000%,

7/01/45

7/25

at

100.00

891,705

Virginia

College

Building

Authority,

Educational

Facilities

Revenue

Bonds,

Marymount

University

Project,

Refunding

Series

2015A:

1,500

(d)

5.000%,

7/01/35

7/25

at

100.00

1,451,177

4,000

(d)

5.000%,

7/01/45

7/25

at

100.00

3,566,818

TOTAL

EDUCATION

AND

CIVIC

ORGANIZATIONS

28,501,477

Nuveen

Virginia

Quality

Municipal

Income

Fund

(continued)

Portfolio

of

Investments

August

31,

2024

(Unaudited)

Principal

Amount

(000)

Description

(a)

Optional

Call

Provisions

(b)

Value

HEALTH

CARE

-

31.6%

(19.2%

of

Total

Investments)

Arlington

County

Industrial

Development

Authority,

Virginia,

Hospital

Facility

Revenue

Bonds,

Virginia

Hospital

Center,

Series

2020:

$

1,550

5.000%,

7/01/29

No

Opt.

Call

$

1,700,708

1,000

4.000%,

7/01/39

7/30

at

100.00

1,004,180

225

4.000%,

7/01/40

7/30

at

100.00

225,224

2,055

4.000%,

7/01/45

7/30

at

100.00

2,001,964

1,465

Arlington

County

Industrial

Development

Authority,

Virginia,

Hospital

Revenue

Bonds,

Virginia

Hospital

Center,

Series

2023A,

5.000%,

7/01/53,

(Mandatory

Put

7/01/31)

7/30

at

100.00

1,599,935

Chesapeake

Hospital

Authority,

Virginia,

Hospital

Facility

Revenue

Bonds,

Chesapeake

Regional

Medical

Center,

Series

2019:

1,470

5.000%,

7/01/34

7/29

at

100.00

1,573,449

1,205

4.000%,

7/01/37

7/29

at

100.00

1,213,217

1,000

4.000%,

7/01/43

7/29

at

100.00

955,539

1,920

Colorado

Health

Facilities

Authority,

Colorado,

Revenue

Bonds,

CommonSpirit

Health,

Series

2019A-1,

4.000%,

8/01/44

8/29

at

100.00

1,827,813

2,700

Colorado

Health

Facilities

Authority,

Colorado,

Revenue

Bonds,

CommonSpirit

Health,

Series

2019A-2,

4.000%,

8/01/49

8/29

at

100.00

2,517,288

4,005

Fairfax

County

Industrial

Development

Authority,

Virginia,

Healthcare

Revenue

Bonds,

Inova

Health

System,

Refunding

Series

2022,

4.000%,

5/15/42

5/32

at

100.00

4,030,843

2,500

Fairfax

County

Industrial

Development

Authority,

Virginia,

Healthcare

Revenue

Bonds,

Inova

Health

System,

Series

2014A,

4.000%,

5/15/44

9/24

at

100.00

2,434,545

3,000

Fairfax

County

Industrial

Development

Authority,

Virginia,

Healthcare

Revenue

Bonds,

Inova

Health

System,

Series

2024,

4.125%,

5/15/54

5/34

at

100.00

2,946,700

1,500

Front

Royal

and

Warren

County

Industrial

Development

Authority,

Virginia,

Hospital

Revenue

Bonds,

Valley

Health

System

Obligated

Group,

Series

2018,

4.000%,

1/01/50

1/25

at

103.00

1,454,272

3,500

(d)

Industrial

Development

Authority

of

the

City

of

Newport

News,

Virginia,

Health

System

Revenue

Bonds,

Riverside

Health

System,

Series

2015A,

5.330%,

7/01/45

7/25

at

100.00

3,503,917

5,000

(d)

Industrial

Development

Authority

of

the

City

of

Newport

News,

Virginia,

Health

System

Revenue

Bonds,

Riverside

Health

System,

Series

2017A,

5.000%,

7/01/46

7/27

at

100.00

5,006,138

2,310

Isle

Economic

Development

Authority,

Wight

County,

Virginia,

Health

System

Revenue

Bonds,

Riverside

Health

System

Series

2023,

5.250%,

7/01/48

-

AGM

Insured

7/33

at

100.00

2,537,167

4,885

Lynchburg

Economic

Development

Authority,

Virginia,

Hospital

Revenue

Bonds,

Centra

Health

Obligated

Group,

Refunding

Series

2017A,

5.000%,

1/01/47

1/27

at

100.00

4,937,245

1,575

Lynchburg

Economic

Development

Authority,

Virginia,

Hospital

Revenue

Bonds,

Centra

Health

Obligated

Group,

Refunding

Series

2021,

4.000%,

1/01/55

1/32

at

100.00

1,459,290

1,000

Norfolk

Economic

Development

Authority,

Virginia,

Hospital

Facility

Revenue

Bonds,

Sentara

Healthcare

Systems,

Refunding

Series

2018B,

4.000%,

11/01/48

11/28

at

100.00

977,506

Roanoke

Economic

Development

Authority,

Virginia,

Hospital

Revenue

Bonds,

Carilion

Clinic

Obligated

Group,

Series

2020A:

875

4.000%,

7/01/36

7/30

at

100.00

893,260

5,000

4.000%,

7/01/51

7/30

at

100.00

4,862,048

Stafford

County

Economic

Development

Authority,

Virginia,

Hospital

Facilities

Revenue

Bonds,

Mary

Washington

Healthcare

Obligated

Group,

Refunding

Series

2016:

1,000

5.000%,

6/15/32

6/26

at

100.00

1,026,062

1,360

4.000%,

6/15/37

6/26

at

100.00

1,348,677

7,000

Virginia

Small

Business

Finance

Authority,

Healthcare

Facilities

Revenue

Bonds,

Bon

Secours

Mercy

Health,

Inc.,

Series

2020A,

4.000%,

12/01/49

6/30

at

100.00

6,769,396

3,000

Virginia

Small

Business

Finance

Authority,

Healthcare

Facilities

Revenue

Bonds,

Bon

Secours

Mercy

Health,

Inc.,

Series

2022A,

5.000%,

10/01/42

10/32

at

100.00

3,266,455

Virginia

Small

Business

Finance

Authority,

Healthcare

Facilities

Revenue

Bonds,

Sentara

Healthcare,

Refunding

Series

2020:

1,150

4.000%,

11/01/38

11/29

at

100.00

1,177,509

2,000

4.000%,

11/01/39

11/29

at

100.00

2,041,986

Principal

Amount

(000)

Description

(a)

Optional

Call

Provisions

(b)

Value

HEALTH

CARE

(continued)

Winchester

Economic

Development

Authority,

Virginia,

Hospital

Revenue

Bonds,

Valley

Health

System

Obligated

Group,

Refunding

Series

2015:

$

1,500

5.000%,

1/01/33

1/26

at

100.00

$

1,529,006

1,000

5.000%,

1/01/35

1/26

at

100.00

1,017,740

2,000

4.000%,

1/01/37

1/26

at

100.00

2,001,528

1,215

5.000%,

1/01/44

1/26

at

100.00

1,224,279

TOTAL

HEALTH

CARE

71,064,886

HOUSING/MULTIFAMILY

-

14.2%

(8.6%

of

Total

Investments)

1,070

(d)

Richmond

Redevelopment

and

Housing

Authority,

Virginia,

Multi-Family

Housing

Revenue

Bonds,

American

Tobacco

Apartments,

Series

2017,

5.550%,

1/01/37

1/27

at

100.00

1,054,901

Virginia

Housing

Development

Authority,

Rental

Housing

Bonds,

Series

2015A:

1,000

3.500%,

3/01/35

9/24

at

100.00

986,087

1,000

3.625%,

3/01/39

9/24

at

100.00

941,645

900

Virginia

Housing

Development

Authority,

Rental

Housing

Bonds,

Series

2015C,

4.000%,

8/01/45

9/24

at

100.00

859,554

2,750

Virginia

Housing

Development

Authority,

Rental

Housing

Bonds,

Series

2015E,

3.750%,

12/01/40

12/24

at

100.00

2,686,350

1,500

Virginia

Housing

Development

Authority,

Rental

Housing

Bonds,

Series

2016B,

3.350%,

5/01/36

5/25

at

100.00

1,428,130

1,700

Virginia

Housing

Development

Authority,

Rental

Housing

Bonds,

Series

2017A,

3.875%,

3/01/47

3/26

at

100.00

1,579,292

3,000

Virginia

Housing

Development

Authority,

Rental

Housing

Bonds,

Series

2019A,

3.800%,

9/01/44

3/28

at

100.00

2,806,864

1,855

Virginia

Housing

Development

Authority,

Rental

Housing

Bonds,

Series

2020E,

2.500%,

7/01/45

7/29

at

100.00

1,359,066

1,000

Virginia

Housing

Development

Authority,

Rental

Housing

Bonds,

Series

2022F,

5.000%,

10/01/52

10/31

at

100.00

1,037,056

1,000

Virginia

Housing

Development

Authority,

Rental

Housing

Bonds,

Series

2023E,

5.250%,

10/01/63

10/32

at

100.00

1,041,825

1,000

Virginia

Housing

Development

Authority,

Rental

Housing

Bonds,

Series

2024A,

4.450%,

9/01/44

9/33

at

100.00

1,003,945

Williamsburg

Economic

Development

Authority,

Virginia,

Student

Housing

Revenue

Bonds,

Provident

Group

-

Williamsburg

Properties

LLC

-

William

and

Mary

Project

Series

2023A:

7,650

(c)

4.000%,

7/01/48

-

AGM

Insured,

(UB)

7/33

at

100.00

7,448,771

2,600

(c)

4.125%,

7/01/58

-

AGM

Insured,

(UB)

7/33

at

100.00

2,563,413

5,000

(c)

4.375%,

7/01/63

-

AGM

Insured,

(UB)

7/33

at

100.00

5,036,898

TOTAL

HOUSING/MULTIFAMILY

31,833,797

HOUSING/SINGLE

FAMILY

-

1.0%

(0.6%

of

Total

Investments)

1,000

Virginia

Housing

Development

Authority,

Commonwealth

Mortgage

Bonds,

Series

2023C,

4.875%,

7/01/48

7/32

at

100.00

1,023,195

1,200

Virginia

Housing

Development

Authority,

Commonwealth

Mortgage

Bonds,

Series

2023E-I,

4.550%,

10/01/49

4/33

at

100.00

1,208,131

TOTAL

HOUSING/SINGLE

FAMILY

2,231,326

LONG-TERM

CARE

-

8.6%

(5.3%

of

Total

Investments)

3,225

Albemarle

County,

Virginia,

Residential

Care

Facility

Revenue

Bonds, Westminster-Canterbury

of

the

Blue

Ridge,

Refunding

Series

2022A,

4.000%,

6/01/42

6/29

at

103.00

3,200,535

700

Henrico

County

Economic

Development

Authority,

Virginia,

Residential

Care

Facility

Revenue

Bonds,

Westminster

Canterbury

of

Richmond,

Refunding

Series

2020,

4.000%,

10/01/45

10/26

at

103.00

668,207

1,155

James

City

County

Economic

Development

Authority,

Virginia,

Residential

Care

Facility

Revenue

Bonds,

Williamsburg

Landing

Inc.,

Refunding

Series

2021A,

4.000%,

12/01/40

12/27

at

103.00

1,058,859

200

James

City

County

Economic

Development

Authority,

Virginia,

Residential

Care

Facility

Revenue

Bonds,

Williamsburg

Landing

Inc.,

Series

2024A,

6.875%,

12/01/58

12/30

at

103.00

221,660

Nuveen

Virginia

Quality

Municipal

Income

Fund

(continued)

Portfolio

of

Investments

August

31,

2024

(Unaudited)

Principal

Amount

(000)

Description

(a)

Optional

Call

Provisions

(b)

Value

LONG-TERM

CARE

(continued)

$

1,000

James

City

County

Economic

Development

Authority,

Virginia,

Residential

Care

Facility

Revenue

Bonds,

WindsorMeade,

Series

2021A,

4.000%,

6/01/47

6/27

at

103.00

$

824,683

1,000

Lexington

Industrial

Development

Authority,

Virginia,

Residential

Care

Facility

Revenue

Bonds,

Kendal

at

Lexington

Retirement

Community

Inc.,

Refunding

Series

2016,

4.000%,

1/01/37

1/25

at

102.00

1,001,278

Lexington

Industrial

Development

Authority,

Virginia,

Residential

Care

Facility

Revenue

Bonds,

Kendal

at

Lexington

Retirement

Community

Inc.,

Refunding

Series

2022.

Forward

Delivery:

1,120

4.000%,

1/01/42

1/29

at

103.00

1,081,852

1,000

4.000%,

1/01/48

1/29

at

103.00

918,691

Norfolk

Redevelopment

and

Housing

Authority,

Virginia,

Fort

Norfolk

Retirement

Community,

Inc.,

Harbor's

Edge

Project,

Series

2019A:

625

5.000%,

1/01/49

9/24

at

104.00

563,201

3,005

5.250%,

1/01/54

9/24

at

104.00

2,761,210

Prince

William

County

Industrial

Development

Authority,

Virginia,

Residential

Care

Facility

Revenue

Bonds,

Westminster

at

Lake

Ridge,

Refunding

Series

2016:

670

5.000%,

1/01/37

1/25

at

102.00

670,099

2,000

5.000%,

1/01/46

1/25

at

102.00

1,928,693

2,920

Suffolk

Economic

Development

Authority,

Virginia,

Retirement

Facilities

First

Mortgage

Revenue

Bonds,

Lake

Prince

Center,

Inc./United

Church

Homes

and

Services

Obligated

Group,

Refunding

Series

2016,

5.000%,

9/01/31

9/24

at

102.00

2,929,322

Virginia

Beach

Development

Authority,

Virginia,

Residential

Care

Facility

Revenue

Bonds,

Westminster

Canterbury

on

Chesapeake

Bay,

Series

2023A:

320

7.000%,

9/01/53

9/30

at

103.00

370,081

1,000

7.000%,

9/01/59

9/30

at

103.00

1,147,904

TOTAL

LONG-TERM

CARE

19,346,275

TAX

OBLIGATION/GENERAL

-

4.1%

(2.5%

of

Total

Investments)

Puerto

Rico,

General

Obligation

Bonds,

Restructured

Series

2022A-1:

3,300

0.000%,

7/01/33

7/31

at

89.94

2,224,126

4,000

4.000%,

7/01/33

7/31

at

103.00

3,970,439

1,000

4.000%,

7/01/41

7/31

at

103.00

950,461

1,000

Richmond,

Virginia,

General

Obligation

Bonds,

Public

Improvement

Series

2024C,

4.000%,

3/01/57

3/34

at

100.00

994,041

1,000

Virginia

State,

General

Obligation

Bonds,

Series

2022A,

5.000%,

6/01/52

6/32

at

100.00

1,096,044

TOTAL

TAX

OBLIGATION/GENERAL

9,235,111

TAX

OBLIGATION/LIMITED

-

22.7%

(13.8%

of

Total

Investments)

1,340

Arlington

County

Industrial

Development

Authority,

Virginia,

Revenue

Bonds,

Refunding

County

Projects,

Series

2017,

5.000%,

2/15/37

8/27

at

100.00

1,405,265

1,000

(d)

Cherry

Hill

Community

Development

Authority,

Virginia,

Special

Assesment

Bonds,

Potomac

Shores

Project,

Series

2015,

5.400%,

3/01/45

3/25

at

100.00

1,002,511

735

Dulles

Town

Center

Community

Development

Authority,

Loudon

County,

Virginia

Special

Assessment

Refunding

Bonds,

Dulles

Town

Center

Project,

Series

2012,

4.250%,

3/01/26

9/24

at

100.00

728,755

1,500

Fairfax

County

Economic

Development

Authority,

Virginia,

Revenue

Bonds,

Metrorail

Parking

System

Project,

Series

2017,

5.000%,

4/01/42

4/27

at

100.00

1,546,414

1,350

(d)

Farms

of

New

Kent

Community

Development

Authority,

Virginia,

Special

Assessment

Bonds,

Refunding

Series

2021A,

3.750%,

3/01/36

3/31

at

100.00

1,315,248

4,000

Government

of

Guam,

Business

Privilege

Tax

Bonds,

Refunding

Series

2015D,

5.000%,

11/15/34

11/25

at

100.00

4,051,528

1,000

Guam

Government,

Limited

Obligation

Section

30

Revenue

Bonds,

Series

2016A,

5.000%,

12/01/33

12/26

at

100.00

1,027,317

2,000

Hampton

Roads

Transportation

Accountability

Commision,

Virginia,

Revenue

Bonds,

Hampton

Roads

Transportation

Fund,

Senior

Lien

Series

2020A,

5.000%,

7/01/45

7/30

at

100.00

2,144,297

3,000

Hampton

Roads

Transportation

Accountability

Commission,

Virginia,

Revenue

Bonds,

Hampton

Roads

Transportation

Fund,

Senior

Lien

Series

2022A,

4.000%,

7/01/57

7/32

at

100.00

2,912,741

Principal

Amount

(000)

Description

(a)

Optional

Call

Provisions

(b)

Value

TAX

OBLIGATION/LIMITED

(continued)

$

1,000

(d)

Industrial

Development

Authority

of

the

City

of

Alexandria,

Virginia,

Tourism

Development

Financing

Program

Revenue

Bonds

(699

Prince

Street

Hotel

Project),

Senior

Series

2022A-1

(Tax-Exempt)

and

Senior

Series

2022B-1,

7.750%,

9/01/44

9/32

at

110.31

$

1,114,007

Lower

Magnolia

Green

Community

Development

Authority,

Virginia,

Special

Assessment

Bonds,

Series

2015:

905

(d)

5.000%,

3/01/35

3/27

at

100.00

906,040

2,995

(d)

5.000%,

3/01/45

3/27

at

100.00

2,953,991

440

Matching

Fund

Special

Purpose

Securitization

Corporation,

Virgin

Islands,

Revenue

Bonds,

Series

2022A,

5.000%,

10/01/32

No

Opt.

Call

471,279

Peninsula

Town

Center

Community

Development

Authority,

Virginia,

Special

Obligation

Bonds,

Refunding

Series

2018:

300

(d)

4.500%,

9/01/28

9/27

at

100.00

304,298

3,000

(d)

5.000%,

9/01/45

9/27

at

100.00

3,004,890

Puerto

Rico

Sales

Tax

Financing

Corporation,

Sales

Tax

Revenue

Bonds,

Restructured

2018A-1:

96

0.000%,

7/01/27

No

Opt.

Call

86,354

94

0.000%,

7/01/29

7/28

at

98.64

78,338

219

0.000%,

7/01/31

7/28

at

91.88

168,165

136

0.000%,

7/01/33

7/28

at

86.06

95,957

3,609

0.000%,

7/01/51

7/28

at

30.01

885,693

8,320

5.000%,

7/01/58

7/28

at

100.00

8,356,795

Puerto

Rico

Sales

Tax

Financing

Corporation,

Sales

Tax

Revenue

Bonds,

Taxable

Restructured

Cofina

Project

Series

2019A-2:

1,550

4.329%,

7/01/40

7/28

at

100.00

1,532,936

150

4.536%,

7/01/53

7/28

at

100.00

143,888

62

4.784%,

7/01/58

7/28

at

100.00

61,350

1,500

(d)

Virgin

Islands

Public

Finance

Authority,

Federal

Highway

Grant

Anticipation

Loan

Note

Revenue

Bonds,

Series

2015,

5.000%,

9/01/33

9/25

at

100.00

1,513,046

2,240

(d)

Virgin

Islands

Public

Finance

Authority,

Gross

Receipts

Taxes

Loan

Note,

Working

Capital

Series

2014A,

5.000%,

10/01/34

-

AGM

Insured

10/24

at

100.00

2,242,816

1,000

Virginia

Gateway

Community

Development

Authority,

Prince

William

County,

Virginia,

Special

Assessment

Refunding

Bonds,

Series

2012,

5.000%,

3/01/30

9/24

at

100.00

1,000,102

2,000

Virginia

Public

Building

Authority,

Public

Facilities

Revenue

Bonds,

Series

2019B,

4.000%,

8/01/38,

(AMT)

8/29

at

100.00

2,004,140

35

Virginia

Resources

Authority,

Infrastructure

Revenue

Bonds,

Pooled

Financing

Program,

Series

2012A,

5.000%,

11/01/42

9/24

at

100.00

35,022

120

(d)

Virginia

Small

Business

Finance

Authority,

Tourism

Development

Financing

Program

Revenue

Bonds,

Downtown

Norfolk

and

Virginia

Beach

Oceanfront

Hotel

Projects,

Series

2018A,

8.375%,

4/01/41

4/28

at

112.76

121,637

300

(d)

Virginia

Small

Business

Financing

Authority,

Tourism

Development

Financing

Program

Revenue

Bonds,

Virginia

Beach

Oceanfront

South

Hotel

Project,

Senior

Series

2020A-1,

8.000%,

10/01/43

10/30

at

120.40

310,207

1,000

Virginia

Transportation

Board,

Transportation

Revenue

Bonds,

Capital

Projects,

Series

2018,

4.000%,

5/15/38

5/28

at

100.00

1,018,545

2,470

Washington

Metropolitan

Area

Transit

Authority,

District

of

Columbia,

Dedicated

Revenue

Bonds,

Second

Lien

Green

Series

2023A,

5.250%,

7/15/53

7/33

at

100.00

2,709,349

2,500

Washington

Metropolitan

Area

Transit

Authority,

District

of

Columbia,

Second

Lien

Dedicated

Revenue

Bonds,

Sustainability-

Climate

Transition,

Series

2024A,

5.250%,

7/15/59

7/34

at

100.00

2,745,510

920

Western

Virginia

Regional

Jail

Authority,

Virginia,

Facility

Revenue

Bonds,

Refunding

Series

2016,

5.000%,

12/01/36

12/26

at

100.00

958,629

TOTAL

TAX

OBLIGATION/LIMITED

50,957,060

TRANSPORTATION

-

49.4%

(30.1%

of

Total

Investments)

Capital

Region

Airport

Commission,

Virginia,

Airport

Revenue

Bonds,

Refunding

Series

2016A:

375

4.000%,

7/01/34

7/26

at

100.00

378,748

400

4.000%,

7/01/35

7/26

at

100.00

403,935

250

4.000%,

7/01/38

7/26

at

100.00

251,265

Nuveen

Virginia

Quality

Municipal

Income

Fund

(continued)

Portfolio

of

Investments

August

31,

2024

(Unaudited)

Principal

Amount

(000)

Description

(a)

Optional

Call

Provisions

(b)

Value

TRANSPORTATION

(continued)

Chesapeake

Bay

Bridge

and

Tunnel

District,

Virginia,

General

Resolution

Revenue

Bonds,

First

Tier

Series

2016:

$

5,320

5.000%,

7/01/41

-

AGM

Insured

7/26

at

100.00

$

5,436,942

1,705

5.000%,

7/01/46

7/26

at

100.00

1,720,279

4,200

5.000%,

7/01/51

7/26

at

100.00

4,227,165

Chesapeake,

Virginia,

Transportation

System

Senior

Toll

Road

Revenue

Bonds,

Capital

Appreciation

Series

2012B:

2,000

4.750%,

7/15/32

7/28

at

100.00

2,111,140

1,000

4.875%,

7/15/40

-

AGM

Insured

7/28

at

100.00

1,046,576

4,225

4.875%,

7/15/40

7/28

at

100.00

4,389,112

1,945

Chesapeake,

Virginia,

Transportation

System

Senior

Toll

Road

Revenue

Bonds,

Refunding

Series

2024,

4.000%,

7/15/47

-

AGM

Insured

7/34

at

100.00

1,884,396

Metropolitan

Washington

Airports

Authority,

District

of

Columbia,

Dulles

Toll

Road

Revenue

Bonds,

Dulles

Metrorail

&

Capital

improvement

Projects,

Refunding

&

Subordinate

Lien

Series

2019B:

4,500

4.000%,

10/01/44

10/29

at

100.00

4,351,157

3,335

4.000%,

10/01/53

-

AGM

Insured

10/29

at

100.00

3,167,406

Metropolitan

Washington

Airports

Authority,

District

of

Columbia,

Dulles

Toll

Road

Revenue

Bonds,

Dulles

Metrorail

&

Capital

improvement

Projects,

Second

Senior

Lien

Series

2009B:

4,000

0.000%,

10/01/26

-

AGC

Insured

No

Opt.

Call

3,750,158

11,825

0.000%,

10/01/34

-

AGC

Insured

No

Opt.

Call

8,221,315

1,135

0.000%,

10/01/36

-

AGC

Insured

No

Opt.

Call

717,744

5,010

0.000%,

10/01/39

-

AGC

Insured

No

Opt.

Call

2,714,780

6,700

Metropolitan

Washington

Airports

Authority,

District

of

Columbia,

Dulles

Toll

Road

Revenue

Bonds,

Dulles

Metrorail

Capital

Appreciation,

Second

Senior

Lien

Series

2010B,

6.500%,

10/01/44

10/28

at

100.00

7,325,203

7,300

Metropolitan

Washington

D.C.

Airports

Authority,

Airport

System

Revenue

Bonds,

Refunding

Series

2016A,

5.000%,

10/01/35,

(AMT)

10/26

at

100.00

7,488,896

375

Metropolitan

Washington

D.C.

Airports

Authority,

Airport

System

Revenue

Bonds,

Refunding

Series

2017,

5.000%,

10/01/34,

(AMT)

10/27

at

100.00

389,717

Metropolitan

Washington

D.C.

Airports

Authority,

Airport

System

Revenue

Bonds,

Refunding

Series

2018A:

2,000

5.000%,

10/01/31,

(AMT)

10/28

at

100.00

2,115,331

3,290

(c)

5.000%,

10/01/36,

(AMT)

10/28

at

100.00

3,441,463

2,000

5.000%,

10/01/38,

(AMT)

10/28

at

100.00

2,085,401

Metropolitan

Washington

D.C.

Airports

Authority,

Airport

System

Revenue

Bonds,

Refunding

Series

2019A:

1,000

5.000%,

10/01/30,

(AMT)

10/29

at

100.00

1,074,076

4,000

5.000%,

10/01/40,

(AMT)

10/29

at

100.00

4,186,829

1,145

Metropolitan

Washington

D.C.

Airports

Authority,

Airport

System

Revenue

Bonds,

Refunding

Series

2024A,

5.500%,

10/01/54,

(AMT)

10/33

at

100.00

1,256,070

New

York

Transportation

Development

Corporation,

New

York,

Special

Facility

Revenue

Bonds,

American

Airlines,

Inc.

John

F

Kennedy

International

Airport

Project,

Refunding

Series

2016:

65

5.000%,

8/01/26,

(AMT)

9/24

at

100.00

65,099

595

5.000%,

8/01/31,

(AMT)

9/24

at

100.00

595,669

1,585

Norfolk

Airport

Authority,

Virginia,

Airport

Revenue

Bonds,

Series

2019,

5.000%,

7/01/38

7/29

at

100.00

1,684,714

Virginia

Port

Authority,

Port

Facilities

Revenue

Bonds,

Refunding

Series

2016B:

3,000

5.000%,

7/01/41,

(AMT)

7/26

at

100.00

3,024,164

3,000

5.000%,

7/01/45,

(AMT)

7/26

at

100.00

3,015,050

Virginia

Small

Business

Financing

Authority,

Private

Activity

Revenue

Bonds,

Transform

66

P3

Project,

Senior

Lien

Series

2017:

9,035

5.000%,

12/31/49,

(AMT)

6/27

at

100.00

9,184,185

805

5.000%,

12/31/52,

(AMT)

6/27

at

100.00

816,796

Principal

Amount

(000)

Description

(a)

Optional

Call

Provisions

(b)

Value

TRANSPORTATION

(continued)

Virginia

Small

Business

Financing

Authority,

Revenue

Bonds,

95

Express

Lanes

LLC

Project,

Refunding

Senior

Lien

Series

2022:

$

1,000

5.000%,

7/01/33,

(AMT)

1/32

at

100.00

$

1,075,229

1,395

5.000%,

1/01/36,

(AMT)

1/32

at

100.00

1,489,760

530

5.000%,

7/01/38,

(AMT)

1/32

at

100.00

560,975

3,120

4.000%,

7/01/39,

(AMT)

1/32

at

100.00

3,039,617

1,500

4.000%,

1/01/42,

(AMT)

1/32

at

100.00

1,422,144

1,500

5.000%,

12/31/47,

(AMT)

12/32

at

100.00

1,571,904

1,840

5.000%,

12/31/52,

(AMT)

12/32

at

100.00

1,914,360

Virginia

Small

Business

Financing

Authority,

Revenue

Bonds,

Elizabeth

River

Crossing

OPCO,

LLC

Project,

Refunding

Senior

Lien

Series

2022:

2,500

4.000%,

1/01/39,

(AMT)

1/32

at

100.00

2,426,703

5,000

3.000%,

1/01/41,

(AMT)

1/32

at

100.00

4,047,478

1,000

Washington

Metropolitan

Area

Transit

Authority,

District

of

Columbia,

Gross

Revenue

Bonds,

Series

2018,

5.000%,

7/01/43

7/27

at

100.00

1,031,350

TOTAL

TRANSPORTATION

111,100,301

U.S.

GUARANTEED

-

6.9%

(4.2%

of

Total

Investments)

(e)

900

Alexandria

Industrial

Development

Authority,

Virginia,

Residential

Care

Facilities

Mortgage

Revenue

Bonds,

Goodwin

House

Incorporated,

Series

2015,

5.000%,

10/01/50,

(Pre-refunded

10/01/25)

10/25

at

100.00

922,637

325

Bristol,

Virginia,

General

Obligation

Utility

System

Revenue

Bonds,

Series

2002,

5.000%,

11/01/24

-

AGM

Insured,

(ETM)

No

Opt.

Call

325,963

360

Chesapeake

Bay

Bridge

and

Tunnel

Commission,

Virginia,

General

Resolution

Revenue

Bonds,

Refunding

Series

1998,

5.500%,

7/01/25

-

NPFG

Insured,

(ETM)

No

Opt.

Call

368,006

100

Embrey

Mill

Community

Development

Authority,

Virginia,

Special

Assessment

Revenue

Bonds,

Series

2015,

5.600%,

3/01/45,

(Pre-refunded

3/01/25)

3/25

at

100.00

101,263

1,000

Fairfax

County

Economic

Development

Authority,

Virginia,

County

Facilities

Revenue

Bonds,

Refunding

Series

2017B,

5.000%,

10/01/33,

(Pre-refunded

10/01/27)

10/27

at

100.00

1,074,252

Fairfax

County

Economic

Development

Authority,

Virginia,

Residential

Care

Facilities

Mortgage

Revenue

Bonds,

Goodwin

House,

Inc.,

Series

2016A:

700

4.000%,

10/01/42,

(Pre-refunded

10/01/24)

10/24

at

102.00

714,401

1,965

5.000%,

10/01/42,

(Pre-refunded

10/01/24)

10/24

at

102.00

2,006,930

Hampton

Roads

Sanitation

District,

Virginia,

Wastewater

Revenue

Bonds,

Subordinate

Series

2018A:

1,415

5.000%,

10/01/40,

(Pre-refunded

10/01/27)

10/27

at

100.00

1,517,891

1,010

5.000%,

10/01/42,

(Pre-refunded

10/01/27)

10/27

at

100.00

1,083,442

1,000

5.000%,

10/01/43,

(Pre-refunded

10/01/27)

10/27

at

100.00

1,072,715

1,000

Hampton

Roads

Transportation

Accountability

Commission,

Virginia,

Hampton

Roads

Transportation

Fund

Revenue

Bonds,

Senior

Lien

Series

2018A,

5.500%,

7/01/57,

(Pre-refunded

1/01/28)

1/28

at

100.00

1,095,912

5,000

Richmond,

Virginia,

Public

Utility

Revenue

Bonds,

Refunding

Series

2016A,

5.000%,

1/15/33,

(Pre-refunded

1/15/26)

1/26

at

100.00

5,170,129

150

Virgin

Islands

Public

Finance

Authority,

Matching

Fund

Loan

Notes

Revenue

Bonds,

Senior

Lien

Series

2013A,

5.000%,

10/01/24

-

AGM

Insured,

(ETM)

No

Opt.

Call

150,420

TOTAL

U.S.

GUARANTEED

15,603,961

UTILITIES

-

6.9%

(4.2%

of

Total

Investments)

4,300

Beaver

County

Industrial

Development

Authority,

Pennsylvania,

Pollution

Control

Revenue

Bonds,

FirstEnergy

Generation

Project,

Refunding

Series

2006A,

4.750%,

1/01/35,

(Mandatory

Put

7/01/33)

No

Opt.

Call

4,563,326

1,675

Guam

Government

Waterworks

Authority,

Water

and

Wastewater

System

Revenue

Bonds,

Series

2016,

5.000%,

1/01/46

7/26

at

100.00

1,698,528

3,000

Norfolk,

Virginia,

Water

Revenue

Bonds,

Series

2015A,

5.250%,

11/01/44

11/24

at

100.00

3,008,057

2,000

(d)

Puerto

Rico

Aqueduct

and

Sewerage

Authority,

Revenue

Bonds,

Refunding

Senior

Lien

Series

2020A,

5.000%,

7/01/47

7/30

at

100.00

2,038,315

1,000

(d)

Puerto

Rico

Aqueduct

and

Sewerage

Authority,

Revenue

Bonds,

Refunding

Senior

Lien

Series

2021B,

4.000%,

7/01/42

7/31

at

100.00

949,698

Nuveen

Virginia

Quality

Municipal

Income

Fund

(continued)

Portfolio

of

Investments

August

31,

2024

(Unaudited)

Part

F

of

Form

N-PORT

was

prepared

in

accordance

with

U.S.

generally

accepted

accounting

principles

(“U.S.

GAAP”)

and

in

conformity

with

the

applicable

rules

and

regulations

of

the

U.S.

Securities

and

Exchange

Commission

(“SEC”)

related

to

interim

filings.

Part

F

of

Form

N-PORT

does

not

include

all

information

and

footnotes

required

by

U.S.

GAAP

for

complete

financial

statements.

Certain

footnote

disclosures

normally

included

in

financial

statements

prepared

in

accordance

with

U.S.

GAAP

have

been

condensed

or

omitted

from

this

report

pursuant

to

the

rules

of

the

SEC.

For

a

full

set

of

the

Fund’s

notes

to

financial

statements,

please

refer

to

the

Fund’s

most

recently

filed

annual

or

semi-annual

report.

Fair

Value

Measurements

The

Fund’s

investments

in

securities

are

recorded

at

their

estimated

fair

value

utilizing

valuation

methods

approved

by

the

Board

of

Directors/

Trustees.

Fair

value

is

defined

as

the

price

that

would

be

received

upon

selling

an

investment

or

transferring

a

liability

in

an

orderly

transaction

to

an

independent

buyer

in

the

principal

or

most

advantageous

market

for

the

investment.

U.S.

GAAP

establishes

the

three-tier

hierarchy

which

is

used

to

maximize

the

use

of

observable

market

data

and

minimize

the

use

of

unobservable

inputs

and

to

establish

classification

of

fair

value

measurements

for

disclosure

purposes.

Observable

inputs

reflect

the

assumptions

market

participants

would

use

in

pricing

the

asset

or

liability.

Observable

inputs

are

based

on

market

data

obtained

from

sources

independent

of

the

reporting

entity.

Unobservable

inputs

reflect

management’s

assumptions

about

the

assumptions

market

participants

would

use

in

pricing

the

asset

or

liability.

Unobservable

inputs

are

based

on

the

best

information

available

in

the

circumstances.

The

following

is

a

summary

of

the

three-tiered

hierarchy

of

valuation

input

levels.

Level

1

–

Inputs

are

unadjusted

and

prices

are

determined

using

quoted

prices

in

active

markets

for

identical

securities.

Level

2

–

Prices

are

determined

using

other

significant

observable

inputs

(including

quoted

prices

for

similar

securities,

interest

rates,

credit

spreads,

etc.).

Level

3

–

Prices

are

determined

using

significant

unobservable

inputs

(including

management’s

assumptions

in

determining

the

fair

value

of

investments).

The

following

table

summarizes

the

market

value

of

the

Fund's

investments

as

of

the

end

of

the

reporting

period,

based

on

the

inputs

used

to

value

them:

Principal

Amount

(000)

Description

(a)

Optional

Call

Provisions

(b)

Value

UTILITIES

(continued)

$

725

Richmond,

Virginia,

Public

Utility

Revenue

Bonds,

Refunding

Series

2023C,

5.000%,

1/15/47

1/34

at

100.00

$

802,757

1,000

Virginia

Resources

Authority,

Clean

Water

State

Revolving

Fund

Revenue

Bonds,

Refunding

Series

2014B,

4.000%,

10/01/27

10/24

at

100.00

1,000,471

1,500

(d)

Virginia

Small

Business

Financing

Authority,

Solid

Waste

Disposal

Revenue

Bonds,

Covanta

Project,

Series

2018,

5.000%,

1/01/48,

(AMT),

(Mandatory

Put

7/01/38)

9/24

at

100.00

1,500,099

TOTAL

UTILITIES

15,561,251

TOTAL

MUNICIPAL

BONDS

(cost

$362,687,025)

369,421,682

TOTAL

LONG-TERM

INVESTMENTS

(cost

$362,687,025)

369,421,682

FLOATING

RATE

OBLIGATIONS

-

(8.4)%

(18,950,000)

VRDP

SHARES,

NET

-

(56.8)%

(f)

(127,712,758)

OTHER

ASSETS

&

LIABILITIES,

NET

-

0.9%

2,039,917

NET

ASSETS

APPLICABLE

TO

COMMON

SHARES

-

100%

$

224,798,841

Level

1

Level

2

Level

3

Total

Long-Term

Investments:

Municipal

Bonds

$

–

$

369,421,682

$

–

$

369,421,682

Total

$

–

$

369,421,682

$

–

$

369,421,682

(a)

All

percentages

shown

in

the

Portfolio

of

Investments

are

based

on

net

assets

applicable

to

common

shares

unless

otherwise

noted.

(b)

Optional

Call

Provisions:

Dates

(month

and

year)

and

prices

of

the

earliest

optional

call

or

redemption.

There

may

be

other

call

provisions

at

varying

prices

at

later

dates.

Certain

mortgage-backed

securities

may

be

subject

to

periodic

principal

paydowns.

(c)

Investment,

or

portion

of

investment,

has

been

pledged

to

collateralize

the

net

payment

obligations

for

investments

in

inverse

floating

rate

transactions.

(d)

Security

is

exempt

from

registration

under

Rule

144A

of

the

Securities

Act

of

1933,

as

amended.

These

securities

are

deemed

liquid

and

may

be

resold

in

transactions

exempt

from

registration,

which

are

normally

those

transactions

with

qualified

institutional

buyers.

As

of

the

end

of

the

reporting

period,

the

aggregate

value

of

these

securities

is

$34,751,459

or

9.4%

of

Total

Investments.

(e)

Backed

by

an

escrow

or

trust

containing

sufficient

U.S.

Government

or

U.S.

Government

agency

securities,

which

ensure

the

timely

payment

of

principal

and

interest.

(f)

VRDP

Shares,

Net

as

a

percentage

of

Total

Investments

is

34.6%.

AMT

Alternative

Minimum

Tax

ETM

Escrowed

to

maturity

UB

Underlying

bond

of

an

inverse

floating

rate

trust

reflected

as

a

financing

transaction.

Inverse

floating

rate

trust

is

a

Recourse

Trust

unless

otherwise

noted.

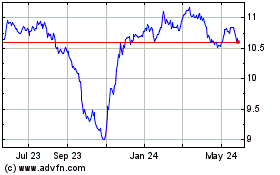

Nuveen Virginia Quality ... (NYSE:NPV)

Historical Stock Chart

From Oct 2024 to Nov 2024

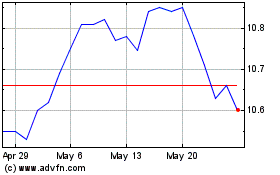

Nuveen Virginia Quality ... (NYSE:NPV)

Historical Stock Chart

From Nov 2023 to Nov 2024